Showing results for tags 'solicitors'.

-

Hi. Hope to make this post as succinct as possible. Thank you for reading and helping. 1.My Union's solicitors wrote to me saying they were taking my case (RSI back-strain from work), but according to the same letter, I am outside the statute for an action as I (not my GP) realised my pain was work-related in 2006 and they say it has to fall within 3 years. Solicitors knew this was the situation - they have my letter of grievance to my HR from 2007, so I don't know why they bothered to say they'd take on the case. 2. My workplace HR did make some noises about making an 'amicable parting of the ways' if first my GP report then their Occupational Health report, concluded it wasn't likely I'd be able to return to work soon enough (been off since Feb). I sent them my GP report last week and I have left numerous emails and phone messages to the HR person but got not a word in reply. She has never done this before. Whassup, d'you think? 3. If I'm too late for legal recourse, could I/my Union negotiate a leaving package anyway, d'you think? Or will they smell that I'm screwed legally if I try? I have just done the ATOS medical and am so screwed as regards employment and money. I do not want to live on benefits so: 4. I was even thinking of just doing Saturday nights at work; I'd get HB and Council T bens and maybe medicine help, but wouldn't have to deal with other benefit groups. That would be my last resort, because I'm terrified my back will get worse. I'd be able to rest up a lot afterwards, though. Sat night is the unpopular shift, of course, so my workmates would fall on me with a glad cry, but not sure employers would wear it. Thing is, I don't want to go through all the other negotiations, lose, and then rely on them being accommodating enough to agree to my last resort. Left a message with the solicitors and my union but neither has got back to me, so I'm appealing for any wisdom from you guys!

- 4 replies

-

- case

- solicitors

-

(and 1 more)

Tagged with:

-

Any advice Please..... In 2008 I was struggling to meet my repayments on various credit arrangements, I went in to the branch on several occasions to discuss the matter of which HSBC refused and on the last occasion told me that it was not their problem. The CAB advised that I stop paying them and negotiate when they contact me. So I stopped paying them and sure enough they contacted me, I spoke to their collections department and arranged a repayment plan, 20 minutes after I ended the call the same department called again and said there was no such plan and I had to repeat the process, this happened repeatedly throughout the day, In the end I stopped taking the calls, things got so bad that I left the phone turned off. On one such call I had asked about getting access to the original documents as I believed that PPI had been applied to the account, I was told that I couldn't have them as the account was frozen; I now know that this isn't true. Shortly afterwards DG solicitors contacted me and I explained everything that had happened to me and they set up a repayment plan. I only had a telephone number and also believed they were DC solicitors. The amount was then £11329.37 and I had arranged to pay £150 per month which went well until June this year when I had to changed my bank, I tried to call the number I had previously used and it would not accept incoming calls, I didn't have an account number to set up a new standing order and a google search for DC solicitor was for obvisous reasons unhelpful. I have now received a countycourt claim form for the sum of £5879.37 which they had sent out to the wrong address and as so taken an age to get to me; I now have till Wednesday to act. It seems to be the usual that other users on here have mentioned claiming that I have failed to pay arrears and wanting to add interest on top at 8%. I'm really surprised it seems unreasonably to apply to the courts without contacting me; I made several efforts to get in contact withthem to no avail. What are my options, looking back over the case could it be argued that I was treated unfairly at the outset using breach of statutory duty under COBS or BCOBS, and argue the same with regard to going straight to county court rather than contacting me in the first instance. Is it worth send the acknowledgement and requesting extra time to fight part of it, or should I contact DG solicitors

-

hi all, ive read alot of bad things about carpenters solicitors being involved in insurance claims or not really getting involved, we have just had a rear end smash and the 3rd party has already admitted liabillity, carpenters called and sound very nice and said they are sending forms out for us to sign, before we do can we go through our own family solicitors......please help

