BabyClanger

Registered UsersChange your profile picture

-

Posts

27 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by BabyClanger

-

Hi All, long time no log in!! I've been battling with Vanquis since their email to me around July time of this year when they advised me that they were uping the minimum payment so that my balance 'can be paid off quicker'. Yeah, right!! Since this increase in the minimum payment, i've been sending them around £190.00 a month since August (my balance was over £3,500) and although i've seen the balance reduce, if you're clearing your balance quicker, surely the more it's reduced the less your minimum payments should be getting every month. Not with these theiving SOB's. I took a ROP payment holiday in September this year and they caused that up to the extent that they actually refunded me £160.00 which i thought was quite amusing, as their Customer Service people had to admit they cocked up!! With regard to the ROP payments i had been making as well - i thought this was only a one-off payment of £40 as that was the way it was explained to me at the time i signed up to it, but it transpires that this £40.00 was being charged EVERY month - quite a high price for a yearly 'payment holiday'. No wonder my balance never seemed to be going down before i had this removed from my account! Another email was received around mid-November time saying 'sorry' about the mis-selling of the ROP facility and they they could have explained it better etc, etc. Bottom line is that they have refunded me the interest AND the premiums over the amount of time i've had this and they credited my account with just over £1,270.00! My balance is now down to £1,700 and after my remortgage is finalised very soon, that remaining balance will be paid off and these people are getting kicked into touch..... after i've told them in no uncertain words what i think of this bunch of thieves. As others have said here - if you have a Vanquis Card, get shot of it as soon as you can. The best thing that can happen to this bunch of blatant Rip-Off merchants is for them to go the same way as Monument did.

-

^ ^ ^ ^ Many thanks Old Cogger. Much appreciated.

-

Does anyone have head office contact information for this outfit? Googled high and low but can't seem to find out anything about them..... other than they are to be avoided!! They just sent a 'pre-approved' CC application letter to my mother..... who has been dead for 7 years...... absolutely disgusting. Any help would be appreciated. Thanks.

-

Having recently (well, just before Christmas) scored just under 7K from Monument for payment break protection payments, i have recently remembered an account i had with The Midland Bank which was some kind of revolving credit arrangement. This was many many moons ago and i cannot remember the exact details, however i do remember that the loan itself was in the form of two credit cards, one Visa and one Mastercard. Another thing i distinctly remember is the branch manager at the time telling me i would 'need to protect my payments'. I don't know if this does fall into the category of a loan or a credit card, but are you of the opinion that this is something that should be looked into? I'd appreciate any input. Many Thanks Nick

-

Monument Payment Break Plan - **WON +£7K**

BabyClanger replied to BabyClanger's topic in Monument cards

Hi again, just to let you know the cheque that i was sent by Monument cleared today. I'm now nearly 7K better off. -

Monument Payment Break Plan - **WON +£7K**

BabyClanger replied to BabyClanger's topic in Monument cards

Thanks. Just seems strange that they said i had contacted them when i haven't. But still - don't look a gift horse in the mouth. Thanks for your confirmation. Cheers, Merry Christmas! -

