Showing results for tags 'global'.

-

Just received letter from MBNA stating they have sold debt to Arrow Financial under a Notice of Assignemt. My questions are Do I acknowledge debt to Arrow Global Can I ask how much they paid for the debt? Is it true that I have basically settled my commitment to MBNA in settling their balance (eve tho Arrow Global have paid it) I have no agreement with AW. Due to financial difficulties I have been paying MBNA £20 without misses for over a year now and the balance is £3450 Any advice please.

-

Hi all, New to the forum as I found you when trying to research the company who have contacted my partner for a £3000 debt he apparently owes. The letter is from Mackenzie Hall on behalf of their pursuers Arrow Global Limited and the original creditor Fairmile Partnership 1 LLP. The letter is dated 4th December 2012, however we only received it on Sat 8th December 2012. There is a "Payment Deadline: Noon, 11th December 2012". Quite a scary letter when you first read it, luckily over the 3 years me and my partner have been together I've become quite apt at dealing with these situations (he wasn't a good boy before we meet, but tigers can and have changed their stripes). This one has worried me a bit due to its aggressive and completely un-realistic deadline. Also the fact that while my partner has admitting responsibility for some of the past debts and I managed to get the amounts reduced or completely written off, if has absolutely no knowledge of owing £3000 to anyone for anything. I did ring them on his behalf just to state that due to his working hours he is unable to contact them within the required timeframe. The operator has said that she will post an enquiry on the account but she is unable to confirm anything with me as I don't yet have authority to speak with them. I asked if the enquiry will hold the account, but she cannot say only that "we shouldn't worry about the deadline". I hate it when people say that as in my experience it means we really should worry about it. I asked how long an enquiry will take and it usually takes a few weeks. Can anyone offer any insight into who these 3 companies named are and what the debt might be related to? Also any advice on how to proceed with them?

-

hi this is my first time here and hoping to get help fast. arrow global are taking me to court for a un paid phone bill. ive told court i will defend it and ive sent a validation letter to arrow asking for prove of the debt ( phone bill statements etc ). the bill is for 445.77 all they sent me back is a copy of there own made up crap its got the orange logo on it with orange address etc but the statement is dated 7 sep 2012 now this dept is nearly 6 years old there are no phone numbers on it or times calls were made.. my name is spelt wrong and it also as my middle name initials on it, i never ever use my or give them to anyone except anything government ( tax papers driving licence etc ) so i know this so called statement is printed by them and its not orginal, the court as sent me a letter saying they have moved the court hearing to court of my choice and will be letting me know when date to attend... can i send arrow anything saying this it not a true copy, also i thought with phone companys if u missed a mths payment they would stop all outgoing calls until its paid, this statement shows i never paid 24th fab 2007 £221,43 24th march 2007 £135.75 24th may 2007 £80.01 would they let a customer run that long with that much bill.. . thanks for ur time in reading this

- 82 replies

-

- arrow

- county court

-

(and 2 more)

Tagged with:

-

In July 2006, I defaulted on a number of debits. One of them was for a visa card with Shell. This was sold on to Arrow Global and in September 2008, Arrow got a CCJ for the £3523 outstanding. I have been paying the shell/arrow at £14.37 a month since 2006. There is still £2790.77 left to pay. I have tried to make a settlement offer to Arrow of £839.55 which is there amount, pro-rater from a lump sum I have received, but they have turned me down saying they can only offer me a 50% discount. All other defaults have been removed from my credit file, but this CCJ will stay until September 2014, so I would like to settle it. Does anyone know how firm they are on the 50% rule. It seems silly that they would rather have £14.37 for another 16 years rather than have the 839 cash now.

