Showing results for tags 'fees'.

-

Hi All, HMRC requested 5 tax returns from me between 2007-2012. I haven't returned any of them, so now HMRC says I owe them £4400 in late fees and interest. I have never been self employed, always employed and taxed via PAYE. My question is: once I complete all my tax returns, is there any possibility that HMRC will reduce the amount owed? The amount owed is roughly 1/3 of my take home pay, so I cannot afford this. Thanks for any advice. James

- 1 reply

-

- assessment

- fees

-

(and 1 more)

Tagged with:

-

Help, My car has been clamped due to an unpaid pcn. Bailiffs are requesting the payment of £427.59 for release of my car. I am unemployed and do not have this. Breakdown of charges are: Parking penalty charge:£70 Charge certificate £35 Debt registration £7 total £112 Bailiffs charges Warrant of execution:£112 letter:£13.4 First visit:£41.66 Second visit:£53.09 Levy £67.40 Enforcement: £114 Vehicle data check: £26 TOTAL £427.59 Are these charges correct? I have offered the council payment of the original fine they do not want to accept my payment, i have also offered a payment plan to the baillifs but they are refusing to accept. I need my car unclamped asap. Thanks

-

I had a Bailiff visit from Chandlers Limited acting on behalf of my council. To cut a long story short, I paid all the fees and outstanding money directly to the Bailiff when he visited. It was only afterwards on examination of the documentation that I noticed the levy was placed against a vehicle not belonging to me, and that a van attendance fee had been charged even though no van was present. Through help on this site, I managed to get in contact with the head of Chandlers and she stated on the 15th May that she would check with the DVLA that the vehicle did not belong to me. This process would take 2-3 weeks and if the vehicle was not mine then the fees of £40+£90 would be refunded. On 12th June I hadn't heard so I emailed and I received a reply stating they hadn't heard from the DVLA. I got fed up waiting so on 19th June I emailed them an invoice claiming a refund of their fees (£130), interest (£7.50) and administration (£25). I heard nothing. On 26th June I emailed again adding a late payment fee of £25 to the original invoice. I've still not heard. Any advice?

-

I'm having some issues with guaranteed transaction charges recently been applied to my Barclays current account. First some background : I'm currently in repayment plans with several payday loan companies after a medical diagnosis forced me to suspend my university studies. I was dependent on at least some of the student loan to pay off my outstanding commitments, however a week before it was due to be paid I recieved a letter stating I wouldn't get anything at all. This left me in a position where I would not be able to make interest repayments every month, let alone tackle the debt itself, so repayment plans were the only option. I was able to secure plans with all but one of the lenders, and budgetted my wages accordingly so that I would not go beyond my overdraft at all, however the lender who didn't want to play ball decided to scupper these plans and take money £20 I didnt have anyway. This particular transaction, however, seems to have triggered not 1 but 3 fees. I spoke to Barclays about this immediately upon receiving the letter but they refused to budge. Now that the transactions have cleared properly and I can see exactly what my balance was, I'm trying to reclaim the money. The first fee is for £30 to lender 1. This went out of my account on 21/05, and at the end of that particular working day my balance was -£1456.61. I have a £1500 overdraft facility in place. The following day lender 2 (who wouldn't agree to a payment plan) took two payments, 1 for £40, then another for £20. The same day I also incurred £32 worth of charges. This left me at -£1550.61 On my online statement only the £40 payment and the charges themselves are shown to take my account beyond my overdraft limit, which is what I was expecting to pay a fee for. I do not know why, but I have not been sent paper statements in several months. Do I have a case here or should I just sit back and take what they like? If I can't reclaim the money I'll have no choice but to apply for further credit with another lender as I have bills due before my next pay date that I can't quite afford.

-

Hi I've been seeing ads from companies who claim they may be able to get care home fees back under certain circumstances. I presume this is something that people could do for free without tehir 'help' but I can't find out anything about it or whether or not it's true. Any ideas anyone? Thanks

-

I am buying a 6 month old car from a Main Dealer for which I am paying the full amount in cash so not having any finance. Tallking to the salesman today on the phone he mentioned there would be an admin fee to pay of about £140. I didn't get into a debate as I was just going out the door. I last purchased a 6 month old car from another main dealer 10 years ago and all I paid was the price on the screen. My question: Is this normal practice nowadays or is this salesman trying to rip me off and put a few quid in his own pocket? I could understand paying admin fees when finance is involved but for paying cash, surely not?

