Showing results for tags 'hsbc'.

-

Good afternoon I have today received a response from IDEM after sending them a CCA letter regarding a HSBC credit card They have sent me a reconstituted copy and statement and their letter says that this is all they need to provide and that the debt once again becomes enforceable. There is nothing enclosed that shows my signature. is this now enforceable without the signature and if not what should my next move be Many thanks

-

Hello, Not surprised (yet rather ashamed) to have received another claim form for my husband's old business debts. Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – 14 Oct 2016 1st Nov 2016 to submit acknowledgement defence by 4pm 15th nov What is the claim for – 1.This claim is for the sum of £8687.88 in respect of monies owing pursuant to an overdraft facility under bank account no. XXXX The debt was legally assigned by MKDP LLP (Ex HSBC) to the Claimant and notice has been served. 2.The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. 3.The Claimant claims 1. The sum of £8687.88 2. Interest pursuant to s69 of the county court Act 1984 at a rate of 8.00 percent from the 23/11/11 to the date hereof 1783 days is the sum of £3395.19 3. Future interest accruing at the daily rate of £1.90 4. Costs What is the value of the claim? . Total £12726.81 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Current account When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? We would have but can't guarantee we have kept it. Did you receive a Default Notice from the original creditor? As above, we would have. Kept some of the early letters. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Probably, no reason to doubt we haven't. Ashamed to say we haven't actually been reading them but am sure we would have. Why did you cease payments? Business failed very suddenly due to recession, stopped payments to all creditors as my husband couldn't manage the debt. My husband intended at that point to go bankrupt but as moved into low paid employment, he needed to save bankruptcy fee. We then had to prioritise moving house due to being harassed by a neighbour and then always something else came along that needed money. Classic burying heads in the sand then followed as we seemed to be getting life back together. What was the date of your last payment? He last paid around April 2011 but Noddle says defaulted in Sept 2011. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I have been through this twice before, once with Hoist and Lowell (both were not pursued once we filed our defence), but notably these were both credit accounts. I clearly have some reading to do to determine in what way an overdraft agreement (and any relevant defence) may be different, but my initial understanding is that I need, in the first instance, to be sending off a CPR31.14 (current account version) and that a CAA request is not appropriate. I will send off the CPR31.14 request tomorrow via recorded delivery. I intend to also acknowledge the claim asap (by 1st Nov) and tick our intention to defend all. I assume that it remains that the onus is on Hoist to show they have the relevant paperwork to prove the debt? I would be very grateful if, in due course, someone would look over our defence. Thank you, r710

-

Good afternoon I have received the attached response following a CCA letter. Is this contact or not as they are now saying the debt has become enforceable. If not correct what do I need to do now. Below is my original post re this Many thanks http://www.consumeractiongroup.co.uk/forum/showthread.php?467679-Unable-to-pay-DMP-as-now-unemployed CCA return.pdf

-

Hello, I'm hoping someone can advise me if what to do. I have received a claim form from Northampton County Business Centre, claimant - Hoist, address for docs - Cohen solicitors, issue date - 7 oct, amount - £10k ex hsbc I think this debt should be statute barred, how can I find out if it is, what should I do next? this is the only contact I've received, in fact the claim form was sent to an old address. Should I ask Hoist to prove the debt is actually owed since I have never spoken with or heard from anyone connected with their company before? Should I ask HSBC for old statements to find out exactly when a last payment or contact was made? All help would be greatly appreciated, I am obviously extremely troubled by this turn of events and having no clue what to do a friend advised me to turn to this website.

-

Background - about 4 years ago we wrote a cheque but there were insufficient funds in our account. Rather than bouncing it, HSBC paid it and this put us into overdraft for £350. Long story short, they have been chasing this through various debt collectors and the debt was sold to Hoist, who have issued a claim against us. We filed a defence, which was that we don't have enough info to confirm or deny the debt and that we had sent a Subject Access Request to the creditor. They responded with a notice of assignment and copy of the terms and conditions. We decided against mediation so the matter got allocated to a small claims court. We then received a CJR065C from the court saying: "Unless the Defendant files and serves a detailed defence complying with CPR 16.5 by 28/09/16 the Defence shall stand struck out without further order and the Claimant be entitled to enter judgement forthwith". we are trying to put together a defence and also see if we can negotiate with the claimant at this late stage. The terms and conditions we were sent state, under the heading When payments will and will not be made by us that payments will be made if there are funds in the account or if an overdraft is in place (there was no overdraft agreed at the time). It doesn't say anything about making payments when there are insufficient funds or no overdraft in place! We also haven't received an overdraft termination notice because no overdraft existed (until HSBC created one to make this payment). Something doesn't seem right here - any advice appreciated!