-

Hi, I will try and cut a long story short!! I stopped making full payment on my Isme and Littlewoods account over a year agodue to the loss of my job, I have since had a baby who is now 6 months old and not working although my husband is. I contacted both catalogue companies advising of my situation and they couldn't come to an acceptable arrangement as we literally had no spare money so was offering £5 p/m on each account. At the time the balance on the Isme account was approx £2,000 and the Littlewoods one was £400. Both accounts went over to NDR which is understand is part of the company and again they could/would not agree to my offer - I still made a few payments of that amount anyway to show willing. Since then charges have been added to both accounts, the Littlewoods balance is now approx £700 and the Isme one is a whopping £3,800 due to interest and charges. Isme have now sold on the account to Capquest. I have had the initial letter from Capquest requesting full payment which I know is pretty standard. I'm not sure who will be taking the Littlewoods account yet but NDR managed to get a further sneaky charge on both account before selling them on. I was going to write to Capquest and advise of my financial situation and offer the £5 per month I have been trying to pay over the last year or so, I am guessing they will not accept this due to the balance. Can anyone advise if they may accept or if they will request a higher amount, also am worried about going to court etc. Can they add even more charges? I am so worried about everything and also about harrassment from them as have read a few things about Capquest - none of them at all nice. Lastly, a family member may be able to help me out a bit but couldn't afford by any means the full balance they say is owing, does anyone have an idea if Capquest may accept a settlement figure and if so roughly how much I would need to offer, do I need to pay low payment first before offering anything? Thanks so much and sorry for the long post - this is my first one so am not familiar with abbreviations.

- 175 replies

-

Hi, haven't been here in a while but wondered if someone could help me please. Credit Card pre 2006, arranged a pro rota agreement in 2006, and paid minimum amount, went to a debt collector, and arranged 20.00 per month. Last payment made was in 2011, and decided to request CCA with the DCA at the time. I rec'd a letter stating that payments had been made towards the debt however Lloyds have advised that they cannot provide a CCA as the debt is too old, and although unenforceable it is still owing. They went on to say that Lloyds have offered a settlement figure previously for half of the original debt, and this still stands. I took that as Lloyds did not fulfill there obligations under the CCA act and thought to thyself that if they were to take me to court then they'd be stupid just because of the admission. Have had a few DCA letters still attempting to chase the debt but I know of them so have ignored. However, Rec'd letter from iQor, .. . I ignored... but have now had letter from gpb working on behalf of iQor stating that they want payment within 10 days otherwise a county court claim may be issued without further warning. Now normally I'd egnore it, but I just needed someone advice as to wether the letter I had from the original DCA would be a defence in court if it did indeed go that far? Should I send a whole new CCA request? Or should I send a letter, including a copy of the letter from the original DCA I just don't want to shoot myself in the foot by assuming, so any advice would be much appreciated as they are demanding payment within ten days and gpb seem to be a legit solicitors. Thanks so much to anyone that can help. Red

- 11 replies

-

My husband owed a firm of solicitors £12k in fees from when his former business partner did a runner and left us with all the debt We have no means to pay this money so solicitors took hubby to court. We defended as they had messed up big time but then agreed to accept the amount they claimed as they were getting a barrister and we could not afford more fees added on. We offered them a sum of money we could just about afford and they have turned it down. They are now threatening to place a charge on our home with a forced sale. They do not have a ccj at present as we agreed (both parties) to try and negotiate a settlement. They have refused all offers as too low. My question is what will happen now? I assume they will go to court and get the ccj against my husband and then try to get a charge on our property. I understand they will only be able to get a restriction as I own half the property and the debt is not mine. Can my husband now write to the courts and ask them to work out what we can afford to pay as the solicitors just seem hell bent on getting a charge and making us sell the house. I think they would find it difficult to get a judge to agree to a forced sale. My husband is disabled and I run my business from the garage (dog groomer) and both our adult children live here along with my son's pregnant girlfriend. There is also not a lot of equity in the property. We really cant offer more than we already have and I am now at a loss as to which way to move forward. Any help would be much appreciated from anyone. Thanks

