fairbyblue

-

Posts

387 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by fairbyblue

-

-

Totally out of order. restons are trying it on and wasting the courts time to do it. Go fight them

-

But I think this is telling from the link !!!!!

Repayments

The main ground on which Judge Smart said Mrs Thorius's credit card debt was unrecoverable was because MBNA could not provide a copy of the original signed loan agreement, which is also a requirement by the Consumer Credit Act.

MBNA applied for leave to appeal, which was rejected, but it may now apply directly to a higher court for permission to appeal.

Or it may be able to appeal if it can find the original loan documentation.

Only when higher courts have decided the issue will the legal ramifications, and the effects on lender and borrowers, be clear.

-

-

Hi, Read my post as I was in very similar position and won with costs

It was posted above but here it is again.

Check dates on default notice but get your hands on the Comms Log via SAR and it will reveal a load of whoppers !!!!

Good luck i will try to help as much as i can

Cheers

-

We'll just have to wait and see what they do next!!

http://www.consumeractiongroup.co.uk/forum/legal-issues/214452-mbna-now-served-3rd.html

-

Cant believe that !! Hope everything works out. Restons just plough on for summary judgement, lets hope the CCA is knackered with no section 11. Thinking of you.

-

Keep going they will try everything to try to undermine you. They just rack up costs for themselves. I was successful against the same combination listening to the advice on here. The dont like us caggers.

-

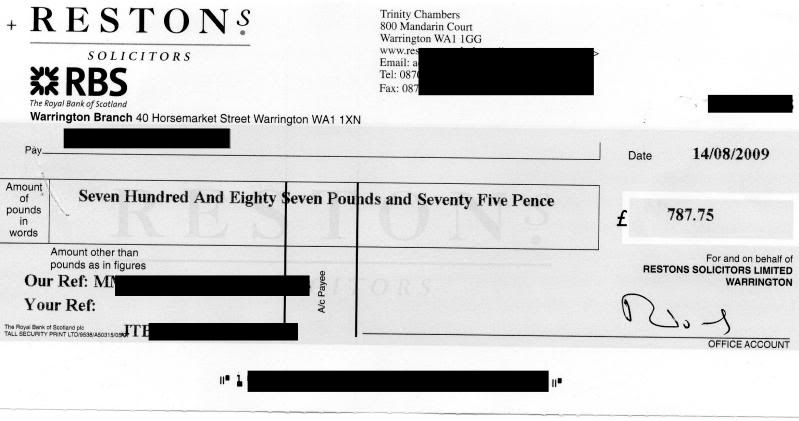

And now I got the costs cheque

-

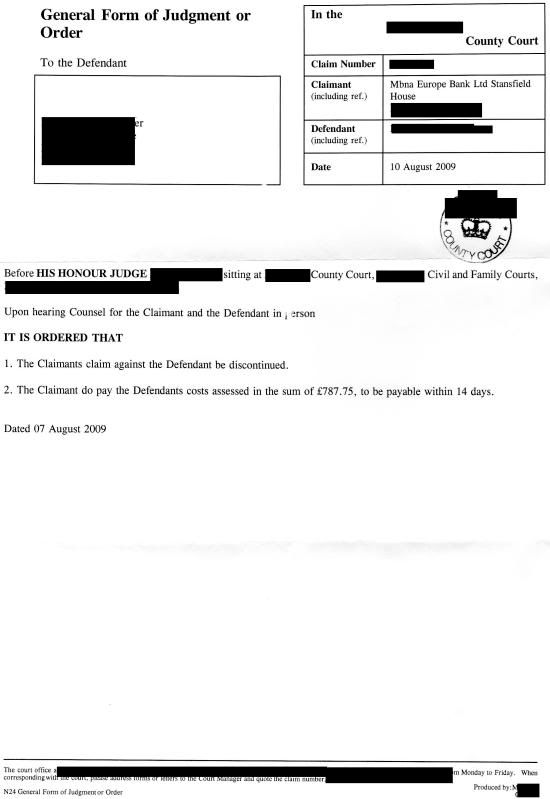

Got the order today, doesnt mention DNs to be removed but that looks pretty final with regard to starting the action again.

thoughts anyone?

