seville

Registered UsersChange your profile picture

-

Posts

65 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by seville

-

Congratulations !!!! Well done!! What bugs me is that the likes of you have the skills and determination to fight these bullies but there are thousand who are just terrified by the big bullies for this type of organisation (or should I say disorganisation) Well done !!! You've one one for the little people

-

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Good news !!! received letter from LCS this morning and they say" ----we are instructed that our client will not persue the matter and has closed its file":D When the estate is sorted out I will be sending a donation to this site --to help keep it going so that others can be helped and received support just the way I have ---thank you all so much -

Hi Blondmusic Just nipped in on your thread to give a little support--Eon are bullys and morons!! I am dealing with an estate of an old lady who died--she owes a few hundred pounds. I told them they will get paid once the estate is sorted and her house sold (in the next few weeks) Guess what---they sent one of their computer generated threatening letters to me!! Threatening with court/bailiffs and to damage my (me as executor) credit rating! I've bounced a formal complaint and I am currently seeking compo. apparently they have a policy of no compensation---or so one of their morons said. They'll have to raid their piggy bank! If they dont pay up the costs of my postage, time and tel calls I will be reporting them to every organisation available---they really annoy me with there bully boy tactics. I feel sorry for your mum ---go on and wipe the floor with these idiots and report the bullys to the utility orgs and try and get the press involved. I'd want Eons head on a platter if they threatened my mum like that Keep a record of all your letters to them and send them recorded or special delivery --for evidence You are in safe hands on this fab site Good luck with EON morons:D

-

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Thanks Pinky --you were up late like me Would you suggest I write to LCS solicitors to tell them to get lost and at the same time tell HFC the DNs are invalid and they have unlawfully sold an invalid debt? Thanks -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Hi and sorry I need help( and a little reassurance )again I recieved HFC reply to my SAR --a huge bundle of papers!! The 2 debts with HFC are now with 1st Credits solicitors , LCS. In HFCs letter they say they cannot provide me with a copy of one of the CCA but before I get too excited about that it shouil be noted that LCS have copies of both agreements; though 'PINKY69' considers them unenforceable because they have HFC boldly printed across the CCA (see previous posts) In the bundle of papers from HFC are the DEFAULT NOTICES for both debts but the covering letter says "The defaut notices are system generated and the copies enclosed are not copies of the original letters,, however they contain the information that was issued to Mr X". Are they still valid? A 2nd point on the re the Default notices is they dont give the full 14(plus the postage days) one issued on the 23rd Oct 06 wants remedy payment by 7th Nov 06(15 days), and the other issued 16th Oc 06 and wants remedy payment by 30th Oct 06 (14 days). Am I right in thinking these are invalid? If so do you know the legislation? I do not have Termination letters but the Default notice says "Termination will take effecton the date show unless paid in full before that date". As no other dates are shown in the DN I assume they mean 7th Nov and 30th Oct?? Is that valid? Invalid or not HFC confirm in their letter that the debts were sold to 1st Credit. They dont give the date or provide a letter of assignment but the account printouts provided by HFC show a "charge off "date in March 07 Can anyone help guide me through this bag of worms? Has HFC sold and unenforceable debt to 1st Credit/(cos of the 14 day+2 days postage rule)? How do I tackle this with HFC and 1st credit/LCS If possible I would love to get these debts (from the estate of Mr X) cancelled on validity grounds. I know the CCA are questionable but certainly if these DN are wrong too it just gives me a twin edged sword ---so to speak. Sorry to ask so much --I have read around on DNs but lack the confidence and tactics to challenge HFC/1st credit Any help will be more than welcome --thanks -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Pinky ---thank you so much ---again I'll get the letter done tomorrow night after work. -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Pinky --can you help or at least give me some reassurance I'm doing the right thing?? On 2nd april 09 have sent the letters like you advised:- 1. To LCS(1st Credit) 'Account in Dispute' --because LCS failed to respond with a legible copy of the CCA agreement (the CCA had HFC copy stamped across it so it was partly difficult to read)--maybe the legality is dubious ??? The courts may find it to be fine 2. SAR request letter to HFC with £10. On 6th April LCS wrote and demanded the full amount and said hey have prvide the CCA 9th April I wrote to LCS asking them to reply to my letter 2nd april & told them I had applied for SAR and also asked them for copy of NOA from HFC. 17th april LCS write saying they havent received my letter of 2nd April and ask for a copy. They say their NOA (from 1st credt to LCS) complies with the CCA 1974 and Law of property act 1925 and say 1st credit are the legal owner of the debt. They do not accept my my reluctance to communicate with LCS until I get a NOA from HFC as 1st Credit own the debt. They have asked for a property valuation and mortgage statments LCS say my SAR to HFC is a separate matter between me and HFC and finally when are they going to get the money!!!!!! I have read a post/link by 'foolishgirl' about absolute and equitable assignments and it may be that LCS have 'absolute assignement' so the SAR should go to LCS--I think? I was going to reply to LCS and ask them to confirm if it is absolute or equitable assignement --apparently it makes a difference on who you send the SAR to Tell them that HFC should also inform the debtor that the debt has been assigned and I am entitled to see a copy of HFC assignment letter to prove the debt is 1st credits to collect? I dont want to send them all the personal stuff (at this stage ) re mortgage statements & house valuation (to prove its likely negative equity) though i will if the debt is definately owing ---I'm not hiding anything but I just dont trust them I feel under pressure from LCS now but I cannot pay anything until the house is sold ---and this is one of the smallest debts of the estate and these horrors are giving me the most grief of all the creditors of the estate. They are starting to get to me Am I heading the right way or have you any other advice? Thanks -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Hi Pinky Ive sent an SAR letter to HFC which also asks for the default notice Ive also sent an " Account in dispute" to LCS(1st credit) like you advised Both send recorded delivery Now Ive had another letter from LCSsolictors (1st Credit) which must have crossed in the post with mine saying that they can now enforce payment because they have given me a copy of the original CCA and the debt was 'ASSIGNED' to them on 14th Sept 2007. They enclosed a copy of 1st credits letter 14th Sept which basically says the debt was asigned to 1st Credit by HFC, payment should be made to 1st credit and not HFC and to contact them immediately re payment. I dont mean to be dumb but should there be a DEFAULT NOTICE from HFC as well as the 'ASSIGNED' letter from 1st Credit? I have read on variouse links that there must be a default notice from HFC Can you give me any Help here ? I'm a little confused I was going to write to LCS and tell them: 1) I'm waiting for a reply to my SAR & copy of the default notice from HFC 2) Read my letter(that must have crossed in the post) that asks for a legible copy of the original CCA 3) Payment cannnot be made until deceased property is sold and after the mortgage has been paid off Any advice on what to do next? -