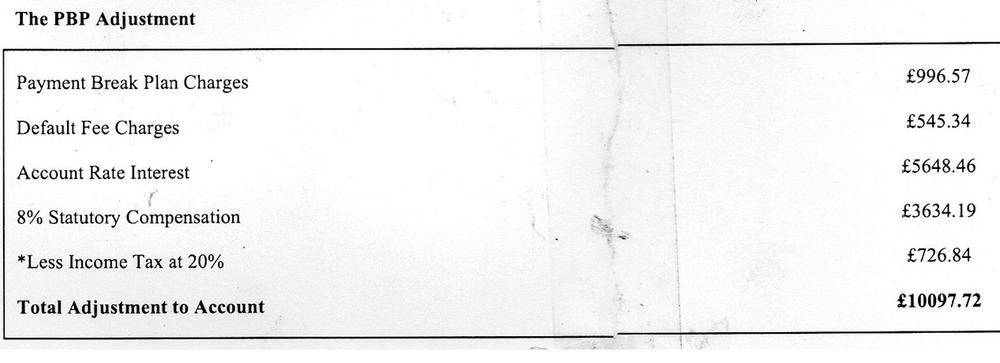

I have received a letter from monument about PBP. It was totally unsolicited, and I have not applied for anything (PPI or the like)or contacted Monument in any way for years. This letter came totally out of the blue and I dismissed it along with all the other letters I have received from them over the years. I ripped it up and put it in the bin. The Short Story My monument account was pulled many years ago , I can't even remember the dates it was so long ago, leaving an unpaid balance of around £3,600 which remained unpaid. The Long Story I have just fished this letter out of the bin as yesterday, I received a cheque in the amount of just over £6,800. The letter I received last week referred to PBP - Payment Break Plan and looks to be a letter of 'without admission of liability'. I have scanned part of this and attached it to this post. It would appear than an adjustment of just over £10,000 has been credited to my account, and the cheque I have received looks to be the difference between the amount of the adjusted credit, and the outstanding balance as mentioned above. I'm just wondering if this is legit or maybe a ruse on the part of Monument to track down their un-paying debtors. I have seen other posts here mentioning refunded PBP - which I never knew I had, but these are dating back to 2014/2015. Obviously we're now at the latter part of 2016, and they 'look' to be still paying out. The letter states they will apply the adjustment values to any outstanding debt from the account, and should this result in your account going into credit, we will issue you a cheque within 28 days - which looks to be the same as others have posted here. I'm not sure whether to put this cheque in the bank or leave it be as I really can't afford to be snared in this way. Any input would be greatly appreciated. Thanks.

-

Just a quick update on this. Well, it's still all going on, and still going round and round in circles. Arsenden keep sending me thinly veiled 'legal action' letters, with the threat of passing this over to their solicitors if I don't clear my 'arrears'. To my way of thinking, and given how long this has now been going on for, if these 'arrears' were legally enforcable, they would have taken me to court long before now. So, i've finally had enough of all the BS, and i'm taking the bull by the horns. I've got a mountain of correspondence which i am going to present to a legal bod at the CAB when i have a couple of days off in August. Everything is there in black and white, bank statements outlining all my payments, various letters from Arsenden including the original letter from July 2009 which started all this and one which admits to sending a misleading letter. I'm going to go through the whole story with whoever is it i get to talk to and see where the land lies with regard to getting these 'arrears' legally removed from my account. Have to point out these are not payment arrears - all my actual mortgage payments have been made in full and on time by Direct Debit. These 'arrears' are their so called administration charges (admin fees) which they keep piling on ad infinitum. So, what do you think? Anyone out there have any ideas as to how this might possibly pan out? Thanks

-

That's the one.... LIBOR!!! Googled quite a bit of info on this and there seems to be quite a few different LIBOR rates. I'll email Acenden to find out which one applies to me. Many, many thanks for your help.

-

Hi Honeybee13, thanks for your reply. This is what i was thinking about MIRAS in that it was finished up a little while back. As far as i can ascertain, Acenden are using the rate that banks lend to one-another to calculate my mortgage payments. Do you know what this is? Thanks

-

Hi, despite the BOE interest rate being static at 0.5% for god knows how long, Acenden still keep finding a way to increase my mortgage payment. I beleve that as i am no longer in a fixed period mortage (the two years fixed rate on my mortgage ended in August 2009) they now apply the MIRAS bank rate to calclulate my payments. This has gone up steadily from just under £300 a month to over £325.00 as of today. Is there any way to check the current MIRAS rates anywhere? I just Googled this and couldn't find anything. Thanks

-

How did they justify these extra charges, or didn't they? And how can they claim a repossession if you have made all your payments? Surely the law must be on your side if you can prove you've made all your payments? What a crock.

-

OK, I am ready to send off the letter to reclaim the unfair charges as outlined in the April Focus email. I have the final amount which is £1629.32 to be claimed back. Have any forum members been successful in a claim such as this? Or can i expect protracted and much drawn out correspondence from Capston/Acenden on their receipt of this letter?

-

What a delicious idea!! I really want to get these suckers in court, as i'm sitting on all my payments documented right back to where all this guff started. I know their solicitors have advised them it's not a good idea to persue the court route, otherwise i would have heard from them by now.

