Showing results for tags 'solicitors'.

-

Hi, After two notices from Indigo Park Solutions I have now received a letter from Wright Hassall Solicitors for failing to pay the Penalty Notice, and requiring me to make payment of £196. The letter states that failure to make payment in full or contact them to discuss repayment 'may result in us recommending to the Car Park Operator that the matter be enforced through criminal court proceedings. Such proceedings would require your attendance at a Magistrates Court.' Should I ignore this letter or reply, and if I need to reply what should I reply with? This is the first time Iv'e ever had to deal with anything like this!

-

Hi CAG, thanks for taking the time to read this. I'll keep it snappy. I recently worked for Lloyds bank but left on 20th June 2016 because I emigrated to Spain, where I now live. I had worked at Lloyds for 6 years. This past weekend (29th October 16) I went back to my old UK address to pick up my post and discovered that at the end of July Lloyds sent a letter informing me they had erroneously paid me my 2015 deferred bonus, and a second letter dated 24th October, stating my 'debt' has been passed on to DrydensFairfax solicitors. The bonus in question was £10k after tax, based on my 2015 performance. £2k was paid on March 20th with the remaining payable £8k on June 20th. The 2k march payment is not disputed, but they want the £8k back I was aware of the deferral system and after discussions with my boss (who i had a great relationship with) delayed my resignation until March 20th, which we both thought was the cut of date, meaning I would mean i would pick up my full bonus on June 20th - my last day as I was on 3 months notice, which I did. I have since checked the small print on one of my letters and it did indeed stipulate that if you are serving your notice period on 1st June 16 you are not entitled to the remainder of the 2015 bonus. So it appears me and my boss were indeed wrong about the date you needed to be not serving notice on to receive the second installment of the bonus, and lloyds made a mistake when they paid it to me. From what I've read this seems to fit the criteria for Estoppel. Discussion with my manager led me to believe this money was mine if i resigned on March 20th, and I have since spent the money (and quote a bit more!) on emigration. If i'm right, then I don't know how to put this in motion. I've not replied to anything yet. I have not had any calls or messages from DrydensFairfax directly, just 2 letters from Lloyds, with the second one asking me to contact drydens to payback the £8k I don't really want to do nothing and risk a court order of black mark on my credit record Thanks again for reading. Any help/advice/thoughts would be hugely appreciated Nick

- 6 replies

-

- handed

- lloyds bank

-

(and 2 more)

Tagged with:

-

The Solicitors Regulation Authority, hold themselves up to be a professional body in place to uphold the professional standards of ALL solicitors, ensuring highest stanards are adhered to at all times. Or so their literature professes. This group do not provide a service for joe public to raise issues, more, they take a complaint twist it around with lies and unfetted supposed undisclosible data and then tell you there is no case to answer, when clearly on the evidence there is. This organistion does not aid the public faith in solicitors and the like, even their own statistics prove this, in 2014 they received 10000 complaints against solicitors and only 50 were upheld, to the point that the solicitor in question was sent a letter telling them to up their game, no disciplinary action or penalties were imposed. Even someone not conversant with stats can see this is not a 'norm' of predications for any complaints procedure in whatever field . So if anyone is considering using the SRA forget it along with the Legal Ombudsman, they will both look for an angle for the legal professional and you as a citizen will not get any recourse. Best form of redress is find a web/blog and blast your issues there whilst providing tags/links/searches everywhere so that the world can see what charlatens these people and their organisations are.

- 52 replies

-

- authority

- regulation

-

(and 1 more)

Tagged with:

-

Good evening, I got a letter today from capquest saying that have sent my account to Restons Solicitors and that they will be in contact with me soon. The debt is for Littlewoods for £1372.00. The reason I got in debt was due to illness and I won't be available for work for the foreseeable future, I am on ESA and can only afford to pay them a small amount as I am debt with other companies. I have read some horror stories about Restons, taking people to court etc and I want to avoid this if possible. What is the best way to go deal with this, I know they are not a DCAicon as such so I am not sure where to start, other DCA's have accept low monthly payments. Thank you in advance for any advice etc.

