Showing results for tags 'lowell'.

-

Name of the Claimant ? Lowell Portfolio I Ltd Date of issue – top right hand corner of the claim form – this in order to establish the time line you need to adhere to. 29/01/2019 Particulars of Claim What is the claim for – the reason they have issued the claim? 1) The Defendant opened a Bank of Scotland ( Credit Card) regulated consumer credit account under reference xxxxxxxxxx on 08/06/2009 ('the Agreement') 2) In breach of the Agreement, the Defendant failed to maintain the required payments and the Agreement was terminated. 3) The Agreement was later assigned to the Claimant on 17/06/2015 and written notice given to the Defendant. 4)Despite repeated requests for payment, the sum of £3,229.76 remains due and outstanding. And the Claimant claims a) The said sum of £3229,76 b) The interest pursuant to s69 Count Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.708, but limited to one year, being £258.38 c)costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol) ? Yes Have you changed your address since the time at which the debt referred to in the claim was allegedly incurred? Yes in January 2018 Did you inform the claimant of your change of address? No What is the total value of the claim? £3753.14 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Yes, credit card When did you enter into the original agreement before or after April 2007 'Don't remember, may well have been 08/06/2009 as mentioned in the claim particulars Is the debt showing on your credit reference files (Experian/Equifax /Etc...) ? Yes Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. The debt purchaser issued the claim Were you aware the account had been assigned – did you receive a Notice of Assignment? I dont remember receiving one Did you receive a Default Notice from the original creditor? Don't remember Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year TBH as soon as I see Lowell on the letter head I tend not to read it - Why did you cease payments? Financial difficulties What was the date of your last payment? 04/12/2012 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I'll be sending a CCA and a CPR31.14 request off tomorrow. I was planning a defence based upon SB but with the last payment being 04/12/2012 I don't think that will stick as the COA date doesn't seem to be the last payment date any longer? 2012/13 was a really bad 12 months financially and personally and Lowell have been harassing me for every defaulted debt from this period for a long time. Lowell already have 3 CCJ's on my file, for 2 of them they placed a charge on my property. These were paid when I moved house at the start of 2018. I don't want a new CCJ and I hate the thought of having to pay these guys a single penny more. Any and all help gratefully received

-

Hi, I've been corresponding with Lowell, who have bought a debt that I had with Shop Direct. They have sent me the following documents which I have uploaded as a PDF. Is this enforceable? Many thanks. Edited DocPDF.pdf

-

Lowell Solicitors sent me a letter in December 2018 saying on 08/08/16 a CCJ was entered against you and you were ordered by the court to pay £50 per month. I haven't paid anything on it. It says they are considering options to enforce the CCJ as its in arrears. The amount of the CCJ is £499.13 It also says to avoid the possibility of enforcement action we need to agree a payment plan with you. This CCJ was issued years ago to an old address, i now know it's my responsibility to inform them of my new address and my circumstances at the time would not allow me to do that but i was just hoping for some advice. It was originally a Capital one credit card. Thanks

- 12 replies

-

Hi all , it is my first time ever discovering forums like these in my life. I'm Matt I'm a 26 year old male and to cut a long sob story short i have been ignoring various debts for years as they always used to get passed from pillar to post so i'm not entirely sure which company owns which debt etc. Following a bereavement in 2012 my life spiraled downwards into chaos , i drank a lot of alcohol every day for a long time i lost my home ,my job , my friends and just about everything you can imagine. I used various payday loans to pay for my drinking once i had lost my job and i tried to take my own life in 2015 because of my debts. I am still involved in mental health services i was diagnosed with Psychosis last year (2018) , i had a terrible time getting abuse 24 hours a day from voices in my head often keeping me awake for 4-5 days in a row. I am enjoying a January voice free, i don't take any medication anymore , it's taken a long time to sit here and have the confidence to post here. I received a letter today from a company called BW Legal which made me think it's about time i start working on a solution. I was hoping for some advice, help with anything you can while i have motivation to try and solve a very big problem i have and this is my debts. I have followed instructions from the site and i have obtained my credit report, to my suprise my debts are nearly £5000 less than i had anticipated bringing my total debt ( on my noddle report ) to £3745. I am currently receiving ESA ( Employment and Support Allowance ) so i do not have a big income to pay a lot of money a month. I did read about the statue barred sticky thread, i do believe some of my debts are older than 6 years old but i am unsure when the date starts from, also my memory is not very good about the past 6 years because i was drinking heavily. It is also the reason i am hesitant about contacting any of the companies for my account information. I do have letters somewhere dated in the past 3 months which i will try and upload. I have 2 CCJ's i believe one is from Capital 1 credit card for around £500 and a parking fine of around £200. Thanks in advance for any help i might get, i have been signposted for stepchange by my mental health worker , but i was worried i might mess up any chance of Statue barring any debts that might be eligible. I have downloaded a PDF from noddle with all my report on if anyone would like to see it. Lowell £ 499 Lantern £ 262 Active Securities LTD £ 442 Capquest Investments LTD £ 1,288 Lowell £ 780 Lowell £ 217 Barclays Bank Plc £ 62 Ee Limited £ 152 Thanks again

