Showing results for tags 'lowell'.

-

Hi, I am new to this forum and new to legal terms and I am confused with what happened in court today. Someone please help me understand? Here is the story. I received an attachment of earnings order for a default judgement I knew nothing about. I enquired and found out that Lowell had applied to court a few months earlier and got the default judgement as I did not get any paperwork. Further, I had written them with CCA request but they never replied I thought that it is over and done with. I applied to local court to set aside the judgement with a witness statement and defence where I explained to court about their dirty tricks and made up evidence etc. I sent all of those documents to Lowell as well so that they could put their side of story in court. what I did not understand was that a day later, they wrote to me with a signed draft order accepting to set aside the default judgment, withdrawing their AoE order application, and paying me court fees, then asking the court for permission to reply to my defence I thought that was a trap I went to court the next day, where I thought that the case would have been heard and judge making a decision. that was not the case, and Lowell hired a local solicitor to put to court the things they said in their letter, judge said to me that was easy and struck out the judgement and AoE order, then set a date for next hearing. I am very confused have two questions; 1. Why the Lowell accepted to set aside judgement and AoE order? 2. Why the judge set another hearing to hear the case when he had already quashed the judgment? I hope someone could answer the above two question. Thanks

-

while I have been away from my home - Restons have instigated a claimform on me for a C/C which I stopped paying over a year ago. It went from Lloyds ( at the time was paying £ per mnth), to Lowell- who didn`t have it for very long. One step later & Cabot had it. They didn't have any payment - so they have moved it to a Claimform- with Restons. Now my question is- at what percentage are these DCA`s buying this debt for - does anyone have any idea? With that knowledge- I could then make a realistic offer- to get rid of the impending CCJ. I see you have 14 days + 5 service days for a defence. If this is not filed, do you then have the full calendar month from the date of service to settle the judgment (with an offer to the solicitors) without it impairing your credit file? All input would be fully appreciated

-

Hey guys I have received a County Court summons for £244.96 Inclusive of Court Fee @£25 and Legal Representatives costs @£50. The original debt was from "Three Mobile" and it says I failed to maintain contractual payments. It says the debt was legally assigned to "Lowell Porfolio 1 Ltd" I can't remember if I paid this in full or not as it was a few years ago. Is there anything I can do about this?

- 21 replies

-

- county court

- lowell

-

(and 2 more)

Tagged with:

-

Hi there I have had a credit card debt with Capital One of £621 that was sold to Lowell in Sept 15, I have been receiving the standard letters from them, however today they have sent me a Pre Legal assessment threatening court action. Have yet to respond to any letters acknowledging the debit I am living in N.Ireland, not sure if that makes a difference. Any advise would be appreciated Thanks

- 19 replies

-

- assessment

- capital

-

(and 1 more)

Tagged with:

-

I have an account with Lloyds, and have admittedly gone over the agreed overdraft a few times. after going through all my statements and calculating the total amount they've charged me, it comes to about £2000 in charges. I've already put in a claim and got the usual response back, however last month they removed my agreed overdraft limit of £500, and won't let me apply for another overdraft, so I opened a new account with a different bank. now I'm getting letters threatening me with court action because I'm £770 overdrawn. What should I do here? Try and agree a repayment plan with Lloyds to get the balance paid back? I do feel it's a little unfair seeing as I'd be a lot better off if their charges hadn't been so ridiculous. any help from anyone here would be great, thanks.

- 172 replies

-

I hope somebody on the forum can help and/or advise me please?. I have received several letters from Lowell regarding a debt with JD Williams which is in dispute, I have sent Lowell several e-mails advising them that the debt is in dispute (I sent several items back to JD Williams which was faulty but JD Williams never acknowledged the return neither did they credit my account, this lead to charges being applied to my account which caused my account to go over limit and even more charges being applied) Lowell never responded to my e-mails and have kept on calling both my landline and mobile despite me asking them to remove my numbers and requesting all communication in writing. Today I received yet another letter from Lowell but one of the paragraphs has me somewhat worried and angry: 'What happens next' We have a copy of your credit file and are in the process of obtaining your employment details. Once we have this information, we will be in a position to decide what next steps to take which may include instructing an external agency who specialise in legal proceedings. So apart from them supposedly having my credit file they intend to carry on harassing me by obtaining my employment details? surely this is illegal and is a form of harassment?. I have sent another e-mail off to them today and have had a automated response from them so I will wait and see what they come back with, I have also started the ball rolling with the FCA as I have all of the e-mails sent to both JD Williams and Lowell as well as the previous letters from them. Also, as this debt is in dispute with JD Williams should my account been forwarded to a DCA?, JD Williams never acknowledged my dispute and everything went quiet until I received a letter confirming that my account had been passed to Lowell in August (I received this letter in October of last year). Any help/advise will be appreciated.

