Showing results for tags 'agreement'.

-

While we all know an OC will assign when they can't be bothered to handle the debt themselves, and we end up dealing with a DCA. The entitlement to do this is usually written into the original agreement. However, even when they assign/sell off the 'rights and duties' to a 3rd party..does that 3rd party also inherit the right to sell off the debt to a 4th party, with all the rights and duties ? The reason I ask this is that where the Agreement defines 'we' and 'you' , the 'we' is described as the name of the OC (Barclaycard for example) not 'and/or' any subsequent 3rd party. This seems to me to state that the legitimate right to assign is solely the right of the OC. If the reassign rights were meant to be transferable then wouldn't it say 'we' is (name of Bank) or any company we have sold/reassigned the rights and duties to ? Where people are dealing with a 3rd, 4th or 5th DCA...is the process where one DCA sells to the next, or do the DCA's always return the agreement back to the OC for them to sell on again ? Has anyone any experience of how the process works ? In addition, if the OC sells to an Agent, then the Agent sells to a DCA...does the Agent have the right to sell too, or should they return the agreement back to the OC for them to deal with ?

-

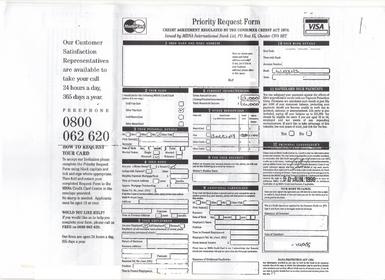

Hi, here is another debt I am trying to help a pensioner with. She is being hounded by these guys and I am just trying to help sort it out and get her to stop worrying when they threaten her with visits etc. She has paid a few pounds every so often which has kept it live and not stat barred. This agreement is from 1999 and was received back with no other terms/conditions from greenwood personal credit responding to a cca request. Being dealt with by C.K.Edrupt &co. agreement copy.pdf The 'right to cancel' doesn't look right to me, stating Isn't the creditor the one doing the agreement then? Why wasn't it shown at the time etc. Can anyone also tell me how correct their APR is please. how enforceable is this agreement? Thanks AS

-

Hi again all Having followed the excellent template letter and spreadsheets on here i filed a claim with tesco two weeks ago. They have replied today agreeing to refund the £80 odd (not a lot but its a start for me ) but still state and i quote "for accounts in arrears, refunds will be paid in to the credit card and the remainder sent by cheque" i stated in my original letter "that I request that payment is made directly to me, by cheque, and that any refund in whole or part should not be allocated to any set off or third parties. Should this occur, my claim will be deemed as unsettled and I will proceed to the Courts for recovery." So far i have drafted the following reply does this look ok to you? I have signed the acceptance form they provided but crossed through the part were they mention payment back to the card. "Dear Sir/Madam Account Number Thank you for your swift reply to my letter. I accept the refund of £xx.xx but would note to you that I request that payment is made directly to me ,by cheque, and that any refund in whole or part should not be allocated to any set off or third parties. Should this occur, my claim will be deemed as unsettled and I will proceed to the Courts for recovery. I look forward to hearing from you again shortly. Yours Faithfully" thanks again in advance

-

I am trying to help out a pensioner sort her debts out. She doesn't have access to internet etc so I am the middle man, this is the first of half a dozen+ debts lol. This is a copy of her agreement via a CCA request. Any advice on the agreement would be great. It was for a credit card taken out in 1998. There are some copied onto the back of the agreement. They also sent some other terms and conditions but nothing that is showing a direct link to the above agreement. I can scan up if required though. Link Financial Outsourcing bought the debt in 2001. Payments have been made a few months ago. All help appreciated AS pdf in post #3

