Showing results for tags 'management'.

-

Hi All I would be grateful for any help received. I have been paying a debt management plan to pay plan since 2008. I am going to be made redundant at the end of the month and was thinking of possibly trying to make full and final settlements to finally get out of debt. After looking at some threads on this forum I thought I would see if this is the best route or should I look into a debt relief order or just continue in my debt management plan. Here are a list of debts below Barclays Bank £1,781.46 Credit Card Cabot Financial £163.91 Next Store Card Cabot Financial £359.15 Store Card Cabot Financial £588.19 Bank Overdraft Hoist Finance £248.14 Store Card Hoist Finance £1,160.59 Credit Card JD Williams £654.43 Fashion World Catalogue Moor croft £533.31 Additions Catalogue Moor croft £2,449.34 Halifax Loan Moor croft £572.96 Credit Card NCO Europe £1,710.74 Little woods Catalogue PRA Group £1,940.82 MBNA Credit card Paragon £1,246.38 Virgin Credit Card Paragon £418.93 DFS Sofa Santander Cards £1,034.55 Credit Card Total £14,862.00 Ive checked my credit rating online with noodle Paragon Virgin Credit card not default that I can see Pra Group Mbna Credit Card defaulted 30/11/15 Barclaycard defaulted 15/06/17 Arrow Global Additions Catalogue defaulted 01/04/14 JD Williams not defaulted that I can see Shop Direct Finance - Littlewoods not defaulted that I can see The rest don't seem to be showing on my file anywhere. Thanks in advance for any responses

-

This is asking for advice ten years ago I was taken very ill and had to give up working have undergone ten years of major surgery and hospital treatment my wife working part time to look after me . rightly or wrongly and I know in hindsight wrongly before I was admitted to hospital I was fully aware I would be unable to keep up with my outstanding debt repayments . contacted a debt management company to handle my debts as I was fully aware that within weeks I would not be in any position to deal with it and thinking that being honest and facing up to this that I would not be able to deal with this along with trying to take pressure from my wife we both signed agreement for the debt management company to act on our behalf and at no time without hiding from any liability. Just in the last few months I have been well enough to relook at what we had done and now realise what a huge mistake I made as after all these years after paying thousands of pounds I have only reduced the by hundreds yet I was paying for PPi and other payment protection schemes on all the accounts yet a few years the same management firm offered a PPI repayment plan although they stated that some of the debt was covered and they reclaimed refund all that happened was it reduced the debt and I ended up with another debt for their fees which was added on to the monthly repayment plan and according to them now it will take another 89 years to repay what we owe by which we shall both be dead Yet when looking through old paper work in the last few weeks due to my health improving I found a credit statement from one of my debt companies stating that they had accepted the monthly repayment of one pound per month but where changing a payment options plan of sixteen pounds and this was three years after I first entered in to this debt management plan. I have within the last few days asked the debt management firm if they had details of copies my original credit agreements and as they acted on our behalf could they forward them to me or ask for them which I was informed they did not and would not be able to obtain them surely how can they undertake a debt management plan without the agreements . I am fully aware now that I have been been ripped off by the debt management firm and by the credit firms and now believe honesty does not pay by admitting my indebtedness trusting somebody to deal with it has now cost my wife's health and I will never recover my my illness . I feel there must be a solution but it seems far to late to do anything now as I accepted the debts by handing every over to a debt management firm as I was not in position to deal with it due my health so any help would be very gratefully

- 5 replies

-

- debts

- management

-

(and 1 more)

Tagged with:

-

Hi Really don't know what to do, I have recently had two letters threatening court action and bailiffs due to a parking charge Unfortunately these letters have been going to my neighbour who has sent a lot back saying return to sender so don't have the date or whereabouts that this incident happened, meanwhile the fine has escalated. I was puzzled why the letters were going to my neighbour I phoned the dvla to check my records who then informed me it had the wrong door number on their data. The information is being updated now this is also strange as earlier in the year I had correspondence from the dvla with the correct door number. The parking company is ica registered, please can someone help.

