fairbyblue

-

Posts

387 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by fairbyblue

-

-

Hello FB!

Not sure about this bit...

Looks like the deal is you pay them £11k at £12 a Month, then they will start to hassle you to death the moment they can to get the £12 raised.

Or am I missing something?

Doesn't look like a very good deal.

Cheers,

BRW

The way im thinking is that it will be next year, before they can do anything, at that point if they want to try to get more then the process starts again and i know what paper work they have and if they want to play silly buggers they can, cos im more prepared. I'd like them to try and serve me a default notice.

-

REstons (Bouchier) phoned without prejudice and said did i want to settle this amicably !!!!. I said i was until you got involved. he wanted me to make an offer, i said i already had but you dismissed it and ploughed onto issueing the 2nd DN. He did really quite grasp the concept that they did not have the paperwork correct. And he still believes he can issue a further DN (The third one after having a letter from restons confirming termination)

I asked for a notice of discontinuence, the balance to remedy at the time of 1st default (£1601.39 instead of 11k)which is all they could cliam for.

Removal of default notices from credit file and £500 cheque for costs (not off the balance but a cheque) and I would pay them £12 per month off £1601.39

He is getting in touch with MBNA.

He doesnt think they will go with that.

oh hang on He just sent email

WITHOUT PREJUDICE SAVE AS TO COSTS

In line with our recent telephone conversation the terms of settlement ARE:-

(i) The Bank files a Notice of Discontinuance in respect of this claim;

(ii) The Bank will pay you the sum of £500.00 in full and final settlement of any claim for costs you have arising out of this action.

(iii) You repay the outstanding balance under the credit agreement of £11,214.35 by monthly instalments of £12.00. The first instalment to be received hereby 31st August 2009. The rate of repayment to be annually reviewed with an expectation that it should increase should your financial circumstances improve.

(iv) If you fail to pay a monthly instalment of £12.00 or any subsequently agreed increase then our client reserves its rights under the credit agreement to take any action it thinks fit.

Please confirm you accept these terms.

As soon as we receive your confirmation we will file the Notice of Discontinuance and send a copy to you.

I think thats a win (note section iv, they aint got one)

Well im happy and in the circumstances I think I'm £500 better off

Thanks to everyone on here for the advice and assistance especially robcag,supasnooper, CCm,PF PT and loads more.

Once cheque clears i will make the appropriate donation.

Guess where I'm going to? Thats right, the pub.

:D:D:D

:D:D:D -

If it all goes pear shaped what is the worst that could happen?

-

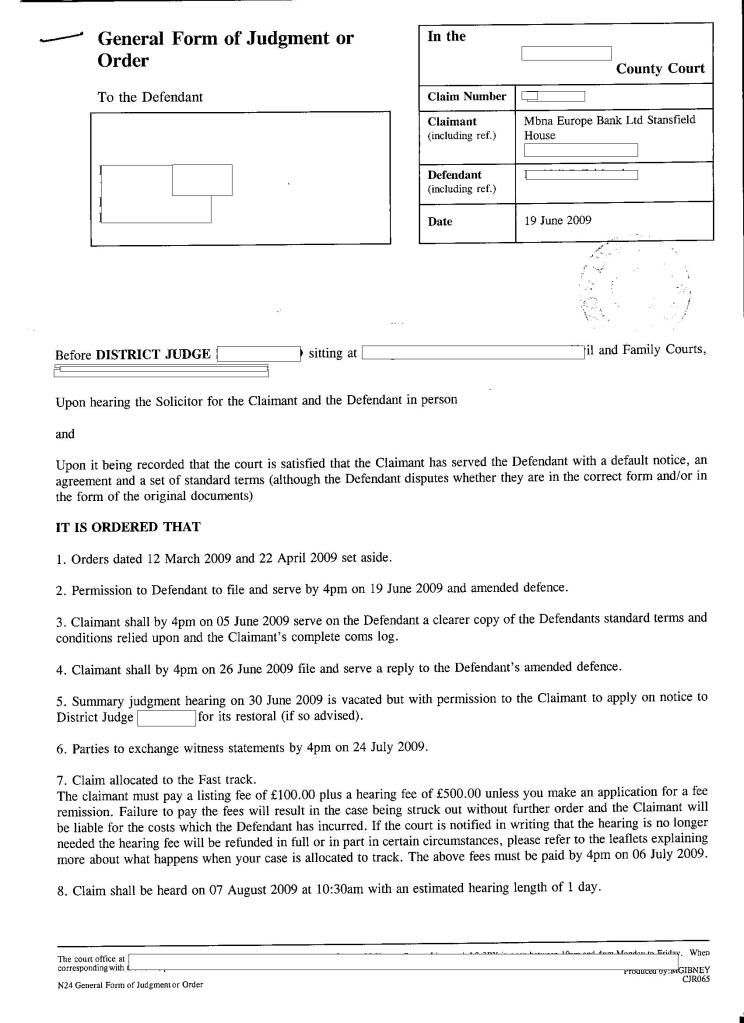

Got the Trial bundle today. Have to work through it. They dont give you much time do they !!!!

-

I would make sure you have a spare copy of Woodchester v Swayne at hand for the Judge and for Restons.