-

Hi All I’m hoping someone can be of help to me on here, be that telling me what to do or directing me to a previous thread. I have received a Court ‘Claim Form’ from Northampton County Court issued by Shoosmiths LLP on behalf of Arrow Global who in turn had purchased my MBNA debt. I had originally written to MBNA in March 2010 asking for a true copy of the signed credit agreement(s) in their original form. I did not receive any response from MBNA and no contact apart from the usual Debt Collectors and other companies that obvious offer discounts if I pay it off. These companies tended to go away once I said the account was in dispute. Arrow Global obviously being made of sterner stuff. I have responded to Shoosmiths prior to the Court letter but these had possibly crossed in the post. I have requested the 28 days from the Court to prepare my defence. Shoosmiths have responded and they have asked me to provide evidence of my contact with MBNA for their consideration. My questions are: Will my ignored request to MBNA count or stand up in Court? I did have a proof of posting but cannot find this now. Even the letter was on a defunct computer that I had to get an IT guy to suck the files out of. Should I continue talking to Shoosmiths prior to the case? Have I any chance of coming through this? If this matter should go to a full court hearing I would not feel confident in representing myself. A friend has said they would lend me a few hundred £ to employ a solicitor. Anyone know of a solicitor who will defend/support me and is up to speed on these sorts of matters (and based in the East Midlands)? How come they have started proceedings now? Has there been a case heard that they have won and so feeling bullish or are they just hoping I will fold and pay? Many thank for your attention, time and consideration.

- 12 replies

-

- arrow

- county court

-

(and 3 more)

Tagged with:

-

Please can someone help I have received a letter this morning from Mackenzie Hall as follows Reference ******** Client Reference ********* Pursuers : Arrow Global Limited Original Creditor: Cyclone Asset Management Limited Principle debt £976.19 IMPORTANT - DO NOT IGNORE We have been instructed by our client to recover this overdue debt on their behalf. Our clients have informed us that they are unaware of any legitimate reason for non-payment of their account and although they would prefer an amicable resolution, they will not hesitate to take such further action as may be appropriate. Payment deadline: noon, 11th December 2012 this letter has come out of the blue, the past debts i had are all status barred so can they still be pursued I have had no further debt in 10 years and my credit rating now is really good. I have no idea who these people are and also have no idea who a) the pursuers Arrow Global Limited or b) Original Creditor Cyclone Asset Management Limited are, I have never been contacted by any of these people before and have lived at my address for 3 years. What do I do ? do i ignore it ? over the years I have had numerous letters from Lowell Finance which I have ignored but I know all these debts are more than 6 years old, but this latest letter has come as a shock as I have never heard of any of these people. can they cause a problem with my credit scoring as it is excellent at the moment ? Can they take me to court ? should I phone them? or email them? I apologise if this has all been talked about on this forum already but I suffer with ill health and am dyslexic so can not sit and go through all the posts.

-

And another victory... Muck have been chasing for an old alleged debt which is statute barred and covered by my BR... Nawty boys... Got sick of the calls and letters now 'cos feeling sorry for the trees... I do not recognise it and it has the stink of a problem with Lowell two years ago whereby Freemans sold a pile of allegedly dodgy debts which both companies admitted and compensated for... This alleged debt has been through Lowell as well... Muck already knew of the BR so should not have been bothering me even if it was my alleged debt... Reports to TS and the OFT via Consumer Direct Just giving you all the heads up 'cos this may be a similar f' up as two years ago and anyone having this issue should check everything

-

Hi, I am new to the forum but I could really use some good advice. I have been reading some of the posts which I think may be relevant to me and have used some of the information already provided but could do with a bit of help if you don't mind? I received a letter last week from Bryan Carter Solicitors stating that a County Court Judgement was entered against me on 23/10/2012 in respect of a debt for £327.96 with Arrow Global. This is the very first letter I have received regarding this. I don't know who Arrow Global are. I emailed Bryan Carter immediately and received a letter 2 days later stating the debt relates to a credit card debt with Capital One. Apparently the agreement commenced on 31/01/2009, and that the last payment of £1.00 was received on 19th August 2009. They state they sent previous letters and made telephone calls but this is not true. I have received nothing from them at all. I then found your forum and read some other posts. I contacted the court and they sent me forms to ask to set the judgement aside which I have returned to the court yesterday. I have also asked Bryan Carter for a copy of the original signed CCA. They replied advising I needed to request this from Arrow Global, again I have done this yesterday. I have also obtained a copy of my statutory credit report from Equifax & Experian. I have accessed the Equifax report online and it shows a debt with Arrow Global for £240.00 It does not show any payments but states a default in September 2009. Bryan Carter have now sent another letter requesting payment as required by the judgement. They state payment is now due today. What should I do now? I do not want bailiffs coming to take goods to the value of the court order. I am currently on Income Support. I have also been in contact with Royal Mail as it turns out my post has been going to an empty house 2 doors down from me and I have no way of accessing my mail that has been sent there instead. If anyone can help, I would be very grateful. Thanks.

