-

Posts

366 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by eggy12

-

Yes got the claim form and ignored it as no money at the time to even try to sort it out. Had many coming through at the time. Meters fitted, sorted electric out but did not use gas as only heating affected so just went cold until I scraped enough to buy a fuel burner. Love it and won't be using central heating ever again. Electric shower so hot water is all good. I'm still with npower so hopefully will have a bargaining chip, get them off my back or I'm off, at least for electric as owe nothing !

-

Exactly. Not sure if they have to leave something saying they have been like they used too before rule change, I would have thought so but have not been able to familiarise myself with new rules as yet. Last dealings with a bailiff sending same letter you provided me with resulted with a un qualified person putting a I've visited letter through letter box. With an outstanding ccj with water company at least I know what direction to go in now thanks to your advice. Will update soon and thank you. My next move is to get in touch with npower regarding this.

-

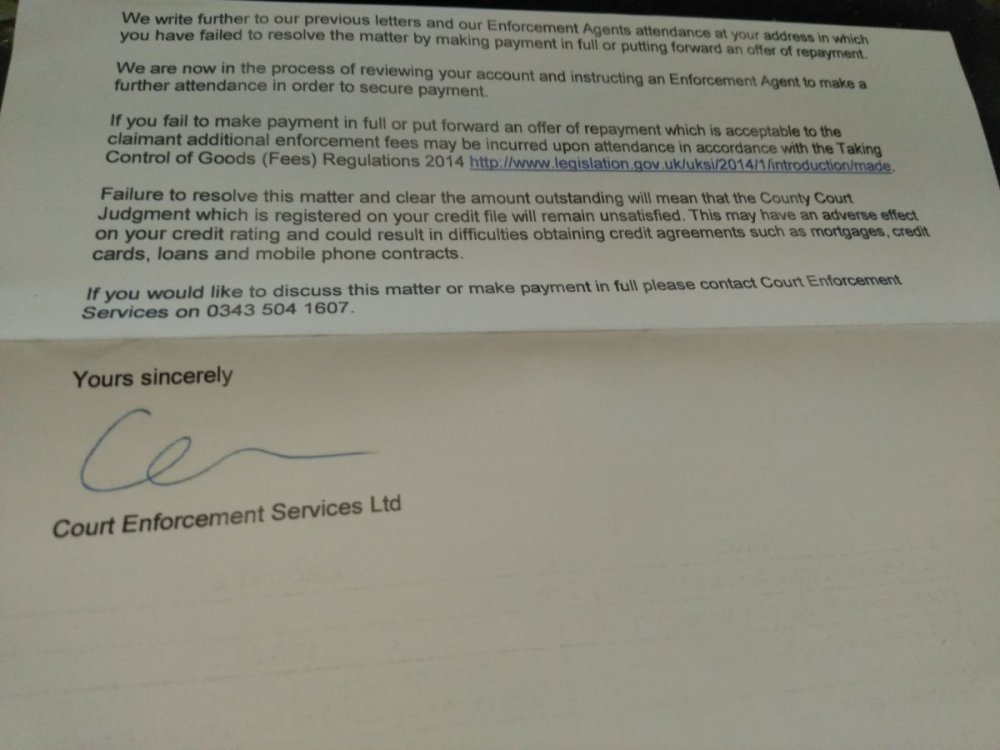

Hi, I thought I had everything under control but seems not. Got into debt with Npower, they got a CCJ and next im dealing with CES (Court Enforcement Services). I made an agreement to pay £60 per month and have done so last couple of years each month but not on a date set. If it got a bit late they text me saying so and i paid but never missed a month. I knew I was close to paying it off so emailed them asking what is left to pay about 4 weeks ago. They said about £1500 when I knew it should be around £400ish. They informed me it stands at £1500 as charges have been added to the account. Ive never recieved any letters and no one has visited my home when im in and nothing has ever been left. Today I receive a letter stating High Court Writ of control saying ive failed to resolve the matter by paying in full or agreeing a controlled goods agreement outlining a repayment plan during our enforcement agents attendance ! No one has been here and ive certainly not spoke to anyone, now they say they are preparing to send someone to take control of my goods. Where do I stand now, do I have to pay them there £1000 ish charges they have added ? Thank you in advance for any assistance in this matter This is what they sent me Letter received Eggy12

-

Originally with n/rock the ccj was for £60 a month with no charging order, arrow went for it after buying debt and i offered in court at £1 a month, that failed and they got charging order. I've paid nothing to arrow at all. No evidence as was just a phone call, my first port of call is to ring them today and see if I can get a payment plan in place. Eggy

