Showing results for tags 'hsbc'.

-

Hello all, We have submitted a defence and then received the DQ. This was returned to us as invalid due to my partner filling it in and asking me to deal with it on her behalf. We have resubmitted another one and they have rejected this as the surname is different to the claimant. We are married now so my wife is using her current name, they wont accept it as the claim in in her maiden name. Can they do this? I feel like they are doing it on purpose because now we are over the 14 day limit to have the DQ filed.

-

Hi Andyorch, I've got my only other creditor willing to accept a settlement however they're saying it would be marked as partial but that they nor no other third party will pursue me. If there's a way to get them to mark it as fully settled that would be great.? If it's best for me to start another thread guys, please let me know?

-

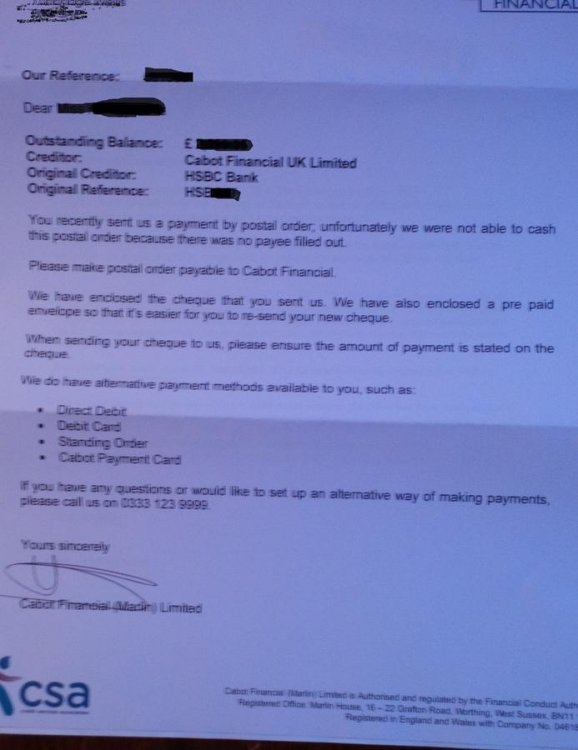

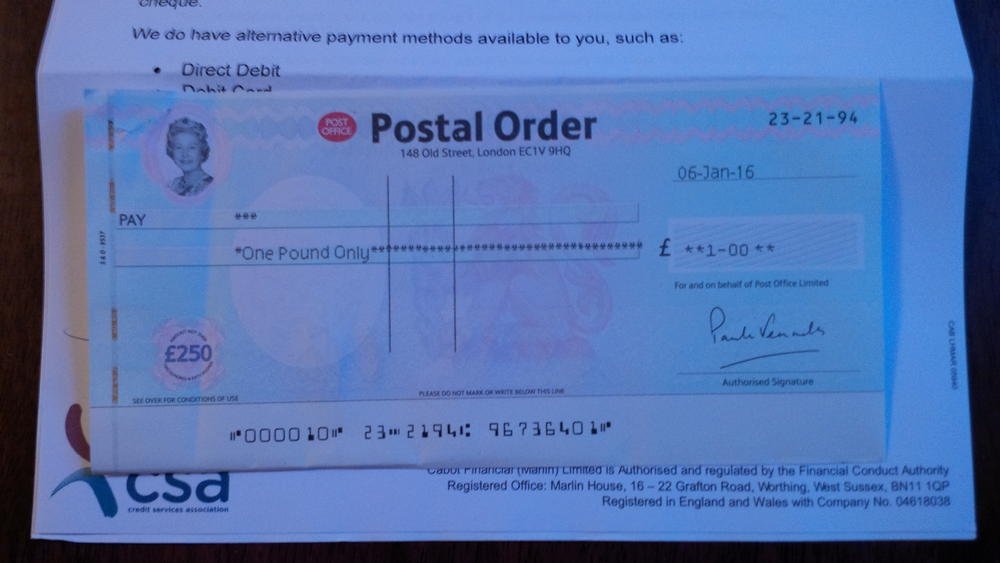

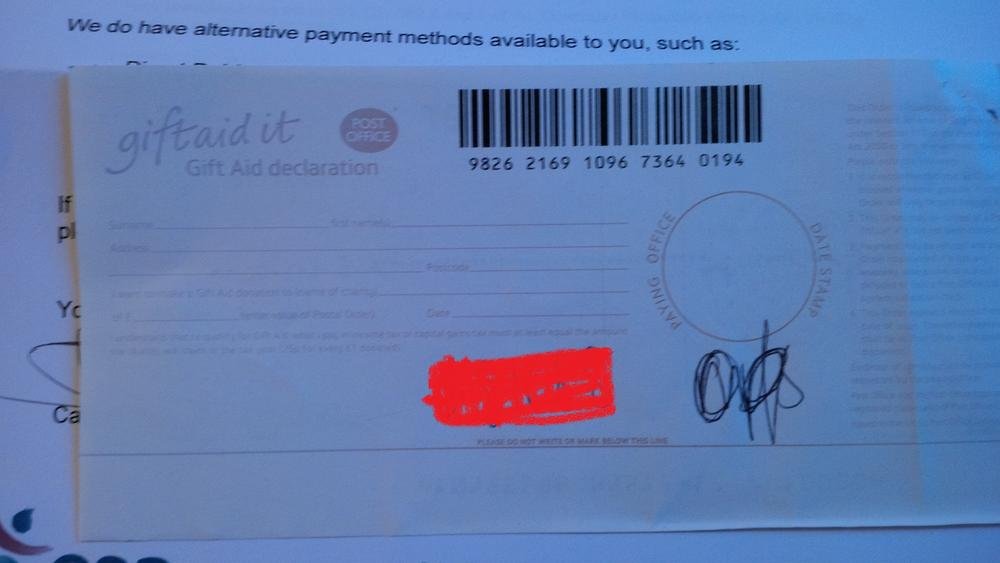

Hello everyone, Credit Card-HSBC Bank, currently with Cabot/ Marlin Account Start Date: 01/2007 Opening balance:£2700 Default balance: £2700 Date of default: 06/2010 I think this probably was an online application.. After defaulted in 2010 Metropolitan Collection Service Limited contacted me and demanded high monthly payments while I was in the hospital- everyday calls etc. .. In the end reduced payments were agreed. I was paying them reduced payments (£10 or £20 I don’t remember exactly) on monthly basis until 2013. They agreed in writing in 2013 a monthly £1 payment : Commencing Date 29/06/13 Finishing date 28/08/2096! A few months after the agreement I was contacted by Marlin (Cabot Financial) advising me to start paying