Showing results for tags 'southern'.

-

Name of the Claimant ? Southern Water Services Date of issue – 12th December 2018 Particulars of Claim 1.The Claimant is a statutory water and sewerage undertaker to the Water Industry Act 1991 (the Act) 2.The Claimant claims the sum of £4559.62 for unpaid water and/or sewerage charges payable under s.142-144 of the Act and the Claimants’ Charges Scheme. 3.The unpaid sum of £4559.62 is for water and/or sewerage services provided to the Defendant(s) at XX XXXXX XXXXX (my address is here) for the period 11/07/2007 to 09/07/2018 4.The claimant claims interest under section 69 of the County Courts Act 1984 at the rate of 8% a year from 09/07/2018 to 11/12/2018 on £154.90 and also interest at the same rate up to the date of judgement or earlier payment at a daily rate of £1.00 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? No What is the total value of the claim? £4559.62 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? water When did you enter into the original agreement before or after April 2007 ? No Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? No Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Original creditor Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Redundancy What was the date of your last payment? Unsure Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan - i made a plan to pay through a card but found it difficult to pay through the card plan ……………. Can anyone help me with filing an online response to a claim form I received via Shulmans for a Southern Water debt. I realise I will have something to pay, but they are claiming from 09/07/2007 and I only moved into the property in the November 2007. In addition, am I right in thinking that that over 6 years is subject to the statute of limitations and can therefore not be claimed for. I completed an acknowledgment form within the 14 days, but I’m now feeling anxious that my online response covers everything correctly to give me the best outcome. Help needed

-

Hi https://www.consumeractiongroup.co.uk/forum/showthread.php?491828-Southern-Water-UKsearchLTD-Shulmans-court-claim-urgent-help-needed-(past-33-days) We are in exactly the same situation having just received a Letter Before Action Letter from Shulmans/UK Search/ Southern Water for alleged bills between 2007 and 2015. This letter is addressed to my partner and his ex who split in 2015. They claim £3343 is owed but this is the first we know about it. Having read through this thread, I am a little confused as the info appears contradictory.... Are we sending the CAG pack to Southern Water, Shulmans or UK Search in the first instance please?

-

Hello, I'm looking for some help regarding a letter I received from Thameslink regarding intention to prosecute. Background to incident. I work in London and buy a monthly season ticket from my Home station, New Malden to London Waterloo. On 18 Sept, the company i work for had a business contingency day and i was instructed to work from our contingency site (i got a call the night before). the contingency site is in Bookham (surrey). So on the 18th Sept I traveled to Bookham by train and tapped in at New Malden to pay by contactless debit card. When I reached Bookham there was a revenue inspector there who informed me that Bookham was not an oyster station. I did try to tap out at Bookham where my debit card didnt work, at which point the revenue inspector took me to one side to explain contact less not support here and took down all my details. I showed the inspector my ticket from New Malden to Waterloo and tried to explain i wasnt fare dodging and had attemted to pay and that i wasnt aware that contact less didnt extend to Bookham. Yesterday, I received a letter from Thameslink, stating that they intended to take the case to the magistrates court and want me to respond with what happened from my point of view. Any advice what i should do? and how serious is this, is it likely to result in a criminal record. Since then I've stopped using contactless, to get out out of the habit if tapping in / out. Feels like a trap. PS, the inspector didnt dispute that i had tried to pay with my contactless debit card, and after i had given all my details mentioned that i would get charged by TFL (whatever the maximum daily fare was) because i hadn't tapped out. Regards, A Zaman

