davey77

-

Posts

2,650 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by davey77

-

-

I haven't seen a tutorial on here myself but personally i use this site to make mine quickly:

Alternatively you can always just change the font for the signature portion to one of those swirly types (like Zapfino in Macs) and use that every time.

-

1

1

-

-

Looks like others are getting the 'toothfairy' treatment:

http://www.consumeractiongroup.co.uk/forum/payday-loans/208315-toothfairy-finance-please-help.html

-

Have you sent the CCA request off for a copy.. or maybe you already have a copy and can remove personal details (using a site like photobucket) and post it up?

Loans tend to be pretty solid (compared to credit card agreements) for the most part but not always, depends on when they were taken out.

-

1997 eh.. good chance they don't have it.. not impossible but a good chance.

Trading Standards been informed of the CCA failure i hope.

-

-

Well i have no idea what they are on about either in post 34 so won't comment as it would be guesswork.

They have probably complied with Section 78 from what they seem to have sent you and therefore you did the right thing moving away from that and going for the CPR route. Having said that, they ignored it.. but they will have taken notice of it even if they didn't admit to it.

To be honest it's a bit of a stalemate which is often they case until A. you start court action or B. they start court action. I know it leaves it up in the air. You could surely go with your letter above (post 49) although it's far too polite

I'm afraid the only words that get taken notice of these days are aggressive in nature and even then they hardly ever budge.

I'm afraid the only words that get taken notice of these days are aggressive in nature and even then they hardly ever budge.You've tried the CPR.. have you tried an LBA?

I would look at the more agrressive letter i am using these days on my Amex thread and pick out what seem appropriate in your instance. Stuff like this:

http://www.consumeractiongroup.co.uk/forum/amex/184309-davey-amex.html#post2014296

Or extra aggressive like this:

http://www.consumeractiongroup.co.uk/forum/amex/184309-davey-amex-2.html#post2053510

http://www.consumeractiongroup.co.uk/forum/amex/184309-davey-amex-3.html#post2081882

But don't start using words like 'extortion' or 'criminal' unless you are prepared to get sued (outside chance) as i am not personally bothered and have nothing to lose.. others are/may be in a different position.

What about charges to reclaim? Would that add up to much and have you done that yet?

This was an interesting route to take and it had a quick cave in from RBS i noticed:

http://www.consumeractiongroup.co.uk/forum/royal-bank-scotland/187177-mint-pay-back-12-a.html

-

Dave are you sure you would fail a credit check?

My hubby and me have both got crap credit history and have never been turned down

That's a good point there Callumsgram.. I haven't actually been through the procedure of going after a property to such a degree that the agent has instigated formal checks.

I know that some i have asked re credit check have stated they use an outside agency to give them a detailed credit worthiness report so that put me off somewhat knwoing how many defaults i have these days.

Never know til i try though to be sure..

-

Mis-sale battle takes five years | Mail Online

"

How long is it reasonable to wait for a complaint against a bank or building society to be resolved - two months, six months or, at a stretch, a year?

The Financial Ombudsman Service, which adjudicates on consumer complaints, says on average it processes complaints within six months. But when it came to Elizabeth and Keith Birbeck's mortgage endowment mis-selling claim it has taken almost five years for a conclusion to be reached."

"

The FOS took almost 18 months to review - and reject - the case. The Birbecks appealed against the decision and by April 2007 a different FOS adjudicator decided that in fact the policy had been mis-sold into retirement and that additional compensation was due.

That should have been an end to the matter, but to the Birbecks' dismay Nationwide appealed. Their case was passed on to an ombudsman, the most senior adjudicator, for a final verdict."

"'The most frustrating aspect has been that different staff within FOS have come back with different decisions. This lack of consistency is frustrating.'"

-

Dave, if you have any cash available, it might be worth suggesting to a potential LL that you are willing to pay 3 months rent in advance.

