Showing results for tags 'lowell'.

-

Hi all, Well I'm certainly bowled over to see there is an entire thread about this guy.! in July 2008 I took out a really terrible loan of £4,000 I paid it until Jan 2009, when redundancy forced us to return to my wife's home country where I had a job offer there. I couldn't afford to maintain payments on a lesser currency from another country and I left it to default, foolish I know but if you haven't got the money what can you do? Over the years various companies have purchased and sold the debt on where now Lowells have it and Fredrickson have been calling and sending letters, I've ignored them as I can't pay it in full and frankly I feel intimidated. On my Noddle credit file the debt is marked under the closed section as 'settled' and hasn't been updated since August 2012. On CreditExpert the default is no longer there. today I arrived home really pleased after seeing our baby for the first time (12 week scan) only to find a letter from Bryan Carter on behalf of Fredrickson/Lowell, stating if I don't set up a payment plan they will 'recommend' that their client Fredrickson start court proceedings. Is this another intimidation letter trying to scare me or are these guys for real? They seem to be really taking on a lot of people of recent. What should I do as this has me a little worried.

-

I need some help I have recieved a claim form off Lowell solicitors through Lowell portfolio for a Very (shop direct) debt of £1,684 I just need to know what options I have for this. They have been sending out letters to an old address which I no longer reside but have somehow got my parents address where the claim form has been sent to. I haven't admitted anything yet to them but wanted to know my options from them and they have told me that it's now £2,040 and needs to be paid off in the next 14 days. They then informed me they could extend this to 21 days but to Avoid a ccj I need to pay it in whole. They bought the account off very on the 12.12.14 Please can someone advise me. I haven't got the money to pay this outright but I'm also in no position to get a ccj that will last 6 years Help please

- 10 replies

-

- ccj

- county court

-

(and 3 more)

Tagged with:

-

Just received a County Court Claim form (Northampton) from Lowell Portfolio relating to a debt from 2010. It is for a Lloyds credit card default. It was a stressfull period as I was made redundant from my job and I had a number of financial issues as a consequence .. . not least having to sell up quickly (nil equity), or risk having my home repossessed as I couldn't pay the mortgage. The debt has been passed through a number of debt collection agencies till Lowell took it on a few months ago. I have no paperwork or information so I'm not sure when the actual default happened . .. it was sometime in early 2010 so it probably isn't time barred as I assume Lowells wouldn't raise a court claim for a time barred debt. I assume its not worth fighting this as I can't prove anything . .. however I'm happy to make things as difficult as possible for Lowell. I assume they bought this debt for under £500 (maybe even less as its passed down a few collection agencies) . .. claim is for £3,547 .. . can I make them declare in court what they paid .. .. and agree to repay what they paid for the debt. If I say I have no knowledge of any debt with Lloyds ...what paperwork or contract will they need to provide to prove this debt actually exists. Is there any defence or method of minimising the claim? I'm no longer working, rent my home and have nil assets, apart from a 14 year old car worth £1k. I'm approaching 65 and live off a moderate (very moderate!) occupational pension. Any help or guidance greatly appreciated.

- 46 replies

-

- county court

- lowell

-

(and 1 more)

Tagged with:

-

Hello all, I'm having some problems and I hope someone can help. Here are some more details. Letter from Lowell when I tried to dispute the debt. **************************************************************************************************** Current Balance: £534.56 This account was opened on the 6th February 2010 and the mobile number on the account was ‘xxx xxx xxx’. The last payment made to Three Mobile was on the 2nd Febuary 2012 for the amount of £65.78. This acount then became defaulted on the 11th July 2012. As payments have previously been made to this account, this is considered acknowledgement for this debt. Furthermore, the email address associated with this account is also the email address you are currently emailing us from. As you can appreciate, with the information that we hold, we do believe this to be your account. Please can you confirm how you would like to proceed with this account? If you find that you are currently facing financial difficulty and would like to seek free debt advice about this, then you can contact one of the below organisations: • StepChange Debt Charity (formerly CCCS): For debt advice throughout the UK, phone 0800 138 1111 or visit http://www.stepchange.org • National Debtline: If you live in England, Wales or Scotland, phone 0808 808 4000 or visit http://www.nationaldebtline.co.uk for debt advice and information. **************************************************************************************************** As I had some financial issues I have decided to terminate this contract as I was with them for about 2 years. I wrote to 3 back in 2012 (around Jan or Feb) explaining that I won't carry on any further contracts as I'm going to cheaper mobile solutions etc. I never got reply or even a phone call until recently I got the letter from Lowell demanding payment of over £500. I looked into my credit file and they put a default as: Account Opened 6 February 20106 February 2010 Default Date 11 July 2012 Default Balance £176 So I guess regardless my letter this contract was still running? For obvious reason I canceled DD with them as well. Any help would be appreciated. Thank you, l