-

Name of the Claimant ? Southern Water Services Date of issue – 10/11/2018 33 days was up on 8/12/2018 (3 days ago) only found court letters yesterday. Particulars of Claim The Claimant is a statutory water and sewerage undertaker pursuant to the water Industy Act 1991 (the Act). The Claimant claims the sum of £1700 for unpaid water and/or sewerage charges payable under s.142-144 of the Act and the Claimants Charges Scheme. The unpaid sum of £1600 is for water and/or sewerages services provided to the Defendant(s) at ************ for the period of July 2011 to July 2018. The Claimant claims interest under section 69 of the County Courts Act 1984 at the rate of 8% a year from July 2018 to November 2018. Claimed amount £1700 Court fee £105 Legal representative costs £80 Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? Received 2 letters from shulmans llp - letter before court action, and multiple from UK SEARCH LTD prior to that What is the total value of the claim? £1800 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Water When did you enter into the original agreement before or after April 2007 ? Been at the property since 2008 Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? Think so Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Claiment on court form is Southern water but they insist it's been passed to UK Search/Shulmans Were you aware the account had been assigned – did you receive a Notice of Assignment? Letters from uksearch Ltd acting on behalf of southern water. Did you receive a Default Notice from the original creditor? Probably Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not sure Why did you cease payments? Haven't made any payments. On benefits can't afford total sum. What was the date of your last payment? Years ago. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes. Made an online application for Southern Waters NewStart Scheme (was ignored). Tried to negiate a payment plan with Southern Water's legal department but they say their is nothing they can do as the debt as been passed on to UK Search Limited.

- 8 replies

-

- county court

- days

-

(and 6 more)

Tagged with:

-

Printed off my credit report last month (Experian) and had the epic 'score' of 580.... Experian emailed me today to say there had been a change on my report. Logged on to see that Southern Water had added a default to the report with a default date of June 2016, no great shakes to be fair because it improved my 'credit' score to 635!!! However, I've not, nor ever have I, received a default notice? What is the MO for these clowns? And why are Experian shockingly inept at processing personal data accurately? Leave it two years for a default to appear on a credit file?

-

I have just realised I have another SPPL Loan. I had one that I have already posted earlier but this one is more straighforward although it was taken out in 2001 and paid off in 2002 so dont know if this is a problem. I had a loan for £15,000 that was a second mortgage on my home. They sent the paperwork and just added the ppi at £2,500. I was self employed and never asked for the ppi was never told why it was on there or anything about it. When I paid it off in 2002 I paid a sum of £17,723.00. Should I send directly to SPPL or to FOS with it being an old loan?

-

Hello all. Firstly, as a first time poster I just want to say how useful this forum is, so I’m hoping you’ll be able to help me out too. I was recently stopped by a Southern Rail inspector. I was travelling on a packed commuter train and (although many of you might think this is an excuse) I suffer from really bad foot pain, which I have been to the doctors about, and sat in first class as I was in real pain. In hindsight, I shouldn’t have done it. I should have asked someone to get up for me, but being a young guy I doubt people would have taken me seriously. I spoke with the conductor who made me feel out a ‘witness statement’ I gave my name, full address, phone number and then she handed it to one of he colleagues who completed the process. He was a nice guy. He told me not to worry and that they would send me a letter in the post asking for a fine. But he didn’t ask me to pay anything there and then, he said I had to wait until the letter comes through. I later revealed some kind of gold badge and asked me a few questions which I answered truthfully. He said not to worry and that this was only ‘civil’ and that I would 100% just get a fine. I’m not a fare dodger and never sit in first class barring this one time. What should I expect? Just a fine? A court summons? Once again, thanks for all your help/advice.

-

Hi, ive had a CCJ claim form in the post recently-ish for a roughly £1500 dept to Southern Water. On doing some research i came across the Water Direct scheme which would allow them to take the debt and future costs direct from my benefits which seems ideal for me. I suffer pretty badly with anxiety so even tho a debt like this SHOULD be a priority its very easy for me to completely ignore things like this while off fixating on anxiety issues for months on end. i just contacted Southern Water and they were pretty good and helpful but it seems they could only help me sort out future payments through the scheme as UK Search have the debt. Should that have appeared on the court forms as the forms only have Southern Waters details and there is no mention of UK Search. Thought it would be best to post up on here first for some general tips before approaching UK Search as i've never dealt with a collection agency before. Ideally id like to just pay through the Water Direct scheme again but not sure if that's something i can do with them (Southern Water said possibly). Should i be haggling with them to write off as much debt as possible too? If i ignore the CCJ are they likely to get Bailiffs involved? Thanks for all and any advice given.

