happycaravan

-

Posts

125 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by happycaravan

-

-

thank you - sounds obvious now you say it!

-

Hi,

What description do i use for the figure i've carried from the CI sheet? (initially suggested post 2014 but this is when the bank announced they changed the interest and fee structure however no interest was actually charged after 21/03/2013 so hopefully i have completed the sheet correctly).

Also under the 'Award Calculation' - is there a more apt term than Monthly PPI Payment I should be using? It's just going to be one amount so am i ok to change it to Total Payment of 'PPI' perhaps?

-

ah ok thank you - thats something i hadn't realised. Will get those sorted too... Thank you again

-

Yes the PPI covering letter, i have the template already but just needed to adapt it as its mainly to do with loans rather than our situation which is the overdraft PPI. Do we have to send the FOS CQ as well or will the covering letter as and spreadsheet be enough? (per claim of course)

Thank you... again

-

I did think it might be worth a bash to be honest, after all what is there to lose?

I had already done the spreadsheet too so no real extra work involved there.

The charges were between £12-£22 i think in the end - not got the exact info with me as im at work at the moment

i do think it worth asking for them refunding - they can only say no cant they?

Thank you so much dx100uk,

this claim alone is quite huge and if we are successful (the PPI is quite certain as Barclays have more or less asked her to claim) we will definitely be making a donation to the site as a thank you.

I just need to get my template sorted now for the PPI,

I have the template but trying to adapt it for the overdraft PPi is tricky

- i have been scouring the forums for days in an attempt to find someone who had posted a similar one lol...

x

-

Thank you so much that makes sense - i do so appreciate you taking the time to explain everything.

I have completed the PAF exactly as you suggested (phew! i have got one of them right!! the only thing i need to do is add the bank address to the letter and get friends signature on said letter!)

The only question i now have is the £10 OD charges you mentioned, i have read back through the thread and can't spot anything obvious but i have been reading all night in an attempt to find a suitable PPI template to adapt (without success!) so my eyes are tired, - is that something i have posted about earlier?

The only thing that i could recall was the penalty charges but slick had advised me not to pursue due to the supreme court ruling...

-

Thank you for replying dx100uk.

I was trying to get my head around your response.

I have tried to keep the 2 claims separate i.e the packaged account fees claim and the overdraft PPI claim but im not sure if thats possible (unless im over thinking)

because from June 2014 the interest was scrapped and then replaced with a daily charge if the OD was used.

If I end the CI sheet as you say above i am left with approx 5 years of PPI charges still (between 2014 to present date) to record, where would i put those?

I seem to be getting muddled and i apologise in advance as im not very good with spreadsheets as is.

its taken me this long to get this far.

Please bear with me

I'm so grateful for your support

- we both are.

x

-

Yes I’ve used the 24.9% as you advised previously thank you

I’ve just noticed that there doesn’t seem to be any interest once the charges switch to ‘overdraft ppi’ around 2013.

I’m wondering if this is because it was maybe included in the monthly fee?

Perhaps more googling is required

....

....

Given the interest charged however am I correct in using the CI Sheet Dx?

And once I establish the answer regarding the interest inclusion Re the monthly fee I assume we don’t add interest on our spreadsheet from the date they stop charging?

Thank you again x

-

Hi dx100uk

ok I’ve checked through the statements again and there is interest on there, it just says ‘interest charged’ and then the amounts differ each month. Would that be the overdraft interest?

Thank you x

-

Thank you

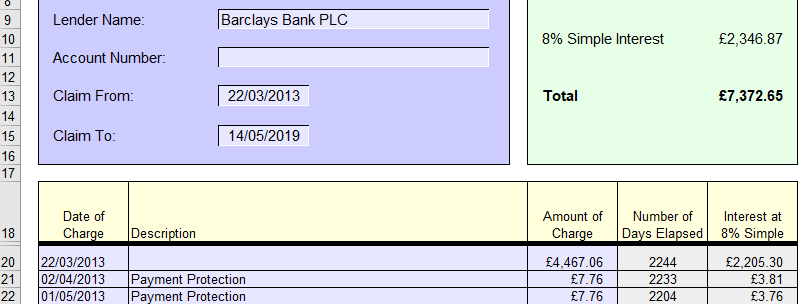

I am just tying everything up now and was looking for a letter template for the bank account PPI, I was browsing the Barclays threads and noticed one previous thread had used the Simple interest spreadsheet as opposed to the Compound Interest spreadsheet for their PPI so i just wanted to double check i had input the information correctly. Aside from how long long it's taken i don't want to get it wrong and give Barclays any reason to wriggle out of it, but given the total amount of the claim i suspect they might - this is a biggie!

-

Hi again Dx100uk

I have a question(s) if thats ok?

Do i need to 'rename' the spreadsheets before printing off? i.e. I have one called Compound Interest - is it best to rename that PPI redress calculation? and the other Packaged Account Fee Reclaim perhaps?

Also as the PPI we are reclaiming is relating the the bank account would it be template letter number 1 to use and adapt?

Thank you

-

Hi again dx - thanks for the info,

Yes - I read about lenders 'not being regulated pre 2005' (i'm learning so much!). I will go ahead and get that done in tomorrows post. How do i find out who the underwriters were?

