Showing results for tags 'global'.

-

I received compensation from a DCA for harassment etc, owning to my step sons debts. My step son as not lived with me for 4 years. Have I wrote to I long list of DCAs giving formal notification that he does not live with me and I will consider any phone calls, letters etc Harassment. One debt which the company I received compensation from(which they legally owned) I was told had been totally closed. Today I received a letter from Arrow Globel claiming that that they owned the same debt since 21/12/2012 and that they were appointing Allied International Credit (UK) to manage the debt. They could not have owned the debt since then because the other DCA owned the debt. Nor would the original creditor (orange) have sold then the debt because it is part of a formal complaint I have made against orange who knew that my stepson did not live with me. As anyone any suggestions on how they got this debt because the Original DCA as assured me that the account was sealed.

-

I'm new here so not sure if I'm posting this in the right place. I need some advice please regarding two old debts. One is a CCA debt, a loan originally taken out with Sainsbury's Bank well over ten years ago now. We defaulted on this loan around 2008 I think. Sainsbury's started court proceedings and wanted an order for sale of our house to which I responded that we had other creditors so it was unfair to them. I got advice from a credit counselling service and she said to offer token payments to all creditors. A few years back we received a letter from Arrow Global saying the Sainsbury's debt had been assigned to them and for us to send payments to Restons Solicitors we have been paying them token payments, although we have received nothing more since from either Restons or Arrow Global. Surely they are breaching the CCA by not providing six monthly statements? The other debt is an old overdraft with Lloyds Bank - the token payments are going to Robinson Way but I don't know if Lloyds still own the debt and whether it is just being collected by Robinson Way. Because it's not a CCA I don't know if there's anything I can do to check whether they are authorised to be taking our money. We historically had two credit cards too which we defaulted on in 2008 but these I should imagine are statute barred by now. The reason I am querying the Sainsbury's and Lloyds debts now is that I recently checked with all three of the credit reference agencies and none of them show these two debts. Experian have told me that even though debts do not show on credit reports does not mean they are not owed. I would like to get advice though as to whether I am paying money unnecessarily. I don't trust debt collection agencies to act reasonably and fairly as we have had a lot of harassment in the past. Any advice you can offer would be greatly appreciated.

-

Hi, I could really do with some help. I have been the victim of fraud by a builder working at my property accessing my credit card without my knowledge and running up a huge debt. I very rarely used the card and never received statements in the post. Turns out the statements were being sent but were being accessed and disposed of whilst I was at work. I have been fighting this debt since 2004 with the debt being sold from one debt collection agency to another. Finally Arrow Global instructed Restons Solicitors to take me to Court for the settlement of the outstanding debt which was not caused by me. Unfortunately I lost the court case and the Judge found in the favour of the Bank (they had a better Barrister than me) and now I have to pay back thousands of pounds of debt that I didn't cause. I have been told I cannot appeal the decision. I am being forced to pay the debt whether I like it or not! I am a single mum and cant afford this and shouldn't have to pay something that has nothing to do with me. I have offered a payment of £50 a month just to keep them quiet but they have rejected my offer. They want nearly £300 per month which I cannot afford. Does anybody know who I can talk to clear my name or is it too late now I have gone to court? They also want to do a charge on my property that I don't want. I have since found out this Builder has a criminal record and has done the same [problem] to other people. If anybody knows how I can deal with this, it would be appreciated. The Police were made aware initially when I first found out what was going on , but were unable to help me, stating it was up to the Bank or Credit Card company to protect me as the Consumer and their Customer. I certainly haven't been protected in any way shape or form.

-

Hi, I have a default account with MBNA dated 31/08/10 for a credit card account opened 31/10/97 which has been sold to Arrow Global on 15/02/12. I wrote to Arrow Global to tell them that I do not recognise the £ amount that they are chasing and also that I currently live in Australia, with full residency, in order that they do not try and lodge a CCJ as I am no longer living in the UK. Today I had an email from them '' Please find enclosed of a copy of the statement showing all transactions on this account. At this time we are unable to obtain a copy of your Consumer Credit agreement fromthe original creditor. This account will not be subject to collection activity until such time as the document becomes available'' I never paid for or formally requested a CCA. My question is if they have said that they have asked for one from the original creditor and it is not forthcoming, will they be subject to the normal 'default' even thoughI have not requested this information myself? Really appreciate some clarity!! Thnaks

