players4you

Registered UsersChange your profile picture

-

Posts

61 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by players4you

-

StepChange DMP +10yrs - Help please

players4you replied to players4you's topic in Debt Management Plan Companies

Thanks both, The only thing I am still not clear on is there were 4 DCA's that were reporting on my credit report and as I complained they have stopped BUT there is no default date on these debts. Can they start reporting these debts again on my credit report if I stop paying. When I tried to re-mortgage a few years ago I was refused as these 4 were showing as in a DMP. Ofc they are not now as I told them it should have defaulted BUT they werent actually able to add the default date - so in theory could this happen again. Thanks so much for your help -

StepChange DMP +10yrs - Help please

players4you replied to players4you's topic in Debt Management Plan Companies

Thanks very much dx Can the ones that have not default date be reported again? I complained and they have stopped reporting. If I stop paying can they start reporting again? Is the I&A completed as part of the DMP legally binding? what if this isnt accurate could this be a legal issue at that point it goes to court? -

StepChange DMP +10yrs - Help please

players4you replied to players4you's topic in Debt Management Plan Companies

Sorry forgot to mention. When filling out the financial situation to get the stepchange payment low I was very economical with the the truth. I dont want this to be an issue as I am worried about that. Thanks very much dx Not sure if your saw my comment re the budgeting as think we may have crossed. Can they start reporting on my credit file again? I really cant have that happen. Is this a risk. The conundrum is - if I settle them now for say 30% of the debt thats around 5k. If I end up having to pay them thru court action then just a few could be that much. I suppose thats a gamble. when they do a letter of claim, I am guessing we then ask for a CCA. If they can provide it do I have the opportunity to pay if necessary before getting a CCJ or it reported again on my credit file? -

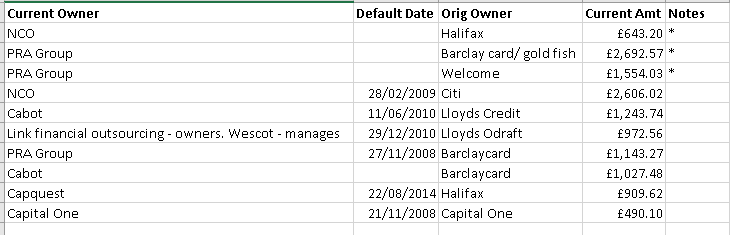

Hi All, I would really appreciate any help in this. I want to stop paying this and am wondering if I need to offer F&F or if I am good just stop paying. A few details first: 1.DMP with StepChange started circa 2010 2.Have been paying every month since 3.Want to stop paying/clear as want a new mortgage in the next 9 months or so 4. None are currently showing on my credit file And the finer detail: * = these were on my credit file until recently. I complained stating that they should have been defaulted as it was unfair. They have stopped reporting now - but werent able to add a retrospective default date. I havent made any enquiries about CCA's etc. I want to just stop paying but also cant have any of them appearing on my credit file as need another mortgage etc. I understand most will likely not have a CCA but there is one overdraft related entry so not sure what to do about that one. Also I think they could CCJ but can they start reporting again - I know the ones with a default date cant but can the others? Hopefully thats enough info. Would really appreciate your excellent guidance Many thanks

-

Virgin Flight Delay from 2008

players4you replied to players4you's topic in Holiday & Airline companies

I will give it a go and report back -

I am looking for some advice on if it is wort pursuing a claim I made several years ago. Back in 2008 my Virgin flight was delayed by a day due to a technical fault. I claimed but was sent the extraordinary circumstances response and the claim was denied. I have since heard that technical faults are now covered following a court case in 2015. I know this is more than 6 years old but my initial complain wasn't. Is it wort attempting to re-claim on this basis?

-

Ok. I have not had any documents from Carters and there 14 days are up now. Defence due on Monday. Should I call them and ask them if they need more time. Can they win without any documents. Not quite sure where I stand now. I decided not to submit defence last month as I received confirmation of the extension from the Court All help much appreciated

-

Carters have agreed to 18th Nov and I have informed the court by email but they have not updated the new defence date officially so was thinking maybe I should get it in by 4th anyway perhaps Here is what I have, has to be in by tomorrow so would really appreciate feedback. Can I submit tomorrow evening as my defence date would be 4th Nov? 1. Paragraph 1 is neither admitted or denied with regards to the Defendant entering in to an Agreement referred to in the Particulars of Claim ('the Agreement') the Claimant has yet to disclose any Agreement. 2. Paragraph 1 is denied with regards to the Defendant owing any monies to the Claimant and the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement with the Claimant; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim; 3. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed; 4. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the Consumer Credit Act 1974. 5.I returned the phone to EE mobile as I was unable to obtain a signal at either my place of work or at home and deemed the service not fit for the purpose it was intended. I informed EE Mobile of this and requested that the contract was terminated early. 6. The amount claimed will likely include an Early Termination Charge amounting to the entire balance of the remaining contract. Ofcom guidance states that any Early Termination Charge that is made up of the entire balance of the remaining contract is unlikely to be fair as it fails to take into account the fact that the provider no longer has to provide and pay for the service. 7. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. Can anyone help with this at all? Needs to be in today

-

Hi Andy, I think the time has come for a defense. I wonder if you might be able to help me with what to put for the fact that I returned the phone due to a poor signal at home and at work, in addition to the fact that they have not shown any agreement or any other documents for that matter. Although I think they may have produced a bill at one point. Many thanks

