dazdubai

Registered UsersChange your profile picture

-

Posts

17 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by dazdubai

-

Below i have scanned attachted letter i got from lloyds I did not receive a enforcement letter on 3 August 2009 nor did i receieve a solicitors letter on 21 August 2009. Also why did it take them 2 years to put default on my account, which i did not realise they had put on. I still am going to pursue in getting this removed and with compensation to regards and destroying my credit rating. Any help would be appreciated Thanks Dazdubai Lloyds Letter 29-06-2012.pdf

- 5 replies

-

- lloyds bank

- put

-

(and 2 more)

Tagged with:

-

The default was put on incorrectly because my account was in dispute, and then i got a default and i only fount out after checking my credit file, this is affecting my credit rating and the issue was not paying the overdraft, the issue was the charges they was putting on and other stuff going on with the account.

- 5 replies

-

- lloyds bank

- put

-

(and 2 more)

Tagged with:

-

Afternoon All I have a default that was put on my account with Lloyds TSB, which I was never informed of and have recently wrote with the removing of this, and still getting no joy. Who else can I write to and tell that the default was put on wrongly and how do i get it removed. Thanks for advice in advanced Daz

- 5 replies

-

- lloyds bank

- put

-

(and 2 more)

Tagged with:

-

Scanned Letter LLoyds.pdf Called the LLoyds TSB number and speaking to a idiot who dont uderstand english and dont get no joy. Im getting sick and tired of dealing with these people. Any help would be appreciated.

-

PPI Claim using (CLAIM2GAIN)

dazdubai replied to dazdubai's topic in Payment Protection Insurance (PPI)

i will look into this with regards to mine and my fiancees PPI claims Daz- 4 replies

-

- claim2gain

- ppi

-

(and 1 more)

Tagged with:

-

PPI Claim using (CLAIM2GAIN)

dazdubai replied to dazdubai's topic in Payment Protection Insurance (PPI)

thanks for your fast reply, will look at other threads, just seems to me @ 25% they charge its alot of money considering the money they charge was infact the money my friend should have got back himself. Will try and pursue myself in claim ppi back and will let you all no how i get on with the matter. PS my fiancee has a credit card where she pays a minimum payment with no interest incurred and she still has a balance,how would i go about claiming PPI for her so the balance would be reduced, settled, or even a refund given. Daz- 4 replies

-

- claim2gain

- ppi

-

(and 1 more)

Tagged with:

-

Afternoon All. Just a quick question on PPI Claims. My friend filed a PPI Claim with [edit] and last week received a refund for over £3,500 it was with a MBNA credit card, but looking on there website they charge 25% plus VAT. He told me he filled in basic paperwork and got refund in 9 weeks, i no there is alot of people putting claims in them selves, and is it easy to do? Maybe if anyone has a basic template or something to them lines to help me file a PPI case myself rather then paying 25% the above company charge on a won case. Any information would be grateful Regards Daz

- 4 replies

-

- claim2gain

- ppi

-

(and 1 more)

Tagged with:

-

Just checked the post offices track and trace and they still have not sent letter, and i posted it for signed delivery on saturday?

-

thanks for your advise, i will wait until i get a reply with my 1st letter i sent and then send another letter to the fraud team for them to also investigate this matter Daz

-

because after all the letters i gave up in the end, i was fighting a losing battle and thought to purse it i would need a solicitor and go court which i didnt have the money and didnt think about coming online for help to be honest, and i was in debt up to my eyebills, now all my debt is clear and older i want to purse this. So now im gonna fight to get my default removed, then after, get them to wipe the account and claim compensation. (fingers crossed)

-

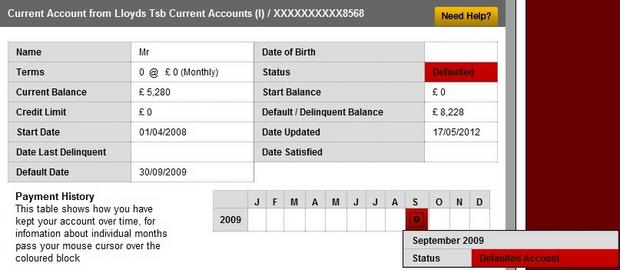

i also remember reading a previous thread that if the default was put on over 6 months after the start date of the case, start date is : 01/04/2008 default : 30/09/2009 that they will have to remove the default regardless, is this correct? Daz

-

This is my current credit report with the default showing, and i refused and wrote to lloyds on numerous times, to look into the fraud and why they was charging interest and in the end i gave up and agreed to pay a sum of £120. if i knew about this site i would have asked for help and information here but didnt no, do you think they can take the default of the account as i have agreed to pay a sum amount and have been paying ever since? Daz

-

-

how do i now contact police after the default was put on in september 2009 and now is june 2012?

-

what do you mean bank accounts dont have cca's? i have a default on my credit file via me going over my overdraft limit, and this was regarding the fraud that made me go over the limit.

-

Also i would like to point out i had a £7000 overdraft limit given to me which i did not ask for or apply for and a premier account was given to me which i had to pay a monthly premium for and got a £500 interest free overdraft allowace, i was also getting charged £120 interest on this overdraft for being over my credit limit which i had fraud come out but LLOYDS TSB still kept putting interest ontop. I wrote 9 letters complaining which i have copies off and still no joy so decided to pay £120 a month until the amount was paid off. I still have not cleared the remaining balance as i feel the rest is now the fraud that come out and charges that they put on. Any help with this would be very grateful, and have i taken the right route to get the default removed. When the default is removed (fingers crossed) then i will write to them again to ask them to remove all charges on the account. Thanks again for your time. Daz

-

Afternoon All. I was searching online and come across this useful and helpful website, so decided to join and post what im in the middle of trying to sort out. I have recently wrote a letter to LLOYDS TSB asking for them to remove my default on my account. which goes like this. Lloyds TSB Plc Customer Service Recovery Centre Charlton Place Andover Hampshire SP10 1RE Date: 2nd June 2012 Dear Sir or Madam, Account Number : xxxxxxxx Sort Code : xx-xx-xx After recently obtaining a copy of my credit file from Experian I was concerned to note that your company has placed a “Default” notice against my bank account. Further to this I have no recollection of ever receiving such a notice, and I therefore require you to substantiate this data at your earliest convience. 1. You must supply me with a true copy of the alleged agreement you refer. This is my right under your obligation to supply a copy of the agreement under the legislation contained within s.78(1) Consumer Credit Act 1974 (s.77 (1) for fixed sum credit). Your obligation also extends to providing a statement of account. I enclose a £1 postal order in payment of the statutory fee, PO Serial Number xxxxxxxxx 2. You must supply me with a signed true and certified copy of the original default notice. 3. Any deed of assignment if the debt was sold on I would request that this data is provided to myself within the next 28 days, if you are unable to provide this data then I must insist that it is removed from my files as unsubstantiated. Yours faithfully, xxxxxx Has anyone else had a default put on your account by LLOYDS TSB and managed to get it taken off at all. Many Thanks Daz

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.