Showing results for tags 'halifax'.

-

Halifax Banking Account Opened account in Jan 2008 account closed and defaulted July 2010 This account is being collected by BLS collections at a figure I arranged via personnel plan/arrangement. This account was mainly used for my gaming problem back in 2008/09 Account shows loans entering and leaving account same day to repay other loans within the Halifax group. £12,500 and £8,000 loan one to pay the other, aswel as many pay day loans entering the account. Account used only for gamimg sites, Betfair, Willaim Hill, Tombola, Gala, Virgin games, Profitable play gaming. ( Pages upon pages of transactions to these sites.. makes me annoyed that I blew such huge amounts during that year) Charges over the period amounted to in access of thousands, to which I reclaimed a large part of. over draft fees, late payments Defaulted in July 2010 however Credit reference companies had on report Feb 2011 to which I made a dispute, after them looking into such, the Halifax made NO contact, therefore ALL reference companies, SUPPRESSED the account from the file, and this hasnt shown on the files for over a year now. Although balance very low now £280.03 after years of paying, CCA will be in post in morning, even though I have all paper work from 2008 to 2016 This thread is per part of first Halifax one but keeping separate as per any CCA reply.

-

After discovering that I had PPI attached to an old Halifax mortgage, I put in a claim for miss selling. Today I had a telephone call from the Halifax in connection with another PPI with them that I knew nothing about. I ventured to enquired about my Mortgage PPI claim and they said that a letter was sent out to me on the 12th July 2016 explaining everything. Today is the 25th July 2016 and I have NOT received any such letter. The lady on the phone then read me the contents of the said letter outlining the reasons for the decline of the PPI. The ones that stood out were :- You had NO savings to support your mortgage payments in the event of sickness or redundancy. You needed PPI to cover sickness, redundancy etc. When the aforesaid "sale" took place I had been in my present employment with Royal Mail for 9 years and continued to work for them for a further 10 years until my retirement. (19 years in total). It doesn't take a genius to work out that a letter sent on the 12th of the month does not take 13 days to arrive at its destination even if it was 2nd class. This letter is still to arrive. At the time of the sale I had cover for sickness (6 months full pay, 6 months half pay) redundancy (12 months pay) and also death in service through my Royal Mail Pension. As far as I was concerned I DIDNT need PPI, being covered through my employment. I have the original paperwork in connection with this PPI and in my Personal financial Report it states :- No recommendations nee4ded From the information you gave me it seems you already have plans in place to meet the following or no need in the particular area * Protecting your financial security * Protecting for critical illness over and above the mortgage debt * Saving for the future * Investing your capital I had a secure job with Royal Mail and a statutory pension plan in place for my retirement which included a payment for death in service. Sick pay and redundancy pay. Why did I "NEED" PPI Was the Halifax right to decline my PPI claim. I understand that it was underwritten by Lloyds. Any information greatly accepted. Thank you

-

Hi All, Having the same run around as a lot of other members it seems, I used a claims company for some credit card PPI claims and saw it was an easy process so I decided to go after Halifax myself, I had records that we had three mortgages with them: 1) 1994-1997 2) 1997-2000 3) 2000-2007 June 00 - July 07 I didn't have all the details so called halifax - they first said we didn't have any mortgages with them!! I gave all addresses and dates. I had to go through some old credit files which gave me one roll number, then they found them all! what a surprise - at that point they confirm all three had poi - I asked for them to setup a complaint - I then had to prove who I was and supply other details.. This was done and they went forward with a complaint - I also found a document from our house purchase (3) which had a redemption figure and confirmation of the mortgage repayments insurance figure - £140.84 a month After about 8 weeks we got a cheque for £16,800 which already had tax deducted - the rate on interest is at 8%, they have said they the overall amount we paid towards the MPPI is £9,539.24 although I have the letter stating £140.84 a month ( just mortgage 3 ) maybe it increased as the years went on. They have put the interest at £9,270.90 based on the amount above and mention this takes into account the date we get paid back, maybe I have used the wrong PPI calculator but the figure I'm getting with interest is near £27k based on their figure of £9539.24, when I put in £148.284 a month its at £33.5k. Am I getting the working out completely wrong? The unbelievable thing is the wife said that doesn't sound right for all three mortgage's - we rang them up and they said, you have only made a complaint about the last mortgage - I said why would we go through everything listing all mortgages then only complain about one, they again confirmed the two previous had Mppi and set a new complaint process going - they even took our account details to hopefully make the payout quicker. 10 days later we have a letter dated 12th saying that they cant find any PPI on those two mortgages, the next day we have a questionnaire asking about why the PPi was taken out, did we claim etc. I called and said we had it confirmed that Mppi was across all mortgages and said we were even given a rough monthly cost when we put in the original claim, the lady let it slip that in the last few days all systems have been updated and old records could have been lost as its so old, I asked her to confirm that this could have deleted the details she said yes. I then said we have been in contact for two months and there must be a record somewhere, she asked me to send in any paperwork to the complaints dept! Great! Thanks for any advice.