-

Hi Id like to keep this separate from my other threads, but i`ve been constantly told by Acenden acting on behalf of Eurosail that they cant do anything as regards charges (or anything else) on our account before Nov 2010 when they supposed took ownership of our loan from Southern Pacific mortgage limited (also known as London Mortgage company , Southern Pacific Personal Loans ,etc......). I was furious when also told this by an FOS adjudicator as well . How can this be ? Southern Pacific Personal Loans Limited are supposedly in insolvency with an address in Leeds, but Southern Pacific Mortgage Limited also named on our paperwork appear to be still going (active and operating from 110-118 Union Street London.) Southern Pacific personal Loans limited (also known as London Mortgages) are described in our paperwork as the appointed representatives of Southern Pacific Mortgage limited. So i would assume SPML would be described as the parent company of SPPL (London Mortages) and so should be liable for the account prior to Nov 2010. Am i completely naive and wrong in thinking this?? Southern Pacific were responsible for alot of the charges /capitalised fees amongst other irregularities on our account. Is there any point in pushing for an actual ombudsmans decision when the adjudicators decision is something we feel is a ridiculous decision. Thanks

-

Dear all, I have recently received a letter of intention to prosecute due to an offence that took place in November. I had decided to try riding the train without buying a ticket as I had realised that there where no barriers at the station near my house and the barriers where always open at my University station(Incredibly stupid I know). I was caught by I believe a loss protection officer for southern rail, who took my statement and cautioned me. The issue being that I panicked and lied to the loss protection officer, claiming that I didn't have time to get a ticket at the station and was in a hurry. I understand from reading other posts here that the best course of action is to send a politely worded letter, offering to pay a fine so as to avoid prosecution. My question is, what is my best course of action? To tell the truth in my letter, or to repeat the lie I told the loss protection officer? The offence listed is : failing to hand over a rail ticket for inspection. Thank you in advance.

-

I have lived at my address for 3 years. I am on a water meter supplied by Portsmouth Water. My meter is usually read in July and January each year. My concern is Southern Water. Every time my meter is read they up my bill. They up my bill twice a year which I feel is unreasonable. At the start I was paying £13, now it looks like I'm going to be paying £21. It means I have had an almost 50% rise in my bill over 3 years. When I get my bill through, they also claim I always have an outstanding balance. I pay fortnightly on a payment card. The bill is saying I owe a balance of £59.73 and they will have to increase payments yet again. I'm not on the qualifying benefit to have my bills capped. Is this justified!?

-

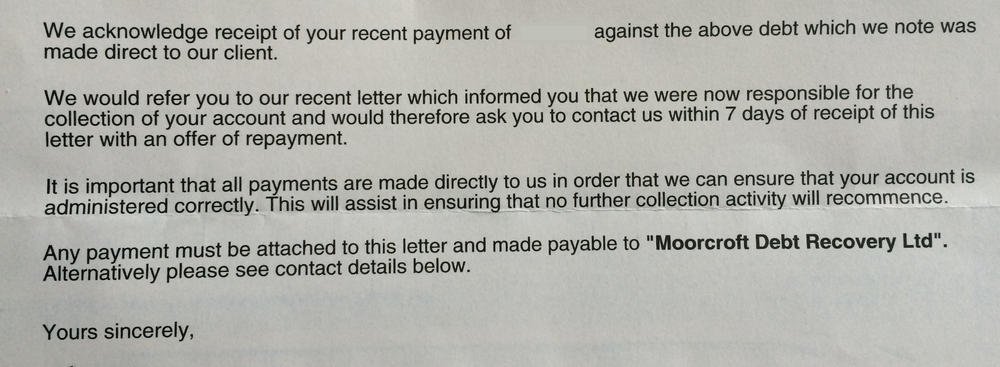

Hi all! I was behind with payment to Southern Water & recently paid a first instalment online after receiving one of their red letters. Soon after I received a letter from Moorcroft (attached) stating I should not pay direct to SW anymore. My question is, should I continue to pay direct to Southern Water, or should i acknowledge Moorcroft & deal with them directly? Many thanks!