-

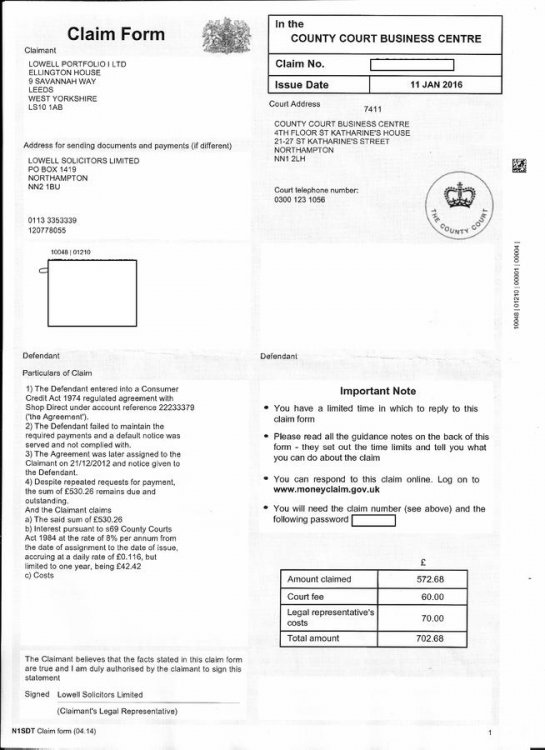

Hi - I have just received in the post a claim form from County Court Business Centre issued on 13/08/15 for an alleged debt for Shop Direct from Lowell Portfolio. The form has no official stamp and does not have a signature only a typed name IAN MARSDEN which it says is the claimants solicitor, who are Brian Carter Solicitors. Is this form genuine? I have never received any proof of this debt. I have just tried the contact number 0300 123 1056 and it just rings (its Saturday). There is something on the form that says I should go online to moneyclaim.gov.uk and it also gives me a password. HELP!!! Sharon PS : FYI you helped me out with a Lowell claim quite a few years ago and they wrote back to say that they would be writing off the alleged debt of +/-£2000, so your advice most definitely does work!!!

-

I have had over £500 worth of loans from what was originally greenwoods but they merged with provident so i'm told. So when my original caller quit after the merger provident sent 5 different callers over a 7 week period and each one i asked to see their identification as anybody would, but each one of them said we don't carry id as it isn't company policy, so i told them no id no payment. They could have been anybody and i don't pay to anybody on my doorstep without id. In recent months i have been recieving letters from lowell threatening court action and bailiffs, and i told them same as i told provident! show me id and i'll pay it but not until, and lowell said they don't have to provide id and my response was in that case i don't have to provide payment. My Question is do they actually have to provide id and am i right in refusing payment?

-

Hello there. My partner received a letter this morning titled "Claim Form" in the top left corner. It is regarding a debt from the mobile phone company Three. The debt we think was roughly 2-4 year ago but we can not be sure. We recognise this debt ourselves but at the time could not afford to pay it and buried our heads and ignored letters from them.(not proud of it) We were out of our jobs and had 4 children so paying off the debt was a difficult job. In hindsight we should of contacted them and told them about the situation but sadly we never. The debt was never an huge amount, the letter states £326.69 initially then goes on to add some further charges. Personally the letter just looks like a photocopied piece as the stamp from the county court doesn't look right. However there is a claim no at the top so unsure . I can upload a image and remove the sensitive information if that is any use. We are unsure about how to go about the debt in terms of repaying it, who to pay, do we challenge the debt or any other options? Myself and my partner are potentially going to open a new business within the next few months and imagine if we let this escalate it will cause damage to this? Any advice would be greatly appreciate. The letter was received yesterday. Thank you

