sharpgun

Registered UsersChange your profile picture

-

Posts

519 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by sharpgun

-

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Dear Sir/Madam, I am writing this letter to give you notice that if I do not receive compliance from Barclays to the order made by the financial ombudsman that you received on the 27th of April (to which you had 28 days to comply) within the next seven days I will commence legal proceedings. I will also seek costs, damages, and interest on all overpayments. In order to comply with the order made, Barclays must do the following: 1.Take the marker off my credit file stating I am in arrears. The Ombudsman have deemed this incorrect. 2. Pay the £2000 compensation as ordered by the ombudsman. 3. Refund all overpayments (including interest charged on such overpayments) that were credited to the arrears account which shouldn’t have existed as that was incorporated in the revised mortgage of April 2019. 4. Provide me with all statements showing the monies going in and out of the arrears account. If I do not receive a reply, or there are no further steps taken by Barclays to rectify the situation within the next seven days, I am not obliged to provide notice to commence legal proceeding through the courts -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Post 9 -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

I have decided to send the 7 day letter and commence small claims court proceedings next week after getting a letter from Barclays for me to fill in a I&e form because it says I am in arrears. Totally amazed at the stupidity of this bank. The only problem I have is I don’t know how much I need to ask them reimburse because they won’t send me statements!! Totally refusing to do it. -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Last thursday< but today barclays asked me to today to do a expenditure form be cause of my arrears which does not exist Have i got anything to lose by sending the above letter? maybe it will g them up? and do I have to put without prejudice -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Yes they said they were escalating but nothing seems to happen -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

I have tried to go through the fos but they dont seem to get anywhere. Can you advise what i need to change in my letter to bcobs as barclays have done nothing but lie and try to obstuct me as much as possible. I was in intensive when this all started and they showed no compassion whatsoever so i want to take them for what i can. -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

But should I send the letter above or adapt it to say about the bcobs? -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

End of April was the decision from the fos -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

How do I go about a bcobs claim -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Yes, that’s the letter above, can they just ignore the fos then? -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

They have not responded in any way other than ask me today to fill out income and expenditure form , which has no relevance as to what the ombudsman has said. Barclays have totally could Here is the ombudsman decision dated April Lo My final decision is that Barclays Bank UK Plc should: Restructure Mr A’s mortgage as if any arrears balance was added to the main balance of the mortgage and the arrears extinguished upon the inception of the mortgage set out in the mortgage offer dated 29 June 2019. Amend Mr A’s credit file and any internal records in line with the above – so that any arrears were cleared upon inception of the new mortgage. If it has not already done so, pay Mr A £2,000 for the distress and inconvenience this matter has caused to him. Once the account has been restructured, send Mr A a revised mortgage statement, highlighting what happened to any overpayments along with an explanation of what happened to the overpayments. Barclays should recognise that Mr A isn’t a mortgage expert so it should tailor its explanation accordingly I’ve been in touch with Barclays this morning to clarify that any payments above what was agreed in the mortgage offer dated 29 June 2019 (upon completion of that being put in place) are overpayments and should be refunded. I’ve asked them to come back to you directly with the bottom point again. I’ve also asked them to come back to me with confirmation or any questions they may have. Please let me know if you hear from them and I will of course be in touch as soon as I have a response from them too. -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

I haven’t sent the letter yet I’m waiting to see if I need to add anything -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

