Turning Worm

Registered UsersChange your profile picture

-

Posts

49 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Turning Worm

-

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

I only requested extension for the defence; not the DQ. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Yes, I requested a time extension to submit the defence as deadlines cause me mental health issues (see post #1 & #25) and that the case stems from an assault that caused severe financial problems. Thanks, you have put my mind at ease a bit. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

I've just called the court who read the memo: "given the defendant's need of reasonable adjustment to participate, please list for allocation/directions" So, I take it that this is an Allocation Hearing rather than a final hearing? No, there was not an N244 included. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

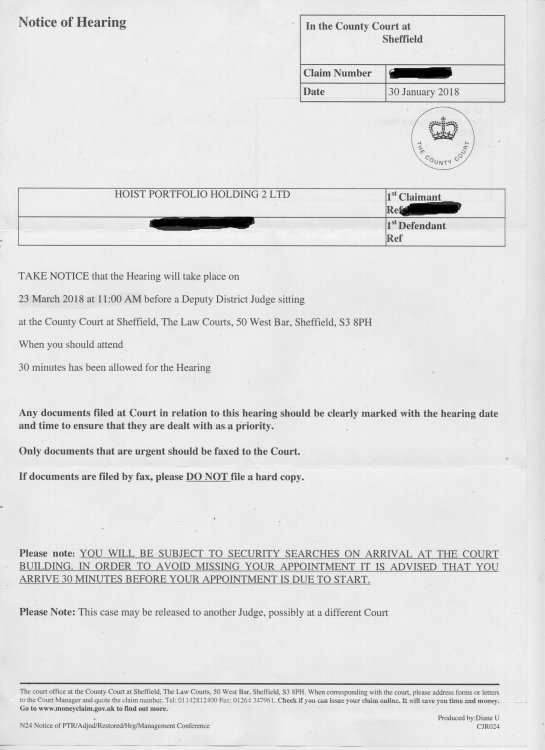

Yes, it does just say a hearing without stating what it is for. I have had some repeat documents from the Claimant. I assumed that the hearing was to hear the case. I will ring them. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

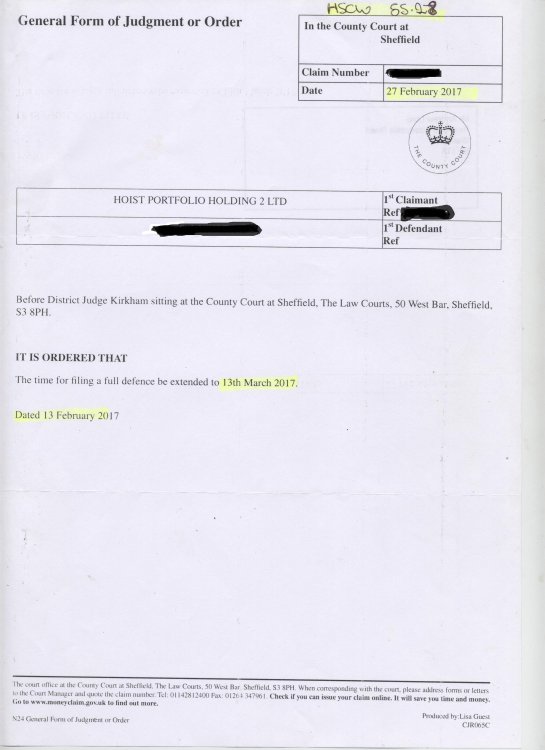

These are the latest two documents received from the court. NB. My defence was submitted 13th March 2017. dx: good call, how might I present that in court? ,tw -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Righto, I'm just getting flummoxed by procedural terminology - that was done as per post #23; I gather that equates to my written defence (N149?) I do not believe I have had a notice of allocation, but have had a notice of hearing (N24). -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

err... no, I thought that was for criminal proceedings. No one has told me to write one. What might that ential in this case? ,tw -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Its a good idea not to close threads. OK, the saga goes on as per post #23 nearly a year on as my defence was submitted about 13th March 2017 (post #30) I've managed to recover a frame of mind to deal with it (having just delt with a unrelated legal matter). They have reopened the claim and there is a court date on 23rd March (Friday) I'm not panicking, just looking for an angle to present at court.,tw -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

if they had any reasonable chance then they would most likely to have acted already. They would then have to have a good reason for not notifying the court on time, and I have not had any indication of any. They took it almost to the line before the debt became statue barred anyway (8% apr statutary interest) My thoughts then are: realistically, then the probability of a DCA persuing at this stage is quite low, but I should just be aware that sometimes they might. I'll give it a few more months before reporting again (maybe then "close" this thread) Thanks again -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

