Showing results for tags 'suspicious'.

-

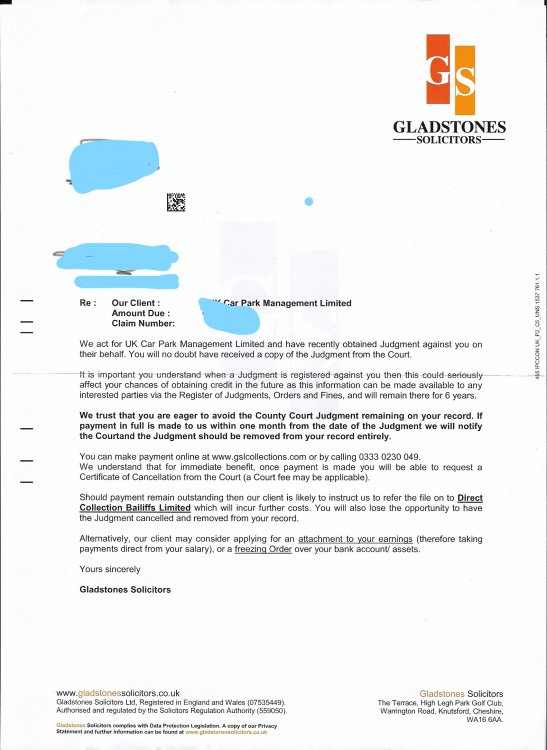

My son, had received a letter back last year claiming he had parked illegally, the charge was £163, I told him to pay it as it be very difficult to prove there was no proper signage, anyway he forgot about it then today he received this letter with a charge of £270. They say they have obtained a judgement against him and if he wants to avoid it he must pay the charge within one month, if he does that they will contact the court and tell them to remove the judgement. I have never heard anything remotely like this before. I have attached a copy of the letter to this post just hope it comes up ok.

-

Hi again, I hope this is in the right forum but I need some advice on what to do with this letter that I received today from Restons. The letter is dated Thursday July 27, 2017 and it arrived this morning (August 5th) It concerns an overdraft and it says that the client is prepared to consider repayment of the balance by instalments. It also states that Arrow has referred the account to Restons for legal action and says it means we are instructed to issue court proceedings against you. They have sent along an income and expenditure form and have asked me to return it to them no later than Thursday August 3rd! I don't really want to call these people up but it concerns me that they can send a letter and ask me to send something back to them before the date that I received the letter in the post. It makes me think its some underhand tactic to issue court proceedings before I have a chance to respond. In the absence of time travel, what are my best options to deal with this?

-

Hi, is there a set procedure which Banks, building society's and investment Co are legally, duty, morally bound to follow, if an account holder/investor reports suspicious activity (Fraud) on their investment/account.? I ask as recently I reported a suspicious activity (Fraud) on an investment and was told it was transferred out to ( a person known to me) and "we will be investigating" I asked should I report it to the police and was told that was my right to report it to police but "we will investigate". I decided to report the fraud and contacted, Action Fraud. I explained money had been transferred out of an investment without my knowledge or authority by a person known to me. Action Fraud explained that it was the reasonability of the investment Co to investigate. and that I could not action any police investigation until investment Co had completed their investigation. I could only give details which would be filed away. I was in contact with the investment Co while they were investigating, and asked "Will the account of the recipient be frozen to prevent them removing/transferring money out, after a few replies that they could not give me those detail (Data Protection Act) I finally got one employee to confirm the account had been frozen. I have recently found out that while the investment Co were investigating, the account the money was transferred/deposited to was not frozen and now the money gone/spent. So my question : Once fraud reported, is there a procedure which Banks, building society's and investment Co need to follow in circumstances like mine to protect investors money from being lost/spent/transfered to other accounts by fraudsters, ?

-

Dear all, The Friday before last (4/7/2014) I went to make a debit card payment for dinner with clients and the transaction declined. I checked my account on my phone (Barlcays App) and my two barclays personal accounts (current and premier) 4 savings accounts and 2 business accounts were collectively showing to be overdrawn by £5,000,000. On 7/7/2014 all available funds in the account were sent to reconcile to Coventry OPS 05 ADV. I logged a formal complaint on (4/7/2014) and after countless calls to customer service advisors who gave excuses ranging from a technical error to an account review and no resolution I sent an email to senior executive at Barclays. Later that day I was contacted by a member of the Barclays customer relations team at their Head Office in Canary which was on Thursday of last week (10/7/14) however he has not been of much help at all, he has not provided any clarity as to what is going on or any time frames as to when I can expect to have my funds released. I have gained an understanding myself and believe it is a Suspicious Activity Report (SAR) that has been filed to the National Crime Agency (NCA) or similar however I have nothing to hide and although its been a good year for business everything is above board and I do not understand why they can't simply ask me for clarity... This freeze on my accounts/blocking of funds is causing serious problems for me and those dependant on me/my business. I was wondering if anyone has experienced a similar situation and if so when the issue was resolved and if there is anything I can do to speed up the process or any other information that might be helpful. It's so frustrating being in the dark and having hard earned money taken away from you with no explanation ! Thanks.