Arrears Incurred After Death's of Parent - Unfair?

seville replied to fazzasx's topic in Mortgages and Secured Loans

Just to add --my ex boyfriend died last year and I have had to pay the mortgage while I sort the estate out --he did leave a will and I was the executor . I have read up all around mortgages/wills/deceased and the earlier posts are definately correct ---the arrears will have to come out of the estate and the mortgage will have to be paid (its a 1st charge on the property) and what left after all debts have been paid goes to the beneficiaries. Hope you get it all sorted out sooner rather than later as the interest keeps adding onto the debt(morgages are one of the few debts were the interest DOESNT get frozen from date of death --unfortunately) -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Thanks everyone!! Pinky, there must be steam comming from your fingers --thanks again I didnt give all the information about the estate because the post would have been so long. Briefly, my ex boyfriend died last year and his mum died in 2007. He didnt sort out his mums estate so when he died I am sorting out both estates and I have probate. My ex has debts are in execess of his assets but as his mums assets form part of the estate there will be enough to clear the debts when I sell BOTH houses(my ex didnt have life insurance andhis house is negative equity but mums is morgage free). Pinky , I will send the letters like you say but one question --What about the default notice? Should I incorporate my request into the SAR letter to HFC? Also should I send a SAR letter to 1st credit too so I can find out what (if anything) he paid to them and what charges they have added ?? am I jumping the gun on that or what ---or should I just see what I get off HFC? Thanks you all so much When I sell both the houses I promise (and I want to!!) send a donation to CAG becasue you are brilliant and I can see how great this site is for us ordinary people who need help and support--the posts say it all:) -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

Thank you all for your help Clemma/Pinky --I can read the notice but because it has "HFC COPY" across it , does it make it invalid and the debt quashed? ---oh if it was that easy. Im just finding my way through all this legalalities and there is so much to take in Shakespeare62- Im dealing with my deceased ex boyfriends estate and numerous debts. I cant find anything that resembles a default notice for these two HFC debts. I have 2 letters (Jan 07) from Howard Cohen (solicitors) saying "Please accept this letter as a notice we are instructed to commencd court action for recovery of above debt. ---payment should be made to our clients agents LEWIS DEBT RECOVER----" Then there is a letter from 1st credit April 08 refering to same debt offering a discout if you pay now.Then later letters are from LCS solicitors for 1st credit. MY ex who died was up to his eyes in debt (I now realise this) and didnt keep everything so I dont know if he ever got a default notice. Ist Credit supplied a list of coded transactions which look like payments made and regular interest entries thats been capitalised and fees but its not easy to understand eg" UDD FEE Assess £15" whats that? I need a customer friendly version--something I can understand and identify and then I can find out if there is anything I can challange. What is the best way to go about: * Getting a copy of the default notice --also who do i get it from? (HFC,Howard Cohen or 1st Credit or LCS) * Should I send a SAR for both the payment/charges history and an actual copy of the default notice I have been reading around the site but Iam a bit confused on which way to go on this and what I am looking for once I get the information and if its valid--all you CAGs seem to know your stuff Any guidence will be greatly appreciated or any links (I've read loads) that you think may fit my circumstances Thanks --so much --its good to know that little people can win against these big boys -