-

I am in dispute with southern electric regarding a quarterly bill 5 times my average usage, we have reached the stage of having the meter removed for an independent test, they have now informed me this could take up to a year due to only 4 centres that can do the test, is this timespan. acceptable

-

Hello! I am surprised that no customers of Acenden/Southern Pacific Mortgages Limited have mentioned the recent refund of charges from SPML? I have been battling with them for years over what I believe to be overcharges and MANY others have made comments on the forums stating the same. We received a letter dated the 2nd of July from SPML, saying that they have agreed with the FCA that certain charges made between 1st of January 2009 and 31st of August 2012 were "found to be higher than the market norm" and have refunded the difference back to my mortgage account. The letter doesn't say what the "norm" is and does not give a breakdown of the amount refunded but it does say it is for Arrears Management Fees and Litigation Management Fees . At the time the charges were made, they were still being added to the arrears balance of the mortgage and therefore several eviction attempts made by SPML were obviously based on unfair overcharges - luckily the court stopped their attempts and I still have the house today (with no mortgage arrears) - yet I am still fighting charges which at todays date total well over £20k (the majority in legal fees!). Anybody else had the same? Any thoughts from anyone on the best way to challenge this? Unsure how they have determined unfair charges between these date yet charges outside of these dates still remain at the same level?

-

Hi everyone I am a newbee to this forum. I have been reading your threads about sspl and could really relate to them. I got a personal loan against my home in 2006. I was told I had to have ppi, however when my ex husband was made redundant we were not covered. I have been trying for years to claim back the money which is over £10,000. everyone just passes the buck. I have got a customer copy of the loan agreement. I have wrote to sppl who claims it is the brokers responsibility who has gone bust. any advice please? Thank You

-

I've just come across an old Insurance certificate in regards to a secured loan we had 2004-2006 . The insurance certificate states the premium was £3269.24 +ipt . I am aware that SPPL are no longer trading and Aceden are a point of contact. I see some people have been refered back to the broker with whom they took out the loan. Thats our first problem as I have no idea who it was . Hubby seems to think it may have been Norton or Ocean. Another thing I have noticed as it stated he had to be employed but he was actually self employed at the time . The loan was paid off early 06. What I need to find out is where do I start . Many Thanks

-

For 2yrs and 5months have been getting calls from SWEL and 3 DCAs trying to recover circa £1200. for some sort of service to a property in Portsmouth. Tracing by SWEL, EOS Solutions UK Plc, UK Search Ltd, and Ruthbridge Ltd. My wife was unlucky to marry into the same Mrs Firstname Lastname as a Miss Firstname Lastname (I believe a widow) and from what I can deduce same DoB. SWEL was notified by email and replied that they would remove our address from the account. There should therefore have been no need to respond when DCAs sent bills, as SWEL will have provided them with correct information wouldnt they? Lol. A month trial of Experian in 2013 showed no alias information on credit report so that was not worth the paper it was written on. My telephone number is listed in my name and whilst I don't answer witheld CLI calls, nor unrecognised callers; the calls are still logged and made available by my provider. The typical behaviour is to call weekdays and Saturday mornings witheldCLI chain dialed up to about 35 calls in a day, plus 1 or 2 calls with a false CLI number such as '678965' or '0000000000' which surprisingly weren't answered or went to voicemail with or without message. The harrassement therefore also creates the extra work collecting the logs, and any voicemails together. The DCAs send out letters and bills threatening to send someone to visit, but sadly they never seem to get around to any action that could have counterclaim. FOI Information from SWEL reveals that SWEL do not check customers identity prior to providing credit for services. This means that they do not actually know which firstname lastname was provided with services. The question therefore arises why pay their bill if you are moving anyway. I spent half a day in 2013 tracing the actual debtor. This took a little time but was quite easy; and I would be prepared to sell the information for decent fee. It became clear that the tracing done on behalf of SWEL amounts to nothing more than searching the CRA databases. In view of the above I am looking to blacklist the calling numbers but there are difficulties - not least is that their numbers benefit from the privacy settings of CLI system which rightly protects the x-directory numbers of individuals; but these companies and Telemarketers should forfeit by the nature of what they are doing. Using Asterisk software, - "If there is no Caller ID received, then the LookupBlacklist has no effect." and to blacklist a false number would be to little avail as the target is moving. Calls having witheld CLI can be normally rejected. We need laws against the presentation of false CLI numbers. We need to allow access to phone numbers used by DCAs and Telemarketers, and Telesurvey companies. We need to be able to communicate with the CRAs without fear of providing ANY information which might be used to add to their collected database. We need legislation that DCA bills or threats MUST be followed up by court action within 1 month or be withdrawn. == Oz