-

Morning All. A bit of a strange one this and I can not find any direction so turned to you for help. Due to my work in 2009 I took out additional Life Insurance FP Level Life. However, in November 2011, as my job role changed it was no longer required and as my wife was made redundant, the money would be best utilised in the family pot. As time marched on I thought no more, foolish. I have recently been contacted by a firm of solicitors acting for the company I had the agreement with claiming their 'Commission Clawback' I wrote back asking for some additional information to save money e.g whether there was a fee agreement, as one is not mentioned in any paperwork I have, because I have read commission is sometimes offset against this and only the commission to the value of this fee may be requested therefore maybe only liable for the difference. I also believe on reading the FSA Website on Unfair Terms in Consumer Contracts the Terms of Business (TOB) agreement I signed may be unfair and in particular reasons for believing this when you use an IFA you should have a choice how you want to pay for the services - I was not given this, and the terms do not state clearly when and how much me, the customer has to pay the IFA so therefore not aware of the full cost of the financial advice. In addition I believe that my TOB agreement allowed the firm to reclaim an amount from me, the customer, if I stopped paying premiums and the IFA had to refund commission to the product provider as appears in this case. my interpretation of the FSA guidelines also leads my to think that this charge is a disproportionately large sum as I have not fulfilled part of my obligations under the contract. Surely a court would not enforce this over and above my rights to cancel this policy. I have also asked these Sols for my cancellation rights to which after a period of 1 month got nothing except a MCOL from Northampton. I also sent them a S10 DPA request as other members from the IFA had tried to contact me via text and email touting for business. In total the sum claimed is £1261 + Court fee made up of original debt £997.31 plus interest, a tracing agents fee because I moved and not told them £42 plus Sol fees £210 plus future interest. So, apart from acknowledging service can I assume this falls under CCA rules or send a CPR 31.14 request. Any help greatly appreciated.

- 164 replies

-

- cancelling

- consumer

-

(and 7 more)

Tagged with:

-

I have received a letter from Bryan Carter Solicitors stating that i must pay an outstanding balance of £99.22 to TMobile and that this "must be paid within the next 14 days or else further costs will be added to my debt if it is necessary to go to court and therefore the outstanding debt will increase." That if I fail to act and they obtain judgment it may prevent me from gaining credit in the future and will remain on the Register of Judgment Debts for a period of 6 years (which I am assuming is like a CCJ). My issue is that I do not owe TMobile £99.22 but in fact £44.40 which I have already spoken to them about and have agreed to clear this as the account was closed and that balance was for the last bill for November 2011. What do I do? I have not contacted Bryan Carter via phone or in writing?

-

have an ongoing battle with lloyds tsb via robinson way , lloyds have admitted that there is no cca for the credit card account but today robinson way letter arives saying our client has advised us due to the terms and conditions that you agreed to when you opened this account you remain fully liable for the amount outstanding , we now require your proposal for repayments . any help here please

- 93 replies

-

- conditions

- gpb

-

(and 5 more)

Tagged with:

-

Hi I have received a Claim Form from Northampton county court regarding an overdraft of less than £3000, the account HSBC have closed. I have sent a letter to DG solicitors asking for CPR request last friday 20/7/2012 aslo I acknowledged AOS on time I phoned the court and they have received. But I could not postpone defence. The court says when I acknowledged I postponed to 30/7/2012. I do not think I will get reply from DG solicitors on time for court so I think I should better put in defence which would be for the enormous amount of charges put on the account in the last 10 to 15 years for which I am pretty sure are unlowful. I don't know how to write defence or what should I do.

- 32 replies

-

- county court

- hsbc

-

(and 2 more)

Tagged with:

-

Hello, My partner has recently recieved a factually inept and incorrect letter from her ex husbands solicitor. In the letter it is addressed to her former married name and not her now maiden name. The divorce was signed and sealed in Feb 12. Does this make the letter invalid? I wondered what people would suggest to do with it? Thanks in advance for any help