-

HSBC have sent me a claim form. I owe £13,500 from a loan taken out several years ago. I intend to respond using the "disagree with the claim" option as I believe I may have been mis sold PPI on the claim. In the event that the judge upholds the claim, how does the process work RE making repayments. Once the judgement has been made, do we have to go back to court another day to agree a repayment schedule. Will HSBC be obliged to offer a repayment schedule or could they start bankruptcy proceedings if I don't make payment in full after the CCJ?

-

which credit agency does hsbc use? (remortgage)

wiosna30 posted a topic in Credit Reference Agencies

Can someone help me with my question? I need remortgage and on experian I have almost excellent scoring and HSBC has the best deal for us, so i need to know which credit agency they using. Thank you -

Hello My ex wife has received a County Court Claim from Arrow Global. They seek over £14,000 for an HSBC Credit Card Debt that was defaulted in 2012 and purchased by Arrow Global in 2014. The pack has no supporting documents such as a copy of the original contract, statements etc. Their Stated Particulars of Claim (suitably Redacted) are as follows: The Claimant claims payment of the overdue balance due from the Defendant(s) under a contract between the Defendant(s) and HSBC dated on or about DATE IN THE NINETIES and assigned to the claimant on DATE IN 2014 The account was defaulted in 2012 and is not Statutory barred and was last acknowledged in 2012 so the stat bar does not come into effect until 2018. The account was opened in the mid nineties so I think I am correct to say it comes under the older Consumer Credit Act so would expect a part of the defence to be that they must produce a copy of the contract and we can examine to see if it is valid. I am about to acknowledge service and get the additional 14 days so I will need to put a defence in on or around 4th September. I would be most grateful for any advice as to how to proceed with this defence. I imagine we are at the first instance looking for production of documents and supporting evidence. How do I ask or that as part of the defence. Many thanks.

-

Hello all, We have submitted a defence and then received the DQ. This was returned to us as invalid due to my partner filling it in and asking me to deal with it on her behalf. We have resubmitted another one and they have rejected this as the surname is different to the claimant. We are married now so my wife is using her current name, they wont accept it as the claim in in her maiden name. Can they do this? I feel like they are doing it on purpose because now we are over the 14 day limit to have the DQ filed.

-

Hi Andyorch, I've got my only other creditor willing to accept a settlement however they're saying it would be marked as partial but that they nor no other third party will pursue me. If there's a way to get them to mark it as fully settled that would be great.? If it's best for me to start another thread guys, please let me know?

-

Hi CAG Back in 2007 I had an HSBC Premier account. I also had an HSBC Mastercard For each, i paid a monthly fee. As I had a premier account, I was entitled to a loan from HSBC. I took out this loan to which i just made repayments. I cannot remember about any PPI applied to this loan. How do I find out if I have PPI on my Mastercard and loan? How can I find out if I am entitled to refund of HSBC Bank Charges ? Please help. Thank you BurmaFriday

-

Hi all. Is there a time limit on attempting to reclaim packaged account fees? I was charged for a packaged account with HSBC between November 2008 and December 2010. They continued to charge the fee even when the account went into an unauthorised overdraft and closed due to default in December 2010. I believe I took the account having been told it would mean I could have an overdraft - which I never actually got. It also provided breakdown cover but I do not drive. I do not know what the other benefits were - I was suffering from mental illness at the time. The delay on me looking into this is due to my illness - I only obtained statements at the end of April this year. Over £350 of packaged fees, but most of them are over 6 years old. Does a time bar apply?

