Showing results for tags 'hsbc'.

-

Hi All, My partner of 3 years received a letter on Friday (sent directly to our house) containing papers from both HSBC and Lowells PLC stating that a debt of £7905 has been bought by the debt collectors from HSBC and must be paid. He has no idea where this debt has come from (he has had previous debts with HSBC which have been paid off) and hasn't banked with HSBC for around 4 years. They haven't made any contact with us in the interim, to our knowledge, via our address or his parents address, where he was living when the first debt was paid off. (My point here is; if they have been sending things to another address, how they have magically got the correct address now?) I was wondering the following things: - Are HSBC in breach of any laws if they haven't contacted us before selling the debt onto Lowells? - Can anyone tell me what the proceedure should be and whether we are eligible to ask for proof of 'contact'? - Could the debt be removed as a default from his credit report providing we begin to pay monthly installments (if the debt is proven) as we aren't able to get a mortgage with this on it? I've never dealt with this kind of situation before, so i might be asking very obvious questions; i'm just looking for some advice on what kind of route we should take. Thanks Rachel

-

I was paying off my credit card via capquest up to November 2009, with a letter from capquest confirming intrest to be frozen. HSBC took it back over in December2009 and did not acknlodge this agreement and have been asking for the amount prior to Capquest taking over the account. I have written to HSBC enclosing the letters but they are ignoring it. I have stopped paying the card and now have a debt collection agency on the case. If it went to court where would i stand, producing copies of the letters would the court agree that they are wrong Cheers

-

Hi, I got a commercial mortgage (interest and capital repayment) of £154000 with HSBC in Jan2010. I am paying interest rate at 3.25% and capital repayment £792.08 each month. This is the term on the facility letter: Interest Rate Interest on the Loan will be charged at 3.25% per annum over the Bank’s Sterling Base Rate as published from time to time or as renegotiated under the Renegotiation provisions set out in the General Terms and Conditions. Repayments The Loan will be repaid by monthly repayments of £792.08, inclusive of interest, commencing one month after drawing. In any event the Loan will be repaid in full by the end of the Term. Recently, I started to check my mortgage account and realised I am not only paying £792.08 and also there is a payment debit interest fee (around£470-£499)each month. I emailed my bank manager about this charges and he replied: "The interest rate being charged is an annual rate and there fore we have to break this down for a monthly interest charge. There are a number of ways that banks calculate interest and one way is to use the highest balance during the year and just charge monthly interest on that. This is more expensive then if the interest is calculated daily and then charged on the monthly date, this takes in to account that the loan balance is reducing and you pay less interest. Therefore to be fair HSBC uses the second method so that you only are charged interest on the actual balance and not a higher one. " I have 2 other mortgages with other banks and they are also interest and capital repayment. I only have to pay one amount that is including both each month, so I dont know why HSBC are charging this extra fee. I am not sure if I really suppose to pay those fees or this is another hsbc managed loan mistake? Thanks for advises.

-

- claim back

- commercial mortgage

-

(and 3 more)

Tagged with:

-

Having endured months of disgusting standards of customer service and making multiple complaints resulting in 4 separate compensation payments totalling £160 and £150 of refunded fees, I have now had the final insult. After a long spell of unemployment, earlier this month I managed to land a job offer in the financial sector. I was informed at the end of the interview that a formal offer of employment would be pending a CRA check. To my utter surprise, a few days later I received a very apologetic letter from the employer stating that I had failed the credit check, and therefore regrettably, the offer of employment would be withdrawn. I was stunned. The last time I saw my credit file some 18 months ago I had a blemish-free record and had worked hard to maintain that good track record After the shock and upset had subsided, I decided to take advantage of an online 10-day free trial service offered by CallCredit, and discovered that HSBC had made 3 separate entries of 'Payment late by one month' against me According to the file held by CallCredit, my account overdraft facility hadn't been exceeded, and as was a Student/Graduate account, wasn't due to start making payments on the overdraft until mid-October this year when it converts to a standard Current Account. Upon cross-referencing the dates of these 3 entries with my statements and notes taken whenever have had to deal with the bank, found that they all fell on the same dates when I had had fees overturned (and in two instances, compensation also credited) The first entry on June 2009 related to an account-status error where I was due to be charged £50. I had gone into the branch prior to the charges being applied and spoken with staff who noticed the mistake in my account records and made the amendment, informing me that the fee would still be taken as was an automated process, but then immediately re-credited. The second entry on December 2009 related to an overdraft arrangement fee of £25 that I successfully challenged on the basis of incorrect information given by callcentre staff, and a few days later was re-credited the fee amount, but not before being sent £25 over my OD limit and then brought back to its limit of £1000 with the re-credit, but no letter was sent to this effect, or 'informal overdraft charge' applied There was also an odd entry on 25 December 2009, a credit and then an immediate debit of 10pence debit interest...an xmas present Mr Scrooge would approve of! The third credit file entry was on February 2010, and the only event to have happened then was two credits of £25 as compensation payments under the heading 'Correction formal OD arrangement fee' I've read through the Data Protection threads here, and also have documentary proof of the tangible damage these entries have caused, in my losing a job offer that would have gotten me out of a financial hole I'm sending off my SAR letter in the morning to see if there are any other internal notes that could shed extra light on this. I've not made HSBC aware of any of this as of yet, as I want to hit them with a broadside out of the blue if I can I'm not sure what sort of case I may have, or how I could bring it, and would appreciate any advice.