-

Can anyone advise me please - if I fall out with Lloyds (which I am likely to do) and I have an overdraft outstanding - will funds in a Halifax Current account be at risk of Lloyds grabbing?

-

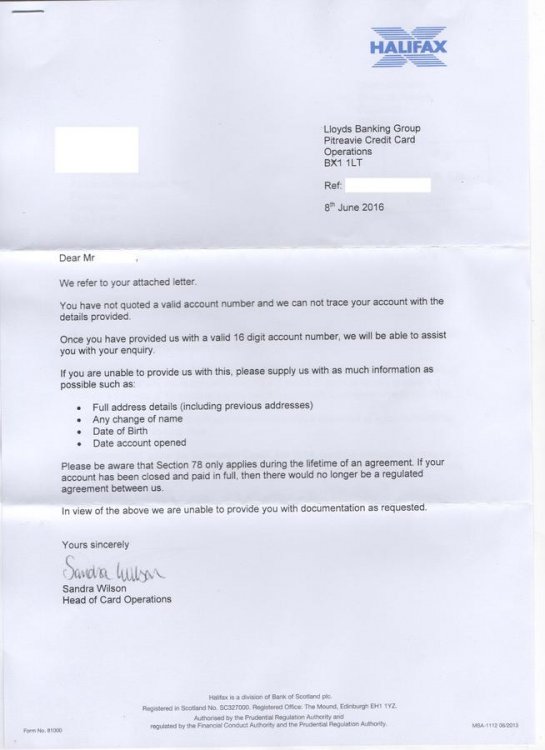

Received this in the post today Along with my original CCA letter. Any advice? I dont know what details they have as I have moved a number of times since then. If it was a credit card I would have thought capquest would have the details Just double checked on my Noodle account. It is listed in my closed accounts (if it is that one) and is shown as settled in Dec 2010 with no missed payments. Edit: it cant be that one on the account as my card limit was £1000 and have been paying £6.52 for years and my outstanding balance is shown as £1211.14 and the account is settled properly. Edit 2: Is it worth doing a SAR with CapQuest to see what they have on file and amounts?

