Showing results for tags 'lowell'.

-

Further to a cca request to Lowell, see my other post (do not know how to link posts) I have received the following: Dear Mr ******* your request for further information we refer to your recent request for further information regarding this account further to our letter dated 20th October 2017, please fine enclosed your returned fee of £1 in regards to your request for information under the consumer credit act 1974. at top of letter - its shows OC which was M&S store card it quotes the original account number and Lowell reference number and a BALANCE of £0 (was around 3K) I have no other letter, so not sure what they are referring to when they say 'further to our letter dated 20th Oct" It looks like a winner to me but shall i contact to see if there is another letter that i have not received, am thinking they may have sold it and that is why they show 0 balance thanks

-

A mate has had a "Pre Legal Assessment " letter from lowlifes, I was told account was Cap One card opened around 2001 via post due to job loss nothing apart from token £1 paid from 2010, for a year or so until C1 stopped them from being able to make online payments, they then phoned them constantly asking for payments, given to Lowell in 2014 whereupon it appears they added their own default. I think the balance of around £3.6K is chock full of charges and late payment fees. Would SAR to Cap1 help establish original default date, and what are lowlifes chances on this one? Have told them to register with Clearscore and Noddle to check what else might be lurking in there.

-

Hi there, First of, any help or advice would be very much appreciated. my sister ended up getting into around £1300 worth of debt with orange due to her teenage daughter running up a very large phone bill in one month. My sister, I assume - has just ignore it all. I only found out yesterday due to her asking to lend money to resolve this. She received a county court claimform on the 27th September and a letter from Lowell's to state court proceedings would be the next option on the 2nd of October (after the claimform had already been submitted). Had I have known earlier I would have sent a CCA or SAR I think it is for her but now obviously things are a little more tricky. I told her to hold off doing anything until I had done some research (prior to this she offered them half but they refused). she totally ignored me because she's a royal pain and sent off the court letter saying she intends to only contest part of the claim. I imagine a few will be slapping their foreheads over this haha. what would you advise to do? She is also a new foster carer and has been informed if a CCJ does register against her she could lose her place as a fosterer. So obviously want to avoid the CCJ at all costs Thanks for reading!

- 3 replies

-

- ccj

- detrimental

- (and 5 more)

-

Hi, Just looking for some advice please. I have been trying to get Lowell to prove a 'debt' to 02 that goes back to 2012.. the debt is for £181 and all they keep telling me is that it is for a phone contract. On Friday I received a letter form Lowell solicitors saying they now have the debt and that I need to talk to them about paying it. . today however I receive a very strongly worded "Letter of claim" letter with several pages for me to input all my details and reasons for why I have not paid. I emailed them and this is the reply I got back from them, I am just wondering if i do have to actually provide them with the details they are asking for? I have sent them the "Prove it" letter from this site via recorded delivery as well. Dear Sir or Madam, Please be advised that if this is the first email we have received from you, we require some information from you in accordance with the Data Protection Act 1998 so that we can conduct our security checks. Please confirm: Our reference number Full name Full address, including post code Full date of birth By replying to this email, you also confirm that you give authority for us to record this email address and correspond with you by this method. We are currently experiencing high volumes of emails. We aim to respond within 5 working days, once we have satisfied our security checks. Please note that until we receive the above information from you, we will not be able to deal with your correspondence. If you are responding to any contact that suggests that we may take further action against you within a specified time, please call us on the below number as we cannot guarantee that we will have seen your email before this action is taken. If you wish to speak with a member of our team, please telephone us between 8:00am and 8:00pm Monday to Friday or between 8:00am and 2:00pm Saturday on 0113 335 3334.