I had the same problem when I left my ex-husband, that most LL wont look at HB tenants. But if you offer them rent in advance, they are somewhat reassured that you will respect their property and are unlikely to lapse on your rent.

Thanks.. yes cash flow is a bit of a problem but you're right, having extra for another month or two wouldn't hurt.

Issue om hitting up against at the mo seems to be that a poor credit file stops any chances at getting a place but i'll keep putting those 20 pence pieces in the jam jar all the same.

-

hi davey

shame your not looking in suffolk, my cousin is looking for a good tennant, she has had some really bad ones

good luck

claire

Thanks Claire,

awww shame.. well tell your cousin to sell up and buy something in berkshire or wiltshire then contact me lol (don't ask much do !)

-

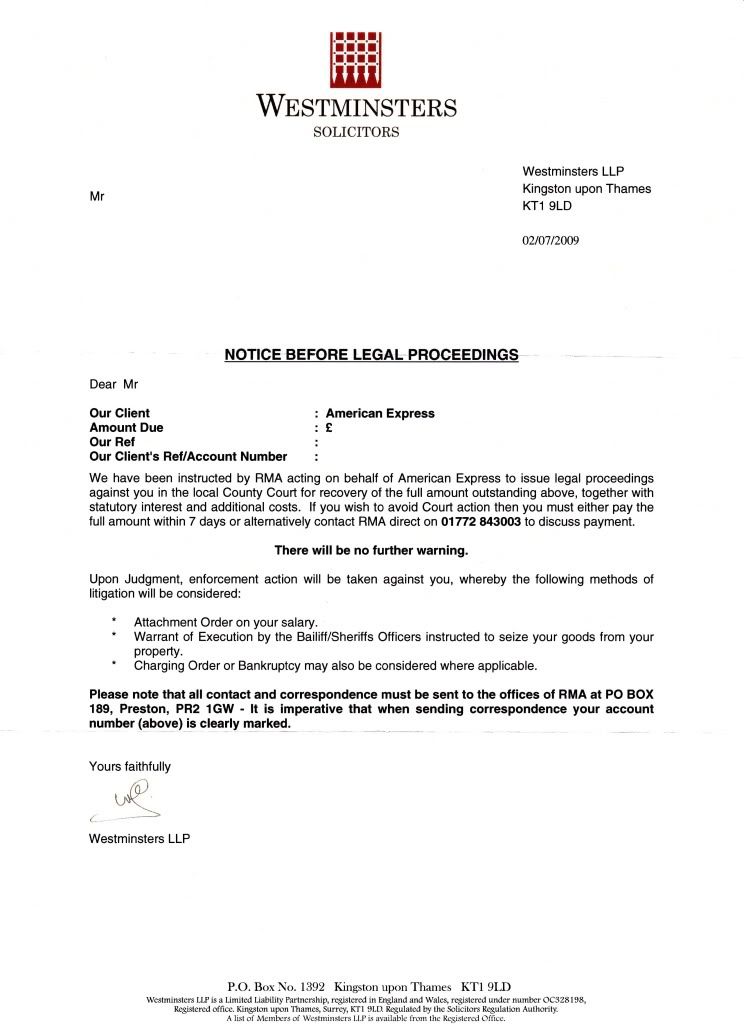

That letter from Susan Edwards is interesting, to say the least.

As for the letter sent to Davey by Westminsters, that is surely illegal? It says "Upon Judgment........" the inference being that judgement is either a formality, or is in the process of being passed. Is it not illegal to send DCA letters masquerading as legal documents?

"Upon Judgment" is a very ambiguous way of saying "Should judgment be entered against you", one sounds imminent, the other is a maybe. These people are beneath contempt.