-

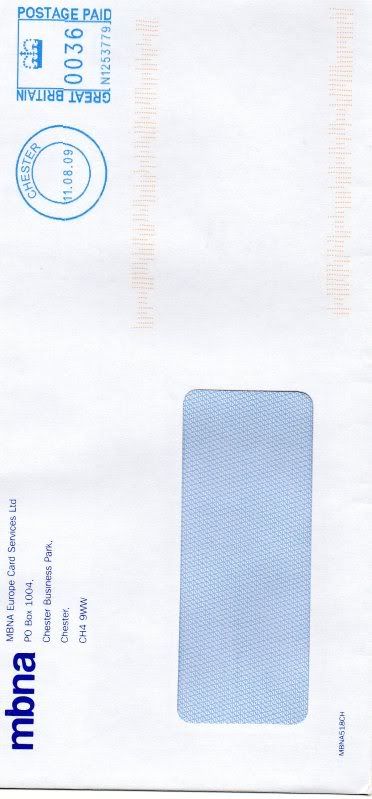

Ah that looks like the franked mail at 36p is 1st class ....shame

Its ok cos i have the envelope covered with MBNA and dated 11/8/09 which makes service deemed 13/8/09 so the 3rd DN is defective.

I'm holding fire to post letter.

-

just checked royal mail business section

and looks as though they can pay 36p

http://www.royalmail.com/portal/rm/content1?catId=600024&mediaId=53800697#44300287

-

Hi, Good thinking but they might get it cheaper cos its franked and they may buy in bulk. Dunno if thats true

cheers

-

Hi FB

I appreciate you're probably itching to give them a piece of your mind but I'd hold your fire for a little bit longer if I was in your position.

I know we've all gone through the whys and wherefores regarding re-issue of DNs after termination etc., but why not wait until after the remedy date on the latest DN has passed, then you can mention why they had to discontinue and rub their noses in it about the fact that even if if it were possible to Default/Terminate you for a third time, their latest attempt at getting it right would have failed again due to them posting the letter the day after they allegedly produced it?

Cheers

Rob

Ah Ah good thinking, I will leave it till after they termniate again !!!

got so much to learn havent I.

Cheers:D

-

Ok this is in the post to them tomorrow.

Dear Sir or Madam,

Re Account number XXXXXXXXXXXXXXXX

Please note that the debt which you are claiming to be entitled to has been before the Court under claim number xxxxx in the xxxxx County Court ,the lender failed to support their claim with any documents to prove I was indebted to their client and the outcome was favourable to me and therefore there is little more to say to you other than the matter has been dealt with, I consider the matter closed and would believe that the doctrine of Res Judicata applies here.

Can you confirm that you have removed all default notices with regard to this account with the appropriate credit reference agencies.

I trust that this will be the last correspondence that I will receive on the matter, however if you persist in attempting to contact me and your conduct becomes what I consider harassing I will instruct solicitors to make an application to the court for an injunction under s3 Protection from Harassment Act 1997. in addition I would report your conduct to the OFT as I consider that this would breach your consumer credit licence conditions.

I look forward to your clarification that the matter is closed, please note that no other correspondence will be entertained in this matter

Regards

-

An ineffective DN/TN can be rectified by "the Creditor", prior to the issuing of proceedings.

They have served 2 DN's and went to court with them and was discontinued on 7/8/09 just before an all day trial. Got costs awarded to me so there has been nothing to change since friday and they go and issue new DN. Its well and truly terminated.

-

Could you have a claim for harrassment. What are they on:confused:

Dunno. They obviously dont like me, it would of been nice to have the costs and the notice of discontinuence before issueing the 3rd DN. Talk about wanting to get in there quick. So it was discontinued on friday 7/8/09 and monday 10/7/09 they print a new DN, I notice the amount to rectify is now approx £120 less than other 2 DN's and I not paid a penny since POC issued last december so god knows where that figure from.

-

as per surfaceagentx20

"By when proceedings have commenced the Claimant will have terminated the agreement. The language of a default notice is framed on the basis there is a current agreement. That language is prescribed. If the Claimant terminated the agreement, to deliver an effective default notice will involve the fiction the agreement is current and never terminated. It would also involve the Claimant reinstating unilaterally. The debtor would be unlikely to agree to reinstatement if to do so would cure the Claimant's difficulties. "

-

Hi FB

So, arguably 1st class (unless it was a heavy 2nd class

).