Huge thanks

-

Hi folks

I have browsed the forums and can't find any recent info on Wagon Finance regarding PPI claims,

I just wondered if anyone else had any success with PPI claims against this company at all?

I am currently working on behalf of my friend who had a car loan with them (hire purchase) back in the late 90's

she then used them again when she bought another car in 2001.

The information we have is from bank statements

so possibly the agreement number from the direct debit as well as the amount per month.

I understand they were bought by First National and then Santander,

is that the most up to date information?

It seems rather sketchy online and there doesn't seem to be many people reporting success

...or failure for that matter.

Thank you as always x

-

Thanks Dx100uk - you're a star as always

-

Hi Slick,

First of all i'm sorry i haven't had chance to respond before today, i'm not in the best of health myself at the moment and I had to wait for my friend to return from her holiday in order to go through some finer details.

In answer to your questions above, and after going over the bank statements again the bank charges are due to the odd occasion when she's gone over her agreed overdraft limit as a result of card payments etc, sometimes there would be 2 or 3 charges at one time. There are a total of 39 charges between the period of 23/08/2000 and 19/01/2012.

If i need to forget about this one then fair enough

- i just thought it worth a shot really but i'd rather focus on the other two as times running short and i really want to get some results on those for her.

Could you have a look at my question on post #29 re the interest on the spreadsheets?

once i know i have the correct rates i can get them sent off.

. I really cant thank you all enough.

From both of us xx

-

My fault Slick I thought it was worth a shot, do we just forget about the bank charges then and focus on the other two? so do we have the correct interest rates on the overdraft ppi? I have completed a compound interest spreadsheet with 24.9% interest and the PAF I have completed the spreadsheet with the 8% simple interest. Hopefully that makes sense - sorry again for the confusion

-

Ah really? i thought i'd read on one thread a rate of 29% or something along those lines but i have seen a lot of threads so could be wrong on that! I'd appreciate your help Slick when you have a second, no rush as it's late and i wont be sorting anything this evening.

Thank you as always dx

-

Hi Slick,

So we have (my friends Barclays bank account) has bank charges, overdraft ppi and also package account fees - all of which require separate claims i believe? (i have separate threads too just that dx has been helping out with them). Apologies for any confusion. I have finished spreadsheets for all 3 claims and they date back almost 20 years - the statements were provided by Barclays as a result of the SAR. Does that help?

Thanks again

-

Thank you Dx - doubting myself now but hopefully ive completed the correct spreadsheets!

sure i have because i followed your advice at the time.

sure i have because i followed your advice at the time.

-

Thanks so much Slick. I will include it anyway and see what she says about going down the court route, i think if it was me i'd take the chance but ive been there and done this so i know it's possible, asking someone to part with £900 on the off chance they might win the case is another matter.

When you say above the compound interest can be included beyond 6 years, but it's different for PPI and account fee reclaims.... does that mean that we can't include anything beyond 6 years for those? Or shall i include and just expect them to 'cut off' after a certain date?

Sorry for all the questions... i've thought the PPI claims could go back as far as you had the info

Thank you all so much for the advice as always.

-

Thanks dx. Yes the MCOL said over £10k it was 4.5% of the claim and that amount it works out at about £900 - today anyway obviously that will only increase. Unless I'm looking at it completely wrong?

I've just found Shelley's thread and spent a while reading that with interest, and from doing so it appears that the banks don't pay interest on the charges if over 6 years old. Do i still include them all on the spreadsheet initially?

-

Thank you again!

I have finally finished all 3 sheets and have had a good couple of hours reading Martin2006's posts too - thank you for that.

One for the Overdraft PPI/Protection (as they call it!)

one for the Account Fees and

one for the Penalty Charges.

I still have to add from December to present day as the statement's they provided were up to Nov 2018 so my friend is going to get the info before i send the spreadsheets and letters off.

Totals are (astonishing!) as follows:

Overdraft PPI/Protection = £27,158.94

Account Fees = £4078.46

Penalty Charges = £20423.10

I was slightly stunned when i realised how much they all totalled and i know the penalty charges are not guaranteed,

my main concern there is obviously they will most likely refuse and if we want to get anywhere it means spending £900 with MCOL,

I'd appreciate your thoughts on the chances of success there if poss.

I don't want to advise her to outlay that kind of money (if she even has it) if there is little or no chance.

Glad to have got these done... still 4 more separate claims to go! i need a holiday lol

-

Thank you dx100uk - so just to confirm, (i know you said to use the 24.9% for the overdraft ppi etc) but as i have a separate sheet for penalty charges do i use the same rate for that too?

Quote -

Hmmm ok i will need to get my head around that one. I am going to see my friend this evening and get some info on the account package fees i.e did she ever use any of the associated benefits etc as far as i know she isn't even aware they exist!

As for the penalties how do i find out what interest rate to pop on the spreadsheet? The statements don't seem to show the detail anywhere...

Thank you again

Barclays Overdraft Fees - Reclaim help required

in Barclays Bank

Posted

Last question... (or probably not!!) regarding the bank charges i have them on a spready but do i include interest or do i just mention these charges on a letter? If i do include interest at what rate?

Thank you as always