Showing results for tags '@mbna'.

-

Hi, Sent a CCA request to MBNA who i have been paying on a DMP with Stepchange 10 days ago, have just found my original welcome letter and it is with Bank Of America / Amazon. I have not had a reply as yet. Account opened in 2012. Wondering if i should have sent the request to BOA rather than MBNA Cheers

-

Hi There, Been playing games with MBNA for months now on CCA etc and they passed onto PRA Group to chase, they have come back now and said the application was done digitally! Not sure where I stand now or what I can do? Thank you in advance for your help. Regards Steve H

- 1 reply

-

- application

- digital

- (and 4 more)

-

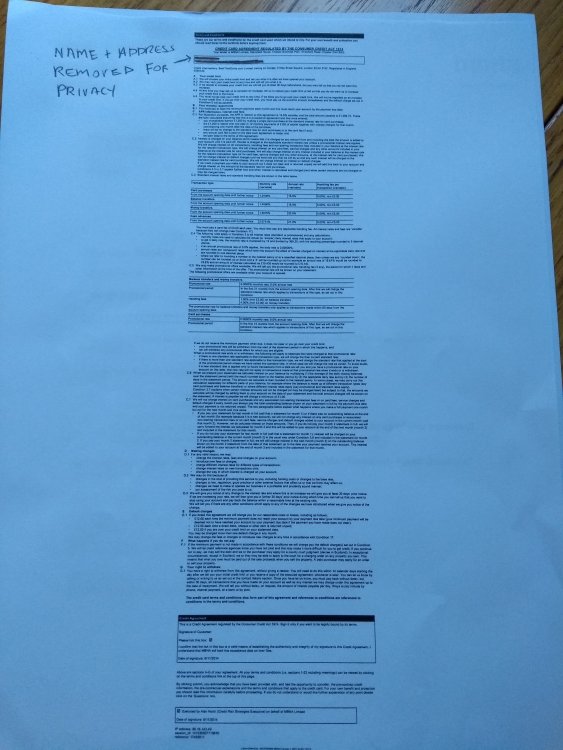

Had the following back from MBNA in response to a CCA request. 2 sets of T&C's, one current, and one supposedly from the time they card was taken out (not sure how I'd actually verify that) A summary statement showing current balance And a "copy executed agreement" Have uploaded the covering letter and the redacted "copy executed agreement". Basically, is this valid? This card was taken out in late 2014, and from what I've read it seems like it probably is a valid an enforceable response to my request, but would like to be sure before taking next step (MBNA bluntly rejected a recent full and final offer of around 60% of balance, claiming they never accept such offers. I should also mention that the debt is still with MBNA and no payments have been made for 3 months now. Current balance is a around £10.5k. Borrowing from family and selling a few things I reckon I could raise £8k tops. It doesn't seem like MBNA would accept this as a full and final, and all the while the interest mounts up.

-

Hi, Im trying to unravel my late father's very complicated finances, as I'm his executor. I found a letter from Hoist Finance dated from last year stating they own the account, with an outstanding balance of £2131.92. When I phoned to say he'd died they told me it would be passed to 'Philips and Cohen' - this was mid-January and I've heard nothing (luckily). Having read these forums I then wrote to MBNA requesting all his account data but they replied stating the 'GDPR only applies to personal data relating to a living individual'. is this true?There's also a letter relating to another MBNA debt from Link Financial, so they have sold the two on. I need to know how old these are etc. Letters scanned and attached. The reason I'm confused is I've also written to Santander (using the same template letter) and have received all the loan info so they obviously have different rules! - I'm not willing to settle anything unless I know how old these debts are and what they relate to. We couldn't find any paperwork at my Father's house. Any advice as what to do next - I did send certified copy of probate certificate with my requests. Many thanks for reading! scan0041.pdf scan0040.pdf

-

Hi, my balance was £6,700 on my MBNA credit card and paid £4,409 which made my new balance £2,224 owed. My direct debit then paid the minimum of £67 which should of then made my newer balance £2,157 but this did not happen, instead, my balance owed went from £2,224 to £2,291, adding £67 to the debt rather than deducting it. I'm currently in a interest free offer and I have not used my card. This has never happened before, it's strange.