So, really, that 28 days means nothing as they can still proceed if they want? -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Well, my defence was sent on 13th March 2017, HPH2 came back with the Notice of Assignment around 4th April, it is now 13th June, more than 28 days, and I have heard nothing further. Might I presume that no further action is likely, or needed; and consequently where they "trying it on"? tw, -

PIP backpayments and staturary interest

Turning Worm posted a topic in Special needs, Disability etc

I've noticed that debt buyers wait unil almost the last minute before a debt becomes statute barred, then going through Northamptonshire Auto-Court. they don't have to supply the regular documentation and they get to charge 8% APR stautary interest on the debt, including the time you take to dealing with them. On the other hand, the DWP want disabled people jump through hoops and introduce delays in the hope that you will cave in. For them, the worst is that they keep the cash until they are forced to make backpayment by a tribunal. Does anyone know about statutary interest on benefits backpayments. tw,-

- backpayments

- interest

-

(and 2 more)

Tagged with:

-

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

OK, update as promised HPH2 have come back with a Notice of Assignment. However, that document is not in my files and I have no recollection of seeing such. Is there any course of action from here? tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

:rockon:Brilliant, thanks a lot! I've got it transferred to the local court, so I am going to take it in in person. I will keep you informed. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Thanks; The difference are paragraphs 1 and 5 I see. Paragraph 1 could revert to the original in #16 No, I did not have an authorised overdraft and only went into the red after an assault that triggered off my symptoms. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Great stuff; I'm taking it in personally but I will take out the special html stuff. This Claim is forthe sum of £663.11 in respect of monies owing pursuant to an overdraft facility under bank account no. XXXXXX. The debt was legally assigned by MKDP LLP (Ex HSBC) to the Claimant and notice has been served. The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. The Claimant claims The sum of £663.11 Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00percent from the 7/04/11 to the date hereof 1986 is the sum of £288.57 Future interest accruing at the daily rate of £ .15 Costs Defence The Defendant contends that the particulars of the claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1. It is admitted with regards to the Defendant once having had banking facilities with the original creditor HSBC.It is denied that I ever had an authorised overdraft facility. It is therefore denied that I am indebted for the alleged balance claimed. Any alleged balance claimed is a result of unfair and extortionate bank charges/penalties being applied to the account. 2.Paragraph 2 is denied. I am not aware or ever receiving any Notice of Assignment pursuant to the Law of Property Act 1925. It is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of theconsumer credit Act 1974. The Claimant has yet to provide a copy of the Notice of Assignment its claim relies upon. 3. Paragraph 3 is denied. I have never been contacted or requested by the Claimant to pay any alleged overdrawn sums. 4. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. The claimant is also put to strict proof to:-. (a) Provide a copy agreement/overdraft facility arrangement along with the Terms and conditions at inception that this claim is based on. (b) Provide a copy of the Notice served under 76(1) and 98(1) of the CCA1974 Demand /Recall Notice and Notice of Assignment. © Provide a breakdown of all excessive charging/fees and show how the Claimant has reached the amount claimed. (d) Show how the Claimant has the legal right, either under statute or equity to issue a claim. (e) Show how they have complied with sections III & IV of Practice Direction - Pre-action Conduct. 5. On receipt of this claim I requested documentation by way of a CPR 31.14 request dated 6th March 2017 namely the Overdraft Agreement, Terms and Conditions relevant at the time of inception for the agreed overdraft and Termination Demand Notice inferred by the Claimant's Particulars of Claim. The Claimant has failed to respond or comply with this request. 6.By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Another quick question, if I did submit by post, would it miss today's deadline, or would it be taken at time of posting? -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Right, so that would be taking the 15th March 2011 closing the account date. OK, back to plan A with the amendments; get it in before 4pm, and wait. I'll give you the update (or more questions) depending on how that goes. Thanks again dx tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Searching through hard drives etc. and have uncovered more documentation To revise your questionnaire: Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes 9th March 2012: I explained the nature of my illness and requested an annulment of any debt that they thought that I might owe. I did not acknowledge any debt. They are attempting to backdate statuary interest from 7th April 2011. This date is not explained. However, I have the last direct communication from HSBC (OC) dated 15th March 2011 closing the account, but my last payment is 20th September 2010. Is there any grounds for considering a statuary barred defence? Neither the claimant nor the solicitor have produced any notice of assignment upto today's post. tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