- 4 replies

-

- dcas

- harrassment

-

(and 3 more)

Tagged with:

-

Having a bit of fun with the above who deal with my waste water. They had been sending lovely red coloured bits of paper every month becasue I had missed one payment of £25, so by their account I was behind with my payments as per my "payment plan"? Confusing as I have never had any such payment plan in place previously, as they have sent me the bill, and I have always set up a standing order to pay them over the year, monthly, no payment plan or agreement/contract has ever been signed by me or them? So the latest letter is now another brightly coloured "Notification before default" informing me that if I do not pay or set up a payment plan by next month then they will mark my credit file with a default which will stay on for blah blah blah, and make obtaining credit yadda yadda yadda, yawn yawn! They are demanding the full years bill, which is never going to happen, if they're lucky £15 a month at most, but my question is how can they mark a credit file without any such agreement contract being in place? I'm not in the slightest bit bothered by this credit file lark, so they're threatening the wrong person, I'm just spoiling for a fight.

-

Hullo, I have just received a letter from a DCA (EOS Solutions) and needless to say, I'm a little irritated... When I moved in this flat, I was paying for an unmetered supply. However, a few months later, it emerged that the flat was actually on a water meter, & all my payments subsequently transferred. No problems there. However, a few weeks back, I received a tetchy letter from Southern to "The Occupier", asking for details regarding the current occupants in relation to an unmetered account. Rang them, and they said "Oh, just an automated mail run. Please disregard". Today, I received a letter from EOS Solutions enquiring as to the occupancy at my current address. Obviously I have no intention of getting in touch with them (I have no relationship with them - as far as I see it, this is an issue for Southern Water to resolve). Also, they don't have my name or any other details. But I thought it best to be safe rather than sorry and check with the experts on here... Would I be right in thinking my best way forward is to ignore the DCA letter entirely, and speak to Southern Water and point out they need to get their bloody affairs in order. Is there any chances of this being linked to my credit rating or anything like that? Any other advice? Thanks in advance all! EDIT: Just saw the DCA link. Letter seems mostly in order as they identify their customer as Southern Water. But they did address the letter to "The Occupier"...

-

Hi all I owe £167.08 to Southern Water Services. This is for the full year. It has been passed on to DCA and I am not sure what to do. Option: ring southern Water pay off the ammount and not even bother contacting the DCA and leave them hanging for their so called 'admin' fee of 45£. Not had this situation before and any help appreciated Attached is the letter received today 25th dated 22nd thanks BB

- 23 replies

-

- dca

- moorcrorft

-

(and 2 more)

Tagged with:

-

Hi Guys, Need your help again. Received letter 'Final Demand' from LCS about a southern electric debt of some £8000.!!! this is apparently for gas used between 2/6/2010-30/12/2010 about 6 months. I own my home and have equity. I cant afford this amount at all. I dont even believe the amount £8k. Some help please.

-

Hi, As above; Southern water fitted a meter to my 76yr Mother's house a few months ago, after 2 leaks at the meter point, the last one a few weeks ago, repaired all seemed well. Firstly; it looks like the yearly water will now rise from £290 to around £440 per yr. Secondly; she's now told the meter cannot be removed after being told if she didn't like it in a year's time, it could be removed. Thirdly; the last straw, because they increased the water pressure a few weeks ago for some reason, it appears this has burst a water pipe under the kitchen floor, and flooded the kitchen. They say they are not responsible for water damage inside the property. Questions; Are they responsible? Is they any action that can be taken? Can she get the water meter removed? Thankfully she has insurance, but how much work and £££ they cover is yet to be found out. Please, any help/answers will be gratefully received, Cheers.