-

My partner has received a letter from the above company stating "they are trying to contact the above named person(her) relating to a personal matter" at an address included in the letter. She has never heard of the address and has no contact with anyone at that address which is over 250 miles from where we live. Is it best to ignore this letter,telephone the number provided or write to them telling them they have the wrong person please? Thanks . Regards Kev

- 43 replies

-

Hi all, on or about the 9th March my stepdaughter sent a CCA request to lowells it appears that on the 18th March the debt was passed on to bpo collections, are they allowed to do that? when a request for a CCA has been made. Regards Concorde

-

hi there, ive received papers from the county court business centre for a debt i do not own, never owned or even acknowledged, how do i defend this? do i need to CCA request lowell? if so i presume its a template letter, which one? what do i enter in the defence or do i leave it blank and await details? ive acknowledged via mcol so hae more time, any advice needed please.

- 36 replies

-

- county court

- lowell

-

(and 2 more)

Tagged with:

-

Hello all. Just arrived home to find a County Court letter for a claim issued by Lowell regarding an old O2 mobile contract. I've never received any thing like this before so not entirely sure what my next steps are. I did consider filing a defence but it doesn't really seem like I have one. Is it just a case of filling out the form, hope they accept my repayment proposal and wait to hear back from the court or do ai have to attend? Many thanks

-

Six years ago I found the details of someone else with the same name (almost as she is a Miss and has a middle name unlike me) and dob on my credit report, I was able to have this removed and have an excellent credit score. However, over a year ago Lowell started ringing me and sending me letters about this woman's debts. I've not had any accounts or involvement with any of the companies who have passed on these debts. The first one I ignored and they subsequently passed it onto a debt collection agency who told me they had proof that the goods were delivered to my address. Action Fraud took this on as a possible fraud and Lowell's response was to write off the debt but still imply that it was mine. The next three debt letters arrived a few weeks later and I sent the template 'prove it' letter. They wrote one off still insisting that it was mine, I'm still waiting for a response to one and finally got a copy of the original credit agreement for another. This clearly gives the other woman's address and actually includes a copy of a letter to her, at her address, stating that she had asked for a copy of the agreement and they are still asking for repayment. Lowell have also done a search on my credit report and found nothing (that must have been disappointing for them!). I'm getting really fed up now of having to do all the work here to prove that these debts are not mine and this other woman is having her debts written off and I don't know what else to do at this point. Is there any point in complaining directly to Lowell or should I take it to Trading Standards.