-

Hi, Several months ago I received a form in the post from MBNA advising me that PPI may have been added to the Credit Card I had once had with them. I found this strange as I had clearly said when transferring the balance to the MBNA card, that I knew what PPI was and didn't want it! Some 4 weeks after completing the form I received a cheque for £572.62; happy days one would think. However during my time with MBNA I had lost my job and got into financial difficulty; I missed two of the payments and subsequently had a default placed on my credit file. The balance was settled due to a loan from my sister; but at no time did they tell me in 2012 that they could also deduct PPI for the balance no matter how small it is. I have asked them to remove the default due to them breaking there own T&C's and TCF guidelines. MBNA have refused saying that the PPI payment wouldn't have made a huge difference to the £3500 balance; however I did default on the payments. Surely if they owe a customer money they cannot default an account no matter how small a payment it is? Can I take legal action through a small claim court against MBNA? I have also raised a FOS complaint. but by the time they get around to dealing with it; the default will be null and void. Many thanks

-

hi lovely people i sent a CCa request on 21/04/14 to Lowells for MBNA old debt from 2005, i have been paying token payments since 2005. i havent had a reply back to CCA request and have recieved a letter from Hamptons legal re-payment options. i have suspended payments since, but while going through the paperwork, i have noticed the a/c number on all their correspondence over the years does not match the account number in question. should i querry this with them?

-

Hi there, I am trying to help my mother reclaim PPI she paid some years ago, she sent in the complaint forms in december..she quite quickly received a letter responding just to say her complaint was received and they will look into it. on the 3rd jan 2014 she received a letter it said this.. "Dear mrs **** Please accept my apologies for the delay in responding to you; however, our investigations are taking longer than anticipated. We will issue a response by 3/2/14" Then today this letter... Latter dated 20/jan/2014 "dear mrs **** Thank you for contacting us in relation to your complaint. I would appreciate it if you could please contact us within the next 7 days on ******** (phone number), this will allow us to progress your complaint If we do not hear from you in the next 7 days, we may provide you with a final response based on our findings from the information we hold Yours sincerely Tristen lynes" What i would like to ask is Should she phone back? Does she have the rights to phone them simply to acknowledge the letter but ask that all communications are done via letters so she has evidence and can build her case? or would it be better to send a letter first class recorded asking for all correspondence to be kept to letters not the phone?. does she HAVE to speak to them on the phone? Any advice would be appreciated:)

-

Hi all, I have had many issues with MBNA, but most have been resolved in my favour. However this one is proving a little more difficult to deal with. I had an MBNA credit card from 1999 to 2003 all was ok until I was signed of sick, I continued to pay MBNA while i was off sick for the first year as i get paid for this and then I tried to activate the PPI that they sold me. I was told that because they didn't see clinical depression as a reason they would not activate the PPI (I have successfully claimed the PPI back). My problem is after I informed them of the financial hardship (ie not getting paid anymore other than SSP) they then added £2800ish in charges and fees which wouldn't have occurred had they not of missold me PPI (they have admitted this already). They would not freeze interest or charges and added all this interest and charges in the 6 months before they sent it to debt collection agents. (I have all the charges and already obtained a SAR and sent the charges sheet into them with the first letter). I lodged a formal complaint with them as soon as they upheld my PPI claim and they have responded stating they will not repay charges as they have no record of me trying to activate the PPI. they upheld my PPI claim on the basis that due to them not activating it for newly diagnosed clinical depression i had been missold it. Can someone give me some advice, on where to go next. How can MBNA state they never had a record of me trying to activate the PPI when they paid a misselling PPI claim solely on this basis. Do i have a good chance of reclaiming the penalty fees they issued after I tried to activate their missold PPI? (please note that this has been fully paid now including all charges and interest) I am happy to issue through court if this is the route to go. Thanks in advance L

-

Hello Forum I apologise in advance if this is answered somewhere else but I cannot find it. My ex-wife had a credit card with MBNA and amassed debts of £4700 on it. This was 7 years ago and I have only found out today that she is still paying this debt off. She is paying the minimum monthly payment which would appear to be mainly interest therefore she is never managing to reduce the amount. Today for instance her latest statement stands as follows: Balance from Previous Statement: £3411.06 Payment Received: £120.41 Cr Interest Charged: £89.02 New Balance: £3379.67 Estimated Interest Next Statement: £77.31 I have no idea as to how to work out just how much interest is being charged but to me it seems that she is never going to be able to pay this off and as she is now a pensioner, I envisage her getting more and more depressed over this. I would appreciate any advice you may be able to offer in how to perhaps approach MBNA to see if things could be improved.

-

Hi, Had 2 letters from these guys in the space of 2 days. Say I owe Caboot 1400 for a credit card from MBNA. Now, I had one of these in 2001 when I was young and stupid but far as I know my parents paid it off at the time. If not there could have been no more than 300 as that was my limit. Any ideas? I'm not paying these clowns.