-

Hi My father received a claim form dated 7th Dec 2015 a couple of days ago I would appreciate any help or advice on how best to deal with this. My father has mental health issues so needs my assistance to respond to the claim form. I wrote to Lowell a couple of weeks ago (in my father's name) in response to a letter from them asking what the debt relates to etc but have not received a reply. The details of the claim form are - Name of the Claimant ? Lowell Portfolio 1 Ltd Date of issue – 7 Dec 2015 Date submit defence ) - by 4pm 8th jan What is the claim for – the reason they have issued the claim? 1.The claim is for the sum of £1330 due by the Defendant under an agreement regulated by the consumer credit Act 1974 for a Vanquis account with a reference of xxxxxxxxxxxxxx The defendant failed to maintain contractual payments required by the agreement and a Default notice was served under s.87(1) of the Consumer Credit Act 1974 which has not been complied with. 2.The debt was legally assigned to the claimant on , notice of which has been given to the defendant. (NOTE: No date was entered here) 3.The claim includes statutory interest under S.69 of the County Courts Act 1984 at a rate of 8% per anum from the date of assignment to the date of issue of these proceedings in the sum of £106 The Claimant claims the sum of £1436 What is the value of the claim? £1586 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Not sure but would think after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned to Lowell Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure - my father has no paperwork but may have ignored/been confused by/binned. Did you receive a Default Notice from the original creditor? Not known Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not known Why did you cease payments? If he did stop payments then probably because he got ill and lost his job What was the date of your last payment? Not known, but nothing in last 3 years Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? No Any advice greatly appreciated, thanks

-

Hi all Need a little help after looking at my credit report i have been trying to clean up my mistakes. I had a old mobile which i fall behind (passed on to lowell) I phoned the company to make payments to where they said i had a outstanding provident loan this was new to me as i said to them i have never had a loan from provident. I ask if they could send me documents of the loan agreement. Its been a few weeks and to day i had a email stating they have investigated my enquiry, but are unable to provide and documents. the email goes on and then ask me to make a payment in full or to call to discuss instalments. im problem is i can honest say i have never had a provident loan and now dont whats best to do. i have also notice that my credit report now is showing this up as of the end of jan with a letter Q (can any one tell me what this means) thanks

-

Hi, I have gotten copies of my credit files and I agree with most of what is on there. However, there is a debt which is currently owned by Lowell for a telecoms bill. The bill was for 02. I ordered a phone several years back and there was a problem with the delivery, it ended up going back to 02 and I cancelled the order as I thought the service was rubbish. I got a phone from tmobile instead. So I have just found a Lowell debt for nearly £1200 on my credit files. Can I complain to Equifax etc? As I never had the phone it would not have been used and there is no way I would have run up a phone bill that high anyway. I have tried emailing Lowell but they are fobbing me off with "the creditor has given them permission to collect the payment from me". Thanks in advance.

-

I received a court letter a few days ago from Lowells solicitors for a court summons for a dept that is over six years old. the last time i paid anything was in 2008, what should i do?

- 52 replies

-

- cat

- county court

-

(and 2 more)

Tagged with:

-

Hi Guys Just looking for some advice, My daughter opened an account with HBOS when she was a student in 2007, Stopped using it in 2008 when she ran up an overdraft, and completely "forgot" about it, She has now received a form N1sDT from Northampton County court signed by Lowell Portfolio demanding nearly £1500. The original overdraft was £500, The claim form states "despite repeated requests for payment" But she swears that she has never had anything from these people, (She has moved house about 5-6 times since leaving her student digs though due to her occupation) Where do we go from here Is it too late to request a SAR and a CCA? What does she put on reply form to court Thanks in advance Cosy

- 2 replies

-

- county court

- halifax

-

(and 2 more)

Tagged with:

-

Hi, New poster here, but have read a lot of the information on here previously and it's always helped. Hope you can now too. I have an apparent debt which the lovely people of Lowell are chasing. Now, the account in question is in my name. And I did previously use it. I finished using it in around February 09. To my knowledge it was left at or around a £0 balance and I haven't thought about it since. Lowell got in touch recently, claiming a debt of around £900 which they'd bought from Lloyd's. I've spoken to them on the phone (I know I shouldn't have, but they're persistent, and as I say, the account is mine) - I requested full statements and an explanation of how the debt is made up. Especially given this account only had £250's worth of overdraft facilities. They sent a letter about a month ago. Saying the account was on hold whilst statements were sent out. And again started chasing a few days later so I rang, said I hadn't received anything. They accused me of lying and said I was holding them up. I said they hadn't sent anything. Requested the statements again and I received a letter mid September. They've sent me 3 pages of statements. From 06/08/09 - 13/10/09 made up of only 10 line items. The opening balance is £898 and closing £954. I know I left it at £0 or thereabouts. Now I've just been on the phone to them, and they're saying they can't and won't send me full statements. And because I won't settle today they're saying I'm refusing to pay and passing me onto their 'litigation' department. Few questions. - Can I force them to send me full statements proving how the balance has been made up? I'm reluctant to pay anything based on no information. - What does their litigation department do? The other strange thing, is that I've signed up to Noddle, and it isn't showing on my credit file. Any help would be fantastic. Thanks in advance.