- 19 replies

-

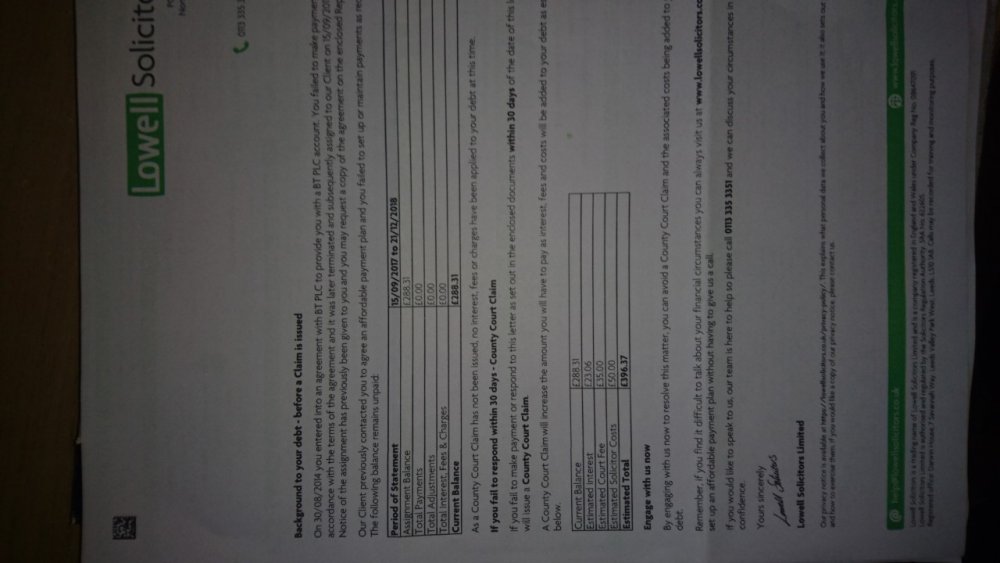

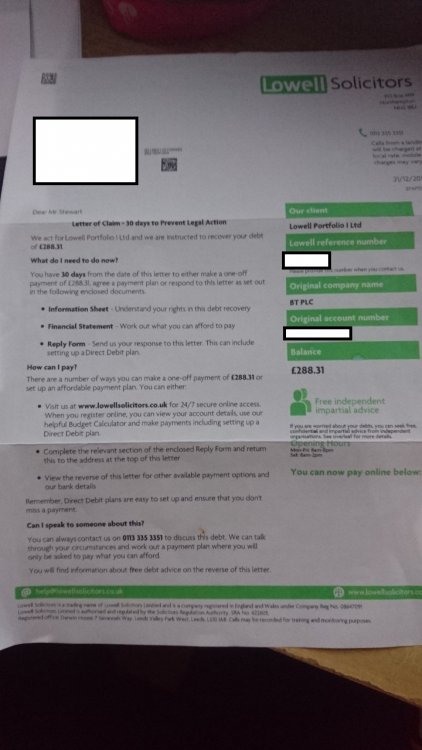

Hello I have received a letter dated 21/12/18 from Lowell Solicitors regarding a 12 month contract I entered into with BT PLC 30/08/14. I believe the contract was entered into over the phone. As far as I remember I made regular payments and gave 30 days notice over that I did not want to roll on to a month to month contract as stipulated by them over the phone towards the end of the contract. I was a student in university at the time. The debt stated as owed to Lowell is for £288.31 due to me not making agreed payments to BT PLC and was purchased in 15/09/17. I queried this with them over the phone and they stated that it was for air time and an early cancellation fee. My issue is that I was told I would not face an early termination fee to the best of my knowledge and that I made regular payments as well as at no time was my service terminated. Lowell stated on the phone there was no obligation for them to provide any kind of evidence and could only offer options as well as no legal advice. The letter from Lowell Solicitors states I must respond within 30 days to prevent a court claim being filed and a potential CCJ being issued against me. This could seriously hurt my career as I work for a bank and upon taking my current job ( A promotion ) was investigated for any CCJ's I might have against me of which I had none. I have contacted BT PLC and they will be responding within 7 - 14 days with access to my final bill and potentially account note access / phone logs if any are held. Originally I contacted BT PLC and was put through to their accounts department offshore. No one at that level could see anything wrong with my account, with one lady stating I just needed to pay an early cancellation fee of £60 and my debt could be removed / recalled. I did not take her word for it and asked to speak to a manager who stated this was not the case and apologised as well as lodged a complaint but stated he could not enter the account due to the age to offer an explanation. It wasn't until I reached out to BT via their forum that I was contacted by onshore mods who have come to the above resolution to my query. What can I do to dispute this debt? What rights do I have? I plan to pay the debt if it is genuinely owed and I have really made some kind of mistake or a payment has not been processed. Additional information that might have some relevance is that I moved out of the property towards the end of that contract with it being a student private rent and have not received any communication from BT / Lowell regarding this debt to the best of my knowledge and I do not know how they have found me at my current address to issue this threat letter. Attached are is a copy of the letter I received with personal info taken out. Any advice offered would be greatly appreciated.

-

