Showing results for tags 'under'.

-

Hi can anyone help as to where I stand here please? I had a letter asking me to name the driver of my car. It was addressed to the company secretary as the the car is in my company name. My wife had opened the letter as she deals with most work post (im secretery tho). The offence was doing 40 in a 30 (dual carriage way). I keep a log of when i am in the car but generally its my wife. unfortunately I couldn't find my diary. My wife rang the police and asked for a copy of the camera photo which they sent out. The photo was very blurred and you couldn't see who was driving the vehicle. She rang the police and informed them we was unsure and that I would have to find the diary. My wife found my daughters dance dates which confirmed that she was driving. She filled out the NIP form with her details and sent them off. Unfortunately this was filled out incorrectly as it should have been me who filled out the form, but also she had put Yes to Q1 but then also filled out section B with her details. A letter was sent out to say that the form was wrong and that we would have to fill the form back out and send it off. My wife rang the police and spoke to a lady to ask why it was wrong eg, she was told that we would have have 7 days to fill the form and get it back to them, this was on Monday 15th feb. The form was filled out and emailed back the them the following Monday 22nd at midday. Around the 26th (cant remember exact date) we received another letter saying that I (well the company secretary) would be prosecuted under section 172 failing to supply information in time? My wife rang the police back and spoke to the clerk who said that we had filled late and that they had said they would only give a couple of days to get the form over, not 7 days. Can anyone shed some light as to where I stand please? Court date is next month. Kind Regards

-

I ordered an under counter black freezer from Curry's , online, a week ago. It arrived the next day. I requested the delivery crew to remove the packaging, and just as well that I did as the top was damaged, scratched and scuffed, very apparent, even the delivery crew were shocked. There are also scratches down the side and several gouges on the front. The delivery crew wrote all this on the delivery sheet and said they would immediately report back. Stupidly I made the mistake of not asking them to take it back with them. T & C state all damaged goods must be reported and returned within 48 hours...try doing this. When I reported it using their correct method I said I would accept a replacement. Their T & C said they will respond within 24 hours. I cannot get a response. I have now contacted them four times, one to the CEO..still silence. This freezer is a 'top up' to my main freezer and is taking up the only available space in my kitchen. I want to order another freezer from another supplier but until this is moved, I have no where to put a new one. The only place I can put this is either on the drive, in the open, but behind locked gates, or in a very full garage, where it will no doubt get dirty and probably more damaged as my son uses this to store his tools (he does not live with me) I know I should take 'reasonable care' until they pick it up. But if they don't respond, where do my duties end in this respect?:?::?: I am now going to go back to credit card company to get payment reversed in the meanwhile/

-

Beneficial interest on HP Agreements. I have tried to simplify this definitions in order to keep them in context with the current discussion regarding, if a vehicles on HP can legally be taken under control. The intention on this thread is not to discuss any success or failings of cases which have gone to court, it is just to examine terms which are unfamiliar to many on the Bailiff forum. It will be necessary to introduce some more terms, which should assist understanding within context. These are: “Property on goods” and “possession in goods”. Property in goods denotes ownership. A landlord has property in goods in a rental agreement for instance. This also applies to the creditor in a HP agreement. “Possession in goods” applies to the hirer in the above case. This is where he takes possession of goods for a period of years on in perpetuity under a lease. This also applies to the hirer under a HP agreement where his legal possession is prescribed by the terms of the HP agreement Interest in goods. An interest in goods occurs when someone who is not their owner, has rights in regard to a part of their value. There are numerous types of interest in goods, legal interest, equitable interest, beneficial interest, etc. All are covered by the above definition but they denote different ways the interest is held or recoverable.

