Showing results for tags 'law'.

-

Hi there, today I received a claim form addressed from the county court business centre in Northampton, which has been filed by Moriarty Law on behalf of JC International Acquisition for a debt on behalf of Talk Talk Limited. I have seen a similar problem to mine posted on here but I can't seem to follow it, so I need help step by step to get me through this maze!! The particulars of claim state: THE CLAIMANTS CLAIM IS FOR THE BALANCE DUE UNDER AN AGREEMENT WITH TALK TALK LIMITED DATED 13/10/2011 WHICH WAS ASSIGNED TO THE CLAIMANT ON 26/03/2014 AND NOTICE OF WHICH WAS GIVEN TO THE DEFENDANT ON THE 26/03/2014 AND WHICH IS NOW DUE AND PAYABLE. THE DEFENDANT AGREED TO PAY MONTHLY INSTALMENTS UNDER ACCOUNT NUMBER 100*****43 BUT HAS FAILED TO DO SO. AND THE CLAIMANT CLAIMS THE SUM OF £167.12. THE CLAIMANT ALSO CLAIMS INTEREST THERON PURSUANT TO S.69 COUNTY COURT ACT 1984 LIMITED TO ONE YEAR TO THE DATE HEREOF AT THE RATE OF 8.00% PER ANNUM AMOUNTING TO £13.36. So with the amount claimed being £180.48 the court fee of £25.00 plus Legal representatives costs of £50.00 the total amount is £255.48!! My response to all this, is that I have never agreed to make monthly instalments because I have never spoken to them regarding this debt and have never responded to any letters. At the time I took out this deal with talk talk I was in a very dark place in my life, not long coming out of a rehab and I was not working! After coming to my senses that I could not afford this because I didn't have any money for food, I contacted talk talk to say I wanted to finish which I believed had been stopped. I made payments to them for the amount which I believed I owed to finish the contract, and unplugged the device not to use it again. I also moved address not long after. I have now got my life on track with work and have got what I believe is a good credit score with nothing against me, so to have this rear it's head against me is a bit of a shock! So please please give me advice on how to tackle this and what steps I need to take!! The issue date of the claim was 29/09/2017 and I received it on 04/10/2017 Thanks in advance for any advice you give.

-

hi guys had a letter from moriarty law stating that i owe £317.02 for a debt i owe to talk talk i did use talk talks services many years ago but paid them in full at the point of cancellation. they are threatening registering a judgement on my credit file if i don't pay by the 28/11, as i have been clearing up my credit file to get a mortgage this would be quite a devastating setback please can somebody help me as although i could pay this to get them off my back, i feel as if im being held to ransom for a debt i don't owe thankyou in hopeful anticipation mark

-

Hi everyone. I have the same issue as antonia26. http://www.consumeractiongroup.co.uk/forum/showthread.php?463115-moriarty-law-JC-International-Claimform-old-Talk-Talk-Broadband-debt-***Claim-Discontinued*** i received a court letter taking me to court as i owe £257.28 As it was advised I have filled the form out and acknowledged of service and said I'm defending the whole claim. I sent a CPR 31.14 request to solicitors requesting information pertaining to their claim . I am not sure if it was done right. I 've received letter from the court about receipt of the Defence. and the letter from solicitors with the text below: we write to acknowledge receipt of the defence filed by you with the Court and in that regard we confirm that our client is processing with their claim. My CPR 31.14 was ignored and now I don't know what to do. Any further steps I should make in this case? thaank you very much for your help