-

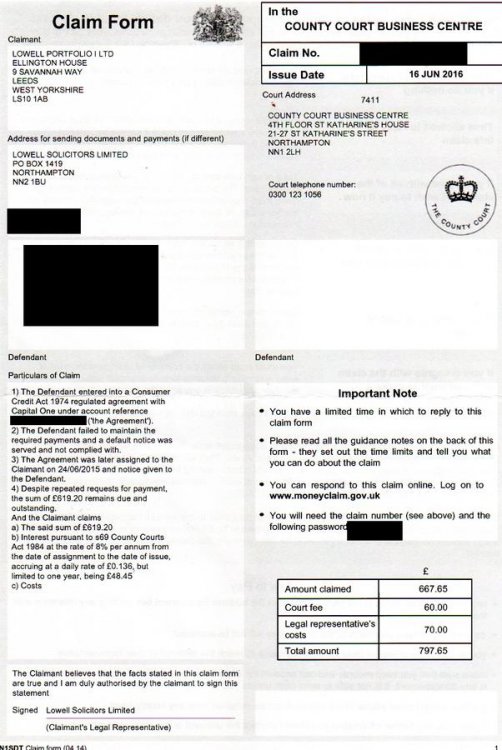

Hi, My girlfriend received a claim from Lowell's regarding a catalogue and I am stumped on this one (I'm an early CAG'er). shes being chased for the incorrect account and I've filed a defence saying so. The odd thing is this claim was issued on the 22nd of March and recieved the 29th I believe. AOS was filed for her on the 30th March. Defence submitted on 19th April, which is exactly 28 days from the date on the form (22nd March). It says recieved on 20th Apri. I believe service is 5 days anyway now, am I correct? What's odd is since then, nothing, nada. Not a peep from either Lowell's or the court and she's a bit worried. I HOPE they've looked at it and realised their mistake. Claim reads: 1) The defendant entered into a Consumer Credit Act 1974 regulated agreement with JD Williams under account number xxxx 2) The defendant failed to maintain the required payments and a default notice was served and not complied with. 3) The Agreement was later assigned to the claimant on xx/xx/xx (was within the last 6 years, not barred). 4) Despite repeated requests for payment the sum of £xxx remains due and outstanding. And the claimant claims: a) The said sum of £x b) Interest pursuant to s69 County Court Act 1984 at the rate of 8% per annum from the dat of issue, accruing at a daily rate of £x but limited to one year, being £x c) Costs. The defence reads: 1: The Defendant received the claim XXXXXX from the Northampton County Court on the 29/03/2016. 2: Each and every allegation in the Claimants statement of case is denied unless specifically admitted in this Defence. 3: This claim appears to be for a Catalogue Account agreement regulated under the Consumer Credit Act 1974. 4: The particulars of claim fail to state when the agreement was entered into. 5: It is denied that the Defendant has previously entered into an agreement with JD Williams for provision of credit under account Number XXXXXXXX (the Agreement). 6: For the avoidance of doubt the Defendants account number with JD Williams is ZZZZZZZZ 7: All previous correspondence from the Claimant used the account number ZZZZZZZZ and not XXXXXXXX (the Agreement). 8: The Defendant was not aware of account number ZZZZZZZZ (the Agreement) until this claim was made. 9: It is denied that JD Williams served any Default notice on the Defendant pursuant to s87 Consumer Credit Act 1974. The Claimant is required to prove that a compliant Default Notice was served upon the Defendant. 10: The Claimants statement of case states that the account was assigned from JD Williams to Lowell Portfolio 1 Ltd on (Last 6 years) The Defendant does not recall receiving notice of this assignment. 11: The Claimants statement of case fails to give adequate information to enable me to properly assess my position with regards the claim. 12: It is denied that the Claimant is entitled to the relief as claimed or at all. Statement of Truth The Defendant believes that the facts stated in this Defence are true. Can I get the claim struck out?

- 2 replies

-

- county court

- girlfriends

-

(and 1 more)

Tagged with:

-

Hi all, Need some help please. Have received a summons from the Bulk Handling Centre for an old Orange Mobile Debt - About 4 years old roughly. Date of Issue: 06/04/16 - Acknowledged - 08/04/16 Details of claim; Claimant: Lowell Portfolio Ltd Defendant myself POC (1) - The defendant entered into an agreement with Orange under account reference xxxxxxxx ("the agreement"). (2) - The defendant failed to maintain the required payments and a default notice was served and not complied with. (3) - The agreement was later assigned to the Claimant on 19/06/2014 and notice given to the Defendant. (4) - Despite repeated requests for payment the sum of £176.54 remains due and outstanding. And the Claimant claims; (a) The said sum of £176.54 (b) Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accruing at a daily rate of £0.039, but limited to one year, being £14.12 © Costs I have acknowledged the Service online with MCOL. I'm no expert here but I've been reading through other threads and it seems the wording is incorrect on the claim form, being it was a Contract for Services rather than an Agreement. Am I still able to send a CPR Request in order to get their ownership of said debt? Can someone please help me a little. I'm drafting documents as I type this but running into a little blank moment from reading so many comments.

-

Hi guys, I CCA'd Lowells about a credit card I had in 2010. I received a response from them, however, the name and address entries are blank and the credit limit is incorrect. There is literally no personal information held about me. So, as this is clearly an attempt at using a correct CCA, assuming i'm stupid, what's my response? Cheers

-

Hi I have just checked my Experian report on Creditexpert and I have a default placed recently on my account from Lowell Group. I have never had any dealing or correspondence that I am aware of from this company. Would really appreciate any information or help on how I can challenge this. Thanks Mark