- 401 replies

-

- agreement

- beneficial

-

(and 3 more)

Tagged with:

-

Hi, I'm afraid I have to go into a bit of slightly irrelevant history before I get to the point, so please bear with me! I own a freehold property that I bought in 2005 and currently rent out. I discovered two months after the property purchase completed, that although my property is freehold, there is a management company involved and a covenant in the Land Registry deeds. The management company refused to agree to the register of the title in my name, until I signed the covenant, so I had no option but to sign it. Around two years after I bought the house, the management company started to try and charge an annual maintenance fee, which I have disputed in full since they first contacted me, on two grounds - firstly that I signed the covenant under duress (although I am aware that is a case of 'caveat emptor' and it may be deemed that I should have been aware of what was in the deeds). The second ground is that the management company have not provided me with any tender documents or invoices for any work carried, despite repeated requests, and the management company's fees represent more than 50% of their annual expenditure. Despite the fact that I have disputed their invoices in writing on numerous occasions, they have passed the debt on to a third party, Property Debt Collection Ltd, who have disregarded, or failed to understand the nature of my dispute, and it is they who have now served the Notice in the thread title. They claim in the accompanying letter that they will commence possession proceedings if the amount remains unpaid; have added a £650 preparation fee to the outstanding sum (disproportionate for a two page Notice, surely?); and refer to an estate rentcharge, which I don't believe this is. They also state in the Notice that they intend to enter the property and take the income thereof. I have tried to research this Section of the Act online, but I am struggling to find out firstly whether this is even the correct Notice as the charges are estate management charges and not a rentcharge, or whether thay can take any action such as their threat to enter without a Court order? I have read of a charge being added to the mortgage under Section 123(4) but I don't want my mortgage company to pay a disputed debt. I would actually be happy to go to court as I would like the opportunity to put my defence! I should also comment that I work in residential lettings, so I am relatively familiar woth most legislation, but this is a new one on me! Any advice would be gratefully received.

-

Hi I am trying to find out what can information retained under the limitations act be used for, I have data held by a university who state in their records retention policy that the information is the be retained for 6 year from end of program with the reason for retention of the data being given is the limitations act 1980. Can data retained under this act be used for any other purpose? the information relates to internal disciplinary hearing in 2009. I left the university in 2010 and returned in 2013 to do a different program. The university now wants to access this information from my previous course, I am arguing that my contract with the university ended on 2010 when i left and that in 2013 when i returned for a different course that was a new contract and staff on the new course should not have automatic access to data from my previous course. Really up against it here any relevant advice appreciated

-

Hi All, I am a new member and so pleased to have found this site, to be able to ask my questions. I will try and keep it brief, my h received a letter inviting him to attend an interview under caution, this has not taken place yet, but it is imminent. He does have a medical condition and has proof of it, he was claiming ESA and the lower rate of PIP, this is only a relative new claim, always told them that I was working full time, no council tax benefit or housing benefit claimed for. He was on the benefit for 5 months, he started to feel a little better and wanted to go back to work, luckily he did find a job, tried to phone the benefit agency many times before starting this work to inform them of a change in circumstances, could never get through, so he decided to put it in writing to them, then started work. The job lasted four months, had to give it up because the medical condition reared it's ugly head again, but during the time he worked, the benefit kept getting paid, he had given all his correct details to his employer and had paid tax and NI. After a few months, he decided yet again to try and get back to work, this time the job lasted 7 weeks, during which his employer had said that he had to register as self employed, did this all correctly. Now he is not working and has to go and have the interview, we have got all copies the paperwork, thankfully. He has got a solicitor to go with him, but I am afraid that they are going to try and make out that it is his fault, if he was trying to do anything deceitful, then why would he give his employers the Nat Ins number, he is not thick, he knows that this would show up and he hoped that at the end of the tax year, they would realise their mistake and stop the payments, by the way the money has not been spent, but saved. We have always worked all of our lives and paid taxes etc, never been in trouble before, oh I do not know the amount of overpayment they are saying yet, but it is their fault in our eye's that it even happened, but I am scared of the DWP, having heard awful stories about them. Any advice would be much appreciated, thank you.