I have now had a final response from the ombudsman on my case which was sent to Barclays on the 27th of April. They have failed to comply within the 28 days laid down by the fos. i am now going to down the small claims route to get the claim put through the courts. this is what I have written!! do I need to add anything else??? maybe without prejudice?? Dear Sir/Madam, I am writing this letter to give you notice that if I do not receive compliance from Barclays to the order made by the financial ombudsman that you received on the 27th of April (to which you had 28 days to comply) within the next seven days I will commence legal proceedings. I will also seek costs, damages, and interest on all overpayments. In order to comply with the order made, Barclays must do the following: 1.Take the marker off my credit file stating I am in arrears. The Ombudsman have deemed this incorrect. 2. Pay the £2000 compensation as ordered by the ombudsman. 3. Refund all overpayments (including interest charged on such overpayments) that were credited to the arrears account which shouldn’t have existed as that was incorporated in the revised mortgage of April 2019. 4. Provide me with all statements showing the monies going in and out of the arrears account. If I do not receive a reply, or there are no further steps taken by Barclays to rectify the situation within the next seven days, I am not obliged to provide notice to commence legal proceeding through the courts -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Ombudsman administrator has come down on my side on everything but Barclays still not having it. So now it’s to the ombudsman himself. -

Barclays re-mortgage, enforcing an FOS ruling in my favour

sharpgun replied to sharpgun's topic in Barclays Bank

Yes but they say I still have debt but my mortgage now covers the old arrears. But they refuse to accept it. Even though I am paying the mortgage -

I recently re-mortgaged with Barclays to reduce my monthly out goings and to clear an arrears amount which was due to ill health. Four years ago I was made redundant from work and then had a heart condition which meant I couldn’t work for a couple of years. went on to interest only, and in all this time I never missed a payment. two years ago started a new business and started to get the arrears down paying a substantial amount on top of my repayment figure. After about a year I rang the arrears dept to try and get the figures lowered and they advised me to go to my local branch and meet an advisor, which I did. I was surprised to learn that I could extend my term and fix my mortgage for five years. By doing all of this it wipe out my arrears saved me 1500 per month. The re-mortgage then went to the underwriters who after some questions approved the re-mortgage. The papers came through and every thing seemed fine. During this period I had open heart surgery and was extremely ill for months. after a couple of months went on to my credit file and found that the marker was still on. I rang Barclays to see why they hadn’t taken the marker off. They told me that my re-mortgage was nothing to do with the arrears which it clearly was. After many phone calls and much distress from complaint handlers who were clueless and many emails I decided to send all my paperwork to the banking ombudsman. I told her the story and eventually she got and realised I had not only been badly treated but I was totally right on everything that I complained about. Barclays admitted they were wrong but offered no resolution that would be in my favour other than offering a measly 2k in compensation. The first part of the ombudsman approach they have come down in my favour on everything but Barclays are still refusing to accept they must honour the agreement which they had agreed to. My question to you guys Is should I go down the legal route or wait for the actual ombudsman to make his final decision. This is very complicated but I know I am 100% right and feel like the bank are trying to bully me into getting a new mortgage again. Your thoughts would be appreciated.

-

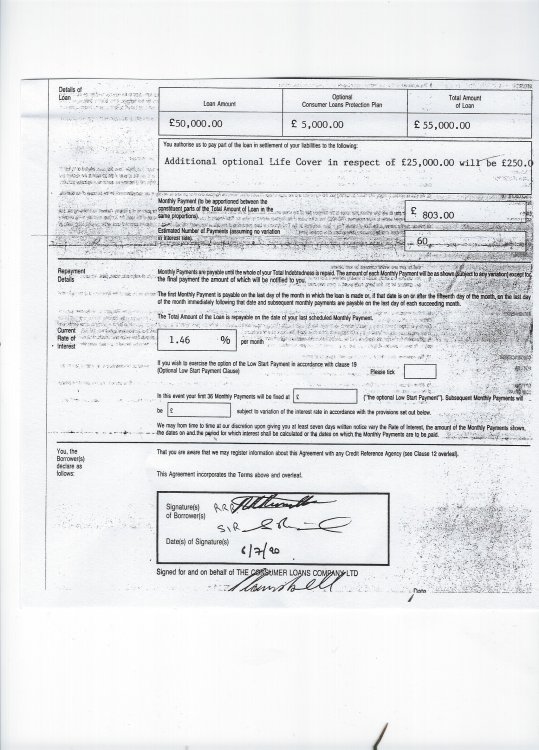

The chrage is for consumer loans and yes I have all transactions the last payment being in 2008 but the loan is agreed with no interest at all nil. and it did have 250 pounds of ppi included in the loan. so from what your saying then I will have to pay a negotiated amount.