HFC loans & LCS -are these enforceable HELP

seville replied to seville's topic in Debt Collection Agencies

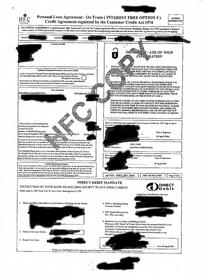

Sorry about the thumbnails. I've uploaded the docs to my photobucket ac****. If you click on the below links there are much better copies of the documents. HFC Doc picture by marieflamenco - Photobucket HFC doc Nov picture by marieflamenco - Photobucket Can you tell if they are enforceable? Any help greatly appreciated on this -

Hi I'm hoping that Peterbard picks this up or one of the CAG experts becasue I need to respond to LCS and I think they are enforceable but I'm not 100% I'm the executor for the estate of my boyfriend (he died in June 08). I have probate There are lots of debts I'm sorting out --there are loads! I'm getting through them and sorting what is to be paid and what is rubbish I need advice about 2 loans with HFC that are unpaid. They were refered to 1st Credit and now they are with LCS. It has taken LCS 6 months to provide me with the CCAs for the loans which are:- 1. Dixons (HFC) Easiplan Dixons 21.8% personal loan signed 5th Nov 2005. 2. currys superstore (HFC) 'Interest free opiton 9'personal loan-April 04 Both CCAs are on one page (they didnt send me page 2) and seem to contain all the data but doesnt have the section on your legal rights (well thats all I can identify thats missing) He hasnt signed up for the PPI and they are signed and dated both by my ex and the shop assistant and dated I've attached the two CCAs --will someone check them for me to see if they are ok? If they are valid I will be looking to attack the extensive charges and try and claw something back subject to me being able to read the coded rubbish they have sent me for the payments and charches schedules sorry to be a pain --I've read lots of threads and stickys re CCAs but I'm still not 100% sure with these two because the legal right bit to cancel isnt there and page two is missing (I dont no if page 2 has anything important on it) Thanks for any help you can give Oh and my son helped me attach the docs because Im not very IT lit:mad:

-

Hi CAGs Well I'm still dealing with the estate but things are moving along. LCS(1st Credit) have raised their ugly heads again I sent the CCA letter back in October 2008 for the 2 debts (1st credit) with the 2 x £1 postal orders. Got the usual drivel of LCS about they will send copies of the credit agreements as soon as they get them off 1st credit. In December 2008 sent a great 3 page letter to them (the one about the debt not being enforceable ---pinched off this site ) Super letter!!! On 3rd March 09 I received a letter off LCS which says--" we write further to our letter dated 12th January 2009 and note we have not heard from you.---we require you to contact this office to discus payment of the outstanding balance" I NEVER got a letter from them in January!!! I still havent had the credit agreements either unless they were enclosed with their January letter. I'm fuming because I suspect they never even sent a letter in January 2009 ! I wouldnt put it past them:mad: What do you think? I am going to write to them and ask for a copy of their January 2009 letter but at the same time send them a copy of my (these debts are not enforceable) letter sent to them by recorded delivery in December 08 I will give them 14 days to to provide a copy of thier letter. Am I being to nice to LCS? Im just being extra careful incase by any miracle their January letter also encloses ACTUAL VALID credit agreements. I havent reported them for failure to deliver the agreement within the 12 days --should i do that now? Who do I report them to? Any advice will be greatly recieved --

-

Dixons online ipod -faulty -what can I do?

seville replied to seville's topic in Currys/PCWorld/Dixons

Hiya Well the ipod is my sons and he (unlike me ) is IT lit. Shame he hasnt mastered the art of cleaning his room or the dishes!!! Well so far so good and the ipod is still working Have a lovely Christmas and thanks for your input:) -

Dixons online ipod -faulty -what can I do?