-

Its that time of year again... searching for car insurance quotes. been on confused.com, rang up brokers etc etc as you do... not one of the figures that I got quoted on the website was the actual price. They were all at least £40 more than quoted without changing any details! After talking to one insurer (Swinton) it appears that the way they get around this is as follows. Paying monthly attracts a lower base premium (apparently something to do with commision) and this payment is the one shown- but it doesn't include any interest.... so you get given one figure (10 x monthly payments) but have to pay another higher fee for a year's payment in full. understand? I didnt either to start with, but its really cunning. The lowest price they quote is a price you will never be able to pay!

-

Just a bit of advice really. I have 1 table 1 search (outstanding debt) carried out by a certain finance company for a very old and SB'd debt. It isnt for much, approx 500 quid which they are chasing me for. I am about to respond with an SB letter, etc, however I will also ask them to remove the search from my CRF. Now given the amount, I wonder if I can use the FOS / ICO complaints charge to 'encourage' them to remove the horrid search since it is likely to cost them more than what the debt is actually worth. So my questions are this. 1. Do all complaints made to FOS/ICO end up with the 'poor' DCA having to pay an investigation fee? 2. If so, how much is it (read alot of conflicting info, somewhere mentioned £850) 3. How much of an effect does a table 1 search for outstanding debt impact my CRF, bearing in mind i'll have a total of 3 over a 18 month period. Appreciate anyones advice here. Cheers

-

- complaints

- fees

-

(and 2 more)

Tagged with:

-

http://www.credittoday.co.uk/article/14089/online-news/councils-acting-illegally-on-bailiff-fees- Local authorities desperate to drive down costs may be acting illegally when it comes to debt collection. Colin Naylor, executive committee member of the Civil Enforcement Agency (CIVEA) and managing director of Dukes Bailiffs says council’s policy of “fees last” should be outlawed from local authority tenders. The practice involves bailiffs tendering for local council work appearing to be providing free of charge services to the authority with the fees then loaded onto the debtors after the debt has been paid. Naylor said: “We can all understand the pressure on local authorities to reduce costs but there is no doubt in my mind this type of arrangement falls outside the regulations.” Naylor went on to explain the “worrying trend” has four unwelcome consequences. Firstly, it opens local authorities up to legal challenges on contract awards. Secondly, it loads disproportionate costs onto debtors. Thirdly, it mitigates against bailiffs who are tendering for work on the correct basis. Fourthly, it encourages bailiffs to adopt a more aggressive stance towards debtors, which is strictly against government policy.

-

Hi everyone, first time thread here so please forgive me if it is a repeat but i have been looking at the threads and cannot find absolute answers. I have recently had a visit from a ross and roberts bailiff for a council tax debt of £504.18 - who obviously was not let in however we did call on the phone later that day and he went on to demand payment in full which we are in no position to do but he then said that if he wanted to make a payment arrangement then the only way he would do it is if we paid his fees in full plus a portion of the debt... .. he then said his "fees" were £241 alone !!!!!!!!!! this to me seems completely excessive for a £500 debt let alone the arrogant abusive little man on the end of the phone demanding that all the fees plus some of the debt be paid in full for him to accept a payment arrangement. he has only made 2 visits to the house and neither time has he got an answer so how are these fees £241??????? i seriously do not understand how they can legally justify making a debt go from £504 to £745 just for the privilege of arranging a payment plan?? any help from anyone here with some actual answers as to what and when can be charged would be much appreciated.