them the £1 monthly and providing me with their details. Noddle currently shows owing of £2400. I was contacted by Marlin over the phone recently for a review -I explained that my financial situation is even worse than it was in 2013. They were fine-still happy to receive the £1 .They also mentioned that a full and final settlement can be arranged at 65% discount but they would consider a lower offer if I go to them with one- they said. I sent them a CCA request on 08/01/16 and a change of address letter. They have received my letters on the 9th. Today I received the following letter (file of the letter attached) advising me that unfortunately they were unable to cash the postal order because there was no payee filled out. Please see the attached letter from Cabot. Apologies for the poor quality of the file- I think it is readable. ..but if it is not let me know an I will try again. They also returned my original CCA request letter and the change of address letter??? So I guess I should return these to them. They have written on my CCA request letter with pen: 'ops req £1' and also attached the sticker for sign for service from the post office (I sent the letter recorded)... I have also attached the file of the postal order. Please tell me what is wrong with the postal order? I asked for a postal order and in the post office they told me that the best is to buy a crossed one if I am going to send it to a company, so I agreed!? I did not ask them to put a name on the postal order... Although I left the postal order completely blank at the back- Cabot has written on it my Ref number and something like a signature next to the ref. number??!!!! Please advise on the above? Very much appreciated! Uploaded PDF files -post 3 .