-

hi to all im a new user on here and need some advice please! here is a brief description on the matter back in 2013 i signed up with talk talk for phone bb and tv services, after approx 3/4 weeks of no services i rang them up and told them i would like to cancel the contract as they had not provided me what im paying for. after numerous phone calls about the above issues talk talk said the contract would be cancelled and that would be the end of the matter there would be no charges due to early termination of contract etc. although i never received anything in writing from them i left it as the matter was delt with. fast forward to two days ago and i got a claim form from Moriarty law working on behalf of jc international acquisition. they are claiming £572 for non payment of agreement from talk talk I'm confused about this as i was under the impression it had been sorted years back!. i have sent a reply to the court with a acknowledgement of service i can get some information about this as i intend to fully dispute this. how do i get information about this old account ? any letters that was sent to me , phone calls ?? how do i file a defence for the court I'm confused by all the info on this if anybody could help id be so grateful many thanks for your help

- 34 replies

-

- aquissition

- ccj

-

(and 7 more)

Tagged with:

-

Hello All, I reside in a property which has an old Enforcement Notice from 1996 for breach of planning conditions against it. Council are NOT taking action against me at the moment, but the threat is always there in the back of my mind. After considerable research I think I have discovered that it was invalid as being "Out of Time" at date of issue. This view is upheld by recent decisions Council have made for other properties here on the same site where the occupants were contravening the same planning condition, but Council accepted that it was too late to Enforce against them and granted "Certificate of Lawful Use" for residential occupation. My problem is that Council say that even if I get the old Enforcement Notice removed, I will have to wait 10 years from the date it was removed in order for it not be used as reason for automatic refusal of an application for a "Certificate of Lawful Use for Existing Development". Can anyone advise. I would have thought that once an Enforcement Notice has been removed as "Invalid at Date of Issue", it should be as if it never existed and cannot therefore be used as reason to refuse anything.

- 2 replies

-

- enforcement

- law

-

(and 1 more)

Tagged with:

-

Hi, so like many over the past few months I'm new to this site and have received a letter from Moriaty Law stating that I owe £877.55 from a loan I took out with Quick Quid back in May 2012. As I'm already paying one debt off with Moriaty I contacted them straight away and questioned it. I probably should have posted about this earlier before taking any action, but here's what's happened so far: I've asked them to provide all/any documentation they can in regards to the load as I genuinely don't remember taking it out. There's a fair chance I did as but I'd like to see proof first. They said it was a fair request and will begin to request the documentation. They then stated that I did, in fact, pay £105.50 off the loan two weeks after taking it out (probably first pay day after getting it). They then said that MMF are willing to accept £700 as a settlement. I've tried to gaina ccess to my old email address used at the time but with no avail. I'm also using a different bank account now so have no way of checking on receiving the load or making the payment. Usually I would just begin to pay the load as I know it's my mess and I have to deal with it, but this one sounds a little suspicious after not hearing about it for years. And I also know what has happened with MMF and read multiple articles stating that £0.5 million has been written off due to unfair practices. Any advice as to what I should do next or when I receive the paperwork would be of great help.

-

Hi all, Today March 30th 2017 i have received Northampton court claim forms for a Talktalk debt of £63.86 its been raised to £68.96. The form is dated 28th march 17. They date it back to 30/10/2009. They also state i agreed to pay this by instalments, but failed to do so (which is news to me). I vaguely remember when we ended the contract with them the paid me money that was owed to me. Moriarty Law are acting on behalf of JC international. Ive checked my credit file and cannot see any closed accounts or otherwise with Talktalk. Im reluctant to call these companies to find out anymore information. After a search on google i've come across statute barred and another situation extremely similar to mine that ended in claim discontinued. http://www.consumeractiongroup.co.uk/forum/showthread.php?463115-moriarty-law-JC-International-Claimform-old-Talk-Talk-Broadband-debt-***Claim-Discontinued*** I cant post link due to less than 10 posts I don't know how to approach/resolve this, any help would be appreciated. Thank you

- 113 replies

-

- acquisition

- courtform

-

(and 4 more)

Tagged with:

-

Hi All, My partner took out a pay day loan agreement with Peachy on 31.10.2013 for £662. She has had sporadic bouts of employment through the following years and the debt was assigned to MMF on 3.01.2014 of which they allege they sent notice. She has been bullied by Moriarty Law and has this very week been sent a letter from them saying she has 14 days to come to an arrangement or they will apply to Northampton for a CCJ. This weekend, she has received the paperwork from Northampton CC. The solicitor has filed for the original debt of £662 plus interest of 52.96 plus their own costs bringing the total to £844.96. Currently she is claiming ESA, although she is trying to start a small business herself and would rather avoid a CCJ, she has no other debt apart from the mortgage and a car loan that is finishing this November. Do I now log on and file an AOS and then have 28 days from then to present a defence? If so, what sort of defence (I am reading through this site as I write)? Would it also be prudent to send a letter disputing the procedures followed by Peachy/MMF for providing the initial loan without taking into account all of her circumstances? I know she buries her head in the sand with these types of things and does not know which way to turn (that's not to say I am a legal expert either!). Many thanks for your help and guidance on this. PB

- 8 replies

-

- county court

- law

-

(and 2 more)

Tagged with:

-

Hi all After doing a lot of research, the general opinion, from enforcers from the police to bailiffs, Seems to be if we have done wrong you can get remedy through the court process, so pay up and correct afterwards. examples arrest for possible breach of the peace, mainly when EA's are involved. social services we will take your children for possible future harm. When was this changed from the accuser has to prove, to the accused has to prove. 3rd party has to prove property is theirs,They should not have to prove anything, just to make it easy for the enforcer whether an EA or police. In this country of ours you are meant to be innocent until proven guilty. Just want caggers views Leakie

-

Vodafone mis-sold me contracts on my account and have refused to cancel them as requested. This has been going on since June last year, even the Ombudsman didn't seem to see where I was coming from legally, but agreed Vodafone had made errors in handling my account and complaint and there was a shortfall in service. The Ombudsman also told me about an invalid charge on the account (which Vodafone have not admitted to me) and a voicemail I was apparently left regarding a credit to the account they were making, but neither has appeared and reduced the balance I'm being asked to pay. If a company don't tell you they are changing their contracts, but mislead them on the phone and make them believe their payments won't change, without mentioning increases in charges and a new 24 month contract, is that not illegal? I've quoted the Consumer Protection from Unfair Trading Practises as I believe they've carried out an unfair practise: Misleading practices – a practice misleads through the information it contains, or its deceptive presentation, and causes, or is likely to cause, the average consumer to take a different transactional decision specifically; general misleading information, creating confusion with competitors’ products or failing to honour commitments made in a code of conduct. They never sent me the promised email detailing the upcoming changes I should expect, which I believe is in violation of the Consumer Contracts Regulations. I also believe they broke their terms and conditions by not correctly informing me of the changes that would take place. Breaking any of these regulations/terms would give me the right to request the contracts be cancelled without penalties. I contacted Vodafone 3 times before I received a response, from June to November. Nick Jefferys was no use and ignored my legal points when I emailed him. I requested a copy of the call that took place in June but Vodafone ignored my requests, which resulted in a complaint to the ICO, who agreed that Vodafone had breached it. Does anyone have knowledge of where I stand legally please? My head's a mess over it all now, any help is greatly appreciated.

-

Hi, just looking for some advice, about 4/5 years ago I got in a circle of getting pay day loans to pay off other payday loans. Long story short, I paid off most of these about 18 months ago (after they had being passed on to debt collectors) I have since being able to buy a property with a mortgage (even know my credit still isn’t the best). I was shocked today to get a letter to my new address from a company called Moriarty Law acting on behalf of Motormile Finance. They state they even sent me a letter last month (which they definitely did not) this is the first one I have ever received. I don’t even know when this loan was how much it was for, nothing. I’m a bit confused because I owed that many company’s money a few years ago the only way to know who I exactly owed money to was from looking at my credit report and going from there, this wasn’t (and still isn’t) on there is it had completely come out the blue . I’m just looking for some general advice before I phone them? Someone has mentioned the three letter process, I’ve looked that up, would that work for this? Thank you for any help you can give me.