thanks for correction, maybe this is in the right ball park at least perhaps it should read 3. Paragraph 3 is denied. I have never been contacted or requested by the Claimant to pay any alleged overdrawn sums. I did so, but not under the auspices of any CPR, so maybe. 5. I requested documentation request dated 6th March 2017, for a copy of the notice of assignment, The Claimant has failed to respond or comply with this request. I also dispute the authority of the sum itself as it was an unauthorised overdraft; there was no agreement or facility to make such a payment and at a time when I was not compus mentus and in need of mental supervision. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Reading your suggested search results, the experiences of others sound eerily familiar. I'm taking a particular thread as a template, as it is quite close, but I've changed the details. http://www.consumeractiongroup.co.uk/forum/showthread.php?471103-Hoist-Cohen-claim-form-ex-HSBC-OD-debt This Claim is forthe sum of £663.11 in respect of monies owing pursuant to an overdraft facility under bank account no. XXXXXX. The debt was legally assigned by MKDP LLP (Ex HSBC) to the Claimant and notice has been served. The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. The Claimant claims The sum of £663.11 Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00percent from the 7/04/11 to the date hereof 1986 is the sum of £288.57 Future interest accruing at the daily rate of £ .15 Costs Defence The Defendant contends that the particulars of the claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1. It is admitted with regards to the Defendant once having had banking facilities with the original creditor HSBC. It is denied that I am indebted for the alleged balance claimed. Any amount claimed is far in excess of any agreed overdraft limit with HSBC. Any alleged balance claimed is a result of unfair and extortionate bank charges/penalties being applied to the account. It is therefore denied that I am indebted for any alleged outstanding residue. 2.Paragraph 2 is denied. I am not aware or ever receiving any Notice of Assignment pursuant to the Law of Property Act 1925. It is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. The Claimant has yet to provide a copy of the Notice of Assignment its claim relies upon. 3. Paragraph 3 is denied. I have never been contacted or requested by HSBC or the Claimant to pay any alleged overdrawn sums. 4. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. The claimant is also put to strict proof to:-. (a) Provide a copy agreement/overdraft facility arrangement along with the Terms and conditions at inception that this claim is based on. (b) Provide a copy of the Notice served under 76(1) and 98(1) of the CCA1974 Demand /Recall Notice and Notice of Assignment. © Provide a breakdown of all excessive charging/fees and show how the Claimant has reached the amount claimed. (d) Show how the Claimant has the legal right, either under statute or equity to issue a claim. (e) Show how they have complied with sections III & IV of Practice Direction - Pre-action Conduct. 5. On receipt of this claim I requested documentation by way of a CPR 31.14 request dated 6th March 2017 namely the Overdraft Agreement, Terms and Conditions relevant at the time of inception for the agreed overdraft and Termination Demand Notice inferred by the Claimant's Particulars of Claim. The Claimant has failed to respond or comply with this request. 6.By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Would something like this be suitable, and can I take a printed copy to court with me tomorrow to submit? tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Right, got what you meant now (and sense a patent for hydro-electric keyboards in Scotland ) Nice one! Yes, I can make it to the county court tomorrow. I'll have a search on what a standard overdraft holding defence, and what I need to do. I will search for dodgy bank overdraft practices to vulnerable people (I think the CAG newsletter might have noted it?). If you have any links to hand, then that would be great. I'll forward useful stuff I find. tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