-

Arrows Chasing HSBC current account claim form

ConsumerMark posted a topic in Financial Legal Issues

I am in the process of getting all my ducks in order. I have an old hsbc current account opened in 2001. I had an agreed overdraft of £1250. In June 2010 I stopped earning and no money has gone into the account for 6 years. I cancelled all debits, but charges meant that I owe crica £1500. There is a default dated August 2011 and has now been sold on. I am confused about overdrafts as I have read a lot of conflicting data. Is is statute barred now or will I have to wait until next August? I am sure that there are a lot of fees and charges on the account, I have also been told that I may be able to reclaim package account fees, this may be cicra £500. Would this be opening up a hornets nest? -

Hi I have claimed for mis-sold PPI on an old GM Card taken out January 1994. HSBC have upheld my complaint without admission of liability. I have statements dating back to 2000 First PPI payment on card was made in Jan 1994 HSBC have made an offer with figures as follows Total PPI premiums - £1487.58 Interest charged to card - £1507.99 All credit interest - £3417.66 Fee Refund - £60.00 Total - £6473.23 Offer to me after tax deduction = £5,789.70 Can anyone advise which calculator should be used to check the above figures are accurate/reasonable If any further info required please get back to me Thanks

- 10 replies

-

- check offer

- gm card

-

(and 1 more)

Tagged with:

-

I wonder if anyone can please help or advise about this situation. I have a home that I currently rent out and the mortgage is paid up to date etc. I had some financial difficulties when everything crashed in the late 2000's. I missed one or two mortgage payments due to being out of work a long time ago, probably 5-6 years. The arrears were paid up almost immediately and have been on time ever since. I have lived with my girlfriend for 4 yrs and have let the house for that period. Today I received a letter from HSBC for the full balance for the property, a FINAL DEMAND. I dont know why they would send such a letter as, like I said I am all up to date. I am wondering if because I should have let them know I was letting the house I am now in default, and should have been converted to a buy to let mortgage. If anyone could shed any light on this I would appreciate it. Thanks

-

I opened a current account with HSBC in December 2007. With various problems I had with PDL's clearing out my bank account, I became overdrawn and I changed banks to avoid them having access to my money. My salary went into my new bank account. With some transactions going through, it went into overdraft and then exceeded my overdraft as well. I argued with HSBC that I had requested these PDL's not to access my account, but I was given the old "You gave them your card details and you owe them money". The amount racked up purely with bank charges. According to my credit report, HSBC closed my bank account in May 2010. In exactly 43 days it will be 6 years since they closed the account. It was apparently sold on to Arrow Global in September 2014. Last week I received a phishing letter from Shoosmiths asking me if I was me living at my address. Ignored the letter. Yesterday received letter from Arrow Global saying the management of my account had been assigned to Shoosmiths and I should direct all correspondance to them. Ignoring that as well. Now my thoughts are this is already statute barred, as it would have been a few months between my last transaction/payment into the bank account and when they closed the account. Does anyone have an idea how quickly Shoosmiths ramp up their harrassment from when they send the first phishing letter to when they become more aggressive? I know that in 43 days it falls off my credit report.

- 14 replies

-

HSBC Warning To anyone thinking of opening a bank account with HSBC, I've just had a credit report from Experian I was shocked to see HSBC had never notified me in any way or form that they had black listed me back in October 2012, it relates to a direct debit of £50 being returned but paid in full four days later,through one single direct debit being paid four days late HSBC have totally ruined my business for a period of 6 years, as its now impossible to obtain any loans for my business, I have obviously raised a complaint with the financial ombudsman today being 15th March 2016 I spoke to a Representative from HSBC dealing with my complaint regarding me unable to obtain loans through HSBC blacklisting me, she could not care less it was a total waste of time, but I intend to post on you tube the letter that I received from her together with the bank statement showing the direct debit being paid in full only four days late, also the information that HSBC gave the credit agencies, which was worded non revolving credit. No one including the Financial ombudsman can believe how HSBC has black listed me without informing me in any form.so now I will be posting this on you tube warning people to be very careful before banking with HSBC obviously I will not be banking with them in the future, I believed HSBC were there to help self employed businesses not to ruin them like in this case,

-

Hi All, I have a HSBC finance credit card, I was hoping to take a loan out but i havent paid this credit card of £2800 since it was defaulted in Feb 2012. I am being rejected for any application but this is the only default on my account. I was wondering if I make an payment arrangement or settle the account will it make any difference in applying for a 25k loan which is very much needed at the moment? I understand a default is on your credit score for 6 years however, as I have not paid anything at all on this HSBC credit card since 2012 so if i start paying something or offer a full and final settlement will this help me now or will it make no difference whatsoever. is there anything I can do with this account to improve my chances of a loan or is it best not to chase them if they are not chasing me. As usual all your help and time is very much appreciated!