- 70 replies

-

- credit reference agency

- data protection act

-

(and 2 more)

Tagged with:

-

Can anyone please advise on what I can do about a HSBC overdraft. I have recently lost my job and currently unemployed.A few bills, mortgage, credit card and a car loan will very quickly eat up what little savings I have. I have sent a template letter to the loan and credit card asking for 6 months interest free grace and I am hoping that they will agree. My HSBC overdraft is currently at circa £2,200 - the limit agreed is £2,000. I have £1,000 in a savings account. Should I write to HSBC and explain the situation and then use the savings for this months mortgage and food. Or should i stay within my overdraft first and foremost? I know that no one will be happy but there is little else that I can do other than being honest and try to get a job. Any advice gratefully recieved.

-

Hi! This is my first post on here and I'm looking for a bit of advice. I have been though the long route seen often on here of 'if you claim I owe you the money, show me the agreement@. HSBC have written to me admitting that they do not have the agreement but have issued county court proceeding against me. I have submitteb the defence as follows:- 1. I XXXXXXX of XXXXXX am the Defendant in this action and make the following statement as my defence to the claim made by HSBC Bank Plc. 2. The Defendant is embarrassed in pleading to the Particulars of Claim as it stands at present, inter alia: - 3. The Claimants' particulars of claims disclose no legal cause of action and they are embarrassing to the Defendant as the Claimant's statement of case is insufficiently particularised and does not comply or even attempt to comply with CPR part 16. In this regard I wish to draw the courts attention to the following matters a) The Particulars of Claim are vague and insufficient and do not disclose an adequate statement of facts relating to or proceeding the alleged cause of action. No particulars are offered in relation to the nature of the written agreement referred to the method the Claimant calculated any outstanding sums due, or any other matters necessary to substantiate the Claimant's claim. b) A copy of the purported written agreement that the Claimant cites in the Particulars of Claim, and which appears to form the basis upon which these proceedings have been brought, has not been served attached to the claim form. c) A copy of any evidence of both the scope and nature of any default, and proof of any amount outstanding on the alleged accounts, has not been served attached to the claim form. 4. On receipt of the claim form the Defendant sent a request for a copy of the agreement which forms the basis of this claim, this was sent special delivery and signed for by a Mr/Ms Whittle at 08:16 on the 20th July 2010. The acting solicitors have not seen fit to respond to that letter. 5. Consequently, I deny all allegations on the particulars of claim and put the claimant to strict proof thereof. 6. The Claimant pleads that that this claim concerns an agreement regulated by the Consumer Credit Act, 1974. However, the Claimant claims interest pursuant to section 69 of the County Courts Act, 1984 which the Claimant should surely know they are not entitled to by virtue of the County Courts (Interest on Judgment Debts) Order, 1991 (SI 1991 No. 1184 (L. 12)) in particular section 2(3)(a), which clearly prohibits such an award: The general rule. 2(3) Interest shall not be payable under this Order where the relevant judgment - (a) is given in proceedings to recover money due under an agreement regulated by the Consumer Credit Act 1974 7. I respectfully request the court’s permission to submit an amended defence should the Claimant file fully particularised Particulars of Claim. Statement of Truth I XXXXXXX, believe the above statement to be true and factual Signed Date 4th August 2010 I then wrote to the solicitors stating the above. They have replied basically saying that they don't need the agreement and if I do not sign the enclosed 'Letter of Consent' (that will never happen) to withdraw my defense they will continue to apply for summary judgement. My understanding is that without any formn of signed agreement , they are just trying it on. I would however be very appriciative of any advice on how to go from here.