-

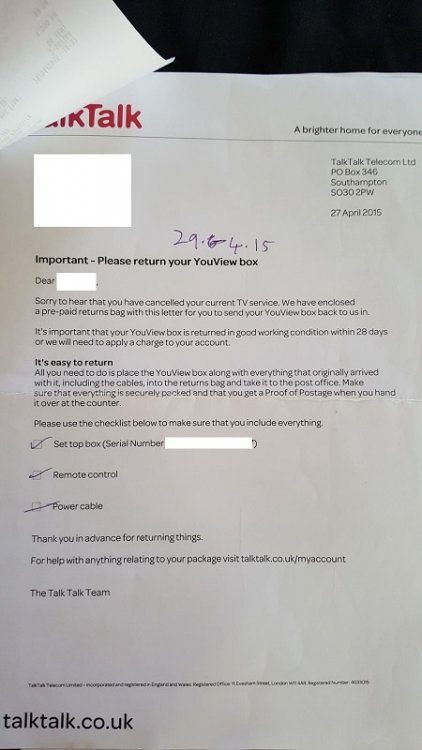

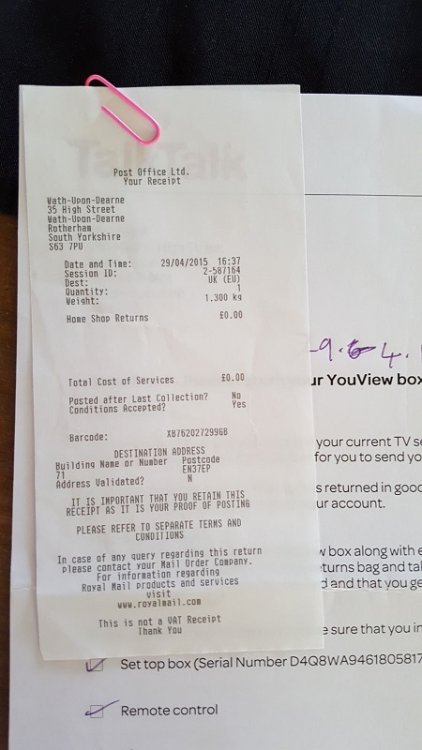

Lowell Claim Form - Old Talk Talk Mobile Contract

davey boy posted a topic in Financial Legal Issues

Name of the Claimant ? Lowell Portfolio 1 LTD Date of issue – 12 sep 2017 What is the claim for – 1) the defendant entered into an agreement with TalkTalk telecom limited under account ref* (the agreement). 2) the defendant failed to maintain the required payments and the service was terminated. 3) the agreement was later assigned to the claimant on 07/12/2016 and notice given to the defendant. 4) despite repeated requests for payment, the sum of £421.27 remains due and outstanding. And the claimant claims a) the said sum of £421.27 b) interest pursuant to s69 county courts act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.092, but limited to one year, being £25.67 c) costs What is the value of the claim? 531.94 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? broadband, TV services When did you enter into the original agreement before or after 2007? go live date was 03/03/15 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? no Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no Why did you cease payments? 1st month was paid. Contract was cancelled within first month of service as there many problems and the service didn't go live as stated, when it did there were still numerous problems, TalkTalk requested return of their property on 27 Apr 2015 and have not heard from them since. That is until Lowell's started sending letters both to mine and my ex's addresses. I moved on 31 Oct 15 to a new property. What was the date of your last payment? circa April may 15, I will have to check Was there a dispute with the original creditor that remains unresolved? not to my knowledge Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management planicon? no Hi there, as the title implies, I have received a claim form from Lowell's, I hope you can give me advice, I have not done anything as yet but realise I need to respond to the claim to avoid a judgement against me. Any advice on how to defend would be fantastic. cheers Dave -

Hi, I've recently had late payment charges on 2 LTSB credit cards. This pushed one of the cards over the limit incurring another £12 on top of that. When I made the next payment I did not include the late payment charges they'd added on to the minimum payments, so they added further charges. These cards were originally an accucard and an Easy card both of which LTSB bought out. I have noticed that the interest rates have crept up to much higher than when the cards were taken out also and when I received the last replacement card it stated "for details of the interest rate please refer to your original agreement. I'm therefore thinking it's time to challenge them for agreements. I've been reading up on the latest CCA info as I'm a bit rusty and things have moved on since I last did this. I'd really appreciate any advice, because it looks a bit confusing nowadays. Adding late payment charges onto the minimum payment really annoys me. How do they expect someone who has struggled to make the basic payment be able to pay all their add ons? Does anyone know please whether adding late payment charges onto minimum payments has been successfully challenged? I'm thinking of sending a standard CCA request letter with an added bit challenging the charges. Any further suggestions would be appreciated.