-

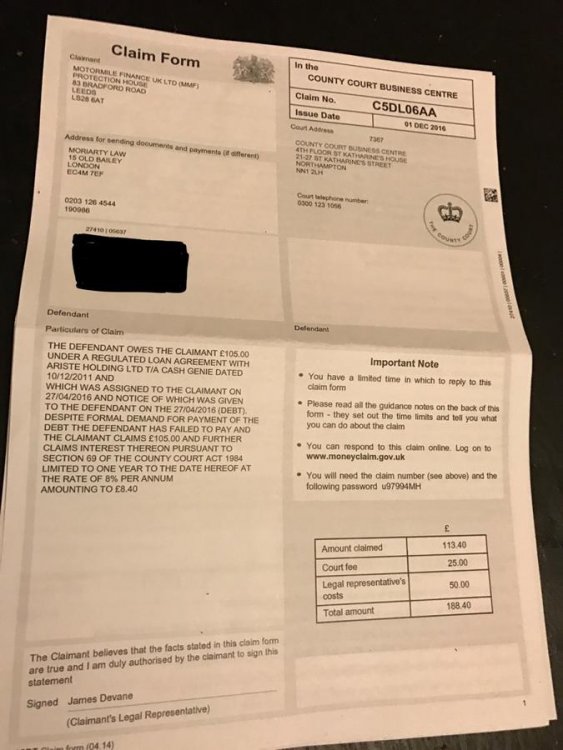

I was gong through bad time financially few years ago and I built up some debts using payday loans such as Cash Genie. Or Motormile finance. I received a letter from Moriarty Law saying they're sending me county court papers for £105 I still owe Cash Genie from 2011. I also received county court claim form and I attached a copy. My main problem that I work for financial institution so if I get CCJ I'll be forced to quit my job. Can they really take you to county for only £105??? Now they increased it to £188 with court fees and theirs. This is looks serious and I'm worried! Any advice is appreciated guys! Thanks in advance Angela.

-

Hello, A number of PCNs from Smart Parking were delivered to my address in the last few weeks, for an alleged breach of the terms of parking at Matalan in Sutton, Surrey. This was subsequently followed by a Notice of Intended Court Action letter from Debt Recovery Plus (DRP), stating the reason for the PCN being issued as: "Overstayed Paid Time". Earlier this week, another letter was received from SCS Law who claim to act on behalf of Smart Parking Ltd who have allegedly instructed this law firm to recover the PCN charges. The letter then goes on to state that Smart Parking are entitled to the outstanding sum under contract law, adding: "When your vehicle parked at the above mentioned site(s), the driver of the vehicle agreed to be bound by the terms and conditions of parking which was displayed on signage throughout the site(s). The driver of the vehicle breached the terms and conditions of parking on each of the above stated occasions for the reason stated. For each contravention, a parking charge notice was issued, for which the sums owed remain outstanding. We refer you to the Supreme Court decision in ParkingEye Ltd v Beavis [2015] UKSC 67. In this case, the Supreme Court found that parking charge notices do not contravene the penalty rule or Unfair Terms in Consumer Contract Regulations 1999 provided they protect a legitimate interest. Unless payment is made within the next 14 days, we are instructed to issue court proceedings to recover the same and any of our client's legal costs, without further recourse to you". I visited the Matalan store last weekend and discussed my issue with a member of staff, with the hope Matalan would intervene and request for the PCN to be cancelled, being a regular customer of the store. The member of staff was not very helpful but did advise me to contact Smart Parking directly for any resolution and also pointed out that Smart Parking were no longer the contracted to manage the car park. I would now appreciate the kind assistance of our very valued forum members to advice on how to fight this PCN successfully and have provided some relevant pictures from the car park, if this helps construct a solid defence. Thank you.