I've crowbarred that into my statement so they just cant wash over it (Hopefully)

-

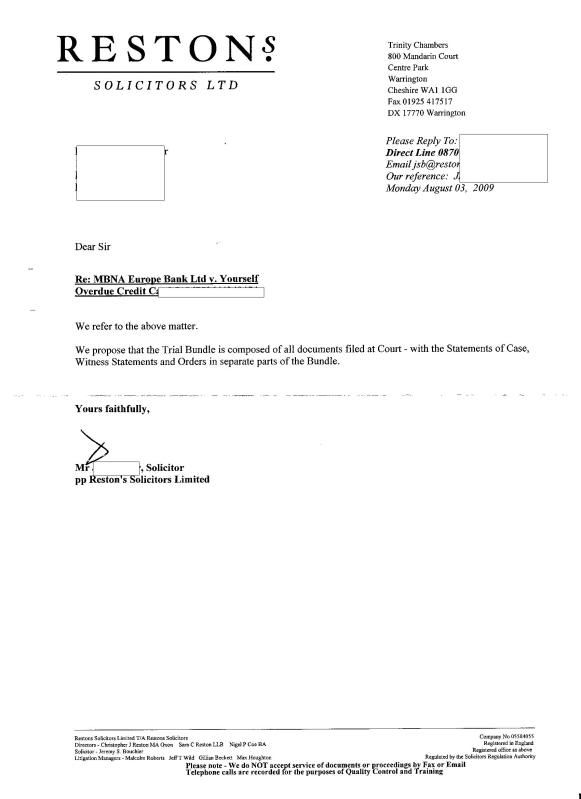

Just had letter from Restons. Any ideas what it means?

-

Court on Friday. Anyone got anymore suggestions as to what to throw at MBNA?

Getting a bit twitchy but if i keep reading the posts they are stuffed. Lets hope the Judge see it that way.

-

One week to go. In court on 7/8/09. Has anyone got any more killer questions for MBNA that will make them realise the error of theor ways.

-

Where is the witness statement of the operator who issued the 2nd default notice? And of the operator who scanned your agreement originally? Have they provided evidence of the verification procedure & evidence of the date & reason why agreement was destroyed?

Good point. The only statements i have had are posted up, so thats a question for Dainne from MBNA needs to answer.

-

Hi fb,

What a load of tosh Restons\MBNA have sent.

Another case of Restons trying to salvage something from the wreckage caused by MBNA's lax approach to paperwork.

There's still time for Restons to send another little WS just before the hearing...........probably 4 days before, but it will only contain more rubbish that can be shot down very easily.

Just try to stay relaxed and let Restons tie themselves in knots.

Have a great weekend.

Cheers SS. The order did say exchange witness statements by 24/7/09 so lets see if it appears. No doubt it willl as they have this unique way of working such as forget what court ordered you to and send some guff when it suits.

At the moment I'm positive. The hearing is on the 7/8/09

Can anyone post some killer questions to ask Dianne from MBNA (if she turns up)

-

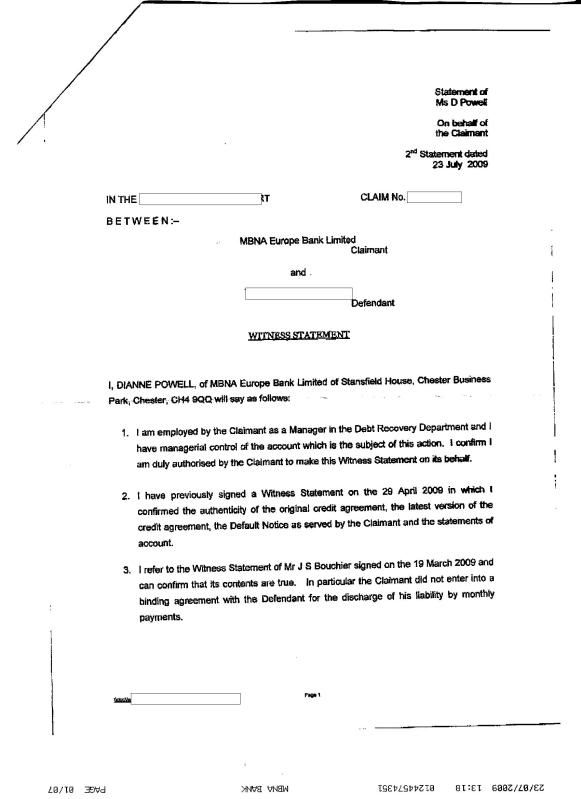

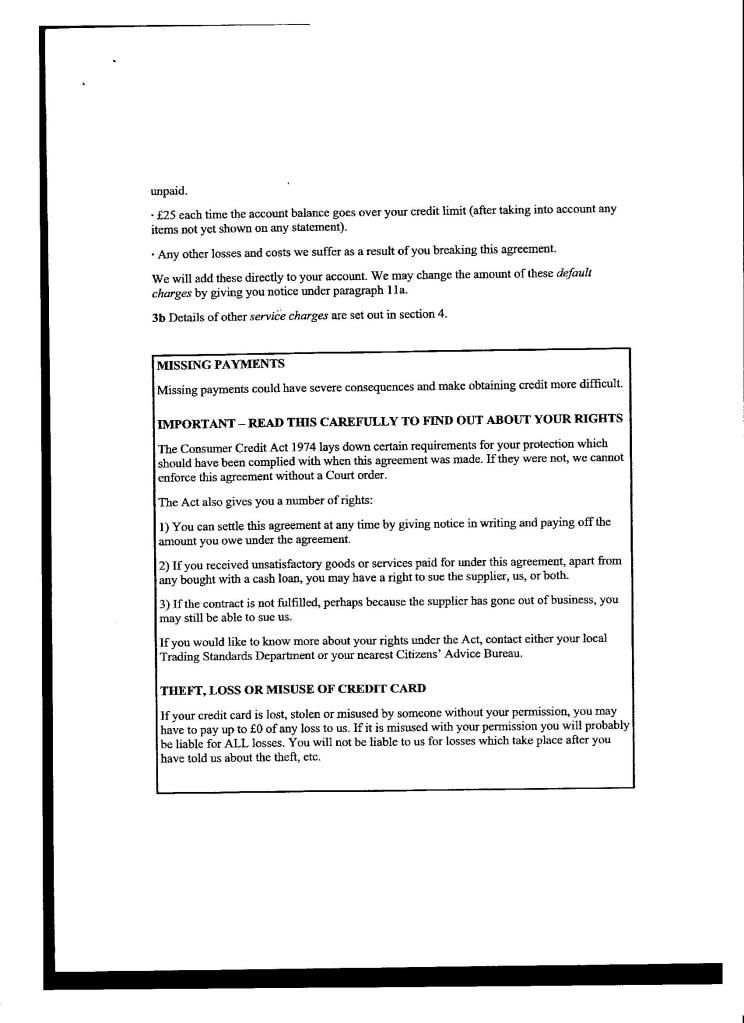

Did I read paragraph 3 of diannes statement correctly as she appears to confirm that there was no binding agreement ???

