Showing results for tags 'yes'.

-

The company we all can not forget, for their poor quality customer service and who cares attitude which landed yes BUST I had a letter in december from them at my new address, the property was built in 2013 so would of been impossible for them to obtain from me. I checked all of my credit files and no searches, Direct Auto finance claim they got it from equifax... so I ask equifax they say no they have not. Direct Auto finance claims that they have the right to trace my address for legitimate business reasons, and they also have to right to still keep 12 years after the end of my agreement all of my data, drivers license, passport, bank statements etc. ICO says not but 3 month backlog, has anyone else had a letter from them? I have also seeked to reclaim gap using the Plevin case as an example, as they failed to advice what commisions were been paid normal brick wall response from them. Now my agreement was late 2005 so not sure if ombudsman or fca with it but they dont seem to like giving deadlock letters etc. Any advice, also if you have recieved this letter about data SAR them it will cost them todo also.

-

I've spent lots of time (and I mean LOTS) reading various threads on the site ref Yes car credit, DAFS etc and PPI.... Has anyone been successful pursuing a claim on a pre 2005 claim? There is one post amounting to 18 pages of very interesting reading and then no outcome - suggesting possibility of a settlement and NDA... Thanks

-

Hi all, some advice required please. i used a ppi claim company to make various claims a couple of years ago, with some positive results,(apart from their charges). i had a couple of cars through YCC pre 2005 and ended december 2007. i claimed against YCC in 2011 but resulting in a letter from the claim company about 3yrs later saying the ombudsman rejected the claim as it was pre feb 2005. would it take that long firstly, and would it be worth making a claim against Direct auto finance??? Or have i been fobbed off by that claim company because they couldnt be bothered? thanks in advance also when i say the company couldnt be bothered, i was being flippant. as ive looked online many times (probably badly) and a lot of people had no joy or no reply from them. i certainly never seen any successful claims being mentioned.

-

Sorry to resurrect this old thread, but with all the recent publicity about reclaiming PPI, can I ask if anyone has actually had a repayment from Yes Car Credit? Briefly, I had 2 accounts with them, one in 2001 and another in 2003. I had PPI on both, and was told I had to have this to ensure I got the loan. It would never have paid out as I was working on a Zero Hours Contract, or an 'as and when required' contract as it was them. The first agreement was settled when I took the second one out. Both accounts where settled in full with not one late payment. I still have the agreement from the second deal, and all my bank statements showing all the payments. I reckon I'm talking about £3-4k in PPI paid. Do I have a chance of getting any of this back? Thanks.

-

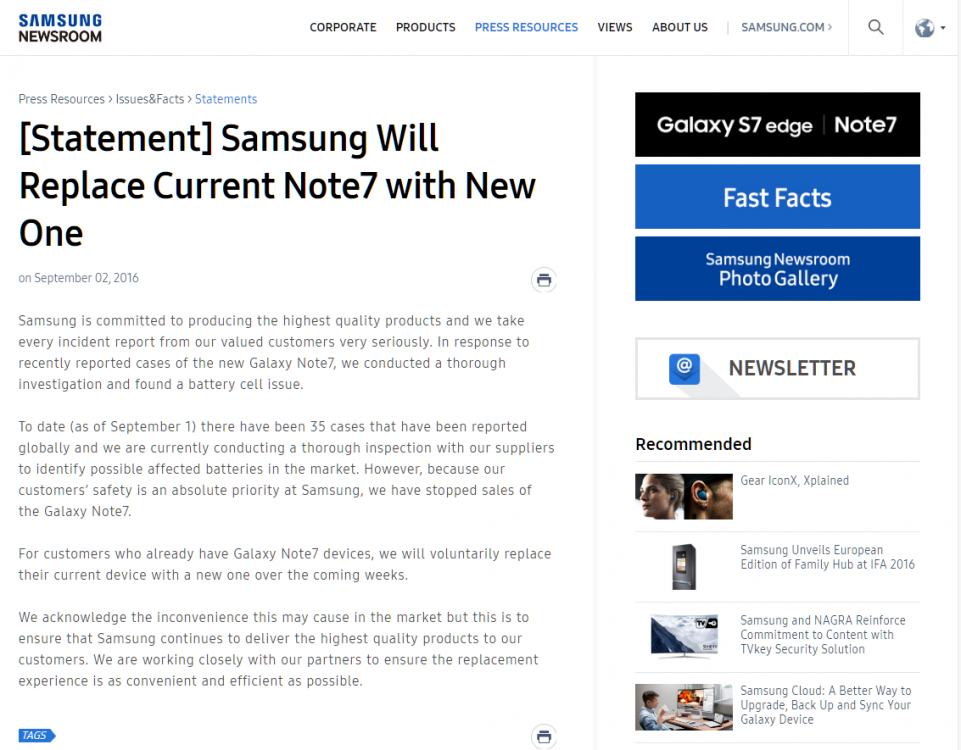

Ladies & Gents... Have you heard the news? Mobile phones are now dangerous... (When did that change?) But no seriously. News from Samsung regarding their Note 7 Product; Selling over a million units already, the device is shaping up to be a catastrophe for Samsung. FAQS Below