-

Hi all, Bit of a desperate urgent one i had arrow global chasing me for £360 for what they say is an unpaid orange phone bill from 2007 ish. I know i did have a few bad debits back then but don't remember not catching up with my phone bill for this amount. When they first contacted me a few months ago i would not give them my dob and personal details as i thought it was a [problem] they refused to give me any info other than what i have detailed above. They finally said they will go back to the client and say that this is unchaseable as they I will not provide security confirmation. I did not hear from them again so belived it was a [problem] and they had lost intrest until reciving a court order for the money yesterday which has already is 7 days from the issue date. I am going for a mortgage next year so cannont have a ccj against me and feel for the minute will just have to pay the money to keep my credit rating clear and fight it out after. Please can someone help and offer advice? Like i said i cannont have this on my credit file and have to sort this out someway tomorrow proberly by paying it but i need the piece of mind that this is sorted. Thank you for any help, Adam

-

my wife has received a (judgement for claimant -after determination) from northampton county court, the debt is £3640.50 and they asking for payment in full or installments of £1094.05 monthly, my wife only earns around £1500 per month and i earn around £1800 per month after all outgoings we are left with around £150, so the amount asked for would put us in serious financial difficulties ,i.e not paying any motgage + other bill for 3 months, is there anyone out there who can give some good advice quickly,thanks in advance

- 3 replies

-

- arrow

- determination

-

(and 2 more)

Tagged with:

-

Hi everyone, I could really do with some help please. The story so far... Originally through MBNA who I contacted back in October 2010 requesting a copy of the original agreement under the CCA, they replied with a letter to say they didn't have it and because of a that, they would not issue any court proceedings, they have since sold it on to an arrow global who have now issued court proceedings! I received a claim form from Northampton county court (CCBC). Particulars of Claim: 1. The claimant's claim is for the sum of xxxxx.xx being monies due from the defendant to the claimant under a regulated agreement between the defendant and MBNA Europe Bank Limited (No. xxxxxxxxxxxxxxxx) and assigned to the claimant on 20/12/2011, notice of which has been provided to the defendant. 2. The defendant has failed to make payment l accordance with the terms of the agreement and a default notice has been served pursuant to the Consumer Credit Act 1974. 3. The claimant claims the sum of xxxxx.xx 4. C has complied, as far as is necessary, wi the pre-action conduct practice direction. Number It arrived late so I called the court and told them it had arrived late and they basically said too bad, it was too late for me to appeal against it and that it had now gone to judgment. A couple of days later I had the judgment for claimant letter arrive which I now need to get set aside using the N244 form. I understand I need to pay £80 for this. The problem is I am not sure what to put in my defence and in fact how to get the wording over correctly. I do have a copy of the MBNA letter and also a letter from a claims management company who also confirmed that MBNA could not produce the agreement. What I have done so far in between receipt of the claim form and the judgment letter is send a letter to arrow for a CPR 31.14 Request which I got from this forum thank you, and also I requested a copy of the original agreement under the CCA with postal order and all sent first class recorded delivery. I also copied everything to Shoosmiths as well, again recorded delivery. I suffer with dyslexia and due to that have trouble with filling in forms and getting my wording out using the right terminology Can someone please help in simple terms as to what I need to put for my defence in the N244 form? Thanks

-

Not posted before but read loads. My thread follows a few that I've read on here. N1 issued in Feb with no docs by Bryan Carter, CPR request submitted, no docs turned up and holding defence was put in. At AQ I submitted a draught order for directions requesting docs or a strike out. Ended up with a hearing with a judge who gave an order for AG to produce a WS and all docs to rely on by 14th Sep. When nothing was submitted by AG I wrote to the court on 15th telling judge we have been prejudiced by a lack of docs and requested direction. Despite phoning the court earlier this week and being assured that a judge would look at it urgently I am still waiting for my letter to be looked at. I need to submit a WS and docs to rely on by tomorrow and the court have advised me to submit these anyway as it will look better and the judge may not get to look at it. Now I'm a little lost. I need to do a WS and prepare a bundle (small claims court). I've never got to this stage before so am not sure exactly what is required. My argument is based on AG not having a notice of assignment with proof of delivery and no DN was issued. (AG were not the original creditor, nor was the previous company). I'm half expecting / hoping that the judge will see my letter and strike te claim out for non compliance with his order but still need to prepare in case he doesn't.

