Showing results for tags 'kapama'.

-

I defaulted on an old minicredit loan in 2012 and the default is due to drop off in 2 months it's now with opos/kapama I have not paid anything or contacted them in nearly 3 years. ive found a few emails in my inbox about the debt, most recently a few weeks ago telling me it is now in the pre-legal stage they sent me a statement loan amount: £100 interest chsarges: £121 debt collection charges: £100 default charge 1: £25 default charge 2: £50 attempt charges: £685 i've paid £20 towards the debt according to the statement through token payments (sounds about right) but the amount owing is still over £1000 for a £100 loan i'm guessing as the default is dropping off soon this is the moment where they will try anything including a ccj to recoup some monies? especially if they dont hear anything from me. currently trying to sort all my debt problems out so.... what would you reccomend as my next course of action with this?

- 3 replies

-

- kapama

- minicredit

-

(and 1 more)

Tagged with:

-

Hi all Back in 2011 when I was in my late teens, struggling for cash and stupid I got a quick payday loan from mini credit for £200. From what I can remember the repayment date was set up a couple of days early, it bounced and they then began adding charges daily and with every payment attempt... I contacted them to try and pay the original amount, I think they wanted nearly double at this point so I panicked as I couldn't afford it and buried it. Years later, it is showing on my clearscore (equifax account) under Kapama Limited for £1033, under closed accounts last updated in 2016. For some reason, they have a shortened, incorrect version of my name which I never give and an incorrect address which I lived at as a child/teenager before moving out in late teens. I never gave them this address, god knows how they have it. I'm at a loss as what to do, 7 years later I have a full time job but with 2 children so adding another monthly bill would stretch things. Should I contact and ask for settlement? Ignore it and hope it drops off my credit file in a few years time? Be really cheeky and dispute it as they have the wrong address and name? I know the moral thing to do would be just ring up and pay it, however I can't afford to dump a grand on it, especially as I borrowed it when I was a moron at 18/19 in an already bad financial situation. Any advice welcome, Many thanks!

-

I took out a loan with Minicredit for £100 (minus their £20 for a faster deposit, so only £80!) in May 2011. In July 2011 I offered to pay the original loan + one month's interest (£125) but never received a reply, but they did continue to add charges to the amount outstanding right up to them defaulting the account. The account defaulted with all their made up charges at over £800 by September 2011. Opos/Kapama have chased this debt since some time in 2012. They stopped harrassing me by email and voicemail messages (I never pick up) last June 2017. The debt fell off my credit files last September when the debt became Statute Barred. Last week the phone calls started again. They are phoning almost daily and telling my voicemail I have until 8pm the following day to make contact. They are also emailing about my 'outstanding balance' that needs paying in full! I know that this debt is Statute Barred, and if they bothered to read their own paperwork they'd know this too. So, my dilemma is this... do I just ignore them as I have done for 6+ years until they get bored and stop again? Is there anything they can do if they are truly ignorant of the fact this debt is SB? Or, should I let them know this debt is SB and tell them to get lost and not harrass me any further? Any advice gratefully received, thanks.

-

Good afternoon. I am back under anew guise. I posted last year about a Minicredit default a £200 that ended up a £1200+ one after non payment. I hate the companies & now the default stands at £522 with Kapama & shows 5 years of non payment on my noddle file but is not present on my Experian or ClearScore files. It's on there till march 2018. Do I let it slide, I've still been getting voicemails from Opos demanding to speak to me (I blocked their numbers so that's their best way of trying to get in touch with me) for all I care they can do 1. Will that default disappear in a years time. I've a couple of other issues but that's 1 I'm looking to clear up for now. Thanks in advance Rob

- 8 replies

-

- kapama

- minicredit

-

(and 2 more)

Tagged with:

-

Thanks for everything you do here – I hope you might be able to help with Opos and Kapama. Although I've read lots of threads about them, I'm struggling with some particular parts of my situation. Brief background – in 2013, lots of foolish unaffordable payday loans to pay more payday loans, including a written off Wonga. Most now dealt with, with my credit file looking like it will be clear by 2020. A few monthly payments still going, including to Opos for a MiniCredit debt purchased by Kapama - notice of assignment issued in late January 2015. The initial Minicredit loan was £450, with Kapama/Opos demanding over £1600. I've been making £20 monthly payments for 18 months, and so have nearly paid the original balance. There is no default listed for MiniCredit on my credit file. The loan is listed as an 'advance against income' with Kapama as the lender and an arrangement to pay – with over £1200 outstanding. I've come to a point where I'm reviewing my financial situation in mind of - first, a reduced income coming up because I'll be retraining in a new career - second, I want to be in a position to get a mortgage when my file is clear. That in mind, the £20 a month is no longer affordable, but as a default hasn't been recorded on that loan, I'm really concerned Opos/Kapama would register one if I stopped the arrangement now, setting back my file several (important) years. Having read through forums and taken a friend's advice, I sent them an email last week referring to the FCA ruling regarding MiniCredit's lending (link not here) but have not received a reply. The crux of that was that if the debt hadn't been transferred to Kapama by December 2014 it should be written off –*they say it was, but I have the notice of assignment – which was sent by email at the end of January 2015. The main questions I have: Can they register a default now? Should/can I stop making payments? They're currently being taken from a debit card by Opos. How should I proceed? Should I continue to complain on the grounds of that FCA ruling? Do you have any contacts at Opos/Kapama better than the general enquires address? I know there's a bit of duplication there - but as I've paid back so much of the original loan, the credit file listing and the potential relevance of MiniCredit's shutdown, I'm really not sure where I stand. Thanks in advance – I really appreciate it.

- 1 reply

-

- getting

- instalments

-

(and 4 more)

Tagged with:

-

Hi Everyone! First time poster here looking for some help dealing with Kapama in regards to a micro credit loan, from some general reading I see there is plenty familiarity with them here so I'll get straight to it. I took out a loan with mini credit in 2012 for £100 and they're now trying to play their old trick of adding many charges on so I apparently owe them £1056.00. I don't believe that these charges are enforceable and I point blank refuse to pay them but they're charming debt manager refuses to back down on the issue. I've offered them the original loan sum, one months interest and the default charge (which from reading around the forums is all I have to pay them). After them messing me around for a couple of months they've finally agreed to post me a copy of their companies complaints policy so I can lodge an official complaint with them which I can then take to the FOS when they still refuse to take the charges off. What I would like some help with is what I can write in my initial complaint letter to Kapama in order to have the charges removed. What are the grounds I can do this under? If anyone could help me I'd be really grateful as I would love to stick two fingers up to them. I should say I am prepared to go to court if necessary, and I've seen a few comments on this forum about the judge removing the charges in the court, but will a judge actually do this? Or would a judge force me to pay the whole amount?

-

Good afternoon A few years ago to cut a long story short I developed a gambling issue and became silly with payday loans. In the midst of that I took out a minicredit loan for £200, it became £1,100 with opos. They were calling me and harassing me constantly. No chance I were paying them that bac ad I have no trace of the loan other than whats on my nodde report. There is a balance on there from Kapama ltd and I just want rid of it & start the credit history from scratch. Any advice on how I could tackle this people, any input would be greatly appreciated I just want it gone & if these lowlives think im paying them at all they have seriously got another thing coming!!!!!! Could do with some advice now I'm considering getting a letter sent of to them in the hopes of getting it wiped off but it needs to go!!! Also on my noddle report my electoral record hasn't been updated yet.

