hermit

Registered UsersChange your profile picture

-

Posts

46 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by hermit

-

Lloyds are claiming that, whilst they might hold data on me and my accounts it's not in a "Relevant Filling System" and hence they don't need to provide this information under the data protection act... How do I get around this?

-

Hi Ims 21, many thanks for your response. I have removed the charges from the spreadsheet and just left the PPI and this still gives a good deal more than they are offering, so I'm going to dispute this with them. The date has defaulted to the american format for some reason, month/day/year... I will send a separate LBA & SOC for the charges quoting the case law you suggest. Many thanks for all the help...

-

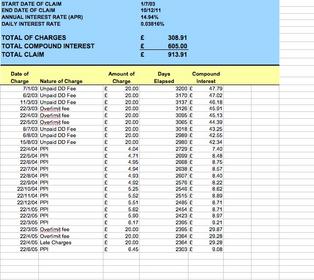

I hope this show's up, I've been trying to upload it for a few days... This is the spread sheet and figures I've used to work out what I think Egg should be paying me, could someone have a quick scan over it and let me know if I'm close to the mark please. Eggs.pdf Egg have split the claim in to two, one for PPI and the other for charges, whilst they have accepted the claim for PPI, they have now rejected the claim for charges saying it was too long ago, however I'm going to press them on this and planing on sending them a LBA next and if they don't respond from that, then Small Claims. Any thoughts appreciated...

-

Whilst claiming for the PPI I have also been chasing up a claim for charges applied to the account, this has so far gone ignored, in my last letter (10th August 2011) I gave them 14 days to pay or said I would start a claim in the courts. It's now my intention to start this process. I have attached a SOC could someone double check I've got the figures right, and when filling out the court claim do I add 8% to this figure? Many thanks...

-

I've just received a letter today offering full and final settlement for the PPI, which is good news. However they have quoted a fee based on the interest on premiums based on the card rate which works out at just under £8. I had used the spreadsheet and had worked a interest fee out at just over £100.... The PPI here isn't a right lot, £70 worth.

-

Last week I requested that NatWest send me statements from my account going back several years as my debt's have been increasing rather than depleting with them and I wanted to know why. They agreed to send them without any fuss. I was working away when they arrived. So I got back to a letter which had been opened by my house mate, which contained all my banking details, statements, etc. Basically they had printed my address, but no name, so all that showed up in the window was the house address, when it's opened the letter is addressed to me, but by then my house mate had access to all my personal details. Are there any grounds I can complain about this on to Nat West?

-

Credit Reports not showing all debts/data

hermit replied to hermit's topic in Credit Reference Agencies

Ok thanks, I was just a bit surprised to see credit searches carried out in the last few weeks when I hadn't authorised anything. -

Credit Reports not showing all debts/data

hermit replied to hermit's topic in Credit Reference Agencies

And that allows them to do a credit search as well? I have ever signed anything with Wescot, but they mange a couple of my debts. -

Credit Reports not showing all debts/data

hermit replied to hermit's topic in Credit Reference Agencies

Are they allowed to do a credit check without my permission? -

I have just registered for the free credit reports from both Experian and Equifax, and they show very few of my debts... I have a large number of debts (£13k) which mostly defaulted around 2004/5 which I am currently paying back to various debt management companies. A few I'm told are still owned by the original lenders/banks, but managed by DMC's. I expected this information to be on my files, to show who actually owned the debt. But it's not? A Barclaycard, which was repaid two years ago through is still showing as having a balance of over £600 and a debt to LLoyds which I'm still paying is shown as settled in October 2007? One other debt that has a balance of over a £1000 is shown as being only £800 and the rest are missing! Equifax also show's that Wescot did a credit search on my file earlier this month, which I never authorised, is that normal?

-

Wow! Thank you so much! My head hurts just reading that! It's been a long time since I've done real maths! So thanks so much for taking the time to work this out! I have written to them asking for their calculations and the amount the expect to pay me, so hopefully I will get an answer in the next week or so... To date, I have had no response regarding the other two loans, but hopefully they are somewhere in the post and will arrive soon, or perhaps they are treating it as one case, but haven't made that clear. If I get anything like what you mention back, it will almost clear the outstanding balance, which will be an enormous weight from my shoulders! Thank you so much once again, I will let you know what they come back with.

-

I've had a long running complaint with Santander now since November. I was involved in a car accident in October and lost a lot of work as a result, which meant I was struggling. I wrote to them and asked for assistance, despite several letters I received no response to my letters, however I received an increasing number of threatening letters from them, and eventually my account was defaulted in February. Anyway, I'm dealing with that, prior to my accident my accounts were in credit, however a couple of missed payments lead to over £600 in charges between November and February. I initially wrote and asked if these could be refunded. If the missed payments had gone out I would have been £5 and £14 in the red. Anyway, I was told that no refund would be offered. I also wrote to them asking for the default to be removed as I had attempted to contact them throughout the process that lead up to the default registering and this complaint is still bouncing back and forward, every time they bring up the request for the charges to be repaid and refuse to deal with the fact that they are incompetent. Anyway, today I have just received a letter from them... thanking me for a telephone call on the 9th August 2011 regarding my recent complaint. Now I know for a fact that I never made that call! Again they go on to bring up the charges, and how they can't refund them. I am writing back, expressing my deep concern regarding this alleged telephone call and asking for further details along with any recording that might have been made. Details of what was discussed, etc. Is there anything else I can throw at them? On this particular point?