- 26 replies

-

- action

- county court

-

(and 13 more)

Tagged with:

-

Name of the Claimant ? Uncle Buck Finance LLP Date of issue – 19 JUL 2017 Date of issue XX + 19 days ( 5 day for service + 14 days to acknowledge) = XX + 14 days to submit defence = XX (33 days in total) - What is the claim for – the reason they have issued the claim? The defendant owes the claimaint £864.00 under a regulated loan agreement with Uncle Buck Finance LLP dated 12/10/2015 (debt) despite formal demand for payment of the debt the defendant has failed to pay and the claimant claims £800.00 and further claims interest thereon pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8.00% per annum amounting to £64.00 What is the value of the claim? £995 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? PDL When did you enter into the original agreement before or after 2007? after 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Original Creditor Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed "Notice of Default sums" – at least once a year ? Not sure Why did you cease payments? rent increase meant I couldn't pay What was the date of your last payment? can't remember Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no

-

Hi I received the attached claim today for which I know nothing about. I have done the Acknowledgment of Service part online. Can anyone draft me the CPR 31.14 please as I'm a bit confused by it and don't want to use the wrong wording. It won't let me upload or link the claim form. The claimants claim is for balance due under an agreement with talk talk ltd dated 21-10-2006 which was assigned to claimant on 26-03-2014 and notice given on 26-03-2014 wh8ch is now all due. The defendant agreed to pay instalments under account number ......... but has failed

- 3 replies

-

- county court

- law

-

(and 1 more)

Tagged with:

-

Hello, I've received a claim form about an alleged outstanding debt with TalkTalk from 2011. I 've been online and acknowledged receipt saying I intend to defend the claim as I have never received any correspondence about it nor is there anything on my credit file that includes and account. I was in the process of writing a CPR 34.14 after seeing all the advice on here and I noticed the address for JC International (the claimant) is in the US - do I send the letter there or is there somewhere else it should be going? Just concerned about claims they never received it and it may also take a while to get there. Thanks in advance for any advice!

- 11 replies

-

- international

- law

-

(and 1 more)

Tagged with:

-

Hi, I am looking for advice regarding a claim form I received on March 17th. I have acknowledged the claim and opted to defend all, details of the claim below with comments further below. Claimant - motormile finance Adresss for sending docs - Moriarty Law Particulars : The defendant owes the claimant £728.40 under a regulated loan agreement with Northway Broker Ltd dated 29/05/12 and which was assigned to the claimant on 06/04/2014 and notice of which was given to the defendant on the 06/05/2014. Despite formal demand for the payment of the debt the defendant has failed to pay and the claimant claims £728.40 and further claims interest Theron pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £58.27 Total plus court fees etc. £916.67 I did have PDL issues a few years back but none of the companies mentioned above ring any bells with me at all. I have had letters from Moriarty Law over the past few months which I disregarded as I'd never heard of them or the debt they were claiming for. Advice on further steps would be appreciated? I have also read on other forums that motormile finance had regulations jumping all over them for bad practices? Thanks for reading, Jellybean

-

Hiya, Not posted on here for quite some time but looking for some advice in how to deal/respond to Motormile Finance. I have today received 4 emails (differing amounts from PTP loans when I was struggling and lost my job) threatening legal assessment by Moriatary Law unless I contact them with 7 days. The last contact I had with MMF was in June 2014 when I sent the template doorstep collection letter then sent the below one. I believe all the debts could be statue barred now (as think they were 2010 but going to double check) and have been working hard to clear my credit file of my other priority debts (credit cards, utility arrears etc) rather than concentrating on the payday loan people and almost back to normal so could really do without anymore black marks on it. Does anyone have any further advice/guidance that maybe useful? Thanks in advance.... I do not acknowledge any debt to you or any other company or organisation that you claim to be representing. I am writing in response to the numerous emails I have received from your company that is practically bordering on harassment even though I have responded to each one individually but then been replied to by your companies generic response. I would question are you not receiving them, if so would suggest you monitor your company email policy more carefully. I request the following from your company : An original copy of the credit agreement you are alleging I owe and statement of account you are alleging All correspondence to be sent to be by post through Royal Mail only Full comments on your company’s breach of the data protection act by giving details of the alleged debt over email without relevant permission Reasons why you believe interest can be added to the alleged debt Reasons why you believe a default can be added to my credit file over this alleged debt Please take further note that I do not wish to make any appointment for a home visit and that I revoke licence under English common law for you or your representatives to visit me at my property and, if you do so, you will be liable to damages for a tort of trespass and action will be taken, including but not limited to, police attendance.