-

Hi CAG Back in 2007 I had an HSBC Premier account. I also had an HSBC Mastercard For each, i paid a monthly fee. As I had a premier account, I was entitled to a loan from HSBC. I took out this loan to which i just made repayments. I cannot remember about any PPI applied to this loan. How do I find out if I have PPI on my Mastercard and loan? How can I find out if I am entitled to refund of HSBC Bank Charges ? Please help. Thank you BurmaFriday

-

Hi All, I have a HSBC finance credit card, I was hoping to take a loan out but i havent paid this credit card of £2800 since it was defaulted in Feb 2012. I am being rejected for any application but this is the only default on my account. I was wondering if I make an payment arrangement or settle the account will it make any difference in applying for a 25k loan which is very much needed at the moment? I understand a default is on your credit score for 6 years however, as I have not paid anything at all on this HSBC credit card since 2012 so if i start paying something or offer a full and final settlement will this help me now or will it make no difference whatsoever. is there anything I can do with this account to improve my chances of a loan or is it best not to chase them if they are not chasing me. As usual all your help and time is very much appreciated!

-

Hi I have claimed for mis-sold PPI on an old GM Card taken out January 1994. HSBC have upheld my complaint without admission of liability. I have statements dating back to 2000 First PPI payment on card was made in Jan 1994 HSBC have made an offer with figures as follows Total PPI premiums - £1487.58 Interest charged to card - £1507.99 All credit interest - £3417.66 Fee Refund - £60.00 Total - £6473.23 Offer to me after tax deduction = £5,789.70 Can anyone advise which calculator should be used to check the above figures are accurate/reasonable If any further info required please get back to me Thanks

- 10 replies

-

- check offer

- gm card

-

(and 1 more)

Tagged with:

-

It has often been said on here that a claimant cannot claim the above interest if the action is brought under the remit of the CCA. Well section 69 certainly does not say that. Now I know people will say yes but look here The County Courts (Interest on Judgment Debts) Order 1991 This appears however to relate to section 74 of the 1984 act not 69 am I missing something here???

-

HSBC Warning To anyone thinking of opening a bank account with HSBC, I've just had a credit report from Experian I was shocked to see HSBC had never notified me in any way or form that they had black listed me back in October 2012, it relates to a direct debit of £50 being returned but paid in full four days later,through one single direct debit being paid four days late HSBC have totally ruined my business for a period of 6 years, as its now impossible to obtain any loans for my business, I have obviously raised a complaint with the financial ombudsman today being 15th March 2016 I spoke to a Representative from HSBC dealing with my complaint regarding me unable to obtain loans through HSBC blacklisting me, she could not care less it was a total waste of time, but I intend to post on you tube the letter that I received from her together with the bank statement showing the direct debit being paid in full only four days late, also the information that HSBC gave the credit agencies, which was worded non revolving credit. No one including the Financial ombudsman can believe how HSBC has black listed me without informing me in any form.so now I will be posting this on you tube warning people to be very careful before banking with HSBC obviously I will not be banking with them in the future, I believed HSBC were there to help self employed businesses not to ruin them like in this case,

-

I was paying off my credit card via capquest up to November 2009, with a letter from capquest confirming intrest to be frozen. HSBC took it back over in December2009 and did not acknlodge this agreement and have been asking for the amount prior to Capquest taking over the account. I have written to HSBC enclosing the letters but they are ignoring it. I have stopped paying the card and now have a debt collection agency on the case. If it went to court where would i stand, producing copies of the letters would the court agree that they are wrong Cheers

-

Hi I've scoured through the previous posts to see if anyone has the same issue as me but didn't find anything thats close to my issue. I'm about to sell my house and have obtained my Title Deeds which have two interim charging orders, one for HSBC (in 2007) which I am aware of the amount and one for HFC (2008) which I have no clue who they are or what the original debt was for. I was made bankrupt in 2010 and added all of my debts to the bankruptcy papers, I believed that this included HSBC and HFC (whoever they were at the time). I have no paper work for either of them or details on my credit history. I was able to get some info about the HSBC one today. I have a letter from the Insolvency Services which states that states "Notice to Bankrupt of Intention to re-vest your Interest in Property I am writing to give you notice that I consider that the continued vesting of the property in your bankruptcy estate to be of no benefit to creditors. One month from the date of this notice, your interest in the property will cease to be a part of the bankruptcy estate and will automatically re-vest in you. I will apply to the Land Registry to have my interests in the property removed from the register" I understood this to mean that my property was not considered part of the bankruptcy. Can anyone advise me on what to do next. Thanks in advanced

-

Can someone please advise the NEW address of hsbc card services?? (gold credit card) They apparently have moved from Chartwell Sq in Southend. To clarify - I wrote a letter, normal postage stamp, regarding an hsbc credit card - and it has been returned as "Gone Away". Yet every google search I do, says hsbc card services are at Chartwell Square. I need to re-send the letter. I rang India !! They advised sending the letter to Coventry. Wasn't sure if that was a joke...