-

Hi there I am not great with wording things so I will try my best here. I took out a car with Yes car credit back in 03/04, I was young and stupid I know. When I purchased the vehicle the salesman told me that in order to purchase the car I had to also take out the PPI otherwise it would be declined, now in 2007 with only 8 months left to pay on the vehicle ( a vehicle I had paid way over the odds for in the first place) I became unemployed and fell behind with payments, a man rang me and said he was coming to collect the vehicle to be sold at auction as I hadn't made in payments in 2 months, no notices were served just a few phones calls from yes car and then a man saying I had to give it back which I found quite intimidating, almost bullying in a way. At the time I did not know my rights my own stupid fault I just thought I had to hand the car back so when this man turned up at my door I did, all I was given was a tiny compliments slip to sign that was it. (I have moved house since and don't have it now) anyway the car was gone and sold at auction, I then began to get debt letters from Direct auto finance saying I still owed a few hundred pounds, demanding payments etc. Then came the PPI scandals and I decided to refuse to pay as I don't believe I owe them anymore having paid thousands already and claim back the PPI. I have tried twice now with the company and both times have been told to get lost and that I signed and accepted to pay so it was tough basically. Then I started getting letters from DLC demanding payment so I complained again saying that I felt intimidated to hand back the vehicle and that in fact I had owned more of it than DAF and I believed the PPI was missold, they responded saying they would investigate and I got the usual response of it wasn't missold etc but they took the other part of my claim seriously and had passed it back to DAF to investigate further. Now all of a sudden DLC have sent me a PPI questionnaire to fill out on behalf of DAF and are also continuing to investigate the claim of how the vehicle was repossessed. I am going to fill out the questionnaire but my question is am I wasting my time again as they stated the last time it was their final response, has anyone ever been successful with these people? Hope this makes sense

-

Just a query really.. .my son parked his car opposite our home. Now where we live there are white lines on the pavement where you are allowed to park two wheels on the pavement and two off then there is a line where it ends. This is due to the road being quite narrow when there are two cars driving on either side. My son unfortunately placed two wheels on the pavement on two off after the line. He received a ticket for this at 22:10 hours. Although he was in the wrong with the two wheels on the pavement, are they allowed to issue tickets at this time of night??

-

Hi All, Brought a car from Yes Car Credit in May 2004, arranged with Yes Car credit to return due to change in circumstances in September 2004. Debt was transferred to Go Debt, apx £6000. Payment plan in place with my DMP and balance currently apx £1600. Been paying this since 2004 to present date. Looking for a way to end this and looking for best way to try? I was missold the PPI on this agreement and was told i could not proceed unless it was taken, PPI was also apx £1600. is there any option to try with this? This was just before the FSA came into effect in January 2005. Also the deposit of £110 was subtracted from the Insurance / PPI section on the agreement not the Vehicle, seen a few comments on here that this can have an impact on the agreement. I have a copy of the agreement but have sent Go-Debt a CCA request. Any Ideas / Best way to proceed? Thanks.

- 53 replies

-

- assistance

- ltd

-

(and 1 more)

Tagged with:

-

hi all i have posted one post my mother passed away last week with breast cancer , my brother has had to work through this as his employment had only just began with the agency transline we hoped he would at least have good friday off and bank holiday but apparantly when he asked his advisor he was told that amazon are a uinted states company and that they didnt celebrate good friday or bank holiday so they dont see it as a "day off" is any of this true ? hes also got to work normal hours with normal pay ? thanks in advance

-

Someone has emailed the following complaint to CAG admin - the following message is exactly as received. No contact details for a response were included. E Credit Plus Ltd 2 Minton Place Victoria Road Bicester Oxfordshire OX26 6QB This Company are HARRASING me with numerous SPAM TEXTS for Yes Card yescardaccept.co.uk~ |THEY ARE A BUNCH A FRADIUSTERS AND NEED TO BE STOPPED!!! I have reported the number from which the text's are sent from to the ICO but no action has been taken. I am sick of it!