-

Just a quick question If the original creditor has not registered a default against you, would a dca (lowells) be able to? Background. I was with talk talk at a previous address. Having lost my job and being in rent arrears, I moved out of there and spent a couple of years in grotty bedsits till I got myself sorted. At the time, I wrote to talk talk stating I was cancelling the contract for the above reasons. 12 months on and I received letters from talk talk saying I owed them over £200. I queried this and was told, we never received the letter and there is nothing on the computer. After arguing for about 20 mins we were at stalemate. fast forward another 9 months and Lowell are chasing me for said amount. Having had nothing but trouble from them for years, I registered a formal complaint with them disputing the debt. After 8 weeks of "investigation" we have spoken to our client who state "We never received the letter and there is nothing on the computer" I have no intention of paying this because I did cancel. Incidentally, out of all alleged debts with them, Lowell have not ever received a single penny off me. I have no problem with ignoring them. however my concern is whether they can issue a default against me. Talk talk never did. I am so close to having my other defaults drop off my credit file and getting some semblance of financial normality that I am concerned this is going to screw it up for another 6 years.

-

Hi all A couple of years ago I left my work after being diagnosed with 2 neurological illnesses, this meant I could no longer work and am now on a long (3 year) ESA award and am awaiting a PIP assessment in a couple of weeks (thats another story sigh) I owed £300-400 to Capital One and due to the illness, depression, hospital stays and lack of money I just stuck my head in the ground and ignored everything. Today court papers arrived from Lowells (attached) apart from filling them in online what else do I do here? The debt is only 2 years or so old so not statute barred and probably half of it is fees and interest I think as the original debt wasn't that high. Thanks for the help

- 9 replies

-

- cap

- county court

-

(and 2 more)

Tagged with:

-

Hi guys been lurking around on the forums for a couple of days using the search function, not sure if this is correct place to make this post so the debts going off my credit report now are (drum roll....) Lowell Telecommunications supplier £1000+ account started 2006 Defaulted 2011 Default every month since 2015 Rang them once or twice going to submit a SAR request under the DPA ------------ Idem Unsecured Loan £3000+ account started 2008 Defaulted 2011 Defaults shows 2 defaults 2016 Rang once or twice going to send a CCA request ------------- Lowell (think it has been moved to another company) Credit Card account start date end of 2007 Defaulted 2011 Defaults every month since 2015 Going to send a CCA request -------- So i was looking at my credit score and there is some old debts on there, i read about defaults being removed after a certain amount of time but if they are defaulting every month it will never end? I have no problem going to court if need's be These are really old debts, i haven't seen a letter from or heard from any DCA's (that i can remember) I can't see how i have a phone bill of £1000+ (they said it was £800+ airtime call charges!) I am willing to fight my corner at all cost's (whats the worst that can happen a CCJ? i get defaults every month i can't even upgrade my bank account from a child account) After a hard time in my life i was homeless (registered with local council etc years ago) Plus i can't remember having these debts! I don't know if this helps me in anyway Has any one got any advice? My main objective here is to get rid of the default's

-

Hello, My wife received a claim form from Lowell Solicitors Limited on Saturday morning. Details are below: Name of the Claimant ? Lowell Portfolio Ltd Date of issue 14th January 2016 What is the claim for – the reason they have issued the claim? The particulars: 1. The Defendant entered into a consumer credit act 1974 regulated agreement with Shop direct under account reference ...... the agreement The defendant failed to maintain the required payment and a default notice was served and not complied with The Agreement was later assigned to the claimant on 2/12/2011 and notice given to the defendant. 2.Despite repeated requests for payment, the sum of £2,030.36 remains due and outstanding Interest pursuant to s69 County courts act 1984 at the rate of 8% per annum from the date of assignment to the date of issue, accuring at a daily rate of £0.445 but limited to one year, being £162.43 What is the value of the claim? £2377.79 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Cat When did you enter into the original agreement before or after 2007? Possibly 2007, not sure as she has ignored calls from them. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell issued the claim Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? I don't think so. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? None Why did you cease payments? Finance problems What was the date of your last payment? Not sure but looking through bank statement to find the last payment. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes I can send a scanned pic of the claim form (details scrubbed out) if that helps, Its just scary getting this in the mail.

-

We had an account with TalkTalk a couple of years ago - they were not very good but we sold our property and changed provider when we did. At that time we sent letters to all the necessary service providers giving them the new address, final readings etc. I had to write to TalkTalk twice as they maintained they never got the first advice but as we had paid up to our final day and the property which we sold was being developed (so no further usage was possible) we did not owe them anything. We have heard no more (though I believe we got a final bill for £0.00 shortly afterwards) until 10 days or so ago when a letter arrived from them saying they had sold our "debt" of £185 odd to Lowell Portfolio. Checking this company on line they appear to be bottom feeders of the worst sort and I'm now getting texts saying they must speak with us urgently. I have seen posts advising to definitely NOT speak with them, correspond ONLY by letter and do not sign manually as they have been known to forge signatures. How can I get these people off my back?

