tacklebob

Registered UsersChange your profile picture

-

Posts

40 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by tacklebob

-

Sorry I do not have a scanner at home. The letter states " we act for arrow global ltd. Our client has instructed us to write to you concerning the sum of £1260.49 owed to it. We note that you made a CCA request to our client in 2013. Please confirm whether you made this request and if so forward us a copy of the same. If you do not have a copy confirm whether you wish to re-submit a CCA request. Unless we hear from you within 14 days of this letter, we are instructed to issue court proceedings without further notice. We hope that it is not necessary to issue proceedings and you make payment by return". When I paid I always paid by cheque and I am not even with that bank anymore so it would be hard for me to find out but I do know it is some years ago.

-

Whoops sorry - read it properly. " we are instructed to .."

-

I believe the original creditor was City Financial - it was a loan I used for a home improvement. I have not paid anything for about six years but don't have the actual date - so don't want to go down the statute barred route. I still worry though every time I get a letter saying within 14 days they will issue a court summons.

-

The debt is at least fifteen years old (from my youth!) Every now and again I get a letter from some DCA and I always send a CCA request - but never get anything back. It does not show on my credit file. What confuses me if they know I have sent a CCA request why do they want a copy or for me to re-submit.

-

Hello. B.Lapthorn have started chasing me for a alleged debit owed to their client (Arrow Global). Arrow Global were assigned this debit in 2013 - I sent Arrow Global a CCA request and received no response and did not chase them up. The latest letter from B.Lapthorn says "we note you made a CCA request in 2013. Please confirm whether you made this request and if so forward a copy of the same. If you do not have a copy please confirm whether you wish to re-submit a CCA request". I would appreciate some advice on how I respond. Many thanks.

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

The original debt was £535. But when it was sold to Marlins it was some time before we got a Notice of Assignment. Between it been sold and me getting notification I continued to pay the reduced payments to YB - but these were not showing on the amount. That has now been sorted although it took some time. I understand the £535 is owing but they have now added interest, solicitors fees and court fees - but they did not send me a payment card. I was not comfortable with giving Marlins my bank details. My concern is do I have to pay these added charges.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

I got a copy of the agreement but I never got any statements.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

PDF attached.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

Hope this is suffice.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

Yes it is a N1CPC claim form - from Mortimer Clarke Solicitors. The claimant is Marlin.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

I wondered what had happened to my post and thought I had done something wrong. Thank you for explaining. I have not checked my credit file for some time. The letter says it is from the county court though do I need to fill it in - I am worried sick about someone calling at the door.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

old YB loan sold to marlins - claim form received - help

tacklebob replied to tacklebob's topic in Financial Legal Issues

wanted to start a new thread, apologies.- 38 replies

-

- account

- county court

-

(and 1 more)

Tagged with:

-

It is 18/04/97. They have not sent any terms and conditions; does that make a difference. Also I am 99.9% sure I have not made any payments within the last six years.

-

Sorry, I have now attached response to my CCA request.

-

I have tried to attach it again.

-

Morning all, I am not sure why but all my attachments are showing too small to read but I have had further correspondence from Robinson Way. I sent an account in dispute letter because they had not provided a CCA, evidence of any payments against the alleged account and no notice of assignment. In their letter they refuse to communicate further with me or to lodge my letter as an official complaint stating they are satisfied of my liability. They state they will continue to process my data and pass to other third parties and will take further action if no payment is received within 14 days. 1, Can they legally refuse to lodge my letter as an official complaint (which was stated in it), not send a copy of their official complaints policy and can they refuse to communicate any further in the matter? 2, How will they try to collect payments if they will not communicate any further? 3, Can they still legally use my data? Many thanks as always.

-

Sorry I am not sure why it is showing small. I am very good at keeping paperwork and can not find anything in the last five years. I am just worried that if I go down the SB'ed route; am I admitting the debt? then if I have paid it in the last five years, have I shot myself in the foot if they havent got an agreement.

-

Morning all, Can someone please advise with some trouble I am having from Robinson Way. They wrote to me regarding a debt they said they had purchased. I wrote a CCA request and have heard nothing for 8 months. Now they have sent the attached. As you will see it says "application form". Also I have had no Notice of Assignment regarding this debt; just a letter saying they have brought it. Also I honestly can not remember this debt. The application form is dated around the time my husband got made redundant and I acknowledge we panicked at the time; so it may be from them but I am 99.9% sure I have not paid anything on it in the last six years. So I dont really know which route to go down with them...help needed please:|

-

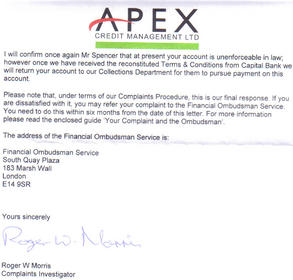

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

Hi, I have already sent that account in dispute letter. This letter is their reply. -

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

Hello, please could you look at the attached letter from Apex. As I read it they are not saying they do not need a copy of the CCA but can "reconstituted one! Thay are quoting a recent court case. Can anyone advise? Thank you -

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

I have now started receiving letters daily from Apex. The one received today says I have ignored all communication. This is a lie and can be proven by recorded delivery slips. The worrying thing is that it says the case is been passed for pre-litigation assessment. What should I do now? Thanks for your help again. -

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

Thank you. Do I keep ignoring or reply? -

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

I have now received another letter. They have admitted that they do not have a copy of the original credit agreement but they are saying because I have previously made payments to this account I am legally liable. Please can you advise further? -

Letter from apex after two months

tacklebob replied to tacklebob's topic in Debt Collection Agencies

Hi, I wrote a while ago to Apex with a CCA request. Some time later they replied with what can best be described as a bit of paper, saying it was my credit agreement and demanding payment. It was some time ago but I did put the alleged agreement on here and was advised it was not enforceable. I wrote to Apex and they said they would go back to the original owner of the debt for a copy of the agreement. Today Apex have wrote again to me, again with only this "scrap of paper". a gain demanding payment. Do I send another letter or ignore it? -

I sent a CCA request two months ago to Apex. Finally I got a response and attach the document they say is the agreement. Please can someone advise me on the following: The document is in parts ineligible, although you can see it says on the top “application” . Also worryingly some of my personal information is not correct. What next? Thanks.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...