Hi all Looking for some quick advice on a court claim from Lowell dated 5th Feb who have a Lloyds overdraft debt sold to them in 2015 although it was around 2013 that Lloyds kept adding more and more charges and fees etc. The POC is as follows : Author Document Debt assigned on 24/11/15 by Lloyds banking group PLC and the claimant claims 1. 3595.98 2.Statutory interest persuant to section 69 of the county courts act ( 1984) at a rate of 8% per annum from 24/11/2015 to 02/02/18 287.68 and thereafter at a daily rate of 0.79 to date of judgement or sooner payment Ref ****************** ( there ref number here ) I will be defending fully but was thinking of using CPR31.14 but the claim does not mention any documentation. Also is it worth sending a SAR request today to help my defence. As stated I know there are multiple charges on the account, I also do not recall receiving and NOA or documents asking me to bring the account up to date in a set timescale. Also as a side not I am currently self employed under contract work until the end of Feb so if it does go to court can I still receive a CCJ for being self employed or possibly unemployed if I do not get any contract work in the coming months .. Thanks...

- 235 replies

-

- county court

- lloyds bank

-

(and 2 more)

Tagged with:

-

Hi there, I've sifted through a few threads trying to get a jist of what to do. Quite a bit of info, I'm hoping someone can help me with my issues Done a credit report and I've currently 5 defaulted accounts and 1 arrangement NatWest credit card - defaulted balance £984 with a current balance of £785. This debt is paid DD £20p/m directly to Natwest, I've ignored ALL letters from Wescot who manage my account on behalf of NatWest. NW have just written to me this week informing that my account has been assigned to Cabot Financial, to cease my payments to NW and make future payments to Wescot for the foreseeable - Thoughts/ advice on what to do at all? Aquacard - Account in arrangement with CapQuest to pay £5p/m, current balance is £1,200. This doesn't show as a default on my credit file. Notes that its in arrangement Vanquis - account is defaulted with Hoist Portfolio Ltd - this was forwarded to Robinson Way and I currently pay £10p/m with them Current balance £320 defaulted balance was £859 (Dec 2018 6yrs expires) JD Williams - Held with Lowell managed with Fredrickson paying £5p/m. £919 defaulted balance, current balance £504 (Nov 2017 6yrs expires) BT - Debt was passed to Past Due, then Capital Resolve, then Freds. I paid Capital Resolve the debt of £91.05 Freds have this as balance owing when I checked online with them Lowell have a default recorded with the account type being Communications Supplier, default balance £72, august 2015 which I think is the original BT debt Oxendales - Default recorded with Lowell, managed and arranged payment with Freds of £5p/m I have just at the moment cancelled all standing orders & DD's, just want to get some clarity on what to do with them Thanks Shelly

