-

Posts

51 -

Joined

-

Last visited

-

Days Won

1

jims45 last won the day on August 7 2020

jims45 had the most liked content!

Reputation

4 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Problem Canceling Contract With Virgin Media

jims45 replied to jims45's topic in Broadband and other Internet issues

Update: After no reply from Virgin media we eventually got an email stating that the contract would be cancelled. We then had more than on email accusing us of not returning the router box we sent another recorded delivery letter to head office with proof of postage and cancelled the direct debit as they were threatening to charge us for the alleged missing equipment. We then got a email informing us that a credit was due so we responded with another letter requiring payment via bank transfer or cheque. After some delay we thought court action would be needed but surprisingly a cheque arrived. A lot of hassle and the expense of sending recorded letters but at least we are free from Virgin Media, diabolical customer service in our experience! Thanks for the help and advice given here. -

Something positive. I joined this site a year ago and had substantial financial problems and was advised elsewhere to sign up for a DRO or file for bankruptcy. Following advice given on this site I was able to get a notorious DCA off my back, settle my most worrying debt with a large discount and get back over £8k in miss sold PPI. I am now in a much better position and will be debt free next year. Keep up the good work and a very big thank you from me.

- 1 reply

-

- 3

-

-

Problem Canceling Contract With Virgin Media

jims45 replied to jims45's topic in Broadband and other Internet issues

I have sent a recorded delivery letter to Virgin asking to cancel the contract. Hopefully I will get a response if not I guess I need to contact Ofcom and complain. Will post updates. -

Problem Canceling Contract With Virgin Media

jims45 replied to jims45's topic in Broadband and other Internet issues

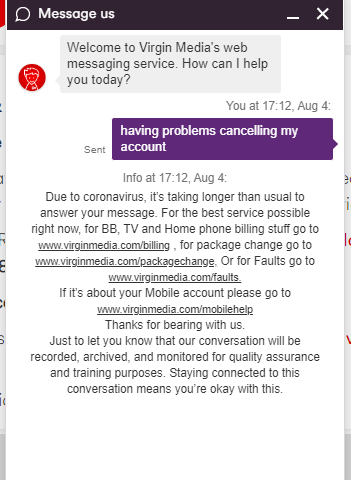

Thanks for the reply. They don't answer the phone just goes around in a loop. I have posted on the Virgin Media "community forum" and several others have had this problem dating back to when Covid began. I am told however that you can sign up no problem! Chat box not working either for me. -

I have been with Virgin Media on a discount plan for broadband and phone which ends next month and is set to double in cost. Virgin are not answering phones, there is no option to cancel via email or online. I have written to the cancellation address on my contract and also Head Office stating the account number and date I wish to cancel via recorded delivery. Further problem is we are moving home at some time this month and concerned about leaving the property with a live phone line for the new tenant to use. Where do we stand legally with this and is postal cancellation fool proof? Thanks in advance.

-

The parent company Worldline IT Services UK Limited is listed as a payment services firm by the FCA but this is not at the bottom of the email I received. I have searched and found a copy online of the FCA handbook but I am struggling to find the section that applies to unlawful charges. Not sure what section to quote them.

-

Thanks for your reply. Should I email them stating that the penalty is unlawful?

-

I run a micro business and opened an account with fuel genie (fuel card) for cheaper fuel. I am currently in the process of changing banks and forgot to update my direct debit with them. The DD was refused upon which I received an email from fuel genie threatening debt collectors if I did not pay promptly and that charges would be added to my account. I paid as soon as I received the email by card and contacted customer support to ask if the admin charge of £49 could be removed as it was a genuine mistake and pointed out that it was exactly three times the sum charged by my old bank. I was told over the phone no but email our accounts dept and they might reconsider. Assuming the answer is still no can they actually charge such a high fee? The other issue is they have just added the charge to my online account and not issued an invoice for the charges so I can not account for them end of financial year. Obviously lesson learned, read small print but any advice appreciated.

-

Thanks for the reply I will sit tight and see what happens.

- 53 replies

-

Happy new year all. After receiving excellent advice from this forum numerous letters received from Cabot stopped and went quiet for several months. Cabot were initially chasing two alleged debts, a credit card and a bank overdraft. After following advice given here I received letters stating both debts were unenforceable. Now letters have started again but only chasing the alleged bank overdraft (the smaller amount). I am now 65 years old and receiving state pension, have no savings or assets, drive an old van worth around £1000 and live in a one bedroom retirement flat rented from a housing association. They are asking my current circumstances and threatening more frequent contact though no mention of legal action. The debt (which I have consistently denied owing) becomes statute barred Jan 2021, should I respond or just ignore the letter as before? Thanks in advance

- 53 replies

-

Thanks for the reply. Strange thing is my previous Bank does not show up as a hard search it is listed as anti money laundering and appears in the section marked as ‘will not harm your credit score’. Maybe the free credit check websites are not 100% accurate.

-

I recently went to my nearest Metro Bank to open a business account. After about 30 minutes waiting I was seen by a member of staff and explained I needed a basic account without overdraft or borrowing facilities. I was then told I needed to produce ID and she would perform a credit check to establish my identity. I wrongly presumed this would be a "soft search" as carried out by my previous Bank. My credit file is not perfect having had dealings with good old Cabot in the past so the account was refused...fair enough. However a few weeks later upon checking my credit file I see that Metro Bank have performed a "hard credit check" and marked it as "credit application". I did not apply for any form of credit but Metro Bank refused to correct the entry on my file. No apology just a letter informing me that was standard Metro Bank procedure. Is there a complaints procedure to get this changed or do I just put it down to experience?

-

As always thanks for the help, just made a donation. Can I complain under GDPR as I have not given Cabot permission to share my number or contact me by phone. I wrote to them stating communication by letter only.

- 53 replies

-

Update, new tactic from Cabot?? After a quiet period I suddenly get a call to my mobile asking for me by my first name to which i answered yes, (my name) speaking. Caller then says this is Cabot Financial, my reply, never heard of you sorry. I ended the call and blocked the number ( a mobile). Ten minutes later I get a text message stating: Hi, its Cabot click this secure message link if you want to hear something beneficial to you ( or words to that effect). I deleted the message and blocked the sender but I am curious as to what this ploy is. I am guessing by clicking the secure message link I will be acknowledging the debt and thereby resetting the statute barred clock. Have any other Forum members experienced the secure message approach? Thanks in advance.

- 53 replies

-

jims45 changed their profile photo

-

No disrespect but look at post 11 above advising me to contact HSBC first. Complaint has been filed with with ICO as instructed but ICO said I had to go back to HSBC first which I have done.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.