-

Dear All, We recently started to receive letters from Lowell asking us to pay 487 for a 3 mobile phone contract. The contract was terminated in 2009 and the last payment was made via direct debit on the 29/12/2009, the first letter from lowell was received in november 2015. We were at the end of the contract at the time and they gave us the option to upgrade but we refused as we wanted to change provider , then the telephone line of that three phone was cut (from their end) and that was that. We never heard from three until we started getting these letters from lowells saying that we have to pay 487 GBP for early termination charges plus monthly fees, no idea where they got these figures from but sure we do not owe that money and no one from three has ever asked for it. I have always replied in writing and recorded delivery and asked to prove the debt , they sent a statement that doesn't make any sense to me, I never acknowledged this debt in my last letter I mentioned that the last payment was made by direct debit over 6 years ago, however they just replied saying that a default notice was placed in June 2006 so the debt is enforceable until june 2016. I find this so strange and I'm stuck. My husband and I are about to apply for UK citizenship and scared that a court order might ruin things. We never had any problems with debts, got our mortgage approved in 2011 and never fallen in arrears. This is upsetting me now. I'm really sorry for the rant. I thank you in advance for any advice you may offer. Barbara

-

Hello All, Hoping this is in the correct forum. I am stuck in limbo with Lowell and 3 Networks with a default on a Pay as Go direct debit, which should not have been there. I called into the 3 Networks Store and asked for my direct debit to be cancelled, I also left £40 credit in that account. It was agreed into store that no money would be owed, I unfortunately do not have anything to back this up in writing I went to apply for a Mortgage last year and was told by the broker to check my credit rating, I checked my credit rating and seen 3 years of defaults for Lowell. I called Lowell up last may and they told me this was a 3 networks debt, I explained my case and Lowell told me to pay the £25 and all would be ok, that this debt would be cleared from my credit rating, it would take up to 50 days. I called Experian to see why this was not cleared as a default on my account, they said I would have to talk to 3 Networks as the default came from them. I spoke with 3 Networks, they understood the issue and want a letter from Lowell to say the debt has been cleared and that there has been a miss understanding, Lowell said they dont do that, however a lovely lady in customer service said she would try her best to talk to 3 Networks. Both Parties just need contact but either one will contact each other, is there a way to make them speak to each other and clear my default which should not have been there? This is the only default on my credit profile, will this affect my credit rating going for a Mortgage? Thanks for any help on this

-

Hi.. Ive just received a court claim from Brian Carter / Lowell for a JD Williams debt.!! The problem is I thought this account was on hold due to my circumstances. In the beginning of this year the OH was diagnosed with cancer of the spine, I informed JD Williams of this and explained the situation, I was told not to worry I could come to an arrangement with them.. .the next thing is I started receiving letters from dca's one I cant remember then fredrickson then lowells. I ignored them all rightly or wrongly !! Now I have received a court claim from Brian Carter/Lowells. Where do I stand here as I have had NO correspondance from JD Williams regarding this.....

-

I have been following this forum for a while and sent the co-op a section 77-78 request for my credit agreement. This is what they have returned. Is this enforceable? If not, what should my reply be? Sorry, I thought that I could place an attachment but cannot. Does anyone know a site I can upload documents to for viewing?

-

Hiya Guys I have a case with Lowell for just under 16 grand. The details of which are as follows 1. They placed a default on my credit file for this and then I didn't hear from them for 4 years 2. They then started sending letters to my mums (I live in Switz) 3. I sent them a CCA request from my Swiss address. 4. They finally responded to that request after over 6 weeks saying that Barlcays cannot find the account in their archive and they are putting my account on hold. They sent the reply letter to my Swiss address so they have finally got hat through their heads that I dont live in the UK. So I take that to mean there is no paperwork then. Can I based on that get them to remove the default then? Will they ever find the paperwork or is it gone? Why would they buy debts without paperwork? Cheers

