-

Posts

1,262 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by Hadituptohere

-

-

Hi all

as posted in other threads I had an account with a Providian CC that stared in 2000 that has been sold to cabot who have entered a default and interest for the past five and a half years, ive cca'd and S.A.R - (Subject Access Request)'d cabot and noted the correspondence between cabot and monument. I got nowhere with cabot (and still playing pass the letter with them) but noticed that all Monument have is a reply card as a CCA, so knowing that the ccard has quite a few charges on and found no default notice decided to SAR monument, I got a reply from Barclaycard with a list of charges that only went back 6 years from the request date so i sent a reminder of what I had requested in the SAR and reminded them of their breach of the Data Protection Act, still had no reply so sent a LBA back at the begining of August (to monument), Ive had no reply to that either so last week sent an amended LBA to both Monument and Barclaycard along with copies of the previous SAR, reminder and LBA for their ease.

They have till tomorrow to respond so what im looking for is advise as to which way to go now with regard to the N1 for enforcement also can I request the judge to remove the default thats being processed?

thanks in advance

Hadituptohere

-

I see Mr Hancock is rolling out the same template letters on quite a regular rate, I dont think anyones getting anywhere with experian until some of the pending court cases of other members conclude

Hadituptohere

-

Had a letter today informing me that CMS in Telford is dealing with my S10-12 notice and that theyll be in touch within 10 days. Still havent had a responce to my LBA or SAR reminder for the missing default notice or legal action papers, they've got till tomorrow to respond. Any advise guys??

Hadituptohere

-

I think so, I had noticed that cabot are slowing down with the silly threats by the lack of help requested in the forums. Going back to your SAR on the original lender, if they cant provide a fully excecuted CCA, default Notice or notice of assignment then they shouldnt have passed it to cabot and cabot dont have the right to default your credit file, thats why ive gone back to the OL and my on coming N1 then ill gun for cabot and experian for processing after ive pointed out my dispute

Hadituptohere

-

Hi mel

Im in a similar position with cabot but ive had reply's to my SAR's for my two so called accounts from cabot all they sent were reply cards, statements, T+C's that showed 12.00 charges although the charges on the statements were 18.00 + 20.00 so the T+C's werent applicable to me, and loads of generic rubbish with representation of letter sent 9th Jan 2000and never across the top, i sent all the same stuff as yourself, S10 +12 notices etc to no avail, what I have done is to SAR the Original Lenders who just sent a list of charges that only went back six years for one and no responce from the other, so ive sent reminders for the none compliance of the Data Protection Act (SAR) and now moved on to Letter Before Action warnings, they now have 2 more days to respond, if they dont then ill issue N1's to the County Courts for enforcement knowing theres no Default Notices for either account and I would use this as evidence in court action agianst the Original Lender, cabot and experian.

Hope that helps a little

Hadituptohere

-

Sent a letter asking cap one to check the balance of the card, to prove the 70-80.00 overlimit amount and produce a statement otherwise we expect the full payment, aslo pointed out to them that unless we recieve the payment in full there will be no contact with the court informing them we have settled. Hope ive done the right thing??????

Hadituptohere

-

Well its kind of good news as my OH has had an offer from cap one its somewhere near so were considering it but theres a few questions I have about there offer, heres it is

Firstly are ms Renshaws figures right??

and secondly my OH's card isnt 80.00 over her limit which makes me question this offer, I understand that is our decision as to accept or not.

