Showing results for tags 'agreement'.

-

Hi A DCA that I have been making regular monthly payments to are unable to show me a signed credit agreement. Does this mean the debt agency are unable to come after me for any more payments? I am thinking of offering a f&f to get rid of them. PLease advise. Many thanks

-

Hi everyone. I was wondering if I might get a few pointers in regard to a tenancy agreement that we had with a previous landlord. Three months into the agreement the landlord started texting daily asking for the rent. he was quite abusive in these texts, swearing and threatening to call at the property to get the keys unless payment was made immediately. The payment from housing benefits had been adjusted and we were waiting for it to be sorted. He has now actually had the backrent that was due. We were a bit concerned for our safety if I'm honest and told him via text and a recorded delivery letter that we were giving him notice. He texted back that yes unless we paid him by the weekend in full he was coming to get the keys and we could leave. We left the property but have now started receiving texts from him saying we owe the remainder of the agreement. Is this true. After doing some reading surely he would have accepted our "surrender" of the property when he stated he would come and get the keys if we could not pay in full b the following weekend? Many thanks

-

Think I might be fighting a losing battle with this one but I'm coming to the end of my contract and checked my phone bill just to see what I pay out. Dont normally check the details I just pay it as I trusted that it was correct Really shocked to see throughout my contract i've been paying insurance which I never agreed to. Contacted Vodafone who said tough as I should have checked the phone bill. They also said I took the insurance out in store. I know I didnt take out this insurance and my query is can anything be done to get a refund? Surely they must have a signed copy of the agreement. Then secondly didnt like the attitude of saying if you dont check your bill then tough. What they're saying they can charge what they want and if you dont notice it then tough Any advice would be appreciated Thanks

-

Hi everyone. just a quick question. i defaulted payments in march this year. They claimed to me that they Terminated the Hire Purchase agreement in May 17. since then i have had calls and emails to contact them regarding payment. This morning a letter arrived of NOTICE OF SUMS OF ARREARS. from what i can gather from google this is sent out because the hire purchase agreement is still active. They have not sent any debt recovery letters but just always send letters under the HP agreement. Is it right they are still sending letters out when the HP agreement is terminated?? Many Thanks

-

Hi Everyone, Mt friend has asked me for some advice, I used to post of here in the past but as I am a little out of touch I thought it best to ask you guys. He has a small business in the event industry and now the season is over in the next 4 months he is going to struggle to pay 2 agreements he has. The first is a Finance Lease agreement and the second is a Hire Agreement (where you keep the goods at the end for one further payment. The first one , the Finance Lease is with Armada Investments for approx 1K a month and the second the Hire Agreement with 1pm ltd for £500 a month. Both agreements are guaranteed by him and his business partner as partners , not Ltd. They were 3 year contracts and only have until March 2018 until they are finished. He has already asked if he can take a payment holiday but been refused, they have only offered to take two payment a month instead of one- which doesnt really help the situation. So , my question is , can they default after one missed payment? Which is what they threatened last month when he was late. Or how many payments can he fall behind without being defaulted or goods taken back. Thanks guys in advance for your advice.

-

Hi everyone, My Daughter has got herself in a pickle - she is going to uni and against our advice re-signed her tenancy agreement that doesn't start till June 2018 my wife was the guarantor but she has not signed and my daughter has not paid any deposit yet. she has now fallen out with the others that she is sharing with currently and does not want to continue staying there next year after the current agreement expires in June 2018. She has been in touch with the letting agents who have told her that there is no way out since she signed unless she finds someone herself to take her place. she only did this due to the amount of emails they kept sending and they were using scare tactics to tell her that if they don't sign some one else will take the property. This and the Uni workload was stressing her so she signed it and now regrets that. is there any way out of it now as Guarantor hasn't signed and no deposit paid ? thanks for your help in advance alix2