-

I received a Letter of Claim(pre action claim letter) from Lowell Solicitors on 03/06/2018, and have 30 days to send them the reply form, but just saw it today. Very worried if it is late. The Account start date 14/01/2013 Date of default 14/12/2013, the original company name is THree mobile, regarding 385.51 balance., so maybe a mobile contract wih handset. Then I sent the reply form back to the solicitors and CCA request to Lowell portfolio I Ltd, On 26/07/2018 received these letters from Lowell solicitor today( please see attached pictures) It says: "As this is former telecommunications matter it is not regulated by the Consumer Credit Act 1974, the original creditor is therefore not required to retain a copy of the Agreement, Subsequently, we are unable to request a copy of this document. A default Notice is a technical document that is applied to a Credit Agreement should a customer fail to repay the account.. As mobile phones have a Service Agreement and not a Credit Agreement, a Default Notice does not apply and is therefor not issued. " Since then they only enclosed a simple bill which is only 92.17 pounds from 3G, but Lowell asking for 385.51 pounds now., there is no other document for how it comes to be 385.51. It is not on the Term and conditions they sent neither. Also, on all the 3G letters, there is no 3G address at all. They said they hold my case for 30 days, otherwise will take court procedure. I am not sure about this phone contract, and not afford such big amount. What should I do next please? Anyone could give me some advise plz, what is my next plz? Should I send SAR to 3G? how can I find the address of 3G which I should send to plz? How should I reply letter for Lowell solicitor letter on 26/07/2018 plz? Thanks a lot for any advices! Thank you

-

Hi can I please get some help regarding three letters that have come from Lowells. We have recently returned to uk after living abroad and previously had advice regarding some if not all of these accounts back in 2014 I believe. The debts are coming up SB mid this year, default dates 2013. I believe we were previously advised to SAR I think, which, I think we did. I also believe one- a capital one debt, we sent a PPI claim for which was denied I think. Here are the accounts. ME-CAPITAL ONE $420 MY WIFE- BRITISH GAS $75 didn't even realise we had this...pretty certain we were on prepayment meter?! MY WIFE- CAPITAL ONE $1695 (SAR sent off 15th May 2013) Do I need to do an SAR again for these? Can anyone advise what to do please. Thanks a lot

-

Having looked at partners credit file Lowell got A default ccj last year Paperwork sent to old address moved out just over 6 years ago. Forms filled for set aside hearing date end of this month. Lowell have e-mailed today We refer to the above matter and in particular your application to set the judgment aside which has been listed for hearing on ## november 2018. Upon consideration,our client is proposing to consent to the judgement been set aside and has instructed us to prepare the attached draft consent order for your consideration.we should be grateful if you could sign and return to us by e-mail if possible or post. Once we are in receipt of the signed draft consent order,we will also sign it on behalf of out client and forward this to the court requesting that the hearing vacated. Should the court approve the draft consent order we should be grateful ifbyou could provide a copy of your defence so we can take instructions. Once this ccj is removed if they send a new claim where would statue barred come into play Did the default ccj stop the clock and restart once removed? It was a shop direct account around 450 so not a big amount last payment would of been early 2012

-

Hi all. Brief background to my delimma; Opened up a vanquis account back in mid 2013, kept on top of it for a few years until I went through an extremely difficult time, they increased my credit limit to £2000 around the same time and I blew the lot and stopped paying because I didn’t care about anything. It was then sold to Lowell’s solicitors I ignored the first letters until I received the pre action protocol letter. I responded to that asking them to prove it. Today they replied stating they were waiting for response from creditor and my account is on hold in meantime. Total debt is £2396. But I also noticed some of the information on this letter is wrong. The last payment date and the amount is incorrect and also the default date. I checked through my bank statements and they’re a month out with the payment date. They have my last payment as November for £70 odd, but my last transaction was in the October for £30 odd. Then the default is recorded in May the following year. I’m wondering if it’s worth letting it go to court if they seem to have wrong information. Would be really grateful for any information or advice anyone has. Many thanks.