-

I had an outstanding amount for a Halifax Credit Card after I defaulted when my dad died some years ago and I was also made redundant. I paid this off over 5 years only to then be told that I still owed them over £1000 as this was for fees. I disputed this and it was when I disputed it I found out that I had in fact had PPI on the credit card when I demanded copies of my statements. I went into a branch of the Halifax with copies of everything and was told by a staff member that I shouldn't in her opinion be paying the fees (PPI should have covered everything but I was in a very bad place at the time and didn't realise I actually had PPI). She took it to her manager who agreed. I was advised to put everything in writing and told there was no reason I couldn't stop further payments as I shouldn't owe them. I asked what would happen if I stopped any payments and was told they would probably send demand letters s o I decided instead to drop them to a token £1 just to stop any threatening letters in the meantime that the complaint was being looked into as it was too stressful. While I was there, it was also established that a previous loan I had had and paid off had also had PPI on but they had refused to pay out on it when I was signed off with depression as it turned out I wasn't covered. This forced me to use the credit card to try cover repayments at the time. I was advised to lodge a complaint about that too - which I did as when I took out that loan the lady who sold it to me told me it covered me for illness. The Halifax wrote back and accepted responsibility and refunded me the PPI. However, they didn't accept it for the credit card. They have ignored the fact completely that I did have PPI on it until I defaulted when I was made redundan t and dad died and continued to demand the fees were repaid. Had the PPI been used then the fees wouldn't even have accrued. I then took it to the financial ombudsman and am still waiting on that. Now, it seems the Halifax have sold the debt to Cabot Financial who are now sending me letters threatening legal action and CCJ's if I don't reply in 14 days. When i found out the debt had been passed to Cabot I stopped paying the token amount and haven't had any contact with Cabot. What would you do? I'm seeing posts saying to ignore but at the same time there are posts where it seems Cabot have actually taken people to court. I can't understand why the Halifax wouldn't take into account the fact that it turned out I did have the PPI on the credit card which I had been paying from the beginning. You can clearly see just by looking at my account (I had a current account with them) at the time I defaulted when my dad died that I had no income at all and that I had been in real trouble. I literally sank. Had I been in a better place at the time we could have discovered this and presumably the PPI would have kicked in and none of these charges would exist but I barely even left the house. I would really be grateful for advice. The ombudsman is taking forever and I'm not entirely confident in them anyway as they seem to take an easy way out and not uphold claims from other posts I've read. I presume I also need to let them know about this latter from Cabot too? Thanks

-

Hi all, I have send a request and got this agreement back. Can someone please tell me if its enforceable? and if so or not what is the next steps? Is there anywhere a guide on what to look for when its enforceable? Thanks a lot! Halifax agreement Page 1.pdf

- 25 replies

-

- agreement

- enforcable

-

(and 1 more)

Tagged with:

-

Can anyone provide the most up to date address for CCA & SAR for HALIFAX CREDIT CARD Not sure if the addresses i`ve found are up to date Many thanks in advance

-

Hi all, first time poster but long time lurker and admirer! I am a former Bank worker (not Halifax) so know a little about complaints procedures but now need your help. For background - My partner was formerly in an abusive marriage. Her ex was emotionally, financially and physically controlling. All of this is documented in court papers and he is not allowed to see my partner's child and has no parental rights. During the course of the relationship, the two of them opened a joint bank account with Halifax (before he became completely abusive). My partner's debit card was at some point confiscated from her by him so she had no access to the account. During this time he attended a branch, obtained a form and forged my partner's signature in order to obtain a £2750 overdraft limit on the account without her knowledge. She had no knowledge of this overdraft (which he maxed out in really short order) until after the divorce proceedings had begun and he had had a restraining order placed on him. Halifax began sending chasers for payment to my partner. She put in a formal complaint which was rejected by Halifax and followed it up to the FOS which was also rejected. Naturally she wasn't best pleased attended the local Halifax branch where the Branch Manager managed to bring a copy of the document she had allegedly signed up on his screen and showed it to her. She then showed him several other documents with her signature on and he confirmed that it was clearly not the same signature or even close. He promised he would look into it and get back to her. Unfortunately he never did. After she chased him twice by email, he just stopped responding. My partner suffers from severe anxiety and depression as a result of the marriage so naturally thought this would be the end of it and simply put it to the back of her mind. This all happened before I met her. The current - Fast forward nearly two years with no correspondence from Halifax to March of this year. My partner received a letter from Halifax confirming that the account had gone past its OD limit and they were now expecting payment of the £86.54 arrears from her. We wrote a formal complaint email to the CEO and requested a DSAR so that we could have a copy of the signature. This was picked up by someone in the executive complaints team and we've been going back and forth with them requesting confirmation that my partner is not liable for the debt (as it was taken out fraudulently by her abusive ex) for the last 4-6 weeks until yesterday when we received what appears to be their final decision. they've completely ignored our request for a copy of the signature (although we are still due to receive the DSAR within the next 4 weeks), completely ignored any points we've made regarding the financial abuse, completely ignored everything - and now the account is being passed to collections, a default is to be registered against my partner and she has been issued with a formal demand for repayment as the account is "jointly and severally liable". As a former bank worker myself, I understand this point but surely this is invalid if we can prove that she did not sign for the OD? WHAT DO WE DO NOW?! I feel like we did the right thing by only corresponding via email/letter and emailing the CEO direct but I just feel like Halifax are completely steamrolling us and insisting she pay this debt. We've tried the local paper (and told Halifax we are contacting them) but so far nothing. Any advice you guys can give would be really appreciated