Cheers

Well that could be read a number of ways !!! From the original agreemnt? or by telephone or by letter

I did offer and make payments, and kept up to date then restons appeared and it all went t*ts up. So much so that the payments were made between the 2 DN's so the 2nd DN amount is wrong and they sent statement to confirm it !!!

-

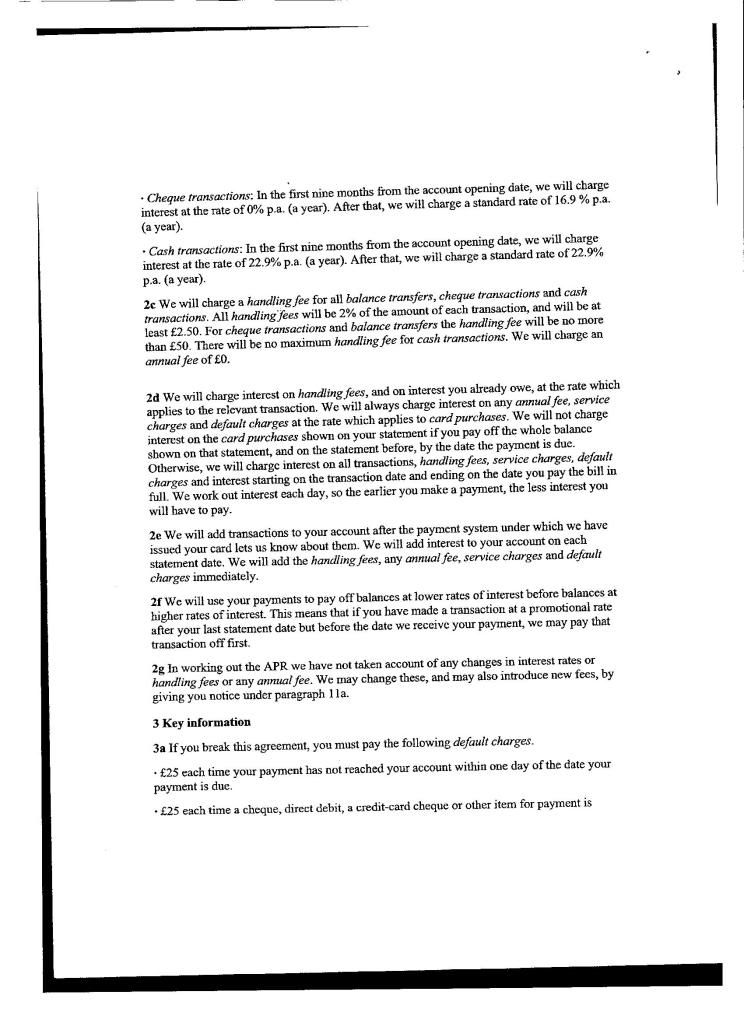

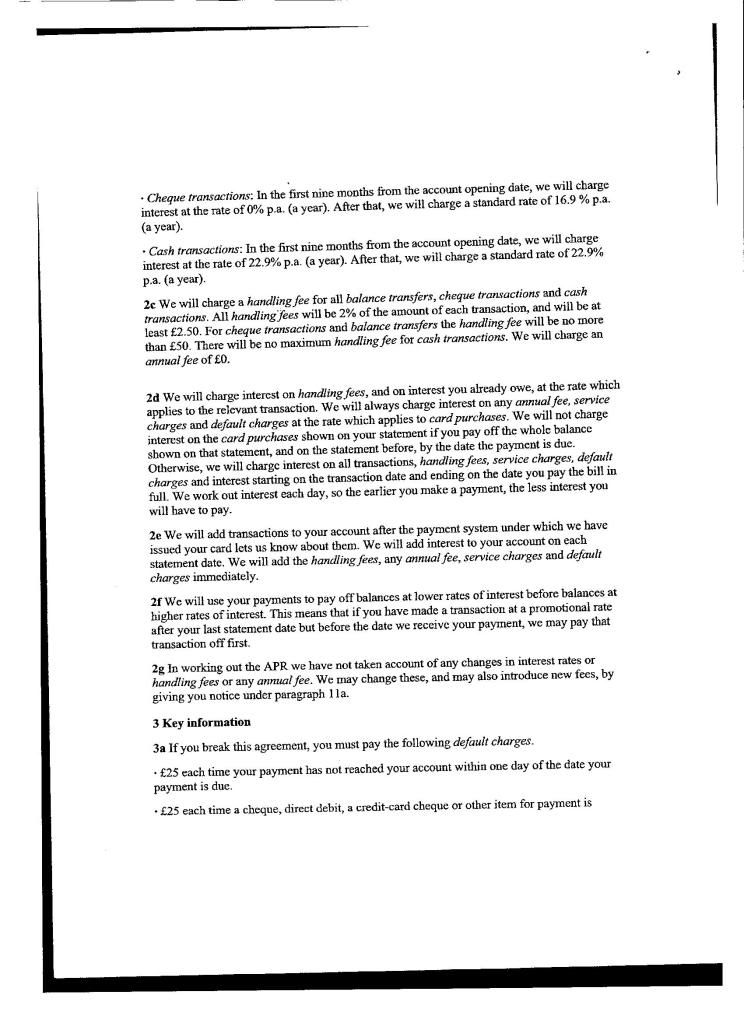

The T&Cs in post 763 refer to section 4 and 11a - section 4 and 11a aren't on those T&Cs, so it is refering you to another document - not allowed, must be in one document:)

Thats what i thought. It aint looking too good for them. Surely they will notice they havent got a leg to stand on !!!