-

Hi, Yesterday I received a court claim for an old catalogue debt (Simply Be), and today a letter from BW legal confirming they had issued a claim and asking me to call them (I won't). Would appreciate some help: I have letters going back to January 2011 regarding this. As it was a catalogue company who added interest, the original letters are for a lower amount than the amount of this claim, but it is still the same account number etc. The higher amount did not appear on the letters until August 2011. Does this date of non payment from Jan 2011 make this statute barred, even though it was for a lesser amount at that time? Brief run down of the time frame: Jan 2011 - Aug 2011 - letters from Reliable Collections, chasing the account end of Aug 2011 - letter from Simply Be, a Notice of Assignment, stating that "We give you notice that one of the above companies may be acquiring from Simply Be all its rights, title and interest' etc. There were six potential companies listed and it stated that the assignment would come into effect within the next 2 weeks. Oct 2011 - letter from Frederickson, who were one of the 6 listed, stating that they had been appointed as JD Williams' agent to collect the debt. (Is that the same as an assignment?) Oct 2011 - Nov 2011 - letters from Frederickson, then a couple from Lewis Debt Recovery in 2012 Feb 2013 - letter from JF Williams stating that they sold the account to Lowell on 20/12/2012 March 2013 onwards-letters from Lowell, Hamptons Legal and Red, both acting on Lowell's behalf. Bizarrely, in Oct 2013, another letter from JD Williams to say they had sold the account to Lowell, on 20/12/2012! This week - letter from Lowell, stating they had sent the account to BW legal, and a 'Letter of Claim', from BW, threatening court action, (stating I needed to contact them to pay the outstanding amount, to avoid court action). Both letters were in the same envelope and dated the 20th February, but not delivered until 8th March, which is the same date as on the court claim. Finally the court claim yesterday and the letter from them this morning. Court claim issue date is 8th March 2017 It states a default notice has been served, but I can't find one, and I have upwards of 40 letters in my possession, which have been received successfully. The amount of the claim includes £35 court fees, £50 legal representative fees and statutory interest pursuant to section 69 of the County Courts Act 1984 at a rate of 8% per annum from the date of the assignment to 20/12/2013 Noddle shows the default date as 4/10/2011 although, as I say, nothing was paid to the account from Jan 2011. Do I have a case to go straight for statute barred, and/or should I pursue other avenues?

-

Hi I'm hoping for a bit of help. I received a court claim from BW Legal on behalf of Lowell who have bought an old debt from Vanquis. I foolishly misread some information and in attempting to acknowledge service on MCOL entered a defence. That said I have issued a CCA request and a CPR 31.14 request for the credit agreement, default notice, deed of assignment and terms of the agreement which were all referenced on the claim form. None of the above have been received and we are now well past the deadlines. I've received the directions questionaire and agreed to mediation, at the same time requested the above in advance to enable me to prepare. Since then I've received an offer from BW legal of a 20% discount valid for 14 days on the balance of circa £2000 but still no documents just a statement of account with all of my transactions. I've today received the mediation questionnaire from the court which asks me to confirm that I require no further documentation otherwise mediation is unsuitable. My questions I guess are whether my mistake with the defence means that my CCA and CPR requests don't need to be complied with? Also whether I should proceed with mediation if only to say I'm still without the documentation to review the claim? Or should I be doing something else entirely? Any advice would be much appreciated.