-

Hi, I am hoping for some advice. I took apparently (I don't remember but I have used payday loan companies so its probably true) took out two loans with minicredit both for £100, one in Feb 2011 and one in April 2011. On my credit file there is entries for Kapama, one for £866 and one for £793. These were not on my credit file a year ago. I have contacted them by email to question what they are and they replied giving me the dates etc. I know I was not working at the time and they did not search my credit file (I have old copies that I checked). Where should I take this next? Is it worth me arguing the interest and then offering £200 to clear the outstanding debt? Thanks in advance

-

Hi guys, I've requested a copy of a CCA a while back (all recorded delivery). I sent the £1 postal order, and waited the 12+2 working days for a reply. I never received a reply (after it was tracked - delivered), so I then sent the reminder - 30 days to respond (recorded). That was also ignored and I had no reply, so then I sent the 'Account in Dispute - Section 10 Notice' letter, which ended "I reserve the right to report your actions to any such regulatory authorities as I see fit. You have 30 days from receiving this letter to contact me with your intentions to resolve this matter which is now a formal complaint." I have also not received a reply from this (all letter have been recorded delivered). I'm not sure as to the next steps to proceed? Has anyone been in this situation before? Thanks

- 21 replies

-

- debt default

- kapama

-

(and 2 more)

Tagged with:

-

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)

Minicredit / Kapama & Opos... Worrying Situation

fkofilee posted a topic in Debt Collection Agencies

Hi Guys Well its not often I need advice haha and this one is a right mess to deal with. Basically as some know, I ended up suffering from Identity Fraud... And im still dealing with it today. So Minicredit wrote of a Balance of £1k and determined themselves it was fraud. However OPOS purchased the account and we started to go through this whole situation of dealing with a 3rd party for a company that doesnt exist. for the 3rd time in a year and a half, I got an email as per below; So I had already told them 3 times already that the account was closed from their end, etc and that I shouldnt be hounded for this... But alas, they still do hound me. I threatened them with a C+D notice last year, and still they persist even though Minicredit confirmed the account was closed due to Fraud etc and OPOS even closed their account. Today i also recieved a statement from them, and this is a shocker; Period Covered: 25/02/2015 to 25/02/2016 Your Account Summary Loan Amount £100.00 Interest Charges £118.00 Debt Collection Charges £100.00 Default Charge 1 £25.00 Default Charge 2 £50.00 Attempt Charges £670.00 Paid £0.00 Adjusted £0.00 Outstanding Balance £1,063.00 £670 in attempt charges?!?!?!?! Anyhow the response i got back last year was to the tune of the below? Any advice on this one? Im really stuck. The original complaint was resolved but its still apparent that it hasnt and the 6 months to refer to the FOS have passed. I am also concerned because if an account is shut down due to fraud then no further balance remains, however the FCA confirmed to me that I shouldnt be getting statements for an account that doesn't exist no longer where I am not a debtor? And Breathe........... -

