Showing results for tags 'pursuit'.

-

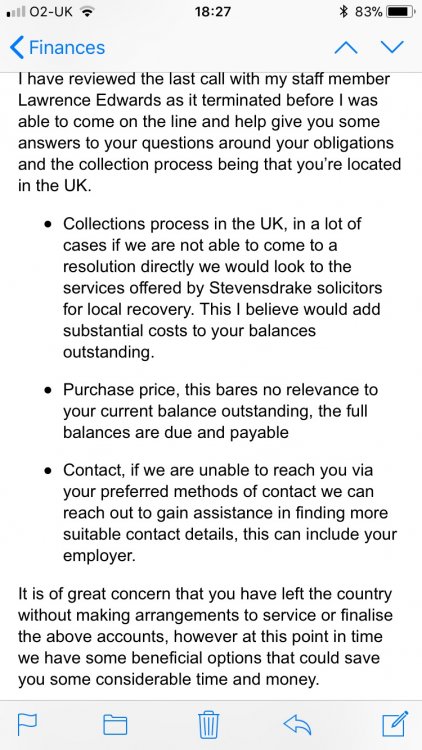

Hi everyone, I received a phonecall out of the blue at work last week regarding an ‘important business matter’. He said they had been sending emails with no response, and sending by post to Victoria with no response. I told him I hadn’t received any emails or the mail, which is true. He asked for my uk email address , I told him to send an email to the one he has on record. I told him not to contact me at work twice and gave him my mobile number instead. 31.01.18 - They rang my mobile, asked to confirm full name DOB and address, I said no due to data protection/privacy. I denied owing anything, and asked how they were going to recover the money. He flustered & couldn’t answer. I said not to ring my employer as it will jeopardise my job as I’m currently on probation. I got the attached email back threatening Stevensdrake. I apparently owe $43k, they’ve reduced it to $37k if I settle in two weeks. I left Australia nearly two years ago. Please see attached email from CreditCorp... There are 3 credit card debts. I’ve received assignment letters for the two smaller debts via email after the phone call, but not the main CBA debt for $27k. I suppose I’m in for the long haul reading about this company & some of the posts on here, just wondering what my next move should be? I told them they could lose me my job if they persist contacting me at work, don’t they realise it’s counterproductive?!! I’m assuming they can’t enter a judgment in Oz while I’m not in Oz anymore, and if not, surely there’s nothing to enforce in the U.K.? Thank you so much for any advice you can provide xxx

- 5 replies

-

- creditcorp

- has

-

(and 2 more)

Tagged with:

-

Hello My ex wife has received a County Court Claim from Arrow Global. They seek over £14,000 for an HSBC Credit Card Debt that was defaulted in 2012 and purchased by Arrow Global in 2014. The pack has no supporting documents such as a copy of the original contract, statements etc. Their Stated Particulars of Claim (suitably Redacted) are as follows: The Claimant claims payment of the overdue balance due from the Defendant(s) under a contract between the Defendant(s) and HSBC dated on or about DATE IN THE NINETIES and assigned to the claimant on DATE IN 2014 The account was defaulted in 2012 and is not Statutory barred and was last acknowledged in 2012 so the stat bar does not come into effect until 2018. The account was opened in the mid nineties so I think I am correct to say it comes under the older Consumer Credit Act so would expect a part of the defence to be that they must produce a copy of the contract and we can examine to see if it is valid. I am about to acknowledge service and get the additional 14 days so I will need to put a defence in on or around 4th September. I would be most grateful for any advice as to how to proceed with this defence. I imagine we are at the first instance looking for production of documents and supporting evidence. How do I ask or that as part of the defence. Many thanks.

-

Dear Caggers The last time I had anything to do with AMEX was in 2009,when in response to a CCA request (for a debt dating back to the early 90s) they sent me an application form with the Prescribed Terms in a separate T&Cs document. I replied setting them straight in their error (sig and prescribed terms in four corners of document etc) and left it that they should no longer pursue me as they cannot prove the debit. They appeared to have taken this advice until last week when I received a letter from AMEX telling me that the account had now been closed, payment in full is due immediately, and that they are referring the debt to a DCA! I assume that they had hoped that if they left it 4 years, that I might forget their CCA failure, or that I might not have the original letter, envelopes and recorded delivery receipts. Wrong! So, do I just ignore them, or do I remind them that the account has been in dispute since 2009. Should I complain to the OFT that they’re harassing me? Cheers MSR

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.