- 11 replies

-

To cut a very long story short, my husband and I have clawed our way out of debt over the years and now I at least have a decent credit rating again. However, there's one glitch on the horizon. We keep receiving letters from Moorcroft about an alleged debt belonging to their clients, Arrow Global. We CCA'd Moorcroft with the usual Postal Order. They sent this back, despite having filled it in so we can't cash it, stating that they have returned the debt back to Arrow Global. A few days later we received a letter from some solicitor acting on behalf of Arrow Global stating that our CCA request wasn't legal as my husband hadn't signed it. We are very reluctant to sign anything, so can we request the information over the phone? We have received several of these letters and have now received a notification that they are taking us to court. What can we do?

-

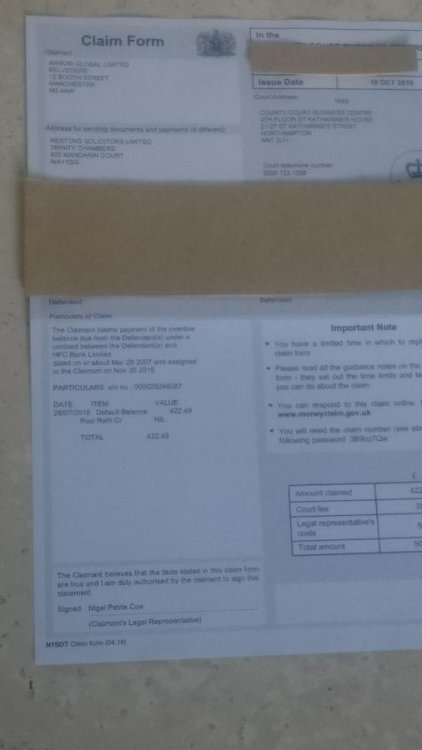

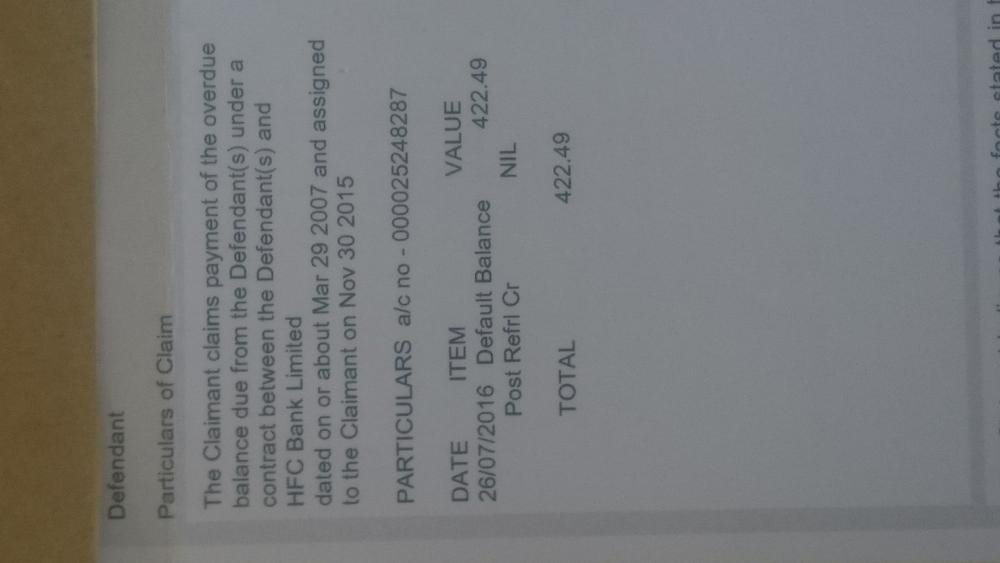

Afternoon Folks, My wife in the post this afternoon has received a County Court Claim Form from Arrow Global/Restons Solicitors and despite reading the forums, I'm a bit stumped on how to proceed. I've attached images of the whole claim form(minus personal information) and also an image of the particulars of claim(which I think is statute barred). My wife has never heard from them until recently and has never responded to them, the Claim form is addressed in her maiden name despite us being married 4 years. Could I have some help on this if possible please. &