-

Intrusive Questions by HSBC Bank I am not happy to answer I have been a customer for several years and not much deposited or withdrawn in the last few years. They now ask the source of my money? If I have other bank accounts here or overseas and details? where do I work now and my employers details, how much I earn and spend? Have I got any property on my name? How much it is worth it? Do I have any other investments and their details? Do I have to answer all those? What protection I have? Do any other banks ask such nuisance questions? Any other banks do not ask such questions? Thank you in advance

-

Hi Everyone, I had a HSBC bank account from the age of 9/10 when I reached 18 they offered me a credit card with nice credit limit of £2500, along with an overdraft of £1000, stupidly at a naive age of 18 I used both of them to their full advantage, making payments every month. Unfortunately a few years later I reached a financial hardship for my age, earning only a low wage and having split from a partner I was living with, I found myself in a house share paying most of my wages to live and eat, also (stupidly in hindsight) taking out Wonga loans to make ends meet, because HSBC were charging me bank charges on top of bank charges. I quickly spiralled into debt land with everything including both my HSBC Credit Card and bank account, luckily I had a second account with Halifax where I could have my wages paid into without it being eaten up with bank charges. My debt with HSBC was soon 'sold' onto their made up 'solicitors' - Restons, and also 'Metropolitan Collections' which I also believe is a subsidiary of HSBC. 6 months into this my mother offered me a place to stay, and I was far to embarrassed to tell her the extent of my debt at the time, 1 day the bailiffs came knocking on her door to advise that I had been ignoring HSBC and not made any payments. My mother and step father sat me down and I vowed to set up a payment plan to avoid this embarrassment for them again and I stuck to this for at least 18 months or so. I was lucky to meet my now fiancé who helped me out a great deal by paying off what I thought was the remaining debt with HSBC, and I found myself back on track. It wasn't until yesterday I came home to an ominous looking letter on my doorstep, advising me that 'Reston Solictors' have issued a Count Court Claim form for the unpaid account for my HSBC Credit Card, which I admit on my part was forgotten about as I thought I had paid them off and never thought to check. As I'm still only young (26) this is the first I've seen of one of these and it really left me shaken at the thought of having to go to court, I called CAB and they were helpful in advising my options with the form to which I made a decision that I want to get rid of it completely and called 'Restons Solicitors' today to settle the account with £772.00. In a matter of curiosity I opened an experian account this evening to check my credit score, I notice two defaults on my account, for both aforementioned HSBC accounts. This has really shaken me again as we're looking to take out a mortgage next year to buy our first marital home. My question to the knowledgeable people of this forum is, am I in any position to make a complaint to HSBC that I don't agree with these defaults as the root cause of the debt initially was due to bank charges which I couldn't pay, it states they were issued in 2011 and I have no recollection of these (does anyone else remember any post they received 5 years ago?!) or - are they quite right to do this to me, for my own stupidity? Thank you very much in advance and thank you for reading my rather lengthy life story post! Also to ask if anyone knows - If both my fiancé and I apply for a mortgage once we're married next year, and he has an impeccable credit score, would the defaults on my account still affect any applications?

-

Hi all In October 2009 I defaulted on an HSBC overdraft, £700 of which was charges, the other £700 ish the actual overdraft. They didn't get in touch until last year (I had previously looked in to a DRO but HSBC wouldnt confirm the details to me as it had been passed to a DCA, my circumstances then changed and I was able to negotiate the other debts I had at the time) The account was originally opened in 2005. I sent MKDP LLP a CCA request, they took a long time to respond and finally responded saying that the account was opened 'interpersonally' (whatever that means) and therefore no agreement was necessary? I've read elsewhere on the forum that pre-April 2007 CCA agreements are required or the debt is unenforcable, can anyone confirm? I now can't afford to pay this debt having exhausted my options previously; I'm begrudged to play ball with them / HSBC when there are so many charges on there and this could have been resolved years ago if they had given me the info I needed for a DRO!