-

Hi I've been getting a number of letters from different debt companies and i stupidly ignored and even stopped opening them. I now have a letter from Northampton county court ordering a payment of over £8,000 for a certain credit card bill. I however suspect that this debt might be over 6 years as i remember getting into financial difficulties and defaulting when i was on maternity leave six years ago. I have read a few threads on here that mention doing a set aside and am guessing this is the route i need take, but am not sure who to contact regarding how old this date is. It was originally with Lloyds bank and has been passed to different companies. They are demanding for payments to start on the 5th April and another 2 companies are issuing their demands too but not gone to court yet. Any advice on what to do is very much appreciated.

-

Good morning everyone, I have been asked by my ex-wife to help her after she got a letter threatening her with bailiffs, She got herself into debt with EE and of course because she was dealing with depression she started to "bury her head in the sand" The consequence is that The lovely Leeds Losers (aka Lowell) have got involved, I only became aware of this situation after she got a letter from the county court, saying that they were about to get the bailiffs after her. My question is, why have they only chosen to partially enforce the judgement, this is something I have never heard of before? because of her depression etc she is not sure she received a letter of assignment etc, would it be worth having a go at getting the judgement set aside(however I have paid the amount they enforced, just to stop her having to deal with bailiffs) Many thanks in advance

-

Hope I can get a quick bit of advice/knowledge from you guys. Lowell have been sending my husband the usual series of threatograms over a Talk Talk account debt and have now sent us a county court claim form. What makes this especially fun is that this debt is absolutely not ours. We have never had an account with TalkTalk. Hubby has even phoned TalkTalk and verified that he has never had an account with them (and they actually confirmed to us that the debt is question is not and never has been registered at our address - but we can't really use that info because under data protection they shouldn't even have told us that much). Hubby has a very common name and I can only assume that Lowell, being unable to find the actual debtor, have just sent out speculative threatograms to everyone they could find with that name in the hope of bullying someone into paying. We haven't bothered replying to the threatograms because, quite frankly, why should we? It's not our debt and we are under no obligation to send them personal and/or financial information (also, in my past experience of DCAs chasing a debt for a previous resident of our address, these companies are extremely reluctant to remove a name/address from their records unless you can provide them with an alternative address at which to chase - they would rather continue to pursue payment at an address they know not to be that of the debtor than have nowhere to send threatograms to). I am submitting our defence to the claim on the website and it's fairly straightforward because it amounts to, Sorry mate, not our debt, sod off. But I would like to get Lowell in as much trouble with the courts as I possibly can for their unscrupulous shenanigans I would like to know what the regulations are (I know there are regulations DCAs are supposed to follow, not that they often do) about chasing debts/issuing court action etc when they haven't even ascertained that the person they are chasing is the actual debtor. Are they in breach of regulations here? Or are they actually allowed to send out threatening letters to everyone with the same name as the debtor they are seeking and take people to court just because they have the same name as a debtor? Any help/thoughts/guidance much appreciated.