-

Im vaguely aware that under EU law? items generally should be replaced/repaired if they are still reasonably new even outside of warranty period. My Sony mobile has just died a month outside of its 2 year warranty and i was wondering what the specifics of trying to pursue this are and if people usually experience any success? Many thanks.

-

Hello all, I have received a county court claim form from Moriarty for an old payday debt from 2011(not quite statute barred yet) I have acknowledged the claim and need help with a defence please. The original loan was from Speed loan finance, I recall making one payment via direct debit but nothing more. I have never received an assignment notice from Speed loan and all I got from mmf was the standard threats and phone calls. Who should I contact to see if they can supply any written proof of this loan? Or should I just admit defeat and pay up? Thanks in advance for your help.

-

Morning everyone, First time poster on here, bit nervous as I've been a bit poorly recently but seen that this site has been fantastic support to so many people! I've received a claim form from UKPC/SCS Law regarding 5 PCNs from 2015 and are issued in a retail park car park where I worked in one of the stores up until about 3 weeks ago. The car park is a 3 hour max stay car park. I have not acknowledged or appealed any of the PCNs (I was following the advice of 'ignore all' but this now transpires may not be the best way, and I have lost some of the PCNs and NTKs) or entered into any correspondence with UKPC/DRP/SCS Law. I have not yet contacted the management company for the retail park as I thought it best to seek advice on here first before entering into any correspondence. LBA from SCS Law received 28/10/16 stating 14 days for payment. Claim Form from Northampton County Court Business Centre received 17/11/16. I'm going to acknowledge the claim on the MCOL website this morning. Any advice would be greatly appreciated! Thanks in advance.

-

READ MORE HERE: https://www.gov.uk/government/publications/court-guide-manual-of-service-law-jsp-830-volume-2

-

- 830

- county court

- (and 6 more)

-

I went through the barriers at Oxford Circus with Grandad's freedom pass (which I used by mistake thinking it was my own ticket - we'd gone out to lunch for my 18th and he gave me his stuff to look after) and got stopped rather aggressively by a Revenue Inspector. I got the impression that he was the police 'cos he read me my rights. I was sh .... ing myself cos I'm not from London but had heard stories of brutality from the police. This guy was definitely trying to provoke a physical response from me but I kept my cool 'cos I was in a suit. He questioned me about the freedom ticket and I explained what had happened. He was having none of it. He was so close to my face that he was spraying spit too. I just immediately volunteered to go and get a ticket which I did and after extensive questioning and detaining me, continued my journey. Next thing I know, I've been charged under s.17(1) TFL Bye law (is this a strict liability offence?) for apparently entering a "compulsory ticket area" without a ticket (I'm not a Londoner and so was pretty shocked by Revenue Inspector's behaviour). He is relying on his statement. I am pleading not guilty because having traced my steps back to Oxford Circus I can't see that it is a compulsory ticket area. My mother is livid and wants to countersue for the guy's behaviour. What I want to ask is (a) because I bought a ticket before getting on a train does that get me off the hook (b) the RI's statement is a lie - it's as if I've been framed because of the way he's worded it. Is the RI's statement still valid if I haven't signed it? Can I sue him back? Is there any good case law I can use in my defence, please. Thank you.

-

I have just completed the pre end of tenancy check list with my LA who said it was law that I had to get the house fumigated as I have a cat....no one I have talked to, including Rentokill, have said this is the law....anyone else heard of it?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.