Poster

Registered UsersChange your profile picture

-

Posts

69 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Poster

-

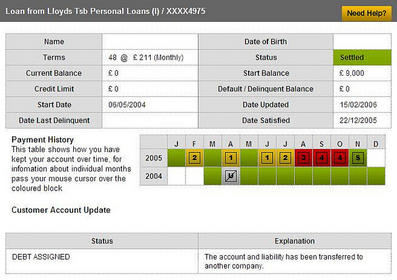

Hi, I've so far sent 3 PPI claims to HSBC and I am waiting for their response. I was a member of staff there at the time but I worked in Fraud Detection so I don't think they can expect me to know all about PPI and use that against me. My question relates to a Lloyds loan I used to have. The Loan was for £9000. I couldn't afford the repayments and it was passed to a debt collector. I SAR'd them and CCA'd the debt collector so it's now all in dispute and I haven't heard from them in months. The SAR report found nothing so I'm not sure if I took PPI or not. My credit report shows the loan was for £9000 and my repayments were £211 over 48 months. This adds up to £10128. Doe that total amount include PPI or is it just the interest? If it was PPI, I will be making a claim to them as well. Thanks

-

Brilliant! Thank you so much for helping and baring with me!

-

Don't think so. All I have done is send an SAR to Lloyds and a CCA request to CCS. Both unable to produce the credit agreement. More than that I have not done. I cannot really dispute the debt as I have been paying it for years already.

-

Sorry for all these questions, just trying to get my head around it. So I send an "Account in Dispute" letter to Moorcroft saying the account is in dispute with Lloyds but I haven't actually declared the account in dispute with Lloyds or CCS yet. Don't I need to officially let Lloyds or CCS know it's in dispute first? All I have done is stop repayments.

-

Sorry another question... Is the account in dispute the CCS or with Lloyds?

-

I just thought that was a trick into getting me to pay. Ok, so I send Moorcroft the account in dispute letter and nothing else? Do I write to CCS since they have chased me again this week or send anything to Lloyds?

-

Would Lloyds accept a debt back that (appears to be) sold to CCS? They marked the credit report as "settled" in 2005 so I assumed that's what had happened. I got the letter from Moorcroft last week but a text from CCS yesterday so I'm confused who is actually dealing with the debt now.

-

I think its the account in dispute letter isnt it?

-

I'll send Moorcroft a letter then saying that it is already in dispute. Do I need to send CCS a letter though letting them know why I'm no longer paying? I just stopped paying them when I found out Lloyds didn't have a CCA.

-

Now attached the full pictures (hopefully)

-

-

Sorry, trying to resolve that now.

-

Attached are the SAR reply letter from Lloyds, the last letter I got from CCS and the first and only letter so far from Moorcroft. I realised that I haven't actually sent CCS a letter saying that as they don't have the CCA, the account is in dispute. Could someone tell me which template to use please? I'm not denying knowledge of the debt to them though as I have been paying them for 5 years. I will send the letter previously mentioned on this thread to Moorcroft as well.

-

I did, yes. I can scan in their reply cover letter tonight. They did mention that they were unable to locate a CCA though.

-

Yes I SAR'd Lloyds. They just sent me a statement showing my monthly payments to CCS (which I thought was weird as I was under the impression CCS owned the debt and Lloyds wouldn't have a record of the payments) and a record of CCS's details as well as my previous addresses. They had nothing else. As far as I can see, I had no charges and I don't think PPI was ever taken out for this loan. I could be wrong though. it was taken out quite a long time ago.

-

I guess it's just a case of repeating this over and over until CCS give up as it looks like Lloyds washed their hands of this a long time ago.

-

If CCS send me a new letter about this, shall I send the harrassment letter as the account is still in dispute. They haven't actually acknowledged my last letter stating that there is no CCA.

-

I got a text message from CCS today regarding the debt asking me to make a payment. I'm confused though. How can CCS still be chasing the debt it Moorcroft are as well. Unless Moorcroft passed the debt back as the account is still in dispute.

-

So it is removed 6 years after the date of the default, not the date of the last payment.

-

Sorry if this is obvious. I know a credit entry drops off your account after 6 years but when does the 6 years start? Does it start from the default date, last payment date or settled? (the settled date I have is actually from when Lloyds sold the debt to a debt collector. I just want to know when the debt will/should drop off. Thanks

-

Thanks. CCS managed this debt for 5 years and never made an entry at all so I think I should be ok. I will send them the letter above once I get their first letter so I can use reference numbers, etc.

-

Here is a copy of what the entry looks like: So they shouldn't be able to do anything to this now should they? This is all I'm worried about.

-

Can they change the status from settled to default now? It's not been 6 years since the settled status was applied to the entry. I'm just wondering if I should tag moorcraft along for a few months until the entry has been removed and then tell them it's still in dispute with CCS.

-

Can I just ask what happens if Moorcraft pass the debt back? Will it go back to CCS or Lloyds? The reason I ask is because Lloyds have actually sold the debt so it doesn't belong to them anymore. They have marked my credit file as satisfied and I want the entry to drop off in Decemeber. I'm worried that if it does get passed back to Lloyds, they will update it. Even though I was making payments to the DCA, none of these payments have been recorded on my credit record.

-

Good news! Thank you. I will await their first letter then so I know who to reply to.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.