danscott666

Registered UsersChange your profile picture

-

Posts

33 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

3rd Oct 2014 haven't paid anything since. I can't see when it was defaulted but in my mind it was well before as I started paying small amounts 20 and 30 pounds up until 3rd Oct 2014 but the minimum payment was approx 400 pounds. 3rd Oct 2014 to Mint directly. I agree and I would like to do this. Someone wrote about the SAR letter previously. Could anyone tell me exactly where to locate this please?

-

I paid £20 which in no way could have brought the account up to date. Looks more like a token gesture. I am going to look at all the statements when I can later and see if a default had been already issued which I think it had. I think there would have been a default charge applied to the account maybe £12 or so. The logic makes total sense.

-

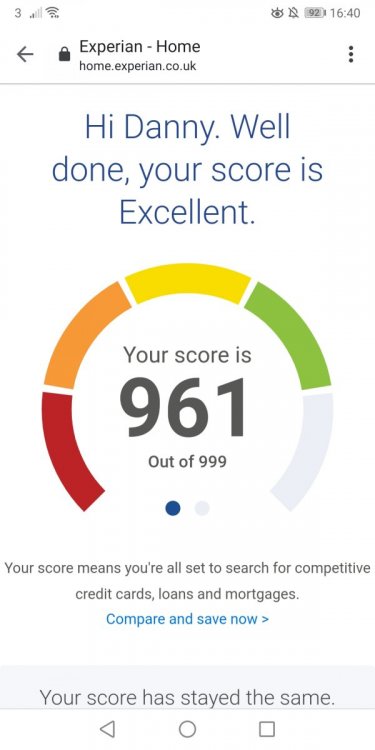

I have just paid £14.99 and I can not see this anywhere. There is something showing for Cabot which again I believe I have paid but I'm not sure which lender that was related to. My credit score is now 961 out of 999. I really don't want ruin it. I am renting now and my chances of getting somewhere to live will be affected if I had to leave this property. If I SAR Mint or is it RBS now? Could they not just add the ticked sheet also? What exactly do I need to ask for?

-

Ok, so I have checked my bank statements and the last payment to Mint was 03 Oct 14. I haven't paid since and haven't acknowledged the debt again in any way. When they called I said I'd need to see proof that the debt existed as I have no knowledge of it. I have checked credit Karma and Clearscore and it just shows 2 credit cards I have settled one with idem and one with capital one. I sold my house in December 14 and thought I'd paid everything off. I am surprised that there is still anything outstanding especially as when I went to buy another house in 2015 one popped up which I paid in full and settled. ( I just don't know who that was with but I paid Northampton County Court) I genuinely thought I had paid all the past debts off and I have a good credit score and have been given plenty of credit since which I have managed responsibility. I am confused as to how this hasn't been paid as all the others have and I've even managed to get a mortgage since. Could I have paid via another debt collection agency and now they ard trying their luck somehow? Is there a way to check all the debts I have had and their status'?

-

Hi, Thank you for the replies. I won't be answering the phone again. I have looked on my credit file and can't see anything. I have been using clearscore and I'm not sure it's very comprehensive. Which checker is best to use and will give me the fullest picture of my previous credit file history? Also I did check back in my accounts and I can't remember exact date now but will check again but I believe it was October nearly 6 years ago that I had last paid. They did also send me all the statements but like I say I'm sure this sheet is with the check box is not true.

-

Hi all, I previously had a credit card with Mint approx 2008 Oct. I came in to some financial difficulties at the time and set up a payment plan. I then tried an unenforceable credit agreement this is all 11 years ago. I stopped making payments 5 years and 10 months from when Cabot called me. So it will be 6 years in October. I requested to see the original agreement, what they have provided is a generic copy of terms etc and an electronically ticked box. Well I DID NOT have a computer then and phones weren't what they are today. I DID originally sign paperwork and post it back as was normal then. This new paperwork is totally fabricated. Where do I stand with this? I don't want to end up with a ccj, I am concerned as I am currently not working again! Any help much appreciated.

-

To be fair I'm not smart enough not to near them. I don't really understand all the technicalities of the financial world. I don't really need the grief and I got myself in this mess trying to follow unenforceable cca in 2009 so now I must face the music. The 2 defaulted accounts are cduk and rbs, I realise whatever I do makes no difference to the default, but with idem they didn't default me which means the account isn't default and will still be reported as 6 until I pay it off and close it, then 6 years from then it will remain on my file. Otherwise I will not get any credit ever again. I did an income and expenditure form which actually shows my out goings are virtually exactly the same as my incoming. I sent them proof of earnings and with the form and still no joy. Would anyone advise I stop paying the defaulted debts and hope they are then grateful for any offer I send in? I feel I have to pay the idem as that is showing I've been paying Ok since April 2012 nearly 2 years despite its worst status of 6 in 2010. I was thinking about paying the full amount to idem so it shows Ok for 2 years then fully satisfied, and hoping in another 3 years it won't be looked too unfavourably by any potential lender. Thanks. Danny.

-

You may be right, but I can't so what can I do now? Thanks.

-

Hi all, i have 3 accounts with MINT, IDEM and CDUK. MINT AND CDUK accounts are in DEFAULT since DEc 2008 and the IDEM account was at worst 6 then arrangement now OK since april 2012. I have made offers of 70% of the totals of each amount to all 3 companies and all have declined my offer saying they would prefer i stayed on a 0% payment plan which works out i will be still paying the full amount over the next 5-7 years. can anyone advise me as to why they are not interested in my offers and how i might be able to change their mind? the total outstanding amount between the 3 is £4500 roughly and i have offered £3150 between the 3, i would have thought they would have snapped my hand off??? regards Dan.

-

Its with rbs but it us not in default and if I stop paying now they will put it in default. Then I have 6 years to wait to get it off.

-

If I partially settle the one which is a 6 on my credit file how long will that 6 and the partial settlement show on my file?

-

Hi again all, just a quick update. I have spent this day trying to settle 3 outstanding accounts and have offered 70% of what is actually owed. They have all refused my offers and I have had to do expenditure forms and affordability etc. They said as I am paying another credit card which isn't in arrears I can afford to pay them more and pay this one less. Also I thought all 3 were in default but one of them is 6 and when I offered on this one they said you are not in default just keep paying or we will put you in default and it will be 6 years from now, ie no mortgage for me in 3 years from now. They said keep paying monthly and they won't take an offer. Any advice for my new situation? Many thanks again.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.