- 16 replies

-

- abusive

- fraudulently

- (and 4 more)

-

this is about a Vehicle that needs around 3,500 - 4000 Costs in Repairs or a Full refund. its been over 2 Weeks since I sent the required Extra Information to Claims Team that they asked for . Today I received this email. "I have checked with management and your file is still under review and hope to have a decision to you by next week. Should you have any further queries, please do not hesitate to Is contact us." I Received this email about 6 Days ago "I am sorry to learn of the difficulties that you are experiencing with this merchant. Section 75 of the Consumer Credit Act 1974 covers purchases made using the card costing between £100 and £30,000, where a misrepresentation or breach of contract has been proven. Please be assured that a complete review of your claim is in progress and I will update you as soon as possible. " I was told on the Phone 7 - 10 Days it has been over that. Really not happy about the amount of time they are taking. Is there anything further I should do at this stage ? Its causing a lot of issues in the House and costing us money. I am planning on going Small Claims Route if I need to. as I am pretty sure it is clear cut case It has been just over 4 weeks since Lloyds where made aware of the Issue. .

-

I appreciate some advise regarding my daughter , She has been seperated from her huband for 5 years and living in the family home he purchased as she wasnt working at the time to have the morgage in her name he is in the army and living in barracks he has had no contact with his 9 year old son for 4 years and has now stopped paying his half of the morgage without warning my daughter . she is now filing for divorce and has her name on the land registry, the home has now been to court due to 5 missed morgage payments and she was advised by a duty solicitor to keep paying the mortgage. Her worry is if she pays the morgage and its in his name where would she stand once divorce is through etc. He husband wants the house repossessed. The house was bought for 99k and valued now at 130k please can you advise as she is getting nowere with solicitors ie not returning calls etc .

-

Hi, Started posting recently as I'm in the process of clearing a few things up. Having signed up to equifax I've noticed a default on my record from my Halifax current account. While in the USA I was using my Halifax debit card and juggling how much I had against converting it from Dollars to Pounds. Ultimately, they authorised a debit card transaction which put me overdrawn (there's no overdraft limit on the account) Because the transaction got authorised I thought I was good for the money at the time. During this situation I was also moving banks to Natwest. As a result I never used the Halifax account again since returning from the trip to the USA. It got left and now I have a default. Is there anything that I can do seeing as they authorised a debit card transaction even though there were insufficient funds? Cheers, Limelight.

-

Hi Just wondering if anyone can help me sort out my sons Halifax Bank Account. He has only had this account for about 8-9 months. Applied on line and didnt take the overdraft option as he doesnt want to be using any overdraft facilities. Account has obviously gone overdrawn once or twice and as he doesnt have his wages paid into it has paid charges in the past which have cost him £6 per day. Doesnt have any paper statements. Only had a debit card - no credit card. He was recently sent a letter to say his account was overdrawn by £120. He has had the telling off for not checking the account sooner. I wrote to the Halifax on his behalf apologising for this error and asked for a breakdown of the overdraft. All we have received is another letter advising this is now overdrawn by £240. The collections department are now asking him for this payment but I think any payment he makes is wiped out by further charges being added. They are adding £42 per week in charges, so if he were to pay £50 a week he would only be clearing £8 per week off the overdraft. Is it ethical or legal for bank charges to be added in this way? He doesnt earn enough to pay all this off in one sum and his partner doesnt work as their baby is due in 6 weeks. Would anyone know how I can aproach this for him to see if we can sort this out to reduce the stress before the baby comes. For obvious reasons, he will have less disposable income then. Thanks for any help anyone can offer. (My son is 20 years old).