-

Assistance needed! I've read the multitude of threads re parking tickets on this site and am hoping for the same useful advice from the regulars as I'm a bit confused re the best course of action On 08/06/2016 at Gateway Plaza, Barnsley I received a parking charge notice on my windscreen. The ticket stated it was issued for the reason of: No Ticket Displayed. The enforcement company is SIP Parking Limited I did some brief research online and decided to ignore the ticket. I did not appeal or make any contact with SIP On 14/07/2016 I received a NTK. The NTK did not mention Schedule 4 of the Protection of Freedoms Act 2012 (PoFA) On 15/08/2016 I received a final reminder. This also did not mention PoFA I have today (23/09/2016) received a Letter Before Claim from Gladstones Solicitors which has had the desired effect of finally making me concerned re the charge. The letter requests a payment of £150. The letter refers to the 'Practice Direction for Pre-Action Conduct under the Civil Procedure Rules and in particular paragraph 13-16 of the same which concerns the Court's powers to impose sanctions for any failure to comply.' The letter stipulates I have 14 days to pay or reply. Please advise! May be worth noting that on this occasion, I simply forgot to pay. I used the car park on dozens of occasions previously and paid using one of the mobile phone apps but on this occasion when I was called in to work early, I forgot. Thanks in anticipation for your advice

-

I have received a claim form from Lowells solicitors for a studio catalogue debt. I have responded to the claim form but need to put in a defence but I am unsure what to write. I have sent a cca request to lowells solicitors and they have responded saying the account is on hold until they receive it from studio but I still need do the defence. help please..........

- 69 replies

-

- county court

- lowell

-

(and 2 more)

Tagged with:

-

Hi all, I bought a property with an ex partner many years ago. I managed the property for the first few years before handing it over to a managing agent. The property was in my name as he was out of the country as the time of signing the mortgage. No declaration of trust was put in place but it was always agreed to split it 50/50 and there is an email showing this (and that intent). The property was sold 2.5 years ago and following a previous legal matter, where the ex wanted access to the property's accounts, my solicitor at the time, who sold the property, agreed to hold the proceeds of the sale on account until we agreed the split. Where I'm at is that I am still agreeing to 50/50 whereas my ex partner wants more (he thinks I benefitted from re-mortgaging the property which I didn't and various other things which are not correct). My solicitor who dealt with the sale has now handed this matter to a Civil Litigation / Family lawyer in his firm who now wants £500 on account to get going and then £250 an hour + VAT. I simply can't afford this. I see this matter with my ex dragging on and on (as have previous matters to cause extra pain and maximum cost) and I do not wish to rack up huge costs which will only benefit the solicitors in the end. Their quote of what it could cost up to would eat up the entire 50% share I am owed. My questions are : - can I handle this matter on my own for now? - If I need a solicitor in the future can a junior, less costly person handle this? Anyone know how much or where to go? - If I went to another solicitor what happens to the money held on account? - What law prevents me from taking my half as it was in my name anyway? - Can I be taken to court if we can't reach agreement? - Is there any other information that could be useful for me? Thanks so much - I really appreciate any feedback or input you have

-

Hi, Hope everyone had a good bank holiday. I (and three others!) missed crap signage and got a Contractual Breach Charge from Ethical Parking on my windscreen over the weekend. Just double checking that it is currently still best to do nothing until a notice to keeper arrives (between 28 and 56 days) before I take any action on one of these? Then if it (NTK) arrives on time post photos of it and signage on here for assistance? Just don't want to get it wrong! Thanks!