-

Had the following email from this outfit in my Spam earlier today pasted verbatim: Yawn

-

- limited

- management

-

(and 1 more)

Tagged with:

-

Please don't fall into their trap like I and others have done. We were approached by Falcon Management Services last year after a company went into liquidation owing us a substantial amount of money. This company contacted us as they were aware we were on the creditors list (not sure where they get this info) and there seemed to be a light at the end of the tunnel that we may get our money back. Of course they had inside information of fraudulent behaviour on the part of the director. It all seemed plausible as we suspected him of wrong doing. For a one off fee they guaranteed they would get our money back or the fee would be refunded. That was the hook. Be warned you will not get your money back and they will pursue you quite aggressively demanding more money from you and threats of various actions if you do not pay within the next few hours. I like to think we are not gullible and knowledgeable enough not to be taken for a ride. But they prey on you when you are when are dealing with the anger, upset and financial loss you have already suffered and entice you with false promises. Article in the Express on Monday 10th of April about Falcon Management services Ltd in the Crusader section http://www.express.co.uk/finance/crusader/790244/the-crusader-debt-collector-trader-falls-victim-get-back-money-owed Hope this post saves someone else from being even further out of pocket and being harassed by them

- 59 replies

-

Hello All, I have just received a 'Parking Charge Notice' from HX Car Park Management Ltd. According to the contravention the: 'Pay and Display Ticket was face down' and they are requesting £60 (if paid within 14 days) or £100 (if paid within 28 days). There are no ticket machines in the car park and on arrival to the car park you pay cash to an attendant, he gives you a piece of square, coloured paper with the date printed on it (which they have photographed as evidence). Each day you're provided with a different colour. With hindsight, I stupidly didn't realise that I needed to place the dated ticket face upwards. I was under the impression that you couldn't park there without going past the parking attendant. Worryingly, I could potentially be liable for at least another three days as I'm not sure if I placed the coloured ticket 'face up' on the following days. Any advice would be most appreciated as this could potentially be an anxiety inducing £240.00 in total (almost a week's wage for me). All the best, Amy

-

received a PCN in the post from New Generation Parking Management 18 months ago - I sent them an email informing them that I am just the registered keeper and not necessarily the driver. (I used the template from this group) NGP never responded to my email. They have now passed 'the case' on to ZZPS/Wright Hassall Solicitors who have just informed me that the Protection of Freedoms Act allows them to County Court me. Is this right? (I did not state who was driving) The driver (my wife) has recently died and would I still be liable for the charge? This has really upset me and Wright Hassall after I told them that one of the drivers of the vehicle was now dead. TIA

- 2 replies

-

- cardiff

- generation

-

(and 3 more)

Tagged with:

-

I am so pleased but also worried sick to find this forum. Briefly, my son was driving my husband's car last year and a third party ran into the side of it resulting in it being written off. It was a classic automatic Mercedes (this may be important). As my son required to travel 50 miles each way to his work location and my husband works in a rural location we required a car asap. We were referrred to Auxilis by Admiral and despite feeling uneasy about it all we agreed to the contract. The following day we were contacted and told that they would deliver a premium automatic car the following day to our home address. I said an auto was not necessary nor a premium and as my son was not in a position to work at this time we agreed for a car to be delivered to our home the following day as we could use the only other car available to us for a day or so. I made a separate call to Admiral and asked very specific questions regarding the hire and cost of it and our liability. I even said that I realise it is very expensive and surely it would be better to get a cheaper hire ourselves. I was told that if we did that then we would be unlikely to get our money back and as it could go on for months before being settled we would be saddled with a big bill, probably thousands. That is exactly why Auxilis is recommended and people like us are referred to them I was told. The following day I phoned Auxilis to see what time to expect the car (as they even suggested that I could choose what type) and was told that the car was already on its way. A brand new 4 x 4 auto thing because our car was a 'premium' car so they provide a premium car as a replacement. This was not agreed to or suggested by me. Cutting this short - the car arrived, it took 6 weeks to get the pay out for the car and we waited to replace it until all was sorted, as we were told we could. The cost of the hire car for 6 weeks is around £7K to my horror. Obviously even though the accident was deemed completely no fault of my son's and the excess was covered in the claim and NCB is unaffected the other insurers are refusing to pay. The court date is set for end October and my husband has to attend (as the insurance is in his name). He is actually unable to attend as he has business travel at that time. I have a few concerns. The paperwork mentions wage slips, credit card details etc. Theoretically we could have put the cost on a credit card or paid from savings - I was told not to. How will this all play out in court? What will happen because he cannot attend, does that look like he is not cooperating, as he agreed he would? We were asked months ago to provide dates he could not attend for the next 6 months. This we did. That brought us to the beginning of September. No questions were asked about any period of time after that so he was not able to tell them that October would not be possible. I am really stressed over this. Any advice please? If we tell the truth in court as above I suspect we would be seen not to try and recover Auxilis' losses.

- 12 replies

-

Stepson parked in a visitor's space in a private development whilst staying overnight with a mate, has received a parking charge notice for not displaying a permit. No notice to keeper yet, and I've asked him to go back and take photos of the signs. Can't find anything about this company through forum search or reading through thread titles, they're IPC so I can guess an appeal will be pointless. Mostly what I need to know is if they do court?