-

She refers to the latest T&Cs - were the orignal T&Cs sent? These originals form part of the agreement and should have been supplied with the response to your s78 request. If they didn't then surely they haven't complied with your s78 request and therefore are prevented from enforcement?!

Never had the original t and c's only some of them as refered to in post 763.

They did give me a copy of current t and c's at hearing for strike out for them failing to comply with my requests.

judge allowed to them to give it to me but did make note in his order that i said they were not in right form nor in the form of original document.

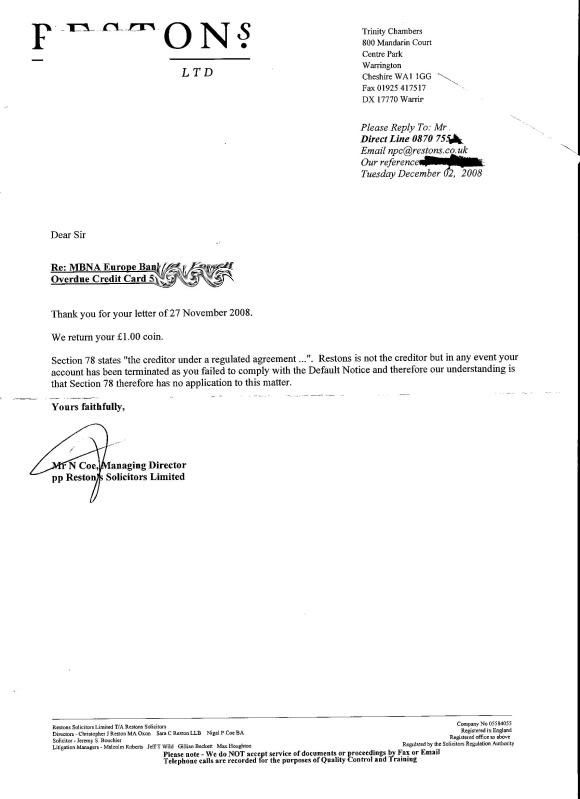

As for S78 see letter from Restons. They say it has no application in this matter !!!

-

OK FB, heres some thought,

Her point 2 in WS Where is the original if she has seen sight of it, surely they will bring it to court as ordered.

Boufonts point 5, you require strict proof of sending, not just some screen printed note.

6. If the claimant is contractually allowed to change things, wheres the original signed agreement that allows them to do so?

7. If you can prove the payment you made, this blows the Tu*d out of the water .

Exactly, they have been ordered to produce original and they have produced what i have previously posted.

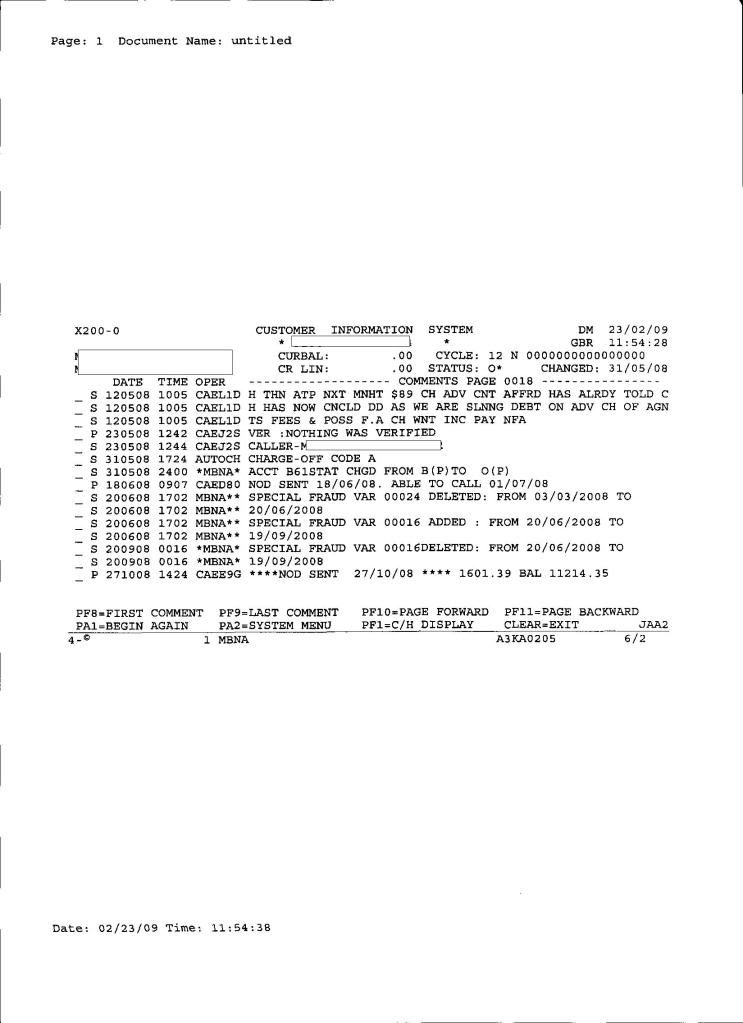

how can boufont confirm MBNA internal case management system?