-

i didnt even know this place existed till today and i came here for another reason a hour later of reading, i am hoping ppl can give me some advice .. i owe a debit which has been bought by lowell now they have been calling of and off for weeks but i have ignored the phone and i had had several letters, wanting payment the amount i owe is £3679 its a littlewoods credit card debt that i fell behind on and finally defaulted through no income. now the thing is it doesnt say littlewoods on the lowell letters it says barclaycard who do own littlewoods card.. but i was told numerous times by barclaycard that they was two diff companies and also by mercers debt agency who was originally dealing with the debt on behalf of littlewoods, that it wasnt a barclaycard and barclays was just the parent company .. i dont kniow what to do about this as at present i claim contribution JSA and in a 20 days time wont even have that so my personal income will be nil.. the littlewoods debt is mine not my wifes and as such she wont be paying it. i was making token payments now and then to mercers they said it wasnt a official payment plan as i was paying 5-10 per month but would stop interest etc on the account then they informed me that the 7 month limit had been reached which i didnt know about and as no official payment plan was in place it would be sent back to littlewoods for a formal demand which littlewoods did.. and then sold the debt to lowells i assume like i said been told littlewoods isnt barclaycard but is owned by barclays and lowell say the debt is for barclaycard sorry if that is as confusing as hell its been a nightmare for months just trying to ignore it as is no way i can pay and if i am declared bankrupt i would lose my license to work i have been told (sia license)

- 308 replies

-

- agreement

- barclaycard

-

(and 2 more)

Tagged with:

-

Hi all, I've now received a copy of my agreement /statement from Arrow after 10 months of CCA request arrow are going to contact a third party to manage the account (letter uploaded). IF Enforceable what could I expect next? With my other account Capital One I make a payment every month and not heard a thing Thanks for any advise

-

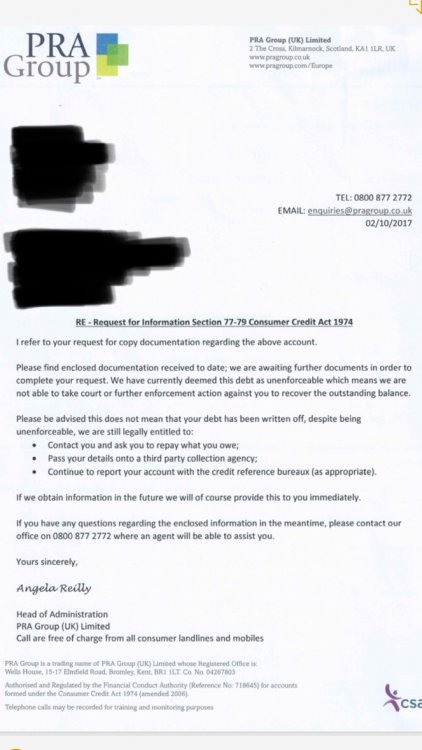

Hi there, My wife and I have unfortunately gotten ourselves into around £20,000 of debt. I recently wrote to the agencies sending out letters using the template to ask for the signed credit agreement. We have received this back from PRA GROUP. Could someone possibly give us some advice on what we need to do next Thank you Here

-

Hi all, I hope your well. Just a quick question please. I am a tenant in North London and the Landlord stopped using the estate agent in 2015, two years after we moved in. I now require a copy of the original tenancy agreement but the estste agent say as they are no longer managing the property, the records are no longer in the office and I would need approach the LL. The LL also says no. I thought the estate agents are required by law to store securly personal information belonging to a customer for a certain period of time, or is that not the case? Any help will most appreciated , Thank you

-

Hi all, Will be claiming HB with a tenancy agreement dating back to 2011, it's a full 8 page Assured Shorthold Tenancy document, signed by myself, the landlord and witness. All above board and legit. A few questions though; 1) Would the JC likely question this, given how old the document is? I have claimed JSA before during my tenancy but didn't realise I was entitled to HB until now. 2) I would prefer they do not contact my Landlord (unless for a special investigation or some such) as he has previously expressed unwillingness to co-operate (that said he owns a flat above and THAT tenant had an AST he used to successfully claim HB - can I specify they do not contact him? 3) The rent has since risen but the contract still holds the 2011 amount, would I need to get a new contract in place to claim for the current amount? Thanks, JB

-

Dont want to reopen a can of worms but we do have an interesting twist on the lender not signing the agreement which is going to court in December.

- 21 replies

-

- agreement

- lancashire

-

(and 3 more)

Tagged with:

-

I took out a Service Plan agreement less than 14 days ago and want to cancel. Essentially you pay £26.99 a month for 18 months and it covers a major and minor service, fair enough. However, Ive decided to cancel and simply pay for each service in lump sums as it will in fact be better for me if I want to change cars within the timeframe as if I did then the balance is due which again is fair enough. However, I have NOT claimed on the plan at all and speaking to VW financial services they are saying ok but that it takes up to 28 days to cancel (funny how it only took 20 minutes to set up) and that the first payment is due within that period and they will take it and its non refundable. Other than cancel the direct debit, have I any recourse and is it me, or does this sound like pretty dubious practice anyway?