-

Hi, I don't know if anyone is able to give me any advice. Three or four years ago I had some financial troubles. Recently I decided to get my head out of the sand and I ordered copies of my credit files. I have found that in addition to the actual accounts that have been defaulted (bank account and storecard etc) Lowell Financial have also added their own default. The main question that I have is can Lowell do this? I was intending to try and pay back as many companies as I could, but I object to paying two people for the same debt. In addition to this my credit file will never clear as Lowell's default date on some of the accounts is nearly a year after the original holders date. Thanks in advance.

-

Hello This is my first post to the forum. I hope you will be able to advise me how to proceed with my dilemma. Once upon a time I owned an Aqua card with a limit of £200. Not long after my circumstances changed dramatically overnight for reasons I won't go into, but I had no option but to go to Stepchange for help. They created a debt management plan for me and I paid my debts off on time with them. Once my time with Stepchange came to an end, I started to received letters from Lowell who had allegedly bought the debt from Aqua at £315. It turns out Aqua had refused the original agreement offered by Stepchange and my debt was growing every month as the amount allocated to Aqua wasn't even enough to cover the interest. In 3 months my partner and I will have a baby, and every penny is a prisoner right now. I feel like I have been duped and consequently I am in more debt than I ever was with Aqua. I asked them for a copy of the original credit agreement and got this back; We are writing to notify you that 25 June, 2014 Progressive Credit Limited has assigned all of its respective rights, title and interest in respect of the above referenced account (including the outstanding balance) to Lowell Portfolio I Ltd, effective 25 June, 2014. The total balance sold was £315.14 as at the sale date 25 June, 2014. Any payments made towards your account after 25 June, 2014, will be forwarded to Lowell Portfolio I Ltd, and will be deducted from the balance shown above. Under the terms of the above assignments, and as defined in the Data Protection Act 1998, Lowell Portfolio I Ltd is now the Data Controller of your Personal Data contained in the records of this account and will not change the purpose for which or the way that your personal details are used. Lowell Portfolio I Ltd is aware that you have been working with a Debt Management Company /Debt Advice Agency to help you manage your financial affairs and are committed to working with them in the future. We would like to take this opportunity to thank you for your commitment to paying your outstanding balance. Any further communications and payments must therefore be addressed to Lowell. Is there any way for me to challenge/fight this debt? Any help would be greatly appreciated, believe me. Thanks in advance CocoLoco

-

Hi All, I've been reading through multiple threads in the hope of finding an answer to my question (and enjoying the hatred for Lowell!) but haven't found a definitive answer that fits my situation. Financial terms and matters of this nature aren't my strong point so would appreciate the most simple explanations possible (sorry!). I left the UK in December 2012 for Australia and returned in 2015. Prior to this I rarely took any forms of credit in the fear it would spiral out of control, I had a small credit card and a couple of mobile phone contracts at the time. Long story short, I ended up letting my UK finances get a little bit out of control whilst away (not massive amounts but frustrating nonetheless). Whilst I was away my mothers address was bombarded by letters from Lowell stating I must pay back my debts to Orange/02 and she forwarded these onto me in Australia - I completely ignored them as I've never dealt with this agency and had no idea who they were or intention of paying them back, but do personally acknowledge that I hadn't paid 02/Orange respectively. On return to the UK, I was instantly greeted with letters again as I setup a new bank account and began working (presumably the vultures were waiting). I began investigating the issue and accessed my credit report in the hope it could shed some light on what was owed and too who - but from reading these threads would I be right in saying that mobile phone accounts would not appear on a CRA? (if so, why not!). Being naive and probably a bit too honest, I wanted to clear the debts in the hope of rectifying my situation and having a clearer conscience, so I called them (d'oh!) and agreed to pay off the 3 amounts I owed (£449.02). Those accounts were paid and I considered the matter closed. At this time, I was obviously frustrated by having to pay such an amount but definitely gave in too quick and felt a bit intimidated by it all. I've since received further letters relating to ANOTHER 02 account for the sum of £172.96 which I'm now starting to question. I initially ignored the letters (and daily calls) as I don't believe there to be any outstanding money owed to any mobile company - the problem is, I simply cannot remember that long ago and what it could possibly relate too. From memory, one of the accounts was mine and another for my Mum, both small monthly amounts. At the moment, I have absolutely no intention of paying them again (until I have the right information to hand) and wish I had done my research before making any payment to them in the first place (not to mention being absolute nasty on the phone). I'm in a bit of a difficult situation now as I've contacted them in the past about my other debts, but have had no contact with them since these letters began arriving again. When I initially spoke with them they only acknowledged 3 accounts, with absolutely no mention of a 4th (I'm aware phone was the worst way to do this and will stand for nothing, but remember the call vividly). I'd greatly appreciate any help on how to address this issue and the best possible course of action to avoid giving them any more money/ gaining evidence to support my concerns about a non-existent debt. Kindest Regards, David