-

Brief history … MBNA credit card into difficulty due to self employed and debt sold to Link Financial who took me to court and won and was ordered to pay full amount but I then applied for Variation order and was awarded to pay £10 per month . But Link did apply for a charging order and was awarded. Now since my CCJ I have paid the £10 by postal order and also sent every payment by recorded delivery to the address on the CCJ. After about the 2nd payment I started getting the standard letter saying I had fail to pay as per the CCJ etc and also constant barrage by phone but talking to these plebs is like talking to a brick wall and informed I had sent and had proof of delivery. However after a lot of arguing it transpired the address on the CCJ was the Caerphilly office and they are not set up to take payment ????? I asked they send me a letter instructing me to make payment to another address other than as stated on the CCJ. I also send them a letter demanding that as of now all correspondence had to be in writing and to stop calling both my land line and my mobile. I also sent them both copy of the postal order and proof of delivery slip and eventually I received an apologetic letter telling me they would cease to call and all correspondence would now be by letter. Now today I received a statement from Link and find that a charge of £72.00 under AGT (whatever that is) and £264.00 under CAT (whatever that is ) has been added to my account. Now my query is what the hell are these charges … and are they not bound by some sort of governing body to make sure you know what the hell is being added … and why are they added. I have proof (as I have already given when they requested ) that all payment where received by recorded delivery before the date. I have sent both a copy of the recent statement and a copy of the Final Response they sent to me telling me that had made a complete balls up lol. Oh and before anybody asks … . Yes there is PPI going back to when I opened the cerdit card in 2003 lol… . About 5 weeks ago I found some old statements in the attic going back to when I first opened account (self employed ) and showing PPI and received the SAR I sent last week so need to sort that out soon as I sort these clowns out and I will create a separate thread for the PPI battle lol.. If there is PPI does it make the Link CCJ legal and also the Charging order. Is there any point in complaining to who ever they are governed by and can I now start charging Link for the constant harassment and bad management that means I have to spend a lot of time dealing with this issue. Any help would be appreciated

-

Hi all, my first post here, hope all are well. Am seeking some educated advice and from my reading of other threads this looks like the place to ask I hope. So the background... I used to have several cards/loans that I ran up and couldnt pay (yep fool i know but that was a while ago now, single, out every weekend etc) summing almost £15k I ended up with CCCS and cleared much of it. I then came into some money with which I got settlement figures from 4 creditors & used all the money and paid them.. .MBNA would not give me a settlement figure & by this time I was out of the DMP with CCCS as I only had MBNA left. This was summer 2010. After requesting settlements & hearing nothing, I sent about £50 a month and was passed to Mortlake Recoveries in Jan this year. I had the card initially from around 2005. It was around £4200 in 2008 and is now at £2400. I missed a payment to Mortlake in April by mistake which I explained to them was due to stress at home ( our son has autism) and then I caught up in May but in June they have passed me on to Arden CM. I have set up a standing order to them of £50 a month... the first one was paid 1/7/12... they keep writing saying Im ignoring them and havent made an attempt to deal with the matter... they call 8 times a day. ..I ignore them as I only contact in writing.. .however they only seem to receive "signed for" letters...surprise. I rang them today and was told that I need to make an official arrangement with them for repayment over the phone and I cant just send money every month.. .I thought this was odd-they either want the money or they dont surely. He also said I need to do a I&E over the phone...I said Id ring back. Am I correct in saying. ..an I&E is not compulsory & my I&E is private unless a result of a court hearing and then only known to the judge? Should I write & tell them they have no right to know this? Should I also send them the request for the CCA and stop the standing order? Also Im seeking info on the "no phone calls or doorstep visit" letters as they are threatening that now. Hope my waffle makes sense thanks for your time guys Paul

-

Hi I hope somebody can help me. I have a debt of c £2,700 which I presume Link bought from MBNA. I have been paying £15 per month for over 10 years and they have now all of a sudden started telephoning me. I dont know how they have my number as it is ex directory and in a different name to the debt. I no longer work and am disabled and really cannot afford the £15 but keep paying just to try to pay the debt off. I owe over £30k in total as I had to give up work due to ill health and I have two very small children also. I have MS and this is making me ill with worry. Please can somebody help and give me some advice. I have sent the letter asking them to confirm that they own the debt but I am now frightened to answer the phone in case its them. Help help help please. Thank you Charlie Do you think I would be better declaring bankruptcy?

