cjhooker

Registered UsersChange your profile picture

-

Posts

82 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

SSE EMAIL. " Thank you for taking the time to speak with me via telephone recently regarding the complaint you have raised. Firstly, I am sincerely sorry for the upset we have caused. Your experience falls exceptionally short of the high level of customer service we strive to provide here at SSE. You initially contacted us on March 25th regarding the bill you have received with the balance of £371.84 This is based on customer reading 0020. As a company we review customers' Direct Debits every 6 months, your review is due on the 22.3.21 We have recently changed our policies and are doing this more often to help our customers manage their bills, I sincerely apologize again that your Direct Debit hasn't been reviewed yet. As discussed on the telephone I would like to offer you a goodwill payment of £50.00 towards the balance as a gesture of goodwill. " I have no idea how they initially came up with £17 a month direct debit? They must have some record of the initial contract? They wouldn't just go ahead without checking surely?

-

Hi Guys i switched to SSE last August for gas only after looking at comparison sites. i was offered a monthly budget plan of £17, didn't really think much about it at the time but now realise it is way too low to cover my gas assuage. I've had 5 bills: For the period: 18 August 2020 to 24 September 2020, Gas charges of £17.55 so the £17 covered it.. for the period: 18 August 2020 to 24 September 2020 Gas charges £313.05 but a few days later an amended bill For the period: 18 August 2020 to 24 September 2020 Gas charges £34.47 so again £17 a month covered it. for the period 25 September 2020 to 15 December 2020 Gas charges £147.70 (I didn't look at this bill so didn't see that i was getting into arrears) For the period: 16 December 2020 to 09 March 2021 Gas charges £308.67 (first time I realised I was getting into big arrears!) I have spoken to them and they said my account is only reviewed every 6months (they appear to of missed the 6 months) I cant believe it is only reviewed every 6months?? why did they allow me to get so in debt?! I have given them regular meter readings so its not been estimated bills. my question is do I have a case to go to the Ombudsman, as i feel they should of never put me on £17 a month, its clearly not enough. they appear to of missed the six month review deadline and they should of let me know after Decembers bill that I was getting into arrears. I budget very carefully each month for my outgoings I cant afford a massive bill out of the blue like this! I have already complained and they have offered £50 . I hope this makes sense! thanks for your help.

-

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

Thankyou for all your help, they have backed down and it looks like I'm getting my money back..case won! attached is the final response to my email.. -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

Thanks for your help. So to be clear, they have broken the law by operating a 0871 number for customer services and complaints phone line? As described in post #5 and here.. http://www.fairtelecoms.org.uk/consumer-contracts-regulations.html There is no ombudsman, they aren't budging on their response not to reimburse me.. So what now? Trading standards, small claims court? -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

hmmm i just did a search online http://www.area-codes.org.uk/more/084-and-087-number-ban.php anyone know if companies are not allowed to use 087 premium rate numbers for customer services/complaints lines? it looks like they're not supposed to. also do you think this thread should be in telephone charges or something? -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

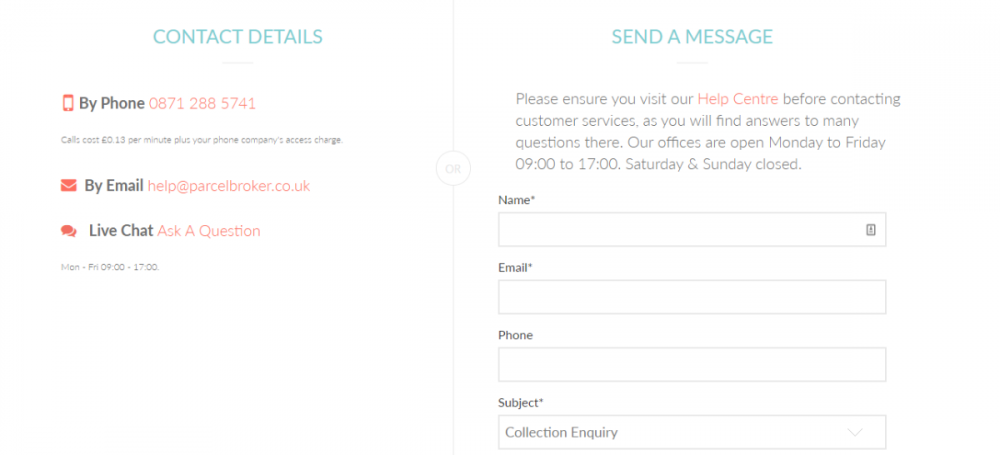

It looks like they have stopped phone support, the last email i got from them was this... Hi Chris, Unfortunately, we do not offer phone support any longer. Please see more information here: https://help.parcelbroker.co.uk/hc/en-gb/articles/360017890937-Why-we-don-t-offer-phone-support- In line with Ofcom regulations, when our phone lines were active we made sure call charges were clearly displayed on our website (please see screenshot below) alongside other options to contact us, we are not able to reimburse customers for calls made to us. You could have, at any point in time, raised a ticket to one of our support staff via our contact page who would've been more than happy to deal with this issue via email, and we encourage people to do so. -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

the company is parcelbroker.co.uk some of the problems were caused by brexit over Christmas but there were so many problems it became a comedy of errors! I really just want my phone charges repaid. i contacted EE and they have agreed to repay £30. I think its reasonable for Parcel Broker to pay the other £50. it was never made clear when calling them that it was a premium rate number. They never rang me, I ALWAYS had to ring them.. -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

Would an ombudsman be able to help? if so which one do I contact? -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

hi thanks for replying it was from a mobile. I didn't contact them by post because i was trying to trace/sort out my parcel so needed immediate action. likewise web chats are useless , i needed to speak in person. i didn't think about the cost of premium numbers..I was just trying to sort my parcel. -

PARCEL BROKER TELEPHONE CHARGES ***Refund in full***

cjhooker replied to cjhooker's topic in Postal and Delivery Services

Hi its really to do with the phone charges i incurred whilst calling them about my parcel. it was to an 0871 number , which I now realise costs a fortune! i spent hours on the phone to them trying to chase my parcel, which took over 12 weeks to get to France. the parcel was returned to me twice in error, other parcels delivered to me by mistake.. the parcel issue is such a mess its hard to explain.. i guess my question is. can i reclaim phone charges incurred whilst ringing their customer service? being it was their poor service in the first place ? -

Hi all, I have had a terrible experience from Parcel Broker, parcel was returned several times in error, wrong parcels delivered, terrible customer service etc.. They have agreed to refund me the postage , however... I have just got my phone bill.. I spent hours on the phone to them at a cost of over £80 !!! I have asked them to reimburse me for this but they have refused.. what can I do? can I take them to the small claims court, if so how? thanks guys..

-

Been paying Wetcloths for 15yrs on LLoyds debts from 2005

cjhooker replied to cjhooker's topic in Lloyds Bank

hi , just an up date , I'm sure your advice will remain the same but just to check. it looks like Wetcloths have found the cca on the loan (see attached letter) does this change anything in regards to being chased for the debt? also, on the second photo from a different letter (received a couple of weeks ago) the amounts circled in green don't add up? any ideas why? I could call them but I don't really want to contact them at the moment. cheers again guys, I do really appreciate your responses. wetcloths CCA return.pdf -

Been paying Wetcloths for 15yrs on LLoyds debts from 2005

cjhooker replied to cjhooker's topic in Lloyds Bank

I'm just worried about endless threatening letters and phone calls...and lloyds getting involved. I know its easy for some but I find ignoring them very stressful.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...

.thumb.png.53b78778bb8602ff6cb778da29b1d1a8.png)