- 20 replies

-

- countrywide

- management

-

(and 1 more)

Tagged with:

-

Name of the Claimant ? - Parking and Property Management Date of issue – 15 Dec 2016 Date to submit defence = by 4pm Monday 16th January(i think) What is the claim for – the reason they have issued the claim? - DATE 22/08/16 - AMOUNT - £150 - DUE DATE - 26/09/16 - - DATE 23/08/16 - AMOUNT - £150 - DUE DATE - 26/09/16 - Total Due - £300 AND THE CLAIMANT CLAIMS The claimant claims the sum of £305.20 for parking charges and indemnity costs if applicable including £5.20 interest pursuant to S.69 of the County Courts Act 1984 Rate 8.00% pa from dates above to 14/12/16. Same rate to Judgment or (sooner) payment Daily rate to Judgment £0.07 Total debt and interest £305.20 What is the value of the claim? £390.20 (£35 court fee, £50 Legal representatives costs) Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Parking and Property Management Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes

- 35 replies

-

- gladstones

- management

-

(and 2 more)

Tagged with:

-

Hi all, I have been on a DMP for a few years, and I have requested a CCA (using the official format and the 1£ fee which was duly sent). The Debt is for an old credit card which I had with Natwest. Moving forward I have been on a DMP for 7 years, currently the debt is managed by Wescot. According to the Debtor I owe about 1.3K on it, however I thought it was lower. Anyhow, I have requested for a CCA and received the following reply: "following your recent request for a copy of the signed agreement, our client has requested you write to the following address and state in your covering letter that this is a section 77/78 request and enclose a postal order or cheque payable to our client CCA requests Card customer services xxxx xxxx There is currently a monthly payment arrangement set on this account ************************************************ Now I am confused! I thought whoever managed my account is lawfully required to send the CCA and so on? I am planning to stop the DMP and I was wondering what the consequences of it would be? Can they put a "mark" on my credit score? ((the account was opened in 2003)...should I send the follow up letter reminding them of their duties and so on? Advice welcome. (PS the reason I asked for the CCA was to ask for a full and final offer etc, but that reply got me slightly annoyed!)

- 5 replies

-

- cca

- management

-

(and 2 more)

Tagged with:

-

Good afternoon First of all I thank everyone for any advice you may be able to offer. On the 24th March 2016 at 19:14 I was parked at the rear of some shops on Slough High Street. I visited a Supermarket (one of those shops) and was in there no longer than 20min. On my return I discovered a parking ticket from Parking and Property Management Ltd with the issue reason 'Not displaying a valid permit'. It was dark so I obviously didn't see the sign post which outlined the conditions of parking there. The following day I went away for work and totally forgot about the ticket. Almost 3 months later I have recieved a 'LETTER BEFORE CLAIM' from Gladstones Solicitors. This letter is dated 7th June, was sent 2nd class and I recieved it a week later?? Having done extensive Googling online I read there should have been a NTK before this? I cannot recall having received one of these. I will be trawling through all my post again just to make sure. They are asking for a payment of £150 or they will take legal action? The easy option would be to pay the fine, however the bay I had parked in was for a Carpet Shop, which was way past closing time at the time I got the ticket! Where do I stand with contesting the ticket? Looking forward to the advice and I appreciate it!

- 72 replies

-

- behalf

- gladstones

-

(and 5 more)

Tagged with:

-

Apparently Falcon Management Services Ltd have had their membership of the Credit Services Association terminated.

- 3 replies

-

- cautionary

- falcon

-

(and 3 more)

Tagged with:

-

I had a non fault accident in July 2011. Stupidly i entered into a credit car hire agreement and should have done my homework first. eventually the other insurer admitted liability and thought everything was settled as i got a letter saying this. A few days ago i got a letter from a solicitor saying that payment for their services have not been paid (Car hire), and they will be raising court action within 14 days against other party. Also states that they will not seek payment from me as long as i co operate etc. ... Had this same letter in 2013. Have read on here about statute barred and see that in Scotland its 5 years. Im in Scotland but the company is in England. Any advice you could offer? I done all my worrying in 2011 after reading horror stories so no point me getting all stressed again. I'll go with the flow Thanks

-

Hello, I've a similar story where my car got rear ended. I've decided to use Sytner (Mercedes dealer) Insurance to claim for me in order to repair the car in the official dealership. Sytner then uses Auxillis and everything was taken care properly but after 1/2 months I've received the contact from Principia Law where they will act for me to recover the HIRE CAR loses. I'm concerned about the terms and conditions where it's mentioned the costs (success costs + police report etc) that I've to pay that I was not aware! I was not aware of the need for an external company and hidden fees, can someone explain a bit more how this works ? Thanks in advance

-

I have discovered that I had PPI with a company by the name of Premier Mortgage Management it started back in October 2004. Am I able to reclaim this please. Any help appreciated.