- 6 replies

-

- bailiff

- enforcement

-

(and 1 more)

Tagged with:

-

Hi all, My step-daughter got herself in a spot of bother (fixed penalty for drunk and disorderly) and pretty much didn't say anything about it, didn't pay it and now the debt has been passed on to Marstons for collection. They claim they are acting on behalf a Magistrates Court Order, which I'm not aware of being sent, and no copy of said court order was in the letter from Marstons. Pretty much it's the usual ugly, threatening debt collection letter - pay in 7 days or bailiffs will come. As she hasn't got the money to pay (went to college to try to turn her life around) I'll pay for her, however while I'm happy to pay the original fine, I'm not happy to pay Marstons £85 fees they've added on! I'm also not entirely happy that the court passed on details of the offence to Marstons, while they could get this information it's seems a bit low I think for Marstons to head the letter in bold offence: Drunk and disorderly in a public place. I wondered if anyone would be so kind to let me know if firstly, do we have to pay the debt collection agencies fees (particularly as the court hasn't informed her that it would be past to a debt collection agency which I believe they need to) and secondly if this is normal practice to highlight the offence? I'm happy to pay off her fine (as she is trying to turn things around and hasn't been in trouble since) but I don't see why I should pay Marstons a penny, especially as their letter doesn't really contain any information regarding any official from the court and she hasn't received anything from the court stating it would be passed to debt collection agencies (which I believe goes against the requirements as laid out by the OFT). Any help would be appreciated. Cheers Matt

- 9 replies

-

- county court

- fees

-

(and 2 more)

Tagged with:

-

Hi guys, Seems ages since I have been on here, been very busy over the past 12 months. Need to ask some advice that I probably could of answered myself a year or so ago, but cannot remember. A friend of mine has a default for Nationwide (I believe) but the balance is completely made up of charges. For what I understand their was no credit facilities and she stoped using the account. However a month after she ceased to use it a fee for a returned DD was applied, then fees for unauthorised OD etc. Now the balance is approx £350 Can she be defaulted for a balance made up entirely of charges? Thanks

-

Hi all, This is for a family member, Their partner failed to let them know they had a "Ultimate Reward Account" with the Halifax. Any way they pay £15 per mth for the account, they have a £200 overdraft facility. The bit here now is they have been regularly going over the planned overdraft, so they have been incurring Unplanned overdraft fees, some months is £35 some it £60 £70 etc. To say the least the account has not been used correctly, I have had a little read of the fees but don't actually understand it all, I did read that they should send out a letter to let them know, so I would presume that these letters should go out every month there is a charge. Well that does not happen. In short do they have any chance of reclaiming back theses unplanned overdraft fees at all. Thanks

-

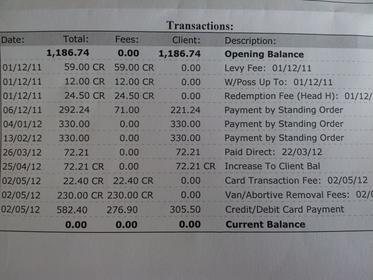

Dear CAG Forum users, I've been following this forum for quite some time but this is my first post. Last week I had the misfortune of a bailiff visit to my property whilst I was away working - to collect Council Tax arrears. He managed to raise the attentions of my landlady, who lives a few doors away, and made a number of verbal threats which clearly distressed her. Luckily, through a series of telephone calls, I managed to sort the matter out remotely and simply paid what I was told I owed in full over the phone as I didn't want the situation to go any further. In the previous week, I had received a letter from the Council stating that I owed £305.50 from last year's Council Tax bill and that this would be collected via Direct Debit. I thought no more about it. I've since made a complaint to the Council in question regarding the way in which they handled this matter. I requested a statement of my account, once settled, from Bristow and Sutor. This arrived today and I've included a copy of it as an attachment here: You'll see that a Bailiff had visited previously, after which I set up an arrangement. I made some errors in my accounting, and thinking the amount owing had been paid in full, I cancelled the payment arrangement I had in place. This was a silly mistake on my part I guess. Bristow and Sutor did not write to me about it and the next I heard was from the Council stating that the amount outstanding would be taken by DD. I thought the matter had been solved. Looking at this breakdown, I've paid in the region of £347.90 in fees in order to sort this out. I am not sure which of these fees are legal and which are not. Can Bailiffs really charge all these? For example, the debit card processing fee of 4% - this appears to me to be paying for the priviledge of paying with money! Certain sites on the internet indicate that these fees are fraudulent for various reasons and may consitute theft. Is this true? Aside from my complaint to the Council, which I doubt will result in a satisfactory conclusion from my point of view, does the forum know of any other way to get any of this money back? I look forward to any responses and advice I might get. All the best.