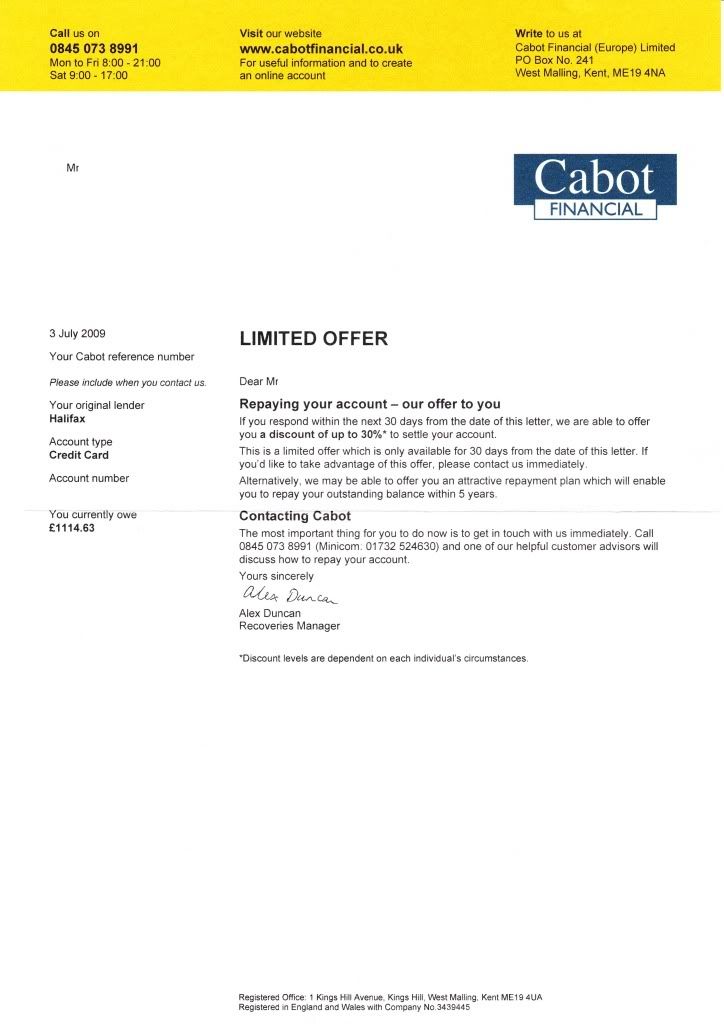

Usual tactics and worded specifically in such a way to make those less aware (or vulnerable) pay up in panic im afraid. Copy though will be sent to TS and the OFT (at least we know the OFT are taking on board these complaints in the background nowadays).

-

Yes Shadow.. certainly think i am going to have to ask about securitisation at every given opportunity.

Thanks for the all the info BRW.. that's really interesting (and potent) stuff to use in an argument indeed.

Looks like i'll be writing some letters today to RMA and Westminsters and the OFT/TS. Although i will not bandy back and forth with these jokers for the next 3-4 months. I'll just get it all in one letter ending with a 'read and filed but not responded to' sentence. Of course, heading it with the 'i do not acknowledge any debt...' just incase that three year statute barred limit i have heard is being discussed ever did come into effect (and incase this never gets to Court.. although be honest i am mighty bored by these well known and impotent threats these days..

-

-

-

Ah yes.. good idea. thanks CB!

-

Thanks Bookwoom

Well, we are quite lucky really, nice street, nice gardens, nice landlord so not in dire straights and there are people out there a lot worse off and deserve to go to the top of the Local Authority list before us for sure.

Personally i think estate agents/landlords are discriminating when they state 'no assisted income/DSS' but that's another battle.

Might put that ad in a paper.. that worked once before. We'll get there in the end. just frustrating more than disheartening.

Onwards and upwards

-

-

No sars.. Payplan are debt management:

Debt Management Plans | Debt Advice | Payplan

or

CCCS - Free Debt Advice from the UK's Leading Debt Charity

Yes i have felt like that but they never do go away. At least if you can come to some arrangement you will feel you are getting somewhere and that in itself can take a weight off.