-

Our house was repossessed in 2009 and sold at auction to recover the outstanding mortgage balance. The sale left a shortfall of £25K+ which the lender came after me for, and being in our late-60s with no savings, assets or investments following a business collapse this is being repaid at £5 per month from Pension Credit sole-income. At this rate it would take over 400 years to settle. I have twice formally requested that this be written off, as it is clear that there is now no expectation in retirement of there being a substantial income or a radical change of circumstance that would make settlement a possibility. My first approach 4 years ago was made direct to the lender, and shortly afterward a response came from the DCA advising that their client was not willing to do so. A follow-up request restating the realities and requesting reconsideration was never replied to. My second approach 2 years ago, and two subsequent chases, have never been replied to. I believe that the mortgage lender’s code of conduct has something to say in such a regard, particularly that a lender should not, or may not, pursue recovery of a mortgage shortfall debt where it is clear that recovery is impractical or unachievable. Is there a mortgage-debt expert on CAG who can confirm or deny this? I intend to request a write-off again, and want to leave zero wiggle-room because clearly 400 years is idiotically silly to enforce at age 68 or indeed any age! Any clarification will be greatly appreciated, thanks!

- 20 replies

-

- clear

- guidelines

-

(and 6 more)

Tagged with:

-

Upgraded my old handset last September to the latest Moto G 3, all worked fine until it became unworkable, kept freezing, and rebooting itself three or four times a day, came to a head when I couldn't even make a phone call! Put it into O2 to repair under the 12 month warranty in March this year, so technically, although I would need to check the exact dates, within 6 months of purchase, so faulty from the start. The letter enclosed stated that the handset had been replaced, it hadn't, a 'board' had been replaced. All was fine until it came to update the software, this update was in German? Then it again started to do it's rebooting habit again. So this was put back into O2 to be repaired Last week, and today I have received a message off them, claiming that the repair isn't covered by the warranty? Confused?, You bet I am. Just waiting for the handset to be returned to the store, so I can read the enclosed letter giving me my 'options' to have the fault rectified. Why is nothing simple? Do we have any O2 reps on here?

-

The government is set to delay implementing enhanced rights for rail passengers by 18 months, Which? has discovered. Earlier this month, it emerged that the government is set to delay the implementation of the Consumer Rights Act in sea and air travel until October 2016. And now, Which? has discovered that rail will be delayed by a further 12 months until October 2017. The Consumer Rights Act came into force across most sectors in October 2015 and was initially due to apply to all travel sectors from 6 April 2016. This delay means consumers will now have to wait another 18 months to be able to claim a full refund or compensation when a train operator does not deliver a service 'with reasonable care and skill'. http://www.which.co.uk/news/2016/04/further-delays-in-store-for-rail-passenger-rights-439947/

-

I have been asked to come to an interview under caution. I was told it was to do with allegations of working whilst claiming universal credit. What was odd was that I received the letter at the beginning of April, yet it was dated mid February. In the letter, it said that if I did not reply within 7 days of the date as posted, then they will assume that I am not attending and it will result in further action. When I called the DWP officer, he said it was just a mistake - but it seems a bit odd that a DWP fraud officer would get the dates so wrong. Also, he told me just to ignore the serious wording of the letter. I said it was a serious investigation, judging by the wording. I felt he was just trying to get me to come in, thinking it was not too serious so that I do not get legal advice. I feel this is a devious ploy. I am thinking of just saying no comment because I cannot afford for a solicitor to attend but I am afraid this will land me in more trouble. Also, I will ask for a copy of the tape at the end of the interview.

-

Bit of background on this issue. Bought a 11 plate car in Feb 2015 from Bristol Street Motors, had a few issues from purchase which was mainly a problem with the tyre pressure going off but unable to reset it. It went back to Skoda (paid for by Bristol Street) and had an ECU reset. There was another issue with the car revving up when braking which would clear when I pressed the clutch. I told the manager of the service depot in Bristol Street about this ongoing issue and he said he would phone me back to book it back in. He never did. As it was an intermittent issue and didn't want to be back forth yet again, I left it. Fast forward to now, and my cruise control has stopped working. A common fault on these cars is a clutch switch, which would also explain the revving up when slowing down, according to several posts on Skoda forums. My question is would I have a claim with Bristol Street, even though they only supplied 3 months warranty. I know I am likely to have to prove that the faults are related and it was likely an underlying issue that was there when sold. I want to go down first and see what they say (likely to **** off I guess) but thought I would ask here first to see what you guys would do and be armed with any relevant info before hand. Thanks in advance DY