-

Hi Everyone, I had a HSBC bank account from the age of 9/10 when I reached 18 they offered me a credit card with nice credit limit of £2500, along with an overdraft of £1000, stupidly at a naive age of 18 I used both of them to their full advantage, making payments every month. Unfortunately a few years later I reached a financial hardship for my age, earning only a low wage and having split from a partner I was living with, I found myself in a house share paying most of my wages to live and eat, also (stupidly in hindsight) taking out Wonga loans to make ends meet, because HSBC were charging me bank charges on top of bank charges. I quickly spiralled into debt land with everything including both my HSBC Credit Card and bank account, luckily I had a second account with Halifax where I could have my wages paid into without it being eaten up with bank charges. My debt with HSBC was soon 'sold' onto their made up 'solicitors' - Restons, and also 'Metropolitan Collections' which I also believe is a subsidiary of HSBC. 6 months into this my mother offered me a place to stay, and I was far to embarrassed to tell her the extent of my debt at the time, 1 day the bailiffs came knocking on her door to advise that I had been ignoring HSBC and not made any payments. My mother and step father sat me down and I vowed to set up a payment plan to avoid this embarrassment for them again and I stuck to this for at least 18 months or so. I was lucky to meet my now fiancé who helped me out a great deal by paying off what I thought was the remaining debt with HSBC, and I found myself back on track. It wasn't until yesterday I came home to an ominous looking letter on my doorstep, advising me that 'Reston Solictors' have issued a Count Court Claim form for the unpaid account for my HSBC Credit Card, which I admit on my part was forgotten about as I thought I had paid them off and never thought to check. As I'm still only young (26) this is the first I've seen of one of these and it really left me shaken at the thought of having to go to court, I called CAB and they were helpful in advising my options with the form to which I made a decision that I want to get rid of it completely and called 'Restons Solicitors' today to settle the account with £772.00. In a matter of curiosity I opened an experian account this evening to check my credit score, I notice two defaults on my account, for both aforementioned HSBC accounts. This has really shaken me again as we're looking to take out a mortgage next year to buy our first marital home. My question to the knowledgeable people of this forum is, am I in any position to make a complaint to HSBC that I don't agree with these defaults as the root cause of the debt initially was due to bank charges which I couldn't pay, it states they were issued in 2011 and I have no recollection of these (does anyone else remember any post they received 5 years ago?!) or - are they quite right to do this to me, for my own stupidity? Thank you very much in advance and thank you for reading my rather lengthy life story post! Also to ask if anyone knows - If both my fiancé and I apply for a mortgage once we're married next year, and he has an impeccable credit score, would the defaults on my account still affect any applications?

-

Intrusive Questions by HSBC Bank I am not happy to answer I have been a customer for several years and not much deposited or withdrawn in the last few years. They now ask the source of my money? If I have other bank accounts here or overseas and details? where do I work now and my employers details, how much I earn and spend? Have I got any property on my name? How much it is worth it? Do I have any other investments and their details? Do I have to answer all those? What protection I have? Do any other banks ask such nuisance questions? Any other banks do not ask such questions? Thank you in advance

-

Hi I've scoured through the previous posts to see if anyone has the same issue as me but didn't find anything thats close to my issue. I'm about to sell my house and have obtained my Title Deeds which have two interim charging orders, one for HSBC (in 2007) which I am aware of the amount and one for HFC (2008) which I have no clue who they are or what the original debt was for. I was made bankrupt in 2010 and added all of my debts to the bankruptcy papers, I believed that this included HSBC and HFC (whoever they were at the time). I have no paper work for either of them or details on my credit history. I was able to get some info about the HSBC one today. I have a letter from the Insolvency Services which states that states "Notice to Bankrupt of Intention to re-vest your Interest in Property I am writing to give you notice that I consider that the continued vesting of the property in your bankruptcy estate to be of no benefit to creditors. One month from the date of this notice, your interest in the property will cease to be a part of the bankruptcy estate and will automatically re-vest in you. I will apply to the Land Registry to have my interests in the property removed from the register" I understood this to mean that my property was not considered part of the bankruptcy. Can anyone advise me on what to do next. Thanks in advanced