-

Hi all I got in a lot of debt trouble 5 years ago. I managed to negotiate full an final settlements with all but one - MBNA. I've moved 4 times since then and they never caught up with me. Out of the blue I received a letter from Restons Solicitors acting on behalf of Arrow Global, who apparently own the debt now. The amount is £7,984.39 I am about to send a SAR and a CCA to Arrow Global. What should I do otherwise? Also what sort of F&FS would they offer me now - part of me just wants to get this off my back but obviously if I can string it out or fight it I want to. Thanks Ben

-

Good afternoon, I received a withheld phone call on tues 19th April asking for my ex husband, told them he doesn't live and as never lived here, they asked if I knew where he is, I said I've not seen him for 19 years, then asked about me as this is a joint dept from 19+ years ago, I was so silly to answer their security question and give them my mobile and email address. Wednesday I received a letter from gdr trace saying that they think I'm the person there client wishes to contact, I've not phoned them as yet as this was posted on the 18th before my phone call on the 19th, obviously they are working together. It was a messy devorce which ended my house got repossessed, I've never hidden away as I still pay a monthly payment to this. They said they sent a letter in 2001 to that address and whoever lived there said I didn't live there, I know for a fact my ex would not say he owed this dept or made any contact, I would think this would be statued barred, I'm so worried at the min about all this and would love for some advice, I've seen the template letters that can be send and would this stop contact, somehow I don't think so with this company. I've looked as well on my credit file and everything is ok there. I'm waiting to still received the letter that they said on the phone call, but have not as yet, they told me I had 2 weeks to get back to them when I do get this letter, many thanks in advance I also don't want my ex's name on any letters as this one from GDR TRACE had both our names on it.

-

I had a credit card account with Lloyds, who have now sold my debt to Wescot, this is for around £3k. I was paying Lloyds £1 a month, but for some reason they have sold my debt to Wescot. I called them today to set up a £1 per month plan and they have asked me to contact Stepchange to get an income and expenditure form. I also had a credit card account with Virginmoney, again for around £3k. I rang them today to ask why are they still charging me interest, and they advised me as its been over 180 days in arrears they have sold my debt to Arrow Global. I was also paying them £1 per month. I have not received any communication from AG yet, although its only been a few days past the 180 days so far. Does anyone have any advice what to do for each of these cases, before I go ahead? It should be noted that I also have two more bank account debts with Lloyds and a credit card with Barclays, all of these are in payment plans, which I am paying £1 a month to.

-

Hi, Last month I opened a Clear Score account to check up on my credit score and see how I was doing. Today was my update day, I logged in to find that I have a CCJ against me which was issued on the 16th of March 16. The web site doesn't give much information, case reference, address, amount and which court issued it: County Court Business Centre The problem is that the address they have used is over a year out of date so I have received no paperwork. I moved out of that address in February 15 and into my fathers address to help him look after my step mother who is seriously ill with MS and bed bound. Just last week I moved out of that address into my girlfriends, who is heavily pregnant and due any day. I am really worried that the bailiffs may turn up and I am not certain what debt it relates to or how to deal with it. I have dug through all my old paperwork I have two debts which are not being paid as I believe them to be statute barred. One is with Barclaycard and the other is with MBNA. The MBNA one is the closest matching, it is roughly £200 difference from the balance that I owe them. The Barclaycard is over £1000 difference. If it is MBNA, the earliest letter I still have from them is dated July 2011, stating that "Following previous correspondence, which confirmed the termination of your MBNA credit agreement".... we will be sending it to a DCA. I have various letters from DCA and then a notice of assignment to Arrow Global Guernsey Limited. I don't have the statements or the letter for when I defaulted but I am sure that it was in early 2010 as that is when I got divorced and had serious financial issues. 1) Is it worth me signing up for Credit Expert to see if the MBNA account appears on file (there is no record of it in Clear Score). And or to obtain more information about the CCJ? 2) Is there any other way to obtain information about the CCJ, the only place I have found is Trust Online and it's behind a pay wall so I'm not sure if it will tell me who submitted the claim. 3) Any suggestions on what I should do next? Many thanks for any advice.