-

I wonder if anyone would know the answer to this? My son is slowly paying back his student loan. If we start a Lifetime ISA which was announced in the budget, will any savings in this ISA be taken or seized to pay back his loan quicker? Or, is it totally separate from his student loan and can't be taken into consideration? I hope I have posted in the right forum, and please move this if need be. Thank you. Miss Anxious

-

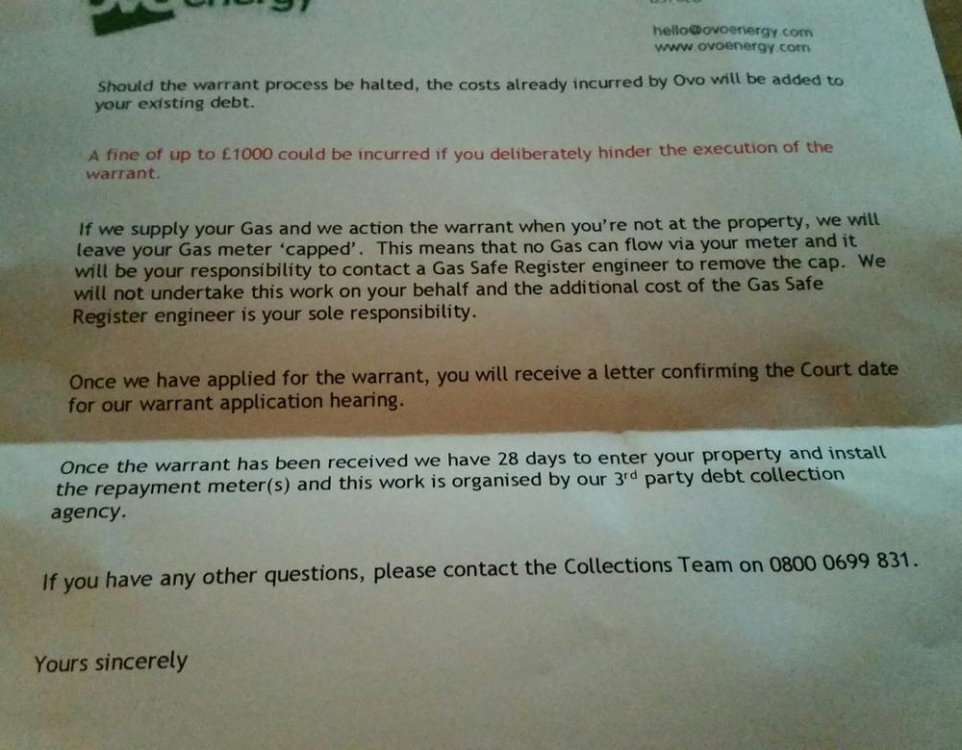

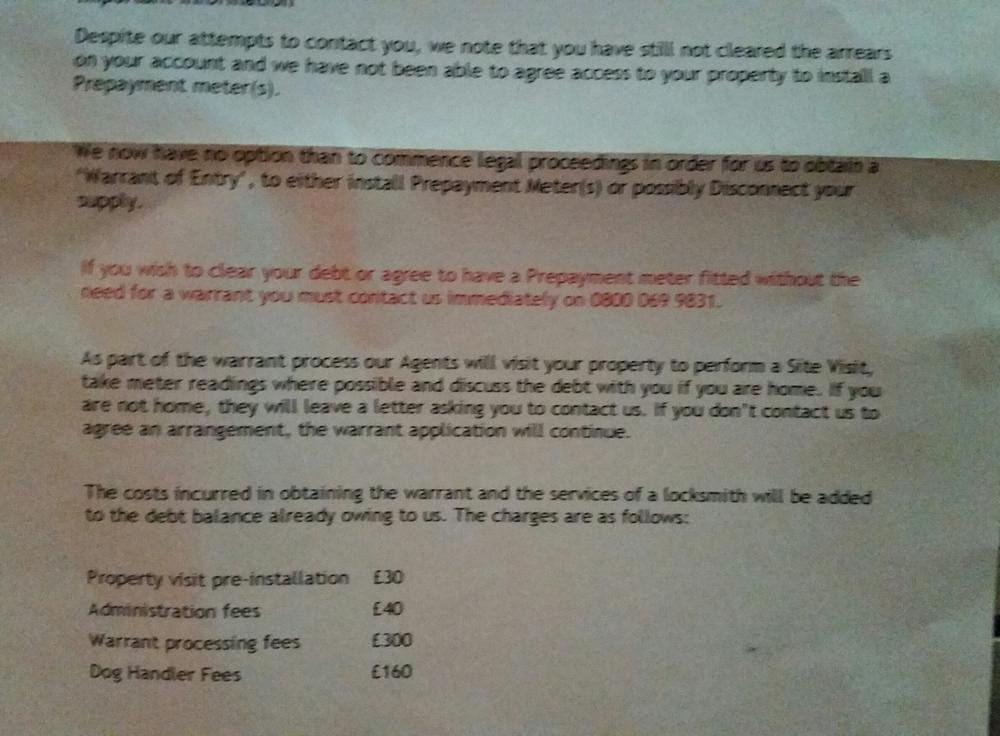

Supply start date Feb 2014 Dispute raised March 2014 based on start of contract meter reading and inaccurate bill. September 2014 Court date set for warrant application and stated to court the warrant process was being misused and the account was in dispute warrant declined as there was no need to attend my meter for any works or service. After the declined warrant application I agreed to have smart meters fitted and debt would be refreshed due to inaccuracy on contract start date. Debt has never been wiped as agreed, so account remains in dispute. The engineers came and declared it unsafe to sit a smart meter due to age of current gas meter, they wanted to replace the meter due to age but due to location would need to consult with national grid as walls needed to be knocked through etc etc and pipes re piped. Nothing materialised, I changed my supplier however as I have discovered today only the electric went through. I was unaware that the supplier was still supplying me and assumed I was on a dual fuel tariff with new supplier however it's electric only. I have today been issued with a notice to obtain a warrant due to debt of £3500. Last meter reading was September 2014. Have bot been provided with an accurate bill in this time. The meter still awaits replacement. Any advice on how to proceed? Upon phoning them They are adamant they either need 50 % payment or they will fit a pre payment meter and deduct 20% of every top up for the debt. I'm happy to have a repayment meter however the amount of debt is not correct

-

Hi there, New to this forum but it all looks helpful. Im sure this question has been posed here before but im just seeking clarity on my legal position. Bought an £800 sony vaio laptop from Currys (for my sins) in Oct 2013. It was the most expensive windows laptop in the shop, sold to me after I explained I use it for work and it gets lots of use so needs to be a machine which will stand up to it rather than a cheap laptop that will struggle to keep pace... It has been repaired once by Currys already in Summer 