- 11 replies

-

- bailiff

- council tax

-

(and 2 more)

Tagged with:

-

Morning all I have been brought to the forum as a result of an unwanted and unnerving visit from TASK Enforcement to enforce a warrant for a debt of £202. This was as a result of an unpaid parking fine from Lambeth Council The car belongs to my sister but I was driving at the time. i made unsuccessful appeals to the council and then missed a deadline when replying to the courts who had increased the amount to the £202 it now stands at. Mt sister no longer lives with us but the bailiffs insisted the would seize goods unless receipts could be provided proving ownership. To the best of my knowledge this is the first contact we have had with the bailiffs. they have certainly never attended prior to today. The total fee of £655.34 was reluctantly paid and was broken down as follows on a 'Notice of Seizure of Goods & Inventory' PCN owing £202 Letter £11.20 Levy Fee £58.95 Attendance to remove Goods/Vehicle £305.50 VAT £77.69 Total £655.34 The attendance to remove Goods/Vehicles seems extortionate and completely unreasonable. The amount was paid, no goods were removed and it is the first time they have visited. Is this the norm and a reasonable charge Is there any advice/steps i can take to try and recover this money from them

-

- attendance to remove

- bailiffs

-

(and 3 more)

Tagged with:

-

Hi, A year ago I left a college, I was on course (ESOL), but before second semester I quit. I payed only a half for course. When I was leaving couple I couple time asked my teacher Will I have any problems with not pay fees. He assured me that if I inform college everything should be alright. I call to college and informed them that I'm leaving and won't pay the rest of the money. They said that ok, don't worry and something more. I left a country. Came back a couple weeks ago. A week ago someone called me, I thought that is some recruitment company and I gave them my new address. They start to talking about the college fees. I totally forgot about this. I called to college and in their record, I didn't pay for second semester, but I FINISH COURSE. And now they sent some Debt Collectors to collect money for the course, which I quit and did not pay. I got a letter that I have 7 days to pay £238.50. I write letter to school that this is some mistake. Should I call to TNC and discuss with them this? What can TNC collectors do? What will happend if I don't pay? Regards, Lucas R.

-

- collectors

- college

-

(and 1 more)

Tagged with:

-

hi there i have an on going claim for an accident i had on a building site in April 2009. i have had several interim payments in the past. now my solicitor is asking me to sign a form for the next payment to be in their name, as they want to take out nearly £700, to pay for our own orthopedic surgeons report, which was done in dec 2009. am i wrong to believe that all medical reports, consultant fees, be paid by the third party.

-

Dear all, I owed a total of £1,923.06 to Camden council: £ 969.43 (council tax for period 29/09/08 to 31/03/09) £ 953.63 (council tax for period 01/04/09 to 28/09/09) I was totally unaware of this debt until I was contacted and visited by a bailiff from Rundle&Co who had taken on my debt. The first visit occured in the first weeks of February. I was away from home and was left a message to contact him. The second visit occured in the last week of February. The bailiff visited me and started bullying me into paying the debt immediately etc. I agreed to pay to the debt by direct bank order. Anyway, I ended up paying a total of £2,440.06: £ 1,168.13 (council tax for period 29/09/08 to 31/03/09) on 17 February 2011 £ 1,271.93 (council tax for period 01/04/09 to 28/09/09) on 28 February 2011 meaning that I paid £517 extra in unspecified bailiff fees. Recently, I requested a breakdown of the fees paid and they replied: Council tax debt for period 29/09/08 to 31/03/09: Debt : £1,054.43 Visit fee 1 : £24.50 Visit fee 2 : £18.00 Levy fee : £55.00 Attendance/Van : £120.00 Total : £1271.93 Council tax debt for period 01/04/09 to 28/09/09: Debt : £953.63 Visit fee 1 : £24.50 Visit fee 2 : £18.00 Levy fee : £52.00 Attendance/Van : £120.00 Total: £1168.13 I understand that the levy fee relates to making a list of my property. This never occured. In addition, I am not sure what the van fee relates to but I am sure it is a fraud charge. Also, why is the debt in the first case increased by £85.00?? Is this a standard bailiff practice to also increase the amount of debt? In addition, is it OK for them to charge twice for the same visit? (The bailiff's visit was related to two separate debt collection cases). My question is this. What is the best route to take in challenging these charges/fees and getting my money back? since seeing this breakdown of fees and reading several other threads on this forum I understand that this over/fraud charging is a standard practice by bailiffs and I have no intention of allowing this! thank you very much for your help! Much appreciated