-

Hi All, got a letter from Carter. Looks like a standard. I see that the extension should be for 28 days and not as they state 14. Once I have got them to agree to the 28 days how do I let the court know? here is the letter: Dear Mrs XXXX LOWELL PORTFOLIO 1 LTD v XXXXXX CLAIM NO: XXXXX UTSTANDING BALANC~ £XXXX We write further to your letter dated 14 October 2013 requesting disclosure under Part 31 of the Civil Procedure Rules and request for an extension. We confirm the claim form was issued by the Northampton county court Bulk Centre and the Court's protocol was followed when issuing the Claimant's Particulars of Claim. Practice Direction 7C point 1.4 (3A) eliminates the requirement to attach the documents to the Particulars of Claim when they are issued by this Court. We confirm that the Claim will most properly be allocated to the small claims Track as this is a simple contractual matter and Part 31 of the Civil Procedure Rules will therefore not apply. We confirm that we have nevertheless requested documentation from our client and hope to revert to you shortly, although this will not be within seven days. It is the original creditor's policy to issue any agreements on or around the date of the contract and statements throughout the duration of the agreement and, in this regard, we ask you to refer to your own records. We confirm we are agreeable to an extension of 14 days to allow you more time to prepare and file your defence. Please note that we have not yet been informed that you have filed the acknowledgement of service. As you will be aware a Claim was issued in this matter on 2 October 2013. Please respond to the Claim using the Response Pack provided by the Court. You should comply with the deadlines outlined by the Court in order to avoid a Default Judgment being entered against you. We recommend you seek independent legal advice Yours sincerely If anyone can help, ~I would be really appreciative. Do I insist on the 28 days extension and get it in writing and then tell the court? Do I tell the court by email? Any help greatly received:-)

-

Again, thanks Andy To be honest I am pretty bamboozled of how to put the additional points in legal speak. Also, I sent the phone back due to a poor signal rather than it being faulty. I cant afford to get to the point where a judge is deciding based on my defence anyway as I wouldnt risk going that far due to the fear of CCJ. I cant help but feel the only defence I am happy with is 'you dont have the documents/proof' as I cant prove when/if I sent the phone back. Any thoughts on this much appreciated.

-

Thanks very much Andy. Intended defence below: 1. Paragraph 1 is nether admitted or denied with regards to the Defendant entering in to an Agreement referred to in the Particulars of Claim ('the Agreement') the Claimant has yet to disclose any Agreement. 2. Paragraph 1 is denied with regards to the Defendant owing any monies to the Claimant and the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement with the Claimant; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim; 4. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. 5. On the alternative, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the Consumer Credit Act 1974. 6. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief.

-

Issue date 2 Oct POC read: This Claim is for 546.16 the amount due under an agreement between original creditor and the defendant to provide finance and/or services and/or goods. The debt was assigned to/purchased by Lowell Portfolia Limited on 4/3/2011 and noticed served pursuant to the law of property act 1925 Particulars Re Three MobileA/C No ******* And the claimant claims 546.16The claimant also claims interest pursuant to s69 county court act 1984 from 04/3/2011 to date at 8% per annum amounting to 112.76 Much appreciated Andy

-

Thanks. I understand now. Re the defence..... I dont really know. Its not SB. I am unsure if they will have the documents. I guess its a good defence if they dont or dont comply to the CPR. I think that can be my defence then. BUT if I am left with just "I sent the phone back and asked to cancel the contract because the reception was bad" and with no proof - then perhaps not. What do you think Andy?

-

Sure, I would rather settle with them than actually have it go to a hearing. I am only interested in pushing them in the hope they will give up, unless I have a good case. I dont feel that I have a good case based upon my lack of evidence etc . I dont want to risk a CCJ. Hope that makes it clearer. Thanks for your help

-

Thanks Citizen. Do I need to enter that I will be defending yet. I should point out that I do not want to have to go to court or risk a CCJ at all as am close to six years for others. Carters also say that there is £75 of call charges but my recollection of it is that I did not use it. As I said, sadly due to illness at the time, I cant remember a whole lot and dont have copies of anything really

-

Thanks so much for your help Issue date 2 Oct POC read: This Claim is for 546.16 the amount due under an agreement between original creditor and the defendant to provide finance and/or services and/or goods. The debt was assigned to/purchased by Lowell Portfolia Limited on 4/3/2011 and noticed served pursuant to the law of property act 1925 Particulars Re Three Mobile A/C No ******* And the claimant claims 546.16 The claimant also claims interest pursuant to s69 county court act 1984 from 04/3/2011 to date at 8% per annum amounting to 112.76

-

Hi All,I have received a claim form from Bryan Carter for a Lowell debt relating to a Three Mobile account back in 2008. I did have the phone but sent it back as there was no reception. I phoned Three a few times. I did not send the phone back recorded delivery. I may have the odd copy of an old letter to three saying that I didnt want it etc. I may also have a letter to three some years later when they were chasing the debt saying that I dispute the monies is owed as I was not provided with the service I have paid for. I let the contract run for 2 months as a gesture of goodwill.I wrote to Lowells/Bryan Carter by email explaining that the account was in dispute. I also asked them to provide a copy of a signed agreement. They said they didnt need to as I could get all the information from Three and get copies of my Bill. They confirmed the account was first connected to the network on 18th Nov 2008 and that this constitutes acceptance of terms and for this reason they do not have to provide a signed contract etc. I feel that CPR may be of no assistance here if they don’t have to provide anything.Not sure at all how to handle this.Any help greatly appreciated.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.