Showing results for tags 'division'.

-

If anyone could give some advice on this I would be great. Following loss of my partner in August I had a nervous breakdown had to go into hospital for a week. My parents had to take care of my children and its been a pretty devastating and traumatic year, given the nature that he passed away. We are back on track now and rebuilding our lives I was out of work for a few weeks and inevitably have fallen behind on a few things. One being council tax, I missed 2 payments totally £84.44. I'm sure I spoke to them on the phone at the time and told them what had happened and that I was struggling i have received a 'south East Surrey Petty Sessional Division Summons for non-payment of council tax' - the summons requires me to attended a local magistrates on 12 December at 9.30AM and includes court costs of £50.00. Any advice would be extremely well accepeted!

-

I am trying to find out how to do an appeal as a lay person to the Queens Bench Division? Basically my friends partner is in prison and a POCA case is due in a few months, they CPS are looking for crazy money or do 15 years in jail extra. Due to a breakdown between the solicitors and the client the court wont allow a transfer of Legal Aid to a new firm as its costing the public purse!! Now Legal Aid is withdrawn my friend is trying to find out how to help him by making an appeal to the Queens Bench Division as Legal Aid Rules clearly say it can be transferred if the relationship breaks down. The judge has said he has to represent himself (hes not English and its an impossibility), he would pay privately but the accounts are frozen. I had done an internet search but cant find any information anywhere and was wondering if anyone can help even with just the form to send the appeal to the Queens Bench Division. Any help appreciated. Thank you

-

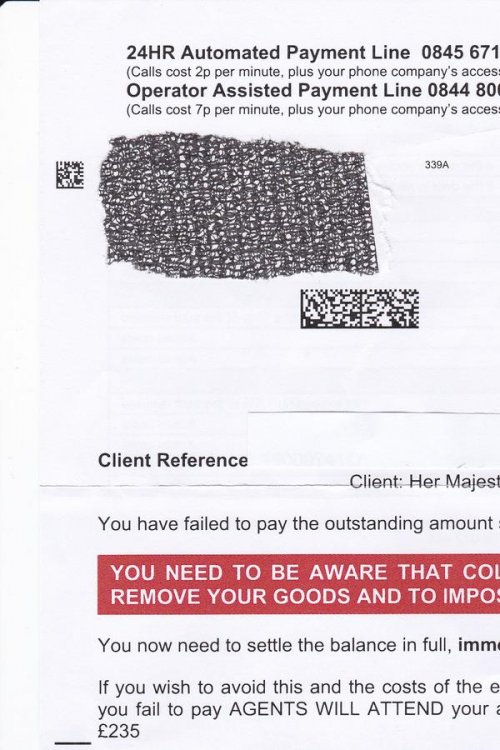

Received this letter which purports to be from Collectica collected a debt from "Her Majesty's Courts & Tribunal Service" Can this be for real? There hasn't been any court papers received concerning this matter. Somebody called without an appointment at the house. No one was in but he left his card. I have no idea who was the original creditor. I got a feeling its a try on and I would like to refer it the OFT and Financial Conduct people. Anybody got any ideas, comments welcome ?

-

Hi all, Firstly, thanks for taking the time to read this thread. I'm not sure if I'm posting this in a sensible place, but googling the problem I'm posting about lead me to another similar post in this forum. If there's a more appropriate place to ask this question, then I request that a mod moves the thread. Thanks! I'm writing this on behalf of a friend of mine, in relation to a dispute over the sale of a property jointly owned and the division of any equity such a sale releases. The person in question purchased a property with her partner. They were NOT married. No legal documents were drawn up at the time to determine a specific ownership position for either party, but both their names are on both the mortgage and the deed. He provided the initial deposit for the mortgage, after which time they split all mortgage payments and associated sundry costs (service charges which include ground rent, buildings insurance and maintenance charges for the development) 50/50. After a few years of joint residence, due to irreconcilable differences, they went their separate ways. At that time, he simply moved out and cancelled his mortgage repayments. My friend had to increase her payments to cover the full cost of the mortgage. In the following months they attempted to reach an agreement for how to proceed, discussing both my friend buying her ex partner out, and sale of the house. However, no agreement could be reached on how to divide the equity, which they were advised by solicitors should also form the basis of any buy-out agreement. In other words, that to buy him out she should offer him the amount of equity he would get, as per their agreement, in the event of sale. Those negotiations ultimately broke down and communication ceased. Since that time, my friend has covered the full cost of the mortgage as well as any sundry costs, and her ex partner has presumably paid rent in order to live somewhere else. Several years have passed in the intervening time. This brings us to the present moment in time. My friend has approached her ex partner again with the objective of resolving the dispute once and for all. She has proposed that they sell the house, and they are currently engaged in discussion on how to divide the equity between them. However, I fear negotiations are destined to follow a similar trajectory as last time.... The crux of their disagreement centres around her ex partners desire to treat the deposit as a fixed cash sum which he should be repaid, as if it were a loan, before any discussion on how to divide equity, irrespective of the sale price of the property. In other words, if the equity released from sale only adds up to the equivalent cash value of the deposit (the value of the property has decreased since purchase) then he effectively believes he should get all that equity and she should effectively be left with nothing. If the property were in her name only, and he had provided her with the money to purchase the property, then I could understand this point of view. However, in reality, they have jointly invested in the property and must jointly bear the brunt of any reduction in value. Similarly, my view is that he must recognise that a deposit contribution is essentially equivalent to capital repayments made against the mortgage, and does not constitute a debt which would be repaid first (i.e. like the mortgage itself). My friend has sought legal advice which clarified the official legal position as being that both her and her ex are joint stakeholders in the property, irrespective of how much either has paid, and are consequently both legally entitled to 50% of any equity released on sale of the property. Similarly, she has been told that if they go to court, that will be the ruling, and that costs will likely exceed the equity in the property anyway. So, my friend feels in a difficult position. She has been strongly advised by solicitors not to accept less than 50% of the equity since that is her legal entitlement, but that leaves her and her ex partner at opposite ends of the negotiating table with seemingly no common ground. My friend has proposed ways of calculating an equity split, based on total contribution to the mortgage and property by each of them, but her ex partner is only prepared to talk about dividing equity AFTER he has received his deposit back first. My friend feels as though her ex partner just moved out and stopped paying when he decided he didn't want to live there any more, and now, as a consequence of her trying to do the responsible thing and take over mortgage repayments rather than allow them to default, she is stuck in a position where she can't sell without his consent, and he is unlikely to give it because - as she sees it - his demands regarding equity division are so unreasonable as to be unacceptable to her. Is there any legal remedy she can pursue to compel a sale? Is this likely to be any more or less expensive than going to court to split the equity? Is there any way they can agree to sell the house on the grounds that the equity will be held in trust by a third party until such time as they can agree a fair split? That latter option seems like the best idea to me. It has the disadvantage of fixing the equity in cash terms at the point of sale, but equally, it allows her to move on with her life and doesn't require her partner to accept an equity split he feels he can't, just to get the sale under way. Thanks very much for your time, if you've got this far! I appreciate it's a long and torturous tale Any help you can offer would be much appreciated! EDIT: Anyone know whether I can edit the title of the thread to fix that typo?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.