-

Hi many thanks for reading my thread and any advise would be greatly appreciated :- I purchased a brand new van in 2007 from Network / Leaseplan, The contract states it's a 'Hire Agreement regulted by the consumer credit act 1974' under payments it says, Timing of rental payments one advance payment of £1057.50, 47 monthly rentals of £351.90 followed by final rental of £6247.48. I have never received any term of conditions and only have the agreement papers. I have other paper work saying - Schule AA Finance Gap Terms of finance 48 months, amount financed £17909.28, vehicle purchase price £19054.91. Having paid the initial £1057.50 and making 37 payments 0f £351.90 up to and including 13/08/2010. I was then hit by the down turn in the ecomony and been late with the payments in July 2010 & Aug. 2010 and not been able to pay Sept 2010 two burly agressive men appeared on made doorstep with a vechile collection reciept (Not A Court Order) and took the vechile. A couple of months later we moved address and I thought that was the last I would hear. Fast forward to April / May 2012, A High court enforement officer appeared on my doorstep saying They was a judgement against me and I owed £4922.94 to Leaseplan. I now started to do a my homework and question the original actions. I have a CCJ against me for £3700.00 from Leaseplan. I sent a N244 to my local county court to 'Stay the High Court Writ' and have the 'Judgement Set Aside' and have the case transferred from Northampton I recieved a court letter today stating the writ of fi fa stayed pending an hearing. The hearing to be THIS Friday 6th Sept. If some one could help me with the following questions please:- * I was never issued witha court order for the van been reposessed * Am I protected under the Supply of Good(Impied Terms) Act 1973 having paid more than a 3rd * Are Leaseplan allowed to transfer the CCJ for High Court Enforcement if protected by the Consumer Credit Act. * I have repeatedly written and requested T&C's still not recieved any. * I was never issued with a sale figure of the van, which I have also repeatedly ask for. * No finance interest rates are on the agreement. Finally what worries me more then anything is the contract Stating 'Hire Agreement (Not hire Purchase) regulated by the consumer credit act 1974, does this effect my rights. Apologises for the long initial statment, many thanks

-

Hi All, Problems problems!! Here are the facts. Financed a car on HP in 2008 for £10380 total amount repayable. Have paid £7000 to date but I am currently 3 months in arrears. Have purchased another car so wish to terminate the above HP agreement as I have paid over 50%. Wrote to finance company and made a huge mistake saying I wish to "voluntarily surrender" please come and collect the vehicle. Finance company replied and sent a form for me to complete agreeing to their terms of surrender. Sent the form back with my own notes added stating that it is a voluntarily termination in accordance with the agreement and that I have paid over 50% and thus not liable for any further payments or costs. (I understand apart from the 3 months arrears). Got a call from the finance company saying that they could not accept the paperwork with my added notes on and also because they had already terminated the agreement due to two months of arrears (since paid up) that occurred 2 years ago. I then received a letter in the post which is a copy of the alleged termination notice dated 2010 which I knew nothing about. So now I'm stuck. How can they have sent a termination notice 2 years ago yet have never reposessed the car and have also continued to collect monthly payments and send statements and chasing letters? If they really did terminate in 2010 then should I be asking back for the payments I have been making from the point of termination? Have I made a big mistake in my original letter by using the word surrender instead of termination? Where should I go from here as I still have the car? Cheers. 1970

-

Hi guys, it seems black horse are being a little stubborn with my ppi claim. i have requested my loan agreement and they have provided me with it. i have the account number for the loan and a copy of the agreement. my case is that i did not tick the tickbox for ppi but i am however paying for it in my agreement. I have sent a questionaire and provided them with my loan account number which i believe would be enough information for them to process my claim. The loan is still active and i took it out mid 2008. they have now replied saying that without the agreement number for the ppi then they cannot process my claim. They would not be able to find information over 3yrs old. I am sure i was never provided with this number to begin with and obviously was totally unaware i had ppi until i looking into my loan agreement. I have changed address since the loan was taken out, maybe that has something to do with it?. Has anybody else here had a loan with lloyds and had a separate agreement number for their ppi? thanks in advance, jamie.

-

Hi there, wonder if you could help me out - apologies if in wrong section. I am currently paying £336 for my car at the moment, and thankfully as struggling my dad has managed to get me finance on a cheaper car for work etc which is great, but I have to VT my current vehicle. I have paid well over 50% of the agreement, have a few worrying points before I send my letter - as I am young my insurance is under my mothers name and to do this the log book shows my mum as the registered keeper, I never sold her the car but had to be done as insurance was expense at the time. Really worried this will affect me when I send my letter for VT. Also lost a set of keys and a small bit of damage at the back of the car. If I am charged for the above, would I be able to come to an agreement with the company for a payment plan so I don't default on any charges? Really cannot afford to keep both cars. Any help appreciated.