- 38 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

-

Hello everyone. I need an advice. Received a letter on 06 July this year from Lowell. It states I owe them £510.38 for an account I had with Three mobile years ago. As far as I remember from previous letters this alleged debt and another smaller one (60) with Three exchanged hands few times and are now owned by Lowell . The thing is I have no idea where this amount of debt comes from. I had 2 contracts with Three, one for mobile broadband (which i closed 5-6 years ago and dont owe anything) and another one which was opened 8 years ago and i kept renewing until I abandoned about 5 years ago and stopped paying. it is likely they put all sorts of charges etc. , for which i have no recollection of letters etc. But still the amount seems too too high and dont know if the original account number with Three they have quoted is mine. I think I need to request info from Lowells without accepting any liability or that the account belongs to me, as they might be just shooting in the dark. Kind of '' prove it letter'', instead of request for summary of account under the consumer protection act. The letter from Lowell : ''Dear Mr. source of income Your Three Mobile account remains unpaid. We are now deciding whether to transfer your account to our solicitors to take legal action against you to recover this debt '' letter continues with explaining what legal action is etc. etc. So in summary : - received letter from Lowell that they consider transferring my account to their legal team - i have no idea if that account belongs to me - i have no idea where the amount of debt mentioned is coming from, have no memory of receiving any letters with charges from original debtor (Three) - need to establish if account is mine and where this amount has been worked out Thank you in advance Also they put a new default date on that alleged debt in my credit file , although the original default date is years ago. How can I include a request for this default to be removed ? P.S. Having debt on my credit file doesnt mean I owe the debt, as I havent checked my debts and credit file for few years due to illness.

- 51 replies

-

- county court

- lowell

-

(and 1 more)

Tagged with:

-

Hi In 2016 Lowell purchased a credit card debt of 3K. I sent 3 letters using templates from a now defunct site and they sent me a copy of my original credit agreement. I have continued to ignore their letters, which were mainly offers of discounted settlement. (the latest was 50% in feb) I now have a Claim Form from the court and unsure what to do as i have top respond soon. I'd be grateful for any advise on whether I should defend, and if so how? Thanks VitSea

-

Hi all, I have had a LLoyds tsb credit card for sometime, but have fallen into financial difficulty. I have been making reduced payments through CCCS for the last 6-7 months. Arrears have built up on this account and i have now received a default notice. The link for the default notice is below:- http://s740.photobucket.com/albums/x...yds%20default/ The above link also includes the credit card agreement which was received with a new updated card. I believe this was in may 07. Can anyone advise me as to the eligibility of the agreement and/or the default notice? many thanks for any help/advice. Ricky

- 24 replies

-

- lloyds bank

- loc

-

(and 1 more)

Tagged with:

-

And here's another one. Name of the Claimant - Lowell Portfolio I LTD Date of issue – 16 JUL 2018 Date to acknowledge) = 03/08 Date to submit defence = 17/08 Particulars of Claim 1) The Defendant opened a Simply Be Regulated consumer credit account under reference xxxx on 10/02/2015 ('the agreement').xxxx 2) In breach of the Agreement, the Defendant failed to maintain the required payments and the Agreement was terminated. 3). The Agreement was later assigned to the Claimant on 12/01/2017 and written notice was given to the Defendant. 4) Despite repeated requests for payment, the sum of £4XX.XX remains due and outstanding. And the claimant claims a)The said sum of £4XX.XX b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.089, but Limited to one year, being £32.58 c)Costs Have you received prior notice of a claim being issued pursuant to paragraph 3 of the PAPDC (Pre Action Protocol)? I don't think so, she has been keeping that comes in now instead of throwing it away and she does not have a copy of that. What is the total value of the claim? - £5XX.XX Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? A Catalogue When did you enter into the original agreement before or after April 2007? After Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Debt Purchaser. Were you aware the account had been assigned – did you receive a Notice of Assignment? Unknown Did you receive a Default Notice from the original creditor? Unknown Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Unknown Why did you cease payments? Payments became too much, the Catalouge kept increasing her limit every month so she spent it, despite being unemployed. What was the date of your last payment? Early 2016 Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, offered reduced payments to clear but they kept adding interest on it which made clearing impossible. They did not respond to further contact through the account portal. Marked as defended and CCA/CPR will be in the post.

-

Hi, I've received a letter from the county court business centre in regards to a supposed outstanding amount on a vodafone contract. The amount is for £1248.72. It says the defendant failed to maintain contractual payments under the rems of the account agreement. I haven't had a Vodafone account in over 11 years. What do I need to do?

