fairbyblue

-

Posts

387 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by fairbyblue

-

-

Oh what a day.

Get to court nice and early plonk my self down is a deserted waiting room (only 3 other people there)then at 10.25hrs their barrister breezes in. Had the same oneAdmin review for SJ.

He then announces to me 'THAT THEY ARE DISCONTINUING"

Happy days.

So then the question of costs arose and I had written a schedule which totaled £835 which he said that earlier I had wanted £500 and then i said that was before Bouffont sent me 5 emails and phoned three times and also Ive attended today and that was without prejudice. I said let the judge decide.

So we go into court and met with the Judge, and in the Judge lottery stakes I hit the double rollover euromillions jackpot cos he was brilliant.

Barrister says that they are dicontinuing, judge says "Very Good now I can watch the cricket". Barr'r says that would not stop them pursuing me for the debt, judge says "If MBNA can prove it, and Mr XXX doesnt pay then Mr XXX would get CCJ". Barr'r reiterated that they would continue and in the words of the judge direct quote "I wish you luck on that one"

The schedule was produced by barr'r and said that my 3 attendences hearing time was excessive I said 9 hrs when it should be 5. I pointed out that i had prepared this prior to MBNA withdrawing and I had anticipated 5 hrs for today and 2hrs each for the other two hearings.

Judge knocked £37 of the total

Barr'r then said 60hrs prep time was excessive and it should be redused to 30hrs. I poitned out that as LIP I had to do research and that i had to type it up myself. Judge agreed so the total costs awarded to me is £798 payable withing 14 days

I asked for removal of DNs from credit file which i got i think have to check order as i was giggling so much.

On way out barr'r says that i have won battle and not war, I said I didnt know I was at war, he said that they will still try and pursue me. I mentioned that it is terminated and cant issue further DN, and the case would be exactly the same as the one that has just been discontinued. and he said we'll see. I then said please dont threaten me with actions you know are without merit.

So all in all a good day. No judgement, Notice of Discontiuence and £798 costs.

So a massive thank you to all those who have helped along the way for the advice and support. Those who talked sense the other day when I waivered.

Special mention to Supasnooper, CitizenB, Robcag, Bazaar and BRW

So when cheque clears an appropriate donation to the site to keep this valuable resource going to fight the greedy banks.

Now I'm going to get blotto.

:D:D

:D:D-

1

1

-

-

I'm ready after a rubbish nights sleep.

Keep calm, dont enter into 'chats' with them, all i need to hear is 'We wish to discontinue'

If it does go ahead, kick off about late stage of introduction of statements then get back on track with 2 defective dN's and 'questionable cca'

Hope dianne from MBNA is there, if she failes to attend then they are snookered.

-

Blimey what planet are they on, they must be really wobbling to be putting the frighteners on you at this hour.

Keep going FBB I can feel another win coming along.

PF

I keep thinking the are going to put my windows in and slash my tyres just to make sure !!!!

Lets see what tomorrow brings cos I wavered the other day to get this monkey off my back but now I'm 100% commited.

Bring it on !!!

-

heres a couple of emails from me old mate bouchers now i dont seem to understand as they do contradict, one is saying forget the termniation and they other says it didnt

5/8/09 at 1746

Without Prejudice

I refer to your recent telephone conversation with my colleague.

The Bank will not agree to merely accept £1601.39 in settlement of this account.

The executed credit agreement – containing the prescribed terms – is within the Court papers and it is enforceable. I am not sure why you have been advised it is not. Are you able to explain why the agreement does not comply with the CCA?

It is clearly open to the Bank as a creditor to serve a new default notice and claim the full balance. If the earlier default notice did not comply with the CCA or regulations made under it as you allege then the agreement could not have been terminated and the fact you have received correspondence indicating the contrary is immaterial. In any event termination of the account does not mean that the liability disappears.

The Bank is still prepared to reach a sensible conclusion on this matter.

Yours

today 6/8/09 at 12.30

The Bank cannot accept only £1601.93.

You will note in your terms and conditions par 10 that the Bank has the right to contractually terminate the agreement at any time - if it does so you are liable to repay the outstanding balance. In other words the Bank does not have to serve a default notice which is only required if the Bank wants to bring the agreement to an end because of a failure to pay arrears or some other breach.

Paragraph 10 allows the Bank to terminate the agreement for any reason i.e. not a reason based on a breach of the agreement.

In other words the Bank does not have to rely on the default notice.

