Showing results for tags 'rises'.

-

The number of people falling victim to identity (ID) theft in the UK has risen by almost a third, figures suggest. Data from fraud prevention service Cifas shows that 34,151 confirmed instances of ID fraud were recorded in the first quarter of the year. Identity fraud occurs when criminals abuse personal data to impersonate a victim or to create fictitious identities to obtain products and services. Avoid identity theft and fraud Identity theft can happen by taking documents from your rubbish bin or by making contact with you and pretending to be from a legitimate organisation. There are simple steps you can take to protect yourself against identity fraud. If you receive an unsolicited email or phone call from what appears to be your bank or building society asking for your security details, never reveal your full password, login details or account numbers. A bank will never ask for your PIN or for a whole security number or password either over the phone or via email so never share your PIN with anyone. Create strong passwords for use online, and don't use the same one for every website you login to. Protect your internet connected devices with up to date security software. Don’t leave things like bills lying around for others to look at. Don’t throw out anything containing your name, address or financial details without shredding it first. If you’re expecting a bank or credit card statement and it doesn’t arrive, tell your bank or credit card company. If you move house, ask Royal Mail to redirect your post for at least a year. http://www.which.co.uk/consumer-rights/problem/what-is-identity-theft

-

Hello All, I recently gained a promotion at work, all be it in title only. I now have the title to cover the actual work and job I do and have done since starting with this company 5 years ago. With this title change came a pay rise, a percentage increase on my previous salary. I have been informed that due to this "Promotion" and pay increase that I will be removed from consideration in the annual pay rises. The company also failed to process the changes in time to reflect on my last two months pays and have said that will backdate once complete. Is it right, legal or fair that I should miss out on consideration due to the timing of this promotion. This change led from our annual appraisal where I, again, voiced my displeasure at my title and inaccurate job description. This is despite me returning all relevant documents etc within their given timescale.

-

There is notification Santander 'intend' to raise the int rate by half percent. The reason it is 'being considered' is because of 'the increased cost to Santander of raising the money which we lend to our customers, including what it costs us to provide you with your mortgage(what ever that is)' apparently those reasons in the mortgage conditions. Nothing mentioned about savers rates so I presume there's no connection there:madgrin: I just feel the BOE rate is low for a reason. How much can these lenders raise the int rate until someone decides to do something about it. I can hear the arguments from the hard line who say tough bananas but it doesn't have to be this way, I hear business economists are getting fraught over Government decisions. Anyone else with an int rate rise from other lenders?

-

TV license fine rises to £4,000 read here http://recombu.com/digital/news/tv-license-fine-rises-to-4000_M13268.html The penalty for not buying a TV license is set to sharply rise, after ministers announced a quadrupling of the maximum possible fine from £1,000 to £4,000. Previously, those who failed to pay for a TV license faced a £1,000 fine and a criminal record. In 2012, almost 180,000 TV license-related criminal cases were brought before the courts, with 70 given a custodial sentence. The reforms of the financial penalties surrounding TV licensing are intended to persuade the courts to issue more fines, and to move away from custodial and community punishments. This announcement comes in the wake of ministers announcing their intent to decriminalize non-payment of a TV License from 2015 onwards. Other financial penalties being increased in the same proposals include those for motoring offenses. Speeding on a motorway will soon attract a maximum fine of £10,000, whilst breaking the speed limit on dual carriageways will attract a fine of £4,000 A TV license is mandatory for anyone who watches live television in the UK, regardless of the device used. It costs up to £145.50 per year, with discounts available for those with black and white televisions. Revenue earned from the license fee is used to pay for the BBC. A TV Licensing spokesperson said: “Increasing maximum fines is a Government decision and not something we have requested. The average fine for TV License evasion is £169. Fines are guided by the Magistrates’ Courts Sentencing Guidelines which, we understand from the Sentencing Council, are not set to change.”

-

I recently received a pay rise in work bringing my hourly rate of pay above the old national minimum wage. I am aware that the minimum wage has recently increased. If my hourly rate with pay rise before the NMW increase was lower than the new NMW (£6.31), is my employer allowed to simply pay me £6.31, or must the new NMW also see the pay rise? And are employers allowed to revoke an increase in pay?

-

Hi all Now 5 of the big six (with speculation mounting that the final one, EON is due to make an announcement of a 6% increase) are increasing their prices, make sure you pay the correct rate for your energy! On the day the price change is due to take effect, make sure you give your supplier meter reads. This will ensure that you are charged for the correct number of units at the old and new rates. If your supplier hasn't got a meter read they will estimate based on previous consumption.

