benjamin54321

Registered UsersChange your profile picture

-

Posts

1 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by benjamin54321

-

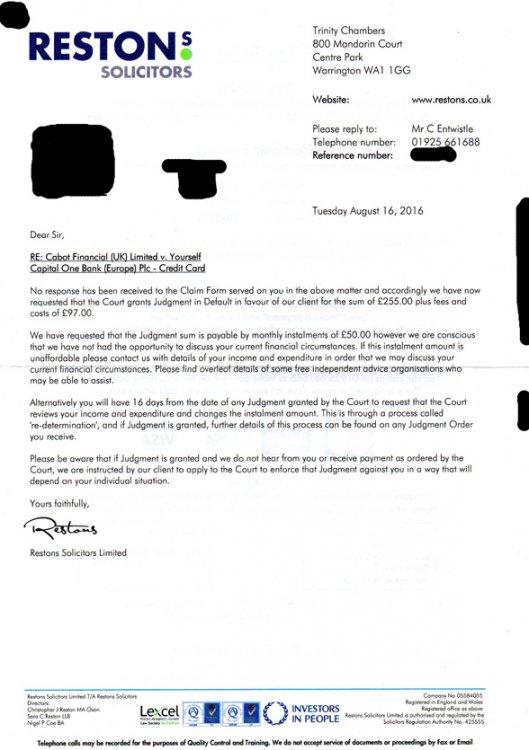

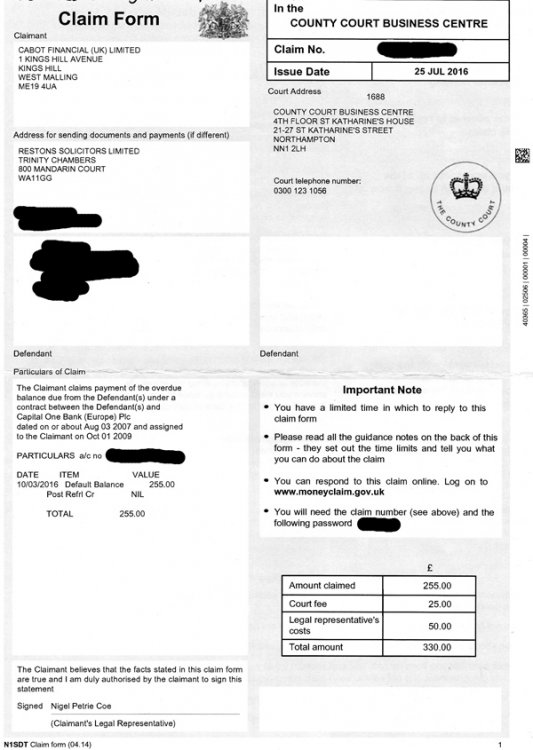

Hi there, Thanks for reading. I'm new to the forum, and hoping I may be able to find a little help with my current situation. I'm in a bit of a tangle!. Essentially I received an N1SDT CCJ claim form in the mail, too late to reply, and subsequently received a CCJ. I believe the debt to be statute barred, and intent to have it set aside if possible. I'm currently trying to claw my way out of long term unemployment by starting a small business (via the JSA/NEA scheme. I'm in the very early stages), so this is pretty awful timing. On the 18th of August I received a claim form dated 25th July. Obviously at that point it was too late to submit a seemingly simple defense, and the court ruled in favour of the claimant. I have received a 'Judgment for Claimant' notification, and correspondence from the claimant. The debt is from a capital one credit card dating back to August 2007, and was apparently 'assigned to the claimant' in Oct 2009 (this information is taken from the 'particulars of claim' section of the claim form that I received). I have no records of the debt, but have had no contact with anyone regarding the debt/account since the point were I stopped making payments (which I assume is 2007). I'm hoping that I can have this CCJ set aside, owing to the debt being statute barred. I'm currently claiming JSA, have no savings/additional income, live in my father's home, and I believe that I meet the requirements for a full remission of court fees, should I be able to go down that route. Though I'm not really sure how I go about doing that. Also I'm not entirely sure what kind of evidence I would have to supply. I have no records from the time, and assume I'll be needing them. Any advice with regards to my options at this point would be greatly appreciate. My understanding's pretty limited, and time is of the essence it seems. Thanks for any help.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.