-

Afternoon all, Could really do with some advice if possible. It's a bit of a long story but I will get through it as quickly and accurately as possible. On 13th June 2013 the wife, the kids and myself moved house (we rent with a HA). When we moved into the house we already knew, through speaking to one neighbour, that the property had been empty for a while due to flooding. Our Housing officer informed us that electric was supplied from Southern Electric, we took meter readings and phoned Southern Electric up. There is no gas supply to the property (or to the village for that matter - very rural). We set up a direct debit for £65 per month. For the first few months living here any post that came for the previous tenant we would bundle together and hand into the HA once we were going past (we had no forwarding address). Once it got past about 6 months we just threw the letters in the bin tbh. About 3 weeks ago we got a letter that was addressed to Miss D xxxx/current occupier, so I opened it. It was a letter from a debt collection agency (face 2 face) operating on behalf of Ovo electricity, demanding £2150.50. I called Ovo to explain that we don't owe this debt, we are with Southern Electric. The guy said to me that was fine and that he would update their records immediately. However, Monday, we were away on holiday and didn't get home until Monday evening, a doorstep collector turned up at our house and obviously as we were not there put a card through the door to say that he called. Again, I called Ovo to complain, saying we didn't owe this debt and that we are with Southern Electric. However, at this point the chap turned around and said, no you are with Ovo. They, as it turns out do supply our property with electric, not Southern Electric, and have done since December 2011. The chap said there was a request from Southern Electric back in March 2013 to take over supplying the property, but Ovo denied it as there was debt outstanding. It turns out this was our HA asking Southern Electric to supply it when they were doing the necessary work on the property when the last tenant left. I phoned Southern Electric to check this out, and after about 30 mins of investigation they confirmed that indeed Ovo do supply the property, not Southern Electric. The lady I spoke to said she would raise a formal complaint on my behalf, but this could take a few months to sort out. Obviously Southern Electric have about £750 of my money. Which leads me on to Ovo. After all this I gave the chap at Ovo our current meter readings. It turns out since we have been here we have used £1650 of electric, so we were massively underpaying Southern. The reason Southern didn't spot it earlier was because all there bills/statement were estimates. The chap at Ovo said to cover current consumption we would need to pay £135 per month - that's fine. However, he also said the debt of £1650 needs to be cleared in 12 months. There is no way I can do that. It would push my bill up to about £275 per month (until I get the refund from Soutern), then down to £220, which I just can't afford. The guy did say the only way they will extend the debt is through pre-pay meters, but they just are not practical where we live. Our nearest pay point shop is nearly 7 miles, and even in this winter, which wasn't that bad by all accounts, we couldn't get out the village for about a week in total through flooding etc. I did, in another conversation, ask them to fit a smart meter as you can top them up online which would be fine, but he said our meter isn't compatible, and as they didn't have to do it until 2020 or something they wouldn't do it. I have told Ovo I can afford £175 per month, but they won't accept. So, what do I do? I have left it that Ovo are going to call me next Wednesday to set up a repayment plan of £275, which in all good conscious I can't do because I can't afford it. I have called Soutern god knows how many times to sort out getting my money back (and compensation) and just get told it is going through the complaints system. Southern are trying to push the blame onto Ovo, saying they should have contacted me well before now. I feel we are being right royally screwed here, and don't know where to turn! Thanks.

- 1 reply

-

- electricity

- issue

-

(and 2 more)

Tagged with:

-

Hi I was wondering if anyone had to pay for a fine at the southern general hospital. I got a ticket for overstaying the 4 hrs limit by CP and was not sure if i should pay or ignore. I am not sure if things have changed over the past year for them to pursue payments nowadays. Please do advise. Thanks

-

Good evening, after having filed a stat dec last week regarding an incident that happened 3 years ago, I received a notice of new hearing yesterday. I am trying to get in touch with Southern Railway to try and see if they would maybe agree to an alternative arrangement out of court. Unfortunately I can't seem to find any contact details for them on the letter, nor on their website. Would anyone who faced a similar matter have a contact phone number or email for me to reach out to them?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.