Nothing at all on 'agreement' stating they can vary t and c.

and best of all , why is there loads of deletes on case mangement system on in june 08 after the sending of 1st DN?

-

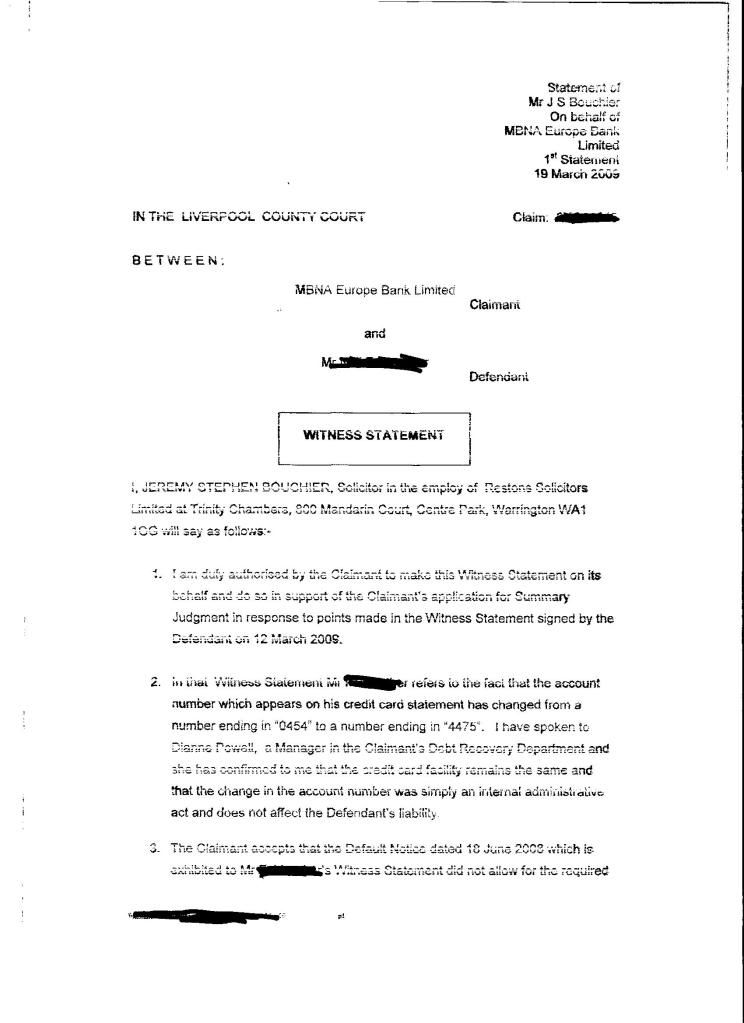

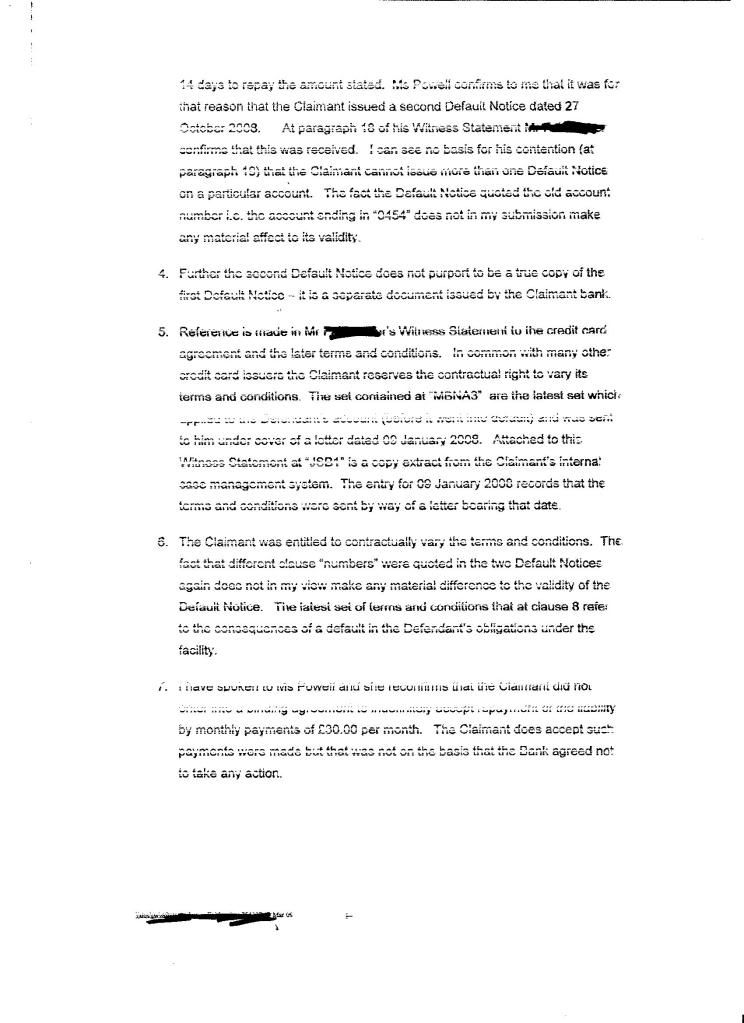

just seen in para 5 and 6 of solicotors statement it states that claimant is contractually entitled to vary terms and conditions. Well thats going to be funny in court when i ask them to point to in in the agreement cos it aint there !!!!