2014 (software failure, they reinstalled windows for me and thats about all). Last week, after 2 years 3 months, it has died completely. I have returned it to Currys for them to asses, but I am expecting it could be a motherboard failure and as such pretty much a write off and time to buy a new one. I have a friend who works for Currys repair centre, and he has advised me that Currys are obliged to repair or replace under the Sales of goods act regardless of warranty, something he described as retails best kept secret. Having raised this point with Currys the lady was quite firm in her denial ("in thrity years of working here ive never heard of a free repair to a 2 year old machine" ...etc). She claimed that wear and tear on the key board and case showing it has been used a lot as opposed to someone using it once a week to check facebook has to be considered when assessing what is reasable to expect in terms of the life of a laptop. While I take the point that number of hours use affects overall years of use, I feel that 2 years 3 months is not a reasonable time for a laptop to fail to the point of replacement, especially not for an £800 machine sold on the basis of its durability. I feel the amount of use is irrelevent given the short time frame, as to support that argument is to say that the laptop was not suitable for business use or capable of being used for anything other than light domestic home use, contrary to advice given at point of sale and contrary to the price tag. Having read some other threads here I am under the impression I may be entitled to some compensation if not a full repair/replacement, on the basis that the sales of goods act states it must "reasonably not be expected to have failed" which I think is the case. The issue of "fault being present from manfacture" can only be prooved by virtue of the fact it has failed, and would only fail after time not necessarily when first purchased. If an indpendent report was needed I can arrange it, I certainly havent spilled anything or dropped it, or otherwise caused reason for it to be faulty and the nature of it being inside the laptop means its hard to really break a motherboard any other way. I would appreicate advice on how to approach the issue given Currys known stubborn attitude to these problems and a better understanding of my legal rights. If needs be I will buy a new laptop (elsewhere), but I do feel I am being robbed of at least a couple of years use of a machine and therefore should be compensated towards the cost of a new one. Many thanks in advance Jon