-

Hi All Need a little bit of assistance with a claim for mis-selling of PPI. This is the first time I have attempted to claim PPI as I think this is the only account I have had PPI on and I didn't think it was possible to claim back from accounts pre-2005. I've read a couple of threads but they seem to be a couple of years old now, so wondering if anything might have changed at all. I purchased a car through YCC/DAF in 2001. The account was settled in 2005. When I was sold the car/finance I was told that taking out the PPI and GAP insurance were mandatory for the credit to be agreed, and I was on a fixed term temporary employment contract at the time so I feel that they were mis-sold. I have none of the paperwork remaining, so do not know account numbers etc Could someone let me know what the first steps are in the process? Is it too late to claim? Do I start with an SAR? Anyone have an up to date address for them? Would I be better off getting a company to do this for me? Any help you can give would really be appreciated. Thanks

-

Hi I posted on here about 12 months ago as my family were evicted (s21 no fault) from a house we were renting. Of my deposit of £1600 I had £300 deducted for 'sham' cleaning. Because we struggled to get another place the landlord took us to court to get the house back. Corporate landlord who didn't want pets in the house. We managed to find another home eventually. It's much scruffier than the last one but we painted it and made it nice etc, but things keep breaking, dodgy plumbing and so on. the owner now wants to sell (she's not a professional landlord). She uses an agent who probably take a large chunk of the rent each month. Agent has sent a s21 and given us a bit longer than the statutory minimum of two months. We paid £1575 deposit and £400 check-in fees to the agent. I have a job after being unemployed for nearly two years, and still catching up with lots of bills each month so I have no savings whatsoever. I have no idea how I'm going to find the agent fees and the deposit for the next house. We have to pay these amounts up front. The rent is going to cost us around £1300/month (Surrey area) and so deposit will be about £2000 plus fees between £400 and £500. My current deposit is not returnable until 10 days after I vacate. Even then I'm still going to be £1k short. My daughter is on HB and income support. She has a very young baby and is expecting another - boyfriend is an ex boyfriend. What a mess! Daughter is suffering post-natal depression so we need to move nearer to family and friends and the rents are not cheap. They aren't cheap anyway, but it is what it is I guess. £1300/month is on the lower end of the scale, with many being more like £1500. Will the council that we plan on moving to help with a deposit? How can we determine which council it will be because we can't put an offer in without the fees available. I'm so lost at the moment and can't see a way round this. I've maxed on credit and don't know anyone with £2.5k sitting in their bank account. Any advice? thanks

-

Hi Guys. I see a number of threads on here about the Sofa Specialists of Droitwich and Brimingham. I have won a Small Claims court by default against these people. Their history makes me wonder if I will acually get anything back. It has become obvious that they are using false business addresses and/or avoiding reciept of mail. In readiness for further action I want to compile as much current information as I can about this business and it's owners. Anyone here with present problems please shout back

- 52 replies

-

- sofa

- specialists

-

(and 2 more)

Tagged with:

-

Going to claim back ppi from yes car / direct auto finance, don't have paperwork, any info on what I do and who to write to as last letter has been returned as no longer at this address, bought the car about 2000

-

So I joined my new job on 6th Jan and was due to be paid on 24th Jan. I didn't get paid so I phoned HR who said I could get paid at any time that day so I waited. It didn't arrive so I phoned HR again to get payrolls number. After many calls it turns out payroll read the last number of my account wrong it was a 4 not a 9. Now I have to wait for it to be returned before I see any of it. They even asked my to contact my bank (halifax) to see if it was waiting to be returned. They say this can take a few days or if the account exists much longer. Is http://www.postcodeanywhere.co.uk/demos/bankvalidator.aspx valid? It claims the account the money went into doesn't exist.

-

Hi Everyone Im new to this site so bare with me. Im just about to embark on attempting to reclaim the PPI from Yes car credit which was on a car I purchased in May 2005. Can anyone give me any hints on what I should do first. I have an original copy of the credit agreement but not sure who or where I should turn to first. Any help greatly appreciated Thanks K