seville replied to seville's topic in Currys/PCWorld/Dixons

Thanks Naxxas --that would be good The IPOD came back 2 weeks ago with a new battery and so far its working fine ----early days though!!! If you manage to find the press release then I will definately check the batch and I will definately take matters further -

Thanks everyone for your advice. I didnt know there is no official time limit to settle the estate. I was advised that the 2 month 1 day limit after the Gazette add was the time limit for all creditors to come forward. I have disputed vertually all the debts of the estate--some are genuine but many have been reduced/vacated but I still have a few (including 1st Credit )thats in dispute. More may come out of the wood work because of the Gazette notice--but I'm ready for them:) and if they are genuine then of course I will pay I dont expect 1st cretin/LCS to produce anything that is enforceable going by the threads I've read on this site--they are really the lowest form of life in my eyes. I wont be bothering arguing with them yet until they produce a valid agreement. Pinky --I will keep enough money to one side to pay anything in dispute --just incase and of course to protect myself. Its been over 4 months since I started with the estate and yeh its been difficult but I'm so grateful to CAG and will be sending a nice £ to the fund when its over to add to the pitance I previously sent a few weeks back Thank

-

Thanks :)cerberusalert Ive been gathering all my receipts for expenses/postage/hire of skip/probate costs.Got to admit that a couple of the postage expense for stamps etc have got lost so I wont claim for the missing ones Because I live 25 miles away from the property I have claimed 30p per mile for mileage (I think thats fair and not too high) and because I have used other peple to do running around for me(I work full time) --like taking items to charity shops/valuers/tip/cleaning/clearing the house etc- I will be paying them 30p per mile too. I've got detailed mileage records to support the true mileage expense I'm hoping that there will be something left in the estate after all the debts so I (as beneficiary) can give a special treat and a few £ the two very good friends who have helped me get through this.Their practical help has been priceless!! Wish I could give them something now but they are good and understand my hands are tied with the probate law Thanks for your advice

-

Hi LCS(solicitors for 1st Credit) wrote to me today in reply to my CCA request (sent on 20th Oct). They were late!!! They say they will forward the CRAs once they get them from the origianl lender(not holding my breath on that one!). They sent me what they call the 'payment history' but to be honest. Its just a list of transactions which look like mainly interest??? Its full ofadded/full of codes and abreviations that I dont understand. The transactions start in 2004 so I assume 1st credit bought the debt in 2004 but its not clear. Anyway i am going to send them a letter as suggested by SP & Rory32 telling them I will execute the will and exclude their unproven debt. I'm not at the stage to execute the will because I have to sell the houses to pay off the debts but I've got to draw the line somewhere. Anyway to cover myself i have advertiszed in the London Gazette inviting creditors to make claims and legally i have to give them 2 months 1 day from the date of the advert I'll get my letter to LCS issued tomorrow Thanks for your help

-

Welcome Theres a lot to take in but once you get going it does become easier ----and the BIG plus is there are people in the similar possition who love to help Its a great site!!! Good luck

-

Unemployment and CII claim refused 7 years ago

seville replied to c3po's topic in Payment Protection Insurance (PPI)

Welcome c3po This is a great site and if you can be helped then you are in the right place Do you know what sort of policy it was Did you pay it monthly and did you pay it up to date Get a copy of the policy --then someone on the site can see if you have any rights either to a claim of if you were missold this policy When you took the policy out --what were you told it covered I'm no expert but the first step must be to get a copy of the policy so the terms/conditions can be checked over While you are waiting for your copy of the policy --have a good look around the site. You can go to the search box and type in something like morgage protection/insurance and read any threads/posts that relate to your probelm Good luck:) -

Hi DaveLeonard Welcome to CAG--I've had help fom this brilliant site. You need to read the info and search around the various threads and your problem.... this will give you a real feel for the site and how it can help Good luck!!

-

Welcome --you are amongst friends who just want to help What sort of debts do you have? What stage are the debts at --threatening letters? threatening court? Which debts are the most worrying just list them here. Depending on what yo have you may be best listing them separately (one of the caggers will tell you) While your waiting for a reply start reading through some of the posts on the site --all good stuff I'm pretty new too but there are some great people here that have helped me LOADS---you are not alone:D

-

Hi Giz Gone from despair to smiling:) I won my first little battle (hep of course from CAGs) --what a Buzz that was. Still got a mountain of debts to fight but so far doing great and in a weird sort of way enjoying the fight --grrrrrrrrr!!! And I have been able to add some hep to other CAG member with a tax problem (thats my comfort zone you see) and that felt good --sort of pay back for allthe help I've had Hope your ok ---I see your posts helping others thats nice No doubt I'll be pestering you again when i get stuck but so far so good Seville

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...