-

Lowell tricked court to win a CCJ EE mobile debt

Samndazzle posted a topic in Financial Legal Issues

Advice please guys In 2012 took a phone contract out with EE and returned phone within a week back to shop simply as no reception In 2014 I had a few debt collection letters all of which went in bin Late 2014 I moved to a new house and started getting letters at new house early in 2015 from Lowell finance all of which went in bin Yesterday I came home to a letter from Lowell solicitors stating a CCJ had been obtained and a court order of £50 a month payment had been missed I rung Lowell solicitors for proof of the CCJ and was given a date and case number I rung Northampton court and was shocked to find the court was aware of my address and there was a £50 repayment order made a month earlier Speaking to court I protested first I knew of this the court official stated Lowell had supplied the address I moved from in 2014 to court and all papers went there, then after obtaining the CCJ they updated court records to my new address The lady at court mentioned 2 ways to deal with this I can pay £250 to get CCJ set aside or inform Lowell of their mistake and they should set the CCJ aside and realist the case I rung Lowell solicitors and they stated they haven't broken any rules will not set the case aside and now a contract exists between us implementing ongoing late payment fees My debt currently stands at over £800 and rising, I'm on benefits and cannot raise the £250 I feel Lowell finance have mislead the court by providing a false address knowing they would win a CCJ and repayment plan so they can collect more fees Help please- 11 replies

-

- ccj

- county court

-

(and 3 more)

Tagged with:

-

Hi All, Lowell have approached me with an account for which I supposedly owe money. The alleged debt is from 2011 and is a Provident Home Credit loan for about £800. I lived at the address in question at the time, but I have no recollection of taking this loan. Lowell told me that payments were made onto the account for a few months and then stopped. I told them that I neither accept nor deny having taken the credit, and that I would like to see the a copy of the credit agreement and a statement of accounts to date. I told them that I would then be able to confirm whether this is something I have overlooked, or if it is indeed false/fraudulent. Lowell sent me a later saying: "Due to the amount of time that has passed, the credit agreement and statement of accounts are no longer available for this account." But they also go on to say that I still owe the money and still need to pay?! Where do I stand with this? Advice is much appreciated. Thanks!

-

I hope Someone can help me as I am in a panic and angry at myself for being so stupid:-x I was served with Proceedings for an old vanquis card which Lowell took over and Bryan Carter issued proceedings. I filed defence and did everything I needed and the matter was allocated to small claims at my local county court for hearing on 30th March. I had problems with both Lowell and Brian Carter in that although I knew I had a balance outstanding on the account and was prepared to negotiate a settlement I did request copy credit agreements as I believed there may be PPI on the card (I had recently had a few successful claims paid out so knew that this card must also have PPI) Also they were claiming almost 4000 when the credit card only had a credit limit of 1000.00. I have never received any paperwork relating to the amounts or copy credit agreement. I received the directions Order for the hearing about 2 weeks ago I received a letter from Bryan Carter saying they were no longer instructed and they had returned the file to their client. Yesterday I received an order from the court stating that my defence had been struck out as I had failed to comply with the direction of the Order dated 25th January. I checked over this Order and I could not see anything at all that I had to comply with. Today I received another order stating the hearing had been vacated and the claimants could apply in writing for judgement detailing clearly the claim they are making. I checked and checked over the Order and could not see anything I had not complied with. I have been so careful with dates etc to make sure everything was filed on time. tonight I have checked through the file that I have been keeping my paperwork in and I even checked the envelopes the letters etc cam in .... .lo and behold in the envelope that the directions order was in (as well as a leaflet on the Court services ) was a second order ahhh. I cannot believe I missed it I took the original order out which is 3 pages and left the leaflet in and obviously the second court Order. I felt like crying I was so annoyed with myself. this Order states that I have to file a statement of truth by 18th February!!!! I am gutted and just want to know if this is the end and Lowell will get a judgment against me for thousands over what I owed initially and get away with ignoring their legal obligation to provided paperwork any advise would be great. Thanks Guys