-

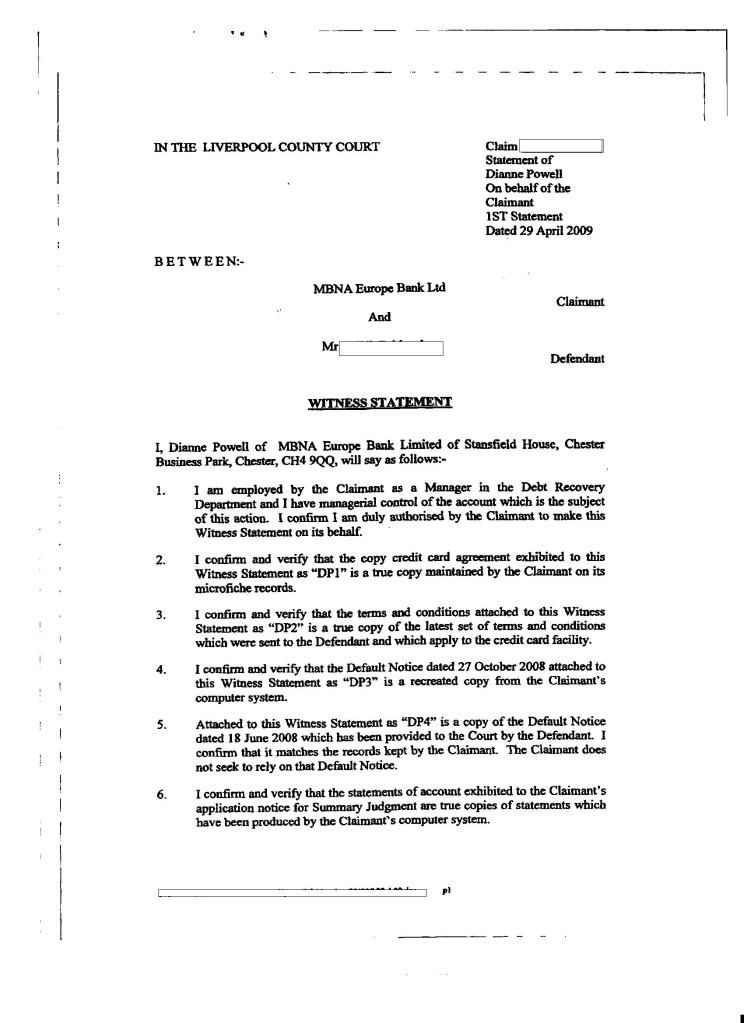

ok they have now sent the statment they rely on in court !!!! I have asked Dianne to attend.

Basically it looks as though Restons and MBNA are just confirming what the other is saying. Nice to know that dianne can confimr Restons statemnt as FACT.

They only sent MBNA statemnt but in it referes to other statement that restons had submitted for SJ hearing.

I think its extrememly vague and rushed job.

I trawled back thorugh and found original statment from Restons which again is hogwash and her statemnt from 29th april.

Heres the letter- note that is only witness statment they are relying on-

Comments please.

and this is statement from solicitor for SJ hearing

and her statemnt

-

EDIT: Thinking about it, they may also say that the link was an integral part of the web page and would not have been printed out on the document.

They could try but it would print out, and looking at where my name and address is at the beginning, that has been typed in after, cos it doesnt fit. It just looks 'recreated'

-

If this was an electronic application then it may have been one continous scroll rather than individual pages. Nonetheless, it's more the fact that it says "Terms and Conditions" link and, as far as I can tell, there is no underlined header stating "Terms and Conditions."

I agree that you should be supplied with a copy of the original t&c's, which is something that MBNA have not managed to provide me either. However, can I ask in what way is MBNA varying them going to help your case? Have they issued a DN quoting para 8f ??

Hope this doesn't sound obstructive...with 3 MBNA accounts myself, I am on your side!!

Yep first DN was para 3 then 2nd DN was para 8.

They have supplied when ordered by the court the 'most recent t and c applied to account' but one of my arguments is that nowhere on the original agreement does it say they can vary the t and c's presumably its in sections 4 - 16 for which there is no link and i cannot check.

I could argue that sections 4-16 state that i dont have to pay cos its a saturday and the judge will say prove it.

By that reasoning MBNA cant prove that they could vary it, and i can only refer to whats been produced.

if you see what i mean. I'll put it better that that.