-

Hi again guys, been having great success so far with these debts (will try to find a link my other post which is about over a year old to give you some context) So the quick back story Lowell owned the debt, bpo was acting on their behalf sent a CCA request bpo passed it back to lowell after not responding, lowell have then ask their legal team (phahaha) lowell solicitors to start court proceeding, rang them for abit of fun informed them that no cca has been sent, they have now supplied me with the request but it is unreadable (will update this post with a picture when I can) Because it is unreadable is it enforceable? It's crazy blurry you have to guess what words say I am also going to start a complaint as they have passed the debt on that was in dispute (no acknowledgement of the debt what so ever) In fact blurry is a bad way to describe it, you can read the larger letters but the smaller print (90% of the page) looks like it been written in a ink cartridge fountain pen on a piece of kitchen roll Edit: I would rather not just ignore it as it is very close to becoming statue barred (a few months) and would rather stall them with some paper work then having to do all of the paper work for a court defence I found this template on another site but I only trust this site for accurate advice what do you guys reckon? Dear Sir, Thank you for the reply to my letter dated XX/XX.XXXX. Having taken the time to look over the documents supplied in response to my statutory request made under the Consumer Credit Act 1974, I have the following concerns The document entitled “credit card agreement regulated by the Consumer Credit Act 1974” which appears to bear my signature fails to comply with the requirements of the Consumer Credit (Cancellation Notices and Copies of Documents) Regulations 1983 (SI 1983/1557). In particular section 2 of the Regulations As you will be no doubt aware, the Copy Document Regulations requires that documents are easily legible and clearly the terms of the agreement are not easily legible, infact far from it. Many of the terms are blurred and cannot be interpreted and I am further unable to make out the prescribed terms as required by schedule 6 column 2 of the Consumer Credit (Agreements) Regulations 1983 (SI 1983/1553). After taking advice on this matter, I am of the belief that this agreement that you have presented before me, as it stands would be unenforceable even by court order. Therefore, I require that you provide me a clearly legible copy of the agreement, where all the terms are clearly legible Should you not be able to supply a clearly legible copy, I would suggest that you give consideration to cancelling this account and reducing the balance to zero. Of course the alternative would be to seek a declaration of my rights under Section 142(1) of the Consumer Credit Act 1974. am advised that with the documents that you have supplied there would be an extremely good prospect of success with such a declaration, however, I am mindful of additional costs that such action could incur both on my part and on yours so I trust you will give consideration to this request Yours Sincerely

-

Hi I am looking for some advice regarding Lowell debt collections. I originally had a Littlewoods catalogue account that had an outstanding balance owing on it due to coming out of work I was paying Littlewoods an agreed £5.00 per month. it then received a letter form Lowell April 2014 to say they had purchased the debt and would like a payment in full. I spoke to the company and explained the situation and was advised by an agent that the £5.00 per moth would be fine to pay to clear the debt owing of £64 I have recently been considering getting a mortgage and have noticed on my credit file they have filed defaults on every payment even though they had agreed this would be fine and did not say that anything would be recorded on my credit file. just wondering if there is anything I can do to get this removed the balance was paid off on July 2015 the account start date was September 2009 account end date was July 2015 thanks in advance

-

hi i am looking for a bit of advice, with a debt i was disputing, it was with a credit card with capitol one, debt is 2052.68, the account was defaulted back in 2013, and registered with lowell, i have not heard anything from them in years, i got a letter last week regarding this debt saying to pay it immediately, or a claim form issued by the court, and a decree registered against me, not sure what the right course to take with this, any advice would be greatly appreciated

-

Hello All, i had a credit card with creation 3 years ago with an outstanding balance of £1000. After doing the rounds with several DCA's it is now with lowells who are taking court action. i have acknowledged service with an intention of defending the whole amount as i believe the debt was sold unlawfully as no default and termination notices were ever received although i guess the assignment letter could be classed as a termination. Is it worth sending them a CPR 31:14 request as it is obviously small claims? POC Are:- (no cca attached) 1/ the defendant entered into consumer credit act 1974 regulated agreement with creation. 2/ the defendant failed to maintain the required payments and a default notice was served and not complied with. 3/ the agreement was assigned with claimant and notice given to defendant 4/ despite repeated requests the amount remains outstanding. 5/ (a) the claimant claims £1000 (b) interest pursuant to s69 county courts act 1984 at the rate of 8% per annum from the date of assignment to date of issue accruing at a daily rate but limited to one year © costs thanks in advance

-

Some advice please. I have Lowells sending threats for court action decided to send off the standard CCA request to lowells and SAR request to Vanquis (however I still am waiting for a response from Vanquis 6 weeks on). I have received the following response from Lowells which is a application details print screen and a copy of the agreement. is this complying with my request and all the details I'm supposed to get or are they hoping it'll keep me quiet to pay up? Many thanks in advance lowells paperwork edited.pdf

-

Hello; I have received a claim form from Northampton from Lowell RE: an old AQUA debt. Genuinely after stop paying them a while ago due to unemployment I have not had any correspondence from from a while until I received the claim form. I will read on here about similar cases but wanted to know where I stand what I could do going forward? Any help will be much appreciated. Thanks T