- 2 replies

-

- management

- mortgage

-

(and 2 more)

Tagged with:

-

Hey guys, I got issued a parking charge notice in January for parking in a visitor space without a permit in Brighton in a flat block. Was not aware that you needed permit for visitor space to. There was 2 small signs around car park which I barely even noticed as writing was small. My friend who lived in flats above told me to ignore it as there is nothing they can do. So I did. The sign has the Ethical parking ltd name on. Now got a debt collector letter which says they will suggest their client takes me to court. I don't have original parking charge notice that was put on car as I threw it away as thought I wouldn't need it. Would this affect me if it went to court? Shall I carry on ignoring them? Should I ask them for prove of parking as I don't remember getting sent a picture of car in bay? Should I just pay £160 parking charge notice ? I have till the 4th to pay the parking charge notice to debt collector before they suggest client goes to court.

-

Hi guys, so over the years i've read the forums and they have helped me out greatly. Now i have something i don't think i've ever read before Bluestone credit management took me to court using banner jones, i requested the case be heard at a local court. The case was heard and i said that the case should not have even been heard since the creditor had not sent me a notice of assignment as directed under the law of property act 1925. The judge decided the claimant has 21 days to send me a notice of assignment, this turned up today, first class recorded. Now the interesting part Since the court has decided that a notice of assignment was never given and bluestone have evidence that they have served me the notice of assignment from the 19th does this not technically make all of the above defaults in my credit file illegal? and what about with regards to the last two entries that state voluntary termination? What options do i have with this now? I know i could claim they have damaged my credit file by illegally placing defaults and i could ask for compensation, £3597 would be convenient and see if they want to call it a null debt? (That's the only idea i can throw out there) but how would i go about this and is there anything i can before this?

- 73 replies

-

I'm glad to see someone else has mentioned this on here, though not as glad as I might have been a few months ago to have seen it –*I'm in a near situation , albeit via Hastings. Passed onto Albany when, after being hit by a third party with the amount of damage virtually guaranteeing the car, an 2002 Ford would be a write off, I asked Hastings about a courtesy car –*Albany were too happy to help and said I needed to check a few documents online and once signed they'd be able to send a car, albeit a hire car, though they were at pains to point out that it wouldn't cost me anything and that anything about fees on the documentation I should avoid as it wouldn't apply. that done i was passed onto Helphire who arranged for a 2015 Vectra to be delivered. Only kept the car two weeks as I bought a new car then and cancelled the hire car which was then picked up. Seemed like the end of the matter. However after Albany saying in October they were submitting the costs, just over £950, to the third party insurers, the third party insurance have refused to pay so Albany then instructed Principia to act and get the money back and have issued a county court claim, with myself named as claimant and third party as defendant. They sent a questionnaire about the accident and whether there are other cars I could have used or if I have credit cards before sending out the county court form. As with the OP I have an insurance policy which indemnifies me against the third party not paying up (including, presumably, losing the case in Court), but that does rely on me cooperating with Albany in recovery of the costs. Stressed doesn't begin to cover it, it's one of those "had I known then" situations really....

-

Hi Guys, has anyone heard of this company?They manage the estate where I live, tidy up the gardens, not front gardens, but communal areas, pick up rubbish out the car park etc.I got a letter off them today because I haven't paid my £42 estate charge, so they have added a £21 admin fee as the cost of writing to me over it. I think this is extortionate. The reason I haven't paid is that the terms and conditions on the back of their paperwork refer to tenants and lease holders, of which I am neither, so I wrote and asked them for a copy of homeowners terms and conditions, which haven't been forthcoming. ThankS Mike