-

Hi All, I strongly believe I am a victim of fraud and I have been cheated, and HSBC is doing nothing to help me. Chrono of events: Jan 13 - Placed order for one (1) iPad Air – Space Grey 32GB WIFI & Cellular, Paid £406.91, via VISA Debit card on HSBC website. Jan 27 - Cancelled order due to non delivery of the Ipad. Jan 30 - Refund was to be issued within 24 hours. Feb 12- Still no refund. Company said refund being processed. Feb 18 - Received Email notification that Company has ceased to trade Feb 19, 20, 21, 24, 25, 27, 28 and Mar 3rd - Company has been informing me that funds have been released to them, my refund has been 'processed' and I should receive confirmation. Repeated empty promises after empty promises - but I have yet to receive anything until today. I called HSBC and they said because I had authorised the payment as a BILL PAYMENT on HSBC website, they will NOT issue a refund to me, and there is NOTHING they can do. I have complained to the FOS and lodged a complain with Action Fraud. I am running out of ideas. Please Help??? I really feel exasperated. I can't get a refund from this Company, and nor can I get a refund from my Bank. I am left empty pocket

- 44 replies

-

- chargeback

- debitcard

-

(and 3 more)

Tagged with:

-

hi been trying to claim back ppi on a credit card with midland bank/hsbc now since 2013 . i have no statements left but can produce some paperwork for 12 months they denied i had a cc but re searched by hundreds of phone calls and eventually they agreed i did have one but no ppi was on it . the cc was from 1986-2003 and did have ppi and went to metropolitan collections in the 90s the debt was fully paid up. hsbc said prove it or go away, i tried the insurance root for the policy number with axa who tell me the credit card number is the policy number and insurance is inhouse with hsbc. hsbc said not with them . so did a sar which was waste of time 7yrs of transactions of banking. eventually enquired with dataoffice and dc sent out by mistake copy of card details, start and end dates customer/card account numbers. i have asked for the past two years for them to confirm that ppi was on card from day one but they will not answer this question, i went down fos route which was fast tracked due to health but they wont or cant get hsbc to answer it either. i am at a total loss as what to do now should i just give up as the stress of this has not helped my illness. this is the short version of this sorry tale the first time i have ever e mailed anywhere so opologies if a bit rubbish.

-

Not sure if this is the right place for this but... https://realfare.wordpress.com/2015/11/26/hsbc-whistleblower-biggest-bank-fraud-in-british-history-carried-out-on-uk-shoppers-and-covered-up/

-

Hi all have been attempting to help my daughter sort out her debt problems . Recent success Bryan carter discontinued court claim due to information from this site . We now however have MKDP claiming for old hsbc debt . details below . Current account overdraft shows on CRA as defaulted November 2007 as does flexiloan . Name of the Claimant MKDP LLP Date of issue 08 June 2015 What is the claim for The claimant claims sum of xxxx being monies due from the defendant(s) to HSBC bank plc under a bank account facility regulated by the consumer credit act 1974 and assigned to the claimant on 08/12/011. The defendant(s) s account number was xxxxxxxxx. It was a term of the bank account that any debit balance would be repayable in full on demand . The defendant(s) has failed to make payment as required by the demand for payment sent by HSBC bank plc. The claimant claims the sum of xxxxxxx and costs . The claimant has complied , as far as is necessary , with the pre-action connduct practice direction. What is the value of the claim? 1,761.70 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Overdraft /combined with loan. Account number claim under is current account no mention of loan account number . When did you enter into the original agreement before or after 2007? bank account 2004 / loan 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. debt purchaser MKDP LLP Were you aware the account had been assigned – did you receive a Notice of Assignment? unsure Did you receive a Default Notice from the original creditor? unsure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Debts were building up not enough money to go round so prioritised to rent and neccesities . What was the date of your last payment? poss 2013 to MKDP under current account number no mention of loan Was there a dispute with the original creditor that remains unresolved? unsure Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? Yes they offered consolidating loan at payments i could not afford , so i refused . Actions so far are as follows AOS done 13/06/15 , CPR 31.14 to MKDP done 15/06/15 , SAR to HSBC done 15/06/15 . MKDP responded to CPR with copy of terms an conditions effective 1st november 2007 , also copy (looks like computer printout as opposed to original ) of a default notice not signed or dated however the account number on this notice is for the flexiloan account and not the bank current account number of which the claim in the POC is for . It would seem that the two debts have been combined and i would say that MKDP are unaware of this , as they make no mention to the flexiloan in their claim . To sum up looking for some advice as to how to proceed as the bulk of the debt is the flexiloan , and the overdraft is mainly charges . I do not want to accidentlly alert MKDP of their error with the default notice and the fact that the loan has been bundled in with a current account as they make no mention of the loan in their claim . Where do MKDP stand if they continue to court ,and what would be the best way forward IE ask MKDP for cca and informing them about the two accounts being combined (as im pretty sure that the flexiloan was statute barred as of 2013 , however as said earlier 10 pound payment was made to MKDP under this debt after constant phonecalls and hounding but with only the current account details . Would appreciate some advice if anyone is able to offer some as defence is due Friday 10th if i worked it out correctly .