-

Hi there, I have joined this forum to ask for any help and/or advice on re-claiming from Yes Car Credit but it is a bit of a complicated one....I think. I bought a car on finance from Yes Car Credit back in 2003. It was a joint agreement with an ex boyfriend (no longer in contact and do not wish to be at all!) The car was later stolen, burned out I think and recovered by police (so there must be something on file) I was in between addresses then and kind of left it there. A few years later-think it was 2007, I had a debt collectors letter saying they had been trying to find me and now that they had I owed them money for the car. I rang, panicked asking what I should do. They said they would write off so much of the debt (don't know why) and that I owed them £3,000 which I paid (Well, my grandma paid for me as I didn't have any money to do so myself) then when all the PPI scandal came about I wondered if I had anything to claim back from YCC I followed some instructions from a forum similar to this and sent off for the paperwork. Sure enough I received a CD with the original credit agreement on there. It shows (in section 3.0 - Additional Optional Non Cancellable Insurances) 10.£ Payment Protection Insurance Cash Premium 11.£ 550.00 Mechanical Breakdown Insurance Cash Premium 12.£ 350.00 GAP Insurance Cash Premium 13.£ 900.00 = Total Insurance Premium Cash Price (10+11+12) 14.£ 300.00 Less: Down Payment provided by Customer 15.£ 600.00 Shortfall Required by way of Credit 16.£ 251.04 Add: Interest 17.£ 851.04 Balance Payable (15+16) 18.£ 1151.04 Total Amount Payable (14+17): 19. 20.0 % APR 20. 48 Number of monthly Insurance Instalments 21.£ 17.73 Amount of each Insurance Instalment (17+20): the first payable one month after the date of this agreement. Apparently I should not have paid anything to the debt collectors as I had GAP Insurance which would have covered the car value when it was stolen? Also as there is a space next to PPI I'm not sure if I had PPI or not, Is Mechanical breakdown insurance re-claimable? I just don't know what to do next in order to find out if I am owed anything at all? If anyone can advise me I would really appreciate it. I am on the verge of calling a PPI claims company but I've seen the rates are 25% plus VAT! Thanks in advance for any help you may be able to give me. Kind regards, MsQ xx

-

Hi all, i had the dreaded ppi on my yes car agreement some years ago. I have recived my information i requested in a SAR and it is very confusing. I have written to yes car requesting a refund of my premiums and have receved a big fat no and it was a final response. I am now looking to claim back from the insurance company. On reading through everything it appears my PPI, Mechanical breakdown and GAP insurance were with3 different companies. Am i able to claim back all 3 or should i just stick with the ppi which was £1248 in 2003 ?

-

It's been a long time folks since i've been on here, so hello all its great to be back. Now, down to business.... Through the FOS i got the current address for the company now handling all of Yes Car Credit information and also Direct Auto Finance stuff too. I emailed them and received a reply saying i had to download a questionnaire about my purchase of PPI when i brought the car (years ago). I have downloaded this, completed it and sent it off along with photocopies of paperwork from the day i purchased a car from YCC (back in 2003). I have since received a letter from them to acknowledge receipt of the paperwork i have sent them, but can anyone tell me what i can expect next, and do i actually have a chance of receiving any kind of a repayment from them, or am i just edging my bets and whistling into the wind > Any help would be great and very much appreciated.

-

Hi - the first and last PPI i took out was with Yes car credit some +/-8 years ago, they really conned me and being new in the country and not knowing my rights said yes, I got the speech "if you don't take out PPI you cannot get the car". Anyway can I still claim, I do have copies of my documents that are scanned on my computer, if yes who do I write, is it the same address? Hopefully someone can help me again - have been a member of CAG which has saved me thousands over the years. Sharon

-

Im going to need some help along the way with this one and hopefully my journey will help others. I have to date had 4 successful PPI Claims 2x MBNA, 1 x Halifax and 1 x Capital One. Yes Car Credit is my final one and reading other threads it appears this will be the most challenging. I have SAR'ed them and received my response today, It makes very interesting reading. Im claiming as i have comprehensive cover through my employment and never have needed it, I was also told I had to take it out to get the finance. 1st my number one referee, has been filled in by them, with a name i have never even heard of, the person has even circiled their relationship to me as 'PARENT'. There are lots of other things that have been ticked by them which i was not aware off. I need help with the whole insurances and what i am actually claiming for... i know im claiming for PPI but do i claim the other insurance. Could someone help with the correct spreadsheet please to workout my claim. My finance was signed 13/6/2002. below is a screenshot of the insurance and finance etc. thanks in advance

-

I really want to take these really nasty people to task for all the misery they caused me. They overcharged me for a car, insisted I take out expensive insurance such as a warranty that was no good and of course PPI insurance that I could not claim on as I was a temporary worker who was recovering from a major operation. Has anyone succeeded in getting money from them ????? I am very determined, I got almost £6000 from the Halifax for bank charges. I even threatened to send in the bailiffs if they did not pay up. It worked a treat so now its Yes Car Credits turn. Any help would be greatly appreciated Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)