Nearly forgot, the amont claimed was 879.27 with 65.00 fees

Thanks Guys

Hadituptohere

-

-

Someone must be looking out for you hey, thats some result

Hadituptohere

-

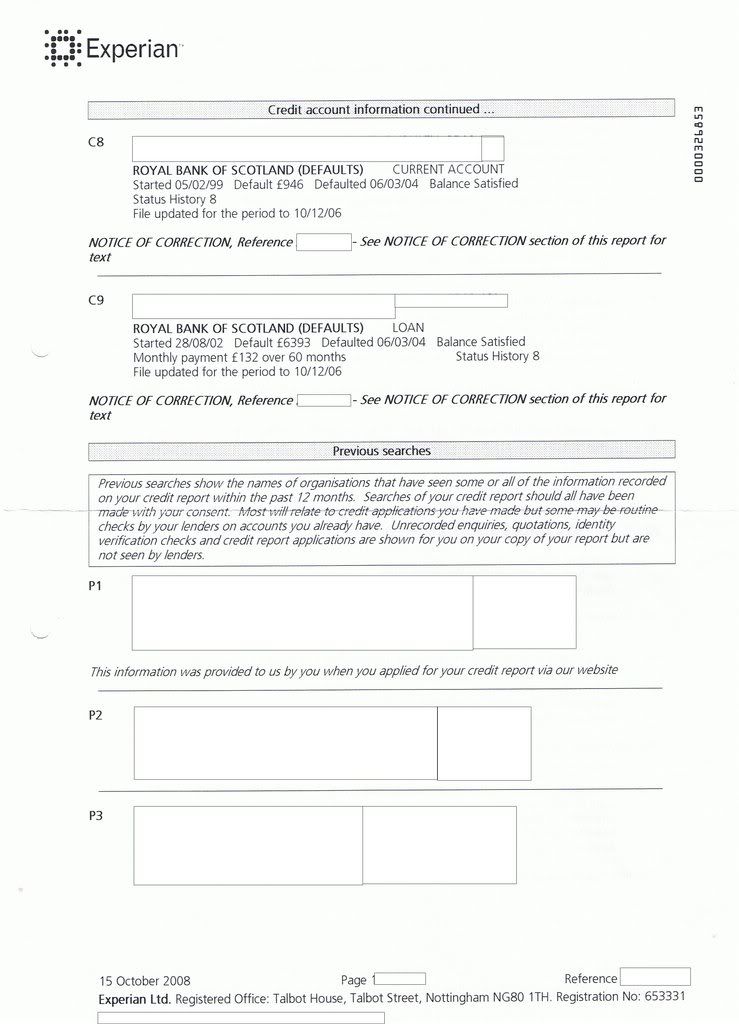

the notice of correction doesnt even apply to the RBS accounts its one I asked to be removed from the cabot account and replaced by a dispute marker