- 10 replies

-

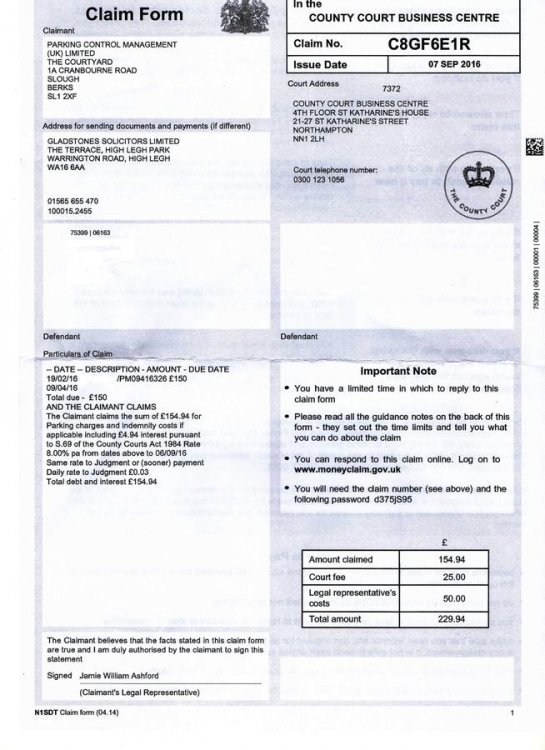

Hello Name of the Claimant ? Parking Control Management Date of issue – 7th September 2016 Date of issue - by 4pm Friday 7 October What is the claim for – 19/02/16 £150 09/04/16 total due £150 AND THE CLAIMANTS CLAIMS The claimant claims the sum of £154.94 for parking charges and indemnity costs if applicable including £4.94 interest pursuant to S.69 of the County Courts Act 1984 Rate 8.00% pa from dates above to 06/09/16. Same rate to judgement or (sooner) payment. Daily rate to judgement £0.03 Total debt and interest £154.94 What is the value of the claim? £229.94 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim ? Parking Control Management, Were you aware the account had been assigned – did you receive a Notice of Assignment? I later received a letter from DRP ( Debt Recovery Plus) who said that the unpaid charges had been sent to them for collection, but there is no mention in the letter of the account being assigned to them. I have registered and completed the acknowledgment of service form online as was advised on this site, so now I suppose that I should be preparing my defence. I hope that I have followed the guideline set out correctly so far. I received a claim form today, below are the details from it which I am supposed to include in this thread. Please could anyone give an further insight or advice about the pitfalls to avoid. Thanks

- 44 replies

-

- control

- management

-

(and 1 more)

Tagged with:

-

Hi guys I have received a parking charge of 100 to be paid in 28 days or 60 if paid in 14 days. I received this just after midnight. I believe that this is unfair as I parked there only for a maximum of 15 minutes to drop my wife and 9months old daughter. It was late in the evening and it was dark. The area is known for drug dealings and drug addicts loitering. I didn't wanted to walk there during that late hours with my daughter and wife. I decided to park near by which is a private road just to drop my family and luggage as we were coming back from holiday. This is the only way to get to access to my flat as it is a new development. By the time I come back to move my car I got a ticket. Kindly advice me on the grounds I can appeal. Thanks Sri

-

Hi there, I've been reading through the forum and have so far only found a couple of older threads relating to these chancers... I've received a Parking Charge Notice through the post from NewGeneration Parking Management stating that i was "not parked in marked bay". This was indeed the case but there were no available visitors spaces and we were staying at a friend's flat in the housing estate. I had a valid parking ticket for the entire period. I've copied the standard answers in to the thread below and have attached a copy of the letter as a pdf. 1 Date of the infringement 05/11/2016 21:43 2 Date on the NTK 11/11/2016 3 Date received 14/11/2016 4 Does the NTK mention schedule 4 of The Protections of Freedoms Act 2012? No 5 Is there any photographic evidence of the event? Yes, photos of my car taken by a digital camera, no ANPR 6 Have you appealed? Not yet. Have you had a response? 7 Who is the parking company? New Generation Parking Management 8. Where exactly [carpark name and town] Prospect Place, Cardiff CF11 0AS It states on the letter that they are a member of the IPC and that they use the IAS for appeals. Should i just appeal via their website stating that the charge isn't valid, using the standard response? Many thanks in advance, Adam IMG_20161114_0001_01.pdf

- 13 replies

-

- charge

- generation

-

(and 2 more)

Tagged with:

-

Hi, I will be very happy to hear your advises for the below case of mine. I have been given a Parking Charge Notice by parking and property management ltd in Reading. I am thinking of not to pay this charge. The reason is I was visiting my friend who lives there and I parked my car in the visitor bay. The other thing is it was close to 9 pm and therefore dark. After I saw the notice on my car, I looked around and there were no visible signs at all. For example, there was no sign in the entrance as a notice that it was a private land and the enforcement rules. When you look inside the parking area, you can hardly see a parking notice, but it was not well lit. So, it also went into darkness. Now, I would like to make a letter of appeal, but what reason should I use? Should I say I parked in the visitor's bay as a visitor of my friend who is resident in that property? or Should I challenge them with stating no clear signs and not lit signs? Hoping to hear from you soon, Thanks

- 4 replies

-

- charge

- management

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.