).However, you have proof of the date of posting (11th) so not deemed served until 13th.

Add 14 days on takes you to the 27th as stated.

HOWEVER, they have used the standard phrase of taking action BEFORE THE DATE SHOWN which means if you take this quite literally, you would have to act by the 26th at the latest to comply with the BEFORE so thereby only giving you 13 clear days.

That argument has been put forward elsewhere in the forums, not least by surfaceagentx20, I think in his excellent sticky on dodgy DNs.

Worth bearing in mind if you need it, but I'm sure you'll be advised how to shake MBNA and their parasitic solicitors off before the neccessity arises!

Cheers

Rob

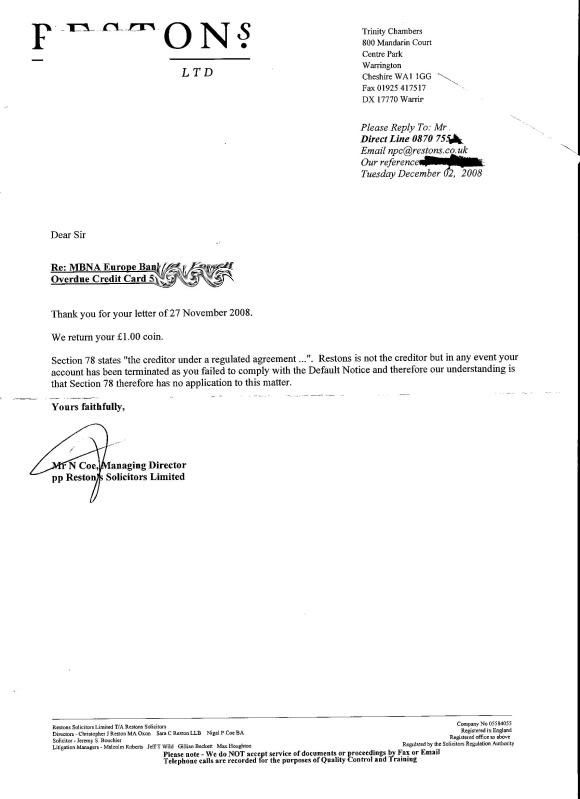

They are unbelievable. So thats their 3rd DN snookered, what about this email quote from solicitor at restons from last week for the original hearing

It is clearly open to the Bank as a creditor to serve a new default notice and claim the full balance. If the earlier default notice did not comply with the CCA or regulations made under it as you allege then the agreement could not have been terminated and the fact you have received correspondence indicating the contrary is immaterial. In any event termination of the account does not mean that the liability disappears.

and

Section 87 of the CCA states that a default notice is required where the

creditor wishes to terminate the agreement and claim the amount owed "by

reason of nay breach by the debtor...."

You will be aware that clause 10 of the Bank's terms and conditions

allows our client to terminate the agreement at any time and can do so

without having to demonstrate that you have breached any terms of the

agreement. It can terminate the agreement without serving a default

notice - which means that any alleged defect with the default notice is

irrelevant as it was not needed in the first place as our client will

rely on its contractual right to terminate the agreement. Your amended

defence states that the agreement is terminated.

and

You will note in your terms and conditions par 10 that the Bank has the right to contractually terminate the agreement at any time - if it does so you are liable to repay the outstanding balance. In other words the Bank does not have to serve a default notice which is only required if the Bank wants to bring the agreement to an end because of a failure to pay arrears or some other breach.

Paragraph 10 allows the Bank to terminate the agreement for any reason i.e. not a reason based on a breach of the agreement.

In other words the Bank does not have to rely on the default notice.

and just to make sure it is terminated that loks pretty final to me

-

Hi FB

In the words of dear old Victor M, "I don't effing believe it!"

They even state on the DN that if you don't comply they will terminate your account AGAIN!

Just out of interest was this sent 1st or 2nd class? It would be funny if they had used 2nd class and the DN was invalid for the same reasons as before!

I think I'd be inclined to ignore it at this stage and wait and see what happens (others may have far better advice though!).

What an absolute load of ballcocks this is turning out to be.