-

Hi not been on here for quite a while as thought all the dcas had finally gone away - only to receive today a notice from Hoist regarding old HSBC loan The first paragraph of the letter is as follows. " We are writing to notify you that MKDP LLP has assigned all of it's respective rights, titles and interest in respect of the above referenced account (Ex HSBC) to Hoist Portfolio Holding Limited effective 26/10/2015. The total balance sold they say is £25,392.20 but curretn balance £25082.20" I stopped paying this back in 2008 due to financial difficulties and although over the years received various DCA chasing letters have had no contact with any of them. Is this statute barred and if so, do I need to do anything? Or do I need to prepare for a court battle? Can anyone advise please? Thank you

-

In simple terms this is 1 of my 3 accounts, its literally used for a couple of direct debits that I want to keep separate. Having second thoughts considering I keep missing them. I had a direct debit come out this morning which I had forgotten about, checked my bank and it had been paid so I thought best transfer enough in so i'd not go overdrawn which I did. And being extremely cynical of banks I take screenshots of everything just incase. Interestingly I just checked back and that same direct debit has now been bounced and if you have a look at my screenshots from lunch time today and this evening you will see that they prized the bounced dd between the dd and the credits. Naturally i'm extremely anoyed about this and you can bet that if i'd not of credited the account they'd of paid it and charged an od fee. I will be charged £25 for this so naturally if I can get around this i'd like to. I should add that there is no charge for being less that £10 overdrawn and they do not charge for being overdrawn if you are bank before 3.30 that working day. Any ideas much appreciated. Screens Lunch : http://i1017.photobucket.com/albums/af299/badgercraig/Dirt/before.jpg Just now: http://i1017.photobucket.com/albums/af299/badgercraig/Dirt/after.jpg

-

Hello, I'm writing about a Credit Card account, opened in the mid 90s and defaulted in 2011. The default shows up twice on Noodle and Equifax but not at all on Experian. One entry has HSBC as the creditor, the other entry has MKDP Llp as the creditor. The entries show the same amount but have different account numbers (the card's account number changed at some point). They also have different default dates. The first thing I would like to find out is how to get one of these entries removed, it looks as if there are 2 different accounts which isn't fair. Secondly, Robinson Way have recently sent a letter to an address I'm linked to asking me to setup a payment plan (for the amount owed on the Credit Card), no minimum payment required. I've never heard from them before and they've not sent anything to my current address (I've lived here for over a decade, it's the address associated with the account and I'm on the electoral roll). I want to arrange for any more letters to be sent back to them, marked with 'Not known at this address' and wait for them to contact me at my address before deciding what to do next - does this sound sensible? Thanks for any help.