-

Thought I’d post an update about Acenden, which is getting better and better by the day. I’ve been having a bit of fun with them of late with a couple of letters which to put it bluntly, DARES them to take me to court over my ‘arrears’!! I recently sent them this…… “I notice there are several items described as ‘Early Stage Arrears’ and ‘Arrears Management Fee priced at £65.00 and £85.00 respectively. These have been highlighted for you in Yellow. Please would you be so kind as to inform me EXACTLY what ‘management’ is involved to charge these amounts. Or is it as I think it might be in that someone there is just pressing buttons or typing a few words on a keyboard. If the total amounts are a combined amount charged by different departments at Acenden, please provide a breakdown of these departmental charges separately. I look forward to a very speedy reply.” They replied of course, with a load of waffle and sent me two copies of their Tariff of Charges which sets out their various ccsts. No attempt was made to answer my question. I then gave them a further opportunity to send a more detailed reply with this on the 19th September………. “With regard to my letter of the 19th August 2011, it would appear that you have not answered my question. I did not ask in which circumstances these fees are charged, I asked what Acenden did to arrive at the level of the fees that are being charged. As it seems that Acenden have a penchant for sending copies (not one, but two copies of your Tariff of Charges and Fees enclosed with your last letter), I return the compliment with a copy of my letter of the 19th August 2011, highlighted with the question that, at this time, remains unanswered. This is now the second opportunity you have been given to respond to this question. Sadly, I am not feeling that charitable to offer you a third opportunity as this nonsense has now gone on for long enough. On a separate note, I seem to recall receiving a letter at least a couple of months ago stating that my mortgage account arrears are now at a ‘serious stage’ and that if a payment plan to clear these arrears is not put in place, I would be hearing from your solicitors within 21 days. At the time of writing, no such communication has been received and I can only assume this is because you have figured out that I have, in fact, sent you every penny you have asked for since your letter of the 20th July 2009 and the misinformation contained therein.” Which they ignored!! No reply ever received. That lack of response prompted this on the 6th October…… “It would appear that I have not received a reply to my letter of the 19th September, a copy of which I have enclosed. As there is a remote possibility that this letter somehow got lost in the post, I have re-sent this to you Recorded Delivery so that I know you have definitely received it. I look forward to your speedy reply.” And they replied this morning. Apparently, Quote - whilst they note my request for a breakdown of the Collection / Arrears administration fees, we must advise that we will be unable to provide these details as it is considered commercially sensitive information. Unquote. So, they won’t tell me what they do to arrive at the administration fee they charge and they totally forgot all about their threat of passing this over to their solicitors!! Is it time now to send them the reclaim of unfair charges letter? This goes back to September 2009 so it’s quite a substantial amount – about £1,600 as it stands at the moment. My gut feeling is that they haven’t passed this over to their solicitors because their solicitors can see and have told them that I have paid every last penny they’ve asked for since all this nonsense began. They have been given ample opportunity to explain their charges which they have declined to do, so what’s the way forward from here? Would love some input!! Thanks.

-

Quick update. I've received a breakdown of the charges and it looks like Capstone/Acenden have been charging me £85.00 a month on top of seizing half my mortgage payment towards the 'arrears'. I don't know what this amount is for, it just says administration fee. This has been going on since Sept 2009 - every month. I received a letter from them yesterday saying that my ‘arrears’ are now approaching a ‘serious level’ and that I should submit realistic proposals to reduce them. Should these proposals not be forthcoming, they will pass this over to their solicitors in 21 days time. I've told them to bring it on. I have kept every piece of correspondence from Capstone/Acenden in particular the letters outlining my expected mortgage payments which they send every three months now that I am no longer within my fixed period. I have made sure that absolutely no payments have been missed since all this started so I really don’t see how they can pass this to their solicitors as there are no payment arrears on my account apart from the shortfall which was a result of their misleading letter in the first place.

-

Hi, thanks for this, but i already have that format. I believe acenden is now a .com (opposed to a .co.uk) domain which is why i'm looking for a new, valid format. Appreciate your reply. Thanks.

-

I've already tried that online form..... it's bleeping useless. More chance of a reply from Elvis Presley. I have two names at Acenden - i just need the name format and the domain format.