-

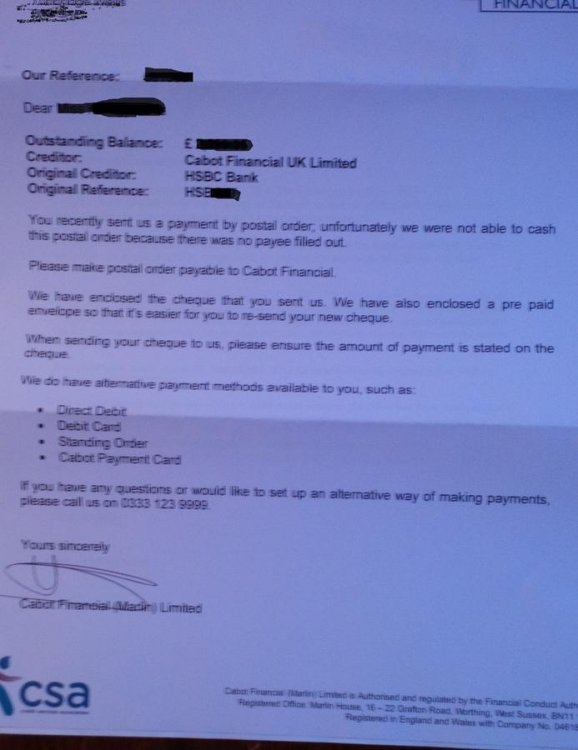

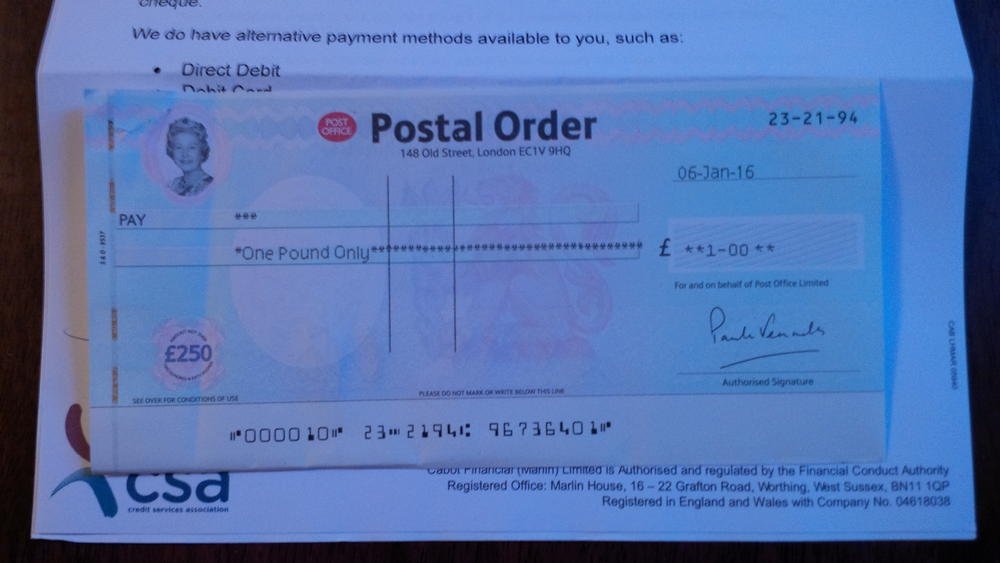

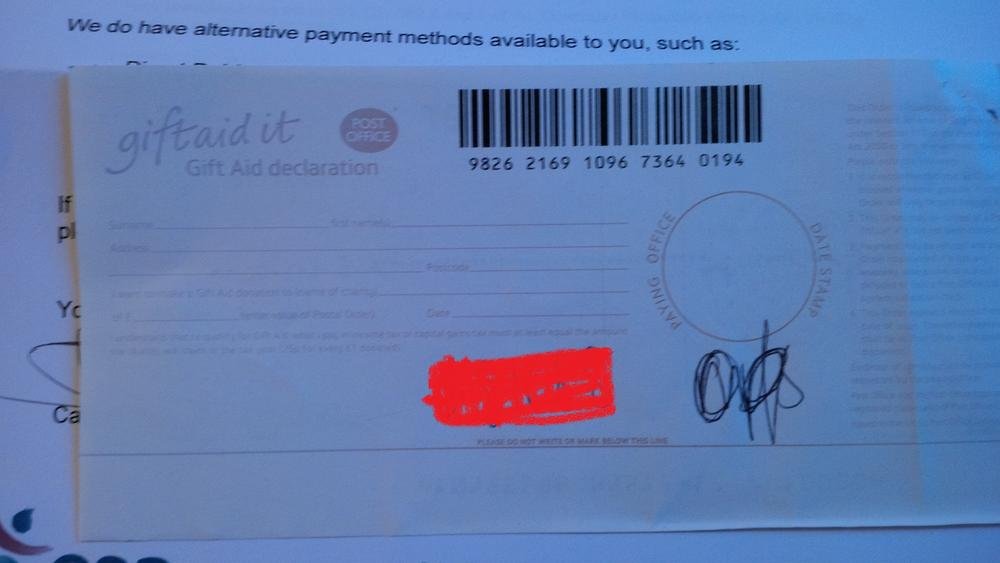

Hello everyone, Credit Card-HSBC Bank, currently with Cabot/ Marlin Account Start Date: 01/2007 Opening balance:£2700 Default balance: £2700 Date of default: 06/2010 I think this probably was an online application.. After defaulted in 2010 Metropolitan Collection Service Limited contacted me and demanded high monthly payments while I was in the hospital- everyday calls etc. .. In the end reduced payments were agreed. I was paying them reduced payments (£10 or £20 I don’t remember exactly) on monthly basis until 2013. They agreed in writing in 2013 a monthly £1 payment : Commencing Date 29/06/13 Finishing date 28/08/2096! A few months after the agreement I was contacted by Marlin (Cabot Financial) advising me to start paying them the £1 monthly and providing me with their details. Noddle currently shows owing of £2400. I was contacted by Marlin over the phone recently for a review -I explained that my financial situation is even worse than it was in 2013. They were fine-still happy to receive the £1 .They also mentioned that a full and final settlement can be arranged at 65% discount but they would consider a lower offer if I go to them with one- they said. I sent them a CCA request on 08/01/16 and a change of address letter. They have received my letters on the 9th. Today I received the following letter (file of the letter attached) advising me that unfortunately they were unable to cash the postal order because there was no payee filled out. Please see the attached letter from Cabot. Apologies for the poor quality of the file- I think it is readable. ..but if it is not let me know an I will try again. They also returned my original CCA request letter and the change of address letter??? So I guess I should return these to them. They have written on my CCA request letter with pen: 'ops req £1' and also attached the sticker for sign for service from the post office (I sent the letter recorded)... I have also attached the file of the postal order. Please tell me what is wrong with the postal order? I asked for a postal order and in the post office they told me that the best is to buy a crossed one if I am going to send it to a company, so I agreed!? I did not ask them to put a name on the postal order... Although I left the postal order completely blank at the back- Cabot has written on it my Ref number and something like a signature next to the ref. number??!!!! Please advise on the above? Very much appreciated! Uploaded PDF files -post 3 .