The Bank will prepared to settle amicably by agreeing a total figure which is less than the balance but cannot accept what has been offered thus far.

and tonight 6/8/09 at 19.46

We enclose by way of service witness statement which we will ask

permission to rely on tomorrow.

Section 87 of the CCA states that a default notice is required where the

creditor wishes to terminate the agreement and claim the amount owed "by

reason of nay breach by the debtor...."

You will be aware that clause 10 of the Bank's terms and conditions

allows our client to terminate the agreement at any time and can do so

without having to demonstrate that you have breached any terms of the

agreement. It can terminate the agreement without serving a default

notice - which means that any alleged defect with the default notice is

irrelevant as it was not needed in the first place as our client will

rely on its contractual right to terminate the agreement. Your amended

defence states that the agreement is terminated.

-

Well bugger me. The t and c they have served on me tonight only starts from para 4 so i look back to the one the produced at the strike out (where the judge said i was contending it was not the original)

the one wher it states they can termniate at will para 10 and alter the agreement para 11.

These are still not the original t and c cos the amount on original for late payments is £25 and on these its £12

So all they have done is binned para 1 to 3 of the current t and cs and said par 4 to 16 was the in the orginal.

Now the percentage rates are different 16.9% on the 1st and now 27.9% on the second set of t and c

so they have just crow barred on the current t and cs but they cannot of been on the original CCA

-

para 10 refers to terminating agreemnt when they want to

para 11 refers to altering the agreement

-

Cheers. They must be on a sticky wicket, sending emails at 1946hrs the day before. witness statements should of been exchanged by 24/7/09. By the way this one isnt dated.

-

Also, is there a clause 10 on the original agreement?? If not, then its just Bouffont trying to harrass you.

no it only goes up to 3B.

-

Hello FB!

They are desperate.

Ask yourself why are they going to all of this trouble if they are so cock-sure of themselves!

Remember what I said about the default issue, and why s76 and s98 are not available to them. This is a Regulated Agreement, so if they are denied the above Sections via s76(6) and s98(6), that leaves them with s87/s88 and back to the old Default Notice chestnut.

Now is the time to hold your nerve, and stick to your guns.

Walk into Court, give them hell (while humming a little tune to yourself, see above)!

Cheers,

BRW

I will type out page 2 of her statement recieved tonight

4. I accept that the credit agreement in the present claim was executed in November 2005 but can confirm from my own knowledge of working within the bank that the right retained in para 11 has been a standard clause of the banks terms and conditions in credit agreements issued by the claimant well before 2005

5. As explained in witness statemnt signed by Dianne Powell on 29 April 2009 the default notice exhibited in her witness statemnt is a recreated copy from the claimants computer system. The version recieved by the defendent would of contained the full details of the claimant - including name and address.

Funny thing is that then throws the rest of the terms out on the CCA that they have served.

How can she say that? and its all hearsay with no proof.

-

Help !!!!!!!!!!!!!!!!!!!!

Restons have emailed me a new statement !!!!! and another little email at the same time

at 19.46hrs

We enclose by way of service witness statement which we will ask

permission to rely on tomorrow.

Section 87 of the CCA states that a default notice is required where the

creditor wishes to terminate the agreement and claim the amount owed "by

reason of nay breach by the debtor...."

You will be aware that clause 10 of the Bank's terms and conditions

allows our client to terminate the agreement at any time and can do so

without having to demonstrate that you have breached any terms of the

agreement. It can terminate the agreement without serving a default

notice - which means that any alleged defect with the default notice is

irrelevant as it was not needed in the first place as our client will

rely on its contractual right to terminate the agreement. Your amended

defence states that the agreement is terminated.

and

a separate one

without my name on or anything like that

Hearing tomorrow

Our client is still prepared to reach amicable and sensible terms of settlement .

