kjh0711

Registered UsersChange your profile picture

-

Posts

25 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by kjh0711

-

Yes. Its a small (complements slip size) cash receipt for the £200. ...Get this...Baliff said when i arrived with money that he was suposed to charge me £70 for his new visit also...but he was able to tell this office that he didnt want that charge to be on the system, so i didnt have to pay for this visit....you see...what a nice baliff he was!

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Thanks PT, thats exactly what i will do this evening. Baliffs are Rossendales if i havent mentioned. Many thanks for info.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Yes cheque was cashed and a couple of days later balif turned up. I had a reply by letter the day after the baliff turned up which didnt answer my question on the charge. It just said that the matter is being dealt with by our van baliff and i should call him on his mobile number. So....they answered the letter, but must have been aware that their baliff had already been anyway.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Update. Didnt work out too good. . I paid the business rates direct to the council. Sent a cheque for £80 for the levy fee to the baliffs along with a letter saying i believe the only fee due is the levy fee and i consider matter closed unless they can explain the £200 other charges. All as talked about previously....... Unfortunately, the baliff returned when my girlfriend was in the shop and said he was taking goods unless he got £200. When i was on the phone to my girlfriend about the matter i heard the Baliff in the background calling on his mobile for a van to come around. I asked him to wait until i got there. I told him that i had sought advice and that he cant charge me £200. He said that it is NNDR (or something similar) and on FASTTRACK. He said it is Business Rates and not council tax. He said he would remove goods now. He called someone on his phone to call off the van when i said i would pay. I had no option. At the time i thought the best thing would be to reclaim the costs rather than run the risk of him removing goods. I guess i didnt have the knowledge to call his bluff. If anyone reads this....whats your thoughts? I have no problem reclaiming, i have successfully reclaimed bank charges in the past. But, could he have removed goods?

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

http://s1232.photobucket.com/albums/ff366/kjh0711/ http://s1232.photobucket.com/albums/ff366/kjh0711/?albumview=slideshow links to baliff documents....

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

interesting. Rossendales in Ambrose v Nottingham City Council. Same people that i am dealing with. Photobucket taking a while...

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Wow. Global levy? dont know what that is..

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Baliffs will get cheque on Wednesday with letter that im about to draft, thanks to all your help. It does say on their form..."cheques accepted at our discretion". If they receive it on 23rd Feb (given that he gave me till end of month) it may not be cleared by that time. Could this be a problem? Can they use the fact that the Levy payment of £82 has not cleared.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

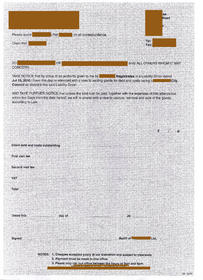

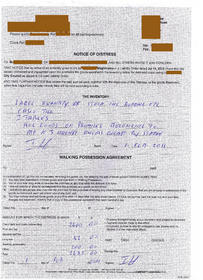

The Inventory states.... Large qty of stock inc bedding etc. casio till. 2 tables. all goods belonging to (me) unless exempt by statue. The baliff didnt believe their was enough stock to satisfy the debt. I sell gifts and homewares, so lots of small items. He didnt even fill out the reverse of the form. Its a bit of a rush job.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

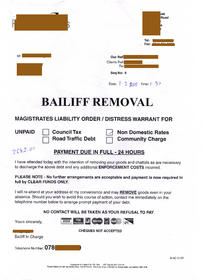

There were 2 pieces of paper. 1 is headed NOTICE OF DISTRESS where he has written some of my goods/walking possession and the fees that i have mentioned. The other piece of paper is headed BALIFF REMOVAL, magistrates liability order/ distress warrant.( in BIG LETTERS) That says payment in full - 24 hours. Giving me the baliffs name and a mobile number. I cant believe someone with the power to take away goods can be so dishonest with their charges.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Just thought...The baliff said that he turned up in a van to take stock. He also said he had just visited someone else. I have no way of knowing as i am in the centre of a town. Infact, he wouldnt have legally been able to load and unload at the time he came, due to restrictions.. Couldnt he say that he has the costs of the van(even though im sure he hasnt). He acted as though he was being generous to me as he believed i was being honest with him, by letting me pay by the end of the month. thnx.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Thats great. Thank you for swift reply. I will go ahead and pay the council £2100 online (receipt is emailed) and phone them tomorrow for a confirmation of no outstanding liability. I will post a cheque to baliffs, guaranteed next day, for the Levy Charge of £82. I guess i should mention why i am not sending payment for the £200 "other costs". Any ideas how i should word my letter to the baliffs when i send them a cheque. Thanks.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Hi. Thank you for replies. Council confirmed i owe them £2100 and i can pay online. But i should also pay baliff fees to the baliffs. Its a good point that there is nothing in writing about giving me till end of month. To confirm, £2100 is the amount the council want, £82 is levy and £200 other is probably the van charge. The baliff could turn up for a second visit if i dont pay their fees, so i think i had better pay up and try to get back.? Or should i pay them what i believe is a true cost in the hope that they have no grounds for a second visit based on their fees to date?

