jdene

Registered UsersChange your profile picture

-

Posts

798 -

Joined

-

Last visited

Reputation

8 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Cabot Global debt recovery for old Vanquis Card

jdene replied to jdene's topic in Provident and associated companies.

Thank you received another today saying pretty much the same thing, with everything else going on in the world these parasites are still scurrying to their open plan offices to harass people and risk spreading this terrible virus only money matters to them. -

Cabot Global debt recovery for old Vanquis Card

jdene replied to jdene's topic in Provident and associated companies.

Received this today they are determined, I have rung Vanquis to find out when this is allegedly from and the wonderful helpful lady told me I have to contact Cabot as they are now administering the account, she did not seem to happy about talking to me about anything. Global cabot 2nd.pdf -

I have finaly managed to find a statement of account I have saved as pdf should I upload this it has no personal details though they could trace it via the payments etc.

-

Yes it is, but still with the threats and no mention of what the discount is, isn't it just a ploy to get me to ring and admit liability by giving them all my details

-

Cabot Global debt recovery for old Vanquis Card

jdene replied to jdene's topic in Provident and associated companies.

I have checked all my records and computer files also my bank account as far back as 2012 and nothing from Vanquis at all so it must have been before this which is way out of the 6 years -

Well their back again it does not say letter of claim so I trust it is still safe to ignore Hello have changed to PDF please remove if still not correct QDR for MMF Discount letter.pdf

-

Cabot Global debt recovery for old Vanquis Card

jdene replied to jdene's topic in Provident and associated companies.

I don't realy want to be in touch with Vanquis again after all this time, but the last record I can find regarding them was 2008 and was disputing their charges then. I will go through my old papers and try to find something more definite on this then get back may send SAR to Cabot would that be a good idea. -

Cabot Global debt recovery for old Vanquis Card

jdene replied to jdene's topic in Provident and associated companies.

I honestly don't know but I did have a thread on here regarding Cabot years ago It must have been put into disput back in 2010 -

Today I have had the misfortune to receive a letter From Cabot informing me they have passed an old Vanquis card debt to Global debt recovery, on the back of the same page was the letter from Global debt recovery, times must be hard if they need to share the same piece of paper, the debt they are referring to was disputed due to the PPI, all other agency's let it go and paid out but Cabot were realy nasty and just refused to accept any of the legitimate claims I put forward with the help of this group, but then they just went away well now they have reared their ugly heads again, really don't need them now I am finally getting back on my feet. I have attached the letters below. As always would be very grateful for any advice. cabot + global letters.pdf

-

Thank You

-

Thank you Dx 100uk just with wife unwell and myself not the best these letters can bring you down a bit, thankfully people like you make a big difference.

-

This is the letter I recieved

-

I have received a letter from QDR Solicitors acting for Lantern debt collection who in turn say they are acting for Quick Quid, I have already sent a claim for irresponsible lending, only to be told first they could not find my details, then they sent a standard reply, meanwhile Lantern have continually sent emails chasing money until I sent them a letter telling them I was claiming against Quick Quid and had been advised they would not investigate any claims until the administration period was over, which could take a while and that they were acting against FSA guidelines chasing me while the claim was still live and while their client was in liquidation. Then I received a letter today saying if I do not respond in 14 days they will take me to court, So why they fighting so hard for a client whos gone into administration think they have bought these debts and now have no one to go back to. Any advise would be helpful im very very tired of fighting these people.

-

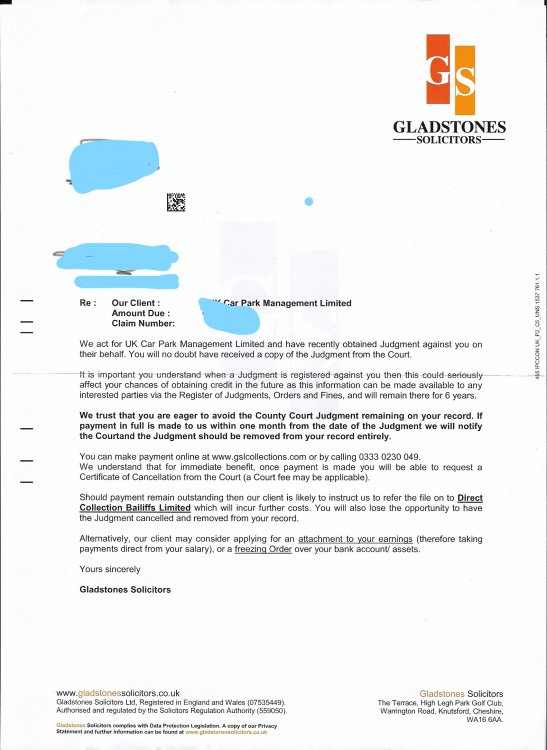

My son, had received a letter back last year claiming he had parked illegally, the charge was £163, I told him to pay it as it be very difficult to prove there was no proper signage, anyway he forgot about it then today he received this letter with a charge of £270. They say they have obtained a judgement against him and if he wants to avoid it he must pay the charge within one month, if he does that they will contact the court and tell them to remove the judgement. I have never heard anything remotely like this before. I have attached a copy of the letter to this post just hope it comes up ok.

-

BT Moorcroft wrong details***Resolved***

jdene replied to jdene's topic in Telecoms - mobile or fixed

Got everything in writing despite Moorcroft having another try BT have sent them a letter and sent me a copy, so happy days again thank you all.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.