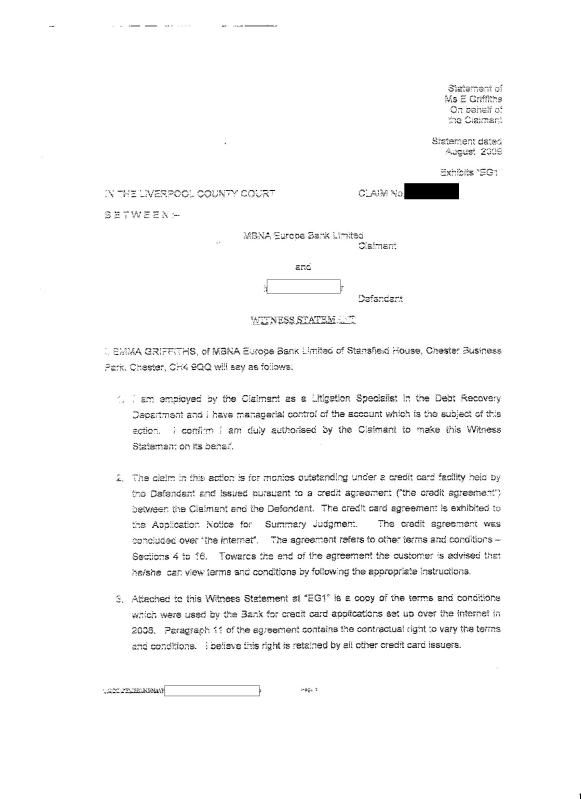

and here is statemnt from Emma Griffiths dunno who she is.

notice they not dated !!!

also in para 3 she states that these were used in 2006, i took my card out in 2005.

I've typed the rest as its difficult to scan as they sent it in PDF form.

4. I accept that the credit agreement in the present claim was executed in November 2005 but can confirm from my own knowledge of working within the bank that the right retained in para 11 has been a standard clause of the banks terms and conditions in credit agreements issued by the claimant well before 2005

5. As explained in witness statemnt signed by Dianne Powell on 29 April 2009 the default notice exhibited in her witness statemnt is a recreated copy from the claimants computer system. The version recieved by the defendent would of contained the full details of the claimant - including name and address.

I dont want all this at this late stage. Help

-

Is it right a LIP gets £9.25 per hour cos with 3 hearings,travelling time and 14 letters @ £12 each and 50hours preparation its upto £741.75 costs. (They wont pay that surely if it goes my way)

-

Just having a final re read and printing off all the points to raise with them.

If they dont proceed is that it? finito?

-

I have such a good mental picture now of FB with an OHP pointing all the times DEFAULT is shown anywhere in a very ott am dram type way, then winking Betty Boop stylie at the bank's sols:D

Is that close to how it would be? Please say yes:lol:

I might even do a powerpoint !!!

-

Was their latest email WITHOUT PREJUDICE too?

If not, then first thing you do is mention how the Claimant has tried to intimidate you before Court.

Cheers,

BRW

No. Ive not reponded and no intention of. Thats the first thing getting hurled at them;)

-

Hi fairbyblue

What a load of cobblers there giving you.

I've got an MBNA Credit card agreement when i took the card out in 2002, and Paragraph 10 don't say anything about the bank can terminate the account at any time.

Paragraph 10 on mine says ( Loss, theft or misuse ).

Good Luck with your case tomorrow.

Gaz

I have the latest set and par 10 does say

We may end this agreement at any time if we write to you first to tell you that we are going to do so. If we have a valid reason we may end the agreement immediately and write to you as soon as we can afterwards, to tell you why we have done so

My argument is they cant use latest set as the have not produced the full original agreemnt it is incomplete and only goes upto para 3b and no where on that agreemnt does it allow them to vary the terms and conditions.

If they manage to get to this set of t and c they have not written to me as i have comms log, and what reason are they giving and why is it not in court.

-

Restons have sent another email !!!! see text in blue

The executed credit agreemnt that they have produced does not have a para 10 and no where in there does it say they can vary the terms there loads of little references in the agreemnt to see later paras but they have never produced the whole agreement.

They have sent a set of generic terms and conditions that they say apply but no where in original agreemnt does it give them the power to do that. because they have not produced the whole original agreemnt

and anyway para 10 also says they should write to me to terminate if it for something else other than a breach and they havent.

And they dont have to rely on the DN. You have to laugh

The Bank cannot accept only £1601.93.

You will note in your terms and conditions par 10 that the Bank has the right to contractually terminate the agreement at any time - if it does so you are liable to repay the outstanding balance. In other words the Bank does not have to serve a default notice which is only required if the Bank wants to bring the agreement to an end because of a failure to pay arrears or some other breach.

Paragraph 10 allows the Bank to terminate the agreement for any reason i.e. not a reason based on a breach of the agreement.

In other words the Bank does not have to rely on the default notice.

The Bank will prepared to settle amicably by agreeing a total figure which is less than the balance but cannot accept what has been offered thus far.