-

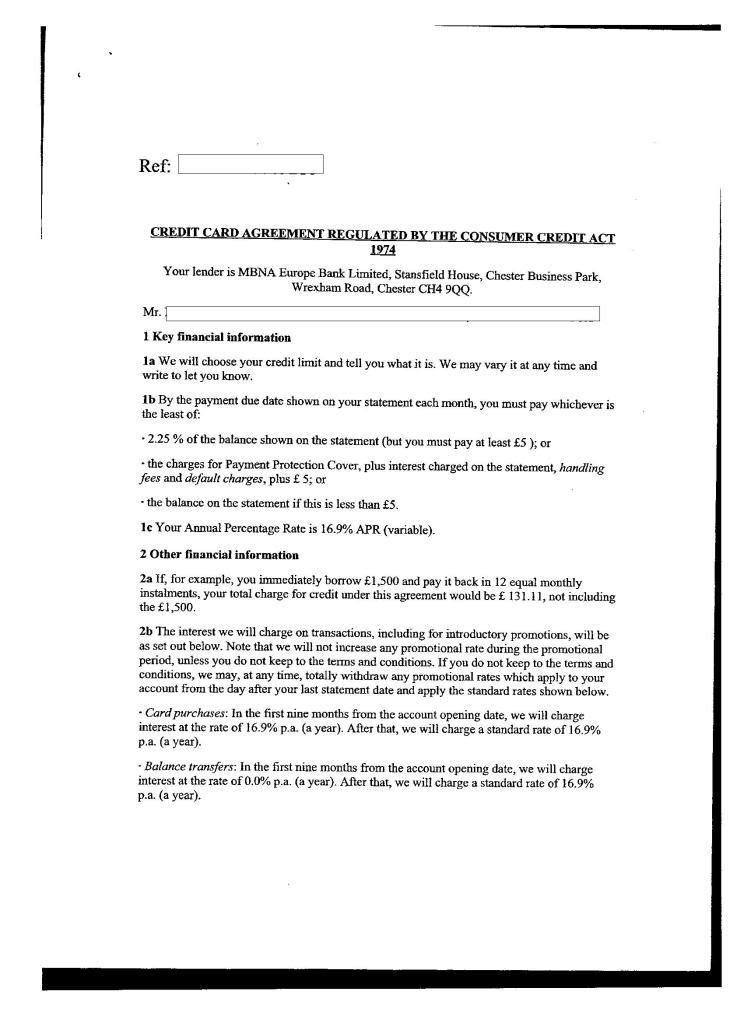

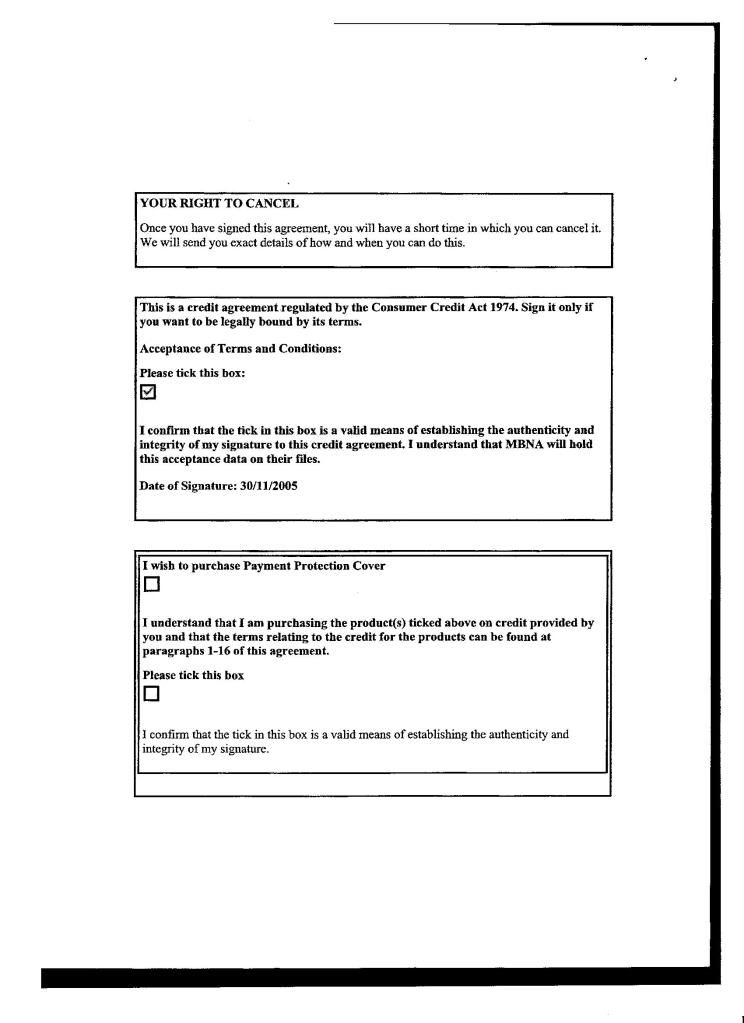

"Four Corners" is only relevant for enforcement under s127(3) as I understand it Fairby.

What you have been issued with is a copy of an executed agreement which is deemed to have been signed by them by virtue of the tick in the box.

I believe that it is permissible to refer to other terms and conditions elsewhere. However, URL's are normally indicate by underlined text and it could be that the link you are looking for is the header entitled "CREDIT CARD AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974" at the top of the first page.

The crux is whether or not all prescribed terms are within the document; it is in the prescribed format and it is signed by both yourself and the bank*.

*Notwithstanding electronic signatures

Hope this helps...

Appreaciate that but the wording on page 5 it says the 'top of this page' specifically says terms and conditions link. It is not there.

As nedabreak says, where does it say they can alter the T and c's It doent so the t and c's are not complete.

-

My agreement is virtually the same as yours FB. Without the rest of the terms and conditions for the original agreement, how can MBNA prove that they have the contractual right to alter the terms at a future date? Therefore in your DN it says you have breached clause 8, but you have not got a clause 8 as your conditions only go up to 4.

Surly by not supplying the agreement with all of the terms and conditions that relate to it, they are in default under s77/78 and therefore should not be able to enforce the agreement anyway.

You could just copy this agreement, insert the judges name instead of yours, include a copy of the generic "Current terms" and ask how he would defend such an agreement.

On your SJ application, do Restons call this an application? they did on mine.

I really hope you take them to task in court and win.

Needabreak.