-

Hi there, yesterday I received a letter from the debt collection company (Shoosmiths) working on behalf of Tesco personal finance to inform me that, despite having a ccj issued in 2009 (which I have consistently adhered to) they require me to fill out an income and expenditure form to review my payments. Following advice from a debt helpline, I was advised to contact them collection agency to request a balance in the hope that I may be bale to offer them a lump sum to clear the debt. Having just done this I have been informed by Shoosmiths that they cannot give me a balance amount as my balance is 'under review'. They also cannot give me a timescale for when I receive information about the balance, despite my having only 14 days to complete the income and expenditure form. This all seems a little 'convenient' in their favour to me- surely a balance is a balance, I have paid x amount off of this so they should have a list with my payments and charges attached to my account shouldn't they? How can they 'review' a balance? And not to be able to let me know when this balance will be available to me seems as though they are stalling for me to complete the income and expenditure form. Has anyone else had dealings with this company or experienced anything similar please? Any advice would be greatfully received Thanks in advance

-

Hi my first post so please excuse any mistakes. Yesterday I was woken up at 6.45am by two burly bailiffs from swift stood in my hallway, they had let themselves in via an unlocked door. The debt is for council tax I owe £184. I asked them to leave as I suffer poor mental health and got upset very quickly. They asked to see my medication but I was so flustered I couldn't find it. I told them I suffer badly with anxiety and paranoia and couldn't cope with them being there I quickly became anxious and stated behaving quite manically throwing DVDs at them etc. Probably sounds an over reaction but I seriously couldn't cope. The one then started writing out a levy of goods which included my sons TV my landlords sofa a broken computer and the DVDs I launched at them. I was led to believe that the only way I'd get rid of them was to sign and as my children were waking up I did under duress to get them to leave. They informed me they would return today at midday to collect payment in full which I told them numerous times I don't have the money. I then filed a complaint with swift which for now has suspended any further action but I know this is only short term. I'm not disputing the debt not trying to not pay. Where do I go from here? I now feel unsafe in my own home I haven't stopped crying I feel violated that my pleas for my mental health were ignored and I'm angry I signed the levy under intense distress. I'm a single mum with 3 dependents receiving ESA and awaiting assessment for pip. Thanks in advance

-

Employer has set a date for signing new contracts. Should an employee wish to work under protest, what is the process... If the employee clocks in on the day, would that be seen as agreeing to the new contract? Does the written statement need to be given before the day of signing, at the time of signing or if not signing given before clocking in the following day? If the employee feels no consulatation has happened, time to seek advice or does not fully understand all the implications of the new contract. Is giving a working under protest notice appropriate? Will likely have some more questions depending on the answers to the above, thanks.

-

Hi Guys i attended an interview under caution as they felt my partner was living with me, according to what i have read on other peoples threads the interview went as standard. So this is going back to 2012 when my partner left his wife and used my address as a postal address until he got himself sorted so 9 weeks ago i was called in and i've since had over payment letters for 3 months benefits to be paid back from aug - nov 2012 we was not living together and up until recently we never was, yes he used to stay a few times a week and also stay at his mothers house they have got some video footage of him leaving my house on 3 seperate occasions. Since the interview apart from the overpayment letters i've recieved i've had nothing else, im wanting to appeal the over payment as there is no way or no proof he was living with me, but i dont know if to wait a few weeks to see if anything else happens in the next couple of weeks, i am very scared i have worked since leaving school and had a period of 5 yrs on ESA due to the hospital messing up on an operation and causing me a further 9 operations I have been back in full time employment since sept 2015 and in oct i was called in for the interview, where after the interview the nasty man said it will be sent to Dundee for a decision normally takes around 5 weeks this is 9 and im wondering who i can contact to see what is happening or if im just going to recieve a letter telling me im going to court ? What is the amount of time these people have to make decisions ect Please help im sorry it's all jumbled up this is my first ever post