- 10 replies

-

- bailiffs

- council tax

-

(and 3 more)

Tagged with:

-

Hi there, As you will see this is my 1st post, so firstly thanks for taking the time to look through this and even more thanks for anybody who can offer any help! I realise that I may be re-asking questions that have already been asked and answered here but I am slightly irate after speaking with Marstons and consequently overwhelmed by all the advice thats been previously offered. Anyway, here is what I need help with.... I have 2 or 3 fines that have been passed to the bailiff as my attitude and ability to pay the courts was quite poor and they have seen fit to allocate the bailiff to recover the money. As much as I do not agree with bailiffs and their (lack of) ethics, I understand why my debt has been passed on. I did try to get the court to revoke the distress warrant in a long letter, and with some justifiable reasons I believe, although they said they were unable to do this. I have made some payments on my fine via the courts although these were too sporadic and I failed to keep to the agreements I made. The courts then passed the remainder of my fine to Marstons, which I believe was £260. Marstons then added a £75 fee which Marstons just told me on the phone was for "working on behalf of the court". I was told by Marstons that a letter would then have been hand delivered and that they person delivering the letter (08.07.11) would not have knocked on the door, and this initself has led to a further £200 being added to my debt. I have the letter which Marstons hand delivered (08.07.11) and it says I owe: fine - £260, fees - £75, costs - £0, VAT - £0, Total £335 The letter then proceeds by saying: "We are in possession of a Magistrates’ Court Order as a consequence of non payment of the above amount. We are instructed to demand immediate payment in FULL from you. We must inform you that unless the TOTAL sum due is paid into our office within 7 days of the date of this letter, our bailiffs will attend to levy distress and remove your goods for sale by PUBLIC AUCTION. This action will involve minimum further costs of £200.” So, here is where I need advice. I am fortunate that my Father has said he will pay my bailiff debt as I am in nowhere near a position to do so, but before he does I feel that the amount to be paid should be far less than demanded from the bailiff. Firstly, the letter that was hand delivered on 08.07.11 stated that a further cost of £200 would be added as a consequence of distress being levied on my goods, this however did not happen. I tried to ask about this when I was talking with Marstons and the answer for the fee was that it was for a bailiff delivering a letter. I mentioned what it actually said in the original letter and didn't feel that the £200 should have been put on my account and was told we're going in circles and they terminated the call. Is this £200 a legal fee on my account? If it is not where do I stand with reporting Marstons to the police for harrassment of money they are not entitled to? Secondly, if I pay the original outstanding fine of £260 via HMCS website (as I am fairly sure they wouldn't accept payment on the phone), where would I stand with regards to the bailiffs fees? And finally I am correct in believing that the bailiffs fees are actually contractual fees between Marstons and HMCS? and if so why are they asking me to pay it? again could I report them to the police for trying to obtain money by using menaces, fraud or anything along those lines? Just a final note, the bailiff does not correspond with me at my current address but one where I used to live so I don't get letters all that frequently (maybe a couple times a month) as I don't see the guy who's house it is all that often. My written complaint to the courts was also rather lengthy but if anybody would like to see the letter I sent them I would be more than happy to forward you a copy. Again, thanks for reading this post and absolutely any help would be very much appreciated!!! Regards, Steve

-

Hi, not sure if this is the correct section to post this but here goes... to cut a long story short.. my maintanance fees where due, Pueblo evita says they could not get into my bank to get the money... they fined me then says i can not come on any of their sites till i pay up, now they have took 100,000 points of me. I wrote to them i found out that they had changed their bank number details my bank did not pay them coz they did not know who they were with the new numbers, Pueblo says it does not matter who's fault it was i was still late paying my maintance fees, now i have no points to go on holiday with as they have in my eyes conned me, it was their fault all along they changed numbers without letting me know just so they could do this... what would be the best thing to do now.. i would like to tell them keep the points im off and not coming back ever agian or ever going to pay fees again.. would i be able to do this.