-

Hi all, I recently CCAed all my creditors in order to try and sort out my finances finally. I have been paying £1 token payments to each, having defaulted on all over 6 years ago. I have moved house a few times since and have lost track of what has happened to them all. having sent a CCA request to Robinson Way, who I originally dealt with for a Halifax debt, I received a strange reply, returning my £1 PO, and saying that "the account is closed on our files, please contact our principal". This was written on a very unprofessional piece of paper that looked more like a memo than a letter! Has anyone got any advise as to how I should proceed with this? The 12+2 days are definitely over. As Robinson Way were dealing with this, is it still their responsibility to respond to my CCA request? Thanks AM

-

Hi everyone Quick review, received a court claim from Cabot claiming £21,000 plus for a loan I am sure I received a statement showing zero balance. As this was before 2008, not sure I have all the old statements but will be looking for these. I sent a defence form back online to say I disputed the full amount. Timeline below: First letter - xx/9/2015 - from Cabot solicitors - Wright Hassall - about this matter threatening court etc. Claim form - xx/10/2015 - County Court Claim Form from Cabot - the gist of this is: Debts... CCA 1974 agreements. The Claimant is the Assignee of the following debts, notice of the assignment having been given to the Defendant in writing etc. Court response to my defence, acknowledged and served on sols - xx/10/2105 Second letter - xx/10/2015 - from Cabot themselves and because this is the most confusing part, they say: Thank your for your letter (SAR sent to them) We notice your change of name and have updated our records - the change of name was 5 and half years ago Unfortunately we have not been able to provide you with the requested information in the relevant time period. We shall continue to request the information... Your account Your credit agreement is currently unenforceable which means we are not permitted to obtain a judgment or decree against you in Court etc. Third letter - xx/12/2015 - from Cabot solicitors - Wright Hassall - they dispute defence etc. go on to say that they have a payment on record of £1xx.xx They state that the debt was assigned in 2008, I have no record of this. Fourth letter - xx/1/2016 - from Cabot solicitors - Wright Hassall + Directions Questionnaire for Fast Track and Multi-Track filled in and Draft Directions Notice of Transfer of Proceedings to my local court - xx/1/2016 Notice of Allocation to Fast Track - xx/1/2016 and court date in February, and the wording below. There will be a case management conference on xx February .... Phew, sorry it's such a long note but wanted to get everything down and xxd out the dates. I have a couple of questions. 1. If the credit agreement is unenforceable, in their words, why are they pursuing this? 2. What happens if they don't supply the documents in the time stipulated as the judge has ordered? 3. As they say the debt was assigned in 2008, isn't this statute barred under the Limitations Act 1980? 4. What do I need to do for the case management hearing? Very worried about this. Any help very gratefully accepted. Thanks!

-

Hi Guys Just looking for some advice, My daughter opened an account with HBOS when she was a student in 2007, Stopped using it in 2008 when she ran up an overdraft, and completely "forgot" about it, She has now received a form N1sDT from Northampton County court signed by Lowell Portfolio demanding nearly £1500. The original overdraft was £500, The claim form states "despite repeated requests for payment" But she swears that she has never had anything from these people, (She has moved house about 5-6 times since leaving her student digs though due to her occupation) Where do we go from here Is it too late to request a SAR and a CCA? What does she put on reply form to court Thanks in advance Cosy

- 2 replies

-

- county court

- halifax

-

(and 2 more)

Tagged with:

-

Hi, we have a suspended repossession order from 2010 (when my partners ex wife was still on the mortgage, she is now no longer) and we have fell into arrears of 6100 over the 5 year period due to unemployment. We made a partial payment in august last year and missed a payment in November last year other than that we have maintained our mortgage payments and have been paying some off the arrears each month for nearly 2 years, now the Halifax have said they are going to be seeking an eviction date if we don't pay £3000 by the 28th of this month. We have kept them informed of the payments missed and have tried to come to new payment arrangements with them each time. We spoke to a man at the Halifax in December who said that we had to pay the full arrears or it would go to repossession, we explained that we didn't have access to that sort of money so we couldn't pay that much, then we spoke to a different woman at the Halifax last week trying to come to an arrangement were we pay £100 extra a month to clear the arrears quicker and she said that if we paid £1400 it would stop any more proceedings, then we got a phone call on Friday saying that we had to pay £3000 by the 28th of the month or they would seek an eviction date, we explained that we didn't have access to that sort of money and that my partner didn't get paid until the 29th of the month and we would be making a payment of £625 (which includes the £100 we said we would pay to clear the arrears quicker), she then replied that they would be sending us an eviction date. We are panicking now as we have 3 children, our eldest child is in her final year at juniors and we are currently waiting to hear if she has got her secondary school place, she also suffers from anxiety, our second child also has epilepsy and possible autism (we have just got an appointment with a specialist doctor after a 19 month wait) so everything is in place at his school for his needs, the Halifax are aware that we have children and one with a disability. I had to give up work in June last year due to severe hand eczema and stress and anxiety, however my partner has a good job and can pay the mortgage and the arrears no problem. I am really really worried they are going to repossess our home as I don't drive and we won't get a private rent in the area and if the council put us in an area where I won't be able to get my children to school, I don't want to have to change my children's schools as there is support in place for them at the schools they are currently in and it could change my sons hospitals and doctors if we aren't in the catchment area. I am going to write to the Halifax with our proposal again, with a breakdown of how long it will take to pay the arrears back, I just don't know what else to say to them and I think it will be rejected as well, I just don't know what else to do.

- 21 replies

-

Long story short i had an old Halifax CC opened in 2006. The CC is in my name, but the debt was not run up by me, but.....by my old man who then refused to pay it, but i think thats by the by. And no, he's won't cough up to pay it. I received 2 letters before xmas, one from Halifax saying the debt had been sold to Lowells in 2014! And the other from Lowell saying they'd bought the debt back in 2014. Now, its not SB as the last payment, of a pound! was made in 2011. Second letter was a nicely nicely letter than i got yesterday telling me i won't have to pay what i can't afford. We struggle to pay our own bills, let alone anything extra. For now, i think my best bet is to ignore the letters? Or do i start the "3 letter process"? Many thanks

-

Dear All, i really would appreciate help and advice on how to deal with my situation. I visited a country on three occasions from last year to date. On each occasion i notified my bank the dates i was going to be away and the country to which i was visiting so that the Halifax knows exactly which country i would be visiting and how long i would be away. On each occasion of my travel i phoned and advised Halifax but more than that, i specifically asked them if it would be possible for me to use my debit card in that country. On each occasion, the Halifax said there was no problem and i could use my debit card there. On the last occasion i met with my account manager on 18 Nov and explained quite specifically that i shall be visiting this country and shall definitely be using my debit card there. he told me that there was absolutely no problem. Whilst i was away on 08 Dec. my account was closed by the Halifax I found this out by chance because someone gave me some money which my partner tried to pay into my account. She was unable to credit my account when she asked the bank, she was told that my account was closed down because i used my debit card in a sanctioned country. As soon as i learnt of this, i phoned Halifax and spoke with a manager there. I explained my situation and explained that i have to pay a hotel bill and i needed to use my debit card. I explained that i advised the Halifax etc. but the key thing was i needed to pay my hotel bill. The manager said he will see what he can do and will call me back. He never kept his promise. I had to settle the bill in cash which my relatives in the country lent me. Had i not been able to pay the hotel bill i would be in prison now. This country is pretty strict. I had banked with the Halifax for 20 years. I have not defaulted on my account. rarely do i go over my credit limit. i returned to UK over the weekend. i have no idea what to do. Will some one please advise me.? What can I do? How can i get my account re-instated? How do i claim compensation against the Halifax? this is rather urgent because, i now have no bank account. (I am trying to see if i can open an account with another bank) but these things take time. Already, my standing orders are effected. please advise me on what i can do thank you Wrecked.