-

:mad2:Hi, can anyone please help! I have been chased by debt collectors for 9 years over a debt of my ex wifes. She fraudulently transferred her littlewoods account into my name. I can and have proved that the account was not in my name but the debt collection letters keep coming and i keep sending them letters basically telling them to stick it. What can i do to stop them?? I have written to the citizens advice but have not had a reply. I have really just about had enough of this now, will they ever stop!? Regards Darren:mad2:

-

Hi all, I'm new here, hello to everybody and I hope you can help me out. I received a letter from Fredrickson International in early December 2011 regarding their client Arrow Global requesting full repayment of a debt of £****. (Just under £3000). This dates back from when I was a student , my world fell apart for several reasons, I could not afford to pay my student debts and so a quite bad spiral began. I replied with a template letter, contents below. Re:−*Account/Reference Number **************** Your ref:- ARR/******** This letter is a formal request pursuant to s.77/78 of the Consumer Credit Act 1974. I require you to provide me with a true copy of the credit agreement relating to the above account, together with any other documentation the Act requires you to provide.* I expect you to comply fully and properly with this request, within the statutory time limit. You are reminded that should you fail to comply with my request, the provisions of s.77 will apply. If it is your view that you are not the creditor, s.175 of the CCA 1974 applies in the case of a simple assignment, and places a duty upon you to pass this request to the creditor. In the case of an absolute assignment, you are a creditor as defined by s.189. If you contend that you purchased the rights but not the duties of any agreement, you are reminded that s.189 of the Act is clear that an assignment is of both rights and duties.* Your attention is drawn to ss.5(2), 3(b),6 and 7 of the Consumer Protection from Unfair Trading Regulations 2008 (CPUTR). If you are unable to comply fully and properly with this request, you should confirm this in writing at the earliest opportunity, and certainly within the statutory time limit for compliance, and return the fee. With reference to the above agreement, I/we would be grateful if you would send me/us a copy of this credit agreement and a full breakdown of the account including any interest or charges applied.* I/we understand that under the*Consumer Credit Act 1974 [sections 77-79],*I am/we are entitled to receive a copy of any credit agreement and a statement of account on request.* I/we enclose a payment of £1 which represents the fee payable under the Consumer Credit Act 1974. Note that these funds are not to be used for any other purpose. I/we understand a copy of any credit agreement along with a statement of account should be supplied within*12 working days. I/we understand that under the Consumer Credit Act 1974 creditors are unable to enforce an agreement if they fail to comply with the request for a copy of the agreement and statement of account under these sections of the Act. I/We look forward to hearing from you. Yours faithfully I received a reply from ARROW GLOBAL dated 22/12/2011 We thank you for your communication regarding this account. We have referred the matter to our client and will revert to you as soon as we are in receipt of instructions. In the meantime, we confirm that we have placed the account on hold. Yours sincerely Fredrickson International Ltd. I then received a letter from ARROW GLOBAL dated 28/12/2011 saying "We thank you for your letter dated 10/12/2011 addressed to our external agency Fredrickson International, which has been forwarded to us for our attention as assignees of the above account, which we received on 28/12/2011 and acknowledge your request for documentation pursuant to the Consumer Credit Act 1974. We do not accept that we are the creditor as envisaged by the above statute. However, we are willing to assist in abtaining that which has been requested. We will now process your request for documentation from the creditor and will revert in due course. We confirm that all collection activity will be suspended pending provision of the documents. We return the payment of £1.00. Your sincerely, Arrow Global." I still have the original postal order they returned. I then heard nothing until today, 23/10/2012, 10 months later when I received another letter from Arrow Global, "Dear Mr ******, DEBT OWED TO Arrow Global Guernsey Limited Assigned by RBS (Account number ****************) In response to a request for a statement under section 78 of the Consume Credit Act 1974, we enclose: 1. Agreement 2. Terms and Conditions 3. Statements The Office of Fair Trading deems reconstituted agreements acceptable for situations where an original copy is unobtainable. OFT guidance on requesting information about credit agreements can be found under Credit Agreements at http:/oft.gov.uk. In December 2009, the High Court ruled that a true copy of an agreement does not need to be a photo copy or an exact copy of the original. A creditor is allowed to provide a reconstituted agreement, as long as that version is accurate and contains all the original information contained in the agreement, apart from a few exceptions that the law allows, which includes the signature, signature box and date of signature. We confirm: a. the account is in default; b. The total sum outstanding is £****.**; and c. The amounts which will become payable comprise interest and costs, depending on what enforcement action is taken against you; Please now provide your proposal for repayment of you debt.; Failure to do so will result in the continuation of collection activity, which in your case may include litigation. Telephone the number below to make arrangements to pay your debt. *** ******** Yours sincerely, Arrow Global." Now I am confused, they said they were not the debtors and now they say they are. They have taken a very long time to come up with the reconstituted documents, is this correct and can they go to court with this and succeed? Are they allowed to put this account on hold like this? I thought there was a time limit for their replies ie. the 12 days? Please can someone give me a little guidance here? Thanks very much, Traintester