-

Hi all I am looking for some advice about a CCJ Claim for I have received in regards to a Lowell Account (Looking from it seems to be a lot of these at the moment) In order for us to help you we require the following information:- Name of the Claimant ? Lowell Portfolio 1 LTD Date of issue – 17th Feb 2017 (on form) What is the claim for – the reason they have issued the claim? 1) The Defendant entered into an agreement with 02 (uk) Ltd under account reference XXXXXXXXXX ('the agreement') 2) The defendant failed to maintain the required payments and the service was terminated. 3) The agreement was later assigned to the claimant on 21/12/2012 and notice was given to the defendant. 4) Despite repeated requests for payment the sum of £941.46 remains due and outstanding. and the claimant claims a) The said sum of £941.46 b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of Issue, accruing at a daily rate of £0.206 but limited to one year being £75.32 c) costs What is the value of the claim? £1016.78 plus costs Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? mobile debt When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt Purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure but more then likely Did you receive a Default Notice from the original creditor? Not as far as I am aware but no paperwork to prove I didn't (moved since 2012 and no sign of paperwork) Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Again not sure Why did you cease payments? Loss of employment and family break up What was the date of your last payment? According to credit report May 2012 (Listed under Lowell not 02 tho I have only ever paid 02) Was there a dispute with the original creditor that remains unresolved? Not as far as I remember Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management Not with Lowell I did try with 02 Also to add - the claim does have my surname wrong but only by one letter in the middle so could be a typo. Any help I can get with this would be greatly appreciated Thank you all in advance.

-

Received a phonecall last week from BW Legal, as i dont do phone calls with anyone unless absolutely necessary nothign was actually discussed. Received today a county court claim, which probably explains the phone call. A very old O2 Account which in essence was not paid due to being made redundant in 2010. I cannot be exactly sure of the dates but last payment would of been made around July/ August time 2010 if not even earlier. Attempted to come to an arrangement with O2, to no avail they eventually closed the account added an early termination fee and never heard anymore from them. I provide details of the claim etc below any advice woudl be greatly appreciated: Name of the Claimant ? Lowell Portfolio 1 Ltd Date of issue – 08/12/2016 Date to acknowledge) = 26/12/2016 Date to submit defence = 09/01/2017 (33 days in total) What is the claim for – the reason they have issued the claim? 1.The Claimant's Claim is for the sum of £ 2.The Defendant failed to maintain the contractual payment under the terms of the agreement and a default notice has been served and not complied with. 3.The claim also includes statutory ineterest pursuant to section 69 of the County Courts Act 1984 at a rate of 8.00% per anum ( a daily rate of £0.11 from the date of assignment of the agreement to xx/xx/2012 being an amount of £ What is the value of the claim? less than £700 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Mobile Phone Account. When did you enter into the original agreement before or after 2007? After. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell Portfolio 1 Were you aware the account had been assigned – did you receive a Notice of Assignment? No. Did you receive a Default Notice from the original creditor? No. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No. Why did you cease payments? Made redundant and disputed account due to unexplained charges and costs. What was the date of your last payment? Estimated prior to June 2010 but definately no payment after September 2010. Was there a dispute with the original creditor that remains unresolved? Yes, challenged regarding charges added to account and refusal to accept payment plan offer. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes. Original Creditor was offered monthly payments but demanded payment of account in full and early termination fee.

-

I have a CCJ from BW Legal / Lowell Portfolio that I was issued 2 years ago. It is for around £2000 from an old credit card debt. I'm not sure if there were any PPI payments made for the card, but there were probably some 'unfair' charges on there. I'm pretty skint at the moment, I'm trying to get a business off the ground can't get any funding due to this CCJ (my credit is fine apart from this). I'm thinking of offering them maybe £200-400 as a full and final offer, I wondered if anyone would be able to answer a few questions first... How likely is it that they'd accept 10-20% as a full and final payment? Would this mean that the CCJ was marked as 'satisfied'? Would this actually improve my credit score? Thanks, for any help.