Excellent point. Cheers thats going in my statement:D

-

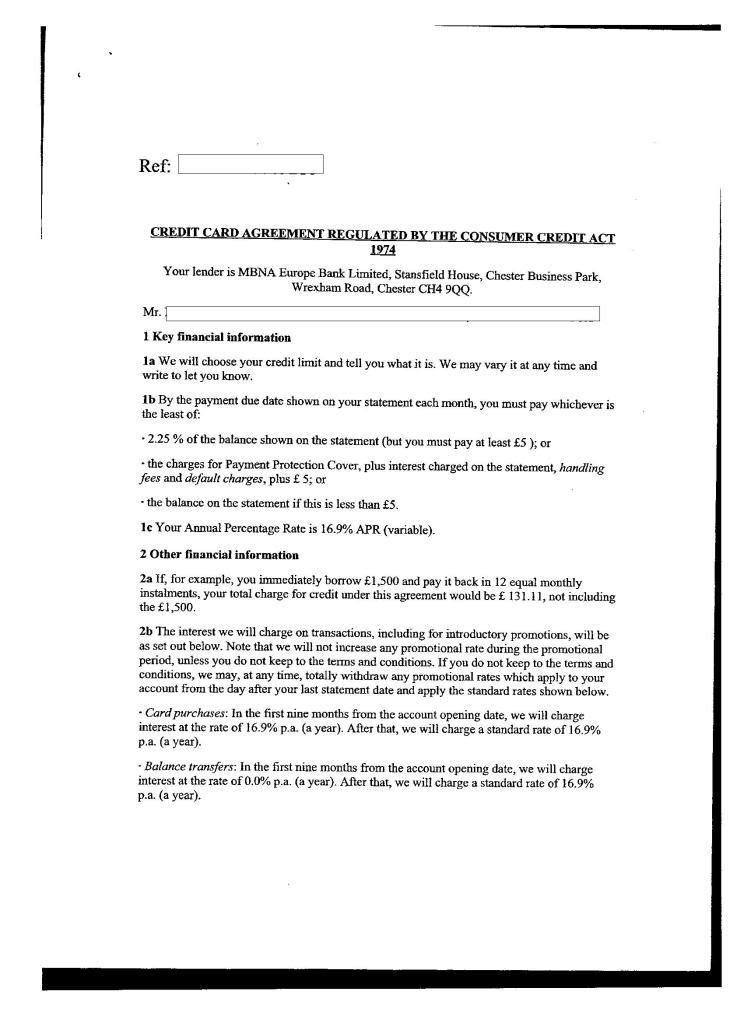

Whilst have a rummage thorugh the mountain of paperwork i dug out the CCA that they sent me.

Can you all pick holes in it for me?

The most obvious thing I can see is that on page 5 just aboe with Jonathan black has ticked his box, it talks of clicking the above link for the rest of terms and conditions. There is NO link. So all the terms are not within the 4 corners of the agreement.

So using this little gem from another thread (thanks 42Man) heres some case law.

In Wilson and another V Hurstanger 2007

A valid credit agreement must contain certain terms within the signature document (s.60(1)(2) CCA 1974). These core terms are the credit limit, repayment terms and the rate of interest (SI 1983/1553 (6 Signing of agreement) which states that the prescribed terms must be within the signature document. (Column 2 schedule 6). s.61(1)(a) states the agreement must contain all the prescribed terms and be signed by both the debtor and on behalf of the creditor.

Further, s.127(3) CCA 1974 makes the account unenforceable if it is not in the proper form and content or improperly executed.

In Wilson and another v Hurstanger Ltd (2007) it was stated “In my judgment the objective of Schedule 6 is to ensure that, as an inflexible condition of enforceability, certain basic minimum terms are included which the parties … and/or the court can identify within the four corners of the agreement. Those minimum provisions combined with the requirement under s.61 that all the terms should be in a single document, and backed up by the provisions of section 127(3), ensure that these core terms are expressly set out in the agreement itself: they cannot be orally agreed; they cannot be found in another document; they cannot be implied; and above all they cannot be in the slightest mis-stated. As a matter of policy, the lender is denied any room for manoeuvre in respect of them. On the other hand, they are basic provisions, and the only question for the court is whether they are, on a true construction, included in the agreement”.

Bump, any one with anymore views on this 'executed' agreemnt

-

I think you could possibly state that you would have been unable to see the full terms if there was no link present, so may not have known what terms you were agreeing to, but DD is IMO right that the prescribed terms can be on a different page as long as those pages can be linked together to show they are from the same document.

I appreciate that but there isnt a link where they say there should be

-

within the four corners of the agreement. Those minimum provisions combined with the requirement under s.61 that all the terms should be in a single document, and backed up by the provisions of section 127(3), ensure that these core terms are expressly set out in the agreement itself: they cannot be orally agreed; they cannot be found in another document; they cannot be implied; and above all they cannot be in the slightest mis-stated.

By clicking the link its another document. However there is no link. The the FULL terms arent within the document

-

Whilst have a rummage thorugh the mountain of paperwork i dug out the CCA that they sent me.

Can you all pick holes in it for me?

The most obvious thing I can see is that on page 5 just aboe with Jonathan black has ticked his box, it talks of clicking the above link for the rest of terms and conditions. There is NO link. So all the terms are not within the 4 corners of the agreement.

So using this little gem from another thread (thanks 42Man) heres some case law.

In Wilson and another V Hurstanger 2007

A valid credit agreement must contain certain terms within the signature document (s.60(1)(2) CCA 1974). These core terms are the credit limit, repayment terms and the rate of interest (SI 1983/1553 (6 Signing of agreement) which states that the prescribed terms must be within the signature document. (Column 2 schedule 6). s.61(1)(a) states the agreement must contain all the prescribed terms and be signed by both the debtor and on behalf of the creditor.

Further, s.127(3) CCA 1974 makes the account unenforceable if it is not in the proper form and content or improperly executed.

In Wilson and another v Hurstanger Ltd (2007) it was stated “In my judgment the objective of Schedule 6 is to ensure that, as an inflexible condition of enforceability, certain basic minimum terms are included which the parties … and/or the court can identify within the four corners of the agreement. Those minimum provisions combined with the requirement under s.61 that all the terms should be in a single document, and backed up by the provisions of section 127(3), ensure that these core terms are expressly set out in the agreement itself: they cannot be orally agreed; they cannot be found in another document; they cannot be implied; and above all they cannot be in the slightest mis-stated. As a matter of policy, the lender is denied any room for manoeuvre in respect of them. On the other hand, they are basic provisions, and the only question for the court is whether they are, on a true construction, included in the agreement”.

MBNA/Restons claimform - old A+L Card **WON+COSTS**

in MBNA

Posted

OK will do