-

Hi Folks I received a letter from Cabot Financial today saying "you account is now being reviewed to determine whether we should commence legal action against you" I defaulted on a number of accounts in 2008 and have been paying a token £1 payment to all creditors since that date up until the start of this year 2015. None of the original debts are on my credit reference file anymore so i stopped paying the token amount around this time to see how things panned out. I've hardly heard a thing from any of my creditors apart from Capquest and Cabot who both took over different accounts. Capquest have been fine for now but cabot are being VERY persistent and have been sending letters almost weekly since April this year culminating with the letter i received today. To clarify. Cabot currently own two debts, one being from an old Halifax overdraft of £2k and the other a Barclaycard default of £7k. The letter i received today if referencing the Halifax account only but i presume i have another letter heading my way regarding the Barclaycard account also. A quick look on the site i see they are actually pushing through with these threats so im asking for some advice on this matter from anyone qualified to hand it out. Any opinions are most welcomed. Many thanks!

-

Halifax is imposing a fee of £1 a day from arranged overdrafts of £0.01 to £1,999 as from 1st Dec 2015. No interest rate is charged. So if one has an arranged overdraft of £100 and goes overdrawn by £0.10, a fee of £1 will be charged and by 100 days, this £0.10 becomes a unarranged overdraft for which a fee of £5.00 is faced. Is this imposing excessive charges or treating customers unfairly??

-

My son had a student account with Halifax when he first went to university. Sadly, due to mental health problems, now diagnosed as bipolar disorder, he dropped out of university. Halifax agreed to freeze the account. In recent months his health has deteriorated again, and he is now claiming Employment and Support Allowance and living back at home with us. Halifax have recently decided to charge him £16 per month for the overdraft, but as this month's payment has put him into 'Unplanned Overdraft' he has been charged another £5 per day on top of this, so the debt is now mounting . I've put some funds into the account to try and alleviate the situation, but wondering what we can do next. He's not in any fit state today to speak to anyone at the bank.

-

Anybody got an actual E-Mail address for the executive of Halifax without going through the rubbish customer complaints area??

-

hello I have just found(searched the house) the actual agreement of Halifax personal loan wondering if someone could help me work out how much I can reclaim ? Taken May 2005 Credit: £6500 Arrangement fee:£65 total charge for credit 1799.68 48 monthly repayment of 172.91 APR 12.1% monthly Interest rate 0.928% Insurance premium Tax included, insurance premium at 5% with this information can I send letter requesting refund, I need a spreadsheet but can't open any of the spreadsheet links on here, can open spread sheet relating to bankcharges from 2007, is the spread sheet the same

-

I'm not sure if I have a case? I was a first time buyer if that helps to say in my case? Just looking through my files, the first year (aug 2001) of my mortgage for PPI all I can find is the Halifax mortgage letter saying thank you for applying for a mortgage "As the loan amount you require exceeds our basic lending limit it is necessary for us to arrange additional mortgage security. you will be advised of the fee in due course. Please note that if you are borrowing less than 90% of the lower of the valuation or purchase price we are currently paying this premium." Then on the mortgage offer letter At the end of the letter it says (oct 2001) SPECIAL NOTE We strongly advise you to consider arranging insurance cover to protect your ability to keep up your mortgage repayments if you become ill, lose your job, etc. You can obtain details of such mortgage repayments insurance from from any of our branches or your financial adviser... Then a few weeks later the halifax letter of acceptance for my mortgage says an additional mortgage security fee of £419 is also due. We will pay this fee. (explaining that they are lending me more than they normally would and additional mortgage security is required) But exactly one year after my mortgage I started paying PPI monthly for the next 12 years to St James Place. So who do I apply to and how do I explain the first year? Very confusing. By the end of the first year I must have believed I needed it but £419 per year is extortion, so I must have shopped around. I've never been in debt, ill, lost job or took out life insurance. any advice gratefully accepted thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.