-

What does seem funny was there was a second agreement signed which was repayment and they havent sent that agreement which is the one that is current. the one that they did send has been fully repaid!!!!

-

Where do I find the library to get a SAR template?? not been on here for a long time. Also is there PPi on this agreement?? Cheers

-

Hi Andy, it was originally interest only then I think it was changed to repayment but we dont have any paperwork, they only just sent the interest only agreement through. Not the agreement after. I suppose I need to SAR them ?? About 10 years ago I took the second agreement to a solicitor who said that he didnt feel that the paperwork was right but that because it was over 25k the was no way to fight it. But I now know that that 25k has risen?

-

I dont know but but Manchester building society have only just come on the scene, so the answer would be that no they wont be on the charge. Ther is something very funny going on, which make me think it isnt straight forward for them.

-

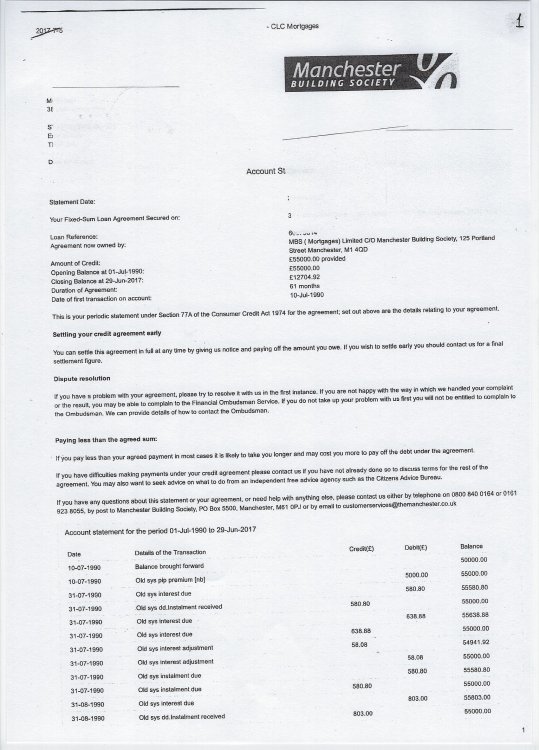

Above is the agreement they sent. My Questions are ! is the document legal? 2 is there anything that can be claimed? 3 Have they got all the legal right to claim back what they are asking? yes the charge is their name but one of them has sadly passed away.

-

havent been on here for a long time but here goes My father in law took a loan out in 1990 with consumer loan company ( now defuncked) for £50k interest only. the loan was fully repaid after 5 years and transfered onto another loan ( Repayment) which had a charge on his property. After quite a few years when the loan had gone down to about 10k I took the paperwork down to a solicitor who told me that although the loan agreement was not legal the fact that it was over 25k meant that he could not claim against C/ loans. He started to get calls from CEO asking if we wanted to make a small paymet to clear the dept. At this point I smelt a rat as I have never known a bank to except a lesser amount. Just as we were about to start sniffing as to why they were trying to do a deal Consumer loans then disappeared. Last year he got a letter from manchester building society saying they had taken over the loan and they wanted to arrange a payment plan. I took some advice verbally from a solicitor to say that they were probably time barred and that unless we acknoledged the dept they would not be able to claim. but that didnt get over the fact there was a charge on the property that needed lifting. three letters later the last one threatening legal action with a copy of an agreement dated 1990 and for 5 years makes me think A they dont have a legal agreement and are trying it on and hoping we are stupid enough to pay them. B dont realise that maybe we have a potential claim. The fact that they have sent this agreement says to me there is something fishy going on. Somepnes thoughts please.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...