-

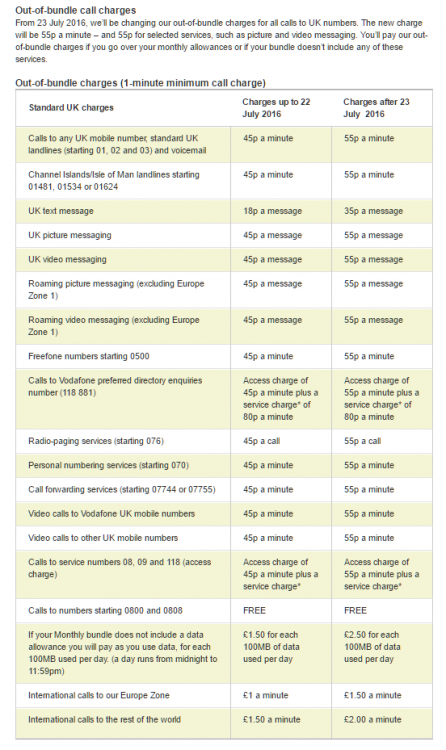

Consumers and small businesses should be allowed to exit their landline, broadband or mobile contract without penalty if their provider increases the cost of their monthly deal, Ofcom announced today. Ofcom is telling providers how to interpret and apply current telecoms sector rules2 in relation to price increases during fixed-term contracts. Ofcom is also confirming the cancellation rights it expects providers to give consumers following price increases. This Guidance sets out that: Ofcom is likely to regard any increase3 to the recurring monthly subscription charge4 in a fixed-term contract as ‘materially detrimental’ to consumers; providers should therefore give consumers at least 30 days’ notice of any such price rise and allow them to exit their contract without penalty; and any changes to contract terms, pricing or otherwise, must be communicated clearly and transparently to consumers. http://media.ofcom.org.uk/2013/10/23/protection-for-consumers-against-mid-contract-price-rises/

-

As we all know that Brighthouse introduced the new single pricing agreement at the start of September 2013 & increased the interest rate to a whopping 67.9% minimum. If you did not know or were aware of, at the same time Brighthouse introduced a sneaky little price rise in the cost of their goods at the same time. The cost of goods purchased from this company increased by 25% that is the cash price displayed, over the terms of the agreement that means those products will cost you the consumer more. If you are unsure about the reliability of this information, I suggest that you visit your local store & ask them. They cannot deny it, Also ask them about the responsible lending policy that they are meant to adhere to. It states that no more than 20% of a customers weekly income can be used to pay Brighthouse, but again I know that is not adhered to.

- 6 replies

-

- brighthouse

- price

-

(and 2 more)

Tagged with:

-

http://uk.news.yahoo.com/barclays-pay-more-mis-selling-114845064.html#uXXP0pr

-

- available

- barclaycard

- (and 4 more)

-

Just heard about this... CAMPAIGNERS have condemned a price rise on mobile phone contracts worth an estimated £52 million from telecommunications giant EE. • EE price rise condemned by consumer campaigners • 3.3 per cent hike criticised as users will potentially see prices go up mid-contract Everything Everywhere announced the 3.3 per cent rise on Orange and T-Mobile contracts to take place on April 10 and May 9 respectively. Consumer watchdog Which? said it was a natural assumption by customers that a “fixed term” contract also meant fixed prices. Which? executive director Richard Lloyd said: “It is outrageous that Everything Everywhere is forcing T-Mobile and Orange customers to collectively pay almost £52 million more per year for mobile phone contracts they thought were fixed.” But EE insisted that contracts subject to the rise for 3G customers was never fixed price. They added that they were now introducing fixed-price contracts. A spokeswoman for Ofcom said: “Ofcom is aware of the pricing changes announced by EE. While current rules allow for contracts to include price increases in certain circumstances, Ofcom is consulting on how to better protect consumers from price rises during fixed contracts. Ofcom is currently running a consultation on mid-contract price rises and expects to reach a decision in June. Was wondering how this affects my current 24-month contract (currently 9 months in) and whether or not I can claim breach of contract?

-

Hi all, ive been with 3 for seven years now, i have 2 contracts with them at £15 a month each they are phone upgrades, so i have another15 or so months until im contract free. They sent me an email today stating that they are increasing my monthly payments by 53p, not alot, but my agreement was 15 a month not £15.53, now if i cancelled early i get a penalty, so iam not happy about this really surely if they have altered the contract i should be contract free and able to cancel anytime now, to be honest im sick of their special offer calls from india 3 times a day, so iam considering cancelling..regards..jim

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)