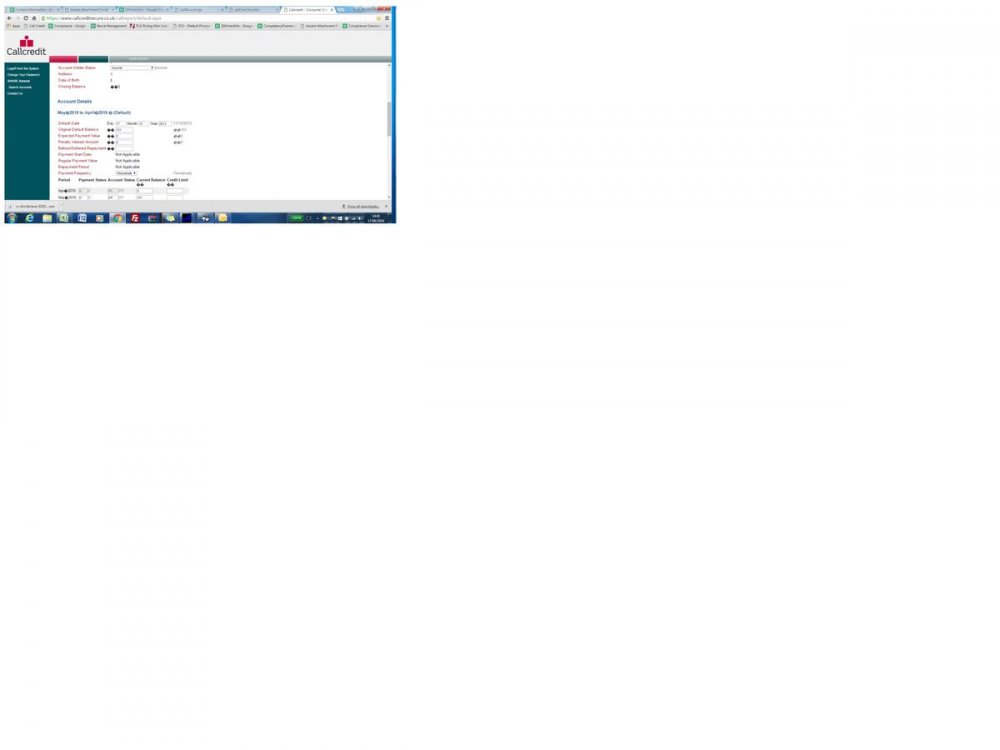

Hi All, New to the CAG and really need some experienced help with my ongoing battle with this company. I first submitted a Formal Complaint against Opos Limited in January 2016. This went to the Financial Ombudsman after I disagreed with their final response. The adjudicator advised that where Opos Limited is the debt collector and Kapama is the debt owner, he didn't think Opos Limited's collection practices were wrong, but he did advise me to send in a second complaint to Kapama about irresponsible lending. The original loan was for £100.00, and with charges etc. it ended up at £300.50. This is where things get interesting... I made a payment to Opos back on the 18th October 2014 for £149.45. When I looked at my credit report on Noddle, the 'Account Default Date' for this Minicredit loan was exactly the same I made a payment to Opos. When the adjudicator questioned them on this, apparently that date was incorrect and Minicredit defaulted me in November 2012. Please bear in mind that I actually took out the Minicredit loan in July 2013 so this definitely isn't correct! Anyway, to resolve the first complaint we agreed a settlement of £100.00 which I paid in full two days after the adjudicators decision. This was 22nd April 2016. Around the same time I sent the second complaint to Kapama for irresponsible lending. On receipt of my second complaint, Opos's Compliance Manager sent me an email on the verge of bribery saying that IF I withdrew my second complaint, she would remove the footprint of this loan from my credit file as a way of resolution. I got in touch with the adjudicator at the FOS about what they offered and he said he is personally going to call them and say it's unacceptable. Their compliance manager said she was going to update my credit file within 28 days since the settlement was received. I check on my credit report at the end of April and there is now new information... Account Default Date is 17th December 2013 with the account showing a balance of £51.45 outstanding? As you can imagine I am now fuming with this. So I phone them, and they make up some sorry excuse that they never received the settlement form (despite having an email from their compliance manager saying the account is settled). When I mentioned court they hung up on me so I emailed them with a furious message. I haven't been satisfied from the beginning that Minicredit defaulted me in the first place, so now I have opened a case with the Information Commissioners Office which they are investigating. On Wednesday 15th June 2016, I received a final response to my second complaint. This time they offered to refund around £50.00 as a gesture of goodwill and decided not to uphold my complaint. (I believe this is very weird considering they had already offered to remove the default without looking further into the complaint and have now offered a refund). They also said that they updated my credit file information through Callcredit and that this is not the same as Noddle and the information may not have shown on Noddle as it takes longer to update. I have not accepted this and again have put it in to the FOS. In response to their Final Complaint I asked a series of questions regarding the default, dates and why they have offered me the above but not upheld my complaint. They responded that they will liaise with the FOS and did not answer any of my questions. Yesterday I decided that I would pay for a subscription to Callcredit (Credit Compass) to see what my file on there shows in regards to this default seeing as this is where they say the updated the information. After looking everywhere for this account, it is NOT on there. Not in settled or outstanding. So I emailed the Compliance Manager again and said that this account is nowhere to be found and yet this is where they supposedly updated the information, and not through Noddle. She emailed me back with a screenshot of her computer with the screen showing my file details with the '£0' balance etc. (I think this could have been a big mistake for them) On that screenshot it shows Account Details 'May 2015 to April 2016'. It also looks like the boxes are available for them to amend themselves! I thought that they notified CRA's to enter personal information like that, I'm not sure if creditors are allowed to do this and are able to amend information freely themselves? What I really need some advice on is surely if Minicredit defaulted me, it would be a case of a name change on the account on my credit file back in 2013 or whatever date they supposedly defaulted me. Minicredit passed over their accounts in December 2014 and on that screenshot they're showing account details from May 2015!? I have phoned Callcredit and they asked me to send a copy of the default showing on Noddle, as well as copy of that screenshot they sent me. I have also fowarded this on to the ICO and FOS. I really apologise for the huge essay but I would like to share my story about these companies to you all. I would advise everyone that has had a default from this company to check the dates etc. If anyone can give me some advice I'd really appreciate it as I'm willing to go all the way with this. I've attached the screenshot for all of you to see. I have loads of emails for evidence and the responses so if you need to see them please let me know. I have probably missed a few things out but this is the main part of it all. Thanks

