asteroid

Registered UsersChange your profile picture

-

Posts

13 -

Joined

-

Last visited

Reputation

1 Neutral-

Barclaycard : Endless BC Saga- Reply help please..

asteroid replied to otisan's topic in Barclaycard

Hi Slick132, My wife received exactly the same letter as Otisan received (T&C and without signature / signature box)after 3 months of requesting the True Copy of CCA. On the first post of this thread showing the 1st page of BC statement which states 2) There may be omitted from any such copy - (b) Any signature box, signature or date of signature ... Does it mean if the BC have fullfilled their obligation under 1974 cca? even by sending "reconstituted copy" WITHOUT SIGNATURES ? My wife received the same letter T&C from BC in Oct.10 bearing her name and the address (abroad address, NOT the UK address) and my wife again sent a letter to BC asking to send CCA with her Signature. After that never received a letter from BC and then in Jan.11 we were bombarded with calls on mobile and landline from Mercers. My wife never gave her name or dob to them and kept asking to write a letter instead of calls and then hang up phone. Mercers never wrote any letters. From now around 3 weeks calls stopped from Mercers and today received a call from SRJ management and again my wife did not give any info and passed the phone to me, I told the guy he is not paying the bill for my landline and we never gave him the permission to call our landline and in future write a letter instead of phone calls. Would you please explain and enlighten the BC statement i mentioned above. Can the BC and / or debt recovery (SRJ) can take my wife to court or take out CCJ on my wife even without the signatures on the CCA. How can one (debtor) be sure of the True copy of CCA sent without signatures is the same at the time of opening up the account ? Thanks a lot in advance. -

Please Advice !!! Un-Authorized access to account by BarclayCard

asteroid replied to asteroid's topic in Barclaycard

Hello again Slick, there are 2 set of letters received, in A4 envalope contains 2 letters both from Northampton, one letter dated 21st Oct. which seems to be the responce to my request for CCA copy (they sent T&C) and the 2nd letter dated 22nd Oct. is the explainations and responce to complaint i made. The 2nd letter is in a small envalope dated 21st Oct. and is from BC, PO Box 9131, 51 Saffron Rd. Leicester LE18 9DE. In this letter all it says please see the T&C enclosed with this letter. This T&C has NO name or address of my wife on it. Very confusing for us. Would you please clarify my quary which i made in my last post. I have read the post #4 in a letter. what I would like to know is a) what is the true copy called ? b) what I understand that the true copy NOT necessarily should contain signature of the debtor when a true copy is requested, in other words the signature can be omitted (wiped off) intentionally by the creditor. IS THAT RIGHT ? If this is right then how the debtor would know the true copy they received is infact the same they were presented at the time of opening the acct. I will be waiting for your reply. Thanks so much for advice and help. -

Please Advice !!! Un-Authorized access to account by BarclayCard

asteroid replied to asteroid's topic in Barclaycard

Hello Slick, we have received reply from the BC and they have sent Terms & Conditions. The heading is "BarclayCard Conditions" and on the next line in small prints it has my wife's name and the address of my wife's parents Abroad. My wife been in UK since 2005 and her non-UK passport had her parents address. BC has pointed out 2 statements in their reply (Ref: Cancellation Notices & copies of Documents) Regulations 1983 "CNC Regulations". This seems to be important so I need to undersatnd in depth as i have no knowledge in these things. "(1) Subject to the following provisions of these Regulations, every copy of an executed agreement, security instrument or other document referred to in the Act and delivered or sent to debtor, hirer or surety and any provision of the Act should be a true copy thereof. (2) There maybe omitted from any such copy- [.....] (b) Any signature box, signature or date of signature ...". I have read the post #4 in a letter. what I would like to know is a) what is the true copy called ? b) what I understand that the true copy NOT necessarily should contain signature of the debtor when a true copy is requested, in other words the signature can be omitted (wiped off) intentionally by the creditor. IS THAT RIGHT ? If this is right then how the debtor would know the true copy they received is infact the same they were presented at the time of opening the acct. I would appreciate if you clarify my points and then I will be in better understanding to send another letter to BC. BC refused to refund the amount they took out of Barclay Bank Acct. -

Please Advice !!! Un-Authorized access to account by BarclayCard

asteroid replied to asteroid's topic in Barclaycard

Hi Slick, been to the bank today and the manager put his hands up saying he can not do anything about this matter, it has to be delt by the Head Office. Anyway I have sent recorded delivery and also e-mailed to complaints in HO. Now waiting to get reply from HO and will update as soon as I have a reply from them but dont know when i will get reply. -

Please Advice !!! Un-Authorized access to account by BarclayCard

asteroid replied to asteroid's topic in Barclaycard

Hi Slick, Thank you so much for the reply and advice. I have written all in my initial message about requesting CCA, Yes i did write to BarclayCard requesting CCA with £1 cheque. Then again on 01/09/10 as a reminder. Both times the request was sent as recorded delivery and were accepted (checked on royal mail site). Just now I was editing the letter from the link you provided and planing to hand in personally to the branch and obtain reciept proof. will let you know the outcome after the bank visit. Thanks again -

Please Advice !!! Un-Authorized access to account by BarclayCard

asteroid replied to asteroid's topic in Barclaycard

Thank you all for the advice, for surely my wife will transfere to other bank. But in the mean time I will write to BB HQ to complaint and asking to refund the £47/-. I checked the statements but did not fing Barclay Bank HQ address. Would you be able to pass me the address ? Thank you -