-

Picking up some old paperwork that I have not dealt with for some time - advice appreciated on next steps I should take. The address at which I received the last letter (see below) is a family member's and not my own - I'm a little concerned that my family may miss a "letter before action" or claim form should one be sent there. DCA: Arrow Global Guernsey Limited Amount : £7k [approx] Type of debt claimed: Credit card Original agreement with: MBNA Original agreement entered into: Apr 2007 Default notice from original creditor: Yes, Sep 2011 Date of last known payment: 5th Jan 2012 (MBNA), 25th Apr 2012 I&E sent to Arrow Notice of Assignment received: Yes, Moorgate (letter, 25.1.12), Arrow (titled "Notice of Assignment" 14.11.12) Received annual statuary notice ("notice of default sums")?: No Why ceased payments: Divorce, moved home, personal circumstances. Dispute with original creditor: No Communicate financial problems / enter into debt management plan: Yes with MBNA Other pertinent dates: 21/02/2014 CCA request sent. Proof of postage. Copy of Letter retained. 25/02/2014 Letter from Arrow - Confirms receipt of my CCA request. 30/06/2014 Letter from Arrow - Holding letter states they are chasing documentation. 18/02/2015 Letter from Arrow - (One year after original request!) They claim they have supplied a copy of agreement, T&C and statements. No signed agreement - in fact, no evidence to say it was the agreement from the time as far as I can tell. They also state that they are looking to outsource the account. I've not received anything since then, so am hesitatnet to chase, with the caveat above of being concerned about the address issue. Does the fact it took them 12 months to reply have any bearing on how things may go in the future (or court)? Does the fact they have not produced a copy of the agreement with my signature have an impact on this too? Is Apr 2007 before or after an important date regarding these sort of debts (it's something to do with CCAs right?)? Should I just wait and see, or is there another preferable course of action? Thanks in advance for your advice.

-

Hi, this is one of two claims I currently have going against me. Both of which are close to statute barred. This is my bigger worry of the two as this one is only statute barred if you go from the date the last payment was made, however it is not quite six years statute barred if it goes from the date the first payment was missed. Name of the Claimant ? Arrow Global Guernsey Limited Date of issue – 11/12/15 Date to submit defence = 12th Jan (33 days in total) - What is the claim for – The claimant claims payment of the overdue balance from the Defendant(s) and MBNA dated on or about October 06 2003 and assigned to the claimant on Dec 20 2001 Particulars a/c no. 444444444555555555 Date :18/11/2015 Item: Default Balance Value: £8200 Post Refrl Cr: Nil Total: £8200ish What is the value of the claim? £8200ish Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit card When did you enter into the original agreement before or after 2007? before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? yes , I received a notice dated 09th march 2010 Did you receive a Default Notice from the original creditor? yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I dont think so Why did you cease payments? Did a CCA request as I couldn't keep up with payments. I took nearly three months to receive a signature document so account was placed in dispute and payments ceased What was the date of your last payment? 02 december 09 Was there a dispute with the original creditor that remains unresolved? yes, following my CCA request I received a photocopy of a tear off slip with my name on and on the rear of the photocopy was a photocopy of terms and conditions, although they are the same size which makes it look as though they are from the same tear off slip I noticed they have different document reference numbers and dont believe the photocopy of the rear I received was the true rear. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no

-

Hi and thanks for looking at this thread. I am about to defend a claim from an old Sainsburys credit card debt which has literally just become statute barred...I hope! Name of the Claimant Arrow Global Limited Date of issue – 30th Nov 2015 Date to submit defence = 4pm 01 Jan16 (33 days in total) - What is the claim for – 1. The claim is for the sum of £7000 in respect of monies owing by the defendant on a credit agreement held by the defendant with Sainsburys Bank PLC under account number 44444455555 upon which the defendant failed to maintain payments. 2,A Default notice was served upon which the defendant and has not been complied with. 3 By virtue of a sale agreement between Sainsburys bank PLC and the claimant, the claim vested in the claimant who has a genuine interest. The defendant has been notified of the assignment by letter. What is the value of the claim £8000 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account - Credit card When did you enter into the original agreement before or after 2007/ - before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. -- debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure Did you receive a Default Notice from the original creditor? yes, notice dated 11th feb 2010 Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I dont think so but couldnt be 100% sure Why did you cease payments? - first payment missed 24th November 2009 What was the date of your last payment? last payment made 24th October 2009 Was there a dispute with the original creditor that remains unresolved? sent CCA request which took 3 months to arrive. The document they sent had a signature on but it was really just confirming personal details and my signature on the bottom. On the rear of the photocopy they sent me were some reconstructed terms and conditions. I placed the account in dispute and stopped payments. I also asked for a photocopy of the actual rear of the document but one was never sent to me. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? no