-

Hi I am currently in the middle of trying to claim some sentimental items from my late fathers estate via a local solicitor. When we started the process i asked about her fees...after picking myself up from the floor, she suggested i could pay a block amount for services ( I think, this was in April) and then produced a bill which i duly paid up front the bill details read as below..... 'professional charges in connection with advising you in regard to your fathers estate; to include discussing probate in general; to advising you on action you can take; to contacting Mrs ****; to include all attendances upon you including in person, by telephone and email; to include all care and conduct throughout.' Now the solicitor is asking for more money...was the bill i paid in April not a complete sum for the job....I refer to the... to include all.... wording doesn't that mean the whole job or am I sorely wrong. I have no problem with the work the solicitor has done and we are now close to receiving the items i asked for...they want to wait 6 months after probate before they hand anything over (why???) but as a part time worker who rakes in a cool £500 a month, only, I find the extra cost a bit steep...she may have forgotten about the block payment and I don't want to pay twice as it were...or I could just be living in cloud cuckoo land regards costs of things as my husband says (he earns a lot more than me!) anyhow I would really appreciate if a lawyer/solicitor could analyse the solicitorese and clarify this for me....

-

Hi. I phoned Morgans today as I sent them a cheque to clear my balance - but have received no paperwork. The woman who answered the phone was very shifty - and said that Morgans had been taken over. I'm worried my balance hasnt been cleared... even though they have had the money... Anybody know anything?

-

Afternoon people, I have just received a nice telephone call from restons solicitors. They would not tell me what the call is regarding as i am not the account holder. OK Im reluctant to call them and just wait for some correspondence via the royal mail. I have my suspiscions that it is for a Littlewoods debt going back quite some time. But unsure how long and i dont want to call them to find out tbh id rather wait for some sort of letter. Initially the debt was accrued through a catalogue agent...It wasnt possible to pay the catalogue agent the monthly payment so the debt was transferred to ourselves to try to arrange a manageble monthly payment. For some reason this was never done and now we are receiving calls from restons. I may be wrong and it may be for some other strange obscure debt but im guessing its them as i beleive HFC bank and littlewoods were the same. Any advice would be much appreciated guys and if any further infor is required just shout. Thanks

-

I got a letter from CapQuest last week stating I owed Barclaycard £450 odd. I thought I had paid the card off and closed my account so checked my credit report and its showing as me being in debt. To cut a long story short I paid off the balance and asked Barclaycard to close my account. I didn't put the request in writing (first mistake I know), I asked them to close the account over the phone. I then moved house and didn't hear anything else from them, not even through the mail redirect I had in place for three months. My card was due for renewal in December 2010 but by then I had a toddler and a young baby to look after and my marriage had fallen apart so kinda had other things on my mind then my Barclaycard. I assume the new card was sent to my old address and the new tennant there has had a shopping spree at my expense. First I hear of the debt is when CapQuest contacted me so I sent them a letter asking them to prove I owe Barclaycard the money. If its an oversight on my part then I will pay but I'm not going to enter a debt repayment plan if I don't owe the money in the first place. (Didn't tell them that, just sent a letter template I got off the National Debt Helpline's website) I got a letter from them today which looks like a pretty standard response telling me to request statements from Barclaycard at a cost of £10 So what so I do now? Presume I contact Barclaycard and pay for the statements firstly as that will show when I paid the balance off and how this debt has racked up. But if it is the new tennant having a shopping spree how do I prove it? I could contact my old Landlord and ask for them to confirm the tennancy dates but would that be enough? Any help would be much appreciated

-

Hi I have posted this elsewhere but then came across this section and I think my problem is linked as the warrant had the claimant name arrow global and is related to a 2nd CCJ so the debt has been split. any help appreciated. i cannot post the link to my original thread properly so hope if you remove the spaces and change DOTS to dot link will work www dot consumeractiongroup dot co dot uk /forum/ showthread.php?346768-CCJ-and-Split-Debt&p=3801279#post3801279

-

- arrow global

- ccj

-

(and 2 more)

Tagged with:

-

I have recently had a judgement against me, which was rushed through without giving me a proper opportunity to defend the matter [another story], but i managed to source funds to repay the debt in full. Whilst the funds were being sourced, i continued contact with the solicitors updating them as to what i was doing. This was done over a 2 week period since the judgement was issued. The final judgement included costs and interest. The solicitors have now written to me and added another few hundred pounds in costs! Can they do this? If so, can they enforce it? If not, have I any recourse of action? Any assistance would be gratefully appreciated. Thank you.