-

Hi am currently trying to help someone with a CCA request. We have received a letter back that says "I have enclosed with this letter a copy of the reconstituted version of your executed agreement and a signed statement of your account. By providing you with the documents attached to this letter, we have satisfied our obligation to provide a copy of the executed agreement under section 78. There is no requirement under the CCA to provide you with a copy of the original signed agreement, b ut notwithstanding that fact, please find enclosed a copy of the front page of the original agreement proving your signature. The prescribed terms of the agreement would have been validly incorporated into the agreement on the reverse of the enclosed sheet or a seperate attached sheet." Is this right?

- 10 replies

-

- agreement

- lloyds bank

-

(and 2 more)

Tagged with:

-

Hi all just registered on here as i need a little advice if anyone here can help me out please I'm in a privately rented semi-detached property which is let out from an Local Estate Agency this is due to end at the point of writing this on the 1st of October 2012, My short assured tenancy agreement states i have to give 2 months notice to leave the property which by there way of think is i should have put my notice to them on the 1st of August 2012. Im having loads of problems with my next door neighbours and it basically kicked off last night when they had a party and my wee 2 year old girl was constantly being woken up, i went to the door to ask them to calm down with all the banging etc (very polite ) i have had to go through to them about 4 times about this. to cut the story short the family became very agressive and so did there quests i called my landlord about them for the 5th time and he told me he only rents the house out to me and there was nothing he could do even though he is friends with them now my question is. if i give notice now 2 months and the date will now run over the 1st of October will i have my tenancy renew to a periodic agreement even though i want out of here no longer than the 1st of October which i believe im legally required and expected to pay full rent til that date if this makes sense, i dont mind paying my rent at all i just dont want to be stuck here for another 6 months when technically legally only signed up to be here until the 1st of October but feel im being forced to stay here and the Estate Agency are tell me i have missed my date of putting notice in and im now stuck here from now til the 6th of August and a further 6 months there after is this correct Any and all help really appreciated and hope this has made sense

-

I'm trying to take care of a PPI claim against Lloyds TSB for my wife. Basically the facts are this:- My wife was in temporary employment when she took out her credit card and was told that she wouldn't be accepted for a credit card unless she took out PPI. My wife the sent a letter to Lloyds TSB asking for her PPI + interest back, they claimed that she knew PPI was optional and have fobber her off. There was no mention of the temporary employment. She then sent a CCA request, to get a copy of her Credit Card Agreement. They've sent her a reconstituted one with no mention of PPI and it contains her married name and our current address, she was unmarried at the time of application, living elsewhere. Luckily she has all but one (earlier this year - it will be somewhere at home) credit card statements going back to when the credit card was taken out, so we have pretty much all the financial information required. How do we get a genuine copy of the credit agreement so we can see what she agreed to at the time? Or is this not worth pursuing and just get straight on with the PPI claim? Also is the reconstituted one legal with wrong name and address? I've posted this in the Lloyds TSB forum, as the initial question is about CCAs. However I suspect it may end up in the PPI forum.

- 4 replies

-

- agreement

- lloyds bank

-

(and 1 more)

Tagged with:

-

HI All After all the excellent advice received previously I may have mislead you all - it is not a HP Agreement but a Lease Purchase Agreement over 48 months. Have paid all below except final Outline as follows :- First £5225 + 47 X £461 + £5000 final rental payment . The car registration document is in my name not lease company (error at purchase stage by dealer - they have asked for it over years but ignored request) Query is will not be able to make final payment due tomorrow of £5000 but should be able to pay by end of September . How should I deal with very aggressive company always threatening repossession . Can they take it or do they need to go to court first / and how long does it take / Should I write to inform them I will pay end of September and offer late interest payment on top as compensation to them ? Thanks for helping