-

Does anyone have any contact email addresses for Capstone/Acenden? The mail address i have are now being bounced back as undeliverable so with their recent name change, i guess they have now changed the old Capsstone email addresses. I have contact names, i just need the format of what the addresses are - first name / last name at xxxxxx dot ......... or whatever it is. Any help greatly appreciated. Thanks

-

Hi there, the amount i paid in September 2009 was £346.47 which was exactly the amount as stated in their letter of July 2009. This (according to Acenden) left a shortfall of £280.00 or there abouts which they offered to split with me 50/50. They have tried to send round a debt councellor but i have declined this every time, so as far as i am aware, no charges for this particular 'service' has been made. I would presume my 'arrears' are becasue of how they are appropriating my monthly payments when i make them. I have paid my mortgage every month in full since the start of all this nonsense, but on a couple of occasions, Capstone/Acenden have tried to take more from the Direct Debit to get an amount to start covering these 'arrears'. On these occasions, i have claimed back the entire payment via the DD guarantee and sent them a cheque for the correct amount.

-

I was very interested to read about the fines imposed on DB regarding their arrears charges and wondered if I can do anything about Acenden (nee Capstone for SPML). To cut a very long story short, in July 2009 I received a letter saying that my fixed term was coming to an end and that my payment for September 2009 would be ‘X’ amount. This was paid, in full and on time and I then start to receive letters (a bombardment would be a better description) stating that there was a shortfall on my September payment despite me sending them exactly what they asked for in their letter of July 2009. I did not (and still don’t) see why I should pay for their mistakes as they offered to split the outstanding amount with me 50/50 which I declined to do, and went to the F.O.S. After 5 months to’ing and fro’ing, the idiot there (let’s call him Tom for sake of argument) adjudged that Capstone’s offer was reasonable and that I should comply with it. This effectovely gave Acended the Green Light to keep sending out incorrect information in their letters - with the F.O.S's blessing. What I did not know until towards the end of Tom’s enquiries was that Capstone had been taking the outstanding amount out of my monthly mortgage payments since October 2009 and putting it against the shortfall from September, so every payment I have made since then has created an ongoing shortfall. And they started doing this while this was being investigated by the F.O.S. which I think is very underhand anyway, and with all the charges and Home Counsellor Visits they’ve tried impose on me my ‘arrears’ are just over £1,000. I do not know exactly what all these charges are, but you can bet that Acenden have been charging me as well as taking half my monthly mortgage payment. Are these charges covered by the ruling against DB? And should I write to them for a breakdown of my ‘arrears’? Thanks

-

More Fredrickson Intl Ltd / Bryan Carter & Arrow Global

BabyClanger replied to BabyClanger's topic in Financial Legal Issues

Hi, just to let you know that i received a letter from FI today saying they were no longer instructed to act on this by their clients. Any ideas on what may happen next with Arrow Global. Will they pass it on to another agency? -

More Fredrickson Intl Ltd / Bryan Carter & Arrow Global

BabyClanger replied to BabyClanger's topic in Financial Legal Issues

Hi again, thanks for this. What i think i'm going to do is ask them to send me a copy of the agreement with Arrow Global - even though i know i they are not the original creditors. I will send it this week. Thanks again. -

More Fredrickson Intl Ltd / Bryan Carter & Arrow Global

BabyClanger replied to BabyClanger's topic in Financial Legal Issues

Ah-Ha. OK. So what would you suggest i send them? A CCA or a prove it letter? Also, as the only info they have given me is regarding Arrow Global, who are not (by the sound of it) the original creditor, what happens then? Would someone somewhere have to go digging for the original agreement? My apologies for all the questions (feeling like Bamber Gascoigne!!) but i really need to know the best next step forward. Thanks again for your help thus far. -

More Fredrickson Intl Ltd / Bryan Carter & Arrow Global

BabyClanger replied to BabyClanger's topic in Financial Legal Issues

Hi again, i was reading another post in the FI/BC threads yesterday and i saw a post from someone who had sent a prove it request to Fi but they were unable to do so. What happens in circumstances ike this? I am going to send off my reqeust this week and i also need to know if i have to enclose a £1 postal order. Thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.