-

Hello I have today received court papers from Northampton County Court and also a letter from Bryan Carter stating that they have started litigation procedures against me. The claim form states that I agreed to pay monthly installments but have failed to do so. The amount is £767.18 and then with fees brings it to £892.18. I have never heard of Arrow Global and best of all the Bryan Carter letter and the court papers have been issued to an address that I lived at 12 months ago. I have moved twice since then. Its only because my friend who now lives in that property passes any mail onto me that I even know about this. I do regular checks on my Experian and Equifax reports and have never seen this debt on there! Im really concerned as to what this may be as I am about to start Maternity Leave and will be on SMP so do not have this kind of money. I am not aware of this debt at all. Am I able to defend this claim and send a prove it letter? Im worried about the correct procedures and being 35 weeks pregnant, I am struggling to get out and about to get to CAB. I also need to get this sorted asap as once my baby arrives I may be more likely to miss deadlines etc. Any help would be greatly appreciated. Many Thanks

-

Hi On Sept 11th i recieved a letter from Transcom Worldwide Ltd claiming i owed a debt of £284.93 and they were collecting on behalf of Arrow Global Guernsey, i sent the letter stating i have no knowledge of any such debt being owed and have today received a reply stating Dear sir/madam we write in reference to your most recent correspondence of which your concerns have been noted please note our clients Arrow Global Guernsey Ltd purchased this debt from Kays and now legally owns all rights to to seek recovery of this debt and we are legitmately instructed to act on their behalf if you believe the matter to be a case of fraudulent activity please provide proof of residency for 2007 so we can investigate this matter further Can anybody point me in the right direction of how to reply to this letter ,i have no recollection of ever having a Kays account so why would they need proof of residency in 2007 when they are already writing to me at my address? i checked my CRA and nothing shows up there and the electoral roll shows i registered at my current address in 2005 so surely they should know this? Thanks

-

Hi All. Just an update as to the continuing saga with Arrow Global. Sent a letter to court asking to strike claim out as AG now continuing on their own Just received letter quoting a fee of £80 to try & get this removed. It also stated that it may be possible to get help with fee. They also state that it may not get struck out even after you pay the fee. Now considering my options. I will let you all know any further developments.

-

- arrow

- county court

-

(and 1 more)

Tagged with:

-

Hi I'm another who has received a Northampton CCBC Claim Form on behalf of claimant Arrow Global Limited The issue date is 5th September 2012 I did the acknowledgement of service online on 12th September 2012 Particulars of claim 1. The claim is for the sum of 1,087.27 in respect of monies owing by the defendant on a credit agreement held by the defendant with Sainsbury's Bank PLC under account number nnnnnnnn upon which the defendant failed to main payments 2. A default notice was served upon the defendant has not been complied with 3. By virtue of a sale of agreement between Sainsbury's Bank PLC and the claimant, the claim vested in the claimant who has a genuine commercial interest. The defendant has been notfied of the assignment by letter Amount claimed = 1087.27 Court fee = 65 Solicitor's cost = 80 I've had a couple of letters from Drydens but have never heard of Arrow Global Limited Default notice issued on 17th September 2009 however CallCredit, Experian and Equifax state a default date of 25th January 2010 Last payment of £10 was made in September 2010 I thought the debt was back with Sainbury's Bank in-house I had PPI on the credit card and tried to claim on this when I became unemployed on all occasions The first time, the claim was rejected as I had been sacked under probation. The subsequent times, I was contracting through an umbrella company as opposed to being a sole trader and therefore deemed self-employed I also had late payment fees and over limit fees of £12 each over a number of months Having read various threads on here regarding this company, I think I understand that the next step is to write a CPR letter, but am unclear who to address this to? Also, do I need to do an SAR and if so does this go to Sainsbury's Bank or Arrow Global? I'd prefer not to write to Arrow Global as I have no evidence of them having any claim over the debt I have 3 other debts and am now worrying that they will issue a CC claim as well, I'm also in the middle of a re-organisation at work and employment is not secure. My income was already reduced 18 month ago through another re-organisation I max out £2000 my overdraft every month. I had some money I was going to use to pay this off, but got caught out by right to off set lasy year I'm currently surviving on pay day loans every month and really struggling to cope. I've tried CCCS and Payplan, but I could not commit to the payment plans (long and complicated story) I'm kicking myself for not keeping on top of things Thanks Nicola