-

I have posted previously on here for help with my LL from hell, and have had some excellent and much appreciated advice. However, as is with the case when delaing with such LLs, I would again appreciate some guidance. I have an AST for 6 months (ends 19 Sep) for which I pay £525.00 pcm direct to my LL. I used to pay this via a LA, but in March the LA ceased trading and my LL insisted on me signing a new TA, even though the previous TA was on a rolling contract. I was told to sign the new one, or she would serve a section 21. Since signing, this woman has been obstinate, bullying, unreasonable and intimidating (to be fair; always in writing, never in person). She has attempted to make claim for previous rent payments she says were never made to her from me, and has been very vindictive in her chasing of this money. She has attempted all number of ways to intimidate me into making payments I do not have to make by threats of legal action, threats of a claim for misrepresentation, continual references to 'criminal matters' and lying in regards to the Liquidators of the LA, whom she has offered many lies to be about so called meetings and demands from me from the liquidators. The woman is a nightmare. I dread the sound of droppage from the postbox after 12pm, as I know it will be her with one of her new harrassment letters. Whilst I have many issues with this LL, I would specifically like advice on interest charges and late fees. I have done some hunting, but there is quite a lot of conflicting advice around. In March 2011, I noticed an error on my Tax Credit award notice, which had my partners earnings at 3 times the actual amount he had earned. Despite phoning them immediately, my WTC payments stopped in April. They promised they would have the issues sorted by 20 June, but I am now being told there is a backlog and they still have not processed my backpayment due from them. When these WTC stopped, my household fell into financial hardship. Our budgets were already tight, and so I was struggling without the extra WTC payments. I am still in the same financial position. I explained all of the above to my LL, before the first late rental payment, and informed her of exact dates when payments would be made. Where I offered her such dates, I have always paid the amount promised on these dates. I initially told her 'I am hopeful that all arrears will be cleared by (but hopefully before) 20 June 2011, as this is the date that HMRC Tax Credits has given as the latest the claim should be rectified.' I have since updated her regularly on the Tax Credit situation, informing her of what has been said over the telephone, as well as letting her know when I will call Tax Credits again to offer her another update. As well as this, I have been making payments wherever possible in order that I do not fall two months into arrears and risk a PO being granted (I have a 2yr old boy, and no money to move at present). The TA states that 'any late payments will be subject to a fixed penalty of £35.00 payable immediately'. This is stated on a seperate sheet from the tenancy agreement, which lists a number of other T&Cs not included in the main agreement/small print. The small print has the usual 'to pay the LL reasonable costs as reasonably incurred.....etc'. There is also a clause in the contract to pay 'an interest charge of 4% above the BOE base rate from time to time prevailing on any rent or other money lawfully due from the T under this TA which remains unpaid for more than 14 days, interest to be charged daily from the date the payment fell due until payment'. Being the kind hearted soul that she is, when I fell 14 days late with my May rent, she activated this clause. There was a total outstanding of £265.00; to the date the rent was paid (33 days) she has added £431.46 in interest charges, a total charge of 164% of the original arrears. Whilst I have managed through begging, stealing and borrowing to clear May's rent, I am now in arrears on June's full rent of £525.00 (it was due 21 June). In a statement sent yesterday she has added interest of £496.12 on these arrears, which will continue to accrue until the arrears are paid. That's a charge of 94% of the original arrears to date, and this will only get higher. At 4.5% per day, I am accruing interest of £23.63 per day. Whilst I understand that a 4% above BOE base rate interest charge is fair, surely this is annually and not daily?! I have no hope of ever clearing this debt at this rate. She has also stipulated ion her last letter that any payments made by me will be credited to the arrears and interest in date order, meaning that even if I make a payment of the full £525.00 now (which I have no way of doing), this would actually be used to clear the £430.00+ interest charge from May, and not clear any rent. Surely this is unfair, as I will be forced to go into arrears every month as monies will be used to pay the interest and not the rental payments. Any help or guidance you can offer would be much appreciated; I am very stressed with having to deal with a restricted income at the moment through no fault of my own, and this is making a bad situation unbearable. I would also pint out that I am an advocate for paying rent; it is my first priority and it would never be my wish not to pay. The only reason I am falling late is because I do not have the money to pay. As soon as Tax Credits get their behinds into gear and make the backpayment, the arrears and late penalty fees will be paid. Many thanks in advance!