-

The OH sent a SAR to M&S. Their reply said the accounts (1 x Personal Reserve and 1 x Budgetcard) were closed a long time ago (2000) and they no longer had any records. The OH sent a reply arguing that they still had my records (from an account opened in 1986 and closed in 2000). Demanded that they send the necessary information. Eventually M&S sent some information printed from their computer system (including name, address, marital status, home and work telephone numbers, occupation, bank account number and sort code). They also sent a reconstituted agreement and application for the Personal Reserve account (but not the Budgetcard). The form contained the OH name, address and date of birth. Everything else was left blank (despite having the necessary information on their computer systems). As part of the agreement and its terms/conditions, it refers to the complaints procedure. To complain about PPI the agreement refers the debtor (my OH) to the GISC. To complain about any other aspect of the Personal Reserve my OH should refer to the Financial Ombudsman. I know that Carey v HSBC allows for reconstituted documents. However, the accounts were opened in the mid 1990s and closed in 2000. The GISC and the FOS did not have responsibility/come into being until 2001. Any advice as to how to respond to M&S given they say that the OH agreed to something in the mid 1990s that did not exist until 6 or 7 years later...?

-

Hi All. I have a thread elsewhere on another debt I have. This is my first post about this one. Now owned by a DCA, it is for a credit card that originally started in 1998. In response to a CCA request for it, the DCA that now owns the debt has provided a reconstitution that is missing the original terms. They also state I am assuming that this soundly makes the debt unenforceable? I know I should know this stuff by now - but please could someone confirm?

-

I recently sent a letter to Credit Resource Solutions (20th June 2012) requesting a copy of a Credit Agreement of an account they are dealing with, to which they allege I owe £450 to. I am disputing the amount owed and was advised to request a copy of the credit agreement and statement of account. As of yet I have received no reply and was wondering what steps I need to take next to resolve the situation. Any help, as always, will be appreciated.

- 5 replies

-

- agreement

- credit resource solutions

-

(and 1 more)

Tagged with:

-

Hi I would be grateful for any help please if possible In 1999 i bought a car on HP which the value at the time was around 2K. Due to severe change of circumstances within one month of buying the car i told the finance company i could no longer keep the car as i was unable to pay for it. I sent them a letter telling them this and also via telephone. Due to the change of circumstances it meant at the time i no longer had a fixed address so there was no way of knowing what reply from the finance company was, also neither was i able to recover any belongings i had before these change of circumstances took place. Speaking at the time on the telephone i was told by the finance company that they would recover the vehicle and IF there was a remaing balance i would have to pay it. this week (13 years later) i have been contacted by a debt collecting agency for the balance of 7K for the car. I have never recieved a default notice or any comunication from the finance company in all the 13 years. I have changed address a couple of times but within 6 years after they recovered the vehicle i was at one address for 4 years. Perhaps stupidly i thought they would contact me and things would have been resolved, but they didnt and no i did not contact them because i had truly forgotton who they were not having any possesions at all from previous to the end of 1999. I am not trying to hide from this in any way i am just trying to resolve this but i do wonder that after such a long period of time what rights i have. I would be grateful if anyone can help. Thanks

-

After major trauma and ending up in debt I am in the process of sorting myself out. I have requested CCA's from DCA's and when recieved have arrange suitable repayments. However one slipped through and got as far as a summons, I defended by requesting a CCA, the summmons was stopped about 6 weeks ago and I have recieved the agreement. The DCA now wants me to sign a Tomlin agreement, i have looked round and dont seem tunderstand what it really is. does someone know of a "Tomlin agreement for Dummies"? Also can I still make a PPI claim on this? Thanks in advance

-

My friend and I have been renting our house since 9th March 2012 through a letting agency. The rental of £475 has been paid in full every month, until.... During May 2012 we received a letter, recorded delivery, addressed to 'The Occupier' from Winterhill Largo with a Notice Of Inspection. The letter went on to notify us of a change in receivership for the property. After a brief phone call I was informed by Winterhill Largo that our landlord had missed mortgage payments on the property and therefore the house had been repossessed. I immediately notified our letting agency but they didn't know anything about it! Further letters were sent from Winterhill demanding payment to them, not the landlord or his representatives. We made copies of all the letters and gave them to our agency who informed us they could not get in contact with this company and adviced us not to pay anything to anyone until the situation had been rectified. We have received a letter today from our letting agency confirming our property is now under new ownership and demanding payment of £1250 in rent arrears! Does this disruption results in a breach of our tenancy agreement? We are now frantically looking for somewhere else to live and would prefer to use the money saved during this period to secure new accommodation. Do I have any rights?