- 10 replies

-

- arrow

- drydensfairfax

-

(and 2 more)

Tagged with:

-

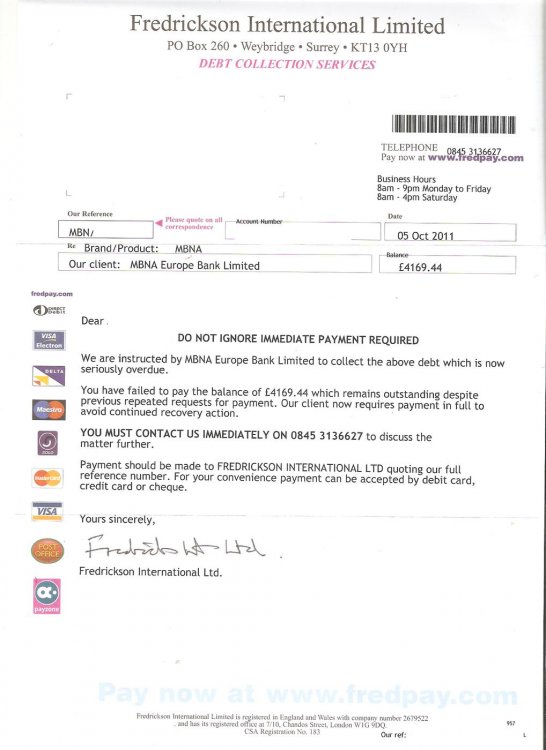

I have a debt with MBNA for £3000+ I was paying £65 per month and had got it down from about £8k over the years. The people who regularly pester me decided £65 was suddenly not enough when it actual fact it had become too much. So I sent them a CCA request and they sent back a copy of my initial application form. Same with Barclays, only Barclays just sent a piece of paper with my old address on from 12 years ago and a big wadge of terms and conditions. No signatures or anything really. I know things have changed since the Taylor case, but still, it didn't seem like enough, so I sent them both letters (from templates on here) saying it was inadequate and that the accounts were in dispute. that's when both of them sent letters - MBNA's was from Fredrickson and Barclays was from Mercers. Can someone enlighten me as to what to do next? I feel a bit stuck. Barclays, throughout all of this, call me between five and ten times a day, in spite of me asking them to just write. Thanks in advance

-

Hi guys, been a long time since I was on here, I finally got my credit rating and history all cleaned up and clear!!! Anyway.. out of the blue the other week, my partner received a letter from Tower Investigations Ltd, which was pretty vague, asking to get in touch regarding confirmation of identify and some information verification. I told the other half to ignore it, especially as it made no reference to any sort of debt owed etc, I naturally assumed it was a fishing trip So today.... The exact same letter arrives along with a similar letter from Global Debt Recovery, basically asking to ring them about a supposed account that they are responsible for. Again there is no reference as to who or what this actual debt refers to other than to ring up and arrange payment. Payment for what??? This all seems really bizarre particularly since its totally out of the blue. My main concern is that she may have had her identity stolen??? Any advice on this please guys?

-

Received court papers from Northampton County Court at weekend. This basically from Carter acting for Global. For weeks they threatened court action but i never replied to their letters as i have had no dealings with them before. However, on receiving these papers now replied back to Carter telling them it will be contested. Also filed a defence on line to the above court. Just waiting now to see what happens.