-

I have a creditor making a claim against me using a firm of solicitors who appear to be behaving incorrectly. The claim has been made and a defence will be filed. However the solicitors have proceeeded to send me two e.mails with PDF versions of the claim complete with responce pack, then amazingly the details of claim appeared at my workplace in an open envelope with no address or covering letter. God knows how many people have had access to this info. This must be unethical, and possibly illegal. It appears just to have been done maliciously in order to bring pressure to bear. Could you give me some advice how to proceed against the solicitors please.

- 54 replies

-

- ccj

- harassment

-

(and 3 more)

Tagged with:

-

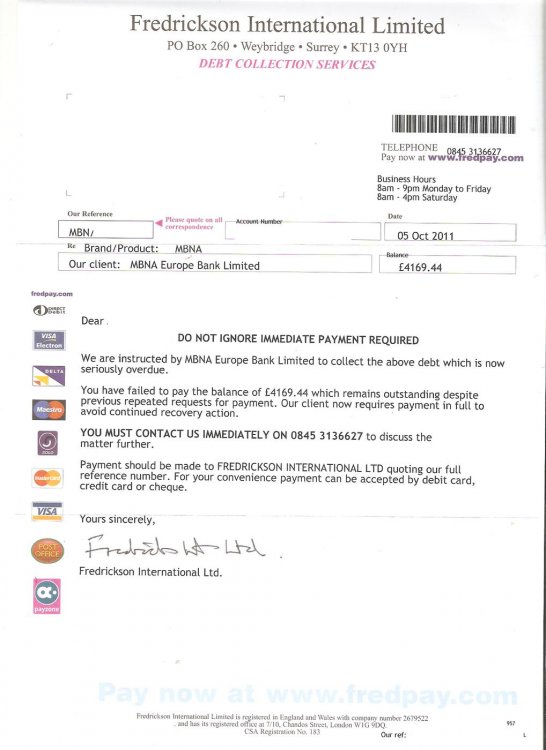

I have a debt with MBNA for £3000+ I was paying £65 per month and had got it down from about £8k over the years. The people who regularly pester me decided £65 was suddenly not enough when it actual fact it had become too much. So I sent them a CCA request and they sent back a copy of my initial application form. Same with Barclays, only Barclays just sent a piece of paper with my old address on from 12 years ago and a big wadge of terms and conditions. No signatures or anything really. I know things have changed since the Taylor case, but still, it didn't seem like enough, so I sent them both letters (from templates on here) saying it was inadequate and that the accounts were in dispute. that's when both of them sent letters - MBNA's was from Fredrickson and Barclays was from Mercers. Can someone enlighten me as to what to do next? I feel a bit stuck. Barclays, throughout all of this, call me between five and ten times a day, in spite of me asking them to just write. Thanks in advance

-

Hi, apologies if this has been asked before. I have a debt with jd williams, i am not disputing the debt and am wanting to make arrangements to pay it off, problem is, for some reason they have 3 separate accounts for me ( i dont know why) and they have been sent to debt collectors. The debt was from 2009 so i understand it being sent to debt collectors, a guy from moorcroft has been to my home, hes really not pleasant and i refused to talk to him, i wrote to moorcroft and complained and asked for any further contact to be by letter, heard no more, now provident have written, offering a discount, i was confused by it so have emailed jd williams directly, and they are getting me details of the 3 accounts and i have made it clear i intend to pay and have explained how i ended up in this mess and they are being amicable, they have advised me that moorcroft is the agency they use and have nothing to do with provident, and to ask provident for further details?... am puzzled now?.... can i not just pay direct to jd williams or will this be refused? i dont like moorcroft and they are clearly ignoring me now, since my complaint... i really want to pay off my debt.

-

HSBC/DG CCJ/CO - old OD - cleared, now what?