-

Accompanied children under 11 will be able to enjoy free travel on all National Rail services in London from 2 January, At the moment children are only allowed free travel when they are accompanied by a paying adult on Tube, Transport for London (TfL) rail, Docklands Light Railway, and London Overground trips. http://www.bbc.co.uk/news/uk-england-london-34791332

-

Hello everyone. New here but hoping for some advice and will try and include as much relevant info here as a starting point. Background.We own the leasehold of a flat in a Council owned purpose built block. Bought in September 2014 and lived here full time since April this year. Property is managed through a "not for profit" ALMO set up by the council in ?2004

-

Hello, I am just wondering if anyone can give me some up to date information. I purchased an LG soundbar from Currys in December 2014. On 1st November the sound bar speaker seemed to blow up and therefore no longer works correctly. As it is under warranty I took it back to currys on 3rd November. I was advised that they would look into the fault and that if it was not ready to be collected in 14days I would be entitled to a replacement product. I got paperwork to say I had left the product but it does not state this 14day clause. Well, today 18th November, I rang know how who could not find my repair and so she called the local store I left it wth and was advised that this store would call me back shortly with an update. They have called but it went straight to answer phone and a message was left to say that as the product was still in the warranty period LG are required to assess it, my sound bar is still sat in the shop as LG have not collected it yet! This suprised me to say the least. Where do I stand legally and what more can I do? I cant find any reference to this 14 day policy either. Your advise would be gratefully received.

-

Hi, My husband suffered a serious brain injury some years back and after a few years it became clear that he was no longer able to manage any kind of finances. His solicitors suggested the Court of Protection which they set up and managed on his behalf, but it was very, very expensive and once all his savings where gone and they where only managing his benefits the cost was almost as much as they where. We recently switched to myself managing the CoP which means that I have a special bank account and his benefits go into that, his bills are paid and then an allowance is transferred to a bank account he can access. I've been trying to sort through all his stuff and I've found a number of credit cards that he's managed to apply for and use. The solicitors 'should' have blacklisted him with all credit agencies and as part of the CoP you: a) Can no longer have any credit. b) You are no longer able to sign any legal documents. c) Your financial decisions are legally made by someone else. I've returned the cards to the companies and made them aware of the situation. I'm assuming that since he should have been blacklisted, unable to apply for credit and unable to sign legal documents that the CCA's are at the very least unenforceable, illegal and that any debt built up is effectively written off? If anyone has experienced similar or has any advice on what sort of problems we might have because of this.

- 8 replies

-

- applied

- county court

-

(and 3 more)

Tagged with:

-

hey. in august i received a letter stating i was + £2000 over payed in housing benefits. i phoned my housing officer up she stated that it was cos i didnt provided my payslips even though i did for the first 3 month and then got told i didn't have to any more. so instead of putting my pay slip in i said i would pay it all back in monthly installments which they agreed to. my partner got a job 4 month after i did and had his jsa got cut off so in turn we stupidly thought that the housing benefit had been stopped as well because he was the main claimer. we did not pay our rent for a couple of month because we was trying to get on our feet and making sure we had gas elec and food in thinking later we would catch up with our rent when we was sorted now we he has received a letter saying he is to go to a interview under cation. i am seriously stressing out over this i am an over thinker and am thinking of all the nightmares that could happen. please could some one help?