-

Still struggling to find somewhere. Estate agents don't even bother replying and often don't update their website for weeks making you think they have properties available when actually they have gone. Promises to send out a property list don't materialise. Bet if i said i had £300k in cash to buy they wouldn't ignore me quite so easily lol

-

How can i get them to freeze interest while i try and pay it off?

That's a difficult task as i have found out. My first thought would be to try Payplan. Haven't used them myself but heard mostly good things about them. If they can arrange a payment plan for you i would stipulate that you can only consider it if interest and charges are frozen and see if they can sort it on your behalf.

What about the unlawful charges aspect? Have you calculated those, reclaimed them etc. That might make a dent in the overall amount.

-

-

I am trying to write a book on being in debt.

I would appreciate any short comments and peoples experiences in their own words on how debt has effected their health and lives. In particular the stress it causes and what being ignored by Lenders and DCAs when you are trying be responsible has felt like.

Only short comments wanted please. Say about 300 word max. No massive letters and i am more interested in the psychological effects and mental state, the frustration and stress that attempts to communicate with creditors has brought, rather than the legal side or section 78 failures etc.

I would prefer comments sent via hotmail or yahoo (link on the left of these posts) and not posted on the open forum please and rest assured your name/username will never be quoted. All in strict confidence and for my own use in writing about the subject matter and any information will be changed as to keep any comments i may add to the book as anonymous and not traceable back to any individual in any way.

Thanks folks... something may come of it. I may be a rubbish author! If it's not good enough for publication and if i ever finish it i'll post it online for download to try to help those being hounded by the evil doers.

-

I am trying to write a book on being in debt.

I would appreciate any short comments and peoples experiences in their own words on how debt has effected their health and lives. In particular the stress it causes and what being ignored by Lenders and DCAs when you are trying be responsible has felt like.

Only short comments wanted please. Say about 300 word max. No massive letters and i am more interested in the psychological effects and mental state, the frustration and stress that attempts to communicate with creditors has brought, rather than the legal side or section 78 failures etc.

I would prefer comments sent via hotmail or yahoo (link on the left of these posts) and not posted on the open forum please and rest assured your name/username will never be quoted. All in strict confidence and for my own use in writing about the subject matter and any information will be changed as to keep any comments i may add to the book as anonymous and not traceable back to any individual in any way.

Thanks folks... something may come of it. I may be a rubbish author! If it's not good enough for publication and if i ever finish it i'll post it online for download to try to help those being hounded by the evil doers.

-

I am trying to write a book on being in debt.

I would appreciate any short comments and peoples experiences in their own words on how debt has effected their health and lives. In particular the stress it causes and what being ignored by Lenders and DCAs when you are trying be responsible has felt like.

Only short comments wanted please. Say about 300 word max. No massive letters and i am more interested in the psychological effects and mental state, the frustration and stress that attempts to communicate with creditors has brought, rather than the legal side or section 78 failures etc.

I would prefer comments sent via hotmail or yahoo (link on the left of these posts) and not posted on the open forum please and rest assured your name/username will never be quoted. All in strict confidence and for my own use in writing about the subject matter and any information will be changed as to keep any comments i may add to the book as anonymous and not traceable back to any individual in any way.

Thanks folks... something may come of it. I may be a rubbish author! If it's not good enough for publication and if i ever finish it i'll post it online for download to try to help those being hounded by the evil doers.

Concerned v MBNA

in MBNA

Posted

The OFT are finally taking notice. Might have to wait a long time before they ever come down hard on the big players but they are starting to tackle the DCA tactics:

The Office of Fair Trading: OFT imposes requirements on 1st Credit over debt collection practices

The Office of Fair Trading: OFT imposes requirements on Mackenzie Hall to improve handling of disputed debts

I'd get the complaint in to TS sooner rather than later and also do a SAR when you can as that allows up to 40 days for compliance and the ICO take quite a while to look at complaints re SAR failure.