DesperateSusan posted a topic in Financial Legal Issues

Hello, firstly, I've messed up big time, though circumstances and ilness I'm in a predicament. I had some bank charges from HSBC. About £2000. I didn't deal with it and it went to court and they got judement against me. They then put a charge against my house and now I have had a letter from the court saying that unless I pay the now £3250 they will send the bailiffs. Which will add more to the debt. I'm not in a position to pay the whole lot, but I can pay a few hundred, maybe more. Please can someone suggest the route to take and help me write letters. Thank you, Desperate Sue -

Hi All, This is a long story so I firstly apologise for this but any help would be much appreciated. It begins with a domestic dispute between myself and my now husband. I got him arrested for pushing me during an argument and the police put an order stopping him from living or communicating with me until the court hearing. It was a scary time for me as although I still stand by my decision the police were very bad in dealing with this and told me that he could go to prison. I decided that I require legal help and on the advice of a friend contacted a solicitor in Watford. I called and after explaining my situation had an appointment. I had an hour of the solicitors time (please note that I signed nothing and did not pay a retainer, his costs and fees were never explained to me) and he advised me that he would contact my husband's solicitor. I was confused as this would be a break of the condition of bail which could send him immediately to prison and pulled the solicitor up on this:mad2:. He had already sent this e-mail and helped me with a letter to send to the police to ask them to drop the case. Soon after this the case was dropped due to lack of evidence and I received an invoice from the solicitor informing me that his fees were £350 but call it £300. I was shocked as I had an hour of time, an e-mail which he never should have written and a letter to police written by him. I asked for the breakdown of fees in a letter and did not hear a reply. I received the same invoice along with notice that if I did not pay within 28 days he would go down legal routes. Again, I sent the same letter asking for the breakdown of costs. Three weeks ago I had a very heavy knock at the door from a bailiff Marstons. I did not get to the door in time and a letter was shoved underneath. It was for a bill of £550 and for the removal of my goods. I immediately did a credit search on myself and saw that I had one CCJ from Watford County Court for the money owed to this solicitors in January of 2011 for £350. After doing more research I find that I have a case for the CCJ to be set aside. I am not entirely sure how to go about this all. I do not want to have another court date to deal with after everything I sent through last year and am now wishing that I just paid the amount even though I disagreed with it. Does anyone have any advice on this, the fact I signed nothing and the fact that I have not seen any information from the courts? At present I am so worried about having the CCJ on my record I would pay the amount if I could get it removed and this would go away. Is this possible?

- 13 replies

-

My mother died last November. In her will she appointed two Executors - my brother and a friend of her's who is a retired solicitor. The latter insisted we instructed solicitors, but the costs are spiralling out of control. The Executors are due to sign the oath of Probate next Monday 14th March. Can we (or technically my brother) dispense with the services of a solicitor? The other Executor (who is actually doing nothing) won't want him to but we're finding it too expensive and also we feel a bit out of control.

- 6 replies

-

- legal advice

- probate

-

(and 1 more)

Tagged with:

-

Hi All My circs have recently changed (separation, loss of job, with dependants) And after one thing and another amd in a mess debt wise, Am n the process of sorting it, have agreed very reduced token payments with a couple of debtors. However, one of them (Next Directory), has now instructed Solicitors, and I have CCJ papers. My query is, I remember ages ago, sending them a letter (as advised by CCCS) requesting copy of signed agreement. They never sent me one, just some letter about how I am still legally obliged to pay. Looking on this site today (which is FANTASTIC by the way), it appears that I could have refused to pay/agreed to pay less????? I need to send these letters back today/tomorrow as due by 24th So any advice would be gratefully received Thanks

-

Hi, I have tried to DSAR a firm of solicitors icw with a mortgaged property repossession, as I am trying to get hold of court papers from 1999 - I've been direct to the court, but they told me that they do not hold the paperwork for more than 5 years. I have written to the solicitors and sent them the cheque etc., but they have replied as follows: The request you have made to access any personal date that we may hold on you refers to personal data that we hold on behalf of our client ***. Therefore your request for a copy of the data should be addressed direct to *** as data controllers. Is this correct? When I DSARd the band direct a couple of years ago they did not provide any information from the solicitors, despite my asking them. If I can DSAR them direct - what arguement do I go back with? Jody

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.