Poster

Registered UsersChange your profile picture

-

Posts

69 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Poster

-

There is no CCA agreement. I asked Lloyds for it years ago when I SAR'd them so it's been in dispute ever since. They are ringing my actual work phone (and my mobile whilst at work). I assume Moorcraft just sold them this debt cheap as they were having no luck with me.

-

Only the "in dispute" letter so far. 30% reduction if I pay within a week, 20% within 2 and 10% within 3 (I think).

-

It's 1st credit now, and no I haven't yet. They call my phone daily and send me an offer letter every week. Only called my work twice before.

-

Fast forward 2 years and now I have 1st Credit on my case. Sent them the same letter I sent Moorcraft so we will see what happens. They are calling my work now too though which is quite annoying. Shame I still have 3 years before it's SB'ed.

-

Yep plus 8% interest and the original interest. They deducted an amount which was a claim my mum used the ppi for for 6 weeks while she was off work ill.

-

And after 18 months wait and lots of fighting, HSBC have finally caved and sent me the offer letter!

-

Back to this a year later... I took things further with the FOB and they agreed with us rather than HSBC and wrote to HSBC telling them to pay my Mum or respond by the 16th of October (2012) if they disagreed with the FOBs decision. Well that deadline has now passed by nearly a month and still no response. I have called the FOB twice and they have heard nothing either. What's the next step? Do I chase HSBC directly? Surely they are in breach by not responding in the time period set by the FOB? Thanks

-

Now got Nelson Guest chasing on behalf of Westcot. I sent Westcot the account in dispute letter the other day though so I'll wait and see what happens.

-

I now have Westcot chasing me. Are they part of moorcroft or have they sold it on?

-

Thanks for the advice.

-

Just a little update.... Just got a letter from "Midas" which I know is part of Moorcraft and another tactic but aren't they now harassing me as they know the debt is in dispute with Lloyds. They sent me another "statement" which appears to be on dodgy Lloyds headed paper (another tactic?!). Do I carry on ignoring them or write them a reminder that the debt is still in dispute and that if they contact me again I will report them for harassment?

-

Hi, I have had a default on my credit file for the last 5 and a half years. I was due to drop off in May and I have been counting down the days. I checked my Equifax report on Friday and the entry seems to have already been removed. I have checked every day since and it's still not on there. I even paid for a credit score report and it showed a good score as I have no defaults on my report. Does this happen often or is there some sort of glitch which means it will reappear again in the next few days? I had another settled default removed at the same time which was due to be removed. Could they have removed the second one by mistake?

-

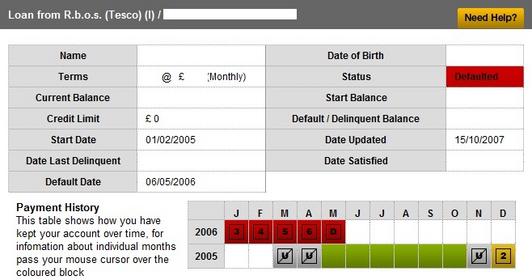

Page 1 has a snapshot of what my credit entry showed at the time it was on my credit file.

-

The credit entry showed that Lloyds had marked it as settled but wrote a note that it had been passed to a DCA (which I thought was weird as i would have expected it to have a default status. The entry has dropped off as the settled status was added more than 6 years ago. I haven't made a payment since June 2011 to CCS. CCS have stopped contacting me. Moorcraft contacted me a few weeks after I told CCS the debt was in dispute. I wrote to Moorcraft saying it was in dispute and haven't heard from them since August until yesterday. Loan was for £10k I think. Paid £55 a month to CCS. Outstanding balance according to Moorcraft is £4400. My main concern is that they can't knock on the door and demand payment. I thought it was all sorted as they had no CCA and that I wouldn't hear from them again.

-

Last payment was made in June 2011. I was paying £55 a month to CCS credit.

-

Ok thanks. I didn't know that. I assume they can't get bailiffs in either without a CCA. The entry has dropped off my account now.

-

Thanks. I'll hold tight and see what happens.

-

I thought that chasing me again while it's still in dispute meant it was now harassment? Even if they send me an offer letter, I'm still not paying them.

-

Update: I got a letter after the last post dated 17/8/2011 saying that they had put the account on hold whilst they investigated. Fast forward to today and I get a new letter: "I write in response to your recent query in relation to the above account and can confirm that we have been in contact with Lloyds and they have advised that a copy application has been ordered on several occasions however, a copy application is not available. I can confirm that I have placed this account on hold for 2 weeks and request you make contact with our call centre to discuss a repayment proposal...." Are they allowed to do this?! In my opinion the account is still in dispute as Lloyds still haven't provided me with the CCA. I haven't made a payment since July 2011 (which was paid to a completely different DCA. Thanks

-

I am collecting the letter from her on Sunday to have a better look. The main issue here (or maybe not) is that she was employed by the HSBC at the time. I can't imagine all of their staff HAVE to be clued up on loan and ppi agreements though. She tried to cancel the PPI 6 months later and was told a new loan would need to be applied for without PPI which got her a bit scared I think so she didn't do it.

-

I'm actually doing it on behalf of my Mum. It was added to the loan as a lump sum at the start of the loan and taken out the same day. She said she was lead to believe her application would fail without PPI being selected which is why she ticked the box.

-

Got my letter today stating that HSBC will not be paying out because they have the original copy of my "tick" next to PPI. I tried to cancel the PPI after 6 months and they told me I would have to apply for a new loan which I didn't want to do in case I failed the credit check. They told me in the letter that what I was told verbally didn't matter as this was not proceedure. What can I do? (if anything?!)

-

HSBC Payment Reward after PPI Refund

Poster replied to Little_Mouse's topic in Payment Protection Insurance (PPI)

I have a similar loan I have put a claim in for. They told me I would get a £500 cash back amount if the loan runs it's course. If my claim is successful, I may just let the loan run until the end. It would be paid off in April anyway so not too long to wait.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.