- 2 replies

-

- agreement

- cancellation

- (and 4 more)

-

Good Afternoon everyone, Having had a read of these forums I have seen how helpful you have been with offering advice to other people so decided to register and post my own situation to see if you can offer me any advice. I am currently a private tenant through a letting agent. I originally signed an Assured Shorthold Tenancy Agreement on the 1st October 2016, which was a 12 month agreement with a 6 Month break clause. This agreement was signed by both myself and my Girlfriend at the time, so this original tenancy has not yet ended. On the 12 June 2017 (3 and a half months before the tenancy end date) I was contacted by the letting agent to re sign a new agreement which would run from 1st October 2017 for a further 12 months, with a 6 month break clause, so this is still a month away from actually commencing. The tenancy is still in the names of both myself and my girlfriend at the time (with myself listed as the lead tenant). Since signing the tenancy agreement on the 12th June 2017 I have had a change in circumstances, in that myself and my girlfriend are no longer together (this happened in the last week). As such I am now in a rather dire situation where I face having to pay a minimum of another 7 months worth of rent (£1200 per month) which on my own I simply cannot afford to do, I don't earn enough on my own to cover the cost of this and council tax/other bills etc. I was wondering if anyone would be able to advise me where I stand legally with regards to now cancelling the tenancy agreement due to start on the 1st October 2017. From what I understand this is only possible with the landlords consent and I would be liable for any costs incurred to re let the property, however as I am the current tenant, at the end of the current agreement I only needed to give 30 days notice, so would this apply? I wanted to know what (if anything) I can do to cancel the AST from the 1st October. Any advice or help would be greatly appreciated. Thanks Jamie

-

Hello anyone out there who knows what's what re CCAs and DCAs etc - will cut short a long story, an original creditor defaulted me 2/3 years ago on a credit card debt, on assigning the account to a DCA, registered amount owing at £0. DCA wrote demanding payment of original debt and I replied giving reason I believed debt to be unenforceable - DCA replied saying would look into this and usually required 4 months to do so. At end of 4 months, I noticed DCA had 'updated' the default, with original amount said to be due, without notifying me, this being some 5/6 weeks ago - still have had no reply from DCA - is this in accordance with any of the various terms of credit card acts etc? - or should I have been written to prior to default being updated - I did read somewhere you could only be defaulted once per debt- More than grateful for any comments on this - thanks in advance.

- 59 replies

-

Howdy, I have a situation that I would really appreciate some input on. Recently Lowell contacted me for a debt I thought i had paid off in 2008. It was as credit card that I took out as a student. I had no previous contact from lowell until earlier this year. I received three letters demanding a sum of money and ignored them. I then received a pre court letter. When i contacted them they said the only way to prevent a cci was to set up a token payment plan in the meantime and they would provide me with proof of the debt. They told me to disregard the court letter. I agreed and set up the plan. The evidence i asked for didn't appear and i cancelled my direct debit before any payments were taken and then called them to ask whats going on and they said they were still waiting to hear back from the original debtor. A couple of weeks went by and then i received a letter from the court saying that a CCJ has been made. I have now received a letter from Lowell saying that they do not have any copies of original agreement etc and the debtor doesn't have them either. What can I do in this situation? I understand that once a ccj has been made there is not much one can do as even though its an unenforceable debt it has already been enforced but can they really demand the money without any evidence I still owe it? Any advice would be greatly appreciated.

-

Looking for some advice please to see if this agreement is enforceable. I hopefully have attached the letter withholding personal information. would be much appreciated if someone could look at this for me a s Cabot / shoesmiths are threatening legal action. thanks cca return.pdf

-

Hi, We own a flat which is 1 of 4 flats that were converted from a single large detached property in 1953. The flats are freehold flats. The maintenance agreement was with a named person on the deeds. That person died years ago, and so the maintenance agreement died with him. we have a situation of 4 freehold flats and no proper maintenance agreement. Over the years not everyone has been in agreement at the same time in getting any work done on the property, and also in getting an agreement sorted out. Recently we have had to get the building re-roofed at a cost of £20k However we now are all in agreement that this maintenance agreement should now be sorted out. Is it better to get the flats put into leasehold with each flat retaining a share of the freehold. or 1 flat owner has suggested Commonhold, of which I know nothing about. or Is there a better solution such as just having a maintenance agreement. Many thanks in advance.