-

Hi, I have received a claim from northampton county court on 31st Jan 18. I have done the acknowledgement online as per the document (and help here) acknowledged on the 31st. I have read some posts about similar and sent a CCA to Lowell and CPR to Lowell Solicitors signed for. I had a Vanquis Card back in 2012 and came out of work and couldn't pay, stuck my head in the sand and ignored everything. Received some letters from Vanquis I think but just binned them. Got some letters from Lowell and they ended up in the bin too. I know it is not far off from being Statute Barred which is why I guess they have decided to try this now. I've now got a claim from Lowell via the court for £2660.50 The claim is broken down as; Amount Claimed £2660.50 Court Fee £105.00 Legal Fee £80.00 Total £2845.50 The Claim particulars are 1 - The defendant entered into a Consumer Credit Act 1974 regulated agreement with Vanquis under account reference xxxxxxxxxxxxxxxxxxxxx (the agreement) 2 - The defendant failed to maintain the required payments and arrears began to accrue. 3 - The agreement was later assigned to the claimant on 04/08/2013 and notice given to the defendant. 4 - Despite repeated requests for payment the sum of £2463.43 remains due and outstanding. And the claimant claims a - the said sum of £2463.43 b - interest pursuant to s69 county courts act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.540, but limited to one year, being £197.07 c - costs Since sending the CCA to lowell I have not heard anything from them at all (sent 1st Feb) Lowell Solicitors have sent a copied version of the notice of assignment which introduces them as the "debt purchaser". It is not an assignment or transfer from the original creditor which is what was asked for in the CPR. I have been working on my defence and this is what I have so far; "The Defendant accordingly sets out its case below and relies on CPR 16.5(3) in relation to any particular allegation to which a specific response has not been made. (1) The Defendant notes the opening sentence referring to an agreement between him and Vanquis. The Defendant has in the past had financial dealings with Vanquis. The Defendant is unaware of what alleged debt the Claimant refers, having failed to adequately particularise its claim. The Defendant has not entered into any contract with the Claimant. (2) The Claimant alleges that the Defendant failed to make the required payments due. This is denied. (3) The Claimant alleges the agreement was later assigned to them on 04/08/2013 and notice has been given to the Defendant. This is denied. The Defendant is unaware of any legal assignment or Notice of Assignment from assignor or assignee pursuant to the Law of Property Act 1925 s136. (4) The Claimant alleges “repeated requests for payment”. This is denied. The Defendant is unaware of what account or contract the Claimant refers to, nor having received any default notice pursuant to the Consumer Credit Act 1974. The Claimant has not complied with paragraph 3 of the Pre Action Protocol. Failed to serve a letter of claim, pre claim pursuant to PAPDC changes of the 1st October 2017. It is respectfully requested that the court take this into consideration pursuant to 7.1 PAPDC. The defendant denies owing any monies to the Claimant and the Claimant is put to strict proof to: (a) Show how the Defendant has entered into a legal signed agreement with the Claimant; and (b) Show absolute proof of how the Defendant has reached the amount claimed for with the Claimant by way of statements showing all amounts levied by the Defendant; and © Show how the Claimant has the legal right, either under statute or equity to issue a claim; (d) To provide an original assignment in writing signed by the assignor at time of alleged assignment pursuant to the Law of Property Act 1925. (e) On receipt of this claim the Defendant requested by way of CPR31.14 and a section 77 request for copies of any documents referred to within the Claimants particulars to establish what the claim is for. To date they have failed to comply to the section 77 request and remain in default with regards to the CPR31.14 request. As per Civil Procedure Rule 16.5(4), it is expected the Claimant prove the allegation the money is owed. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act 1925 and Section 82a of the Consumer Credit Agreement Act 1974. The Defendant feels that in the event the Claimant does not have a right to issue claim, pursuant to the Law of Property Act 1925 it may be a contempt of court in that the Claimant brings a claim that is misleading by representing they have ownership by assignment and making that representation in their particulars of claim before the court. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief." Any chance anyone can help me out with this? I'm trying to get everything in the right order and such but it is a little daunting on my own.