-

Hi all I had a Very Account which was passed onto Lowell Financial and received a Claim Form dated 24th March from their solicitors Lowell Solicitors which I assume are the same people. I then received a letter dated 29th March after the claim was issued that they have issued legal proceedings and I would be receiving the claim against me soon as I failed to make payment or respond to their letter of claim. On 5th March I had a miscarriage and was in hospital since 3rd March and for obvious reasons wasn't well and was recovering, I was given the bad news on 23rd Feb. On opening my mail to see how quickly this claim came about I realised that I was sent a 'notice of Acting' letter from Lowell Solicitors dated 22nd Feb with another letter attached to the same letter dated the same 22nd Feb from Lowell Financial stating they have sent it to Lowell Solicitors to arrange payment. I then received a letter dated 28th Feb a 'letter of claim' stating that they have not heard from me and have been instructed by their client - Lowell Financial to commence legal action and issue a claim. There is barely 7 days between the 2 letters and how they expected to allow me time to receive these letters and respond beats me..... . It then went onto saying that in order to avoid this action contact them by 14th March otherwise action will be taken and costs increased. Due to my miscarriage I hadn't opened my mail etc, then the claim arrives. I called Lowell Solicitors and explained the situation and asked them to retract the claim as I was willing to come to an arrangement and wasn't happy that their timing with letters was unacceptable. The lady I spoke with said she'll allow me additional time for the acknowledgment till 26th April to which I have acknowledged the claim online. I told her my mitigating circumstances and she said the only way they could retract the claim was by my defending it..... I need to defend this as soon as possible regarding the timescale issues and my circumstances, and that this claim should never have happened had their letters allowed me time to respond to them. I told her that this has just increased the balance and that I am just getting back to normality and I am on working tax credits. I would really appreciate any help towards the defence and any other advice that would help. Regards IM4347

-

Hi, First of all, I apologise if this was posted in the wrong place. I have just been contacted by Lowell Portfolio about two accounts: 1. An outstanding balance with o2 for £500 odd. I have no recollection of this account. I had an account with T-mobile (now EE) which I defaulted on and have no paid up. This account was taken out in 2010 and defaulted in 2011. Therefore, if i did have an account with O2 it would have been prior to this and would therefore be statute barred? The person that I spoke to could not confirm the date of the default and have gone back to O2 to request more information - however, they have confirmed that I have never made any payments to Lowell on this account 2. An account with Barclaycard that I owed around £1500 on. They said i had a repayment plan set up with them which cleared the bulk of the balance (only £70 left). They said my last direct debit bounced but I have had no contact from them in the 4 years since the direct debit bounced. What is the situation with this balance? it does not show up on my credit report. Thanks in advance for all responses.

-

I've had 2 CCJ's from Lowell appear on my credit file that went to my old address, this meant that I was unable to defend them. During that period Lowell were constantly writing to me at my current address regarding 2 other debts. This meant that they must have known where I live now and could have easily sent the Claimforms there. Is there any precedent for getting these set aside?

-

Hello, So what do I do now? Start paying £1 to Vodafone or does Lowell now actually own this debt? Or do i just leave it as it is for now? I mean, the debt is mine, was defaulted Aug 2016, and I would like to pay it off but can only afford £1/month. Lowell_Vodafone_CAG.pdf

-

Hi Everyone right here is my story, i took out a mobile phone contract with orange about 3 years or more ago now im not going to lie 3 years ago i was a little bugger and thats just say i took the contract out not for the contract and never paid a PENNY so i do owe orange the money, lowell have been sending me letters for years but have only recently threatened court action The thing is a week letter i receive this letter for a discounted offer, does this mean they have no evidence if they are offering me 40% discount, it does say if i dont pay this by the 30th they will take me to court the original amount is for something like £778 and now there offering me to just pay £467 something like that. Below i have attached the letter if you would like any more information please do no hesitate to ask Best Regards Backswine https://ibb.co/iDjBH5

- 21 replies

-

- action

- county court

-

(and 2 more)

Tagged with:

-

Name of the Claimant: Lowell Portfolio Date of issue: 28 July 2017 What is the claim for – the reason they have issued the claim? 1.The claim is for the sum of £640 due by the defendant under the agreement regulated by the consumer credit act 1974 for a J D Williams account with an account reference xxx. 2. The defendant failed to make contractual payments required by the agreement and a default notice was served under s.87(1) of the Consumer Credit Act 1974 which has not been complied with. 3.The debt was legally assigned to the claimant on xxxx, notice of which has been given to the defendant. 4. The claim included statutory interest under S.69 of the county courts act 1984 at the rate of 8% per annum from the date of assignment to the date of issue of these proceedings in the sum of £50. The claimant claims the sum of £700 What is the value of the claim? 700 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Catalogue When did you enter into the original agreement before or after 2007? Probably, but not confirmed Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure Did you receive a Default Notice from the original creditor? No Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Could no longer afford it What was the date of your last payment? Approx sometime in 2012 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I received the above today. Have had a little read around and know I need to state I will be defending and I need to send off a CCA request and a 31.14 letter, which I will do. One question, if I go online to the court page and click the acknowledgement of service, do I still have the full time scale as I am away next week, so wont have the ability to send it later on, however I don't want to limit myself to 14 days from acknowledgement. Thank you

-

Name of the Claimant ? Lowell Portfolio 1 Ltd Date of issue – 07 July 2017 date to submit defence 8th August 2017 What is the claim for – 1) The Defendant entered into an agreement with Orange under account reference ..... ('the agreement'). 2) The Defendant failed to maintain the required payments and the service was terminated. 3) The Agreement was later assigned to the Claimant on 21/12/2016 and notice given to the Defendant. 4) Despite repeated requests for payment, the sum of £160.09 remains due and outstanding. And the Claimant claims a) The said sum of £160.09 b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.035, but limited to one year, being £6.91 c) Costs What is the value of the claim? £242.00 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? Mobile phone account When did you enter into the original agreement before or after 2007? After Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell Were you aware the account had been assigned – did you receive a Notice of Assignment? I was aware Lowell had acquired the debt when they suddenly began bombarding me with communications. Did you receive a Default Notice from the original creditor? Unfortunately I can't recall. I've heard nothing from them (I don't think) since Orange was acquired by EE, and that was years ago. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Actually I cancelled the account in full accordance with the original claimant's cancellation procedure. As a safeguard I also cancelled the direct debit agreement, knowing that no more money was owing. Unfortunately they later claimed that more money was indeed owing on the account, which I completely dispute. However I wasn't able to properly dispute this with them, as they had already referred the debt to a third party, who I beleive was Moorcroft. What was the date of your last payment? I can't be certain, again because this whole matter has been quiet for so very long, but I think it was circa September 2011. That would place us close to 6 years, which I'm guessing may not be a coincidence. Was there a dispute with the original creditor that remains unresolved? Very much so, although I can't evidence this in any way at this late stage, and it's difficult to recall the finer details. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No. There were no financial problems. As far as I am concerned the account was cancelled correctly and paid up in full. Hello all. I've been referred here by a long standing user, and I hope you guys can help... I have received a claim form from Northampton County Court Business Centre, for a claim issued by Lowell in relation to an old mobile phone debt, the validity of which I question. They are claiming £167.00 plus costs, fees etc. I have completed the Acknowledgement Of Service, and I would very much like to defend the full amount of the claim. My answers to the standard questionnaire are above My thanks in advance for any and all assistance you can offer. Dave

- 22 replies

-

- county court

- dubious

-

(and 2 more)

Tagged with:

-

Hi all, Back in 2013 and a period before I had some pretty turbulent financial times. Some of my debts have now dropped off my credit file this morning I got a letter through from Lowell. I've had tonnes before including an offer £350 for a partial settlement a few months back. I have just been ignoring these letters or marking them RTS. I'm just slightly concerned because this one is a different format to usual with the heading 'Pre-legal Assessment'. Should I just continue to ignore? Once I calmed down I noticed the text was less clear than it first appeared - 'whether to transfer' and 'a decree may be registered' The problem is I don't have the money to pay this there is another one with Lowell for about £600 on my credit file if I were to pay I suspect they'd come after me for that too. Also... quick question on the decree. If a decree were to be issued would it drop ofter after 6 years from being issued or 6yrs after the initial default? The default was issued in Oct 2013. Thanks for your help in advance. Lowell.pdf

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.