Hadituptohere

-

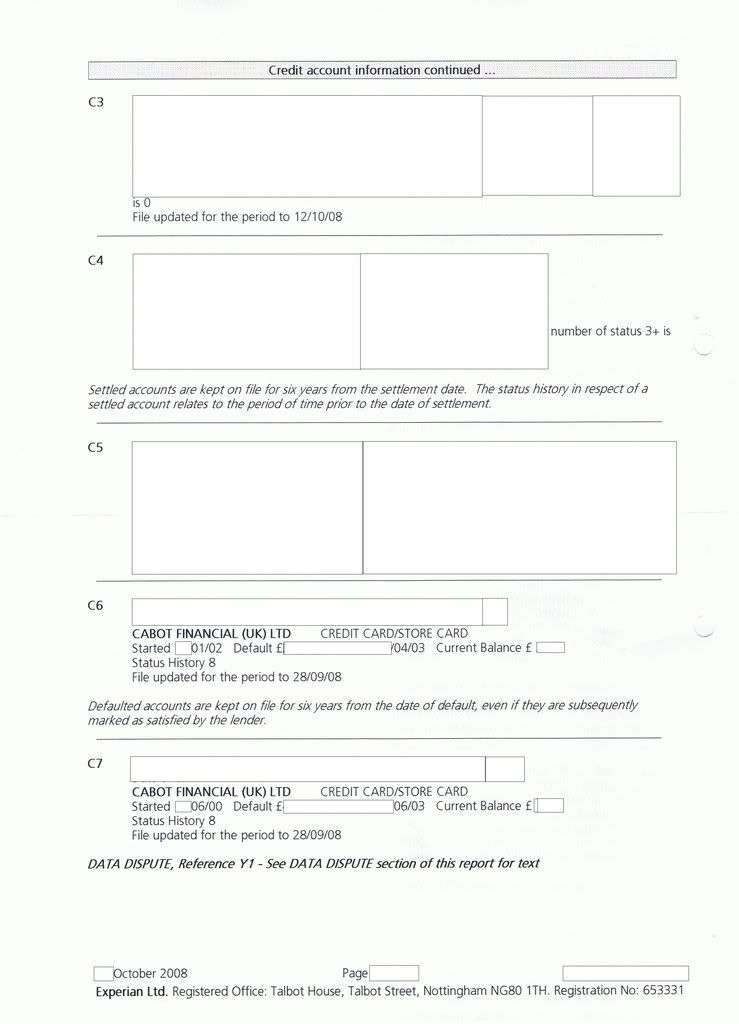

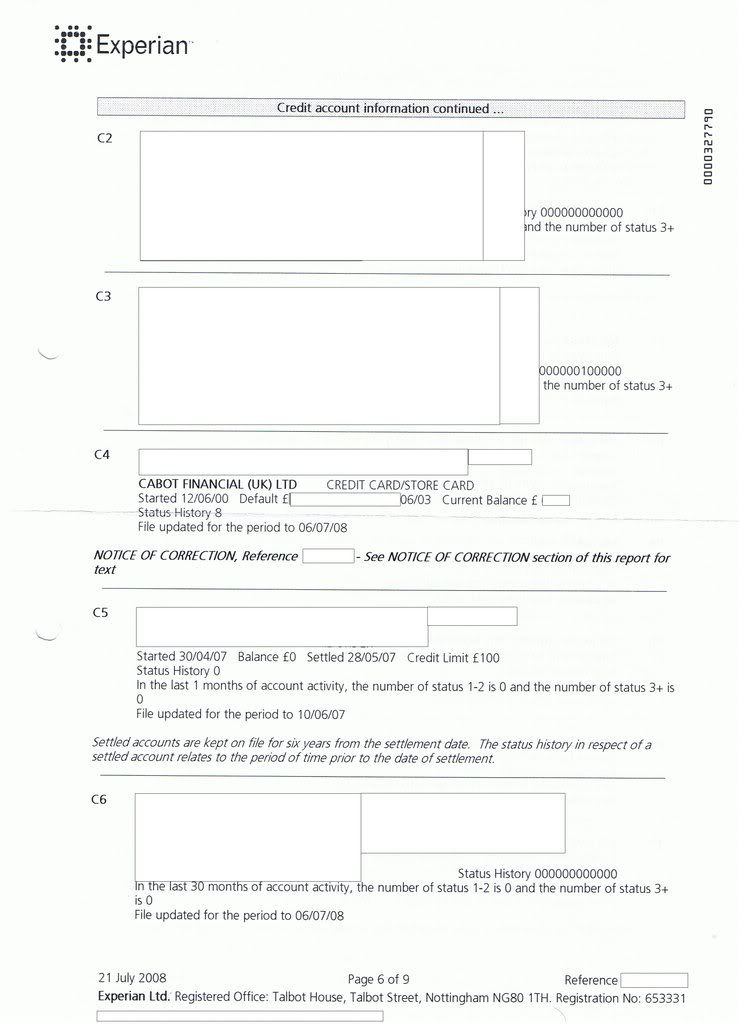

this was octobers credit report from experian showing four defaults after disputing the cabot account over lack of default notice incorrect amount due to unlawful charges, surley this is done out of spite for trying to tidy up my credit file

sorry ive also posted this on one of my other threads by mistake..

-

-

-

This was july 08 credit report from experian, 1 default showing

Hadituptohere

-

Hi rmw

Did you have to issue court papers to recieve this info?

Hadituptohere?