- 57 replies

-

I have answered the below to the best of my knowledge : Name of the Claimant ? Lowell Portfolio I Ltd Date of issue 28/7/2016 What is the claim for – the reason they have issued the claim? Particulars of claim 1) THE DEFENDANT ENTERED INTO A CONSUMER CREDIT ACT 1974 REGULATED AGREEMENT WITH CAPITAL ONE UNDER ACCOUNT REFERENCE **** ('THE AGREEMENT'). 2) THE DEFENDANT FAILED TO MAINTAIN THE REQUIRED PAYMENTS AND A DEFAULT NOTICE WAS SERVED AND NOT COMPLIED WITH. 3) THE AGREEMENT WAS LATER ASSIGNED TO THE CLAIMANT ON 12/03/2015 AND NOTICE GIVEN TO THE DEFENDANT. 4) DESPITE REPEATED REQUESTS FOR PAYMENT, THE SUM OF £331.33 REMAINS DUE AND OUTSTANDING. AND THE CLAIMANT CLAIMS a) THE SAID SUM OF £331.33 b) INTEREST PURSUANT TO s69 COUNTY COURTS ACT 1984 AT THE RATE OF 8% PER ANNUM FROM THE DATE OF ASSIGNMENT TO THE DATE OF ISSUE ACCRUING AT A DAILY RATE OF £0.073, BUT LIMITED TO ONE YEAR, BEING £0.00 c) COSTS What is the value of the claim? 442.84 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? credit card When did you enter into the original agreement before or after 2007? AFTER Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? yes Did you receive a Default Notice from the original creditor? yes PROBABLY Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? not sure BUT prob yes Why did you cease payments? lost job and little money What was the date of your last payment? prob in 2014 Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? no Hi All, Filed to defend all. My acknowledgment of service was submitted on 03/08/2016 at 19:48:00 My acknowledgment of service was received on 04/08/2016 at 08:02:24 I have prepared my CCA request to send tomorrow but not sure about the CPR 31.14. Can someone help me with time-frames please & what to expect now?

- 24 replies

-

- county court

- lowell

-

(and 2 more)

Tagged with:

-

Hi, Just wondering how can you be traced where you live in the UK?

- 18 replies

-

- collectors

- find

-

(and 2 more)

Tagged with:

-

Good afternoon First of all I thank everyone for any advice you may be able to offer. On the 24th March 2016 at 19:14 I was parked at the rear of some shops on Slough High Street. I visited a Supermarket (one of those shops) and was in there no longer than 20min. On my return I discovered a parking ticket from Parking and Property Management Ltd with the issue reason 'Not displaying a valid permit'. It was dark so I obviously didn't see the sign post which outlined the conditions of parking there. The following day I went away for work and totally forgot about the ticket. Almost 3 months later I have recieved a 'LETTER BEFORE CLAIM' from Gladstones Solicitors. This letter is dated 7th June, was sent 2nd class and I recieved it a week later?? Having done extensive Googling online I read there should have been a NTK before this? I cannot recall having received one of these. I will be trawling through all my post again just to make sure. They are asking for a payment of £150 or they will take legal action? The easy option would be to pay the fine, however the bay I had parked in was for a Carpet Shop, which was way past closing time at the time I got the ticket! Where do I stand with contesting the ticket? Looking forward to the advice and I appreciate it!