MCOL has never allowed me to log-in (just tried again; still doesn't) Can you elaborate on the first line of what you said, not sure what you meant. -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Thanks, OK, according to my original question: I'll go into a little more detail with the recent timeline. 2016-09-19 Claim by Hoist Portfolio Holdings 2 Ltd. (HPH2L) Via Howard Cohen Solicitors Ltd. (HCL) 2016-10-25 As I was experiencing a crisis at the time, then an emergency note had to be put in the defence section stating that I had a medical history: clearly this was not intended as a defence. The procedure seemingly has no provision for handling emergencies so the note was automatically accepted as a "defence", and forwarded to the solicitor as such. 2016-11-04 The solicitor then wanted copies of medical reports "referred to in your Defence form." 2016-11-23 Notice of proposed allocation to the small claims track. 2016-12-12 Defendant's N180 and attachment (retuned by me) – rejecting mediation as inappropriate, and noted that medical reports were private and confidential and for the court only. Included was an attachment which stated: the crisis note was NOT intended as a defence. That ongoing mental health problems were causing delays but were not being handled correctly, but instead symptoms were being exacerbated by deadlines. 2016-11-27 Claimant's N180 (asking for mediation) 2016-12-16 Notice of Transfer of Proceedings. To local court stating that a defence had been filed. 2017-01-21 General Form of Judgment or Order: IT IS ORDERED THAT: 1. The claim be struck out. 2. Unless... makes an application to extended the time for filing a full defence, with reasons, ... 2017-02-08 Application to extend time. Long detailed reasons for need of extension; explanation of the symptoms and difficulties caused and their effects; that I dispute the underlying debt; and a reaffirmation of vulnerability and elevated risk (and note need for, but inaccessibility of, proper assessment). 2017-02-27 General Form of Judgment or Order IT IS ORDERED THAT: The time for filing a full defence be extended to 13th March 2017. With no further justification for this date or any reference to my application details. I'm painfully aware of my slowness, and of looming deadlines. This order effectively gave me 7 workdays (mostly to find the head-space) to quickly research whether a Deed of Assignment or notice of assignment was sufficient and necessary proof, and to get copies thereof as suggested; or depending on that, whether I would have to demonstrate the fundamental problem with the original overdraft (not quite as easy). I have letters from various DCAs including assignment between HSBC and MKDP LLP; I have requested copies of such notice from both the Claimant and their representative as I do not have assignment from MKDP LLP to HPH2L. Hope this makes sense. tw, -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

Name of the Claimant ? Hoist Portfolio Holdings 2 Ltd. Date of issue – 19 September 2016 What is the claim for – 1.This Claim is for the sum of £663.11 in respect of monies owing pursuant to an overdraft facility under bank account no. XXXXXX. The debt was legally assigned by MKDP LLP (Ex HSBC) to the Claimant and notice has been served. 2.The Defendant has failed to repay overdrawn sums owing under the terms and conditions of the bank account. The Claimant claims The sum of £663.11 Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00percent from the 7/04/11 to the date hereof 1986 is the sum of £288.57 Future interest accruing at the daily rate of £ .15 Costs What is the value of the claim? 1081.68 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Current account When did you enter into the original agreement before or after 2007? Account opened 26th September 2006 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser (claims this has been assigned) Were you aware the account had been assigned – did you receive a Notice of Assignment? I don't think so. Did you receive a Default Notice from the original creditor? I don't know Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I don't know Why did you cease payments? Serious illness. What was the date of your last payment? 20th September 2010 Was there a dispute with the original creditor that remains unresolved? This has not started yet. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No -

HPH2/Cohen Claimform - No proof of debt ownership,

Turning Worm replied to Turning Worm's topic in Financial Legal Issues

I'm sorry, its easy to misinterpret raw text as sarcasm in my dizzy frame of mind (this debt has been only a tiny part of of a much more overwhelming problem). I agree, scanning isn't straightforward. claimform xxx.pdf

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...