-

Hi all, I was studying Business at the University of South Bank in Elephant & Castle London in the year of 2008/09. I ended up finishing the year of but did not want to carry on because i did not enjoy the course. I was playing for the university basketball team at the time as well. In 2009/10 I went out to America just before September trying to get a scholarship for a university out there but it didn't end up happening so I ended up coming back to London but it was too late to enrol onto any course here in London so I started working. Couple of months go by and I get a message from the University demanding half a year of tuition fee. I called up and asked why this was and they said I had enrolled myself onto the same course as the year of 2008/09. I told them I didn't re enrol onto the any course let alone the course I didn't enjoy in my first year and all they said was they would get someone to call me back. No one called me back until recently I receive another letter from the University demanding the money or they would pass me on to a credit agency/solicitors. I don't understand how they got the information that I enrolled myself on to the same course for that year. I went to speak to them two days ago and they said I must of sent a letter back or went on-line and re enrolled. I know for a fact that I did not re enrol and I did not attend any lectures or seminars at the University. When I told them that and also asked them to check for attendance they did and realised I didn't attend any lectures or seminars but said I had swiped my card 6 times to get into the University so they assume I was still there. The reason it was swiped 6 times was because I would get invited back to train with the basketball team and I would go into the sports arena and train with them whenever I didn't have to go into work. I did not once attend any lessons/lectures/seminars. I kept telling the person at the finance department that I had not been at University that year at all to study and I did not re enrol. The person ended up giving me an email address to email and write my appeal for the £1680 the university is asking for. Any advice on this matter would be great. Many thanks

- 3 replies

-

- fees

- south bank university

-

(and 2 more)

Tagged with:

-

Hi While studying for a qualification, I was student member of a professional body (this cost me nothing - I assume the training organisation paid). One of the perks of this was being able to upgrade to a full membership for one small fee (under £50), compared to the usual membership of nearly £200. I completed my qualification, waited until I had my certificate, and then upgraded my membership online - it all went smoothly and I paid by debit card Then I received an email saying that, as I'd completed my qualification, I was no longer a student member, and would either have to pay the full fee, or they would refund my reduced fee. However, I'm wondering if they can change their mind like this - they allowed me to upgrade online - is that a contract made? I was still a member of some sort when I upgraded, as my login details etc. still worked. It seems to me that they hadn't got round to updating their database, removing those who were no longer valid student members. I would have happily accepted that I missed out, had they not allowed me to upgrade in the first place, but as they alllowed me to log in, complete registration and took my money, is in not their problem that they hadn't removed me from their database of members? I would still like to be a member, but I'm not sure I can afford the full fee. Does anyone have any ideas where I stand as regards my rights in this matter (before I respond)? I'd be most grateful for any information Thank you

-

Newmans Debt collectors for Ebay

Stressed Out and Worried posted a topic in Debt Collection Agencies

I have been a member of ebay for over 9 years and a few months back I sold some items and owed ebay some fees of £16, I never intended not to pay just really forgot about it. Last week I went on ebay and paid the fees which then reopened my account, so ebay took the fees as settled, well thats what I thought. Today I get a letter from Newmans Debt Collectors saying thank you for the part payment (although I paid all the fees I owed to ebay) and I still owe £8. Now I know I dont owe it as my ebay account is now saying I owe nothing and I can use my ebay account. So I phoned them and they said the £8 was a fee because they have got involved. This is the first letter I have had off them and surely since ebay took the payment and my account is now clear I do not owe these debt collectors anything. As I say I have never dealt with them. I aksed them to send proof of the debt, which they said they would. Should I pay these sharks or not? My credit rating aint good so im not bothered about them listing £8 against me.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.