-

Hi, Got paper work from Court today. Sum is around £12k. Long story short, It was a N/rock loan unsecured, they sold it on then arrow bought it and got a charging order. That was a good few years ago. A few weeks after they got the order they sent me paper work stating as such and wanted it paying. I rang them, verbally agreed on a minimal payment and I asked for a sort code and account number to pay. I got nothing from them and as the months rolled by I just ignored it. As things were at the time I would not have been able to keep up with payments anyway but now that things are much brighter Im confident I can offer and keep up payments. How do I go from here.. Ive only 3 years left to pay on the mortgage and would hate to have this upon me now but yes its my fault and would the court take into circumstance I can pay this off and not force the sale of the house. I live here on my own ! Regards Eggy12

-

Birmingham midshires Eviction **still in house, all sorted **

eggy12 replied to eggy12's topic in Home Repossessions

Just an update to this thread, things have been going quite smooth and paying up as promised I found out that BM upped there SVR Sept last year. I thought I was paying off £100 per month arrears but it turns out its just £12 after their rate rise. Only have 3 years left on mortgage and although I know I more than likely wont get my home repossessed as at least ive made monthly payments last couple of years and a bit extra could it be possible to move my mortgage to elsewhere with big arrears ? Dont want to rock the boat by getting all the charges back just yet but would do if I could move. ? Eggy12 -

Birmingham midshires Eviction **still in house, all sorted **

eggy12 replied to eggy12's topic in Home Repossessions

Got a letter from BM today, says We did not send you the Notice of default sum, that we should have according to the consumer credit act blah blah blah Im sorry this has happened and we have now enclosed a notice of default sums which includes all the dates when you were charged a default sum. Loads of £35 charges totalling a snatch over £500 and this is just my second mortgage/secured personal loan.. I dread to see what my main mortgage charges compiles of, this one dates back to 2009. Is this something I can take advantage of as have arrears on both ? Regards Eggy12 -

Emailed them asking after I pay this amount will I be up to date with nothing left to pay, received this reply... Yes that’s correct. You just be then paying your current bill which you are already paying anyway monthly All I ever paid was the c/tax plus summons fee nothing more so however they worked that out I'm unsure and wont be asking..

-

After asking what the bill was for, they sent me this... The debt relates to the 2013/2014 bill which was originally for £836.23. Due to no payments being made to this amount on 16th May 2013 you were summonsed which added £130.00 costs to your account. Obtaining a Liability Order from the court enabled us to instruct our Enforcement Agents to act on our behalf. As the debt was not paid in full (£396.23 remaining) on 29th January 2015 it was passed to Jacobs Enforcement Agents who added their compliance fee of £75.00 and then the enforcement fee of £235.00 totalling £310.00. Total amount now due to Jacobs £706.23. On 24th April 2015 you did make a payment to us for £396.23 to clear the amount remaining. However as your case was with Jacobs we had to pay them a proportion of their fees out of this amount totalling £147.44. This is the balance that is due to us from 2013/2014. Regards Not sure what the proportion means but I figure it saves me paying all the bailiff charges

-

This is a bit more confusing than I thought.. Sept through October I made payments in 2013. From Oct 2013 through to 15 April 2014 I was on jsa and it being paid for me. On 24 April I made a payment of £416. Give me a little time to sort this out, there was one year I earn just below 6k and did not claim for low earnings.. Ok lets say I made the full owing payment on 24 April 2014

-

So this coming into affect on 6th April 2014 surly the LO issued for the amount on 6/6/13 has no effect to this matter, this is I thinking it only means " from 6/4/14 and after" has an effect .. That aside my concern is that pre date I paid the LO off in full and left the bailiff to chase there money. Can they now restart chasing the LO adding the new rule charges from something I paid off previously.. That is what the council are threatening ?

-

Got a letter a few days ago saying an outstanding LO from 2013 is still unpaid from the council. Now ive always known ive owed bailiff charges for this amount but refused to pay them but thats a different story Ive just had a quick look online at accounts and the likes on the council website and it seems the council have paid the bailiffs out of the money i paid online to the council to clear the council tax arrears (in full) on the councils website at the time eg clear the LO and worry about what I owe the baliffs another time. It showed only last year I was up to date with my council tax but owed bailiff charges for this amount and now they have what seems messed with figures to make out its still an LO issue Bit stuck on this one so any advice would be much help when I can spend a day or two collecting my own data Thanks Eggy12

-

Is this what its all came down to.. Ppl jumping into a thread because they love to tell others where there wrong because they know better.. Any site team here have my permission to delete this thread, if I want do gooders and gossipers I would ask

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.