-

Hello, I've not posted on these forums before but I have been an occasional reader and understand they may be occasionally monitored by DCA staff, so I'mm be intentionally vague with some of my personal info... I have been contacted by Lowell regarding an alleged Barclaycard debt that they have purchased. Although I have had an account years ago with Barclaycard that defaulted whilst in dispute over a number of issues, I do not recognise this debt as mine as the figure quoted by Lowell is much higher than that which I left in default. The amount quoted is a significantly high figure, but is less than £10k. As I did not recognise this debt I thought Lowells might be trying it on, so I ignored their contact as I felt I had better things to do with my time and I'm also something or a procrastinator. I open the most recent letter to find that it reads like this: "Having assessed our options, we intend to take legal action to recover this debt if you do not contact us to agree a repayment plan" "What legal action means" "1. A claim form is issued by the court." "2 Court fees, colicitors costs and interest will be added to the claim form which could increase the amount owed" "3. If you do not respond to the claim form a CCJ may be granted against you" "4. Should a CCJ be granted, this will be registered on your credit file for upto 6 years and may impact your ability to obtain future credit" "We'd prefer to work with you" "Our preference is to work with you without taking legal action. Please visit our website, etc etc." There is also a deadline on the leter by which to contact them, which I noticed was not on their other letters. The deadline is for a date this week (I opened the letter a little late, sadly, but I still have time to mail them) I don't know if anyone else has had this exact letter, but by the assertive "we intend to take legal action" phrase on it, I'm guessing that this is likely what they will do given how close the Stat Bar date is unless I can take some action to prevent them from doing so... The last payment I made to BC was VERY VERY nearly 6 years ago, but not quite. We're talking about a matter of weeks here. Other info that may be relevant is that the BC card itself was originally taken out circa 2002 and I've heard the credit agreement info for BC cards can be hard for them to obtain from that time period? Further; this card did have PPI on it from inception through to more or less the default, although not quite, as I do recall it being cancelled perhaps 6 months prior to that. I've submitted to claim toward this PPI to-date, but given my employment status at the time (6 months worth of full sickness pay as a benefit, and so on) it seems likely this would be considered mis-sold at the time of taking. Just me guessing though. Furthermore, the disputes I had with Barclaycard were regarding penalty charges. Also, they sent me a letter in early 2010 telling me they had been charging me incorrect interest and applied a credit to my account. I feel that this incorrect application of interest at an earlier stage of my BC contract may also have contributed to me struggling to make payments at the time, leading to the penalty charges, and leading to the ultimate default. That last part is perhaps a bit of waffle, but Barclaycard were pretty terrible at handling my account. My last payment was actually to Mercers who took a payment from me on the condition that they would reduce my balance down to he level I felt it should be at from prior conversations. They took my money and reneged on the agreement as no adjustments were made, so I made no further payments. The truth is that I was aware this debt would be statue barred very soon, and wasn't particularly worried about it until Lowells sent me this most recent letter, as they may well file a court claim literally days before the statute bar. I've seen a letter on another site entitled "pre action request for information" which is supposed to mean that action cannot be taken until my request for information is handled. Is this is true, it would make it virtually impossible for a court claim to be submitted prior to the statute of limitations period being reached. However, I want to ensure I'm taking the right steps before I do anything rash. The last thing want to do is somehow occidentally acknowledge the debt when I don't, because I never owed that sum of money! Has anyone had a similar experience to this in terms of the timescales and so on.. . is the pre action request for information a good idea, or would there be a better letter to send? I'd really like to post my response today or tomorrow so any quick replies or reassurances would be greatly appreciated. I'd paste the letter from the other site here, but I'm not sure if that's bad form? I chose to ask for help on this site as it seems a lot more active and I've seen some people get great results here from past readings ^^ Thanks in advance... Sorry, just to clarify froma typo, I have NOT submitted a claim in respect to the PPI... I somehow made it sound like I had (couldn't find an edit option after I'd posted)

- 16 replies

-

- assessment

- barclaycard

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.