I wonder if they'll use Restons again?

posted 11/8/09 and franked with 36p

As for restons hope so cos if i string it out long enough they will be paying costs again next year for my spends for my hollibobs

-

Following my recent day in court when Restons discontinued see thread here http://www.consumeractiongroup.co.uk/forum/dca-legal-successes/170484-fairbyblue-mbna-restons-court-49.html#post2355090

MBNA have now sent a further DN (the 3rd) for the same account that was in court. The account is terminated as I have letter from Restons confirming it, they have tried to take me to court already over this

So how can remedy something that doesnt exist?

So what do i do? Cos this is an abuse of process

-

Thanks for all your support and congrats, will post up scanned cheque from Restons, although dunno when that will be as I dont hold to much hope to actually getting it in full on time.

Once that clears a complaint to the SRA for them

Do they have to remove the DN's on credit file as a matter of course or do I have to write to them to tell them?

Just re read the whole thread and they have tried to constantly pulled 'fast ones' all the time. I chuckled at a few comments and remembered how I felt at the time.

The things I have learned throughout this episode are;

1 Dont get married and let the now ex-missus anywhere near your credit card.

2 When the sh!t hits the fan deal with it (I did and am thankful I did)

3 Dont bury your head

4 Listen to the advice

5 Act on it

6 Don let the sols/banks/barristers try to steam roll you (I did waver but with support we ploughed on)

7 Put the work in and 'Be Prepared'

8 You are not alone ( Caggers are invaluable)

9 Be thankful for the unamed individuals who, without wanting something in return, gave sound legal advice ( I will make a donation though)

10 that 'the legal profession' know sod all about the law !!!!

Thanks and my binge drinking is over for the weekend. And the first good night sleep awaits !!!!!!!

-

Hi FB

I was awarded £40 odd for attending a 'wasted' hearing (as restons lost their application

) which the Judge ordered to be paid within 21 days after their barrister argued against 14 days. Needless to say i did not receive the cheque on time.

) which the Judge ordered to be paid within 21 days after their barrister argued against 14 days. Needless to say i did not receive the cheque on time.However, when they finally discontinued, I waited a few days then banged in a letter to Restons mentioning my schedule of costs which had been handed in to the Judge at the aforementioned hearing.

I expected to have to fight for the costs, but I received a cheque from Restons (and it was a Restons cheque) for the full amount by return. It was the quickest response throughout the whole process.

From posting my letter to banking the cheque was about 3 days!

Cheers

Rob

Heres hoping cos Im sick of Lidl and fancy a move up market to Aldi:D

-

Lets see if restons do theor favourite trick of posting documents late ie the cheque !!!!!!

-

Well I think FB must still be on his bender - probably won't surface until Monday:p

No i'm up and just about to start day 2 of the Restons Appreciation Soceity all weekend bender !!!!

MBNA/Restons claimform - old A+L Card **WON+COSTS**

in MBNA

Posted

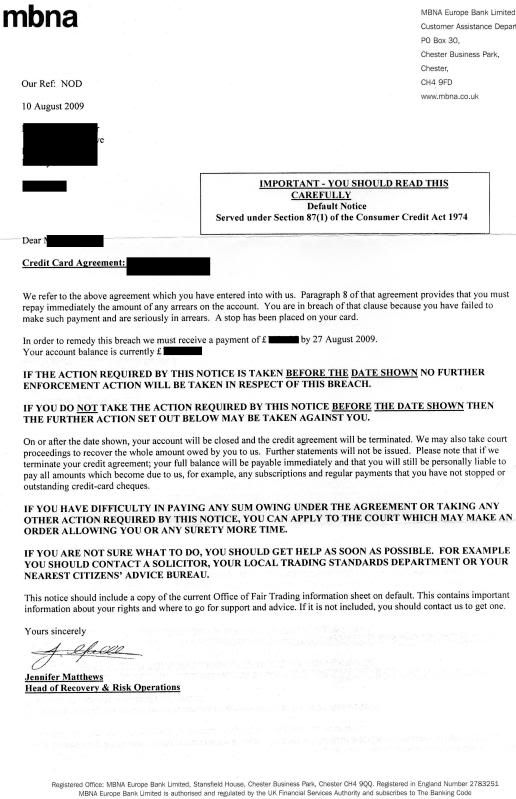

Ok recieved this today from out friends at MBNA. Anyone got a view on this letter