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Hi. I hope someone can give me some help with baliffs charges. I have until the end of the week to pay. I was visited by a Baliff on 1st Feb 2011. I had missed a couple of payments of business rates in December2010 after making an arrangement with the council in June 2010. He told me he was there to seize goods. After discussion he said he would give me till the end of the month (feb). I now have the money to pay the bill but noticed his charges (although not as big as some ive seen) seems a bit high. He completed a walking possession. It states. Outstanding debt £2400. First visit fee is blank. Second visit fee is blank. Levy fee £82. Walking possession blank. Other £200. Total £2682.00. I had paid £300 the day before his visit, so the actual amount should be reduced by £300. Can anyone tell me if the charges of £82 and £200 are justified. I only received the 1 visit. Also, should i pay the baliff or pay the council online as i normally do with business rates? Im worried that if i didnt pay the baliff charges and only paid the outstanding debt, that i may get a second visit. Time is against me. Please help. Thanks.

- 38 replies

-

- baliff charges

- baliff fees

-

(and 3 more)

Tagged with:

-

Filled out N1 form http://www.hmcourts-service.gov.uk/c...ms/n1_0102.pdf and will be taking to court tomorrow. 20th june 2007. claim is £4458.50 plus 1398.44 interest and is accumulating 98p per day. fees will be £250. reading forum for other cases now and doing my homework. ...there are some inspirational stories out there.

-

14 days are up. posting LBA today 31st MAY 2007. included threat of OFT complaint as I have done it when they did not comply with the Data Protection Act. So will definately do it if (?..ahem....when) they do not comply again.

-

Hi Knelly K. Well done with your first victory and best of luck towards your second.

-

Used spreadsheet (excel) to calculate charges. £4458.50. Didnt bother with interest that i have been charged by Abbey for each penalty charge because Info supplied for past 6 years doesnt really give you all the details that you need to be 100% sure of calculation. ie. account balance at time . was it charged at unauth overdraft rate or just overdraft rate. What was the rate of interest for my overdraft?I know 28.7% is unauth overdraft rate but has it always been this?.....dont have these answers so will proceed to reclaim all my charges. If it goes to court then i think adding 8% will make me smile...Infact it already has, the excel doc works that out for you. SENDING PRELIM LETTER WITH STATEMENT OF CHARGES TOMORROW 14/05/07

-

Hi. Dont know if you have sorted your problems out yet or wether this helps but....... if you copy a cell.......and then paste it into another cell...then you are actually copying the formula and not the figure thats in it. so, choose a cell that you know works ok. right click mouse and select copy. move to a cell that doesnt work anymore...rick click mouse and select paste. this cell will now calculate as it used to. the spreadsheet works out the interest right up to today because the date on the "notes" tab is current. ie. at the bottom of this page in a coloured box...there is a formula which keeps it up to date. the formula is... =TODAY() sorry if you knew this. best of luck.

-

hi. thanks for advice. luckily for me, i have the original bank statements covering the period of the spreadsheet. I have now gone through them all and can say that all the charges are correct (that surprised me). i do have unauthorised overdraft fees on the statement and they are correct also. good luck.

-

good luck to you all!! ...heres me so far... ABBEY received request for last 6 years statements on 12th March On day 25 (3rd April) i received a letter saying that last 14 months statements would be sent under seperate cover. and info prior to this is archived and will be sent at later stage. received my 14 months statement a few days later. ...mmm....when would i receive the rest i wondered? sent letter reminding them that i require all info within 40 days. on day 42 (monday april 23rd) received 2 year spreadsheet listing all charges for that period. OK THEN...thats 3 years info so far!!.. sent letter to abbey from the template library to remind them that they have not complied and have 7 days. 7 days later ....nothing.............. monday 30th April (DAY 47) REPORTED ABBEY TO THE INFORMATION COMMISSIONER ONLINE and posted letter telling Abbey what i had done and that i will start a court proceeding for non compliance in 7 days time. I also returned the £10 cheque that they wanted to refund me. Probably didnt need to do that, but who knows... an acceptance of the refund may be seen as an acceptance of the delay....(which i dont accept) .....received all information TODAY 3rd MAY. NOW to sort through the info, collate charges and start the serious stuff.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.