- 11 replies

-

- d&g solicitors

- hsbc

-

(and 2 more)

Tagged with:

-

Any advice on this one Had a CC debt with HSBC tried to claim on PPI but as my ill health was down to existing condition it did not cover me - recieved court summons replied arranged via court to pay £20 per month However mum diagnosed with cancer missed one payment £20 but contacting them to apologise and issuing payment for further 3 months in advance so I would never be in a position to miss a payment again - yet recieved summons re charging order went to court by myself and Charging order was granted Since which time however on reading info about missold PPI's via CAG wondered if I could go back to court and argue on the ground it was mis sold so putting the account back in dispute in an effort to get charging order lifted ? and refund of payments £100 per month to my recollection this way there would be little or no Debt? I did check with Solicitor CCA was enforcable but she never commented about PPI. Or would I be just whistling in the wind ? Any Ideas OSW

-

In August 2005 I took out an HSBC Mortgage. In September 2005, I went back to university to study for a full-time MBA. To help with cash flow, HSBC kindly offered a 6-month payment holiday. I took the payment holiday option in December 2005 with the mortgage payment holiday ending end of May 2005. In June 2006 I received a call saying my mortgage account was 6-months overdue. I explained the Mortgage Holiday and was sternly told, “HSBC doesn’t do Mortgage Payment holidays – and all money must be immediately repaid.” WTF...? I arranged a payment plan to pay off the £4,400 ‘holiday arrears’ over the next 24 payments. It was about £180 per month. But because of the HSBC Mortgage Holiday, my credit score has been destroyed. My Equifax credit report lists me a “Poor” and shows 6-months mortgage arrears from the period June 2006. Is there any publicly available evidence showing HSBC have given out bad advice with Mortgage payment Holidays? I need to get this removed from my credit file and will call the HSBC Mortgage arrears team – on Monday (08456 029 512). Before I call, I need your help to provide previous examples of HSBC giving out bad 'Mortgage Payment Holiday' advice... Any sources or ideas?

-

About 18 months ago my wife claimed PPI back from HSBC. They were very quick to offer the money and also to get her to accept. I didnt think it was a lot but we accepted. Recently we did a CCA and lo and behold it looks like both our application forms are not valid or enforceable. No wonder they were quick to sort it out. She accepted as full and final settlement I think. My question is can she ask for a breakdown of the PPI she paid over the years and check if they have screwed us over with the payment and if they have can we put in another claim against them?

-

Can anyone help? I have some large credit card debts on about 5 cards. I have sent a standard letter asking for a copy of the CCA and had replies back but some seem a bit dodgy. I'm no expert sp I joined the forum to see if there is any help here for me. Do I tell them that I dont think they have complied with what I asked for and put the account in dispute and pay the £10 for the SAR? Are they legally entitled to chase me for payments while the account is in dispute? I can post documents if anyone wants to have a look. Cheers

-

hi this is the first time posting on here , so i hope im in the right place i have a personnal loan from hfc taken out in 2004 which i missed payments on it was passed to lewis group who now have passed it on to moorcroft i have recieved the cca today which is a photocopy with the terms and conditions photocopied on the back the terms and conditions are almost unreadable there is no date of signiture at all also i have just noticed they have been charging me ppi, can i still claim for this thank you chris

-

It has often been said on here that a claimant cannot claim the above interest if the action is brought under the remit of the CCA. Well section 69 certainly does not say that. Now I know people will say yes but look here The County Courts (Interest on Judgment Debts) Order 1991 This appears however to relate to section 74 of the 1984 act not 69 am I missing something here???

-

Hi guys, I am trying to claim my bank charges back (I think about £3000 worth over past five years) I have sent them a letter asking for the records of bank charges back 6 years and I sent them the £10 cheque. I have had no reply in one whole week.... Can they really get away with ignoring customers??? Please help

-

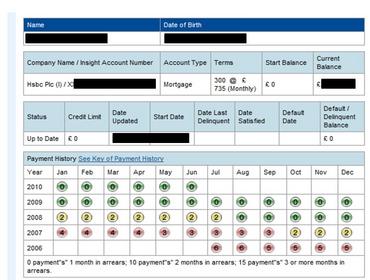

I have a number of accounts that I am paying back on an agreed debtmanagement plan, one being a credit card with HSBC. The dilema I am in is that all the other companies have changed the status of my account on experian to Special Instruction Indicator: Arrangement and I have been paying them upto date for over a year now. All this is showing a green symbol. In trying to rebuild my credit rating and finances etc HSBC Credit Card have not changed this, yet they accept my payment of £x.xx per month and have frozen the interest (although it it with MCS) This still shows as a red symbol Is there anyway I can get them to alter this to relfect I am on an agreement and that I have kept up with monthly payment? The arguement they came back with before was that they wanted more than triple what I offered to and am currently paying and therefore did not accept the agreement?? Yet they have settled for a reduced amount and have done so for some time Any thoughts please?