-

Hi everyone. This is the letter I have sent to one of my suppliers. What do to when a supplier from abroad refuses to refund for a manufacturing issues on the item bought. 05 October 2015 Dear Mr. X, Request full refund Order N 6513 dated May 2015 23rd + invoice 29617 + 30 EUR for storing. I am writing to you to make official request of full refund for the purchase of the Scooter model H300 I have bought for my customer Mr. X X. As you were previously made aware of, the scooter was received by the customer with manufacturing issues such brakes not perfectly working, speedometer not set for showing the speed as described in the scooter specifications and the main issue, the handlebar broken in two pieces. After making request for repairing the scooter, I was charged for the repairs despite the scooter had arrived already broken to the UK. I was also charged for the delivery from London to the warehouse in Germany and from the warehouse to London. As a third charge, it was added an extra 10 EUR for each week the scooter was kept in the warehouse after repairs were done. In regards to this last charge, I have never received the invoice, which complicates the situation as no payments can be requested without the invoice being issued. Please, find below the steps which have brought me here: • May 23rd: - I bought the SXT H300 from the website sxt scooters. Within the first 14 days you were made aware of the issues shown on the new scooter once the parcel was opened. • June 29th - The scooter was collected by Parcel Force from the X Ltd office in London for being delivered to your warehouse in Germany. • July 6th - The scooter was received by you and the paperwork signed by X. • August 13th - 39 days after you have received the scooter in your warehouse, I was informed by email that your mechanic had finished the check of the scooter stating that they had not found the issues described be me (I have all the pictures about the broken handlebar. After checking the scooter, you have stated that the parameters of the speedometer were wrong, that the brakes needed some fixes and that the wheels needed to be inflated. All this means that the scooter was not checked before the delivery and it was received by the customer in not acceptable conditions) • August 13th - This same day you have invoiced me for repairing all these issues were shown once the scooter was received by the customer. • August 19th - You have informed me that I will be charged extra 10 EUR for each week the scooter is kept by you in your warehouse. • September 7th - The invoices 29617 (delivery plus repairing) and the non-invoice never issued (storage for the scooter) were paid to your bank account as requested in order you to re-deliver the scooter back to London. • September 16th - 73 days after delivering it to you for the scooter being repaired, the scooter was received in London and the delivery was signed by Mrs X X which has opened the parcel in front of me and noticed that the handlebar is mounted upside-down and that the speedometer is broken. (I have sent you the pictures of it) • September 17th - I personally sent you an email making you aware of the receipt of the scooter with the handlebar mounted upside-down and the speedometer broken (the picture were attached to this email). No answer was received by you. • September 20th - I sent you the second email advising you again of the fact the scooter was received with some broken parts (speedometer) but unfortunately no answer was received by you. • September 30th - I sent the third email to the same email address we have had in the last 2 years our correspondence and for the third time I have not got any reply. I have asked your assistance for a scooter that was received for the second time with manufacturing issues. After 125 days still the scooter is there on a side in the office and it is not possible using it. During this time more than one consumer and businesses defense center and departments - German Patent and Trade Mark Office, HM Revenue & Customs and UK Trade & Investment, UK European Consumer Centre, The German-British Chamber of Industry & Commerce, Verbraucherzentrale, German Federal Ministry of Justice and Consumer Protection - were informed of your behaviour, about your conduct, about your threats for having published a correct review of the issues happened with the scooter sold by you. No international laws prevent a consumer or a business by publishing on internet the behavior of another business which they have a cooperation with as long as all the statements correspond to real facts. This will be considered as a threat and valuated as such. With this letter, I would like to ask you to issue a refund for the money spend for buying the scooter which, after 4 months and 4 days after its purchase, is still not possible riding on the road (private) because of the issues mentioned above. The total amount to be refunded is: 1151,43 EUR • 873,84 EUR for the purchase of the scooter. • 157,59 EUR for the delivery UK-Germany and Germany-UK and repairing of the scooter under warranty. • 30,00 EUR extra charge for storing the scooter within your premises (invoice illegally not issued) • 90,00 EUR as anticipation for delivering back a scooter that since the beginning was not possible to ride because of its issues. As a matter of the facts, the departments mentioned above will be receiving copy of this correspondence with you in order to be updated with the development of the facts. They will be also authorized of proceeding with further investigations about this report in order to make more clear the reasons which have brought you to behave against the rules. Nonetheless they will be requested to make public this report as we strongly believe that users and potential buyers must be made aware of your conduct as a Company. I have never got an answer. I have the item broken in my house and cannot use it. What to do? Does anyone have a clue? Regards.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.