- 182 replies

-

- action

- county court

-

(and 1 more)

Tagged with:

-

Hi, I have a question regarding my credit file & 4 Lowell accounts which were closed as a "goodwill gesture" due to my ongoing mental health illness. Due to them constantly contacting me via telephone and threatening letters, I contacted them first email to request they stop contacting me via my telephone and also to try and setup some kind of affordable repayment plan to clear these accounts. I also explained my health circumstances and my very low income. They requested I complete a income/expenditure and some proof of my illness. I replied with my doctor's report and explained I will send a income / expenditure form once I have some advice from the National Debtline. One of the accounts was being administered by BWLegal who had issued a warrant of control which Lowell advised would be stopped and they would take over the account. A few weeks later, Lowell wrote to me to explain all accounts have been closed and no further action will be taken to collect any outstanding amounts. (Although they didn't inform the bailiff who turned up at my door and left a card, but having spoken to him he is now aware the debt has been cancelled, so all good) Should all these closed accounts (all equal around £1500 combined) be updated as "closed" on my credit file? Obviously I realise defaults / and the 1 CCJ remain on file for 6 years, but should the other accounts be listed as closed rather than as still active with there outstanding balance? (which they presently are) Lowell closed the accounts about 6 weeks ago, which did surprise me but obviously took a weight of my mind. Due my present circumstances I obviously won't be applying for any credit etc for some time, so I'm not too bothered about my credit file status but I like to make sure information on it is kept up to date nonetheless. Any advice appreciated, thanks

- 4 replies

-

- accounts

- disability

- (and 4 more)

-

My partner started to receive letters from a company called Lowell financial a while ago. When I saw them alarm bells started to ring and I did a bit of research on here. From what my other half tells me, these debts were from well before we met so are probably 10 years or more old. The debts were from capital one, three, jd wiliams, and shop direct. We sent a cca request and £1 postal orders for all the debts. Lowells have acknowledged all the cca requests and closed the three account. It has now been a month since we have heard anything from lowells about the remaining 3 accounts. We have checked on experian and it seems lowells have 2 of the named accounts showing as in arrears for about 4 years. From what I read on another post, my other half should not pay them anything ever. They have failed to provide any of the original documents so as far as I can tell they are unenforceable and should be off her credit record after 6 years. Am I correct And should we be worried about it?

-

Hi, hopefully this is is the right place to post. I took out a personal loan with Tesco bank back in 2014, Shortly after I ended up moving overseas. I continued to pay this loan but in 2016 I had a few personal difficulties and couldn’t make payments. I am currently still overseas and had an email recently come through from Lowell that they now have taken on this debt. i haven’t made payments since 2016 so just over 2 years. the amount was a fair amount £16000 left. my financial situation isnt great currently but I did contact Lowell back and explain to them the situation. I did offer some money I had received through a gift of £2000. As a full final settlement. They did not accept this as I thought would be the case and offered a 50% discount.T i explained again I really can’t make monthly payments and ended up emailing saying I can’t get this debt down currently and the £2000 is what I could give or monthly payments of £1 (supposed to be sarcastic) i found this surprising they emailed back saying yes £1 payment a month is fine? this has just set a bad feeling for me as I have no idea why they would want £1 payments it would never be resolved? I really do want to do the right thing and fix my mistake but I just have a bad gut feeling about accepting this £1 payment. is this normal and what should I expect going forwards?

-

Good Evening I'll try and keep this short. I have been successfully defending Court claims from Lowell's with the help of this group, they usually give up when it gets to the stage where the judge tells them to supply the court and me with my cpr requests or file a properly completed claim by a certain date or the case will be struck out. Today they have sent me a curve ball for their latest claim against me. They have sent me a Tomlin Order to sign. They have not supplied all of the information they were told to supply. I'm guessing its their last ditch go at trying to scare me, they have 3 days left to supply the court with the information requested. Is it ok for me to ignore this letter? It's states that if I ignore this letter they will produce it at the hearing to prove that attendance costs could have been avoided. Thanks in advance.

- 8 replies

-

- lowell

- solicitors

-

(and 1 more)

Tagged with:

-

Good Morning I have 3 accounts with Lowell im dealing with at the moment...one is a old mobile phone contract, a payday loan and a british gas account. I seem to everything in order but when i have sent the CPR requesting statement of accounts, loan agreements, notice of assignment, notice of default, termination notices etc etc. They have responded with its not legal for them to supply a notice of default or termination notice from the companys? Is this correct ? They have instructed me to go direct to the companys for this info. Thanks In advance

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.