-

There is lots of money to be made by those who administer this green rubbish, they are inflicting a lot of harm on the majority of people in this country, while making themselves very rich. They are the main cause of the terrible flooding in this country, they in my opinion deliberately failed to do the dredging required, causing flooded homes and farm land.

-

I'll try to keep it brief but succinct: I've received various bog standard letters from Shoosmiths on behalf of Arrow Global, about a HSBC Credit Card debt they bought from the Bank in 2014. I have taken no action with regard to these. Shoosmiths have however today tried to up the ante by threatening Court Action unless they have my proposals for repayment within 14 days. Is it appropriate, at this stage, to send a CCA Request letter (and am I correct in sending it to Arrow Global, who are the owners of the debt, and not HSBC, the original creditor? The letter from HSBC that I have, dated July 2014, states that "Arrow Global is now the owner of the account"). Should I also request that Arrow Global advise Shoosmiths not to take any further action until / unless my CCA Request has been complied with? Should I further write to Shoosmiths, advising them of the request that I have made of Arrow Global? This debt was previously (2012) being handled by CapQuest, on behalf of HSBC. I sent a CCA Request at that time. CapQuest acknowledged that they were unable to provide copies of the relevant documents. Should I advise Arrow Global / Shoosmiths of this fact, or is it better to keep my powder dry at this stage? If the above course of action is not the correct one for me to take, I'd be most grateful if you could point me in the right direction! Many thanks Airtomoreira

- 19 replies

-

- arrow

- county court

-

(and 4 more)

Tagged with:

-

credit card debt. was with Arrow. they sent letter that all "queiries, correspondence and payments" should be with Restons. recently got letter from Restons. I sent a CCA to Restons.(£1) They have returned it saying they are not the creditor, and that I made the PO payable to them. I am confused. Have I wasted all that time and effort (sent as Track and Trace)? do I resend CCA to Arrow?

-

Hello, As seems to be the case with a few people on here and other forums, I have recently received court papers from Arrow Global on what I assumed was a written off (or statute barred) debt. I am now aware of the standard template and answers I need to give - but I did just have a quick "pre question" - it would appear that I made a "rogue" payment on this account (not to Arrow - but to a different DCA) in 2012 - I had a Standing Order set up on an old bank account - forgot about it - and happened to have enough money in account to pay it - other than that - the previous payments were made in 2010 - I know this is still within the 6 year period - however, it does seem a bit confusing as to "last payment/contact" concerning a debt - I thought I'd read somewhere it was more a case of when a payment was "due" rather than when an actual payment was made? Also - I'm assuming if I made an agreement to repay in instalments with a DCA, then new "due dates" would have been set. I really haven't had any correspondence about this debt for several years - it has not (and is still not) showed up on my noddle credit report. The claim is for a hefty sum of money (more than £10k!) - and I really am in no position to pay it off - even over 5 years. I would appreciate some advice to come to my best case scenario. I will post up the answers to the questions in the next day or so when I get a chance. Many thanks in advance for any help. thanks b799

- 149 replies

-

- arrow

- attachment

-

(and 3 more)

Tagged with:

-

I have received a claim form from Restons / Arrow global dated 10th December. Date of issue – top right hand corner of the claim form – this in order to establish the time line you need to adhere to. The are claiming just short of £4000 for an old loan debt The loan started in 2005 and should have completed in 2010. I was in a serious amount of difficulty in 2009. I used the advice from another forum (cant recall which sorry) to send a number of template CCA request letters and the account has been in dispute without payments since June 2009. I believe that I should send a CPR31.14. Also, I should acknowledge the claim online within 14 days and send a defence within 28 days. It will be difficult for me to find the money quickly and hopefully the court date is later in the year to give me more time so I am very stressed right now.