- 15 replies

-

MBNA I'm in the middle of a PPI claim (have been self-employed since 1995 but discovered I've been paying PPI on my credit card since I took out the card in 2003). Today, I had the most annoying letter, from MBNA, saying the following: 'You may recall that we recently wrote to you and requested that you complete and return a questionnaire to provide further information in relation to your PPI complaint. To date we have not received your questionnaire. I have completed a review of the account based on the information we currently hold and am unable to uphold your complaint or issue a refund on the premiums you paid. This is our final response to your complaint. If you remain dissatisfied you now have the right to refer your complaint to the Financial Ombudsman, which you must do within 6 months o the date of this letter. For more information about how to do this, please read the enclose Financial Ombudsman's leaflet. Their address is as follow: [FO address] Yours sincerely Rachel Nixon' This letter is astonishing and annoying as: 1) There is no telephone number to call them up about this letter. 2) In early-Jan, I started a PPI complaint against MNBA. I called them for some basic info and said I'd send them a filled out copy of a PPI form (which I found online via a BBC site). They said not to bother as they would fill one out for me. The inference was that this was a 'service', that they would speed up proceedings as they had all the facts and figures to hand. Stupidly, I trusted them. I actually waited around 10 days for the form to appear and all that was on it was my name and surname. No other data. So they had simply slowed the process down by ten days. 3) With the form was a letter, demanding that I fill out the form within 21 days, or the matter would be closed. I don't ever recall entering into a contract with MBNA saying I had to jump to their timetable. This was especially rich as they had wasted 10 days - and had, in fact, sent a follow-up letter, apologising for *their* delay in sending out necessary information. When the apology came, I assumed something else would be arriving in the post from them - it didn't. 4) As I was busy with work at the end of Jan, it wasn't until around the 20-day mark that I was able to get down to the form. I actually called them, first of all, for some data (the start date of my credit card contract). At that point, they had every opportunity to say the case was closed, due to some strange time limit they'd imposed without my permission. They did not. 5) I spent the best part of a working day looking through the questions on the form, then posted it to them. 6) On 23 January, I received the above letter, dated 15 January (when did post ever take that long to arrive?). ...I have never, in my life, come across what feels like such a blatant attempt to renege on responsibilities. This, coupled with a lack of reply address, gives me an even lower opinion of MBNA and their insurance companies. Am I within my rights to go back to them? I don't want to go to the FOS - I'm a busy person and would like a speedy resolution to this matter (I estimate MBNA owe me within the region of £4000. However, if there is no other option but to go to the FOS, is there anything I can say to the FOS about these frankly dodgy practices? Brenda

-

I have read other posts, but have difficulty following since my brain shrunk! I am just about 69.= Old! I thought it best to start my own thread. I had an arrangement with MBNA, Who accepted token payments for a few months, following help and advice from CCCS. Wife and I do have other creditors, All have ripped us off in the past with Mis-sold PPI, both S/E, Had they not done so, we would not be in the position we are now! I am trying to get into claiming these back, but it seems that before I get into that, I have to defend us against the likes of Moorcroft, and now Arden, my first question is, should I answer the phone to Arden? Am I right in thinking I do not have to make a contract with Arden? I have continued paying token payments to MBNA, They have not asked me to stop! I have had much treatment for Stress and mental heath problems caused by Banks and Debts. Any advice to start me off gratefully received. Regards Ro

-

I have had na MBNA card for more than 15 yrs, for the first time ever 6 months ago I stopped making payment due to financial difficulties, amount currently outstanding is GBP 1,700, I had a phone call from MBNA a few days ago at my work place (I dont know where they got the number from) and they threatened me that if I didnt make a payment of outstanding amounts overdue approx GBP 350, they would sell my debt to a third party, I tried to reason with them, and they asked me what was the minimum payment I could make, I told them nothing at the moment, they then suggested GBP 45 p.m, and that had to be made this month. I have been living in Spain for the last 10 years and have been making payments by bank transfer frm my Spanish bank account. Please advice, thank you

-

Just a 'normal' £600 penalty + interest claim but (as usual?) I may have to take, or threaten to take 'them' to court. I understood from somewhere in the forum that county court procedures have changed, as have N1s ; but I can't find where I read it and I need to bring myself up to date. As soon as my pension arrives I shall seek to renew my copy of 'Small Claims procedure...' but I may have to take some action earlier. Can anyone point me in the right direction PLEASE? Ken

-

Hi There Having agreed a token payment to MBNA of £1 per month until circumstances change, they have just sent a letter saying they have "transferred ownership of debt" to Link Financial Outsourcing Ltd. Any comments/advice will be welcome

-

Oh dear Experto have sold O.Hs alledged account onto Aktiv Capitol;

-

It has come to my attention that a bunch of [EDIT] called Restons have obtained a charging order without having a CCJ. surely this is an abuse of process? I notified Restons, and they acknowledged, that I was living outside the UK. I did not receive any County Court Summons. I have since checked the Registry Trust and I do not have any CCJ. My understanding is that a summons has to be issued from the court to give the debtor a chance to pay before a CCJ is entered. Only when the CCJ is not satisfied, or any agreement to pay is not maintained can a charging order be sought. How can these [EDIT] abuse the system like this? Any comments gratefully received. Frank.

-

http://www.consumeractiongroup.co.uk/forum/content.php?834-Fair-Treatment-for-Credit-Card-Holders-and-Borrowers Maybe you should use this?

-

Hi, Just got my sar back from MBNA credit card & am trying to find out what interest rate to use when claiming back the charges. The only ones I can find are an intraductory rate when the card was taken out @ 14.9% in 2001 & another one in 2004 @ 22.9%. Any help greatly appreciated. Cheers

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.