-

Hi Guys hope you can help, I took out car finance in 2002, now Ive put a claim into Welcome for my ppi back and got the standard letter back saying "Final response, Thank you for your letter received on 28th May 2012. I regret to inform you my decision to reject your complaint because it is outside the relevant time limits, I understand that this will be a disappointment, but what follows is my explanation of why I have rejected your complaint and how the time limit applies. The rules of our regulator (the Financial Service Authority -FSA) state that where a complaint relates to an event that took place before 27th February 2003, we are not required to investigate your complaint. Sales of insurance made before this date were the responsibility of the insurance provider, not the broker who sold it". It then goes on to say contact the fos if you dont agree etc. Im guessing that this is a standard letter, Now do I take my complaint to Norwich Union Insurance LTD (now Aviva) or refer it to FOS? I have tried to use the spreadsheets to figure out what I should claim for back, But Im just going around in circles and making a mess of it. Here is the orig agreement minus personal details any help would be really well received, The reason I have not claimed before is I totally forgot about it, Until when I was cleaning out the safe of old rubbish I came across all the paperwork at the bottom, that was on the 20th may.

-

Hello, I hope someone can help me. I took out an Egg credit card about 2001 / 2002 & I have received from BarclayCard a copy of the credit agreement. The copy they have sent me (which I presume must be the only one they have) is not signed by myself as I applied for it online and I cannot remember being sent something in the post to sign and send back. Is this agreement legally enforceable and if it's not what should my next step be? Many thanks in advance.

- 15 replies

-

- agreement

- barclaycard

-

(and 1 more)

Tagged with:

-

Hi all. As the title suggests I'm struggling at where to start with my debts. Mostly obtained during life as a student, and snowballing charges, my debts were made worse through a couple of periods of redundancy (Jun 06, returning to work in Dec 06, made redundant again in Feb 07) a separation from my partner and the arrival of children! I've been burying my head in the sand now for years and through a combination of family life, work, and a certain degree of procrastination haven't faced up to these dates.....until now! I have a number of issues/questions and I would greatly appreciate any help in dealing with these. 1. Bank Account I have a closed current account with HSBC for which ownership has recently been transferred to MK Rapid Recoveries (?MKDP LLP / ?Compello). The outstanding balance for this current account is £1237 and the CRA entry shows this as having defaulted on 06/10/08. I did attempt to reclaim bank charges but, to be honest, I'm not sure what happened here - I was granted a hearing for the removal of the stay on 3rd Oct 2007 but did not attend due to (i) a breakdown in my relationship with my partner and separation from her and my 1 yr old and (ii) to being away on residential training with new employment over that date. I also moved house around this time and therefore received nothing further from the courts. I am currently in the process of trying to access my old claim via MCOL. I have made no contact with the bank since the incomplete attempt at reclaiming, or MK Rapid Recoveries, as I still believe that this debt is largely due to the banks unfair treatment and therefore contest this debt. I have recently started receiving recovery letters from MK but have stupidly ignored them. Can anyone offer any advice on this? How does my failed effort at reclaiming these debts affect my way forward? Is the financial ombudsman route still a possibility? 2. Credit Cards I have two credit cards, A and B. (A) defaulted on 11/01/09 and has a current outstanding balance of £2924. (B) defaulted on 14/12/06 and has since been transferred to a different company ©. Token payments have been made to these credit cards since I was made redundant in June 06. I continue to make token payments each month to these, although since being transferred the payments to (B) don't always reach ©, according to my credit reports anyway)?! Looking at Experian both (A) and © are listed twice, whereas they are only each mentioned once at Equifax - is this anything to worry about? There are 3 other Credit Agreements duplicated on Experian, whether 'default - satisfied' or 'satisfactory - settled', which are each only listed the once on Equifax. At first glance at Experian there appears to be 9 defaulted Credit Agreements!! 3. Store Card There also appears to be some fishy goings-on with regards to an old store card agreement (D) which I have been making token payments to since June 06. This agreement recently disappeared off Equifax, followed by a recent alert that a credit limit had been changed from £0 to £900. On checking Equifax, and more recently Experian, an agreement has re-appeared from (D) with a balance of £903, a credit limit of £900, acknowledging that I have had an agreement to pay since July 08 but repeatedly stating that I am 6 payments late? I received a default notice from the initial lending company in Nov 06, and again in Apr 07. In June 07 I received notification that the ownership of my account had been assigned to another company. I received another default notice on August 07. How many default notices can be given and from which one does the 6 year period begin. Why are there no references to any of these default notices with either CRA? On the upside I have been given some early inheritance and, whilst not a massive sum, had hoped that this would one day go towards a deposit on a house to hopefully provide a better living for my family. I am aware, however, that no mortgage lender would even consider me, especially in the current climate, with my current Credit Report and it is therefore necessary to put this inheritance towards clearing debts. Unfortunately it doesn't cover the total debt and I was considering making partial/final offers if it would mean I could have some of these defaults marked as settled. What are people's ideas on this and where do I start? What should be my starting offers be to my debtors? Although I started the claim for unfair charges against the bank, I haven't looked into reclaiming these for any previous credit cards, defaulted or not, or loans. Nor have I investigated being mis-sold PPI on any previous Credit Agreements. Should I start reclaiming charges, look into PPI or perhaps make offers to pay first? I'm guessing anything is better than burying my head, even though that would be much easier!! Thanks everyone who has taken the effort to read this - I'm aware I've written alot / asked alot of questions!! DD