- 5 replies

-

- agreement

- commonhold

-

(and 2 more)

Tagged with:

-

Hi seeking some advice if possible , i read some of your posts regarding Lowells and i sent a request for a copy of the original credit agreement using the template supplied on site. I received a letter sometime back saying they would request it from the credit card company and that would take 40 days !!, as of today 14/12/16 i received a recorded delivery letter with an enclosed copy of a so called original agreement , this agreement has no date on it , no agreement number on it no signature on it and the address is spelt wrong it looks like they have just typed it up and sent it off This can't possibly be an original copy can it ? the original was taken out in 2012 they also attached some copy of statements which do have the address spelt correctly .

-

PDL company admitted fault in final response offered compensation which was accepted and a date by which it would be paid was agreed. That date has come and gone and the PDL company now say they are to busy with claims to pay up and don't know when they will pay the money. Is the agreement you already have with them as legally binding as it would be had they been directed to pay by the Ombudsman. It seems this is the latest from CFO lending and there are multiple reports of them doing this.

-

My friend and her family need to move of out of the current rented property due to relocation of her company to North of England. If they do not move they will be unemployed. she sent the landlord a letter to say that they need to move and give them one months' notice. There is ample notice and they undertook the tenancy on the 13th last year. the 13th of April to 13th of May would have been sufficient. In fact she is giving one month’s notice as of today giving them 10 extra days. However, the letting agent has sent the following email asking them to pay for the whole year. Is this common? Can they do this? Your early response would be greatly appreciated. This is what the letting agency said: Quote The Landlord will agree to market the property with a view to releasing you early subject to the following terms: • You will remain fully responsible for the property, rental payments, utility payments and additional contractual obligations outlined in your tenancy agreement until the date that a new tenancy commences • You will cover the following costs on behalf of the Landlord associated with re-letting the property: - Inventory check in - Let fee of £354 (inclusive of VAT) - Agreement fee of £180 (inclusive of VAT) These costs are in addition to the standard costs associated with you leaving, i.e. professional cleaning and check out fee. Unquote

-

I bought a caravan in August 2016, during the process was somewhat misled with the purchase and how beneficial it could be. I can afford the repayments, but unfortunately the information we was given on purchase wasn't 100% accurate and our homework wasn't as thorough as it could be, so now we are in a position where we cannot afford the site fees for the caravan and are now looking at the caravan being evicted off the park. This however leaves us in a bad spot as there is nowhere else for thee caravan to go, and moving it off site is expensive. The whole game is wrapped right up. I purchased the caravan for £11995. I paid a cash deposit of £5691. I took out a HP agreement on the remaining balance of £6304. Looking at my HP agreement for options, there is an option to "Terminate the HP Agreement" which for us would probably be the best solution. The text reads as follows: Reading this, the amount payable is exactly 50% of the total amount of the van. The cost of the HP, including the interest at 12.9% is £7997.28. £7997.28 + the cash deposit of £5691.00 = £13688.28 50% of £13688.28 = £6844.14 Reading this, then the agreement includes the cash deposit. Therefore, in order to make the total of £6844.14 I would need to make 7 monthly payments on top of the deposit to have the ability to terminate. However, speaking to the HP company, it appears that the total that should be in the Termination section is incorrect. I don't really want my credit report to be destroyed over this mistake as I am looking to be buying a house in the next 3 years. Please can you help? My main issue is that the balance for the VT is wrong. The balance for VT should be 50% of the amount on finance, not the total amount of the entire purchase. When I phoned the creditor, they confirmed that it was wrong. Basically, the amount to VT should be 50% of the finance, which including interest is 50% of £7997.28 = £3998.64. However, they have taken the full balance including the cash deposit into consideration. My question is, where do I stand now. If the entire balance, including the cash deposit is taken into consideration, then I have paid more than 50% of that agreement as my cash deposit and the 7 payments made to date exceeds the 50% mark. If they do not take the cash deposit into consideration, then there is an outstanding balance, but the agreement I have in front of me is wrong. My issue is that if the latter is applicable, the caravan will need to be put somewhere until the 50% is paid unless the creditor will take the van off me and agree for me to continue making payments until the 50% is reached (but that doesn't change the fact that the agreement is wrong). Please can you advise me on this. Several people, including myself, believe that the policy is incorrect and therefore void. What's your input? Please note: I have also posted this query on another site (Money Saving Expert), but am looking for solid advice so looking here too. Apologies to any member who has read this on there too.

- 7 replies

-

- agreement

- blackhorse

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.