-

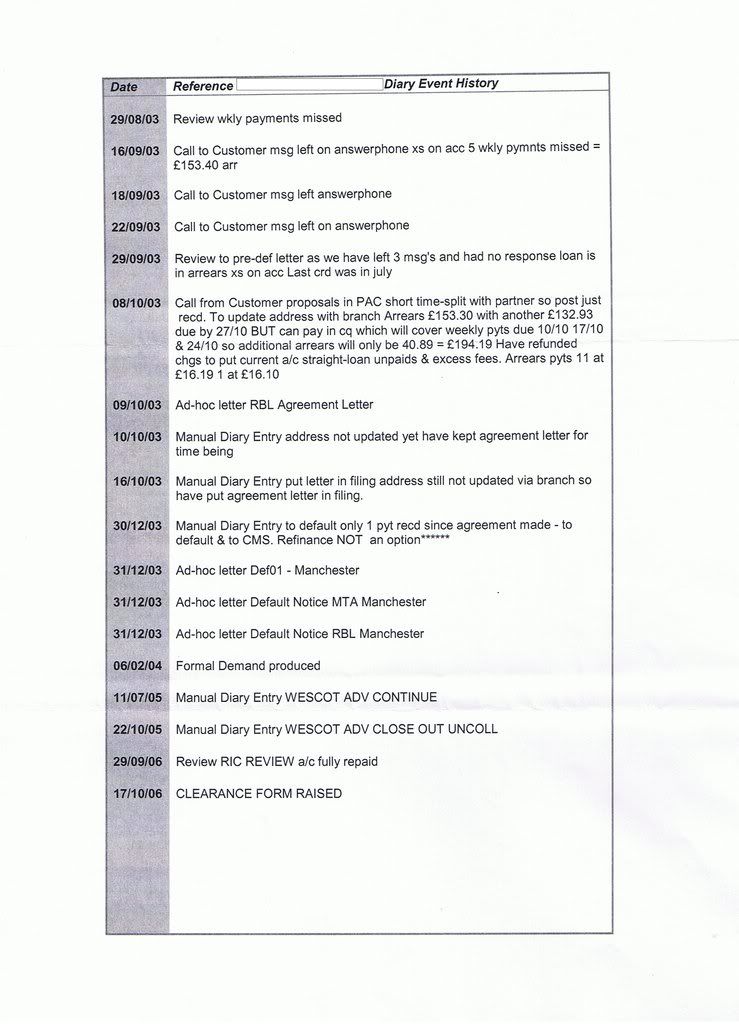

Yes just looked back and the notice gives them 7 days to cease processing but the covering letter gives them 21 days. I was only adding the bit about the s10,12 notice to let people know where im up to, still confused as to wether its worth righting to them and asking for a copy of the default notice or would the fact they refer to it in there Diary exclude any court action due to lack of default notice?

Hadituptohere

-

Hi guys,

well the 40 days was up yesturday for RBS and my SAR, they have provided me with a copy of the Credit Agrement but no default notice although they have refered to Ad-hoc Default Notice MTA Manchester and Ad-hoc Default Notice RBL Manchester in their Diary Event History which they have sent.

Should I write to them asking for a copy of the default notice?

I have recently sent them Surley's s10, s12 Data Protection Notice due to the contract ended once the account was settled to see if that works but that was back on the 9th Oct and had no acknowledgement to that letter I gave them 7 days to respond.

Hadituptohere

-

I will try and explain how far I have got with experian regarding my credit report

and how obstructive has been regarding tidying up my file.

Please bear with me, I have posted something similar elswhere ion this site a while ago.

I have two so called accounts with cabot for previous credit cards that were defaulted around June 03 on my credit file

but only one of these showed up on my experian report

and both on my equifax report along with two settled defaults from RBS from March 04,

as I realised after finding this site these two accounts (cabot) were made up of unlawful charges,

after SARing the Original Lenders to find they only had Unenforcable Agreements/application forms

and no Default notice on one and only recieving a list of charges that dated back six years

although the card was from 2000 on the other I disputed the accounts with cabot and got the usual rubbish from them.

As the balances were incorrect and the appropriate paperwork required for marking or issuing a default were none existant

I decided to dispute these defaults that experian and equifax are disclosing,

I sent letters to both along with proof of correspondence to the original lenders

and cabot that these letters were in dispute,

equfax acknowledged my dipute placed a dispute marker on file

and then removed the default info due to no responce from their client within the 28 days.

Experian on the other hand passed my letters to mr who wrote several letters asking me

on what grouds is the info incorrect, informing me that unenforcable agreements do not warrant removal of defaults

( although the accounts had the unlawful charges and id sent him proof of the charges),

I tried serving them s12 Data Protection Act notices and got the usual this does not apply to experian,

in that repy he notified me he was placing a dispute marker on my file,

which he had already notifed me of when I raised the dispute with them some 64 days previous,

off went a letter reminding him of this and of the Information Commissioners Office quidelines

as to dispute markers were after an appropriate time say 28 days the info removed if no reply from their client.

He has now written back informing me hes had a responce from cabot informing him

the info should remain on my file which I find unbeliveably coincident.

To top things off I have just recived my credit file from experian and it now shows both alledged accounts with cabot

and the two settled defaults from RBS, now to me that seems a little underhand.

Any advise please

Hadituptohere

-

Hows it gone Bigad? any news?

Hadituptohere

-

Notice that Acknowledgement of Service Has Been Filed recieved today, Cap one intend to defend all the claim.

Is there anything I should be doing..?

Hadituptohere

-

Hi jo

The letter in post 88 is te one advised to send

-

Sorry ive noiced the mistake myself, its only the info from within CMS.....

Dohhhhhhhhhhhhhh!

-

Right, today ive recieved this in the post from RBS, to me this clearly doesnt suffice as a S.A.R - (Subject Access Request). Along with these two doc's came a glossary of tems and a page of personal info (name, DOB, acc no etc) that is it.

Any thoughts as what to do next plz...???

Hadituptohere.

-

Good Luck finlander, lets hope theres no gagging clause in any deal done with the CRA's so you can come back and tell everyone.

Hadituptohere

Providian then Monument then Barclaycard reply

in Barclaycard

Posted

Forgot to mention that the default was for 4922.00 cabot are still processing the default at 6501.00 and ive paid cabot in excess of 1000.00, if this helps

Hadituptohere