-

What was i thinking, i nearly wavered if it wasnt for you guys (and gals) The DNs are both invalid (one admitted by them and 2nd wrong amounts and no n/address of creditor) and the CCa is not enforceable not complete. In boucher statement he submitted it said that they are allowed to vary the t and c but in CCA they are using nowhere does it say they can. it is refered to in another document and they have never produced it. He has assumed it is complete. Loads of 'deletes on comms log' from mbna which needs explaining by them. Plus got a letter of termination from managing director of Restons saying its temrnated, so how can they issue further DN's?

Roll on friday !!!!!!!!!!!

-

And this is what they have now sent. Looks like i will see them on friday. Shall i respond to his email?

Without Prejudice

I refer to your recent telephone conversation with my colleague.

The Bank will not agree to merely accept £1601.39 in settlement of this account.

The executed credit agreement – containing the prescribed terms – is within the Court papers and it is enforceable. I am not sure why you have been advised it is not. Are you able to explain why the agreement does not comply with the CCA?

It is clearly open to the Bank as a creditor to serve a new default notice and claim the full balance. If the earlier default notice did not comply with the CCA or regulations made under it as you allege then the agreement could not have been terminated and the fact you have received correspondence indicating the contrary is immaterial. In any event termination of the account does not mean that the liability disappears.

The Bank is still prepared to reach a sensible conclusion on this matter.

Yours

If he bothers to read my statement its all in there!!!

As for the DN's they are snookered, how many do they need?

The termination seems pretty final to me.

The bank is prepared to reach a snesible conclusion, no they are not. well see you on friday and make sure Dianne from MBNA is there.

They caught me at weak moment.

-

And this is what they have now sent. Looks like i will see them on friday. Shall i respond to his email?

Without Prejudice

I refer to your recent telephone conversation with my colleague.

The Bank will not agree to merely accept £1601.39 in settlement of this account.

The executed credit agreement – containing the prescribed terms – is within the Court papers and it is enforceable. I am not sure why you have been advised it is not. Are you able to explain why the agreement does not comply with the CCA?

It is clearly open to the Bank as a creditor to serve a new default notice and claim the full balance. If the earlier default notice did not comply with the CCA or regulations made under it as you allege then the agreement could not have been terminated and the fact you have received correspondence indicating the contrary is immaterial. In any event termination of the account does not mean that the liability disappears.

The Bank is still prepared to reach a sensible conclusion on this matter.

Yours

-

Ok Ok nearly made a boo boo there. Emailed them and phoned them just to confirm i will be in court on friday unless they accept the £1601 figure.

-

Heres the email i sent to restons

Dear Mr Bouchier

Further to the offer i now refuse it and point out that the amount outstanding is £1601.39. Otherwise I will see you in court on Friday

I will accept if you change part iii to

(iii) You repay the outstanding balance under the credit agreement of £1601.39 by monthly instalments of £12.00. The first instalment to be received hereby 31st August 2009. The rate of repayment to be annually reviewed with an expectation that it should increase should your financial circumstances improve

Please respond

ASAP

-

Hello FB!

Maybe write back and suggest they have made a typing mistake, Section (iii) should read like this:

That is what I'd do.

The trouble is, you could be going back to Court and with them armed with an Agreement made in August 2009 saying you agreed to pay them £11.2k.

Bearing in mind the Judge Lottery, that could be a disaster.

Sorry to labour this, just don't want to see you end up in a bad position, that only becomes apparent later. You can bet they will do all they can to make you miss a payment, to then use that as an excuse to go for the full amount of £11.2k.

Cheers,

BRW

Is that not without prejudice he cant bring it up in court?

-

no offence but you must be totally nuts if you think this is a good result

Thanks

-

it does say

You repay the outstanding balance under the credit agreement of £11,214.35 by monthly instalments of £12.00. The first instalment to be received hereby 31st August 2009. The rate of repayment to be annually reviewed with an expectation that it should increase should your financial circumstances improve.

Trust me it wont and then its back to court if they say it will

And we be back at square 1, next year.

MBNA/Restons claimform - old A+L Card **WON+COSTS**

in MBNA

Posted

LITIGANT IN PERSON: COSTS - LITIGANTS IN PERSON

The rate I used is £9.25 per hour (I did 60 for preparation/research and typing up) and letters have a look at your agreemnt and if they charge £25 per letter bang that on for your letters (I used £12 per letter and did 14 of them)

Hearing time at £9.25 per hour and travelling time, then all your court fees if you made any applications.

it soon adds up but to no more than 2/3 rds of what legal rep could of charged.