-

Long story short Aktiv bought MBNA credit card debt which had been incurred by my son. Unfortunately card was in my name. Son made payments to MBNA for years (his monthly payments to MBNA were more than my income) until he incurred mental health problems and b*ggered off leaving me with the mess. I've written to AK advising of situation, got copy CCA from them (it's an old combined application form/CCA from 1999 WITHOUT full T&C's), used template letter asking Aktiv to write off debt, explained about my son and said all I could offer was nominal £1 a month (also sent AK budget sheet showing I have no spare income as I'm disabled and on benefit). AK wrote back saying "Having reviewed the details and based on the information that you have provided, I can confirm that AK can not agree to writing off the balance and closing this account. This decision has been based on your income and expenditure and the severity of your health issues. I do wish to be constructive in this matter and sympathise with your situation. In an effort to assist you AK is prepared to accept nominal payments of £1 per month towards your outstanding balance. This decision has been taken in view of your current situation and will be reviewed in 6 months unless we are advised of a change in your circumstances." I almost sent them £1 right away but something made me suspicious. Why were they so ready to accept £1 a month plus why the 6 month review when they know my financial situation won't change? Nothing has been paid to the account since October 2012. Am I right to be suspicious? Debt is just over £10K and AK offered just over £1K discount in the second letter they wrote me after they bought the debt in November last year and before I've even replied to them. Maybe I'm too cynical but something just doesn't seem to sit right with me.

-

I have a Rotary watch which had been very little used except for special occasions. Just outside the 12 months warranty a piece of the bracelet clip fell off making it impossible to remove the bracelet from my hand. I went to a Rotary outlet who kindly removed a link from the bracelet to 'get me out'. I then reported the matter to the original vendor (a provincial specialist watch retailer). He was unable to obtain a replacement fastener for the bracelet and advised me to approach Rotary myself. I did this and they advised that they do not sell spare parts and I must send the watch to them for assessment and repair. I did this and received a quotation to service the entire watch and replace the fastener at a cost of about a half of the original retail cost of the watch. The watch itself looked and worked like new so I did not require it to be serviced. I requested that they simply replace the catch as I had requested which they did, they sent the watch back in a Jiffy envelope (not carefully boxed in bubble wrap as I had sent it!) Looking at the watch it had stopped working. I took it to my local 'proper' watch repairer asking him to fit a new battery. The watch did not work even with a new battery and he said that the movement would need replacing. Obviously it is now my word against the repairers but it seems an extraordinary coincidence that this new fault should occur in the post. My concern is that a technician may have 'sabotaged' the electronics when I refused to accept the repair quotation. I contacted Rotary Sales office who referred me to the repair centre who said send the watch back again (adding extra postal costs to those I have already experienced with no firm prospect of resolution) possibly costing me more money on what is already seeming an expensive and regretted purchase. Their response did not appear contrite or helpful. Is this a common situation or what hope do I have to bottom the issue out? I am minded to bin the watch rather than pursue the matter.

-

Hi All - this is my first post as such on this site so please forgive me if I ramble! I recieved a call yesterday (11/06) at 16:50 from a man (Mark xxx) claiming to be from the DWP. He asked if I had recieved the forms sent 6-8 weeks ago and was I going to reply to them. He at no point asked me any security questions (such as NI number etc) and I asked what the forms were relating to, apparently these were relating to to a possible refund of benefit of some sort. He had details of my mobile no. my present address and DOB. He asked for my employer details - which I foolishly gave him- and he explained tha new forms would be sent in the post. He rang again 15 minutes later and asked me to confirm my employers name - I became suspicious at this point and asked to which address he had sent the original forms. He said to put my mind at rest and that these had been sent to an address which I had lived at 14 years ago..... I did not have time to ask for his direct number to verify his ID etc and am now worried that it was some sort of false call from debt collection agencies. I have contacted the DWP - various departments (including debt management / social fund / job centre plus - which were very helpful) but they had no record of calls made to my number or of any such person called Mark xxx. The only clue I have is that the debt management team said I have an account to do with a social fund loan and they could not give any details (the last time I had ay social fund loans would be from over 15 years ago?) - yet the social fund staff say that they have no record of such? I do have a recent ongoing issue with a motor dealer that are pursuing a debt from over 13 years ago (which is a long story) and time statute barred. I have also informed my employer that should anyone attempt to contact them by telephone or letter in any matter not work related that they are not to issue any details and to put the call through to me. My worries are that a debt collector has posed as a DWP staff member to glean information about my employer - which according to DWP is a criminal offence? What can such agencies do with the information (my employers name only - but they have previous address and mobile number / DOB) ? If my employer is suddenly contacted after this bogus call can I then take action against them as they would be the only agency to have called in the first place and therefor must be the person posing as DWP staff member? Has anyone else had the same experience? Any advice gratefully recieved - thanks

-

Hi, I'd appreciate any comments on the following. I received a letter last week from Marks and Spencer Financial Services informing me that they have sold my M&S credit card debt to Arrow Global who would be contacting me in due course. Over the last couple of days I have had several phone calls (number witheld) supposedly from a company selling wine. They ask for Mrs ....... and then my Christian name, followed by my address so that they can send out some brochures. Needless to say, I refused to give out any personal information and hung up. Am I being cynical and is this all too much of a coincidence or is this a trick that debt collectors use to find out information? Many thanks, Ruthie

-

Hi, My husband has his c.v. on job websites because he is unemployed and he has had an e-mail from a company who have offered him a position as a 'Financial Services Officer', home based and they want to put money in his bank account. Here is an except from the e-mail they have sent him Your main job would be monitoring your on-line Task Manager, which you'll create on our site. Once the funds enter your account, your supervisor will notify you and assign you your tasks for the day. At this point you would go to your bank, withdraw the funds and transfer them using Western Union or Money Gram, as instructed by your supervisor. In the beginning you will only receive 2 to 3 transactions per week. Every transaction is followed by an invoice with our company's seal. You would always be aware of where the funds are coming from and where they are being transferred to. They are promising £1,500 pcm to be available 9-11 a.m. 5 days a week plus 8% commission. They say it is 'global outsourcing' and for the expediency of money transfer. Has anyone else heard of this - to me it seems too good to be true and I worried it could be money laundering. Any advice anyone? Thanks in advance.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.