-

I have had a letter from Brian carter Solicitors saying that a ccj has been entered against me on the 17 December 2015. I did get the court papers but stupidly ignored them after reading different things on the internet about not admitting anything. The bill is for £501.64 and he is asking for £50 a month which I can't pay. The letter says they will consider further enforcement action if the payment is not made. I don't know what to do. I have also received another letter from Lowell which says pre legal assessment threatening another bill being sent to their solicitors (probably Brian carter again) . The bill is for £836.77 and the letter talks about ccjs and possible bailiffs. I have absolutely no idea where I stand as far as bailiffs are concerned. I don't own my home. Do I have to let them in? I've seen programmes on bailiffs and the thought terrifies me. I realise this is my own doing but trying to pay rent and council tax as well as feeding 2 kids has been my main priority. I had these debts as well as some others with stepchange but the payments got too much and I had to cancel the agreement. Stepchange said one of the options was bankruptcy but I panicked and just left things. But because they have been paid a little bit, this is surely classed as acknowledgement of the debt? Any advice would be greatly appreciated. I'm frightened of answering the front door. Thanks, Tracey

-

Hi All, I've had Lowell and Carter lodge a claim for £1,450 against me for an unpaid overdraft on behalf of Lloyds TSB in November. I acknowledged the claim online and later then submitted a defense to the tune of I do not recognise I owe this debt and that I am unable to defend myself unless proof of the debt is disclosed and that it is the claimants obligation to provided the defendant proof. The defense was accepted by the court and a DX was sent out to which I returned and opted yes to meditation and to allocate to my local county court. In the meantime I emailed Lowell and Carter about the fact they still have not provided any evidence that this debt even exists and that I am unwilling to enter any discussions or meditation until this is produced. A couple of days ago they e-mailed me back with this ------------------------------- Thank you for your email. We are seeking our client’s further instructions regarding your request for evidence however it is our understanding that it is the policy of the Original Creditor to provide its customers with agreements at the point of contract and statements throughout the duration of the account; consequently, you have previously been provided with validation of the debt and you are referred to your own records for the same. We trust this clarifies matters. Yours sincerely ------------------------------- This got my back up obviously as from my interpretation of this e-mail is it is up to me to seek this out myself so I e-mailed them back the below copying in the court e-mail with my claim number ------------------------------- Thank you for your response, I would like to remind you that it is not the original creditor trying to obtain a judgement against me through the small claims court. Are you telling me Is it your policy to take on instructions from your clients for commencement of legal proceedings without sight of any proof that the alleged debt is actually owed then? If I have been supplied with validation of the debt (To which I do not recall) Then I am sure that you will be able to speak to your client who sent this originally and reproduce this without a problem then proving to me and the court that this debt in fact exists as despite numerous requests I have yet to see it, and forgive me being the dubious person I am I fail to take your word for it that I have been 'provided with this before'. This is not the remit of either myself or the alleged original creditor (Lloyds) this is the responsibility of Lowell/Bryan Carter to prove beyond all doubt that this debt exists if you think I will be bullied into thinking any other way you are very mistaken. I await your response. I also trust this clarifies matters too. ------------------------------- I maybe should have been a bit more professional but they just seem to think it's okay to bully people into paying debts they potentially do not owe. Has anyone seen this before, do they have any proof on this debt? Surely they'd have this to hand if they did? Thanks!

- 11 replies

-

- carter

- lloyds bank

-

(and 2 more)

Tagged with:

-

Name of the Claimant ? Lowell portfolio I ltd Date of issue – 10 july 2015 What is the claim for – the reason they have issued the claim? 1.the claimants claim is for the sum of 724.73 being monies due from the defendant to the claimant under an agreement regulated by the consumer credit act 1974 between the defendant and vanquis under account reference xxxxxxx and assigned to the claimant on 23/02/2012, notice of which has been given to the defendant. 2.the defendant failed to maintain contractual repayment under the terms of the agreement and a default notice has been complied with. 3.and the claimant claims 724.73 the claimant also claims statutory interest pursuant to s.69 of the county act 1984 at a rate of 8% per annum from the date o assignment of the agreement to date but limited to a maximum of one year and a maximum of 1000 amounting to 57.96 What is the value of the claim? 782.69 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? credit card When did you enter into the original agreement before or after 2007? after Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? not sure but probably Did you receive a Default Notice from the original creditor? again not sure but probably Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? not sure Why did you cease payments? was self employed at the time and was going out of business What was the date of your last payment? don't know, not recent Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.