- 72 replies

-

- behalf

- gladstones

-

(and 5 more)

Tagged with:

-

Hello i wonder if you can help me pls have received a pay within 7 day letter from Thomas Higgins partnership solicitors however i am of the understanding i don't owe them the debt they say i do its from a local firm of plumbers for the sum of 81.53+ vat total = 97.84. In Dec 2015 i moved house and decided to get Monthly Boiler cover from Npower they said i needed my boiler to be serviced in order for them to cover me the Local Firm was then employed By NPower and they came in to service the Boiler in Jan - this was done with an all clear and service book signed by them 2 days later on the 29th Jan the boiler wouldnt work i rang Npower who came back to me saying the local plumbers have said it actually needs an air pressure switch and they could come in 2 days later to fit it they attended on 1st Feb - to fit part when the engineer arrived he said this boiler doesnt need an air pressure switch it needs a complete new circuit board rewire - he asked if i would like a quote - i said you would need to speak to NPower - he said they probably wont authorize it as its about 600 hundred pounds - i said well i will speak NPower I did contract Npower and told them what the plumber had said , and they (NPower)said well as it now has a major fault and if i wanted to continue with their cover i would have to pay to have to repaired myself and no longer would be eligible for their service cover . 2 weeks later Npower wrote to me asking had i got the major circuit board fault fixed i said no - they cancelled my policy I heard no more till the beginning of April when an statement arrived from the local Firm claiming an invoice dated the 22nd Feb for goods and services was overdue and to be paid within 7 days - so i wrote back saying their contract is with Npower not Myself - No- Response Then at beginning of May another Statement arrived this time with a copy invoice invoice date 22nd feb for this Air pressure switch and labour charge £97.84 again pls pay within 7 days - this time i wrote back on the 9th May asking them to prove me with Written Evidence the debt was mine - i sent this letter via recorded delivery - again no response today i get the solicitors letter from this Thomas Higgins Partnership saying they have been instructed by Local firm to collect this debt within 7 days or they will issue proceedings including interest and court costs Having looked up Thomas Higgins its one of their standard £2 + vat threat letters Should I Respond to this Or Ignore it , is it just a if we talk in BOLD CAPITALS and say were a solicitors you might pay us can you pls advise - do you think they will take me to court ? ( sorry for the sermon )

- 9 replies

-

- higgins

- partnership

-

(and 3 more)

Tagged with:

-

Good Morning just received a load of paper work from these solicitors not sure if I have been on here about this before the letter says we have reviewed the file following the issue of our clients claim you filed a defence In order our client could provide you with the documentation we were ordered to place your account on hold and take no further action in relation to the proceeding's until we received the requested documentation from our client it then says please find attached Credit agreement credit card statements our clients statement of account Your Defence In your defence you deny all knowledge of this matter. We enclose a copy of our previous correspondence providing background of the claim Our clients position is that the enclosed documents clearly evidence the debt The credit agreement bears your signature The way forward It is not clear what your defence to this agreement is we as that you set out the precise legal basis of any defence within 14 days Alternatively our client would like to settle matters without the need for further court proceedings We therefore we ask you put forward repayment proposal's to address the outstanding balance The next page then offers a 40% discount then there's a letter explain the background saying it relates to a credit card agreement for capital one entered on the 11/2011 terminated 05/09 the debt and agreement has been assigned to Cabot financial (UK) ltd sorry so long winded but wanted to give as much info that I have received as I could Many Thanks

- 13 replies

-

Hello, Can anyone please help me, I have received a claim form from Northampton County Court Business Centre. It is an old Simply Be debt, seems to be with ME III now, no idea who they are. Amount Claimed is: £1181 - this includes costs (their legal costs)

-

Had laser eye surgery done last year. 1k left on a 2.6k loan, stopped paying it as I lost my job. I have no assets or anything, do you think they'll actually take me to court? other debt letters i've received have said "may take you to court", these guys seem serious though. They said if they don't recieve a check for the full amount within 7 days they will issue proceedings. Worst case scenario, what happens? They take me to court and I pay £1 a month? Can they remove goods from our house? Or is that only if I miss payments? Best way to proceed?