-

Name of the Claimant ? Arrow Global Ltd Date of issue – – 24/2/2016 What is the claim for – 1.The claimants claim is for the sum of £3480 being monies due from the defendant under a regulated agreement between the defendant and Marks & Spencer Financial Services PLC(acount no. xxxx) and assigned to the claimant on 30/1/2013, notice of which has been provided to the defendant. 2. The defendant has failed to make payment in accordance with the terms of the agreement and a default notice has been served pursuant to the Consumer Credit Act 1974 3. The claimant claims the sum of £3480 4.C has complied , as far as necessary with the pre-action conduct practice direction. What is the value of the claim? £3480 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? credit card When did you enter into the original agreement before or after 2007? after 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. ARROWS Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? I may have but it was many years ago if I did, around 2006/7 possibly Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I have received nothing since september 2013 Why did you cease payments? I was in financial difficulties so entered into a DMP with Payplan which I ended in September 2013. What was the date of your last payment? I made my last payment to Payplan in either August or September of 2013 Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? Yes I have acknowledged the claim and that I intend to defend it all and have sent off my CCA and CPR requests.

- 19 replies

-

Dear all, I am new to the forum and in a bit of a panic. I just don't know what to do. We have been in a debt management plan since 2008 and so since then I of course have not had any credit. I've had a letter from Shoosmiths and now a Court Claim via Northampton County Court Business Centre about an Overdraft I supposedly had with M&S. I thought this strange as I have never had a bank account with M&S. The Particulars of the Claim actually state: The claimant claim is for the sum of £4219.76 being monies due from the defendant to the claimant as a consequence of the defendant incurring an overdraft whilst operating a bank account. It says the debt was assigned to them on 30/1/13 and it says they notified me of that but i have no record of that. I pay another debt to Arrow Global though so I may have received something and assumed it to be part of that. I just don't know. I did have a Personal Reserve with M&S but this was operated like a loan. There was not a bank account. The sum of the Personal Reserve was approximately £3000 but this has been part of the Debt Management Plan so I have no idea what this refers to. I sent a letter to Shoosmiths stating I din't know what they were referring to and that if it is true it is a very old debt so queried their legality in asking for it. I think we crossed post with this court summons though. I've said to the court I will defend all of it but I have to write a defence and I don't know how to do that. Can my defence be that I have no knowledge of that account and have asked for them to prove it is genuine? Losing sleep over this and have that awful sick feeling in my tummy. I don't shy away from my responsibilities and have paid back over £20,000 in debts. I would really appreciate any advice you could give me.

-

Hi, So the other half received an initial letter from Arrow Global today saying that they are trying to contact him about a personal matter aka trying to recover a debt. After reading other posts myself and the OH are in two minds whether to ring them as most have said to deal with them in writing. However without phoning them we can not access how much debt they are trying to collect and from what company they are collecting on behalf for. Any help on this would be great!

-

Hi all, Can I ask for some advice, I have sent a CCA request to NCO Europe and sent a chaser as had not received a response. They have sent the below. Do I need to make payments and can they reflect this negativity in my credit report until they supply the requested info? Would anyone be able to advise how I respond/any action I need to take? I was led to believe my account had to be put on hold during this time? Good Morning/Afternoon, NCO ref: ***** Arrow Gloabl Ref : ****** Balance : £767.41 Thank you for your recent correspondence regarding our mutual client, the content of which has been duly noted. As we made you aware with our last email , we are chasing this as a matter of urgencey. As soon as we have any response from Arrow global we will be in touch with yourself. However we regret to inform you at this time that there is a contractual amount attached to this account at £1.19 per calendar month. This is from the original terms & conditions you would have signed when they first opened the account. We have to make you aware failure to meet the contractual amount may result in arrears on your account. This may lead to their account being updated as defaulted, which will have a negative impact on their credit rating, and make it more difficult to secure further lines of credit for up to six years after the default date. No interest or charges are being applied