-

Not sure if this is the right place for this but... https://realfare.wordpress.com/2015/11/26/hsbc-whistleblower-biggest-bank-fraud-in-british-history-carried-out-on-uk-shoppers-and-covered-up/

-

Hi not been on here for quite a while as thought all the dcas had finally gone away - only to receive today a notice from Hoist regarding old HSBC loan The first paragraph of the letter is as follows. " We are writing to notify you that MKDP LLP has assigned all of it's respective rights, titles and interest in respect of the above referenced account (Ex HSBC) to Hoist Portfolio Holding Limited effective 26/10/2015. The total balance sold they say is £25,392.20 but curretn balance £25082.20" I stopped paying this back in 2008 due to financial difficulties and although over the years received various DCA chasing letters have had no contact with any of them. Is this statute barred and if so, do I need to do anything? Or do I need to prepare for a court battle? Can anyone advise please? Thank you

-

hi been trying to claim back ppi on a credit card with midland bank/hsbc now since 2013 . i have no statements left but can produce some paperwork for 12 months they denied i had a cc but re searched by hundreds of phone calls and eventually they agreed i did have one but no ppi was on it . the cc was from 1986-2003 and did have ppi and went to metropolitan collections in the 90s the debt was fully paid up. hsbc said prove it or go away, i tried the insurance root for the policy number with axa who tell me the credit card number is the policy number and insurance is inhouse with hsbc. hsbc said not with them . so did a sar which was waste of time 7yrs of transactions of banking. eventually enquired with dataoffice and dc sent out by mistake copy of card details, start and end dates customer/card account numbers. i have asked for the past two years for them to confirm that ppi was on card from day one but they will not answer this question, i went down fos route which was fast tracked due to health but they wont or cant get hsbc to answer it either. i am at a total loss as what to do now should i just give up as the stress of this has not helped my illness. this is the short version of this sorry tale the first time i have ever e mailed anywhere so opologies if a bit rubbish.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.