-

I have recently been contacted by GDR who claim that I have an unpaid debt with Lyodds TSB. I did bank with Lyodds when I was a kid but closed the account and moved to Halifax about 12 years ago. I have read many of the posts on this site so would appreciate a bit of advise as to whether this is statute Barred as I have already managed to trick GDR into confirming the account was closed in 2000 and that no payments have ever been made and no payment plans have ever been in place. Surely 12yrs is long enough. These jokers keep trying to say that as I did not tell the bank I moved house i'm commiting fraud. Again I do not beleive this but would appreciate any assistance. Cheers

-

Hi, I SAR'd Style financial which was due to expire today (9th Aug). I enclosed a cheque for £10 which was cashed 24/7/12. Today I received a letter from Arrow Global thanking me for my letter dated 13th June addressed to Style and that it had been forwarded to them as they are the asignees of my account. They acknowledge my request for a SAR but say I need to pay them £10 for the data and until payment is received my SAR has no effect. What!??? so will Arrow have all my statements anbd history for the entire life of the account? and why did Style cash my cheque? Now shall I ignore this letter and report Style to ICO for non-compliance and prove they cashed cheque or shall I contact Arrow, tell them to go take a run and jump for another £10 fee? not sure what to do but one thing I do know is that these banks certainly know how to wind people up! Any advice on way forward appreciated

-

Hi I have been chased for a while by Rockwell for an old Halifax overdraft that they claim was never repaid when they closed my account. I knew that bank account had been closed in around 2001-02 and so I know this to be SB. The account was passed across the office to Fenton Cooper who keep sending threatograms and calling etc. I keep saying "in writing only" etc and putting the phone down. I'm quite happy for them to waste their time and postage costs but something I never spotted before just occured to me. Before I knew about this site and its fantastic advice, I spoke to Rockwell on the phone. I didn't admit the debt and nothing was in writing anyway but I did ask them to send whatever details they had to my little used hotmail address. I didn't bother reading the email as I know it to be SB. Today I looked in the hotmail account and read Rockwell's email, dated 25 April 2012. This is what it says: Dear maplins Re: Outstanding balance of £xxx.xx owed to Arrow Global Ltd (HBOS xxxxxxxxxxxxx) We can confirm that the above account relates to HBOS bank account that was opened on xx/xx/1996 account number: xxxxxxxxx our clients purchased the above account from HBOS on xx/xx/2003. They have since instructed us to deal with this account on their behalf. A payment of £xx.xx was made on the xx/xx/2004 to European collections. Our investigations lead us to believe that this matter relates to you and the balance above remains outstanding. Please complete and return the attached form including your repayment proposals. The above account is on hold for the next 30 days to allow time for your response. So Rockwell knew this debt was SB yet still attempted to collect and then gave Fenton Cooper the pleasure of wasting their time and money. Oh, and the payment in 2004 that they mention is a complete fabrication but even if it were true, the debt would still be SB. I'm bored with their tedious communications now so I'm going to send the SB letter. Is there anything else I can say about them attempting collection on a debt they knew was SB?

- 2 replies

-

- arrow

- collection

-

(and 2 more)

Tagged with:

-

Hi everyone, I've been receiving letters from the above companies for some time and have decided to do something about it, need a little advice though if possible. They are telling me that I owe £399 for an Orange mobile phone contract from Sept 2007. This was the result of a dispute with Orange over items on my bill that I refused to pay and (at the time) it went away and I thought nothing more of it......I am actually still an Orange customer at the moment!! I ignored the letters on the basis that I was under the impression the matter was done and dusted but now feel that I need to do something as they have raised their game somewhat in recent weeks. I am now getting letters sent to my, my mother's and my girlfriends address.......I am receiving calls on my mobile, my mothers landline and my girlfriends landline........I even had a call at my Boss's home address (which is the registered address as per companies house but not the office address) while I was there having dinner!!! All of the calls have asked me to confirm my details (which I obviously will not do) and the letters are getting a bit more threatening (which in truth doesnt really bother me.....more annoys than scares:-x). I sent them a CCA letter, inc postal order etc, to prove the debt.......they have come back to me stating that the CCA doesnt apply and I need to confirm my salary, expenses and bank statements etc immeadiately in order to set up a payment plan. I'm dismissing their requests immeadiately but I'm just wondering where to go from here, I've drafted another prove it letter not mentioning the CCA but I'm wondering if this may well end up i court. The debt was made up of 4-5 monthly payments that I refused to pay so I'm assuming that the SB date would be somewhere around April/May next year.......gives them quite a bit of time to take further steps!! Any advice much appreciated!

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.