- 16 replies

-

Can somebody help please, I'll be honest I've not really got a clue where to start to deal with this so I may as well start with my situation. I'm now 23 years old ,Back in 2012 around Christmas time I stupidly took a minicredit payday loan the usual 100 pound loan of which I only received 80. In the following weeks I lost my job as I worked for a self employed builder who due too work had too move over 3 hours away so I couldn't keep the job. I panicked and as a result took a wonga loan out as well which I have since fully settled. I managed too agree too a payment plan with wonga but always found minicredit hard too deal with. They kept adding charges, I couldn't afford too pay just those never mind the actual debt. A combination of this situation and being unable too find work made me suffer from severe depression and anxiety. After the debt reached over £800 I just buried my head in the sand and hoped it would all just go away. September 2014 i finally found solid work and became much happier but still ignored the debt. Finally now in March this year I thought it would actually be gone as I checked my credit file for minicredit it wasn't there they removed all defaults as well. I have just checked my credit file again too see I now owe £1041 too Kapama for what is the £100 minicredit loan. I searched google for help and found this forum. I would really appreciate anybody's help who has been in a similar situation or knows how I can deal with it I really don't want too feel down over debts again as this is the only thing I now owe. Sorry for the long post hard too explain over short text. Thank you

- 1 reply

-

- kapama

- minicredit

-

(and 1 more)

Tagged with:

-

I'm going to have their heads! Back a while ago minicredit decided to kill my loan off when I complained due to the fraud. They advised it was all said and done. Opos then got their hands on it and it was a battle to get them to follow suit and do as Minicredit said they were going to do.. Finished I thought.... NO! My Noddle credit file updated this morning and I have an entry against Kapama Ltd for the exact same loan! Even though OPOS promised in writing that it was over and done with!? (Kapama are Opos) Any ideas here? This is the third time I've had to deal with this...

-

Hi all. A few years ago, I got myself into a mess with various payday loans and have spent the last couple of years paying them all off. Earlier this week I received an email from a company called "kapama credit" stating an account of mine had been passed onto them from Opos. The loan in question is from minicredit. A loan for £100 of which I only received £80. Due to being in the midst of my payday loan mess, this wasn't paid back.. As my head was firmly stuck in the sand, I did nothing. I was in touch with opos back in 2012 and at one point was offered the chance to pay a settlement of £150 which ended up not paying. The email i received this week states I owe over £700. In a panic, I offered them the £150 again, which they refused, stating the minimum they can accept is £392!! I then asked them for a breakdown of the account and this is their response: Principle - £59.89 Interest - £69 Attepmted payment fees - £555.50 Debt collection fee - £100 I want this sorted asap but not sure of my next steps. How much of this do I technically owe?

- 7 replies

-

- appreciated

- kapama

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.