-

Ok, been digging through my statements.... On LOAN ONE, I made 24 payments at the full amount and then 6 payments at a reduced amount of £20 per month. LOAN TWO, was 19 payments at the full amount and then 6 at £20. After the 6 payments of £20 both loans were refinanced with LOAN THREE, I managed 13 payments, before the account was closed and passed to CDR. Looking through my statements with a clearer head now, than I did back then, the reason I defaulted on the third loan... I was paying in the £52.60 a month to cover the loan, but not enough to cover the £7 a month account charge the added on top.... so I was always in the red, if only we could go back in time...

-

Ruddy hell, I'm not doing very well tonight am I! I spent ages, masking out all my personal details and then upload the originals... and then mess up typing up my info... Sorry guys! LOAN ONE Monthly repayment = £38.29 PPI Repayment = £9.87 Total Monthly Repayment = £48.16 LOAN TWO Monthly repayment = £62.85 PPI Repayment = £15.64 Total Monthly Repayment = £78.49 Not 100% sure on the date I took this out, its missing from the paper work, but looking in my files now. LOAN THREE (Not Two) Was taken out 24th August 2004 Monthly repayment = £39.07 PPI Repayment = £13.53 Total Monthly Repayment = £52.60 The breakdown on loan three: Overdraft £853.28, Insurance £1834.54, Balance transfer from loans One & Two £4446.72 I'm not sure how many payments were made on each loan, my problems started early 2004, however loan payments had largely been met until quite late on, as they just kept taking the money and adding to the overdraft.

-

CFA File? Is that my credit reference file? I have tried scanning these documents in, and for some reason they aren't scanning, two scanned fine (attached) but the rest are all scrambled! I've not seen anything like it before.... Almost as if it's some form of anti scan text or something.... Anyway, I'll do it the hard way.... I was originally offered a 5k loan after trying to extend my student overdraft, I only took part of it, to form loan one. a few months later I took the second part as loan two. 3 years later, I was broke, struggling with debt/work/etc and it was refinanced along with my overdraft in to loan three. I am still paying this today, all be it to 1st Credit, they tell me their client is Lloyds, but I don't know this for sure. LOAN ONE: 18th December 2001. Cash Loan to me £1500. PPI (cash price) £386.57. Total Loan £1886.57. APR 19.8% Repayment over 60 months. LOAN TWO: March/April time 2002. Cash Loan to me £2550.00. PPI (cash price) £634.52. Total Loan £3184.52. APR 17.9% Repayment over 60 months. LOAN TWO: March/April time 2002. Refinance Loan £5300.00. PPI (cash price) £1834.54. Total Loan £7134.54. APR 1% Repayment over 144 months. Let me know if there is anything else.... File0001.PDF

-

I have several outstanding complaints with LLoyds TSB... One of which I have received a response from today... I think it's what I want, but just checking... I have had three loans with LLoyds, all of which had PPI applied, I have made three separate claims for refunds! Today I have received a letter saying at least one has been uphold! As a final response they are offering a refund of all PPI premiums paid (inclusive of interest) plus simple interest at 8%. This is what I want right? There is no mention yet as to how much they are giving me back... Saying that will be calculated at the next step! I have to sign and return a letter agreeing to the above as full and final! They also go on to mention arrears on my account, now the first two loans were consolidated in to the third loan, which defaulted and has been passed to a DCA, I'm now paying this back at £50 a month. They say the PPI refund will be used to repay the any arrears on the account. If its with a DCA will it still be counted as arrears? Because I would rather have my money back and then use it to reduce my overall debt, rather than just the one to them!

-

I also sent mine to : Lyn Cook DSAR Team DSAR Unit, Lloyds TSB BANK PLC, Customer Service Recovery, Charlton Place, Andover, SP10 1RE However it is some one else who is responding!

-

Hass, so much of yours sounds familiar to me.... I also have three outstanding claims for PPI on three loan accounts with them. On the first two I was categorically told by the branch manager that I needed the PPI to get the loan, a loan I didn't even want, I wanted an extension on my overdraft... he insisted I needed a loan... the third loan was a consolidation loan several years later after I had lost my job, I never signed any paper work for it, they just amalgamated my current account and two outstanding loans in to one new loan.... and yep whacked on their PPI.... LLoyds TSB have robbed me of the best 10 years of my life, but now I'm back fighting... I will get them....

-

I haven't requested any information on the destruction of data, can I do this now in a follow up letter?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.