-

Hello all I would like some advice into how I can successfully contest a job seekers agreement. I went for my first interview and whilst the advisor went through the types of jobs and time restrictions ect, to which I agreed to. A print off was then given for me to sign. What had been added was I must spend 6 hours a day job seeking and write to ten employers a week. I was never asked if I agreed to this. I have every intention of finding a job, i am concerned that it would be difficult for me to prove what constitutes as 6 hours worth of jobseeking, if at any point it is decided I have not done that. As we all know job seeking is demoralising, depressing and energy sapping and I am sure occasionally I may fall not stick rigidly to the agreement as we all need a break. I have been job hunting since May but only just signed on and after applying for many, most do not even reply as to whether your application was successful or not. I sometimes find I need to take some time to re-energise myself and re-motivate myself. I do not know how the decsion has been made that I should do 6 hours a day job search and under what basis it was made. I feel that the the advisor just picked the numbers out of thin air. I believe that the job seekers agreement is used purely as a tool to beat you with and stop your benefits when you find yourself in a down time after so many rejections. I wish for it to be reduced to a level that even when I am feeling down I am still able to adhere to it. Would the reasons I give above be good enough reason to have it changed?

- 48 replies

-

- agreement

- contesting

-

(and 1 more)

Tagged with:

-

Hello - my partner financed a car for me last year. I was sold on this special offer specifically for the free insurance. I later found that I did not qualify for the free insurance despite the salesman assuring me I was (3 times but stupidly on my part not in writing). I now cannot afford the car with the additonal insurance I need to pay, infact the car has been off the road for a few months because I cant pay the insurance. I have read somewhere that If an agreement was not signed on the premises that it is unenforceable, is this rubbish or true as my agreement was not signed on the premises. I know that I dont have a leg to stand on as I did not get it in writing from him about the free insurance but if this was true then does this mean i can give the car back on this basis? I do realise that i am in this mess becuase of own stupidity which at my age i really am annoyed with myself about. but on the otherside of the coin they told me incorrect info to land a deal. In fact I conferenced call my partner in on the phone conversation where he said id qualify, but nothing in writing. Any help or advice would be greatly appreciated. Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.