-

Hiya all Sorry I am new to this site so hope I am doin this right. I want to firstly say having browsed around previously before joining i have found the information here extremely helpful. I bank with HSBC and over many years have been charged bank charges which i feel are excessive, only last month I was charged £225 in one month and when they took this from my account, it then took me over my overdraft and they began ringing me to ask why i had gone over my limit.. ..i said i wouldn't have done if you hadn't have charged so much. All I have had from HSBC over the last couple of years is hassle! Just wondered what the procedure is to claim these back and can you still do it as I believe they were holding these until a case was heard? Can anyone advise please? Many Thanks

- 72 replies

-

- action

- anticipating

-

(and 1 more)

Tagged with:

-

Hi to all who read this. This is my first post, prompted by yet another day of hassle from HSBC. Some 6 yrs ago, I opened 3 accounts, Business, Joint and Personal. All had small overdraft facilities. Within the last 3 years the Business and Joint accounts always in credit had, with no reason given their facilities withdrawn also my wifes credit card which she had never used. My personal account has varied from £20,00 credit to £2,200 in debit, facility lmit £1,500. Latterly the limit has been exceeded fairly regularly. Inevitably charges and interest have been applied. I have sought meetings with Branch managers, been continually fobbed off, appointments made on bank holidays and on two occasions, people who stated they were the wrong people to see. I then decided on a letter only policy, my letters being passed on to Customer Service staff for reply. My questions are not answered and I am asked for duplicate information. All the time I am issued with threats. When the overdraft was cancelled on the joint account, I was forced to replace it with a Flexi Loan. Today went to check my SO and DD list on internet banking only to find that all my SOs and DDs had been cancelled by HSBC, without anyone having the decency to tell me!. I have not as yet taken any action regarding Interest and Charges, they must be considerable and I am using the Advanced Spreadsheet. Could any of your members advise me as to what I should now do?.

-

First Direct have sent these in response to CCA request. They may well be genuine scans of the front and back of an original document. They have the same "Folder" reference at the top of each page (removed) and have "Page 1 of 2" and "Page 2 of 2" (although the terms are only a subset of those on a separate document, referred to at the beginning.) It doesn't look like it was properly executed - just "Agreement executed" in the box with no date. The date stamp did have a full date on it but it just says "Received", not "Approved" or "Executed" like others I have seen. Anyway, assuming they are both from the same original document, does this form an enforceable agreement? Some views would be helpful please as I'm being pestered by Metropolitan now.

- 20 replies

-

- first direct

- hl legal

-

(and 3 more)

Tagged with:

-

Hi... .new member.. ..I have spent some considerable time looking at Consumer Forum and have followed various threads and used the advice posted to write to Sainsburys Bank, Halifax bank, HSBC, Barclaycard, asking for CCA I enclosed the postal order for £1, my letters dated 25th January 2009. to date no reply apart from a Formal Notice from Halifax. I get the feeling I should have started a thread back in January and followed advice from the begining. However I hope it is not to late to ask what is the next step that I should take as I am keen to find out if the CCAs are unenforcable..... .....HELP

-

I had a Loan with hsbc in 1999 i lost my job in 2001, the loan had protection and i had that paid for 12months after this I could not pay as was on a course and I defaulted on the loan and the debt went to Metropolitan collection services. I was paying them back £48 per month during the 2003 and put it up after they wanted more money to £51 per month now out of the blue I was contacted by Direct Legal and collections demanding £10k on my mobile phone and also my home phone. I asked the lady on the phone who are you I have never heard of you, She said that a letter was sent saying that they had bought the debt. She asked for my date of birth and postcode I said sorry I dont know you, you are probably a fraudster write to me if you got all my details. after contacting MCS they told me they passed on the debt to Hillesden on the 13th Jan 2009.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.1b86f160057887670bb40461dba7eac1.jpg)