Hello guys, I will get direct to the point. In the past my wife went over the agreed limit on Visa BarclayCard. Agreed limit was £250/- and she went up to £420/-. Due to financial hardship she agreed to pay £6/- pm direct to BarclayCard to bring the account to normal. A direct debit was setup from her barclay bank account to pay toward the Visa BarclayCard. It carried on nearly a year like this and after reading some coments on this site she sent a recorded delivery letter with £1/- check on 16th July 10 asking BarclayCard to provide a true copy of Comsumer Credit Act. BarclayCard never replied, so another recorded letter was sent to them on 1st Sept. as a reminder. Before the 1st Sept. my wife cancelled the direct debit to BarclayCard just because they did not reply and not provided the copy of CCA within 28 days of the first letter. In this reminder she also informed them of stopping the direct dedit and will start paying them once they have provided her with the copy of CCA. Near the end of Sept. she recieved a phone call from BarclayCard demanding to pay the balance. she tried to expalin the operator that she will start paying once she receive CCA. After bit of argument with the operator my wife cut the call. Today she recieved a Barclay Bank statement showing £47/- have been debited by BarclayCard. A 2nd letter from BarclayCard in which stated "as your acct. was in arrears we have carried out our legal right to set off the outstanding arrears owing to BarclayCard from your Barclay Bank Account". Bottom of the letter in small prints written " as your other account is also with Barclay Bank PLC we are able to apply funds from this account to repay the debt owed on your BarclayCard". We want to know if BarclayCard allowed to take this action without my wife's authorization, and what can she do to get £47/- back. she will be going to bank to ask them why her account has been debited without her authorization. Can any of you advise what other actions can be taken against BarclayCard and Barclay Bank ?

-

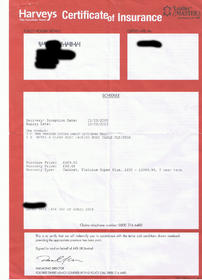

Hello Guys, we just found ourselves in problem with the insurance firm. The story is we bought a Glass table from Harveys in April 2008 and with it bought the insurance too for 5 yrs (please see the attached cert front and back). Nearly 2 wks a go I was trying to cover the hole in the ceiling and by doing so the lader wobbled and during this the hamer dropped on the table which chipped the glass size of 10 pence and few very small cracks around it. I phoned the Insurance firm (Leather Master) and explained the incident. They arranged for the technician to visit on 23rd Sept. On 22nd Sept. while i was out, my wife was at home with our 2yr old son. My wife was busy in kitchen and my son somehow managed to pull out adjustable spanner and hit on the glass table which caused the glass into pieces. Again I reported to insurance firm (Leather Master). Their technician came on 23rd Sept. and asked me the cause of glass break. I told him the whole lot and the technician put the report as Accidental Damage. Today I received a letter from Leather Master stating they are refusing to go ahead with claim because in their policy (Terms & Conditions) it states a damage caused by childern is not covered and is excluded. I read the T&C and did not find any statement in Exclusions regarding children. I phoned the insurance firm and they pointed out under "Exclusions" (para 3.3) 'any damage, soiling or staining caused' (sub Para) 'to the insured item(s) arising from negligence by you' I told the leather master operator that none of the statements imply to children but only to the policy holder. That stupid operator said that you people neglected your child and due to this negligence the claim is refused. I am fuming with her statement and want to take them to court, but unfortunately my financial situations dont allow me to, plus same reason I can not afford solicitor's fee as I am in a part time job. I would be greatful for and advice and help by you guys.

-

Hello kurvaface thanks for replying, what is the prescribed time for the creditors ?

-

Thank you guys for the advice. I require some info on similar matter. As i mentioned in my 1st post that my wife ran some bills which I could not afford to carry on paying due to change in my employment from full time to part time. Creditors started demanding repayments which also included threats if we dont cough up money. I, on behalf of my wife wrote to 7 creditors with budget sheet given by CAB offering each creditor £2 a month which they accepted as they had no choice and I started paying them direct debit. My query is that we did NOT ask any of the creditors or their agents to provide a copy of Credit Agreement Form signed by my wife. Can we ask them to provide a copy of signed credit agreement form now as we are paying them £2/- a month since Feb.09. Are the creditors still under obligation to provide these forms if asked ? and what difference would it make if any of the creditors can not provide a signed agreement form, would we have right to stop paying them ? I would appreciate your replies to my queries. Thank you

-

Thank you Spamheed, i do feel like sending them a photocopied fiver. Thanks again for your advice and reply.

-

Hello people, I am here to get some advice and to know what would / should be our next step. My wife had a New Look card and ran the bill up to £100 which is not a lot but then suddenly we went in to hardship, i work as part time, she unemployed and have 3 kids under 8yrs. My wife or I could not pay as she ran some huge bills on other cards for which I end up paying min amount towards those cards. New Look had pass this matter to IKANO who demanded us to pay. i searched in to this forum and then wrote a letter to IKANO asking to provide us as a proof the copy of credit agreement form on which my wife signed this agreement. I sent as recorded delivery with £1.00 Credit agreement charges. After 4 months received a reply from IKANO stating that "after searching their records they are unable to provide a copy of signed agreement form". instead they sent a 'blank agreement form' saying the form my wife signed is similar to this form. Then the letter says that the account has been passed on to the Debt Collection Agency ( no name given of any debt collectors) on their behalf, please contact them to arrange for repayments. Could someone advice us what should be our next step ? are we still liable to pay ? can we refuse to pay just because "there is no signed credit agreement" ? Please advice. Thank you

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.