- 9 replies

-

- addlestone

- capital

-

(and 3 more)

Tagged with:

-

Hello Everyone, It all bagan when i received a letter from drydeensfairfax solicitors dated 29 February 2016 in regards to debt owed to Lloyds Banking Group. They said they are acting on behalf of Capquest investments Limited for an outstanding amount of £23926.23, i've enclosed all correspondence between me and them to help you guys understand, as i do not have very good education to be able to write very well. The Account number from the solicitors and the account number from capquest are different, the CCA sent is from Hailfax insted of Lloyds Bank, and the statement had no letter head to show where they came from. Any help will be appreciated Thank you guys. docs1 .pdf

- 17 replies

-

- capquest

- drydensfairfax

-

(and 1 more)

Tagged with:

-

Hello all Today (18/4/2016) my wife received a letter from Lowell Solitors reminding her of a CCJ. Letter states as follows. As you will now be aware, on the 17/09/2014 a CCJ was entered against you. The court has ordered you repay this debt as follows. Installment amount £50 Monthy First payment due 17/10/2014 Amount owed £299.49 The letter goes on to say 'we haven't heard from you' and urge repayment to avoid possible enforcement action. Ive spoken to my wife (of rather attempted too. She is very poorley with a number of conditions and has been for years now) And she has very little recollection of the claimant who is Shop Direct. Ive been opening her post for her for a while as she doesnt have the mental capacity to deal with stuff most days. Im wondering what my first step should be.

-

I have just received two letters from a solicitor acting for the freeholder of the flat. We are currently in arrears on the ground rent on our flat. It isn't a huge amount, £250. Unfortunately I have been off work due to disability for the last two years. First letter was dated 23rd March. It demanded payment of the account in full within 7 days. They also added £180 in admin fees for the landlord and a further £120 in legal fees for the solicitor. Second letter was dated 1st April. It says they have choice but to issue proceedings as they have not heard from us. They have added a further £69 bringing the total due to £619. They have now also contacted our mortgage lender as well. We only received both letters today. The reason being is that we collect our post from the local sorting office every few days. (We have had issues with post going missing in the building previously) This has caused a huge amount of distress and I wanted to figure out where I stood and the best course of action. I'm a little bit perturbed that they think they can issue a demand for full payment within 7 days of the date of the letter when that covers Easter. Should I contact the landlord on Monday or the solicitor? Some notes. We don't seem to have received any "final demand" or similar from the landlord. Also, the letter of the 23rd of March includes a latest statement dated the 22nd of March. We haven't received that from the landlord. The last contact from the landlord was an application for payment dated 27th November 2015 Looking back over things we had a "final reminder" dated October 2015.

- 19 replies

-

I need some help I have recieved a claim form off Lowell solicitors through Lowell portfolio for a Very (shop direct) debt of £1,684 I just need to know what options I have for this. They have been sending out letters to an old address which I no longer reside but have somehow got my parents address where the claim form has been sent to. I haven't admitted anything yet to them but wanted to know my options from them and they have told me that it's now £2,040 and needs to be paid off in the next 14 days. They then informed me they could extend this to 21 days but to Avoid a ccj I need to pay it in whole. They bought the account off very on the 12.12.14 Please can someone advise me. I haven't got the money to pay this outright but I'm also in no position to get a ccj that will last 6 years Help please

- 10 replies

-

- ccj

- county court

-

(and 3 more)

Tagged with:

-

Can anybody help I am looking for a Solicitors who can help me deal with the minefield of a Council Tax Liability Order in the South Yorkshire Region. I have had a letter (first time from this firm), stating that they are acting on behalf of the Local Authority regarding outstanding Council Tax Charges. I have been in constant contact with the council and this letter says I must not contact the Council but them. does anyone know of a solicitors firm in the South Yorkshire Region that can help with this. Disabled person in need of help here

- 3 replies

-

- deal

- libilities

-

(and 2 more)

Tagged with:

-

Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – . 01 March 2016 what is the claim for – the reason they have issued the claim? 1.Claim forr the sum of £7600 in respect of monies owing under an agreement with account no 5301************ persuant to the consumer credit act 1974. The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 2.The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defendant persuant to s.87(1) CCA. 3.The Claimant claims 1. The sum of £7600 2. Interest persuant to s69 of the county court Act 1984 at a rate of 8.00 percent from the 27/04/11 to the date hereof 1765 is the sum of £2900 3. Future interest accruing at the daily rate of £1.67 4. Costs What is the value of the claim? total £11100 (all figures rounded) Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned Were you aware the account had been assigned – did you receive a Notice of Assignment? Don’t Think So Did you receive a Default Notice from the original creditor? Don’t Think So Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Dont think so Why did you cease payments? Redundancy in 2006 but maintained payments until savings ran out in 2010, then entered into a payment arrangement until I think 2011 What was the date of your last payment? Not sure, sometime in 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into plan? Yes .................. I have filed my acknowledgement of service (07/03/16) and sent a CCA Request to Hoist and a CPR 31.14 request to Howard Cohen, no response to either yet (received 9th and 8th March respectively). I am hoping for some help in filing a defence which needs to be by 1st April 2016, I think. I’m sorry if I seem to have left this late, but I thought I had this all under control and was getting my defence ready today for submission later this week. I was reading through the forums for advice on how best to word my defence when I came across a post describing my exact experience, which was the return of my postal order for £1, rejecting my CCA request, stating the request had been passed on to Cohen’s solicitors who would respond in due course. Whilst I wasn’t fooled by their granting of a 14 day extension to file my defence, I still felt I had fulfilled my requirements to place Hoist in default under S.78. Based on advice posted on the other thread, I am now going to send another copy of the CCA request with a copy the letter rejecting my original CCA request to Hoist and the payment. In the other thread, the advice given was that it is no longer appropriate to state that " the claimant is in default of my request pursuant to section 77/78 and is therefore not permitted to enforce or request relief of the alleged agreement", and instead the defence should be along the lines of the claimant has continually refused to comply with my request by returning the statutory fee in an attempt to frustrate and avoid its legal responsibilities with this request and I therefore request that the court direct their compliance in this matter ". Based on the info I have given below, would you think that this advice would apply to this case also? Once again apologies for leaving it so late. I have been caught out by this unexpected and underhand tactic. Thanks in anticipation

- 108 replies

-

- barclaycard

- cohen

-

(and 2 more)

Tagged with:

-

Hi, I have been a member for years, but this is my first post. My husband has received a letter from UCS, stating that they have been instructed by UK Parking Limited, for a PCN in (afaik) a private car park. It states that UKPL wrote to him & that we did not respond & therefore cannot appeal. We have had no correspondence from them, And I presume that they would have had to write with date & time stamped photographic proof? They are stating that we were parked after the expired time on a P&D ticket and the original charge was £100 and they have added a £60 Admin Fee. They have threatened him with a solicitor, if he either does not pay, or does not say who was driving the car, if it wasn`t him. They are also trying to use scare tactics by quoting the case of Parking Eye V Beavis. The letter then goes on to "advise" us not to believe information given on the interent, and to gain legal advice. I have been trying to find an email contact for them, so that I have a paper trail & also because I do not want to speak to them (hubbie doesn`t have time due to work, so I am dealing with it). I wanted to email this - Pls can anyone advise if it is acceptable to send? Hello, I am contacting you as my husband was sent a letter from you, saying that UK Parking Limited had instructed you to contact him, due to non payment of a parking charge notice. The reference number is - ******** We have not received anything in writing from UK Parking Limited and I presume that they have to contact us with evidence of any wrong doing, such as timed & dated photographs. I am sure that as a legitimate company, you wouldn't expect anyone to make payment without such proof. I presume that you will be contacting them to send us the relevant information before you proceed. Yours sincerely, Our 14 days to respond is up tomorrow (well today as it is now gone midnight!) Thanks & Kind Regards

- 22 replies

-

- behalf

- collection

-

(and 6 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.