-

Hi Everyone, I wonder if anyone could help me. I've received a letter from Moorcroft Group regarding a debt bought by Arrow Global. To my knowledge I haven't paid anything towards the debt. The original loan was taken out in 2006-2007. I got made redundant from my job in 2008 and stopped making payments because I couldn't afford to be making payments. I couldn't even get any assistance (job seekers allowance) because I was married and my wife was the only one working and she was working too many hours to get any help. Now here we are in 2016 I'm now receiving letters about this debt. I responded to them via email stating that in no circumstances am I acknowledging this debt as I believed it was now statute barred. They have replied stating that Arrow Global have informed them that a payment was made in 2011 but I have been through my records and cannot find anything regarding this payment. I have sent them another email stating that I want to see physical proof of where the payment came from and that I still do not acknowledge the debt and will not do so until I receive the documents. My next question is this. Would the emails I've sent count as a communication and therefore restart the clock on the 6 year limit even though I have said that I do not acknowledge nor take any responsibility of the debt until I get original documents showing when the payment was made etc. Any help or advice would be appreciated. Kindest Regards, Brett Rogers

-

I have recently applied for a mortgage and found a default on my credit file from Arrow Global. The debt i believe is in relation to a business loan i took out with HSBC in 2005, the business was shut down approx 3 years ago as well as all associated accounts including i assumed the loan account, HSBC informed me nothing was owed when i shut the accounts, they even transferred some money that was in the current account to another business account i had with them. I received a letter from Arrow Global in April 2016 mentioning a debt and i contacted them directly for more information, they never returned my calls. I have spoken to HSBC this morning who have just said that the account was closed? They wouldnt give me any further information. I have spent years perfecting my credit rating and to say i am absolutely livid about this default is an understatement, my mortgage was rejected and my personal credit rating completely trashed. The default was put on in February 2015!!! What can i do, i have today sent SAR requests to both HSBC and Arrow Global as well as request for the record of default notice to Arrow Global. On my credit file the address for the default was a house i lived in over 10 years ago?? Latest letter says debt has been passed to Moorcroft Group PLC I am contemplating paying the amount owed £910 to mark it as satisfied but i dont want to pay what i have been told isnt owed, money is not an object and i will gladly pay whatever it costs to get this default removed.

-

In order for us to help you we require the following information:- Claimant: Arrow Global Limited Issue date 9 / 8/ 2016 What is the claim for – 1.The claimants claim is for the sum off £9500 being monies due under a regulated agreement between the defendant and MBNA europe and assigned to the claimant on **/11/2015 notice of which has been provided to the defendant . 2. The defendant has failed to make a payment in accordance with the terms of the agreement and a default notice has been served pursuant to the consumer credit act 1974. 3.The complainant claims the sum of £9500 4. C has complied as fas as is necessary with the pre action conduct practice direction . What is the value of the claim? £9500 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? in 2003 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. - Arrow Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Not aware of this Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Not sure What was the date of your last payment? Dec 2012 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? No Hello Received the above claim on 12 8 2016 ,I was unaware of this debt until i received the paperwork , I was not living at my address for 2 years as i was renovating it and moved back in april 2016 . I was receiving post there but dont recall and default notices . Any help would be much appreciated Thanks

- 24 replies

-

- arrow

- county court

-

(and 2 more)

Tagged with:

-

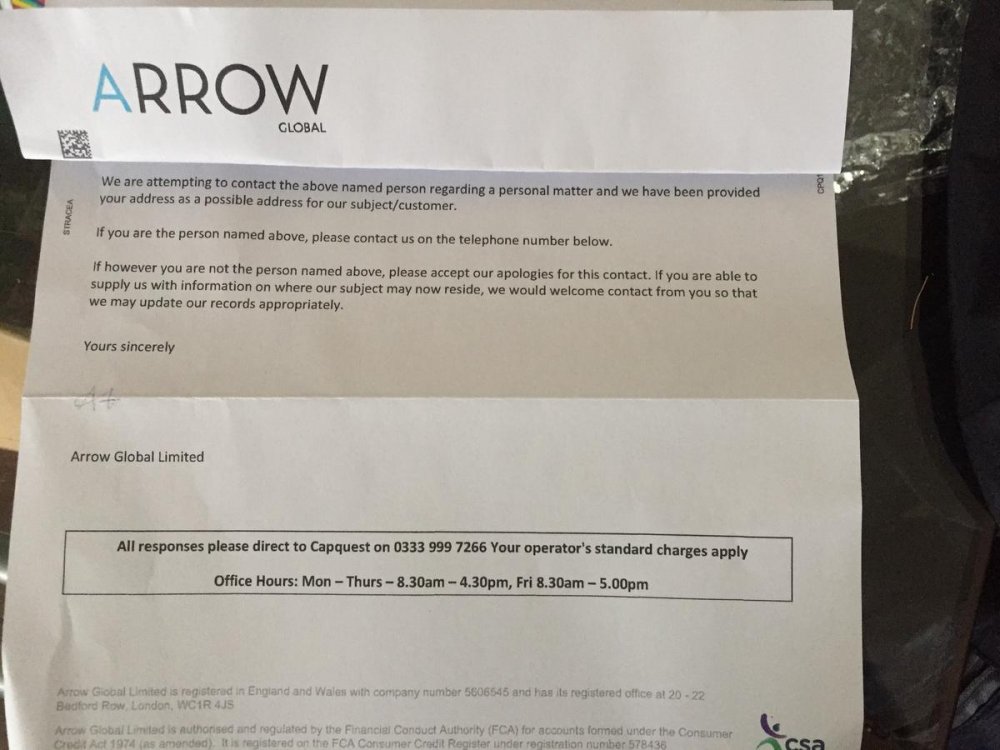

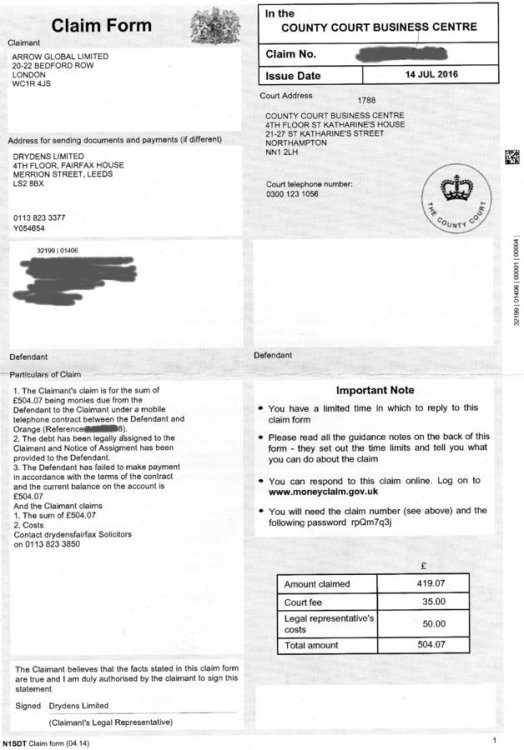

Hi To all . new here and seeking some advice , I have received a claim form and a letter on Friday relating to an old orange mobile debt from 2011 which has been banded about between several debt collectors over time . I am just asking advice and what is the best way to go forward with this. I do not have any old paperwork so I have no records of whether I received default ect . regards

- 19 replies

-

- arrow

- drysdensfairfax

-

(and 2 more)

Tagged with:

-

Arrows/Restons Claimform - old Orange mobile 'debt'

peter78 posted a topic in Financial Legal Issues

Hi – wonder if you guys can help. I have acknowledged on line with Moneyclaim – and now need to prepare a defence… Name of the Claimant: Arrow Global Limited Date of issue – 26TH July 2016 Defense due: 25th August 1.The claimant claims payment of the overdue balance due from the defendants under a contract between the defendants and orange dated on or about October 2010 and assigned to the claimant on December 2012. Default balance £439.63 Court fee £35.00 Legal fee £50.00 What is the value of the claim? £524.63 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? MOBILE PHONE ACCOUNT When did you enter into the original agreement before or after 2007? AFTER Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. DEBT PURCHASER Were you aware the account had been assigned – did you receive a Notice of Assignment? NO Did you receive a Default Notice from the original creditor? Not sure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? NO Why did you cease payments? I only remember I wanted to cancel the contract – and discussed with them – but cant remember why or what happended? What was the date of your last payment? August 2011 I think Was there a dispute with the original creditor that remains unresolved? Only in trying to cancel the contract – I seem to recall I wanted to cancel and had to wait 1 month until the year was up. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? NO Do I need to request a SAR from orange and a CPR31.14 FROM Arrow? In the meantime how would I prepare my defence?- 34 replies

-

- action

- county court

-

(and 3 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.