-

Evening all, I was hoping for some opinions on a recent complaint to HSBC over mistakes they have made with reporting incorrect information to the CRA's. I took out this loan (£60,000) in 2008 to pursue my dream job as a commercial pilot and despite passing all the training, the economic downturn in 2009-2010 led to my redundancy in 2013. The loan was set up based on my expected salary with the company I was sponsored by and the monthly repayments were £939/mnth. Since the redundancy it has been difficult to keep up with payments and i've tried my best to communicate with the bank and request help but to no avail. In August 2014 the balance of the loan was just over £30,000 and after trying to grow our business for some time, payments were getting tight. My resolution was to finish the refurbishment of a property we had bought and refinance it to release enough equity to clear the loan. The figures made sense and there was no reason we wouldn't be able to do it. I contacted HSBC and explained the situation and that I need some assistance to get through the few months it would take to refinance the property. After several heated conversations they finally agreed to put in place a reduced payment plan but I was advised that I would have to let the loan fall into arrears by 2 payments in order to implement it. The agreement was for 12 months and providing I made the reduced payment, my credit file would be frozen at 2 missed payments throughout. I discussed this with our mortgage broker and he in turn approached the lender to explain my circumstances. They advised that because there was a history to the situation and I was in this position due to the economic downturn and not through irresponsible spending, they would consider an application with the 2 missed payments on my file and didn't see that this would prevent a mortgage being agreed especially since the property was very comfortably covering the expected mortgage payments. We applied in December 2014 and early into January 2015 I was advised that it had been declined at the initial stag due to credit. I queried this with the broker but the underwriting department would not clarify why the sudden U-turn. Now under time pressures to refinance the property (we had a private investor to pay back too) we were told that our only hope was for me to gift my equity to my father and for him and my partner to apply for the mortgage whilst I resolved whatever was happening with my credit file. We did this but due to my fathers limited experience as a landlord, we were only offered a sub-prime product which we had no option but to take. This allowed us to repay the investor but didn't leave anything to pay off my loan. I downloaded a copy of my credit file to make sure everything was as agreed and to my surprise, I found that HSBC had not honoured their end of the agreement. My credit it file had continued to accrue arrears and was now showing as borderline default. No wonder the mortgage company wouldn't even look at my application, it made me look an idiot after explaining that it wouldn't get any worse than 2 missed payments. I complained to the bank and explained that not only was I now unable to pay off the loan but it had cost me around £15,000. This was made up from a capital gains bill from transferring equity to my father, increased fees and interest on the sub-prime mortgage and astronomical early redemption penalties to get out of the mortgage down the line. After many weeks they eventually agreed they were at fault but then tried to wriggle out of it by saying that I didn't give them adequate time to resolve the issue before going ahead with the equity transfer and sub-prime mortgage. They offered £3,000 in compensation to be taken from the arrears that had accrued. I politely declined and explained that I would refer to the Ombudsman, which I did. Whilst this was happening, they again reported incorrect information to the CRA's and this was picked up when we were declined a bank account for our Ltd company. I immediately notified HSBC and they apologised, promising to fix it. This has meant we cannot begin trading as a ltd company and we are therefore at increased personal risk until this is resolved. Added to all of this, the payment plan which was agreed for a period of 12 months was removed early and with no warning or communication. I received a call on 18th September advising that it the bank had decided to remove it at the end of August (conveniently as I had taken my complaint to the Ombudsman). I was advised that as of that date I was 2.7 payments in arrears. I never received any letters or warning that this was going to happen. I frantically tried to raise enough to make a full payment before it jumped to 3.7 missed on the 24th Sep. I couldn't manage a full payment so managed to keep it at 2.9 by paying 0.8 of a payment and in October as things became tighter still, I only managed 0.2 of a payment leaving me at 3.7.... or so I thought. I then received a default notice stating that I was over 4.5 payments in arrears. I immediately contacted the bank who explained that it had been sent in error and they would look into the arrears and let me know. They then reported that 4.5 was correct which means that the payment plan had to have been removed earlier than they told me it was. To keep this as short as I can, I today received a letter from the Ombudsman explaining that they have found the bank at fault on several things over the period of the loan. They have suggested a further £200 to compensate me for the inconvenience, financial loss and stress over the past 12 months!! I find this a joke considering that I am now over £15,000 out of pocket and it's almost certainly down to the string of mistakes made by HSBC. I have thought about small claims court but i'm aware of the risk if I don't win. Is there any other avenue I could go down? Thanks in advance if anyone reads this far, your advice or thoughts are much appreciated. Best wishes Richard

- 1 reply

-

- credit file

- hsbc

-

(and 3 more)

Tagged with:

-

Hi Everyone My wife and I hit difficult times in 2008 like most people and we eventually faced the Grimm truth that we could not afford our debts in 2009. Two of these debts were with HSBC, credit cards, that we agreed a zero percent interest rate and a fixed monthly fee to pay them off. Our combined debt equated to nearly £14k. In 2010 we signed with Payment services Bureau so that we could avoid paying interest. We signed standing order mandates to 2018 for my wife and 2020 for me. Over the last few years we have never missed a payment and the standing orders continue to go out of our bank account every month without fail. I have never received any official letters from HSBC stating any re-assignment and the fact that the standing orders keep going out have made me suspicious of recent claims by Cabot that they can hassle me for the balance. Tonight I have returned home to see two letters from Reston Solicitors stating that they have been instructed to seek immediate payment of the outstanding monies. They have given me two weeks from the date of the letter to settle - is this legal?? First of all I've never signed anything with them. Second, I have never had a re-assignment letter on official HSBC paper. Third, I received the letter today (November 16th), how can they demand a response in just over a week? Fourth, the balance they have demanded between us is just under £6,500 so why the high pressure when we've already paid off over half the outstanding amount from 5 years ago? I am working away for a few days and this really limits my capacity to research these parasites. Could somebody help me please? I have attached the three letters - HSBC to confirm deal and freezing of interest Payment Bureau to agree repayment schedule and Reston threatening us We have almost two sets of identical documents, the names, dates and values are the only differences. Can somebody help me with the next steps I must take please?

-

I checked my credit report and there is a default to HSBC from 2010 for £167. I tried to call to pay it off but couldn't pass security went to the branch and they told me it was a closed account and now being dealt with by Metropolitan Collections Services All of the numbers I can find for them go through to HSBC giving me the same problem of passing security (i dont remember telephone banking passcode). I've had no letters or anything, just trying to clear my credit report and this default is proving hard to get to the bottom of. What can I do to chase it?

-

Evening all I have a debt that I have (yes very stupidly) not dealt with and Im struggling to understand what this now means for me and I would appreciate any help just telling me what if anything I should be doing before I have to attend court on the 22/11 The debt in question is with HSBC where claim forms were originally issued apparently in Dec 2013 - Last week I received 3 letters that came together through the post - a copy of an N244 that has been completed by HSBC litigation team , A general directions order and a notice of transfer of proceedings.. . on the N244 is states the order asked to be bein made is 1. The claim be restored and 2. Forthwith Judgement for the claim to be entered In the evidence box this is what is written: "The claim form was issued to the defendant on the 05/12/2013/. The claim form was returned to the claimant but only the 1st page of the form was included. the defendant did not fill out any information and no offer was made. The full claim forms was not returned. The claimant rec'd a letter on the 20/01/2014 from the defendant making an offer of £200. The claimant requested judment to be entered by installments of £200 p/m. The defendant failed to pay for 3 months the claimant was under the impression that judgement had been entered. The claimant called the courts on the 04/02/2015 who confirmed that judgement had been rejected. Claimant then considered entering into a consent order for £200 per month which the defendant failed to respond to. We now seek that claim be restored and forthwith judgement entered for the claimant as er the attached N225. The general direction order says that it is ordered that as nothing has been done for nearly 2 years, the application to lift the stay must be heard on notice claim to be transferred to local county court hearing centre Notice of transfer of proceedings says as a result of the order made claim transferred to my local county court. Today I have received a Notice of hearing of application to attend on 27/11 another identical copy of the N244 and also a copy of the N225 that HSBC filed October 2015. Debt was 5028 court fees £100 legal rep costs £190 + £30 since issue I have paid £1025.00 amont now showing payable as £4323.10 - the £200 installments were stopped when my circs and income dropped - i have a mountain of other debts and was bein hassled left right and centre and started payin bits and pieces off as my circs changed but this had gone quiet and I didnt pay anything further - In April 2015 I was re made aware of this debt when I did infact receive the Consent order paperwork which I completed and agreed to and sent back heard nothing and subsequently I didnt chase it up and forgot all about it - I stupidly didnt send it recorded delivery (which I usually do - or if I did I have no references etc to prove it or check it) and would seem they are saying they never received this - I always take a copy for my own records when complteing anything like this and it will be filed away somewhere which I will try and find , but not sure thats going to be any use to me anyway etc... I have never had to go to court - I have absolutely no idea what to expect or what to do now ... any help would be hugely appreciated - if you got this far thank you so much for taking the time to read it xx

- 13 replies

-

- ccj

- county court

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.